Audio Amplifier IC’s Market: Global Industry Analysis and Forecast (2024-2030)

The Audio Amplifier IC’s Market size was valued at USD 3.57 Bn. in 2023 and the total Global Audio Amplifier IC’s revenue is expected to grow at a CAGR of 7.5% from 2024 to 2030, reaching nearly USD 5.92 Bn. by 2030.

Format : PDF | Report ID : SMR_2008

Audio Amplifier IC’s Market Overview

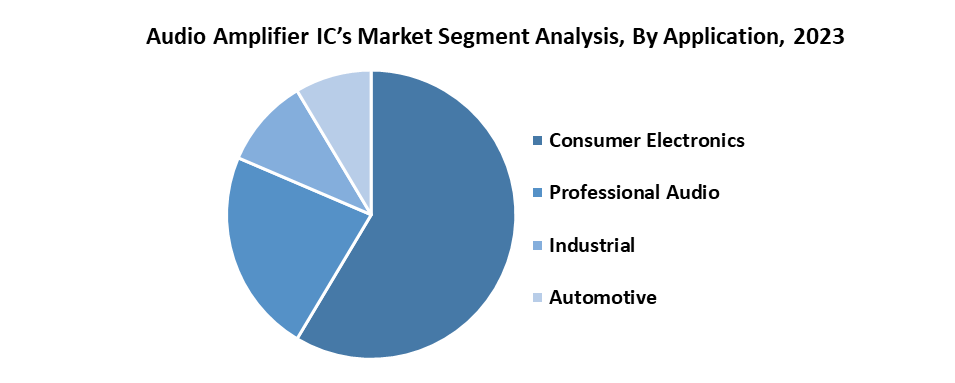

Audio amplifier IC's refer to integrated circuits that are specifically designed to amplify audio signals. These IC's are commonly used in electronic devices such as amplifiers, headphones, speakers, and other audio equipment to increase the strength of audio signals for better sound quality and volume output. The report provides a comprehensive analysis of Audio Amplifier IC’s market trends, key players, drivers, challenges, and opportunities shaping the Audio Amplifier IC’s industry. Also, the report covers the key driving factors of the Audio Amplifier IC’s market such as Consumer electronics, holding approximately 55% market share, leading the demand due to the integration of ICs in smartphones, tablets, smart TVs, and portable devices, focusing on high-quality audio and innovative features.

Automotive applications, representing around 10% market share, require high-performance audio solutions for in-car entertainment and ADAS, driving the need for advanced IC’s. The rise of IoT and smart home devices, such as smart speakers, also enhanced demand for efficient, high-quality audio IC’s. Technological innovations, including Class D amplifiers and ICs with wireless connectivity and voice recognition, further drive market growth.

Investing in the Audio Amplifier IC’s market offers promising opportunities. Companies developing advanced technologies like Class D amplifiers and IC’s with integrated wireless connectivity and voice recognition capabilities are poised for high returns. The increasing adoption of smart home and IoT devices presents lucrative growth prospects for firms providing efficient, high-quality audio solutions. The automotive sector's growing integration of advanced infotainment and ADAS systems makes investment in automotive audio amplifier IC’s highly profitable. Also, companies focusing on energy-efficient audio amplifier IC’s to meet consumer demand for longer battery life in portable devices offer attractive investment opportunities. Strategic investments in these areas yield a significant return.

To get more Insights: Request Free Sample Report

Audio Amplifier IC’s Market Dynamics

Rise of IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices and smart home gadgets is significantly driving the growth of the audio amplifier IC’s market. IoT devices such as smart speakers, home automation systems, and wearable technology increasingly require efficient audio amplification to deliver high-quality sound. The demand directly influences the production and innovation within the audio amplifier IC’s market. The surge in IoT device adoption has significantly increased the demand for audio amplifier IC’s, pushing manufacturers to develop IC’s with better sound quality, lower power consumption, and smaller sizes for compact devices.

Innovations like Class D amplifiers, known for their efficiency and reduced heat production, are crucial for IoT devices that require extended battery life and high audio performance. The Audio Amplifier IC’s market has diversified to serve various applications, including consumer electronics, automotive, and smart home devices, thus spreading risk and creating new revenue streams. Also, Audio Amplifier IC’s manufacturers are incorporating secure design principles to prevent unauthorized access and data breaches, enhancing the demand for their products.

