Blood Grouping Reagents Market: Global Industry Analysis and Forecast (2024-2030)

The Blood Grouping Reagents Market size was valued at USD 2.2 Bn. in 2023 and the total Global Blood Grouping Reagents revenue is expected to grow at a CAGR of 8.9 % from 2024 to 2030, reaching nearly USD 4.07 Bn. by 2030.

Format : PDF | Report ID : SMR_2056

Blood Grouping Reagents Market Overview

The Blood Grouping Reagents Market constitutes a vital segment within the healthcare industry, focusing on the production, distribution, and sale of reagents indispensable for blood typing and cross-matching in transfusion and transplantation procedures. These reagents are instrumental in safeguarding the integrity of blood transfusions, ensuring compatibility, and pre-empting potential risks of adverse transfusion reactions. The market's growth is intrinsically linked to the escalating global demand for blood transfusions, driven by the prevalence of blood-related disorders such as anemia, hemophilia, and blood cancers.

The comprehensive report researches the dynamic landscape of the blood grouping reagents Market, offering detailed analysis and strategic insights for stakeholders. It investigates the nuanced trends, drivers, challenges, and opportunities in the sector. The report uses a meticulous methodology combining primary and secondary research to reveal complex market dynamics, consumer behavior, regulatory frameworks, and competitive landscapes. It accurately outlines the market's current dimensions, growth patterns, size, and the nuanced trends that use significant influence.

Central to the healthcare sector, the blood grouping reagents market furnishes indispensable tools for transfusion medicine, enabling safe blood transfusions through meticulous blood compatibility testing. These reagents are pivotal in delineating ABO and Rh blood groups, alongside identifying minor blood group antigens, thus facilitating the judicious selection of compatible blood units for transfusion. With a surge in demand for blood products fueled by increased surgical interventions, trauma cases, and the prevalence of chronic ailments necessitating transfusions, the market for blood grouping reagents is composed for sustained growth.

- For Instance, according to givingblood.org, in 2023, 4.5 million Americans needs blood transfusion each year. 43,000 pints amount of donated blood is used each day in the U.S. and Canada.

To get more Insights: Request Free Sample Report

Blood Grouping Reagents Market Dynamics

Rising Burden of Chronic Diseases Drives Blood Grouping Reagent Market

The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, is significantly driving the demand for blood grouping reagents. These chronic conditions often require ongoing medical intervention, including blood transfusions and other blood-related treatments, which necessitate accurate and reliable blood typing. The American Heart Association reports that the burden of cardiovascular diseases continues to rise, driving the need for more blood grouping reagents in clinical settings

- According to the CDC, six in ten adults in the U.S. suffer from at least one chronic disease, and four in ten have two or more. These conditions often necessitate regular blood transfusions and diagnostic testing, underscoring the need for accurate blood typing.

- According to the SMR analysis, over 34 million Americans have diabetes, and the disease's complications often lead to conditions such as anemia, necessitating frequent blood transfusions

As the incidence rate of these diseases rises, hospitals and clinics are seeing a higher volume of blood tests and transfusions.

- For instance, the American Cancer Society reports that cancer treatments frequently involve blood transfusions to manage anemia and support patients during chemotherapy. This has led to a increase in the production rate and sales volume of blood grouping reagents, essential for ensuring patient safety and effective treatment.

Recent advancements in medical technology and increased healthcare investments have also contributed to the growth of the blood grouping reagent market. Enhanced diagnostic capabilities and greater access to healthcare services have led to more frequent and accurate blood typing, boosting Blood Grouping Reagents market revenue. This development further supports the growth of the blood grouping reagent market, enhancing market revenue and ensuring that healthcare providers can meet the rising demand driven by the increasing prevalence of chronic diseases.

