Agricultural Tractor Machinery Market: Global Industry Analysis and Forecast (2024-2030)

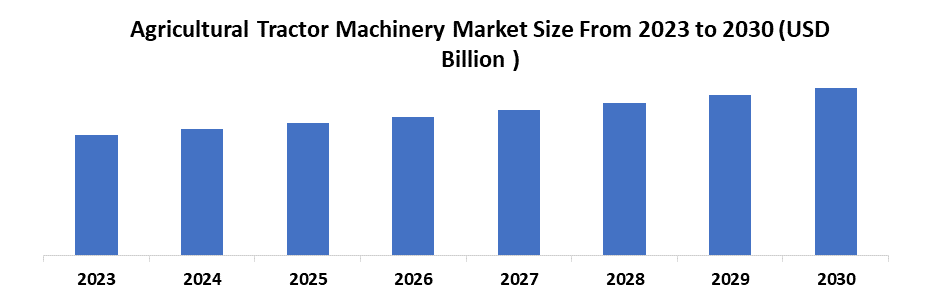

The Agricultural Tractor Machinery Market size was valued at USD 136.87 Bn. in 2023 and the Agricultural Tractor Machinery revenue is expected to grow at a CAGR of 5% from 2024 to 2030, reaching nearly USD 190.47 Bn. by 2030.

Format : PDF | Report ID : SMR_1997

Agricultural Tractor Machinery Market Overview:

A tractor is a farm vehicle that provides the power and traction to mechanize agricultural tasks, especially tillage. The use of tractors has been shifted to various farm-related tasks. Agricultural implements are towed behind a tractor that then provides a source of power for the mechanization of implements. Agricultural use of tractors is the largest segment in the agricultural machinery sector. Improvement in efficiency is one of the reasons why tractors are popularly employed by farmers.

The Agricultural Tractor Machinery Market Report delivers an in-depth analysis of leading and emerging players in the market. The report focuses on providing insights into the current trends, key players, challenges, and opportunities shaping the industry landscape. Also, the report provides comprehensive lists of key companies that have been enlisted based on the type of products they are offering & other factors in the Market. Among company profiling market analysis, the analysts who worked on the report gave the year of market entry for each mentioned player considered for the research analysis.

To get more Insights: Request Free Sample Report

Agricultural Tractor Machinery Market Dynamics:

Technological Advancements Driving Growth in the Global Agricultural Tractor Machinery Market

The adoption of tractors and related equipment is being propelled by technological advancements in agricultural machinery, including GPS guidance systems, precision farming techniques, and autonomous functionalities. These advancements assist farmers in enhancing their processes, cutting costs, lowering environmental effects, and increasing production.

In addition, the global agricultural tractor machinery market is experiencing a rise in demand for effective and mechanized farming techniques. With the increasing global population, there is a heightened need for food, leading farmers to feel pressure to enhance their productivity levels. Agricultural tractors and machinery help farmers complete tasks like plowing, planting, and harvesting more efficiently and on a larger scale than traditional manual methods.

The Impact of Weather, Trade Barriers, and Commodity Prices on the Agricultural Tractor Machinery Industry

Farming operations are greatly affected by weather conditions, with factors like droughts, floods, or other extreme weather events causing disruptions in agricultural activities. Unpredictable weather conditions affect the need for farming equipment, causing fluctuations in market expansion.

Government-imposed trade barriers, tariffs, and import/export restrictions obstruct the smooth movement of agricultural machinery between countries. These obstacles raise the price of equipment for final consumers and restrict market entry for producers. Additionally, changes in the prices of commodities like grains, oilseeds, and livestock impact farmers' earnings and ability to buy goods. In times of low prices, farmers delay or decrease spending on new machinery, affecting the demand for agricultural tractors.

