Bovine Gelatin Market: Global Industry Analysis and Forecast (2024-2030)

Bovine Gelatin Market size was valued at USD 2.71 Bn. in 2023 and the Bovine Gelatin revenue is expected to grow at a CAGR of 6.28% from 2024 to 2030, reaching nearly USD 4.15 Bn. by 2030.

Format : PDF | Report ID : SMR_2100

Bovine Gelatin Market Overview:

Bovine-derived edible gelatin is prepared from collagen found in the flesh of cattle. The food grade gelatin makes this product applicable in many uses within the food industry. Bovine gelatin is widely applied in the sectors of food, pharmaceuticals, nutraceuticals and photography as well. Biotechnology however is transforming Bovine Gelatin Market segment by introducing more efficient and sustainable production methods. Additionally, research is underway to synthesize bovine collagen with specific qualities using recombinant DNA technology, which leads to even more tailored gelatin products.

According to historical data, the food and beverage industry used to be the largest consumer of bovine gelatin. However, promising new uses of bovine gelatin are emerging. In pharmaceuticals, bovine gelatin is a crucial element in capsules and tablets, offering a safe and biocompatible method of drug delivery. The haemostatic properties of this product have applications in wound dressing items. The rise in demand for nutraceuticals that merge food and medicinal properties has catalysed the market of bovine gelatin. This development is in line with its ability to enhance joint health and gut health. Manufacturers are capitalizing on this by producing a variety of collagen-based nutraceutical products.

The market is continually changing because of technological advancements in manufacturing processes. One significant aspect is the emphasis on reducing environmental effect. Manufacturers are looking into ways to use more cattle by-products and adopt cleaner production processes. In addition, research is being conducted to find alternative collagen sources, which reduce dependency on bovine collagen sources.

To get more Insights: Request Free Sample Report

Bovine Gelatin Market Dynamics:

Wide Use in Food Industry and Growing Nutraceutical and Pharmaceutical Industries is Driving the Bovine Gelatin Market.

Because of its gelling, stabilising, and thickening qualities, bovine gelatin is frequently used in the food industry to make desserts, confectionery, dairy goods, and meat products. The need for food is rising because of the growing industry. Functional foods and beverages that provide health advantages beyond basic diet are becoming more and more popular with consumers. Because of its high protein content and additional health advantages, bovine gelatin is a widely used ingredient in this industry. Because of its binding and gelling qualities, bovine gelatin is used in the pharmaceutical and nutraceutical sectors in the form of capsules, tablets, and other forms. The need for bovine gelatin is increased by the growth of these sectors.

Customers who desire natural and identifiable ingredients are increasingly drawn to clean label products. As a natural product, bovine gelatin fits right into this trend. Also, because of its advantageous qualities, bovine gelatin is utilised in the personal care and cosmetics business for usage in skin care, hair care, and other cosmetic goods. Bovine gelatin has more uses and is more widely accepted across a range of sectors because to advancements in processing methods and quality enhancements. The demand for gelatin is being driven by rising consumer knowledge of its health benefits, including its function in digestion, skin health, and joint and bone health. All these factors together are driving the bovine gelatin market.

Fluctuating Raw Material Prices and Health and Dietary Restrictions are affecting the Bovine Gelatin Market.

The cost and availability of raw resources, like cow hides and bones, have an impact on the price of bovine gelatin. The stability of the market and the total cost of production both are impacted by changes in these prices. The number of customers adhering to vegetarian, vegan, or other dietary regimens that forgo animal products is rising. This restricts the amount of bovine gelatin that these consumer groups purchase. Porcine and fish gelatin, as well as plant-based alternatives like pectin and agar-agar, are becoming more and more popular as bovine gelatin substitutes. The market share of cow gelatin is reduced by these substitutes. Bovine Spongiform Encephalopathy (BSE) is one of the diseases that raises worries because it affect how consumers view and how closely items generated from cows are scrutinised by regulators.

Water use and trash production are two environmental effects of the gelatin making process. Concerns about animal welfare and the usage of animal products also have an impact on market growth, particularly among consumers who are ethically and environmentally sensitive. Strict rules and regulations pertaining to food safety, medications, and cosmetics apply to the bovine gelatin industry. Adhering to these rules is expensive and difficult. High-quality bovine gelatin production necessitates sophisticated infrastructure and equipment, which raises the capital and operating costs considerably. Small-scale manufacturers and new competitors find this difficult to enter into bovine gelatin market. All these factors are hampering the bovine gelatin market.