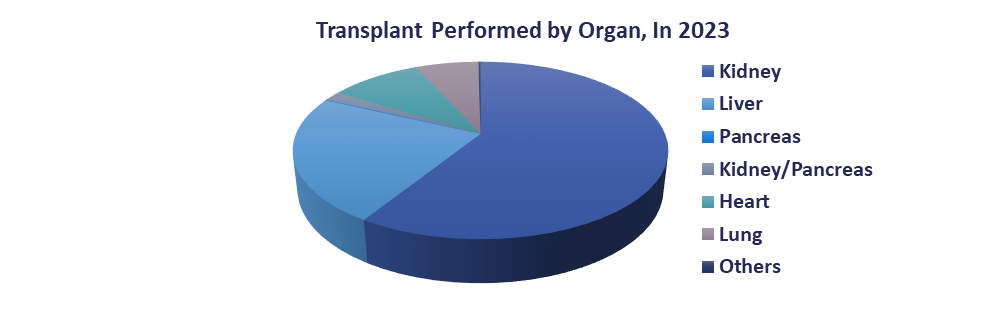

Rising Need for Organ and Blood Transplants

The rising need for organ and blood transplants is a significant driver for the blood grouping reagents market. Advances in medical science have led to an increase in the number of organ transplant surgeries, necessitating precise blood typing to prevent rejection and ensure compatibility. This surge in demand directly influences the market revenue for blood grouping reagents, as hospitals and medical facilities require reliable and accurate reagents for these critical procedures.

Organ transplants, which includes kidneys, liver, heart, and lungs, require the matching of blood types to prevent complications. Blood transfusions, frequently needed during and after these surgeries, further amplify the demand for blood grouping reagents. The global shortage of donor organs means that every transplant is carefully matched to optimize the chances of success, thereby increasing the reliance on accurate blood grouping reagents.

The profitability in this market is underscored by the high profit margins associated with medical reagents. As the healthcare sector continues to grow and more patients receive life-saving transplants, the demand for precise blood grouping reagents will likely continue to rise, driving Blood Grouping Reagents market growth and increasing revenue potential for companies in this sector.

- According to SMR Analysis, 46,000+ transplants were performed in 2023.

- In 2023, the United States achieved a record-breaking 46,632 organ transplants, reflecting a nearly 9% increase in deceased donor transplants from the previous year. This milestone was made possible by the generosity of over 16,000 deceased donors and the continuous efforts of the organ donation and transplant community?

- According to the American Red Cross, an estimated 6.8 million people in the U.S. donate blood with almost 13.6 million units of whole blood and RBCs collected in a year further increasing the blood grouping market

- According to the United Network for Organ Sharing (UNOS), it has implemented several initiatives to increase equity and access to transplants. These include removing race from kidney function measurements and enhancing policies to ensure quicker and more efficient organ matching and transportation.

Concerns over Efficiency and Accuracy of Blood Grouping Test Kits

The efficiency and accuracy of blood grouping test kits remain a significant concern in the medical community. Accurate blood typing is crucial for patient safety, particularly in emergencies and for those requiring regular transfusions due to chronic diseases like diabetes and cancer. The CDC emphasizes the importance of precise blood typing to prevent adverse transfusion reactions. Recent evaluations have emphasized variability in test kit performance, raising issues about their reliability.

- According to MMR analysis, discrepancies in results leads to serious clinical implications, including delayed or inappropriate treatment.

- A report from the FDA has urged manufacturers to enhance quality control measures to ensure consistent test kit accuracy.

- For example, in 2023, a recall of a popular blood grouping test kit was issued due to false-negative results, underscoring the critical need for rigorous testing and validation of these kits before they reach the market.

This incident has intensified calls for stricter regulatory oversight to guarantee that all blood grouping reagents meet high standards of accuracy and efficiency, safeguarding patient health concerns over Efficiency and Accuracy of Blood Grouping Test Kits.

Market Trends of Blood Grouping Reagents

Technological advancements in the Blood Grouping Reagents Market have revolutionized blood typing and compatibility testing, enhancing efficiency, accuracy, and safety in transfusion medicine. Some notable advancements include:

PCR-based and microarray techniques: These molecular methods offer high-throughput capabilities and precise identification of blood group antigens, enabling comprehensive blood typing with minimal sample volumes and reduced turnaround times.

Massively parallel sequencing (MPS) techniques: MPS technologies allow for simultaneous analysis of multiple blood group genes, providing comprehensive and accurate blood typing results. This approach is particularly valuable for rare blood group detection and compatibility assessment in complex cases.

