Aircraft Gears Market: Global Industry Analysis and Forecast (2024-2030)

Aircraft Gears Market size was valued at USD 340 Mn. in 2023 and the total Aircraft Gears Market size is expected to grow at a CAGR of 2.92% from 2024 to 2030, reaching nearly USD 416 Mn. by 2030.

Format : PDF | Report ID : SMR_2113

Aircraft Gears Market Overview

Aircraft gears are pivotal elements in the aviation sector, crucial for the functioning of numerous aircraft systems. Their primary role is to facilitate the transmission of mechanical power and motion across various parts of the aircraft, thereby ensuring efficient and dependable operation.

The comprehensive market investigation provides detailed information on crucial factors expected to drive market growth and potential barriers that hinder it later on. Besides opportunities for investment in the Aircraft gear industry, the report provides a thorough assessment of the competitive landscape and the variety of products provided by top firms. The analysis has also explored the industry's characteristics, both qualitatively and quantitatively.

The analysis provides a comprehensive overview of the main divisions along with multiple subgroups. Information from both primary and supplementary sources was collected for the Aircraft Gears Market. Press releases, annual reports, government websites, as well as input from industry professionals, analysts, experts, and researchers from different companies, are considered primary research sources. Additional sources of information include the economic, social, political, and market conditions. Merging these two data sources creates a summary outlining the essential actions for enhancing growth. A SWOT analysis was carried out to identify the strengths and weaknesses of the Aircraft Gears market, while a PESTLE analysis was used to assess the impact of micro-economic factors on the Aircraft Gears market.

To get more Insights: Request Free Sample Report

Aircraft Gears Market Dynamics

Advancements in Materials and Technology Fueling Aircraft Gears Market Growth

The surge in aviation gears has boosted its function better and last longer thanks to the development of strong, lightweight materials like titanium and composites resulting in higher demand for the aircraft market growth. These materials enhance fuel efficiency and reduce overall aircraft weight by providing higher strength-to-weight ratios. Gear design has been done more precisely and effectively, by improving reliability and performance, thanks to developments in computer-aided design (CAD) and simulation tools that have boosted the aircraft gears market.

The rise in the demand for new commercial airplanes has been driven by the increased air travel demand globally, especially in emerging economies, and the need for aircraft gear, which is used in both the manufacture of new aircraft and the maintenance of current fleets, has propelled the aircraft gears market growth.

Additionally driving demand for cutting-edge gear systems is the development of next-generation military aircraft with enhanced capabilities. Consider the U.S. s. Specialized military aircraft gear is in high demand due to programs like the F-35 Joint Strike Fighter and similar initiatives in other nations. Regular maintenance, repair, and overhaul services are more important as the world's aircraft fleet grows and as older aircraft become. Because they are essential parts that require routine inspection and replacement, this in turn fuels the demand for aircraft gears.

High Costs, Supply Chain Disruptions, and Skilled Workforce Shortage

High-performance aircraft gears are made using expensive, sophisticated materials like titanium and composites, which call for specific manufacturing techniques resulting in hindering the aircraft gears market growth. Production costs are increased by precision engineering upholding superior manufacturing standards and investing in state-of-the-art equipment and highly qualified personnel drives up these expenses even more.

The production of aircraft gear is reliant on an intricate global supply chain. Production schedules and costs have been significantly impacted by disruptions in the raw material or component supply brought on by geopolitical unrest, natural disasters, or economic factors. Engineers and technicians are among the highly skilled workers needed to manufacture high-precision aircraft gear. Maintaining production quality and innovation is difficult in this industry due to a lack of qualified workers. Keeping the workforce up to date with the newest technologies and manufacturing processes requires ongoing training and development programs, which raises operational costs.

Aircraft Gears Market Segment Analysis

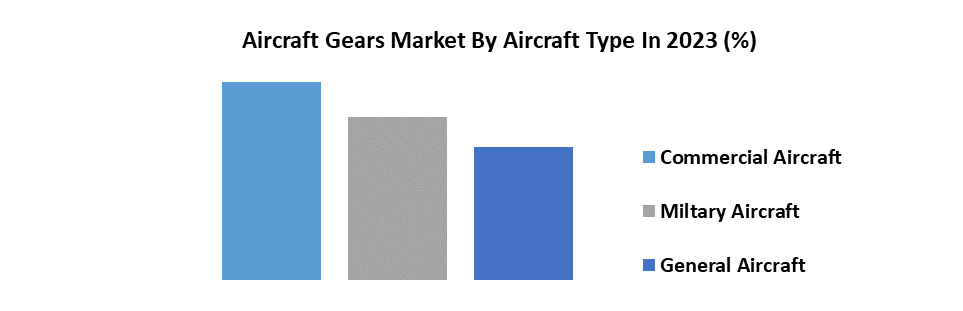

Based on Aircraft Type, the Commercial Aircraft segment dominated the Aircraft Gears Market share and is expected to maintain its dominance through the forecast period with an increasing CAGR. The major factor influencing the growth of aircraft gears are rise in globalization, urbanization has resulted in higher demand for the aircraft gears market. According to the International Air Transport Association (IATA), global passenger traffic is expected to double over the next 20 years, necessitating the growth of airline fleets.

