Auto Parts Market: Global Industry Analysis and Forecast (2024-2030)

The Auto parts Market size was valued at USD 691.23 Bn. in 2023 and the total Global Auto parts revenue is expected to grow at a CAGR of 5.85% from 2024 to 2030, reaching nearly USD 1029.1 Bn. by 2030.

Format : PDF | Report ID : SMR_2018

Auto Parts Market Overview

Auto parts are components or pieces that are used to repair, maintain, or enhance a vehicle. These parts can include items such as brakes, tires, filters, and engine components. The report provides an in-depth analysis of the market, focusing on the North American region, segment analysis by end-user, recent developments, and the impact of government initiatives. It also examines market share, cost factors, and key players dominating the market. Technological advancements are reshaping the auto parts market with three key trends. The surge towards electric vehicles (EVs) increases demand for batteries, electric motors, and power electronics. the focus on safety regulations drives the need for sensors, cameras, and advanced driver-assistance systems (ADAS).

The integration of IoT in connected vehicles creates opportunities for telematics, infotainment systems, and vehicle-to-everything (V2X) communication components. Also, global vehicle sales growth, particularly in emerging markets because of urbanization and rising incomes, increases aftermarket sales. Meanwhile, the replacement demand for auto parts in mature markets, propelled by aging vehicle fleets, focuses on segments like brakes, tires, and suspension components. The shift towards lightweight materials, driven by emission regulations, fosters demand for aluminum, composites, and high-strength steel components, enhancing fuel efficiency and vehicle performance.

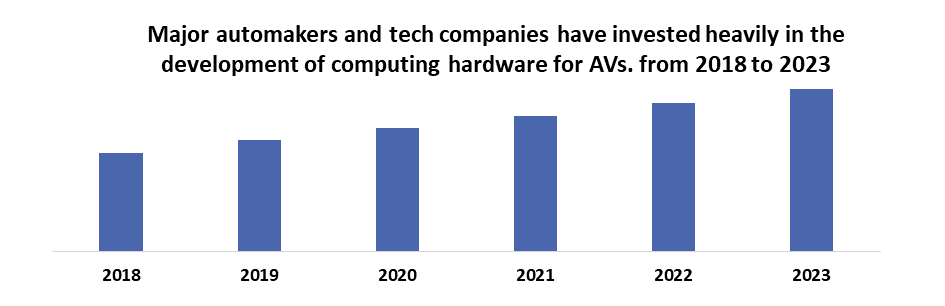

Investment opportunities abound in the auto parts market, particularly in three key areas. In electric vehicle components, there's potential for research and development in advanced battery technologies like solid-state batteries and fast-charging solutions. Manufacturers of high-efficiency electric motors and motor controllers capitalize on the growing demand for EV powertrains. Additionally, investing in EV charging infrastructure development, including fast-charging networks and wireless charging technology, presents lucrative prospects. In advanced safety and connectivity, there's room for investment in sensors, cameras, radar, and lidar technologies to support autonomous vehicle development.

Telematics platforms, software solutions, and connectivity services for vehicle-to-vehicle and vehicle-to-infrastructure communication offer further investment opportunities. sustainable manufacturing initiatives, including recycling technologies and eco-friendly materials like bio-based plastics and recycled metals, provide avenues for investment to support environmental sustainability and reduce environmental impact.

To get more Insights: Request Free Sample Report

Auto Parts Market Dynamics

Technological Advancements and Electrification in the Auto Parts Market

The shift towards electric vehicles (EVs) represents a fundamental transformation in the auto parts market. As EVs gain popularity, the demand for traditional internal combustion engine (ICE) components, such as fuel injectors, exhaust systems, and engine blocks, is declining. On the other hand, the market of EV-specific parts, such as battery packs, electric motors, and power electronics, is experiencing rapid growth.

The shift is driven by a combination of regulatory mandates for lower emissions, technological advancements, and increasing consumer acceptance of EVs. EVs require a completely different set of parts compared to traditional gasoline-powered vehicles. Internal combustion engine (ICE) components like pistons, spark plugs, and exhaust systems are being replaced by electric motors, battery packs, and power electronics. The shift creates a new demand for EV-specific parts, disrupting the traditional market.

Supply Chain Disruptions

Recent global events such as the COVID-19 pandemic, geopolitical tensions, and natural disasters have exposed significant vulnerabilities in the auto parts supply chain. These disruptions have caused widespread material shortages, and logistical challenges, and have highlighted the need for more resilient supply chain strategies. The global chip shortage significantly impacted auto production, with IHS Markit estimating a shortfall of 10 million vehicles in 2021.