The Audio Amplifier ICs market faces several challenges that impact its growth and development.

- Technological Complexity

As consumer demands for better sound quality and efficiency rise, manufacturers face increasing technological complexity in designing and producing advanced audio amplifier IC’s. Keeping up with rapid advancements while ensuring product reliability is a significant challenge

- Supply Chain Disruptions

The global semiconductor industry, including audio amplifier ICs, is susceptible to supply chain disruptions caused by geopolitical tensions, natural disasters, and pandemics. These disruptions can lead to shortages and increased production costs. The semiconductor shortage caused by the COVID-19 pandemic led to a significant supply chain disruption, with the average lead time for semiconductor components, including audio amplifier ICs, increasing from 12 weeks in 2019 to 26 weeks in 2021. The disruption highlights the vulnerability of the supply chain to external shocks.

- Integration with IoT and Smart Devices

Ensuring seamless integration of audio amplifier ICs with a wide range of IoT and smart devices requires adaptability and compatibility with various communication protocols and platforms, adding to the design complexity. The number of connected IoT devices is projected to grow from 17.8 billion in 2018 to 30.9 billion by 2025. Ensuring that audio amplifier IC’s are compatible with various communication protocols and platforms across these devices is a complex task that requires continuous innovation and adaptation.

Audio Amplifier IC’s Market Segment Analysis

By Application, Consumer electronics dominate the audio amplifier ICs market, holding a substantial 55% market share. The segment includes a wide range of devices, including smartphones, tablets, smart TVs, gaming consoles, and portable audio devices. The prevalent integration of audio amplifier IC’s in these products drives significant demand. Consumers increasingly prioritize immersive audio experiences and seamless connectivity, spurring innovations in audio quality, power efficiency, and connectivity features. As a result, the consumer electronics segment plays a crucial role in shaping market trends and driving overall Audio Amplifier IC’s market growth.

Recent advancements in consumer electronics focus on enhancing audio quality, connectivity, and user experience. Manufacturers are integrating high-resolution audio support in smartphones, tablets, and audio players, necessitating advanced audio amplifier ICs for superior sound reproduction. The surge in wireless audio streaming popularity drives demand for ICs with Bluetooth, Wi-Fi, and other wireless connectivity standards, enabling seamless pairing across devices. Also, the rise of smart home devices increases the need for ICs optimized for IoT connectivity and voice control features. To address consumer demand for energy-efficient devices, manufacturers prioritize low-power designs, extending battery life in portable electronics.

Audio Amplifier IC’s Market Regional Insights

The Asia-Pacific region holds significant importance in the Audio Amplifier IC’s market because of its increasing consumer electronics industry and the presence of key manufacturing hubs. The region's rapid urbanization, rising disposable income, and increasing adoption of smart devices drive the demand for audio amplifier IC’s. Governments in China, South Korea, and Taiwan provide investment incentives, tax breaks, and subsidies to stimulate semiconductor manufacturing and R&D, enhancing the audio amplifier IC’s market. Regulatory frameworks prioritize innovation, intellectual property protection, and industry standards compliance, adopting an environment conducive to audio amplifier IC’s development.

Infrastructure development initiatives, including semiconductor manufacturing parks and research institutes, aim to encourage the semiconductor ecosystem and facilitate the growth of the audio amplifier IC’s market. These government initiatives drive innovation, investment, and infrastructure development, propelling the Asia-Pacific region to the forefront of the audio amplifier IC’s industry.

- Asia-Pacific has witnessed a surge in the adoption of Class D amplifiers due to their high efficiency and compact size. These amplifiers offer improved power efficiency and reduced heat generation compared to traditional Class AB amplifiers.

- Manufacturers in Asia-Pacific are focused on miniaturizing and integrating audio amplifier ICs to meet the size and power constraints of portable and IoT devices. This trend involves advancements in semiconductor packaging technologies and system-on-chip (SoC) designs.

- Technological innovations in power management circuitry enable audio amplifier ICs to operate more efficiently, resulting in extended battery life and improved audio performance in battery-powered devices. The adoption of advanced power management solutions in Asia-Pacific is forecasted to increase by 15% annually from 2021 to 2026, driven by the demand for energy-efficient audio solutions.