The surges focused on replacing aging aircraft with newer, more efficient models in the airlines have propelled the market growth of the aircraft gears market. Additionally, modern aircraft offer better fuel efficiency, lower maintenance costs, and enhanced passenger comfort has escalated the market growth. The need to comply with stricter environmental regulations also drives the replacement of older, less efficient planes. Innovations in aircraft design and manufacturing, such as the development of lightweight composite materials and more efficient engines, have resulted in aircraft that consume less fuel and produce fewer emissions. These advancements are appealing to airlines looking to reduce operating costs and improve sustainability.

The growth of low-cost carriers, particularly in Asia-Pacific and Latin America, has been a significant driver of demand for new commercial aircraft. LCCs have grown their fleets to increase market share and serve more routes, especially in emerging markets with growing air travel demand. The rise of e-commerce and global trade has led to an increased demand for air cargo services. Airlines are investing in freighter aircraft and converting passenger aircraft to cargo configurations to meet this demand, contributing to the overall growth in aircraft orders.

Aircraft Gears Market Regional Analysis

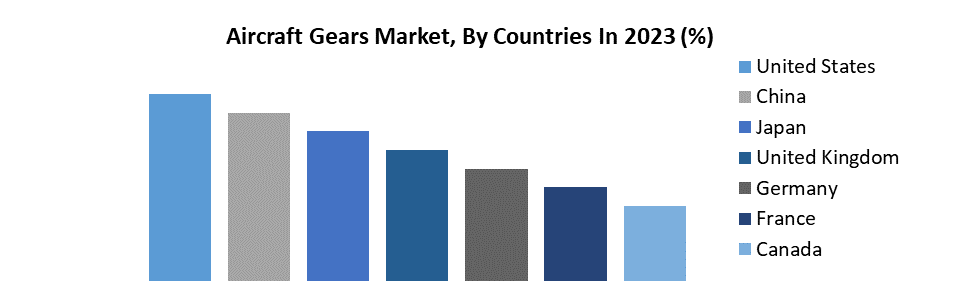

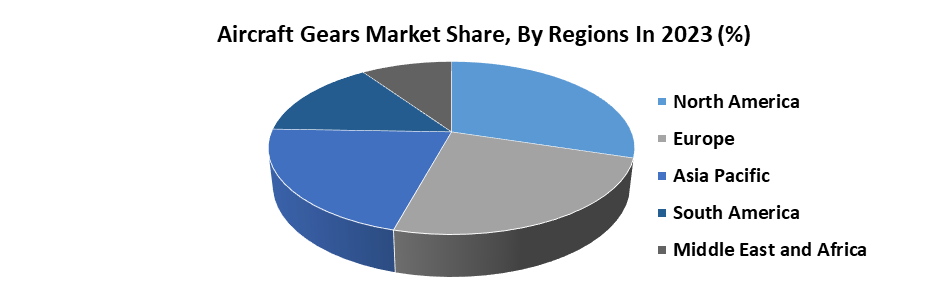

North America dominated the Aircraft Gears Market and is expected to maintain its dominance through the forecast period with an increasing CAGR. A large manufacturing base in North America is able to produce highly accurate aircraft gears. This includes cutting-edge facilities for heat treatment, machining, forging, and quality assurance. Additionally, the area is home to a large number of testing facilities that guarantee aircraft gears fulfill strict performance and safety requirements.

Major Market Leaders of Aircraft Gears in the world, including Boeing, Lockheed Martin, and Northrop Grumman, are based in the United States as a result it has boosted the market share in the region. These businesses are fuelling the Aircraft Gears Market by putting a demand on premium aircraft gear. Canada makes a substantial contribution as well, with prominent players in the engine and aircraft manufacturing industries including Bombardier and Pratt and Whitney Canada.