Automation and robotics: Automated platforms streamline blood grouping procedures, reducing manual errors and enhancing workflow efficiency. Integrated robotics further improve sample handling, reagent dispensing, and data management, optimizing laboratory operations.

Enhanced reagent formulations: Continuous innovation in reagent formulations improves specificity, sensitivity, and stability, ensuring reliable and consistent blood typing results. Advanced reagents also offer extended shelf life and compatibility with various testing platforms.

Point-of-care testing (POCT) solutions: POCT devices enable rapid blood typing at the bedside or in remote settings, facilitating timely transfusion decisions and improving patient outcomes, especially in emergencies.

Value Chain Analysis of Blood Grouping Reagents

The value chain for blood grouping reagents contains multiple stages, starting from research and development where innovative techniques are devised, followed by manufacturing where reagents are produced in bulk. Distribution channels ensure efficient delivery to healthcare facilities, while quality control processes maintain product integrity. Healthcare professionals utilize these reagents for blood typing and compatibility testing, ensuring safe transfusions. Post-transfusion monitoring and adverse event reporting complete the chain, providing feedback for continuous improvement. Each stage adds value to the final product, safeguarding patient health and optimizing transfusion outcomes.

Blood Grouping Reagents Market Segment Analysis

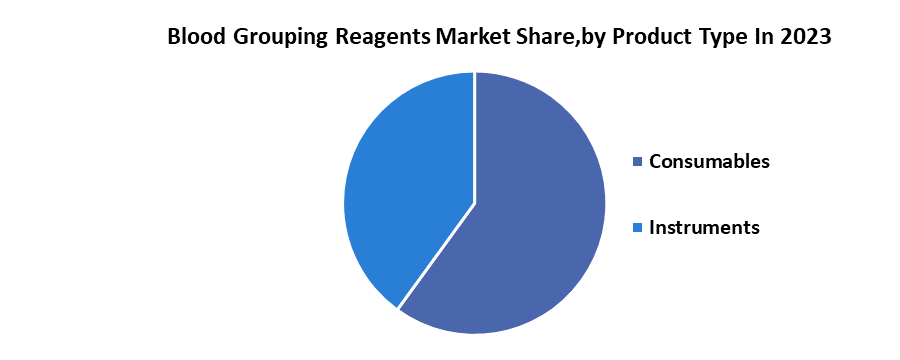

Based on the Product Type, the consumables segment held the largest market share of about 68.1% in the Blood Grouping Reagents Market in 2023. According to the SMR analysis, the segment is expected to grow at a CAGR of XXX % during the forecast period and maintain its dominance till 2030. The consumables segment dominates the blood grouping reagents market, driven by the increasing demand for blood typing in medical diagnostics and transfusion procedures. Consumables, which include antisera, red blood cells, and anti-human globulin, are essential for accurate and efficient blood typing and cross-matching.

- According to a report by the National Center for Biotechnology Information (NCBI), the consistent need for these reagents in routine blood tests and emergency transfusions has spurred market growth.

The American Association of Blood Banks (AABB) states that advancements in consumable technologies are enhancing the precision and speed of blood grouping, further fueling their adoption. The U.S. Food and Drug Administration (FDA) indicates an uptick in approvals for new blood grouping reagents, underscoring the segment's expanding role.

- For example, the FDA recently approved a next-generation antisera product, which offers improved reliability and compatibility testing. This trend is expected to continue, driven by the rising prevalence of chronic diseases and the consequent increase in blood transfusion needs.

Blood Grouping Reagents Market Regional Analysis

North America Leads the Charge in Blood Grouping Reagents Market, Driven by High Demand and Established Infrastructure

North America has dominated the Blood Grouping Reagents Market, which held the largest market share accounting for XXX% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. The North America blood grouping reagents market, driven by the high demand for blood transfusions and the presence of well-established healthcare infrastructure. The region's blood banks and hospitals rely heavily on these reagents to ensure safe and compatible blood transfusions, which is crucial for patients undergoing surgeries and treatments this demand is met by the presence of major players such as Bio-Rad Laboratories and Immucor, Inc., which have established strong distribution networks in the region.