- A Japanese semiconductor company, Asahi Kasei Microdevices, launched a new audio amplifier IC with integrated support for Dolby Atmos® technology, a popular 3D surround sound format

- South Korea's Samsung Electronics announced a new line of audio amplifier IC’s manufactured using recycled materials, aiming to reduce their carbon footprint by 20%

Audio Amplifier IC’s Market Competitive Landscape

The introduction of advanced audio amplifier IC’s with improved signal processing and power efficiency enhances audio performance in consumer electronics and automotive applications. New product launches diversify applications, including smart speakers, automotive infotainment, and IoT devices, driving market growth and penetration into emerging sectors. Companies gaining a competitive edge through innovation attract customers seeking superior audio quality, energy efficiency, and connectivity. The availability of innovative audio amplifier IC’s stimulates market demand, promotes technological advancements, and contributes to the overall expansion and evolution of the Audio Amplifier IC’s market.

- On June 2023, Cirrus Logic unveiled a premium audio solution for PCs, featuring the CS35L56 smart amplifier for higher-performing audio and the low-power CS42L43 SmartHIFITM PC audio codec with integrated MIPI SoundWire interface (v1.2). This solution promises a louder, more immersive audio experience for ultrathin laptops and headphones. It not only simplifies design for PC manufacturers but also contributes to space savings and reduced material costs by minimizing the total number of components.

- On July, Cirrus Logic announced the release of their new CS47L63 Smart Codec with advanced noise cancellation and beam forming capabilities, catering to the growing market of smart home devices.

- On November 2022, Infineon launched its new MA2304 series, featuring the second generation of MERUS multilevel switching technology. These ICs offer a compact form factor, low switching losses, and high efficiency, making them ideal for battery-powered speakers, Bluetooth/wireless speakers, and multi-room audio systems.

- On April 2022, STMicroelectronics launched their new product TDA7901 automotive amplifier, which integrates a buck controller for class-G power switching and supports high-definition audio, a market-unique combination for great listening and high efficiency.

|

Audio Amplifier IC’s Market Scope |

|

|

Market Size in 2023 |

USD 3.57 Bn. |

|

Market Size in 2030 |

USD 5.92 Bn. |

|

CAGR (2024-2030) |

7.5 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

|

By Application Consumer Electronics Professional Audio Industrial Automotive Others |

|

By Device Type Mono Amplifiers Stereo Amplifiers Multi-Channel Amplifiers |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Audio Amplifier IC’s Market

- STMicroelectronics N.V.

- ON Semiconductor

- NXP Semiconductors

- Infineon Technologies AG

- ROHM Semiconductor

- Cirrus Logic Inc.

- Analog Devices Inc.

- Texas Instruments Incorporated

- Monolithic Power Systems, Inc.

- MediaTek Inc.

- XXX Inc.

Frequently Asked Questions

Key challenges in the Audio Amplifier ICs market include technological complexity and high production costs, effective heat dissipation in high-performance ICs, and supply chain disruptions impacting raw material availability. Addressing these issues is crucial for maintaining production efficiency and meeting growing market demand.

The Asia-Pacific region dominates due to strong manufacturing capabilities, significant demand in consumer electronics, and supportive government initiatives. Countries like China, South Korea, and Japan are major contributors.

The Market size was valued at USD 3.57 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 7.5% from 2024 to 2030, reaching nearly USD 5.92 billion.

The segments covered in the market report are by application and device type.

1. Audio Amplifier IC’s Market: Research Methodology

2. Audio Amplifier IC’s Market: Executive Summary

3. Audio Amplifier IC’s Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Audio Amplifier IC’s Market: Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Restraints

4.3. Market Opportunities

4.4. Market Challenges

4.5. PORTER’s Five Forces Analysis

4.6. PESTLE Analysis

4.7. Strategies for New Entrants to Penetrate the Market

4.8. Regulatory Landscape by Region

4.8.1. North America

4.8.2. Europe

4.8.3. Asia Pacific

4.8.4. Middle East and Africa

4.8.5. South America

5. Audio Amplifier IC’s Market Size and Forecast by Segments (by Value in USD Million)

5.1. Audio Amplifier IC’s Market Size and Forecast, by Application (2023-2030)

5.1.1. Consumer Electronics

5.1.2. Professional Audio

5.1.3. Industrial

5.1.4. Automotive

5.1.5. Others

5.2. Audio Amplifier IC’s Market Size and Forecast, by Device Type (2023-2030)

5.2.1. Mono Amplifiers

5.2.2. Stereo Amplifiers

5.2.3. Multi-Channel Amplifiers

5.3. Audio Amplifier IC’s Market Size and Forecast, by Region (2023-2030)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Audio Amplifier IC’s Market Size and Forecast (by Value in USD Million)