The U.S. S. Department of Defense (DoD) allows large sums of money for defense and aerospace, which includes the creation and acquisition of cutting-edge aircraft. This increases the need for military aircraft's high-performance gear. The rise in the government programs and initiatives that support the growth of the aircraft gears industry including funding for aerospace research and regulations enforced by the Federal Aviation Administration (FAA) has accelerated the market growth. The labor force in North America is extremely talented and has received specialized training in the engineering and manufacturing of aerospace products. Prominent academic and technical establishments offer research and education opportunities that support the aerospace sector.

Aircraft Gears Market Competitive Landscape

- In March 2023, Lufthansa Technik was awarded an MRO service contract dealing with the repair and maintenance of landing gears of the operational aircraft fleet from Emirates. The company signed a long-term contract with extending its services for up to 13 years.

- In February 2024, Liebherr Aerospace announced a long-term service contract with Japan Airlines for the overhaul of aircraft landing systems. Liebherr has offered its extensive service and product portfolio for the maintenance, repair, and overhaul of landing systems for JAL’s operational fleet.

- In October 2023, Safran Landing Systems announced that the company signed a five-year contract that would provide MRO operations for 57 aircraft.

- In December 2023, Safran Aero Boosters, based in Belgium's Walloon region, and the Flemish company BMT Aerospace are expected to partner under the Memorandum of Understanding (MoU) that Safran Aero Boosters signed with Pratt & Whitney. The signing took place at Lockheed Martin, manufacturer of the F35 aircraft, in Texas (USA), during the roll-out ceremony for the first Belgian F35, and was attended by Prime Minister Alexander De Croo and a large Belgian delegation.

- In October 2023, KKR, a leading global investment firm, announced that it has agreed to invest in Precipart a leading contract manufacturer of precision components for the medical device and aerospace industries. KKR plans to support the Company in its continued growth organically and through M&A. Financial terms were not disclosed.

|

Aircraft Gears Market |

|

|

Market Size in 2023 |

USD 340 Mn. |

|

Market Size in 2030 |

USD 416 Mn. |

|

CAGR (2024-2030) |

2.92 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Gear Type

|

|

By Application

|

|

|

By Aircraft Type

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Aircraft Gears Market Key Players

- Batom Co. Ltd (Taiwan)

- BMT Aerospace (Belgium)

- Gear Motions (US)

- Precipart (US)

- Gibbs Gears (UK)

- Delta Gear (US)

- WM Berg Inc. (US)

- Riley Gear Corporation (US)

- Northstar Aerospace (US)

- Aero Gear Inc. (US)

- Kapp Technologies (Germany)

- Klingelnberg GmbH (Germany)

- Höganäs AB (Sweden)

- Haas Schleifmaschinen GmbH (Germany)

- Liebherr Group (Germany)

- GE Aviation (US)

- MTU Aero Engines AG (Germany)

- SKF (Sweden)

- Timken Company (US)

- Rolls-Royce Holdings plc (UK)

- Collins Aerospace (US)

- Aubert & Duval (France)

- XXX Ltd.

Frequently Asked Questions

High cost of material has restrained market growth.

The Market size was valued at USD 340 Million in 2023 and the total Market revenue is expected to grow at a CAGR of 2.92 % from 2024 to 2030, reaching nearly USD 416 Million.

The segments covered in the market report are by Gear type, Application and Aircraft Type.

1. Aircraft Gears Market: Research Methodology

2. Aircraft Gears Market: Executive Summary

3. Aircraft Gears Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Aircraft Gears Market: Dynamics

5.1. Market Drivers

5.2. Market Trends

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Analysis of Government Schemes and Initiatives for the Aircraft Gears Industry

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

5.11. Aircraft Gears Market Size and Forecast by Segments (by Value USD)

5.11.1. Aircraft Gears Market Size and Forecast, by Gear Type (2023-2030)

5.11.1.1. Spur Gears

5.11.1.2. Helical Gears

5.11.1.3. Bevel Gears

5.11.1.4. Worm Gears

5.11.2. Aircraft Gears Market Size and Forecast, by Application (2023-2030)

5.11.2.1. Landing Gear Systems

5.11.2.2. Engine Components

5.11.2.3. Flight Control Systems

5.11.3. Aircraft Gears Market Size and Forecast, by Aircraft Type (2023-2030)

5.11.3.1. Commercial Aircraft

5.11.3.2. Military Aircraft

5.11.3.3. General Aviation

5.12. Aircraft Gears Market Size and Forecast, by Region (2023-2030)

5.12.1. North America

5.12.2. Europe

5.12.3. Asia Pacific

5.12.4. Middle East and Africa

5.12.5. South America

6. North America Aircraft Gears Market Size and Forecast (by Value USD)

6.1. North America Aircraft Gears Market Size and Forecast, by Gear Type (2023-2030)

6.1.1. Spur Gears

6.1.2. Helical Gears

6.1.3. Bevel Gears

6.1.4. Worm Gears

6.2. North America Aircraft Gears Market Size and Forecast, by Application (2023-2030)

6.2.1. Landing Gear Systems

6.2.2. Engine Components

6.2.3. Flight Control Systems

6.3. North America Aircraft Gears Market Size and Forecast, by Aircraft Type (2023-2030)

6.3.1. Commercial Aircraft

6.3.2. Military Aircraft

6.3.3. General Aviation

6.4. North America Aircraft Gears Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Aircraft Gears Market Size and Forecast (by Value USD)