Agricultural Tractor Machinery Market Segment Analysis:

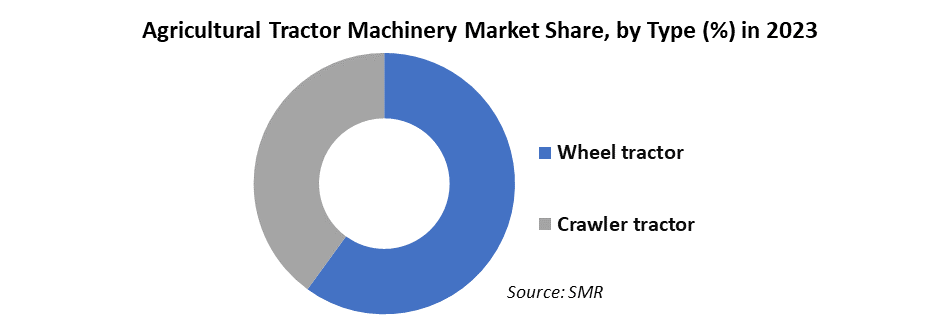

The wheel Tractor segment held the largest share in 2023 for the Agricultural Tractor Machinery Market. Wheel tractors are versatile machines used for a variety of tasks in farming operations, such as plowing, planting, cultivating, and harvesting. They are equipped with wheels, which provide mobility across different types of terrain, making them suitable for various agricultural applications. Wheel tractors are available in different power ranges, from small utility tractors to large, high-horsepower machines. Farmers choose tractors based on their specific requirements for fieldwork, depending on the size of their farm, the type of crops grown, and the tasks to be performed. With increasing focus on sustainability and environmental conservation, there's a growing demand for fuel-efficient and eco-friendly wheel tractors. Manufacturers are developing models with improved fuel efficiency and lower emissions to meet these requirements.

- India exports most of its Wheel tractors to the United States, Mexico, and Italy.

- The top 3 exports of wheel tractors are Germany followed by France, and Belgium.

Agricultural Tractor Machinery Market Regional Insight:

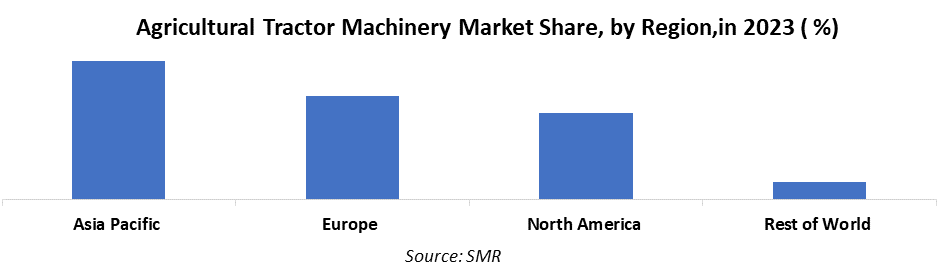

Asia Pacific has dominated the region in 2023 for the Agricultural Tractor Machinery Market. Emerging markets, particularly in Asia and Africa, present significant growth for domestic tractor and agricultural machinery manufacturers. These regions are witnessing a rapid transformation in their agricultural sectors, driven by the need to increase food production and improve farm productivity. As a result, there is a growing demand for advanced agricultural machinery and equipment. The Indian market for agricultural tractor machinery is fragmented with large-scale manufacturers focused on developing advanced machinery, followed by small-scale and village manufacturers who are focused on cost-effective simple machinery and tools used in agriculture.

Tractors of between 30 and 100 horsepower are suitable for a variety of agricultural jobs because they strike a balance between power and mobility. They work well on small to medium-sized farms and are capable of efficiently carrying out a variety of tasks like transporting, planting, tilling, and plowing. Larger, higher-horsepower tractors are often more expensive than tractors in the 30–100 HP range.

China is the world’s largest manufacturer of farming equipment and the largest market for agricultural machinery. China's agriculture industry is essential to the country's economy and to feed its enormous population. Modern farming methods would not be possible without agricultural tractors, which are essential for the effective completion of numerous chores like planting, harvesting, and ploughing. Japan is well known for its high level of production and technological innovation. The knowledge is reflected in the market for agricultural tractor machinery, where manufacturers continuously spend R&D to develop innovative features and technologies. Additionally, Australia's agriculture industry has been using cutting-edge technologies, such as automation and precision farming. Modern tractors with features like telematics and GPS navigation systems are becoming more and more common.

