Canola Oil Market: Global Industry Analysis and Forecast (2024-2030)

The Canola Oil Market size was valued at USD 35.21 Bn. in 2023 and the total Global Canola Oil revenue is expected to grow at a CAGR of 3.81% from 2024 to 2030, reaching nearly USD 46.49 Bn. by 2030.

Format : PDF | Report ID : SMR_1907

Canola Oil Market Overview

Canola oil is an edible vegetable oil obtained from the seeds of canola that are high in monounsaturated fatty acids. It helps to cut down the human body's cholesterol levels. Canola oil is a good vitamin E source, which serves as an antioxidant that protects the body's fats and proteins from free radicals.

- Canola oil is the third largest vegetable oil by volume after palm and soybean oil.

The report from Stellar Market Research presents a thorough analysis of the Canola Oil Market, focusing on predicting market growth trends and offering valuable insights into the value chain and supply chain dynamics. The analysis of the Canola Oil market scope provides a detailed comprehension of the complex network of processes and stakeholders involved in the production, distribution, and application of canola oil. The research objective is to understand the current landscape of usage, applications, and distribution channels of the canola oil market.

Key players play a crucial role in driving innovation and improving product efficacy, underscoring the importance of targeted strategies to meet evolving consumer demands. The report highlights the significance of import and export activities in the Canola Oil market, ensuring continuous transactions between suppliers and end-users. The market is experiencing steady growth driven by the rising preferences of individuals for food products that align with their dietary goals, the growing environmental and sustainability concerns, and the increasing use of canola oil in various culinary applications.

The market scope includes opportunities in new product development and advancements in technologies, which propel market growth and innovation. Through quantitative research methods, the report offers statistical data on the effectiveness of Canola Oil in various applications and their impact on market trends. Competitive intelligence analysis aids in comprehending market dynamics, competitor strategies, and customer perceptions, empowering market players to gain a competitive advantage in the global Canola Oil market.

To get more Insights: Request Free Sample Report

Canola Oil Market Dynamics

Canola Oil as a Sustainable Catalyst in the Biodiesel Revolution

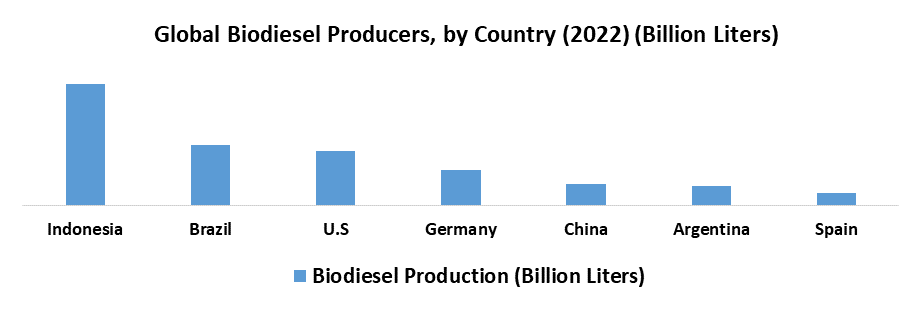

As the world struggles for sustainable energy sources, the canola oil industry has seen a rise in innovation and technology related to biodiesel production. Canola oil's unique composition, rich in monounsaturated and polyunsaturated fats, makes it an excellent choice for high-quality biodiesel, fueling growth in the canola oil market. This environmentally friendly fuel source has gained widespread acceptance owing to strict environmental regulations and customer preferences for cleaner energy alternatives, leading to increased demand for canola oil and boosting sales for producers and manufacturers.

The competitive production cost of biodiesel derived from canola oil makes it an attractive option for consumers and businesses. Additionally, the profit margin associated with canola oil-based biodiesel has encouraged agricultural producers to dedicate more land to canola cultivation, ensuring a steady supply to meet growing demand. The reliance of the biodiesel sector on canola oil has driven innovation within the industry, prompting researchers and scientists to improve the efficiency of production processes. Advanced extraction techniques and optimized refining methods have minimized waste and enhanced the overall quality of the end product, meeting customer preferences for high-performance biofuels. The canola oil market has seen an increase in technological innovation, with the development of advanced processing facilities and cutting-edge equipment.

These advancements have streamlined the production process, reducing energy consumption and production costs, thereby enhancing competitiveness and influencing market trends. E-commerce platforms have facilitated the seamless distribution of canola oil-based biodiesel, surpassing geographical boundaries and meeting the growing demand from both residential and commercial sectors. As global awareness of environmental sustainability continues to grow, the canola oil market is poised for significant growth. Governments are promoting biofuel usage through incentives and subsidies, making canola oil a key player in the global biodiesel industry.

