Baby Stroller and Pram Market: Global Industry Analysis and Forecast (2024-2030)

The Baby Stroller and Pram Market size was valued at USD 3.11 Bn. in 2023 and the total Global Baby Stroller and Pram revenue is expected to grow at a CAGR of 4.58% from 2024 to 2030, reaching nearly USD 4.45 Bn. by 2030.

Format : PDF | Report ID : SMR_2172

Baby Stroller and Pram Market Overview

A baby stroller and pram are essential products used to transport infants and toddlers comfortably and safely. Strollers are typically designed for older babies who can sit and hold their heads up, while prams are used for newborns as they lie flat. These products provide convenience to parents and caregivers while ensuring the safety and comfort of the baby.

- According to SMR studies, in 2022, the United States was China's largest exporting destination for baby carriages, with an import value of around 500 million U.S. dollars while Germany was the second-largest Chinese baby carriage importer, with an import value of 130 million U.S. dollars that year.

The global baby strollers and prams market has been experiencing growth owing to the increasing number of people living in urban areas, higher levels of disposable income, and a growing recognition of the advantages of baby care items. Parents are increasingly searching for top-quality, versatile strollers and prams that prioritize the safety, convenience, and comfort of their children. Major industry players such as Graco Inc., Chicco (Artsana Group), Evenflo, Peg Perego, etc. are emphasizing innovative designs, advanced safety features, and visual appeal to attract consumer attention.

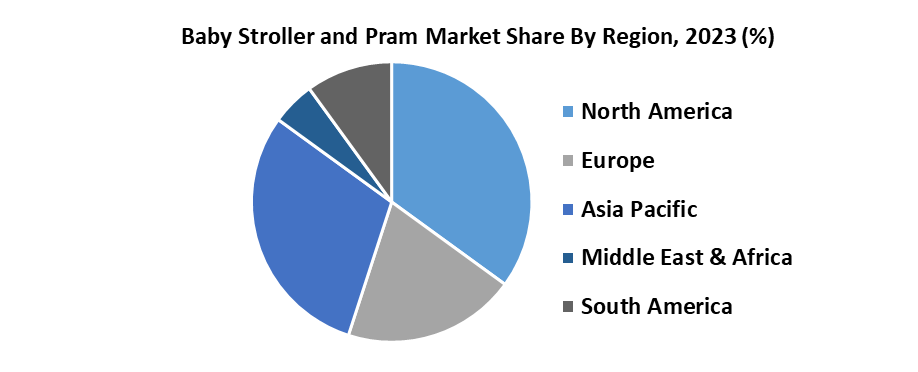

The market is segmented based on product type, age group, sales channel, and geographical location. Product types include lightweight strollers, jogging strollers, and travel systems among others. The online sales channels have been seeing rapid growth given the convenience they offer to busy parents. The Asia-Pacific region is experiencing the fastest growth in the baby stroller and pram market, attributed to rising disposable incomes, and a growing middle-class population. Countries like China and India are leading this regional growth owing to their large populations and growing retail sectors.

The market abounds with opportunities, as technological advancements are leading to smart strollers equipped with GPS, automatic folding mechanisms, and other intelligent features. There is also a growing preference for eco-friendly strollers made from sustainable materials, meeting the needs of environmentally conscious consumers. Additionally, collaborations and partnerships among major industry players for product development and distribution are expected to further fuel baby stroller and pram market growth.

The adaptable nature of the market, combined with evolving consumer preferences, presents numerous opportunities to capitalize on for both established companies and new entrants.