Agricultural Tractor Machinery Market Competitive Landscape:

- In November 2022, CNH Industrial N.V. signed a long-term agreement with Monarch Tractor, an AgTech company, to develop fully electrified autonomous tractors. The initiative would enable the former company to increase its product portfolio.

- In Jully 2022, Mahindra & Mahindra Ltd. launched the Yuvo Tech+ range supported by ELS 4-cylinder engines and mZIP3 cylinders for better mileage, torque, and power. The range has three options of speed(H-M-L) for optimal performance based on different agriculture and soil types of applications. This launch was expected to strengthen its position it in the market.

Agricultural Tractor Machinery Market scope:

|

Agricultural Tractor Machinery Market |

|

|

Market Size in 2023 |

USD 136.87 Bn. |

|

Market Size in 2030 |

USD 190.47 Bn. |

|

CAGR (2024-2030) |

5 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Wheel tractor Crawler tractor |

|

By Application Farm Landscape garden Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Agricultural Tractor Machinery Market Key players

- John Deere

- CNH Industrial (Case IH and New Holland Agriculture)

- AGCO Corporation (Massey Ferguson, Fendt, Valtra)

- Kubota Corporation

- Mahindra & Mahindra

- Claas

- Escorts Limited

- JCB Agriculture

- Kioti Tractor

- Mahindra USA

- Zetor Tractors

- Farmtrac Tractors Europe

- TAFE (Tractors and Farm Equipment Limited)

- Fieldking

- Massey Ferguson North America

- Tractor Junction

- Alma Tractor & Equipment

- XXX Inc.

Frequently Asked Questions

By weather conditions, with factors like droughts, floods, or other extreme weather events are challenges for the Agricultural Tractor Machinery Market.

The Market size was valued at USD 136.87 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 5 % from 2024 to 2030, reaching nearly USD 190.47 Billion.

The segments covered in the market report are by Type and Applications.

1. Agricultural Tractor Machinery Market: Research Methodology

2. Agricultural Tractor Machinery Market: Executive Summary

3. Agricultural Tractor Machinery Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Agricultural Tractor Machinery Market Import Export Landscape

4.1. Import Trends

4.2. Export Trends

4.3. Regulatory Compliance

4.4. Major Export Destinations

4.5. Import-Export Disparities

5. Agricultural Tractor Machinery Market: Dynamics

5.1. Market Driver

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Agricultural Tractor Machinery Market Size and Forecast by Segmentations (by Value USD Million)