- In 2021, around 6.5 million people in the U.S. donated blood, with around 1.7 million of these people donating for the first time. Those with blood type O-negative are universal blood donors, meaning their blood can be transfused for any blood type. Therefore, this blood type is the most requested by hospitals. However, only about 7 percent of the U.S. population has this blood type.

- In 2022, the United States imported $1.4 billion worth of blood grouping reagents, while exporting $0.5 billion, whereas Canada imported $0.2 billion and exported $0.1 billion

- In 2023, Bio-Rad Laboratories launched a new blood grouping reagent, further expanding its product portfolio.

- Immucor, Inc. partnered with a leading blood bank to improve blood typing efficiency and accuracy

Blood Grouping Reagents Market Competitive Landscape

The blood grouping reagents market is characterized by the presence of key players, including Bio-Rad Laboratories, Ortho Clinical Diagnostics, and Grifols. These companies focus on product innovation, quality control, and regulatory compliance to maintain their competitive edge. For instance, Bio-Rad's comprehensive portfolio and robust distribution network have solidified its market position. Partnerships and collaborations, such as Grifols' agreements with various healthcare providers, enhance market reach and service quality. Recent advancements in reagent accuracy and efficiency, driven by regulatory standards from agencies like the FDA and CDC, continue to shape the competitive dynamics

- In 2023, Arena BioScien has recently launched a new blood grouping reagent, further expanding its product portfolio

- In July 2023, ARKRAY Inc. has recently partnered with a leading blood bank to improve blood typing efficiency and accuracy.

- Jan 10, 2022, Calibre Scientific has been declared the acquisition of Medline Scientific, a distributor of laboratory consumables and equipment with headquarters in Oxfordshire, United Kingdom.

- In July 2023, Calibre Scientific Inc. has recently partnered with a leading healthcare provider to enhance research and development in the field of blood grouping reagents.

- In July 2023, Merck KGaA has recently launched a new product line focused on improving blood typing efficiency and accuracy.

- In October 2020, Alba Bioscience Limited received approval from FDA for ALBAclone Anti-C (Human/Murine Monoclonal), ALBAclone, Anti-e, (Human/Murine Monoclonal), and ALBAclone Anti-Cw (Human/Murine Monoclonal).

- On Oct 20, 2020, Calibre Scientific Acquires Blood Grouping Reagent Manufacturer Lorne Laboratories

- October 24, 2018 – Agena Bioscience (Agena) and DaRui Biotechnology (DaRui) declared that the MassARRAY® System has formally passed the registration application of Guangdon Food and Drug Administration, becoming the first CFDA approved MALDI-TOF mass spectrometry-system to directly detect nucleic acids for in vitro diagnostics in China.

Blood Grouping Reagents Market Recent Development

- On 16th May, Thermo Fisher Scientific put forward a DNA-based test offering much more precise identification of blood and its potential compatibility—going much further than the traditional positive and negative blood types of A, B, AB, and O.

- In July 2021, PerkinElmer acquired BioLegend, a leading developer of antibodies and other research tools, by signing a $5.25 Billion deal becoming a significant supplier of reagents and supplies for the development of diagnostic tests and precision medicine.

- In July 2020, Merck KGaA invested 18 million euros in new life science laboratory in Switzerland. The laboratory facility is to be built in Buchs (Switzerland) to support the growth of the company in the reference materials.

- In April 2018, Quotient Limited received FDA approval for U.S. commercialization of seven new blood bank reagents

|

Blood Grouping Reagents Market Scope |

|

|

Market Size in 2023 |

USD 2.2 Bn. |

|

Market Size in 2030 |

USD 4.07 Bn. |

|

CAGR (2024-2030) |

8.9% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

|

by Type Blood Group A Reagents Blood Group B Reagents Blood Group O Reagents Others |

|

|

by Product Consumables Instruments |

|

|

by Test Type Blood Group and Phenotype Antibody Screening Cross-matching Tests Antibody Identification Coombs Tests Antigen Typing |

|

|

By Technique PCR-based and microarray techniques Assay-based techniques Massively parallel sequencing techniques Serology Others |

|

|

By End User Hospitals and blood banks Clinical laboratories Academic and research institutes Others |

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Blood Grouping Reagents Market