To get more Insights: Request Free Sample Report

Baby Stroller and Pram Market Dynamics

Smart Technology Revolutionizing Baby Strollers

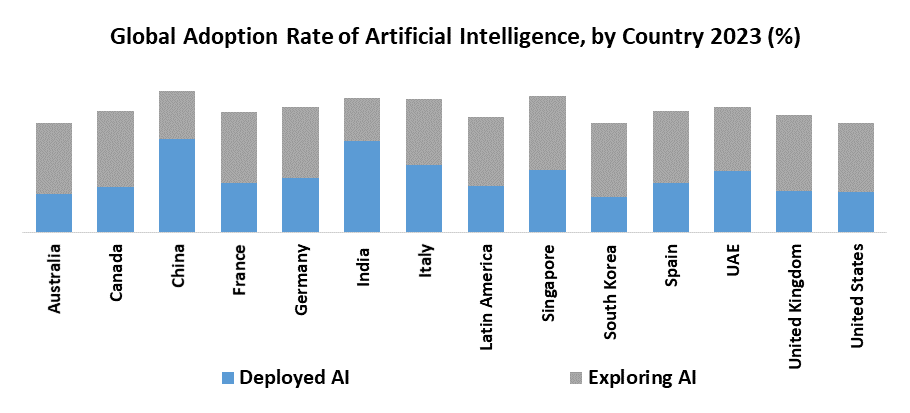

Cutting-edge features like lightweight materials, integration of smart technology, and improved safety features are increasingly attractive to modern parents. The inclusion of smart features such as GPS tracking, climate control, and self-driving capabilities has transformed convenience and safety for users. For instance, Glüxkind's Ella stroller integrates cutting-edge AI for enhanced safety and convenience. Its advanced monitoring system alerts parents to potential dangers and accommodates both babies and toddlers. The innovative Hands-Free Mode (Beta) allows parents to move freely when the stroller is unoccupied, maintaining a safe distance. This represents a significant leap forward in integrating AI technology into strollers for safer urban parenting.

This rise in technologically advanced strollers aligns with the growing demand for multifunctional baby products driving the baby stroller and pram market. Additionally, the incorporation of temperature sensors and automatic braking systems enhances the overall user experience by providing real-time data and improved security. The global adoption of IoT and increasing internet penetration also play crucial roles in baby stroller and pram market growth. A further factor accelerating the trend is parents' growing understanding of comfort and health advantages. For instance, Stokke's Xplory, with its adjustable height feature, is designed to reduce back strain by bringing the child closer to the parent, emphasizing comfortable advantages.

This surge in technological advancements and innovative designs is reshaping the competitive landscape, with manufacturers continually seeking to distinguish their products and capture a larger market share further fueling the baby stroller and pram market growth. Smart strollers are significant because of growing disposable incomes and changing customer preferences for high-end, full-of-function goods. The baby strollers and prams market is entering a new age as a result of these advances, which not only meet the growing needs of childcare but also represent a wider trend towards intelligent, connected living solutions.

Regulatory Challenges Hindering Market Growth

Organizations such as the Consumer Product Safety Commission (CPSC) in the United States and the European Committee for Standardization (CEN) establish strict testing procedures and adherence demands that limit the growth of the baby stroller and pram market. For instance, strollers are required to meet the ASTM F833 standard in the U.S., which includes demanding criteria such as a stability test requiring the stroller to remain upright on a 12-degree slope. Similarly, prams need to adhere to the EN 1888 standard in Europe, which mandates rigorous assessments for endurance and limits on harmful substances like phthalates and heavy metals.

These rules require substantial investment in research, development, and production procedures to ensure compliance, which increases manufacturing costs and delays time to market. Failure to comply carries serious consequences, including substantial fines, recalls, and potential legal action. In 2021, the CPSC documented 13,800 stroller-related injuries in children under five years of age, highlighting the crucial significance of these regulations. As a result, manufacturers need to allocate resources for ongoing monitoring and updating of safety features to meet changing standards.

This emphasis on safety also impacts pricing strategies, as higher production costs result in higher retail prices, potentially limiting market access for budget-conscious consumers. Additionally, global supply chains encounter disruptions due to varying regional safety requirements, prompting companies to implement different manufacturing protocols for different markets. Adhering to these strict regulations ensures product safety and consumer confidence, but it also restricts the dynamics of the baby stroller and pram market, influencing product innovation and competitive strategies.