7.1. Europe Aircraft Gears Market Size and Forecast, by Gear Type (2023-2030)

7.1.1. Spur Gears

7.1.2. Helical Gears

7.1.3. Bevel Gears

7.1.4. Worm Gears

7.2. Europe Aircraft Gears Market Size and Forecast, by Application (2023-2030)

7.2.1. Landing Gear Systems

7.2.2. Engine Components

7.2.3. Flight Control Systems

7.3. Europe Aircraft Gears Market Size and Forecast, by Aircraft Type (2023-2030)

7.3.1. Commercial Aircraft

7.3.2. Military Aircraft

7.3.3. General Aviation

7.4. Europe Aircraft Gears Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Aircraft Gears Market Size and Forecast (by Value USD)

8.1. Asia Pacific Aircraft Gears Market Size and Forecast, by Gear Type (2023-2030)

8.1.1. Spur Gears

8.1.2. Helical Gears

8.1.3. Bevel Gears

8.1.4. Worm Gears

8.2. Asia Pacific Aircraft Gears Market Size and Forecast, by Application (2023-2030)

8.2.1. Landing Gear Systems

8.2.2. Engine Components

8.2.3. Flight Control Systems

8.3. Asia Pacific Aircraft Gears Market Size and Forecast, by Aircraft Type (2023-2030)

8.3.1. Commercial Aircraft

8.3.2. Military Aircraft

8.3.3. General Aviation

8.4. Asia Pacific Aircraft Gears Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Aircraft Gears Market Size and Forecast (by Value USD)

9.1. Middle East and Africa Aircraft Gears Market Size and Forecast, by Gear Type (2023-2030)

9.1.1. Spur Gears

9.1.2. Helical Gears

9.1.3. Bevel Gears

9.1.4. Worm Gears

9.2. Middle East and Africa Aircraft Gears Market Size and Forecast, by Application (2023-2030)

9.2.1. Landing Gear Systems

9.2.2. Engine Components

9.2.3. Flight Control Systems

9.3. Middle East and Africa Aircraft Gears Market Size and Forecast, by Aircraft Type (2023-2030)

9.3.1. Commercial Aircraft

9.3.2. Military Aircraft

9.3.3. General Aviation

9.4. Middle East and Africa Aircraft Gears Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Rest of ME&A

10. South America Aircraft Gears Market Size and Forecast (by Value USD)

10.1. South America Aircraft Gears Market Size and Forecast, by Gear Type (2023-2030)

10.1.1. Traditional

10.1.2. 2 in 1

10.2. South America Aircraft Gears Market Size and Forecast, by Application (2023-2030)

10.2.1. Landing Gear Systems

10.2.2. Engine Components

10.2.3. Flight Control Systems

10.3. South America Aircraft Gears Market Size and Forecast, by Aircraft Type (2023-2030)

10.3.1. Commercial Aircraft

10.3.2. Military Aircraft

10.3.3. General Aviation

10.4. South America Aircraft Gears Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Batom Co. Ltd (Taiwan)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. BMT Aerospace (Belgium)

11.3. Gear Motions (US)

11.4. Precipart (US)

11.5. Gibbs Gears (UK)

11.6. Delta Gear (US)

11.7. WM Berg Inc. (US)

11.8. Riley Gear Corporation (US)

11.9. Northstar Aerospace (US)

11.10. Aero Gear Inc. (US)

11.11. Kapp Technologies (Germany)

11.12. Klingelnberg GmbH (Germany)

11.13. Höganäs AB (Sweden)

11.14. Haas Schleifmaschinen GmbH (Germany)

11.15. Liebherr Group (Germany)

11.16. GE Aviation (US)

11.17. MTU Aero Engines AG (Germany)

11.18. SKF (Sweden)

11.19. Timken Company (US)

11.20. Rolls-Royce Holdings plc (UK)

11.21. Collins Aerospace (US)

11.22. Aubert & Duval (France)

12. Key Findings

13. Industry Recommendation