- Merck KGaA (Germany)

- Beckman Coulter, Inc (US)

- Haemokinesis Pty Ltd (Australia)

- MTC Med. Produkte GmbH (Germany)

- DAY medical SA (Switzerland)

- Ortho Clinical Diagnostics (US)

- Yuvraj Biobiz Incubator India Pvt (India)

- Aikang (China)

- Arena Bio Scien

- ARKRAY Inc.(Japan)

- Atlas Medical GmbH (Germany)

- BAG Diagnostics GmbH (Germany)

- Calibre Scientific Inc. (US)

- Danaher Corp. (US)

- Grifols SA (Spain)

- QuidelOrtho Corp. (US)

- Thermo Fisher Scientific Inc. (US)

- Fortress Diagnostics (UK)

- Paragon Care Ltd. (Australia)

- XXX.Inc

Frequently Asked Questions

North America is expected to hold the highest Blood Grouping Reagents Market share.

The Blood Grouping Reagents Market size was valued at USD 2.2 Billion in 2023 reaching nearly USD 4.07 Billion in 2030.

Increasing demand for advanced diagnostics and personalized medicine. The rise in chronic diseases and the growing number of surgical procedures worldwide opportunity for an accurate blood grouping reagent market.

The segments covered in the Blood Grouping Reagents Market report are based on Type, Product Type, Test Type, techniques, and End User.

1. Blood Grouping Reagents Market: Research Methodology

2. Blood Grouping Reagents Market: Executive Summary

3. Blood Grouping Reagents Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Import and export of Blood Grouping Reagents

5. Blood Grouping Reagents Market: Dynamics

5.1. Market Drivers

5.2. Market Trends

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Regulatory Landscape by Region

