Agriculture Grade Zinc Chemicals Market: Global Industry Analysis and Forecast (2024-2030) by Type, Application, and Region

The Agriculture Grade Zinc Chemicals Market size was valued at US$ 1.58 Bn in 2023. The Global Agriculture Grade Zinc Chemicals Market is estimated to grow at a CAGR of 6.8% over the forecast period.

Format : PDF | Report ID : SMR_467

Agriculture Grade Zinc Chemicals Market Definition:

The main raw ingredients used to make agriculture grade chemicals are zinc, sulphur, bentonite, and chlorine. All of the other basic chemicals, except chlorine, are naturally occurring and in sufficient quantities. Before being utilised as a feedstock for the creation of these products, the raw materials are processed. Zinc is a micronutrient that plants require to survive. The report on the agriculture grade zinc chemicals market includes the market size and forecast on the basis segments, by type, application and region.

While certain soils in Minnesota are capable of supplying appropriate levels for agricultural production, others require the addition of zinc fertilisers. Zinc is a micronutrient that should be included in fertilizer regimens for corn, sweet corn, and edible beans. Micronutrients are one of the most important ingredients in the production of agrochemicals. They're important for maintaining the structural integrity of cellular membranes. Zinc-binding proteins make up around 10% of all proteins in the overall biological system, according to the International Zinc Association (IZA).

To get more Insights: Request Free Sample Report

Agriculture Grade Zinc Chemicals Market Dynamics:

The rising global food demand, as well as growing awareness of the importance of zinc chemicals in agriculture, are driving the expansion of the agriculture grade zinc chemicals market. Furthermore, growing population density and human activities contribute to a decrease in soil mineral and nutritional content, which promotes market growth. The market's growth is further aided by the environmentally friendly method of yield improvement. The increasing need for animal feed, chemical fertiliser, and other uses is driving the growth of the global agriculture grade zinc chemicals market. This industry is also rising as people become more aware of the advantages of employing zinc-based products in agriculture. Furthermore, the increased use of these products in developing nations is expected to drive market expansion in the coming years.

Excess micronutrients in the soil, which can harm the environment, particularly microorganisms and earthworms, as well as a lack of information about the precise and necessary amount of zinc required to produce high-quality crops, are stifling the growth of the agriculture grade zinc chemicals market. During the projection period, challenges such as fluctuating raw material prices and strict regulatory criteria may stifle market expansion. As manufacturers try to keep up with technical revolutions, dependability, and commonality of Agriculture Grade Zinc Chemicals Market product affairs, new traders in the Agriculture Grade Zinc Chemicals Market encounter stiff rivalry from old global dealers, which is a major challenging factor for the market.

In the Agriculture Grade Zinc Chemicals Market, the rising tendency is to customise products to cater to a specific application rather than improving product features as a whole. To generate opportunities in the Agriculture Grade Zinc Chemicals Market throughout the projected period, businesses should integrate digitally linked processes and focus on operational efficiency, diversifying supply sources, and cost control.

The interaction of grade zinc chemicals ash with sulphuric acid produces zinc sulphate. With recycling water wash water, the sulphuric acid is diluted to 65-70%. Grade zinc chemicals ash is used to neutralise the acid. The reaction mass is constantly agitated. Apart from this Zinc sulphate, which comes in both crystalline monohydrate and heptahydrate forms, is the most widely used zinc fertiliser on the planet, owing to these factors, the market is constantly rising.

Agriculture Grade Zinc Chemicals Market Segment Analysis:

By Type, the market is segmented as Zinc Oxide, Zinc Sulphate, EDTA Chelated Zinc, Sulphur Zinc Bentonite and Others. The Zinc Oxide segment dominated the agriculture grade zinc chemicals market with a 42.2% share in 2023. Zinc oxide is an odourless white powder used as a pigment, food additive, sunscreen, and other cosmetic items. Some ointments and lotions for diaper rash and skin irritations contain it as well. Zinc oxide, one of the healthiest substances, may provide skin with the UV protection it requires. Screening out harmful UV rays, helps preserve cells from damage, slows down the ageing process, and prevents skin dryness which is a major reason for driving the growth of this segment.