6.1. North America Audio Amplifier IC’s Market Size and Forecast, by Application (2023-2030)

6.1.1. Consumer Electronics

6.1.2. Professional Audio

6.1.3. Industrial

6.1.4. Automotive

6.1.5. Others

6.2. North America Audio Amplifier IC’s Market Size and Forecast, by Device Type (2023-2030)

6.2.1. Mono Amplifiers

6.2.2. Stereo Amplifiers

6.2.3. Multi-Channel Amplifiers

6.3. North America Audio Amplifier IC’s Market Size and Forecast, by Country (2023-2030)

6.3.1. UK

6.3.2. France

6.3.3. Germany

6.3.4. Italy

6.3.5. Spain

6.3.6. Sweden

6.3.7. Austria

6.3.8. Rest of Europe

7. Asia Pacific Audio Amplifier IC’s Market Size and Forecast (by Value in USD Million)

7.1. Asia Pacific Audio Amplifier IC’s Market Size and Forecast, by Application (2023-2030)

7.1.1. Consumer Electronics

7.1.2. Professional Audio

7.1.3. Industrial

7.1.4. Automotive

7.1.5. Others

7.2. Asia Pacific Audio Amplifier IC’s Market Size and Forecast, by Device Type (2023-2030)

7.2.1. Mono Amplifiers

7.2.2. Stereo Amplifiers

7.2.3. Multi-Channel Amplifiers

7.3. Asia Pacific Audio Amplifier IC’s Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.2. S Korea

7.3.3. Japan

7.3.4. India

7.3.5. Australia

7.3.6. Rest of Asia Pacific

8. Middle East and Africa Audio Amplifier IC’s Market Size and Forecast (by Value in USD Million)

8.1. Middle East and Africa Audio Amplifier IC’s Market Size and Forecast, by Application (2023-2030)

8.1.1. Consumer Electronics

8.1.2. Professional Audio

8.1.3. Industrial

8.1.4. Automotive

8.1.5. Others

8.2. Middle East and Africa Audio Amplifier IC’s Market Size and Forecast, by Device Type (2023-2030)

8.2.1. Mono Amplifiers

8.2.2. Stereo Amplifiers

8.2.3. Multi-Channel Amplifiers

8.3. Middle East and Africa Audio Amplifier IC’s Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.2. GCC

8.3.3. Egypt

8.3.4. Nigeria

8.3.5. Rest of ME&A

9. South America Audio Amplifier IC’s Market Size and Forecast (by Value in USD Million)

9.1. South America Audio Amplifier IC’s Market Size and Forecast, by Application (2023-2030)

9.1.1. Consumer Electronics

9.1.2. Professional Audio

9.1.3. Industrial

9.1.4. Automotive

9.1.5. Others

9.2. South America Audio Amplifier IC’s Market Size and Forecast, by Device Type (2023-2030)

9.2.1. Mono Amplifiers

9.2.2. Stereo Amplifiers

9.2.3. Multi-Channel Amplifiers

9.3. South America Audio Amplifier IC’s Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.2. Argentina

9.3.3. Rest of South America

10. Company Profile: Key players

10.1. STMicroelectronics N.V.

10.1.1. Company Overview

10.1.2. Financial Overview

10.1.3. Business Portfolio

10.1.4. SWOT Analysis

10.1.5. Business Strategy

10.1.6. Recent Developments

10.2. ON Semiconductor

10.3. NXP Semiconductors

10.4. Infineon Technologies AG

10.5. ROHM Semiconductor

10.6. Cirrus Logic Inc.

10.7. Analog Devices Inc.

10.8. Texas Instruments Incorporated

10.9. Monolithic Power Systems, Inc.

10.10. MediaTek Inc.

10.11. XXX Inc.

11. Key Findings

12. Industry Recommendation