Navigating Intense Competition from Established Edible Oil Rivals

In a competitive market with many edible oils competing for consumer preference, canola oil faces strong competition from established alternatives, leading to high market concentration and competitive pricing. The presence of age-old edible oils like soybean, palm, and sunflower oils has created a fiercely competitive environment. These oils have well-established supply chains and customer bases and often benefit from economies of scale, potentially resulting in lower manufacturing costs. This situation makes it difficult for canola oil producers to compete on price, limiting their ability to gain market share. Additionally, the global edible oil market is susceptible to volatility caused by various factors, including weather patterns, geopolitical tensions, and fluctuations in agricultural yields.

This volatility significantly impacts the availability and pricing of canola oil, making it less appealing compared to more stable alternatives and hindering its widespread adoption. Government tariffs, import quotas, and subsidies have a significant impact on the flow of canola oil across borders, potentially distorting market forces and creating an uneven field for producers and suppliers. As consumers lean towards more affordable options, the demand for canola oil is impacted, leading to reduced profitability for producers and manufacturers which hinders investment in research, development, and infrastructure improvements, obstructing the industry's growth and innovation potential.

A trend towards market consolidation, with large multinational corporations acquiring smaller players, creates significant barriers to entry for new entrants in the canola oil industry, making it challenging for smaller producers to establish a position and compete effectively. Despite these challenges, the canola oil market continues to explore niche applications and differentiation strategies to mitigate the impact of competition from other edible oils.

Canola Oil Market Segment Analysis

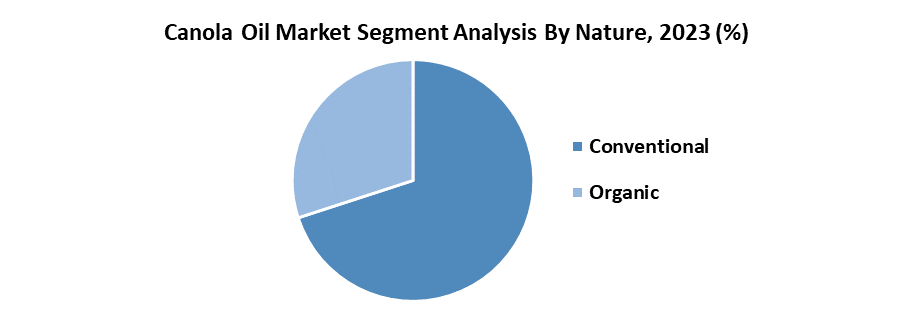

By Nature, According to SMR research, the Conventional segment held the largest market share and dominated the canola oil market in 2023. The segment caters to traditional consumer preferences, giving importance to affordability while maintaining quality standards. The effective strategies for positioning the product have established conventional canola oil as a versatile and cost-efficient cooking oil, appealing to a wide consumer base. While health-conscious consumers have been inclining toward specialty oils, the conventional segment continues to attract a major portion of the population seeking affordable and dependable cooking solutions driving the demand for the canola oil market.

Additionally, the adoption of market penetration strategies by leading canola oil manufacturers has significantly contributed to the dominance of the conventional segment. Strategic pricing, along with extensive distribution channels, has ensured widespread availability and accessibility. The segment's dedicated devotion to well-known brands is proof of the durable appeal of recognizable and dependable brands.

Customers frequently connect these brands with excellence, dependability, and affordability which results in frequent business and steady consumers, which strengthens the canola oil market position. Efficient supply chains and strong retailer partnerships ensure consistent availability of canola oil products, fostering brand loyalty and consumer trust. Although specialty segments like organic and non-GMO canola oils have gained traction among health-conscious consumers, the dominance of the conventional segment in the market remains unchallenged. Its ability to cater to diverse customer preferences, combined with strategic market penetration strategies and extensive distribution channels, has firmly established its position as a staple in households worldwide.