5.9.1. North America

5.9.2. Europe

5.9.3. Asia Pacific

5.9.4. Middle East and Africa

5.9.5. South America

6. Blood Grouping Reagents Market Size and Forecast by Segments (by value Units)

6.1. Blood Grouping Reagents Market Size and Forecast, by Type (2023-2030)

6.1.1. Blood Group A Reagents

6.1.2. Blood Group B Reagents

6.1.3. Blood Group O Reagents

6.1.4. Others

6.2. Blood Grouping Reagents Market Size and Forecast, by Product (2023-2030)

6.2.1. Consumables

6.2.2. Instruments

6.3. Blood Grouping Reagents Market Size and Forecast, by Test Type (2023-2030)

6.3.1. Blood Group and Phenotype

6.3.2. Antibody Screening

6.3.3. Cross-matching Tests

6.3.4. Antibody Identification

6.3.5. Coombs Tests

6.3.6. Antigen Typing

6.4. Blood Grouping Reagents Market Size and Forecast, by Technique (2023-2030)

6.4.1. PCR-based and microarray techniques

6.4.2. Assay-based techniques

6.4.3. Massively parallel sequencing techniques

6.4.4. Serology

6.4.5. Others

6.5. Blood Grouping Reagents Market Size and Forecast, by End-user (2023-2030)

6.5.1. Hospitals and blood banks

6.5.2. Clinical laboratories

6.5.3. Academic and research institutes

6.5.4. Others

6.6. Blood Grouping Reagents Market Size and Forecast, by Region (2023-2030)

6.6.1. North America

6.6.2. Europe

6.6.3. Asia Pacific

6.6.4. Middle East and Africa

6.6.5. South America

7. North America Blood Grouping Reagents Market Size and Forecast (by Value Units)

7.1. North America Blood Grouping Reagents Market Size and Forecast, by Type (2023-2030)

7.1.1. Blood Group A Reagents

7.1.2. Blood Group B Reagents

7.1.3. Blood Group O Reagents

7.1.4. Others

7.2. North America Blood Grouping Reagents Market Size and Forecast, by Product (2023-2030)

7.2.1. Consumables

7.2.2. Instruments

7.3. North America Blood Grouping Reagents Market Size and Forecast, by Test Type (2023-2030)

7.3.1. Blood Group and Phenotype

7.3.2. Antibody Screening

7.3.3. Cross-matching Tests

7.3.4. Antibody Identification

7.3.5. Coombs Tests

7.3.6. Antigen Typing

7.4. North America Blood Grouping Reagents Market Size and Forecast, by Technique (2023-2030)

7.4.1. PCR-based and microarray techniques

7.4.2. Assay-based techniques

7.4.3. Massively parallel sequencing techniques

7.4.4. Serology

7.4.5. Others

7.5. North America Blood Grouping Reagents Market Size and Forecast, by End-user (2023-2030)

7.5.1. Hospitals and blood banks

7.5.2. Clinical laboratories

7.5.3. Academic and research institutes

7.5.4. Others

7.6. North America Blood Grouping Reagents Market Size and Forecast, by Country (2023-2030)

7.6.1. United States

7.6.2. Canada

7.6.3. Mexico

8. Europe Blood Grouping Reagents Market Size and Forecast (by Value Units)

8.1. Europe Blood Grouping Reagents Market Size and Forecast, by Type (2023-2030)

8.1.1.1. Blood Group A Reagents

8.1.1.2. Blood Group B Reagents

8.1.1.3. Blood Group O Reagents

8.1.1.4. Others

8.2. Europe Blood Grouping Reagents Market Size and Forecast, by Product (2023-2030)

8.2.1.1. Consumables

8.2.1.2. Instruments

8.3. Europe Blood Grouping Reagents Market Size and Forecast, by Test Type (2023-2030)

8.3.1. Blood Group and Phenotype

8.3.2. Antibody Screening

8.3.3. Cross-matching Tests

8.3.4. Antibody Identification

8.3.5. Coombs Tests

8.3.6. Antigen Typing

8.4. Europe Blood Grouping Reagents Market Size and Forecast, by Technique (2023-2030)

8.4.1. PCR-based and microarray techniques

8.4.2. Assay-based techniques

8.4.3. Massively parallel sequencing techniques

8.4.4. Serology

8.4.5. Others

8.5. Europe Blood Grouping Reagents Market Size and Forecast, by End-user (2023-2030)

8.5.1. Hospitals and blood banks

8.5.2. Clinical laboratories

8.5.3. Academic and research institutes

8.5.4. Others

8.6. Europe Blood Grouping Reagents Market Size and Forecast, by Country (2023-2030)

8.6.1. UK

8.6.2. France

8.6.3. Germany

8.6.4. Italy

8.6.5. Spain

8.6.6. Sweden

8.6.7. AustriaValue

8.6.8. Rest of Europe

9. Asia Pacific Blood Grouping Reagents Market Size and Forecast (by Value Units)

9.1. Asia Pacific Blood Grouping Reagents Market Size and Forecast, by Type (2023-2030)

9.1.1. Blood Group A Reagents

9.1.2. Blood Group B Reagents

9.1.3. Blood Group O Reagents

9.1.4. Others

9.2. Asia Pacific Blood Grouping Reagents Market Size and Forecast, by Product (2023-2030)

9.2.1. Consumables

9.2.2. Instruments

9.3. Asia Pacific Blood Grouping Reagents Market Size and Forecast, by Test Type (2023-2030)

9.3.1. Blood Group and Phenotype

9.3.2. Antibody Screening

9.3.3. Cross-matching Tests

9.3.4. Antibody Identification

9.3.5. Coombs Tests

9.3.6. Antigen Typing

9.4. Asia Pacific Blood Grouping Reagents Market Size and Forecast, by Technique (2023-2030)

9.4.1. PCR-based and microarray techniques

9.4.2. Assay-based techniques

9.4.3. Massively parallel sequencing techniques

9.4.4. Serology

9.4.5. Others

9.5. Asia Pacific Blood Grouping Reagents Market Size and Forecast, by End-user (2023-2030)

9.5.1. Hospitals and blood banks

9.5.2. Clinical laboratories

9.5.3. Academic and research institutes

9.5.4. Others

9.6. Asia Pacific Blood Grouping Reagents Market Size and Forecast, by Country (2023-2030)

9.6.1. China

9.6.2. S Korea

9.6.3. Japan

9.6.4. India

9.6.5. Australia

9.6.6. Indonesia

9.6.7. Malaysia

9.6.8. Vietnam

9.6.9. Taiwan

9.6.10. Bangladesh

9.6.11. Pakistan

9.6.12. Rest of Asia Pacific

10. Middle East and Africa Blood Grouping Reagents Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Blood Grouping Reagents Market Size and Forecast, by Type (2023-2030)