Additionally, shortages of steel, aluminium, and rare earth elements disrupted manufacturing and increased costs. Logistics issues, such as port congestion, container shortages, and rising shipping costs, further delayed parts delivery, leading to production halts and longer wait times for new cars. In response, automakers are reshoring production to reduce dependence on overseas suppliers, diversifying their supplier base, and investing in technology for better supply chain visibility to proactively manage disruptions.

- The global semiconductor shortage, exacerbated by the COVID-19 pandemic, has severely impacted the automotive industry. For instance, in 2021, the shortage led to an estimated loss of production of 7.7 million vehicles globally, costing the industry around $210 billion in revenue.

- The prices of steel and rare earth elements have seen significant volatility. For example, the price of steel increased by over 50% from mid-2020 to mid-2021. Rare earth elements, critical for electric vehicle components, saw price spikes due to increased demand and supply chain constraints, with neodymium prices increasing by 74% from 2018 to 2021.

- The shortage of semiconductors, which are vital for modern vehicles' electronic systems, has led to halted production lines and significant delays in vehicle manufacturing. For example, General Motors and Ford were forced to temporarily shut down several North American plants in 2021 due to chip shortages.

- Investment in technologies that enhance supply chain visibility has increased. According to SMR, spending on supply chain technology solutions is expected to reach $10.9 billion by 2023, up from $7.9 billion in 2018. These technologies help companies track and manage their supply chains more effectively, reducing the risk of disruptions.

Auto Parts Market Segment Analysis

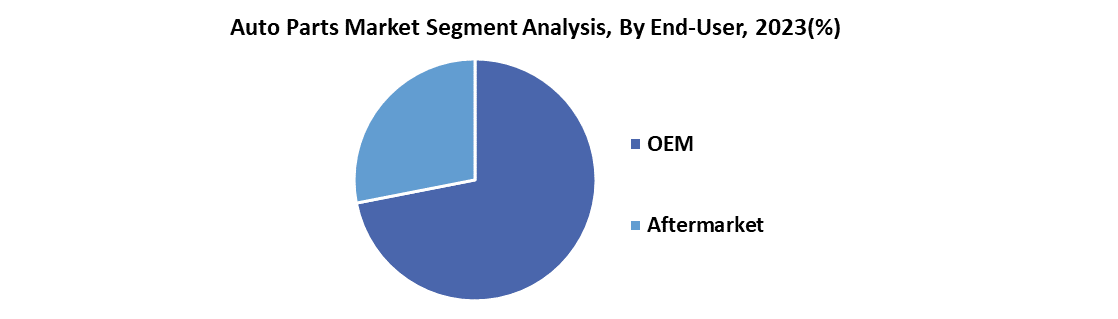

By End-User, The OEM segment constitutes a significant portion of the auto parts market. OEMs are responsible for producing parts that are used in the assembly of new vehicles. The segment is typically dominated by large automotive manufacturers and their tier-1 suppliers. OEM parts are produced to the exact specifications and quality standards of the original vehicle manufacturer, ensuring reliability and performance, crucial for brand reputation and customer satisfaction. OEMs lead in innovation, integrating the latest technologies in powertrain, electrification, safety, and autonomous driving, setting industry standards, and driving market advancements.

The OEM segment significantly impacts the economy through its large-scale operations and employment, with investments in R&D and manufacturing increasing local economies. However, the OEM market's dependence on a complex global supply chain makes it vulnerable to disruptions from geopolitical tensions or pandemics, affecting production and market stability.

Auto Parts Market Regional Insights

The North American auto parts market has experienced significant shifts because of various factors such as technological advancements, consumer preferences, and economic conditions. One major impact has been the increasing demand for electric and hybrid vehicles, leading to a surge in the production and sale of related auto parts such as batteries, electric motors, and electronic components. Also, the growing focus on sustainability and fuel efficiency has driven the demand for lightweight materials and eco-friendly manufacturing processes in auto parts production.

Recent developments in the North American auto parts market include strategic collaborations, mergers, and acquisitions aimed at enhancing product offerings and market presence. For example, in 2023, Ford announced a partnership with a leading battery manufacturer to secure a steady supply of lithium-ion batteries for its electric vehicle lineup. Similarly, General Motors unveiled plans to invest in increasing its production capacity for electric vehicle components in the region.