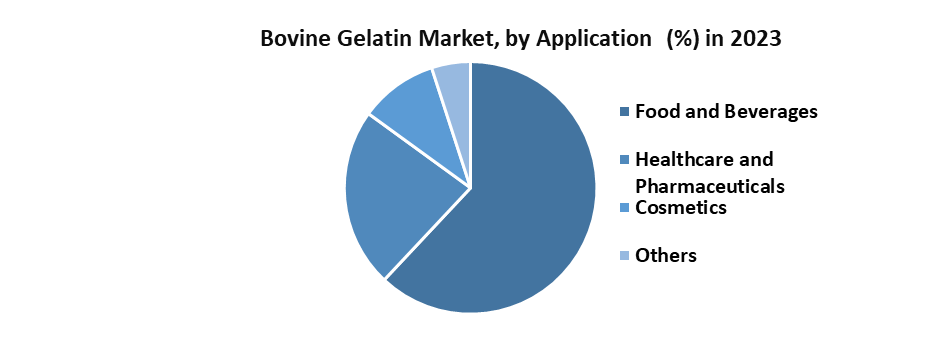

Bovine Gelatin Market Segment Analysis:

By Application, the market is segmented into food and beverages, healthcare and pharmaceuticals, cosmetics, and other categories. The food and beverage segment has the highest market share because of increased demand for natural ingredients in everyday products. The increasing use of various gelatin-based products and other supplements for a protein-rich diet boosts both demand and market growth. Because it gels and improves texture, bovine gelatin is frequently used in gummy candy, marshmallows, and jelly sweets. It enhances the texture and durability of ice creams, yoghurts, and cream cheese.

It is used to improve texture and moisture retention in sausages and other processed meats as a binding agent. Also, it is used to give shape and rigidity to pie fillings, cakes, and pastries. All these factors are fuelling the growth of the segment in the market. Additionally, the ingredient's increasing use in vaccinations, medicines, and tissue engineering applications drives market growth. The increasing prevalence of cosmetic operations, bone-related disorders, and wound healing treatments, together with rising consumer affordability, are driving the rise of this segment.

Bovine Gelatin Market Regional Insight:

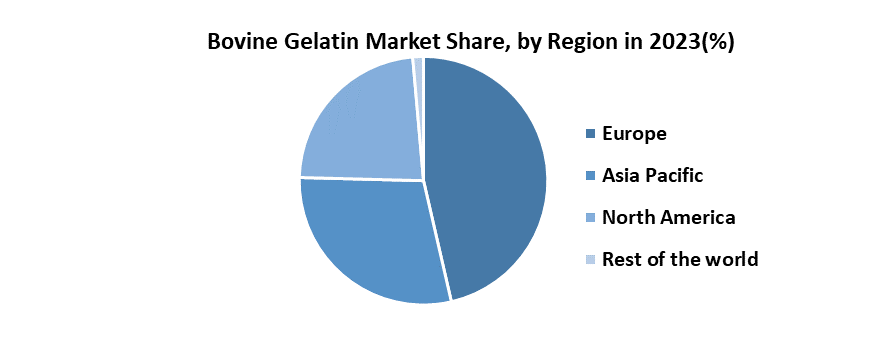

Europe dominated the Bovine Gelatin Market in 2023, with the highest market share. This is mostly owing to increased demand for bovine gelatin from end-use sectors such as cosmetics, pharmaceutical products, food and drinks, and others. Gelatin is in high demand because of its use as a stabilizer in packaged goods and to improve shelf life, particularly in Germany and the United Kingdom. Bovine gelatin is widely used in the well-established pharmaceutical sector in Europe to make pills, capsules, and other pharmaceutical items. Bovine gelatin is still used in Europe's varied and creative food and beverage industry because of its texture and stabilising qualities.

Leading producers of bovine gelatin with state of the art facilities are found throughout Europe. Prominent producers such as Belgium, France, and Germany add a great deal to the market supply. Key participants in the European market are growing their business by offering new items and partnering with stakeholders to boost profits. All these factors are propelling the growth of the bovine gelatin market in the region.

Bovine Gelatin Competitive Landscape:

The global market for bovine gelatin is fiercely competitive, with market leaders including Tessenderlo Group (PB Leiner subsidiary), Gelita AG, and Rousselot (a division of Darling Ingredients Inc.). All the players are highly competitive and are well-known for their wide range of products, potent R&D skills, and dedication to superior standards. The players or companies prioritises growing into emerging markets and health products, as well as sustainable production methods and ongoing innovation. Focusing on efficiency in production and sustainable sourcing, companies trying to provide a wide range of gelatin products to the health and nutrition industries and try to grow internationally.