6.1. Agricultural Tractor Machinery Market Size and Forecast, by Type (20232-20320)

6.1.1. Wheel tractor

6.1.2. Crawler tractor

6.2. Agricultural Tractor Machinery Market Size and Forecast, by Application (20232-20320)

6.2.1. Farm

6.2.2. Landscape garden

6.2.3. Others

6.3. Agricultural Tractor Machinery Market Size and Forecast, by Region (20232-20320)

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

7. North America Agricultural Tractor Machinery Market Size and Forecast (by Value USD Million)

7.1. North America Agricultural Tractor Machinery Market Size and Forecast, by Type (2023-2030)

7.1.1. Wheel tractor

7.1.2. Crawler tractor

7.2. North America Agricultural Tractor Machinery Market Size and Forecast, by Application (2023-2030)

7.2.1. Farm

7.2.2. Landscape garden

7.2.3. Others

7.3. North America Agricultural Tractor Machinery Market Size and Forecast, by Country (2023-2030)

7.3.1. United States

7.3.2. Canada

7.3.3. Mexico

8. Europe Agricultural Tractor Machinery Market Size and Forecast (by Value USD Million)

8.1. Europe Agricultural Tractor Machinery Market Size and Forecast, by Type (2023-2030)

8.1.1. Wheel tractor

8.1.2. Crawler tractor

8.2. Europe Agricultural Tractor Machinery Market Size and Forecast, by Application (2023-2030)

8.2.1. Farm

8.2.2. Landscape garden

8.2.3. Others

8.3. Europe Agricultural Tractor Machinery Market Size and Forecast, by Country (2023-2030)

8.3.1. UK

8.3.2. France

8.3.3. Germany

8.3.4. Italy

8.3.5. Spain

8.3.6. Sweden

8.3.7. Russia

8.3.8. Rest of Europe

9. Asia Pacific Agricultural Tractor Machinery Market Size and Forecast (by Value USD Million)

9.1. Asia Pacific Agricultural Tractor Machinery Market Size and Forecast, by Type (2023-2030)

9.1.1. Wheel tractor

9.1.2. Crawler tractor

9.2. Asia Pacific Agricultural Tractor Machinery Market Size and Forecast, by Application (2023-2030)

9.2.1. Farm

9.2.2. Landscape garden

9.2.3. Others

9.3. Asia Pacific Agricultural Tractor Machinery Market Size and Forecast, by Country (2023-2030)

9.3.1. China

9.3.2. S Korea

9.3.3. Japan

9.3.4. India

9.3.5. Australia

9.3.6. Indonesia

9.3.7. Malaysia

9.3.8. Vietnam

9.3.9. Taiwan

9.3.10. Bangladesh

9.3.11. Pakistan

9.3.12. Rest of Asia Pacific

10. Middle East and Africa Agricultural Tractor Machinery Market Size and Forecast (by Value USD Million)

10.1. Middle East and Africa Agricultural Tractor Machinery Market Size and Forecast, by Type (2023-2030)

10.1.1. Wheel tractor

10.1.2. Crawler tractor

10.2. Middle East and Africa Agricultural Tractor Machinery Market Size and Forecast, by Application (2023-2030)

10.2.1. Farm

10.2.2. Landscape garden

10.2.3. Others

10.3. Middle East and Africa Agricultural Tractor Machinery Market Size and Forecast, by Country (2023-2030)

10.3.1. South Africa

10.3.2. GCC

10.3.3. Egypt

10.3.4. Nigeria

10.3.5. Rest of ME&A

11. South America Agricultural Tractor Machinery Market Size and Forecast (by Value USD Million)

11.1. South America Agricultural Tractor Machinery Market Size and Forecast, by Type (2023-2030)

11.1.1. Wheel tractor

11.1.2. Crawler tractor

11.2. South America Agricultural Tractor Machinery Market Size and Forecast, by Application (2023-2030)

11.2.1. Farm

11.2.2. Landscape garden

11.2.3. Others

11.3. South America Agricultural Tractor Machinery Market Size and Forecast, by Country (2023-2030)

11.3.1. Brazil

11.3.2. Argentina

11.3.3. Rest of South America

12. Company Profile: Key players

12.1. Lockheed Martin Corporation

12.1.1.1. Company Overview

12.1.1.2. Financial Overview

12.1.1.3. Business Portfolio

12.1.1.4. SWOT Analysis

12.1.1.5. Business Strategy

12.1.1.6. Recent DevelopPulpts

12.2. John Deere

12.3. CNH Industrial (Case IH and New Holland Agriculture)

12.4. AGCO Corporation (Massey Ferguson, Fendt, Valtra)

12.5. Kubota Corporation

12.6. Mahindra & Mahindra

12.7. Claas

12.8. Escorts Limited

12.9. JCB Agriculture

12.10. Kioti Tractor

12.11. Mahindra USA

12.12. Zetor Tractors

12.13. Farmtrac Tractors Europe

12.14. TAFE (Tractors and Farm Equipment Limited)

12.15. Fieldking

12.16. Massey Ferguson North America

12.17. Tractor Junction

12.18. Alma Tractor & Equipment

12.19. XXX Inc.

13. Key Findings

14. Industry Recommendation