Ascorbic Acid Market: Global Industry Analysis and Forecast (2024-2030)

The Ascorbic Acid Market size was valued at USD 1.4 Bn. in 2023 and the total Global Ascorbic Acid revenue is expected to grow at a CAGR of 5.4% from 2024 to 2030, reaching nearly USD 2.02 Bn. by 2030.

Format : PDF | Report ID : SMR_2145

Ascorbic Acid Market Overview

Ascorbic acid is a type of vitamin that is also known as Vitamin C. It is a water-soluble vitamin that is found in various foods like citrus fruits, strawberries, and broccoli. The report provides a comprehensive analysis of key Ascorbic Acid market trends, drivers, challenges, and opportunities shaping the ascorbic acid industry. The ascorbic acid Market demand is driven by increasing consumer focus on health and wellness, driving interest in preventive healthcare and dietary supplements. The trend supports robust growth in the market, with rising preferences for fortified foods and beverages further augmenting opportunities. In the pharmaceutical sector, there is a significant demand for vitamin C due to its pivotal role in therapeutic formulations aimed at treating and preventing various ailments.

The demand is underpinned by ongoing research validating its efficacy and health benefits, reinforcing its essential position in both consumer and healthcare markets globally. Allocating resources towards advanced production technologies enhances efficiency and lower production costs, bolstering competitiveness. Emerging markets present lucrative prospects, driven by increasing healthcare spending and growing consumption of dietary supplements. Innovating new formulations and applications is crucial to meeting evolving consumer demands and regulatory standards. The strategic focus on innovation positions companies favorably in a dynamic market landscape, driving Ascorbic Acid Market growth and differentiation in the global ascorbic acid market.

To get more Insights: Request Free Sample Report

Ascorbic Acid Market Dynamics

Health and Wellness Trends and Their Impact on the Ascorbic Acid Market

Increasing awareness about health and wellness, consumers are more inclined towards dietary supplements and fortified foods containing ascorbic acid (Vitamin C). Vitamin C is renowned for its immune-boosting properties, which has significantly driven its demand, especially during health crises like the COVID-19 pandemic. During the COVID-19 pandemic, the demand for Vitamin C supplements surged as consumers sought to increase their immune defenses. The trend has continued, leading to sustained growth in Vitamin C supplement consumption.

The global aging population is another key factor driving the demand for ascorbic acid. As people age, they become more susceptible to various health conditions such as cardiovascular diseases, arthritis, and weakened immune systems. Vitamin C, with its antioxidant properties, is sought after for its role in preventing or managing these age-related diseases.

- According to SMR Analysis, 77% of respondents were taking dietary supplements, with Vitamin C being one of the most popular choices. This was a significant increase from 65% in 2018.

- In the United States, sales of Vitamin C supplements increased by over 50% in the first quarter of 2020 compared to the same period in 2019.

Raw Material Supply and Price Volatility

The production of ascorbic acid heavily depends on specific raw materials, primarily corn and sugar, making the Ascorbic Acid market vulnerable to disruptions in their supply. From 2018 to 2023, corn prices increased from $3.50 to $3.85 per bushel by 2020 due to heightened demand and adverse weather conditions, with further spikes to $6.00 per bushel in 2023 amid geopolitical tensions and pandemic-related supply chain disruptions. Similarly, global sugar prices rose from 164.9 to 186.8 in January 2020, reaching 203.0 by January 2023 due to weather impacts and Ascorbic Acid market uncertainties.

These price fluctuations directly influenced the cost of producing ascorbic acid, causing its average price to rise from $7.50 per kilogram in 2018 to approximately $8.50 per kilogram by 2020. By 2023, the price had escalated further to around $10.00 per kilogram, reflecting ongoing volatility in raw material costs and supply chain challenges. The market impact has been profound, with supply chain disruptions leading to production delays and shortages. Ascorbic acid Manufacturers faced higher operational costs, impacting their pricing strategies and Ascorbic Acid market stability. These challenges underscore the critical need for robust supply chain management and strategic planning to mitigate risks and ensure consistent supply and pricing in the market.