Canola Oil Market Regional Analysis

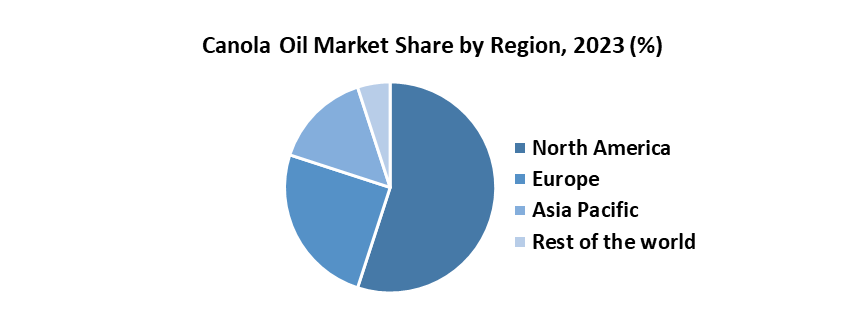

The dominance of North America in the global canola oil market in 2023 has been supported by favorable market conditions, international trade relationships, proficient distribution channels, and planned production. Canada accounts for about 60% of the global exportable supply by being the world’s largest producer and exporter playing a central role in the dominance of North America in the global canola oil market. The geographical advantages like the ideal climate and fertile soil for canola cultivation provided by the fertile Canadian Prairies consistently deliver high-quality crops and increased yield. Additionally, advanced agricultural practices and biotechnology innovations have driven the North American canola oil market.

The dynamics of international trade make Canada one of the world's largest exporters of canola oil, with products being shipped to the US, China, Japan, and Mexico. The USMCA has facilitated trade between these nations by lowering tariffs and expanding market access. The market research data shows the rise in canola oil consumption in North America fuelled by consumer preferences shifting toward healthier cooking oils with canola oil being the preferred option as well as growing awareness of the health benefits which include a lower saturated fat content and a higher omega-3 fatty acid content increasing the demand for canola oil market.

- According to SMR analysis, the total production of canola oil increased by 2.18% to 6.55 MMT from 6.41 MMT in 2022-2023 in the US.

The widespread distribution channels ensure the availability of the growing demand for convenient and diverse canola oil products. Retail giants like Costco, Kroger, and Safeway, as well as food service distributors like Sysco and US Foods, play a crucial role in distributing canola oil across the region. Innovations in canola production are supported by government initiatives and research centers in both Canada and the US, ensuring a competitive advantage in the global canola oil market. The dominance of North America in the global canola oil market has been attributed to strategic production capabilities, robust international trade relationships, favorable market research statistics, efficient distribution channels, and flexibility in responding to shifting consumer preferences.

Canola Oil Market Competitive Landscape

The competitive landscape of the Canola Oil market includes key players such as Archer Daniels Midland Company (ADM), Bunge Limited, Cargill Inc., CHS Inc., Louis Dreyfus Company, Richardson International Limited, and Sime Darby Oil, among others. These companies play a significant role in the manufacturing and distribution of Canola Oil globally, catering to various industries like beverages, processed food, pharmaceuticals, and cosmetics among others. The market is characterized by competitive dynamics, market share, and strategies employed by these key players to maintain their position and drive growth in the industry.

- In 2023, Bunge Limited and Chevron’s Renewable Energy Group Inc., a subsidiary of Chevron Corporation, acquired Chacraservicios S.r.l., based in Argentina, from the Italian-based Adamant Group to add a new oil source in Bunge and Chevron’s global supply chains. This is anticipated to help both companies meet the growing demand for lower-carbon renewable feedstocks.

- In 2023, Archer Daniels Midland (ADM) Company announced the acquisition of Prairie Pulse Inc., owners of a pulse crop cleaning, milling, and packaging facility in Vanscoy, Saskatchewan, Canada.

- In 2023, Cargill Incorporated, a U.S.-based company, announced its plans for investment of around USD 50 million to upgrade and expand its oilseed crushing facilities in Newcastle, Narrabri, and Footscray. This investment has helped the company cater to the growing demands of customers for omega-3 and omega-6 enriched rapeseed oil and cottonseed byproducts such as oil and meal.

- In 2023, Louis Dreyfus Company, a global crop trader, disclosed its plans for expansion by opening new production plants, which will double the facility's annual capacity to around 2 million tons by the year 2025.

|

Canola Oil Market Scope |

|

|

Market Size in 2023 |

USD 35.21 Bn. |

|

Market Size in 2030 |

USD 46.49 Bn. |

|

CAGR (2024-2030) |

3.81% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Nature Organic Conventional |

|

By Application Food Processing Biofuels Household Personal Care Others |

|

|

By Distribution Channel Store-based Non-Store Based |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Canola Oil Market