Baby Stroller and Pram Market Segment Analysis

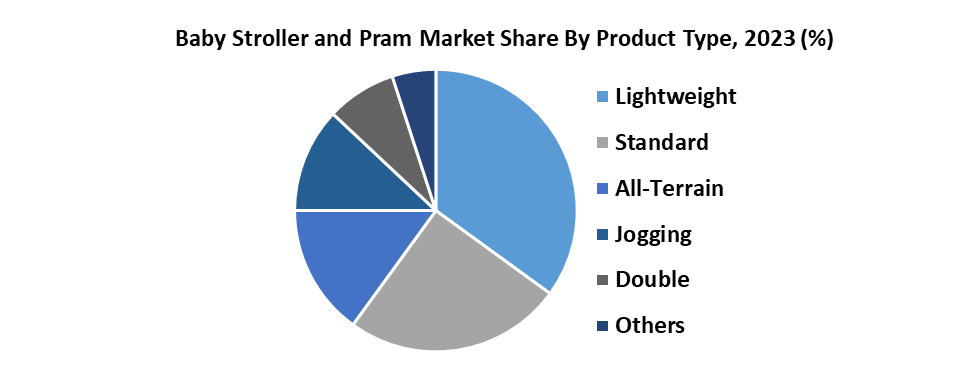

By Product Type, according to SMR research, the lightweight segment held the largest share in 2023 and is expected to dominate the Baby Stroller and Pram Market over the forecast period. As families continue to grow in urban settings, strollers that are feasible, small, and simple to use are becoming increasingly necessary. Over 65 million U.S. residents are members of health and wellness clubs, reflecting a significant group of parents who prioritize active lifestyles and require strollers that support their fitness routines without interruption further driving the dominance of the segment in the baby stroller and pram market. The trend towards compact living spaces further emphasizes the need for lightweight and foldable strollers as they facilitate effortless navigation through crowded urban areas, catering to the practical needs of modern families.

In addition to practical considerations, style and personalization play a significant role in the purchasing decisions of parents. Lightweight strollers often come in a variety of stylish designs and customizable options, allowing parents to choose products that are aligned with their tastes while ensuring the comfort and safety of their children. Parents in these households look for strollers that blend convenience with safety, ensuring that their daily routines are smooth and efficient.

The dominance of the lightweight segment in the baby strollers and prams market reflects the broader shifts in lifestyles. Parents are looking for products that integrate seamlessly into their active, urban lives, offering both practicality and aesthetic appeal. As these lifestyle trends continue to evolve, the demand for innovative, high-functioning, and stylish lightweight strollers is expected to sustain its growth trajectory in the baby stroller and pram market.

Baby Stroller and Pram Market Regional Analysis

North America held the dominant position in the global baby stroller and pram market in 2023 and is expected to continue its dominance during the forecast period. The increase in consumer spending on superior-quality baby products has majorly contributed to the dominance of the region in the baby stroller and pram market. North America, particularly the United States has a significant trend as parents prefer high-quality products given the concerns of the child's safety.

- According to SMR, the increase in disposable income in the United States from $18,356.1 billion in Q4 2021 to $19,136.0 billion in Q4 2022 is evidence of the significant market performance that has been achieved as a consequence of the parent’s preference for child safety.

The demand for high-end baby strollers has increased since economic development, which has forced producers to innovate and enhance their product lines. The key players in the region like Graco, Evenflo, and Britax dominate the market with advanced stroller designs and safety features appealing to the consumers to spend on luxury baby goods enhancing brand loyalty, and making the region dominant in the global baby stroller and pram market.

In addition to the increased disposable incomes and urban lifestyles, top-selling North American regions including New York, Los Angeles, and Toronto show increased demand for affordable and dependable infant baby transportation alternatives. The trends in the region indicate that innovation is highly valued, as seen by the ongoing creation of strollers including cutting-edge safety features, comfortable designs, and environmentally friendly materials. In addition to meeting customer expectations, this dedication to quality and innovation establishes a high standard in the baby stroller and pram market. With the ability to adjust to changing consumer preferences and sustain a solid development path, North America maintains its leadership position in the baby stroller and pram industry.

Baby Stroller and Pram Market Competitive Landscape

The competitive landscape of the Baby Stroller and Pram Market includes key players such as Graco, Chicco, Evenflo, Peg Perego, UPPAbaby, and Britax among others. These players are focusing on increasing their footprint around the globe in the stroller market with huge infrastructure, R&D support, technology, product launches, and competitive pricing. The market is characterized by competitive dynamics, market share, and strategies employed by these key players to maintain their position and drive growth in the baby stroller and pram industry.

