Bioplastic Packaging Market: Global Industry Analysis and Forecast (2024-2030)

The Bioplastic Packaging Market size was valued at USD 14.60 Bn. in 2023 and the total Global Bioplastic Packaging Market revenue is expected to grow at a CAGR of 15.3% from 2024 to 2030, reaching nearly USD 39.55 Bn. by 2030.

Format : PDF | Report ID : SMR_1972

Bioplastic Packaging Market Overview

Bioplastics, derived from renewable resources and biodegradable polymers such as PLA, PHA, PBAT, and starch, are gaining prominence as viable solutions. The bioplastic packaging market is witnessing substantial growth driven by increasing consumer and regulatory demands for sustainable alternatives to conventional plastics. This drive is boosted by rising environmental concerns and a recognition of the detrimental effects of plastic waste.

Bans on single-use plastics and incentives for biodegradable materials are implemented by governments worldwide. Also, heightened awareness of the environmental impact of plastic waste and the benefits of bioplastics are encouraging companies to adopt these solutions. Technological advancements are enhancing the properties of bioplastics, improving their performance, durability, and aesthetic appeal. Innovations such as enhanced barrier properties, greater heat resistance, and better printability are expanding the application range of bioplastic packaging across various industries, from food and beverages to personal care products.

- According to the SMR Study Report by European Bioplastics, global bioplastics production capacity is expected to increase significantly by 2025. Government initiatives, such as Japan's policy to promote plant-based bioplastics to combat marine plastic waste, further drive market growth. With these trends and developments, the bioplastic packaging market is poised for continued growth.

Bioplastic Packaging Market Trend

Stellar Market Research recently released an extensive report examining trends within the Bioplastic Packaging Industry, aiming to predict its growth trajectory. This thorough analysis covers essential elements such as industry size, market share, scope, growth potential, and more, providing valuable insights for businesses to navigate opportunities and risks effectively. The report meticulously investigates various aspects including market overview, segmentation, current and future growth forecasts, competitive landscape, and beyond.

With a research goal focused on delivering a comprehensive understanding of the Bioplastic Packaging market across parameters such as Material, Type, and Application region, the report offers rich data on factors shaping market dynamics. It assesses competitive strategies, including mergers, expansions, product launches, and technological advancements, highlighting key players propelling innovation in diagnostics technology. Utilizing quantitative research methodologies, the report presents statistical analyses to showcase the effectiveness of Bioplastic Packaging and its impact on market trends. Moreover, the incorporation of competitive intelligence analysis assists in deciphering market dynamics, competitor strategies, and customer perceptions. These insights enable market participants to devise targeted strategies, thus gaining a competitive advantage in the global Bioplastic Packaging Market landscape.

To get more Insights: Request Free Sample Report

Bioplastic Packaging Market Dynamics

Rising Environmental Concerns and Sustainability drives the Market Growth

Rising environmental concerns and a growing emphasis on sustainability are driving market growth. Consumers are increasingly prioritizing environmentally friendly products and services, creating demand for sustainable alternatives. This shift in consumer behavior is prompting businesses to adapt their practices to meet these preferences, thereby driving market growth for sustainable offerings. Governments and regulatory bodies are implementing stricter environmental regulations and standards, compelling businesses to adopt sustainable practices to comply with these requirements. This regulatory pressure encourages innovation and investment in sustainable technologies and processes, further stimulating market growth.

Businesses are recognizing the long-term benefits of sustainability, including cost savings through resource efficiency, enhanced brand reputation, and access to new markets and customers who prioritize environmental responsibility. As a result, companies are integrating sustainability into their core strategies, driving innovation and market growth in areas such as renewable energy, green transportation, eco-friendly packaging, and sustainable agriculture. The convergence of consumer demand, regulatory pressures, and business incentives is fueling market growth in sustainable solutions, creating opportunities for companies that prioritize environmental responsibility.