However, the Zinc Sulphate segment is expected to grow at a CAGR of 6.6% during the forecast period. Zinc sulphate is a crystalline white powder that is water-soluble. It's utilised as a fertiliser as a feed supplement for cattle and poultry. Zinc sulphate can also be used as a foliar spray on crops. It aids in the improvement of plant overall health by enhancing pest and disease resistance. It also plays a significant function in photosynthesis. Additionally, a form of zinc chemical known as EDTA chelated zinc is widely utilised in agriculture. The interaction of EDTA with zinc ions produces a water-soluble complex. Zinc deficiency in plants and animals is treated with this chemical. It's also utilised as a fertiliser and an ingredient in animal diets. The capacity of EDTA chelated zinc to boost plant growth, yield, and quality is only one of its many advantages.

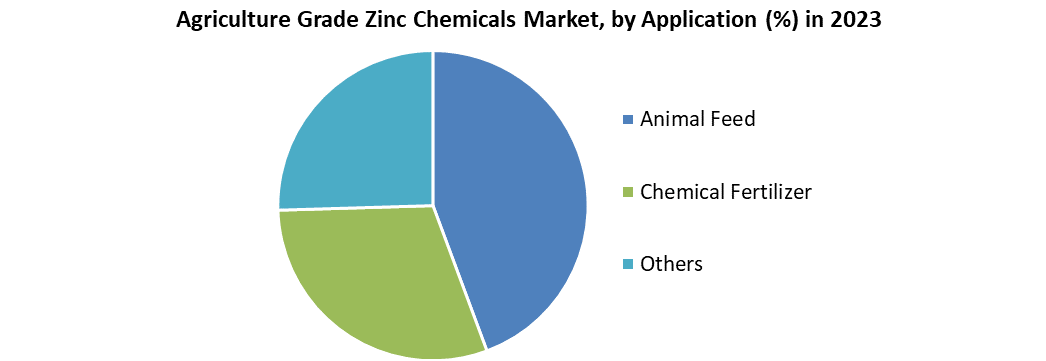

By Application, the market is segmented as Animal Feed, Chemical Fertilizer and Others. The Animal Feed segment dominated the agriculture grade zinc chemicals market with a 68% share in 2023. Zinc is an indispensable mineral for animals and is used as a complement in animal feeds. Zinc recovers feed digestibility as well as animal growth, health, and reproductive performance. It also aids in the lessening of illness in animals. Other compensations of zinc in animal feeds include higher nutritional absorption, improved coat condition, greater fertility, and increased milk output which is a major reasons for fuelling the growth of this segment.

However, the Chemical Fertilizer segment is expected to grow at a CAGR of 5.6% during the forecast period. Agriculture Grade Zinc Chemicals are used to deliver nitrogen and phosphorus in chemical fertilisers. It aids in the growth of strong plants that are disease and insect resistant. It also enhances soil quality by bringing the pH levels back into balance. Furthermore, it aids in the plant's absorption of other nutrients. As a result, the use of Agriculture Grade Zinc Chemicals in Chemical Fertilizers benefits both plants and soil.

Agriculture Grade Zinc Chemicals Market Regional Insights:

The Asia Pacific region dominated the market with a 42% share in 2023. India and China, for example, are key agro-economies in the region. High zinc output, primarily in China, and the presence of tight regulatory rules governing the industry characterise it. In terms of revenue. The introduction of sustainable farming practices is expected to fuel the expansion. In terms of agricultural demand, India is the second-largest market in the Asia Pacific, accounting for around 42.5% of total demand. From 2019 to 2025, the country is expected to grow at a significant CAGR of over 7.2% in terms of revenue.

However, the North America agriculture grade zinc chemicals market is expected to grow at a CAGR of 8.6% during the forecast period. Agriculture Grade Zinc Chemicals are mostly sold in the United States and Canada in North America. The region's agriculture sector is well-developed, thanks to government policies and initiatives. Furthermore, the region includes a big number of farmers who use contemporary farming techniques and technologies to increase agricultural productivity. Furthermore, the presence of major manufacturers in the region is supporting market expansion.