10.1.1.1. Blood Group A Reagents

10.1.1.2. Blood Group B Reagents

10.1.1.3. Blood Group O Reagents

10.1.1.4. Others

10.1.2. Middle East and Africa Blood Grouping Reagents Market Size and Forecast, by Product (2023-2030)

10.1.2.1. Consumables

10.1.2.2. Instruments

10.2. Middle East and Africa Blood Grouping Reagents Market Size and Forecast, by Test Type (2023-2030)

10.2.1. Blood Group and Phenotype

10.2.2. Antibody Screening

10.2.3. Cross-matching Tests

10.2.4. Antibody Identification

10.2.5. Coombs Tests

10.2.6. Antigen Typing

10.3. Middle East and Africa Blood Grouping Reagents Market Size and Forecast, by Technique (2023-2030)

10.3.1. PCR-based and microarray techniques

10.3.2. Assay-based techniques

10.3.3. Massively parallel sequencing techniques

10.3.4. Serology

10.3.5. Others

10.4. Middle East and Africa Blood Grouping Reagents Market Size and Forecast, by End-user (2023-2030)

10.4.1. Hospitals and blood banks

10.4.2. Clinical laboratories

10.4.3. Academic and research institutes

10.4.4. Others

10.5. Middle East and Africa Blood Grouping Reagents Market Size and Forecast, by Country (2023-2030)

10.5.1. South Africa

10.5.2. GCC

10.5.3. Egypt

10.5.4. Nigeria

10.5.5. Rest of ME&A

11. South America Blood Grouping Reagents Market Size and Forecast (by Value Units)

11.1. South America Blood Grouping Reagents Market Size and Forecast, by Type (2023-2030)

11.1.1. Blood Group A Reagents

11.1.2. Blood Group B Reagents

11.1.3. Blood Group O Reagents

11.1.4. Others

11.2. South America Blood Grouping Reagents Market Size and Forecast, by Product (2023-2030)

11.2.1. Consumables

11.2.2. Instruments

11.3. South America Blood Grouping Reagents Market Size and Forecast, by Test Type (2023-2030)

11.3.1. Blood Group and Phenotype

11.3.2. Antibody Screening

11.3.3. Cross-matching Tests

11.3.4. Antibody Identification

11.3.5. Coombs Tests

11.3.6. Antigen Typing

11.4. South America Blood Grouping Reagents Market Size and Forecast, by Technique (2023-2030)

11.4.1. PCR-based and microarray techniques

11.4.2. Assay-based techniques

11.4.3. Massively parallel sequencing techniques

11.4.4. Serology

11.4.5. Others

11.5. South America Blood Grouping Reagents Market Size and Forecast, by End-user (2023-2030)

11.5.1.1. Hospitals and blood banks

11.5.1.2. Clinical laboratories

11.5.1.3. Academic and research institutes

11.5.1.4. Others

11.5.2. South America Blood Grouping Reagents Market Size and Forecast, by Country (2023-2030)

11.5.3. Brazil

11.5.4. Argentina

11.5.5. Rest of South America

12. Company Profile: Key players

12.1. Merck KGaA

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Beckman Coulter, Inc

12.3. Haemokinesis Pty Ltd

12.4. MTC Med. Produkte GmbH

12.5. DAY medical SA

12.6. Ortho Clinical Diagnostics

12.7. Yuvraj Biobiz Incubator India Pvt

12.8. Aikang

12.9. Arena Bio Scien

12.10. ARKRAY Inc.

12.11. Atlas Medical GmbH

12.12. BAG Diagnostics GmbH

12.13. Calibre Scientific Inc.

12.14. Danaher Corp.

12.15. Grifols SA

12.16. QuidelOrtho Corp.

12.17. Thermo Fisher Scientific Inc.

12.18. Fortress Diagnostics

12.19. Paragon Care Ltd.

12.20. XXX.Inc

13. Key Findings

14. Industry Recommendation