Limited Availability of Raw Materials Restrains the Bioplastic Packaging Market Growth

The limited availability of raw materials significantly restrains the growth of the bioplastic packaging market due to several interconnected factors. Bioplastics primarily derive from renewable sources like corn, sugarcane, and other biomass. Also, these feedstocks compete with food production and other industrial uses, leading to potential conflicts over land and resource allocation. This competition drive up the cost of these raw materials, making bioplastics less economically viable compared to conventional plastics. Agricultural variability due to climate change, seasonal fluctuations, and geopolitical factors disrupt the consistent supply of these raw materials. This inconsistency poses a significant risk for manufacturers relying on a steady input to maintain production levels and meet market demand.

Expanding the cultivation of bioplastic feedstocks requires significant land, water, and energy resources, which can have environmental implications and face regulatory hurdles. These constraints limit the scalability of bioplastic production, hindering the market's ability to grow and compete with the established petroleum-based plastics industry. In essence, the limited and fluctuating availability of bioplastic raw materials directly impacts production costs, supply stability, and environmental sustainability, collectively restraining Market Growth.

Regulatory Support and Policies Create Lucrative Growth Opportunities for the Bioplastic Packaging Market

The bioplastic packaging market is poised to experience significant growth due to regulatory support and policies that promote the use of eco-friendly packaging alternatives. Governments worldwide are implementing regulations to reduce the use of traditional plastics and increase the adoption of bioplastics.

- For example, the European Union has set targets to increase the use of bioplastics and has implemented bans on single-use plastics. In 2019, the European Parliament banned single-use plastic products like cutlery and straws as part of a comprehensive rule against plastic waste that damages beaches and pollutes waterways.

- Also, countries such as India have introduced legislation to ban single-use plastics, such as the Environment Ministry's announcement in August 2021 to ban single-use plastic items starting July 1, 2022.

These regulations create lucrative growth opportunities for the bioplastic packaging market as companies adapt to the new requirements and consumers become more aware of the environmental impact of their purchasing decisions. The demand for bioplastics is expected to continue growing as governments and consumers prioritize sustainability and reduce the use of traditional plastics.

Bioplastic Packaging Market: Segment Analysis

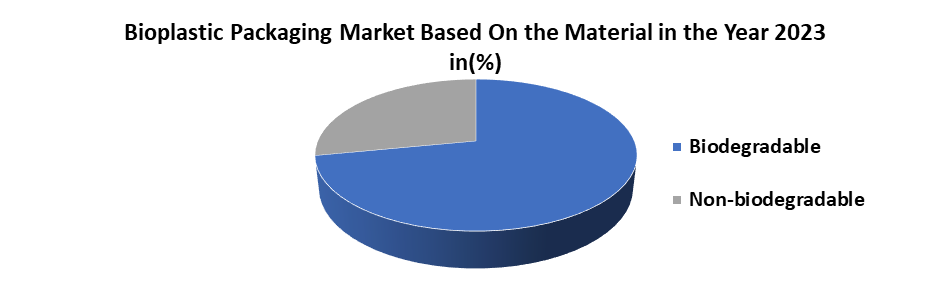

Based On the Material the Biodegradable sub-segment dominated the Material segment of the Bioplastic Packaging Market in the year 2023. Due to a combination of regulatory pressures, consumer preferences, and corporate sustainability initiatives. Governments worldwide are enacting stringent regulations and bans on single-use plastics, compelling companies to seek compliant alternatives such as biodegradable bioplastics. These materials are favored for their ability to decompose more readily under natural conditions, thereby mitigating landfill accumulation and environmental pollution.

Growing consumer awareness and demand for eco-friendly products have significantly boosted the adoption of biodegradable packaging solutions. Businesses are also increasingly prioritizing sustainability, integrating biodegradable bioplastics into their operations to meet environmental goals and enhance their green credentials. Technological advancements have strengthened this segment by improving the performance and viability of biodegradable materials for diverse packaging applications. Together, these factors drive the market dominance of the biodegradable sub-segment, positioning it as a key player in the shift towards more sustainable packaging solutions.