- In 2023, Bugaboo launched the latest version of their popular all-terrain stroller, the “Bugaboo Fox 5”. The Fox 5 features improved one-hand functions, extra-large puncture-proof wheels with advanced suspension, and an extendable toddler seat that can grow with the child.

- In 2022, Baby Jogger introduced the most compact-folding 4-wheel modular stroller “The City Sights™ Stroller” that offers parents modern design, versatility, and all-terrain performance, a reversible seat, all-terrain wheels and suspension, and a one-hand, compact fold that collapses the stroller for instant storage.

|

Baby Stroller and Pram Market Scope |

|

|

Market Size in 2023 |

USD 3.11Bn. |

|

Market Size in 2030 |

USD 4.45Bn. |

|

CAGR (2024-2030) |

4.58 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Type Lightweight Standard All-Terrain Jogging Double Others |

|

By Age Group 0-6 Months 6-12 Months 12-36 Months |

|

|

By Sales Channel Baby Boutiques Departmental Stores Online Retailers Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Baby Stroller and Pram Market

- Graco Inc. (USA)

- Artsana Group (Italy)

- Evenflo (USA)

- Peg Perego (Italy)

- UPPAbaby (USA)

- Babybee (Australia)

- Britax (USA)

- Bugaboo (Netherlands)

- Stokke AS (Norway)

- Emmaljunga (Sweden)

- ABC Design (Germany)

- Baby Trend (USA)

- Thule (Sweden)

- Hauck (Germany)

- Cybex (Germany)

- Nuna (Netherlands)

- Babyzen (France)

- Joie (UK)

- Inglesina (Italy)

- Baby Jogger (USA)

- Mamas & Papas (UK)

- Quinny (Netherlands)

- Cosatto (UK)

- Silver Cross (UK)

Frequently Asked Questions

Demand for luxury and designer brands driven by consumer choices, parental preferences, and convenience are the drivers of Baby Stroller and Pram Market.

Asia Pacific region is the fastest-growing region in the global Baby Stroller and Pram market during the forecast period.

The Market size was valued at USD 3.11 billion in 2023 and the total Market revenue is expected to grow at a CAGR of 4.58 % from 2024 to 2030, reaching nearly USD 4.45 billion.

The segments covered in the market report are product type, age group, sales channel, and region.

1. Baby Stroller and Pram Market: Research Methodology

2. Baby Stroller and Pram Market: Executive Summary

3. Baby Stroller and Pram Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Baby Stroller and Pram Market: Dynamics

5.1. Market Trends

5.2. Market Drivers

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Value Chain Analysis

5.9. Technology Roadmap

5.10. Strategies for New Entrants to Penetrate the Market

5.11. Regulatory Landscape by Region

5.11.1. North America

5.11.2. Europe

5.11.3. Asia Pacific

5.11.4. Middle East and Africa

5.11.5. South America

6. Baby Stroller and Pram Market Size and Forecast by Segments (by Value USD Billion)

6.1. Baby Stroller and Pram Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Lightweight

6.1.2. Standard

6.1.3. All-Terrain

6.1.4. Jogging

6.1.5. Double

6.1.6. Others

6.2. Baby Stroller and Pram Market Size and Forecast, by Age Group (2023-2030)

6.2.1. 0-6 Months

6.2.2. 6-12 Months

6.2.3. 12-36 Months

6.3. Baby Stroller and Pram Market Size and Forecast, by Sales Channel (2023-2030)

6.3.1. Baby Boutiques

6.3.2. Departmental Stores

6.3.3. Online Retailers

6.3.4. Others

6.4. Baby Stroller and Pram Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Baby Stroller and Pram Market Size and Forecast (by Value USD Billion)