The objective of the report is to present a comprehensive analysis of the Global Agriculture Grade Zinc Chemicals Market to the stakeholders in the industry. The report provides trends that are most dominant in the Global Agriculture Grade Zinc Chemicals market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of the Global Agriculture Grade Zinc Chemicals Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in the Global Agriculture Grade Zinc Chemicals market report is to help understand which market segments, regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in the Global Agriculture Grade Zinc Chemicals market. The report studies factors such as company size, market share, market growth, revenue, production volume, and profits of the key players in the Global Agriculture Grade Zinc Chemicals market.

The report provides Porter's Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals are existing, who they are, and how their product quality is in the Global Agriculture Grade Zinc Chemicals market. The report also analyses if the Global Agriculture Grade Zinc Chemicals market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence the Global Agriculture Grade Zinc Chemicals market. Economic variables aid in the analysis of economic performance drivers that have an impact on the global Agriculture Grade Zinc Chemicals market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the Global Agriculture Grade Zinc Chemicals market is aided by legal factors.

Agriculture Grade Zinc Chemicals Market Scope:

|

Agriculture Grade Zinc Chemicals Market |

|

|

Market Size in 2023 |

USD 1.58 Bn. |

|

Market Size in 2030 |

USD 2.50 Bn. |

|

CAGR (2024-2030) |

6.8% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

by Type

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Agriculture Grade Zinc Chemicals Market Key Players:

- UPL Limited (India)

- Syngenta (Basel, Switzerland)

- Indian Farmers Fertiliser Cooperative (India)

- Yara International (Norway)

- Zochem (Canada)

- EverZinc (Belgium)

- Rubamin (India)

- Sulphur Mills (India)

- Aries Agro (India)

- Prabhat Fertilizer (India)

- OldBridge Chemicals (U.S)

- American Chemet (U.S)

- Tiger Sul (Shelton)

- TIB Chemicals AG (Germany)

- Flaurea Chemicals (Belgium)

Frequently Asked Questions

The Asia Pacific region is expected to hold the highest share in the Agriculture Grade Zinc Chemicals Market.

The market size of the Agriculture Grade Zinc Chemicals Market is expected to be 2.50 Bn by 2030.

The forecast period for the Agriculture Grade Zinc Chemicals Market is 2024-2030

The market size of the Agriculture Grade Zinc Chemicals Market in 2023 was US$ 1.58 Bn.

Chapter 1 Scope of the Report

Chapter 2 Research Methodology

2.1. Research Process

2.2. Global Agriculture Grade Zinc Chemicals Market: Target Audience

2.3. Global Agriculture Grade Zinc Chemicals Market: Primary Research (As per Client Requirement)

2.4. Global Agriculture Grade Zinc Chemicals Market: Secondary Research

Chapter 3 Executive Summary

Chapter 4 Competitive Landscape

4.1. Market Share Analysis, By Region, 2023-2030(In %)

4.1.1. North America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.2. Europe Market Share Analysis, By Value, 2023-2030 (In %)

4.1.3. Asia Pacific Market Share Analysis, By Value, 2023-2030 (In %)

4.1.4. South America Market Share Analysis, By Value, 2023-2030 (In %)

4.1.5. Middle East and Africa Market Share Analysis, By Value, 2023-2030 (In %)

4.2. Market Dynamics

4.2.1. Market Drivers

4.2.2. Market Restraints

4.2.3. Market Opportunities

4.2.4. Market Challenges

4.2.5. PESTLE Analysis

4.2.6. PORTERS Five Force Analysis

4.2.7. Value Chain Analysis

4.3. Global Agriculture Grade Zinc Chemicals Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.3.1. Global Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.3.1.1. Zinc Oxide