Bioplastic Packaging Market: Regional Analysis

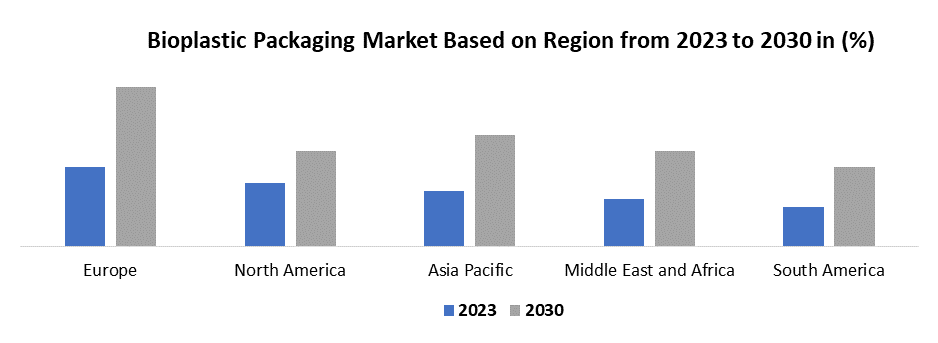

Europe dominated the bioplastic packaging market in 2023 due to a combination of progressive regulatory frameworks, strong consumer demand for sustainable products, and substantial investments in research and development. The European Union's stringent environmental regulations and directives, such as the Single-Use Plastics Directive, have significantly driven the adoption of bioplastic packaging. This directive aims to reduce plastic waste and promote sustainable alternatives, compelling businesses to shift towards bioplastics.

Consumer behavior in Europe also plays a crucial role. European consumers are increasingly eco-conscious and prefer products with minimal environmental impact. This shift in consumer preference has encouraged companies to adopt bioplastic packaging to meet market demands and enhance their brand image. Europe has been a hub for innovation in bioplastics. Substantial investments in research and development have led to advancements in bioplastic materials, making them more competitive with traditional plastics in terms of performance and cost.

For example, major European companies such as BASF and Novamont have developed advanced biodegradable and compostable bioplastics, driving market growth. A case in point is the collaboration between Danone and Nestle, two European giants, with the startup Origin Materials to develop 100% bio-based PET bottles. This initiative exemplifies how Europe's strong regulatory support, consumer demand, and innovative capabilities have positioned it at the forefront of the bioplastic packaging market.

|

Bioplastic Packaging Market Scope |

|

|

Market Size in 2023 |

USD 14.60 Bn. |

|

Market Size in 2030 |

USD 39.55 Bn. |

|

CAGR (2024-2030) |

15.3 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Material Biodegradable Non-biodegradable |

|

By Type Flexible Rigid |

|

|

By Application Food & Beverages Consumer Goods Cosmetic & Personal Care Pharmaceuticals Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Bioplastic Packaging Market

North America Bioplastic Packaging Market Giants

- Eco-Products, Inc. (USA)

- Solegear Bioplastic Technologies Inc. (Canada)

- Green Dot Bioplastics (USA)

- Danimer Scientific (USA)

- NatureWorks LLC (USA)

Europe Bioplastic Packaging Market Key Players

- API S.p.A. (Italy)

- Solvay SA (Belgium)

- Biotec GmbH & Co. KG (Germany)

- BASF SE (Germany)

- Novamont S.p.A. (Italy)

- Biome Bioplastics (United Kingdom)

- Corbion (Netherlands)

- FKuR Kunststoff GmbH (Germany)

- Arkema S.A.(France)

Asia Pacific Bioplastic Packaging Industry Leaders

- Mitsubishi Chemical Corporation (Japan)

- Plantic Technologies Limited (Australia)

Frequently Asked Questions

Increasing awareness about environmental issues such as plastic pollution and climate change, there's a growing demand for sustainable alternatives to traditional plastic packaging.