- April 2023, Darling Ingredients Inc. acquired Glenex, a leading manufacturer of gelatin and collagen products in Brazil.

- July 2022, Perfect Day, a US dairy start up, announced its plan to acquire one of the world’s largest manufacturer of gelatin, Sterling Biotech, after winning a bid at auction. Perfect Day bid around 79.8 million to acquire the company.

- December 2023, Gelita, a global gelatin expert, introduced Easyseal gelatin, to substantially limit wastage and production costs related to soft gel leakers.

- December 2023, Life Is Chill, which is a science-based provider, expanded its line of THC soft gels with the latest live resin THC capsules, which is a first of its kind for the Arizona market.

Bovine Gelatin Market Scope:

|

Bovine Gelatin Market |

|

|

Market Size in 2023 |

USD 2.71 Bn. |

|

Market Size in 2030 |

USD 4.15 Bn. |

|

CAGR (2024-2030) |

6.28 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Application Food and Beverages Healthcare and Pharmaceuticals Cosmetics Others |

|

By Form Powder Capsules and Tablets Others |

|

|

|

By Nature Organic Conventional |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Bovine Gelatin Market Key Players:

- Darling Ingredients

- Nitta Gelatin

- India Gelatine & Chemicals Ltd.

- Tessenderlo Group

- Lapi Gelatine

- Trobas Gelatine B.V.

- Weishardt

- Gelken

- Narmada Gelatines

- Organika Health Products

- Lapi Gelatine

- Great Lakes Wellness

- ITALGEL S.p.A.

- Jellice Gelatin & Collagen

- Merck

- PB Leiner

- Bernard Jensen Products

- Nutra Food Ingredients

- Zint LLC

- Lonza

- Others

Frequently Asked Questions

Fluctuating Raw Material Prices and Health and Dietary Restrictions are the challenge in the Bovine Gelatin Market.

The Market size was valued at USD 2.71 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 6.28 % from 2024 to 2030, reaching nearly USD 4.15 Billion.

The segments covered in the market report are by Application, Form, and Nature.

1. Bovine Gelatin Market: Research Methodology

2. Bovine Gelatin Market: Executive Summary

3. Bovine Gelatin Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Bovine Gelatin Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Bovine Gelatin Market: Dynamics