Ascorbic Acid Market Segment Analysis

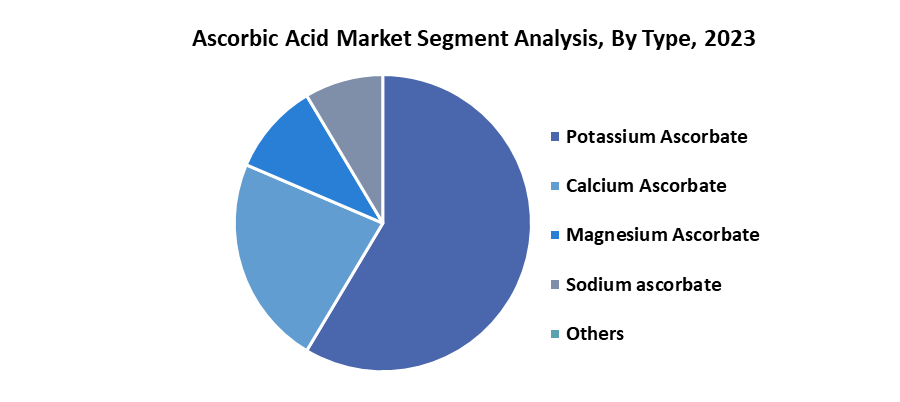

By Type, Potassium ascorbate is a crucial segment in the ascorbic acid market, known for its stability and bioavailability in various formulations. It plays a significant role in pharmaceuticals and dietary supplements, where stability is paramount for product effectiveness and shelf life. The segment benefits from the rising demand for health supplements and functional foods fortified with vitamins.

Its stability makes it a staple in pharmaceutical formulations, prominently featured in both over-the-counter medications and prescription drugs. Preferred for its efficacy, it enriches vitamin C supplements, bolstering immune support and overall health benefits. With the rising trend of fortifying foods, potassium ascorbate is integral in enhancing the nutritional value of beverages, snacks, and functional foods. Its versatility ensures widespread adoption, meeting diverse consumer needs in health and wellness products.

Ascorbic Acid Market Regional Insights

Europe represents a significant Ascorbic Acid market driven by its diverse applications in pharmaceuticals, food and beverages, and dietary supplements. The region's market dynamics are influenced by factors such as consumer health trends, regulatory frameworks, and economic conditions. In recent years, Europe has experienced significant developments in the ascorbic acid market. There's been a notable surge in demand for ascorbic acid driven by increased consumer awareness of the health benefits of dietary supplements and fortified foods.

Manufacturers are investing in advanced production technologies to increase efficiency and cut production costs. Meanwhile, stringent regulatory changes in food fortification and dietary supplements are reshaping Ascorbic Acid market dynamics, necessitating adherence to rigorous quality standards to meet consumer expectations and regulatory requirements effectively. Government initiatives in Europe regarding ascorbic acid include stringent regulations ensuring production, labeling, and marketing compliance to uphold consumer safety and product quality standards.

Health policies promoting healthy eating habits and nutritional supplementation are boosting demand for ascorbic acid in dietary products. Additionally, substantial research funding in pharmaceutical and nutritional sciences is raising innovation in ascorbic acid applications, aiming to enhance its efficacy and expand its beneficial uses in healthcare and consumer products. Germany emerges as a dominant player in the European ascorbic acid market. It boasts advanced pharmaceutical and food industries, significant research capabilities, and strong regulatory compliance. Germany's robust economy and large consumer base make it a key hub for ascorbic acid production and consumption within Europe.

Ascorbic Acid Market Competitive Landscape

- July 2021: Krating Daeng, a brand of TCH Group, announced that they were collaborating with DHC, the market leader in food supplements in Japan to cater to the Vitamin C demand arising in Thailand.

- In June 2020: Concentrated Active Ingredients & Flavors Inc., a California-based ingredient supplier, announced that they were coming out with a new concentrated acerola ingredient. The company claims the product is expected to contain 32% vitamin C, 100 times more than an orange.