Investors can capitalize on opportunities in the Bioplastic Packaging market by focusing on companies that are leading in innovation trends such as advanced technology adoption. Additionally, investing in companies with strong distribution channels and a growing online retail presence can offer the potential for growth as the market grows globally.

The Market size was valued at USD 14.60 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 15.3 % from 2024 to 2030, reaching nearly USD 39.55 Billion.

The segments covered in the market report are, Material, Type, and Application region.

1. Bioplastic Packaging Market: Research Methodology

2. Bioplastic Packaging Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Bioplastic Packaging Market: Dynamics

3.1. Bioplastic Packaging Market Trends

3.2. Bioplastic Packaging Market Dynamics

3.2.1.1. Drivers

3.2.1.2. Restraints

3.2.1.3. Opportunities

3.2.1.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technology Roadmap

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

4. Bioplastic Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

4.1. Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

4.1.1. Biodegradable

4.1.2. Non-biodegradable

4.2. Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

4.2.1. Flexible

4.2.2. Rigid

4.3. Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

4.3.1. Food & Beverages

4.3.2. Consumer Goods

4.3.3. Cosmetic & Personal Care

4.3.4. Pharmaceuticals

4.3.5. Others

4.4. Bioplastic Packaging Market Size and Forecast, by Region (2023-2030)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Bioplastic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

5.1.1. Biodegradable

5.1.2. Non-biodegradable

5.2. North America Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

5.2.1. Flexible

5.2.2. Rigid

5.3. North America Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

5.3.1. Food & Beverages

5.3.2. Consumer Goods

5.3.3. Cosmetic & Personal Care

5.3.4. Pharmaceuticals

5.3.5. Others

5.4. North America Bioplastic Packaging Market Size and Forecast, by Country (2023-2030)

5.4.1. United States

5.4.1.1. United States Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

5.4.1.1.1. Biodegradable

5.4.1.1.2. Non-biodegradable

5.4.1.2. United States Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

5.4.1.2.1. Flexible

5.4.1.2.2. Rigid

5.4.1.3. United States Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

5.4.1.3.1. Food & Beverages

5.4.1.3.2. Consumer Goods

5.4.1.3.3. Cosmetic & Personal Care

5.4.1.3.4. Pharmaceuticals

5.4.1.3.5. Others

5.4.2. Canada

5.4.2.1. Canada Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

5.4.2.1.1. Biodegradable

5.4.2.1.2. Non-biodegradable

5.4.2.2. Canada Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

5.4.2.2.1. Flexible

5.4.2.2.2. Rigid

5.4.2.3. Canada Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

5.4.2.3.1. Food & Beverages

5.4.2.3.2. Consumer Goods

5.4.2.3.3. Cosmetic & Personal Care

5.4.2.3.4. Pharmaceuticals

5.4.2.3.5. Others

5.4.3. Mexico

5.4.3.1. Mexico Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

5.4.3.1.1. Biodegradable

5.4.3.1.2. Non-biodegradable

5.4.3.2. Mexico Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

5.4.3.2.1. Flexible

5.4.3.2.2. Rigid

5.4.3.3. Mexico Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

5.4.3.3.1. Food & Beverages

5.4.3.3.2. Consumer Goods

5.4.3.3.3. Cosmetic & Personal Care

5.4.3.3.4. Pharmaceuticals

5.4.3.3.5. Others

6. Europe Bioplastic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.2. Europe Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.3. Europe Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4. Europe Bioplastic Packaging Market Size and Forecast, by Country (2023-2030)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.1.2. United Kingdom Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.1.3. United Kingdom Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.2. France

6.4.2.1. France Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.2.2. France Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.2.3. France Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.3. Germany

6.4.3.1. Germany Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.3.2. Germany Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.3.3. Germany Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.4. Italy

6.4.4.1. Italy Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.4.2. Italy Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.4.3. Italy Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.5. Spain

6.4.5.1. Spain Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.5.2. Spain Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.5.3. Spain Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.6. Russia

6.4.6.1. Russia Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.6.2. Russia Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.6.3. Russia Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.7. Austria

6.4.7.1. Austria Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.7.2. Austria Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.7.3. Austria Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