7.1. North America Baby Stroller and Pram Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Lightweight

7.1.2. Standard

7.1.3. All-Terrain

7.1.4. Jogging

7.1.5. Double

7.1.6. Others

7.2. North America Baby Stroller and Pram Market Size and Forecast, by Age Group (2023-2030)

7.2.1. 0-6 Months

7.2.2. 6-12 Months

7.2.3. 12-36 Months

7.3. North America Baby Stroller and Pram Market Size and Forecast, by Sales Channel (2023-2030)

7.3.1. Baby Boutiques

7.3.2. Departmental Stores

7.3.3. Online Retailers

7.3.4. Others

7.4. North America Baby Stroller and Pram Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Baby Stroller and Pram Market Size and Forecast (by Value USD Billion)

8.1. Europe Baby Stroller and Pram Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Lightweight

8.1.2. Standard

8.1.3. All-Terrain

8.1.4. Jogging

8.1.5. Double

8.1.6. Others

8.2. Europe Baby Stroller and Pram Market Size and Forecast, by Age Group (2023-2030)

8.2.1. 0-6 Months

8.2.2. 6-12 Months

8.2.3. 12-36 Months

8.3. Europe Baby Stroller and Pram Market Size and Forecast, by Sales Channel (2023-2030)

8.3.1. Baby Boutiques

8.3.2. Departmental Stores

8.3.3. Online Retailers

8.3.4. Others

8.4. Europe Baby Stroller and Pram Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Baby Stroller and Pram Market Size and Forecast (by Value USD Billion)

9.1. Asia Pacific Baby Stroller and Pram Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Lightweight

9.1.2. Standard

9.1.3. All-Terrain

9.1.4. Jogging

9.1.5. Double

9.1.6. Others

9.2. Asia Pacific Baby Stroller and Pram Market Size and Forecast, by Age Group (2023-2030)

9.2.1. 0-6 Months

9.2.2. 6-12 Months

9.2.3. 12-36 Months

9.3. Asia Pacific Baby Stroller and Pram Market Size and Forecast, by Sales Channel (2023-2030)

9.3.1. Baby Boutiques

9.3.2. Departmental Stores

9.3.3. Online Retailers

9.3.4. Others

9.4. Asia Pacific Baby Stroller and Pram Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Baby Stroller and Pram Market Size and Forecast (by Value USD Billion)

10.1. Middle East and Africa Baby Stroller and Pram Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Lightweight

10.1.2. Standard

10.1.3. All-Terrain

10.1.4. Jogging

10.1.5. Double

10.1.6. Others

10.2. Middle East and Africa Baby Stroller and Pram Market Size and Forecast, by Age Group (2023-2030)

10.2.1. 0-6 Months

10.2.2. 6-12 Months

10.2.3. 12-36 Months

10.3. Middle East and Africa Baby Stroller and Pram Market Size and Forecast, by Sales Channel (2023-2030)

10.3.1. Baby Boutiques

10.3.2. Departmental Stores

10.3.3. Online Retailers

10.3.4. Others

10.4. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Baby Stroller and Pram Market Size and Forecast (by Value USD Billion)

11.1. South America Baby Stroller and Pram Market Size and Forecast, by Product Type (2023-2030)

11.1.1. Lightweight

11.1.2. Standard

11.1.3. All-Terrain

11.1.4. Jogging

11.1.5. Double

11.1.6. Others

11.2. South America Baby Stroller and Pram Market Size and Forecast, by Age Group (2023-2030)

11.2.1. 0-6 Months

11.2.2. 6-12 Months

11.2.3. 12-36 Months

11.3. South America Baby Stroller and Pram Market Size and Forecast, by Sales Channel (2023-2030)

11.3.1. Baby Boutiques

11.3.2. Departmental Stores

11.3.3. Online Retailers

11.3.4. Others

11.4. South America Baby Stroller and Pram Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Graco Inc

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Artsana Group

12.3. Evenflo

12.4. Peg Perego

12.5. UPPAbaby

12.6. Babybee

12.7. Britax

12.8. Bugaboo

12.9. Emmaljunga

12.10. Stokke AS

12.11. ABC Design

12.12. Baby Trend

12.13. Thule

12.14. Hauck

12.15. Cybex

12.16. Nuna

12.17. Babyzen

12.18. Joie

12.19. Inglesina

12.20. Baby Jogger

12.21. Mamas & Papas

12.22. Quinny

12.23. Cosatto

12.24. Silver Cross

13. Key Findings

14. Analyst Recommendations