- In June 2020: Homart Pharmaceuticals announced that they were launching three new products containing vitamin C under their Toplife and Spring leaf brands to cater to the growth of immunity-boosting products during the pandemic.

|

Ascorbic Acid Market Scope |

|

|

Market Size in 2023 |

USD 1.4 Bn. |

|

Market Size in 2030 |

USD 2.02 Bn. |

|

CAGR (2024-2030) |

5.4 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Potassium Ascorbate Calcium Ascorbate Magnesium Ascorbate Sodium ascorbate Others |

|

By Form Powder Liquid |

|

|

By Application Food and beverages Pharmaceutical Beauty and personal care Animal feed |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Ascorbic Acid Market

- Luwei Pharmaceutical Group Co. Ltd. (China)

- Merck KGaA (Germany)

- Medisca Inc. (Canada)

- Vega Group Company Limited (China)

- Chemceed (U.S.)

- Reckon Organics Private Ltd. (India)

- Superior Supplement Manufacturing (U.S.)

- CSPC Pharmaceutical Group Limited (China)

- FUJIFILM Corporation (Japan)

- Muby Chemicals (India)

- Aland Health Holding Ltd (China)

- Bactolac Pharmaceutical Inc. (U.S.)

- Foodchem International Corporation (China)

- Botanic Healthcare (India)

- ACP Chemicals Inc (Canada)

- DSM

- Koninklijke DSM N.V.

- Glanbia PLC

- Pharmacompass

- NBTY Inc

- XXX Inc.

Frequently Asked Questions

Opportunities include investing in advanced production technologies to improve efficiency, expanding into emerging markets with growing healthcare expenditures, and innovating new formulations to meet evolving consumer preferences and regulatory requirements.

Sustainability concerns are driving demand for eco-friendly production methods and sourcing practices. Companies are increasingly focusing on sustainable sourcing of raw materials and reducing their environmental footprint.

The Market size was valued at USD 1.4 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 5.4% from 2024 to 2030, reaching nearly 2.02 billion.

The segments covered in the market report are by Type, Form, and Application.

1. Ascorbic Acid Market: Research Methodology

2. Ascorbic Acid Market: Executive Summary

3. Ascorbic Acid Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Ascorbic Acid Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Ascorbic Acid Market Size and Forecast by Segments (by Value Units)

6.1. Ascorbic Acid Market Size and Forecast, by Type (2023-2030)

6.1.1. Potassium Ascorbate

6.1.2. Calcium Ascorbate

6.1.3. Magnesium Ascorbate

6.1.4. Sodium ascorbate

6.1.5. Others

6.2. Ascorbic Acid Market Size and Forecast, by Form (2023-2030)

6.2.1. Powder

6.2.2. Liquid

6.3. Ascorbic Acid Market Size and Forecast, by Application (2023-2030)

6.3.1. Food and beverages

6.3.2. Pharmaceutical

6.3.3. Beauty and personal care

6.3.4. Animal feed

6.4. Ascorbic Acid Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Ascorbic Acid Market Size and Forecast (by Value Units)

7.1. North America Ascorbic Acid Market Size and Forecast, by Type (2023-2030)

7.1.1. Potassium Ascorbate

7.1.2. Calcium Ascorbate

7.1.3. Magnesium Ascorbate

7.1.4. Sodium ascorbate

7.1.5. Others

7.2. North America Ascorbic Acid Market Size and Forecast, by Form (2023-2030)

7.2.1. Powder

7.2.2. Liquid

7.3. North America Ascorbic Acid Market Size and Forecast, by Application (2023-2030)

7.3.1. Food and beverages

7.3.2. Pharmaceutical

7.3.3. Beauty and personal care

7.3.4. Animal feed

7.4. North America Ascorbic Acid Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Ascorbic Acid Market Size and Forecast (by Value Units)