In terms of service costs in North America, the auto parts industry faces various expenses, including labor costs, transportation costs, and overhead expenses. The cost of profit margin varies depending on the specific products and market dynamics but typically ranges from 10% to 20% for manufacturers and distributors. Raw material costs, such as steel, aluminum, and plastic, can fluctuate due to factors like supply chain disruptions and global market trends, impacting overall production costs.

In North America, the United States is the most dominating country in the auto parts market. The U.S. boasts a robust manufacturing base, a large consumer market, and a well-established supply chain network, making it a key player in the region's auto parts industry. However, Canada and Mexico also contribute significantly to the market, particularly as manufacturing hubs for various automotive components and assemblies.

Auto Parts Market Competitive Landscape

The auto parts market is characterized by intense competition among key players, including OEM (Original Equipment Manufacturer) suppliers, aftermarket parts manufacturers, and technology firms. NVIDIA and Intel Mobileye stand out in the realm of technology firms for their pivotal roles in advancing automotive innovation. NVIDIA specializes in cutting-edge AI and computing solutions tailored specifically for autonomous driving and advanced driver-assistance systems (ADAS), enhancing safety and efficiency on the road. On the other hand, Intel Mobileye is renowned for its expertise in computer vision and machine learning, driving the development of ADAS and autonomous driving technologies to new heights. Together, they represent the lead of technological progress in the automotive industry, shaping the future of mobility with their revolutionary contributions.

- In May 2023, Gabriel India finalized an investment deal with Inalfa worth US$ 20.58 million (Rs. 170 crores) to establish a new manufacturing facility named Inalfa Gabriel Sunroof Systems (IGSS) in Chennai. The facility, slated to commence operations in the first quarter of 2024, signifies a significant step towards enhancing production capabilities.

- In October 2021, Sona BLW Precision Forgings Limited, via its wholly-owned subsidiary Sona Comstar eDrive Private Limited, entered into a collaboration agreement with Israel's IRP Nexus Group Ltd. The collaboration is geared towards the development, manufacturing, and supply of magnetless drive motors and corresponding controller systems designed specifically for electric two- and three-wheelers, underlining a strategic move towards advancing electric mobility solutions.

- In March 2023, Hitachi Ltd. expanded its operations by establishing a new auto part manufacturing facility in India. The move aimed to serve both domestic and overseas markets, signaling Hitachi's strategic investment to capitalize on the growing automotive industry in India while enhancing its global presence

|

Auto parts Market Scope |

|

|

Market Size in 2023 |

USD 691.23 Bn. |

|

Market Size in 2030 |

USD 1029.1 Bn. |

|

CAGR (2024-2030) |

5.85% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By End-User OEM Aftermarket |

|

By Distribution Channel Offline Online |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Auto parts Market

- Robert Bosch GmbH

- Denso

- Valeo

- Continental

- Aptiv

- ZF Friedrichshafen

- Magna International

- Faurecia S.A.

- Magneti Marelli

- Aisin Seiki

- Brembo

- Akebono Brake Industry

- Hella KGaA Hueck

- ACDelco

- AISIN CORP.

- Akebono Brake Industry Co. Ltd.

- Autoliv Inc.

- BorgWarner Inc.

- Brembo Spa

- HELLA GmbH and Co. KGaA

- Hyundai Motor Co.

- Lear Corp.

- Magna International Inc.

- Marelli Holdings Co. Ltd

- Schaeffler AG

- Stellantis NV

- Tenneco Inc.

- The Goodyear Tire and Rubber Co.

- XXX Inc.

Frequently Asked Questions

To overcome supply chain challenges, companies are reshoring production to reduce reliance on overseas suppliers, diversifying their supplier base to avoid over-dependence on a single source, and investing in technology solutions that enhance supply chain visibility. These strategies help manage disruptions proactively and build more resilient supply chains.

Economic fluctuations impact the auto parts market by affecting consumer spending on vehicles and aftermarket parts, causing volatility in raw material prices, and influencing currency exchange rates. These factors can lead to reduced sales, increased costs, and squeezed profit margins.

The Market size was valued at USD 691.23 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 5.85% from 2024 to 2030, reaching nearly USD 1029.1 billion.

The segments covered in the market report are by End-User, and Distribution Channel.