6.4.8.2. Rest of Europe Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

6.4.8.3. Rest of Europe Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7. Asia Pacific Bioplastic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.2. Asia Pacific Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.3. Asia Pacific Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4. Asia Pacific Bioplastic Packaging Market Size and Forecast, by Country (2023-2030)

7.4.1. China

7.4.1.1. China Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.1.2. China Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.1.3. China Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4.2. S Korea

7.4.2.1. S Korea Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.2.2. S Korea Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.2.3. S Korea Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4.3. Japan

7.4.3.1. Japan Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.3.2. Japan Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.3.3. Japan Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4.4. India

7.4.4.1. India Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.4.2. India Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.4.3. India Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4.5. Australia

7.4.5.1. Australia Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.5.2. Australia Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.5.3. Australia Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4.6. ASEAN

7.4.6.1. ASEAN Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.6.2. ASEAN Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.6.3. ASEAN Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

7.4.7. Rest of Asia Pacific

7.4.7.1. Rest of Asia Pacific Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

7.4.7.2. Rest of Asia Pacific Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

7.4.7.3. Rest of Asia Pacific Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

8. Middle East and Africa Bioplastic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

8.2. Middle East and Africa Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

8.3. Middle East and Africa Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

8.4. Middle East and Africa Bioplastic Packaging Market Size and Forecast, by Country (2023-2030)

8.4.1. South Africa

8.4.1.1. South Africa Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

8.4.1.2. South Africa Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

8.4.1.3. South Africa Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

8.4.2. GCC

8.4.2.1. GCC Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

8.4.2.2. GCC Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

8.4.2.3. GCC Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

8.4.3. Nigeria

8.4.3.1. Nigeria Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

8.4.3.2. Nigeria Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

8.4.3.3. Nigeria Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

8.4.4. Rest of ME&A

8.4.4.1. Rest of ME&A Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

8.4.4.2. Rest of ME&A Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

8.4.4.3. Rest of ME&A Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

9. South America Bioplastic Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

9.2. South America Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

9.3. South America Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

9.4. South America Bioplastic Packaging Market Size and Forecast, by Country (2023-2030)

9.4.1. Brazil

9.4.1.1. Brazil Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

9.4.1.2. Brazil Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

9.4.1.3. Brazil Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

9.4.2. Argentina

9.4.2.1. Argentina Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

9.4.2.2. Argentina Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

9.4.2.3. Argentina Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

9.4.3. Rest Of South America

9.4.3.1. Rest Of South America Bioplastic Packaging Market Size and Forecast, by Material (2023-2030)

9.4.3.2. Rest Of South America Bioplastic Packaging Market Size and Forecast, by Type (2023-2030)

9.4.3.3. Rest Of South America Bioplastic Packaging Market Size and Forecast, by Application (2023-2030)

10. Global Bioplastic Packaging Market: Competitive Landscape

10.1. MMR Competition Matrix

10.2. Competitive Landscape

10.3. Key Players Benchmarking

10.3.1. Company Name

10.3.2. Product Segment

10.3.3. End-user Segment

10.3.4. Revenue (2023)

10.3.5. Headquarter

10.4. Market Structure

10.4.1. Market Leaders

10.4.2. Market Followers

10.4.3. Emerging Players

11. Company Profile: Key Players

11.1. Eco-Products, Inc. (USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Solegear Bioplastic Technologies Inc. (Canada)

11.3. Green Dot Bioplastics (USA)

11.4. Danimer Scientific (USA)

11.5. NatureWorks LLC (USA)

11.6. API S.p.A. (Italy)

11.7. Solvay SA (Belgium)

11.8. Biotec GmbH & Co. KG (Germany)

11.9. BASF SE (Germany)

11.10. Novamont S.p.A. (Italy)

11.11. Biome Bioplastics (United Kingdom)

11.12. Corbion (Netherlands)

11.13. FKuR Kunststoff GmbH (Germany)

11.14. Arkema S.A.(France)

11.15. Mitsubishi Chemical Corporation (Japan)

11.16. Plantic Technologies Limited (Australia)

12. Key Findings

13. Industry Recommendations