8.1. Europe Ascorbic Acid Market Size and Forecast, by Type (2023-2030)

8.1.1. Potassium Ascorbate

8.1.2. Calcium Ascorbate

8.1.3. Magnesium Ascorbate

8.1.4. Sodium ascorbate

8.1.5. Others

8.2. Europe Ascorbic Acid Market Size and Forecast, by Form (2023-2030)

8.2.1. Powder

8.2.2. Liquid

8.3. Europe Ascorbic Acid Market Size and Forecast, by Application (2023-2030)

8.3.1. Food and beverages

8.3.2. Pharmaceutical

8.3.3. Beauty and personal care

8.3.4. Animal feed

8.4. Europe Ascorbic Acid Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Ascorbic Acid Market Size and Forecast (by Value Units)

9.1. Asia Pacific Ascorbic Acid Market Size and Forecast, by Type (2023-2030)

9.1.1. Potassium Ascorbate

9.1.2. Calcium Ascorbate

9.1.3. Magnesium Ascorbate

9.1.4. Sodium ascorbate

9.1.5. Others

9.2. Asia Pacific Ascorbic Acid Market Size and Forecast, by Form (2023-2030)

9.2.1. Powder

9.2.2. Liquid

9.3. Asia Pacific Ascorbic Acid Market Size and Forecast, by Application (2023-2030)

9.3.1. Food and beverages

9.3.2. Pharmaceutical

9.3.3. Beauty and personal care

9.3.4. Animal feed

9.4. Asia Pacific Ascorbic Acid Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Ascorbic Acid Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Ascorbic Acid Market Size and Forecast, by Type (2023-2030)

10.1.1. Potassium Ascorbate

10.1.2. Calcium Ascorbate

10.1.3. Magnesium Ascorbate

10.1.4. Sodium ascorbate

10.1.5. Others

10.2. Middle East and Africa Ascorbic Acid Market Size and Forecast, by Form (2023-2030)

10.2.1. Powder

10.2.2. Liquid

10.3. Middle East and Africa Ascorbic Acid Market Size and Forecast, by Application (2023-2030)

10.3.1. Food and beverages

10.3.2. Pharmaceutical

10.3.3. Beauty and personal care

10.3.4. Animal feed

10.4. Middle East and Africa Ascorbic Acid Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Ascorbic Acid Market Size and Forecast (by Value Units)

11.1. South America Ascorbic Acid Market Size and Forecast, by Type (2023-2030)

11.1.1. Potassium Ascorbate

11.1.2. Calcium Ascorbate

11.1.3. Magnesium Ascorbate

11.1.4. Sodium ascorbate

11.1.5. Others

11.2. South America Ascorbic Acid Market Size and Forecast, by Form (2023-2030)

11.2.1. Powder

11.2.2. Liquid

11.3. South America Ascorbic Acid Market Size and Forecast, by Application (2023-2030)

11.3.1. Food and beverages

11.3.2. Pharmaceutical

11.3.3. Beauty and personal care

11.3.4. Animal feed

11.4. South America Ascorbic Acid Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Luwei Pharmaceutical Group Co. Ltd. (China)

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Merck KGaA (Germany)

12.3. Medisca Inc. (Canada)

12.4. Vega Group Company Limited (China)

12.5. Chemceed (U.S.)

12.6. Reckon Organics Private Ltd. (India)

12.7. Superior Supplement Manufacturing (U.S.)

12.8. CSPC Pharmaceutical Group Limited (China)

12.9. FUJIFILM Corporation (Japan)

12.10. Muby Chemicals (India)

12.11. Aland Health Holding Ltd (China)

12.12. Bactolac Pharmaceutical Inc. (U.S.)

12.13. Foodchem International Corporation (China)

12.14. Botanic Healthcare (India)

12.15. ACP Chemicals Inc (Canada)

12.16. DSM

12.17. Koninklijke DSM N.V.

12.18. Glanbia PLC

12.19. Pharmacompass

12.20. NBTY Inc

12.21. XXX Inc.

13. Key Findings

14. Industry Recommendation