1. Auto parts Market: Research Methodology

2. Auto parts Market: Executive Summary

3. Auto parts Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Auto parts Market: Dynamics

4.1. Market Drivers by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Restraints

4.3. Market Opportunities

4.4. Market Challenges

4.5. PORTER’s Five Forces Analysis

4.6. PESTLE Analysis

4.7. Strategies for New Entrants to Penetrate the Market

4.8. Regulatory Landscape by Region

4.8.1. North America

4.8.2. Europe

4.8.3. Asia Pacific

4.8.4. Middle East and Africa

4.8.5. South America

5. Auto parts Market Size and Forecast by Segments (by Value in USD Million)

5.1. Auto parts Market Size and Forecast, by End-User (2023-2030)

5.1.1. OEM

5.1.2. Aftermarket

5.2. Auto parts Market Size and Forecast, by Distribution Channel (2023-2030)

5.2.1. Offline

5.2.2. Online

5.3. Auto parts Market Size and Forecast, by region (2023-2030)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Auto parts Market Size and Forecast (by Value in USD Million)

6.1. North America Auto parts Market Size and Forecast, by End-User (2023-2030)

6.1.1. OEM

6.1.2. Aftermarket

6.2. North America Auto parts Market Size and Forecast, by Distribution Channel (2023-2030)

6.2.1. Offline

6.2.2. Online

6.3. North America Auto parts Market Size and Forecast, by Country (2023-2030)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Auto parts Market Size and Forecast (by Value in USD Million)

7.1. Europe Auto parts Market Size and Forecast, by End-User (2023-2030)

7.1.1. OEM

7.1.2. Aftermarket

7.2. Europe Auto parts Market Size and Forecast, by Distribution Channel (2023-2030)

7.2.1. Offline

7.2.2. Online

7.3. Europe Auto parts Market Size and Forecast, by Country (2023-2030)

7.3.1. UK

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Austria

7.3.8. Rest of Europe

8. Asia Pacific Auto parts Market Size and Forecast (by Value in USD Million)

8.1. Asia Pacific Auto parts Market Size and Forecast, by End-User (2023-2030)

8.1.1. OEM

8.1.2. Aftermarket

8.2. Asia Pacific Auto parts Market Size and Forecast, by Distribution Channel (2023-2030)

8.2.1. Offline

8.2.2. Online

8.3. Asia Pacific Auto parts Market Size and Forecast, by Country (2023-2030)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. Indonesia

8.3.7. Malaysia

8.3.8. Vietnam

8.3.9. Taiwan

8.3.10. Bangladesh

8.3.11. Pakistan

8.3.12. Rest of Asia Pacific

9. Middle East and Africa Auto parts Market Size and Forecast (by Value in USD Million)

9.1. Middle East and Africa Auto parts Market Size and Forecast, by End-User (2023-2030)

9.1.1. OEM

9.1.2. Aftermarket

9.2. Middle East and Africa Auto parts Market Size and Forecast, by Distribution Channel (2023-2030)

9.2.1. Offline

9.2.2. Online

9.3. Middle East and Africa Auto parts Market Size and Forecast, by Country (2023-2030)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Egypt

9.3.4. Nigeria

9.3.5. Rest of ME&A

10. South America Auto parts Market Size and Forecast (by Value in USD Million)

10.1. South America Auto parts Market Size and Forecast, by End-User (2023-2030)

10.1.1. OEM

10.1.2. Aftermarket

10.2. South America Auto parts Market Size and Forecast, by Distribution Channel (2023-2030)

10.2.1. Offline

10.2.2. Online

10.3. South America Auto parts Market Size and Forecast, by Country (2023-2030)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest of South America

11. Company Profile: Key players

11.1. Robert Bosch GmbH

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Denso

11.3. Valeo

11.4. Continental

11.5. Aptiv

11.6. ZF Friedrichshafen

11.7. Magna International

11.8. Faurecia S.A.

11.9. Magneti Marelli

11.10. Aisin Seiki

11.11. Brembo

11.12. Akebono Brake Industry

11.13. Hella KGaA Hueck

11.14. ACDelco

11.15. AISIN CORP.

11.16. Akebono Brake Industry Co. Ltd.

11.17. Autoliv Inc.

11.18. BorgWarner Inc.

11.19. Brembo Spa

11.20. HELLA GmbH and Co. KGaA

11.21. Hyundai Motor Co.

11.22. Lear Corp.

11.23. Magna International Inc.

11.24. Marelli Holdings Co. Ltd

11.25. Schaeffler AG

11.26. Stellantis NV

11.27. Tenneco Inc.

11.28. The Goodyear Tire and Rubber Co.

11.29. XXX Inc.

12. Key Findings

13. Industry Recommendation