6.1. Market Trends by Region

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Middle East and Africa

6.1.5. South America

6.2. Market Drivers by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Restraints

6.4. Market Opportunities

6.5. Market Challenges

6.6. PORTER’s Five Forces Analysis

6.7. PESTLE Analysis

6.8. Strategies for New Entrants to Penetrate the Market

6.9. Regulatory Landscape by Region

6.9.1. North America

6.9.2. Europe

6.9.3. Asia Pacific

6.9.4. Middle East and Africa

6.9.5. South America

7. Bovine Gelatin Market Size and Forecast by Segments (by Value Units)

7.1. Bovine Gelatin Market Size and Forecast, by Application (2023-2030)

7.1.1. Food and Beverages

7.1.2. Healthcare and Pharmaceuticals

7.1.3. Cosmetics

7.1.4. Others

7.2. Bovine Gelatin Market Size and Forecast, by Form (2023-2030)

7.2.1. Powder

7.2.2. Capsule and Tablets

7.2.3. Others

7.3. Bovine Gelatin Market Size and Forecast, by Nature (2023-2030)

7.3.1. Organic

7.3.2. Conventional

7.4. Bovine Gelatin Market Size and Forecast, by Region (2023-2030)

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Middle East and Africa

7.4.5. South America

8. North America Bovine Gelatin Market Size and Forecast (by Value Units)

8.1. North America Bovine Gelatin Market Size and Forecast, by Application (2023-2030)

8.1.1. Food and Beverages

8.1.2. Healthcare and Pharmaceuticals

8.1.3. Cosmetics

8.1.4. Others

8.2. Bovine Gelatin Market Size and Forecast, by Form (2023-2030)

8.2.1. Powder

8.2.2. Capsule and Tablets

8.2.3. Others

8.3. Bovine Gelatin Market Size and Forecast, by Nature (2023-2030)

8.3.1. Organic

8.3.2. Conventional

8.4. North America Bovine Gelatin Market Size and Forecast, by Country (2023-2030)

8.4.1. United States

8.4.2. Canada

8.4.3. Mexico

9. Europe Bovine Gelatin Market Size and Forecast (by Value Units)

9.1. Europe Bovine Gelatin Market Size and Forecast, by Application (2023-2030)

9.1.1. Food and Beverages

9.1.2. Healthcare and Pharmaceuticals

9.1.3. Cosmetics

9.1.4. Others

9.2. Bovine Gelatin Market Size and Forecast, by Form (2023-2030)

9.2.1. Powder

9.2.2. Capsule and Tablets

9.2.3. Others

9.3. Bovine Gelatin Market Size and Forecast, by Nature (2023-2030)

9.3.1. Organic

9.3.2. Conventional

9.4. Europe Bovine Gelatin Market Size and Forecast, by Country (2023-2030)

9.4.1. UK

9.4.2. France

9.4.3. Germany

9.4.4. Italy

9.4.5. Spain

9.4.6. Sweden

9.4.7. Russia

9.4.8. Rest of Europe

10. Asia Pacific Bovine Gelatin Market Size and Forecast (by Value Units)

10.1. Asia Pacific Bovine Gelatin Market Size and Forecast, by Application (2023-2030)

10.1.1. Food and Beverages

10.1.2. Healthcare and Pharmaceuticals

10.1.3. Cosmetics

10.1.4. Others

10.2. Bovine Gelatin Market Size and Forecast, by Form (2023-2030)

10.2.1. Powder

10.2.2. Capsule and Tablets

10.2.3. Others

10.3. Bovine Gelatin Market Size and Forecast, by Nature (2023-2030)

10.3.1. Organic

10.3.2. Conventional

10.4. Asia Pacific Air Traffic Control (ATC) Communications Market Size and Forecast, by Country (2023-2030)

10.4.1. China

10.4.2. S Korea

10.4.3. Japan

10.4.4. India

10.4.5. Australia

10.4.6. Indonesia

10.4.7. Malaysia

10.4.8. Vietnam

10.4.9. Taiwan

10.4.10. Bangladesh

10.4.11. Pakistan

10.4.12. Rest of Asia Pacific

11. Middle East and Africa Bovine Gelatin Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Bovine Gelatin Market Size and Forecast, by Application (2023-2030)

11.1.1. Food and Beverages

11.1.2. Healthcare and Pharmaceuticals

11.1.3. Cosmetics

11.1.4. Others

11.2. Middle East and Africa Market Size and Forecast, by Form (2023-2030)

11.2.1. Powder

11.2.2. Capsule and Tablets

11.2.3. Others

11.3. Bovine Gelatin Market Size and Forecast, by Nature (2023-2030)

11.3.1. Organic

11.3.2. Conventional

11.4. Middle East and Africa Bovine Gelatin Market Size and Forecast, by Country (2023-2030)

11.4.1. South Africa

11.4.2. GCC

11.4.3. Egypt

11.4.4. Nigeria

11.4.5. Rest of ME&A

12. South America Bovine Gelatin Market Size and Forecast (by Value Units)

12.1. South America Bovine Gelatin Market Size and Forecast, by Application (2023-2030)

12.1.1. Food and Beverages

12.1.2. Healthcare and Pharmaceuticals

12.1.3. Cosmetics

12.1.4. Others

12.2. South America Market Size and Forecast, by Form (2023-2030)

12.2.1. Powder

12.2.2. Capsule and Tablets

12.2.3. Others

12.3. Bovine Gelatin Market Size and Forecast, by Nature (2023-2030)

12.3.1. Organic

12.3.2. Conventional

12.4. South America Bovine Gelatin Market Size and Forecast, by Country (2023-2030)

12.4.1. Brazil

12.4.2. Argentina

12.4.3. Rest of South America

13. Company Profile: Key players

13.1. Darling Ingredients

13.1.1.1. Company Overview

13.1.1.2. Financial Overview

13.1.1.3. Business Portfolio

13.1.1.4. SWOT Analysis

13.1.1.5. Business Strategy

13.1.1.6. Recent Developments

13.2. Nitta Gelatin

13.3. India Gelatine & Chemicals Ltd.

13.4. Tessenderlo Group

13.5. Lapi Gelatine

13.6. Trobas Gelatine B.V.

13.7. Weishardt

13.8. Gelken

13.9. Narmada Gelatines

13.10. Organika Health Products

13.11. Lapi Gelatine

13.12. Great Lakes Wellness

13.13. ITALGEL S.p.A.

13.14. Jellice Gelatin & Collagen

13.15. Merck

13.16. PB Leiner

13.17. Bernard Jensen Products

13.18. Nutra Food Ingredients

13.19. Zint LLC

13.20. Lonza

13.21. Others

14. Key Findings

15. Industry Recommendation