4.3.1.2. Zinc Sulphate

4.3.1.3. EDTA Chelated Zinc

4.3.1.4. Sulphur Zinc Bentonite

4.3.1.5. Others

4.3.2. Global Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.3.2.1. Animal Feed

4.3.2.2. Chemical Fertilizer

4.3.2.3. Others

4.4. North America Agriculture Grade Zinc Chemicals Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.4.1. North America Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.4.1.1. Zinc Oxide

4.4.1.2. Zinc Sulphate

4.4.1.3. EDTA Chelated Zinc

4.4.1.4. Sulphur Zinc Bentonite

4.4.1.5. Others

4.4.2. North America Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.4.2.1. Animal Feed

4.4.2.2. Chemical Fertilizer

4.4.2.3. Others

4.4.3. North America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.4.3.1. US

4.4.3.2. Canada

4.4.3.3. Mexico

4.5. Europe Agriculture Grade Zinc Chemicals Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.5.1. Europe Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.5.2. Europe Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.5.3. Europe Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.5.3.1. UK

4.5.3.2. France

4.5.3.3. Germany

4.5.3.4. Italy

4.5.3.5. Spain

4.5.3.6. Sweden

4.5.3.7. Austria

4.5.3.8. Rest Of Europe

4.6. Asia Pacific Agriculture Grade Zinc Chemicals Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.6.1. Asia Pacific Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.6.2. Asia Pacific Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.6.3. Asia Pacific Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.6.3.1. China

4.6.3.2. India

4.6.3.3. Japan

4.6.3.4. South Korea

4.6.3.5. Australia

4.6.3.6. ASEAN

4.6.3.7. Rest Of APAC

4.7. South America Agriculture Grade Zinc Chemicals Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.7.1. South America Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.7.2. South America Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.7.3. South America Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.7.3.1. Brazil

4.7.3.2. Argentina

4.7.3.3. Rest Of South America

4.8. Middle East and Africa Agriculture Grade Zinc Chemicals Market Segmentation Analysis, 2023-2030 (Value US$ MN)

4.8.1. Middle East and Africa Market Share Analysis, By Type, 2023-2030 (Value US$ MN)

4.8.2. Middle East and Africa Market Share Analysis, By Application, 2023-2030 (Value US$ MN)

4.8.3. Middle East and Africa Market Share Analysis, By Country, 2023-2030 (Value US$ MN)

4.8.3.1. South Africa

4.8.3.2. GCC

4.8.3.3. Egypt

4.8.3.4. Nigeria

4.8.3.5. Rest Of ME&A

Chapter 5 Stellar Competition Matrix

5.1. Global Stellar Competition Matrix

5.2. North America Stellar Competition Matrix

5.3. Europe Stellar Competition Matrix

5.4. Asia Pacific Stellar Competition Matrix

5.5. South America Stellar Competition Matrix

5.6. Middle East and Africa Stellar Competition Matrix

5.7. Key Players Benchmarking

5.7.1. Key Players Benchmarking By Application, Pricing, Market Share, Investments, Expansion Plans, Physical Presence and Presence in the Market.

5.8. Mergers and Acquisitions in Industry

5.8.1. M&A by Region, Value and Strategic Intent

Chapter 6 Company Profiles

6.1. Key Players

6.1.1. UPL Limited (India)

6.1.1.1. Company Overview

6.1.1.2. Source Portfolio

6.1.1.3. Financial Overview

6.1.1.4. Business Strategy

6.1.1.5. Key Developments

6.1.2. Syngenta (Basel, Switzerland)

6.1.3. Indian Farmers Fertiliser Cooperative (India)

6.1.4. Yara International (Norway)

6.1.5. Zochem (Canada)

6.1.6. EverZinc (Belgium)

6.1.7. Rubamin (India)

6.1.8. Sulphur Mills (India)

6.1.9. Aries Agro (India)

6.1.10. Prabhat Fertilizer (India)

6.1.11. OldBridge Chemicals (U.S)

6.1.12. American Chemet (U.S)

6.1.13. Tiger Sul (Shelton)

6.1.14. TIB Chemicals AG (Germany)

6.1.15. Flaurea Chemicals (Belgium)

6.2. Key Findings

6.3. Recommendations