- Archer Daniels Midland Company (ADM) - USA

- Bunge Limited - USA

- Cargill Inc. - USA

- CHS Inc. - USA

- Louis Dreyfus Company - Netherlands

- Richardson International Limited - Canada

- Sime Darby Oils - Malaysia

- COFCO Corporation - China

- Wilmar International Limited - Singapore

- Nisshin OilliO Group, Ltd. - Japan

- Borges Agricultural & Industrial Nuts - Spain

- Astro Oils Pvt. Ltd. - India

- Cootamundra Oilseeds Pty Ltd. - Australia

- Louis Dreyfus Company - Netherlands

- Sunora Foods Inc. - Canada

- Associated British Foods - United Kingdom

- Jivo Wellness Pvt Ltd - India

- American Vegetable Oils - United States

- Highwood Crossing Foods – Canada

- La Touramgelle - France

Frequently Asked Questions

The increasing prevalence of chronic diseases and the popularity of plant-based diets are the drivers of the Canola Oil market.

The volatility of the raw material prices is the major challenge in the global canola oil market.

The Market size was valued at USD 35.21 billion in 2023 and the total Market revenue is expected to grow at a CAGR of 3.81% from 2024 to 2030, reaching nearly USD 46.49 billion.

The segments covered in the market report are nature, application, distribution channel, and region.

1. Canola Oil Market: Research Methodology

2. Canola Oil Market: Executive Summary

3. Canola Oil Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Canola Oil Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Strategies for New Entrants to Penetrate the Market

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

4.10. The Global Import-Export Analysis

5. Canola Oil Market Size and Forecast by Segments (by Value Units)

5.1. Canola Oil Market Size and Forecast, by Nature(2023-2030)

5.1.1. Organic

5.1.2. Conventional

5.2. Canola Oil Market Size and Forecast, by Application(2023-2030)

5.2.1. Food Processing

5.2.2. Household

5.2.3. Personal Care

5.2.4. Biofuels

5.2.5. Others

5.3. Canola Oil Market Size and Forecast, by Distribution Channel (2023-2030)

5.3.1. Store-based

5.3.2. Non-store based

5.4. Canola Oil Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Canola Oil Market Size and Forecast (by Value Units)

6.1. North America Canola Oil Market Size and Forecast, by Nature(2023-2030)

6.1.1. Organic

6.1.2. Conventional

6.2. North America Canola Oil Market Size and Forecast, by Application(2023-2030)

6.2.1. Food Processing

6.2.2. Household

6.2.3. Personal Care

6.2.4. Biofuels

6.2.5. Others

6.3. North America Canola Oil Market Size and Forecast, by Distribution Channel (2023-2030)

6.3.1. Store-based

6.3.2. Non-store based

6.4. North America Canola Oil Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Canola Oil Market Size and Forecast (by Value Units)

7.1. Europe Canola Oil Market Size and Forecast, by Nature(2023-2030)

7.1.1. Organic

7.1.2. Conventional

7.2. Europe Canola Oil Market Size and Forecast, by Application(2023-2030)

7.2.1. Food Processing

7.2.2. Household

7.2.3. Personal Care

7.2.4. Biofuels

7.2.5. Others

7.3. Europe Canola Oil Market Size and Forecast, by Distribution Channel (2023-2030)

7.3.1. Store-based

7.3.2. Non-store based

7.4. Europe Canola Oil Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Canola Oil Market Size and Forecast (by Value Units)

8.1. Asia Pacific Canola Oil Market Size and Forecast, by Nature(2023-2030)

8.1.1. Organic

8.1.2. Conventional

8.2. Asia Pacific Canola Oil Market Size and Forecast, by Application(2023-2030)

8.2.1. Food Processing

8.2.2. Household

8.2.3. Personal Care

8.2.4. Biofuels

8.2.5. Others

8.3. Asia Pacific Canola Oil Market Size and Forecast, by Distribution Channel (2023-2030)

8.3.1. Store-based

8.3.2. Non-store based

8.4. Asia Pacific Canola Oil Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Canola Oil Market Size and Forecast (by Value Units)

9.1. Middle East and Africa Canola Oil Market Size and Forecast, by Nature(2023-2030)

9.1.1. Organic

9.1.2. Conventional

9.2. Middle East and Africa Canola Oil Market Size and Forecast, by Application(2023-2030)

9.2.1. Food Processing

9.2.2. Household

9.2.3. Personal Care

9.2.4. Biofuels

9.2.5. Others

9.3. Middle East and Africa Canola Oil Market Size and Forecast, by Distribution Channel (2023-2030)

9.3.1. Store-based

9.3.2. Non-store based

9.4. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Canola Oil Market Size and Forecast (by Value Units)

10.1. South America Canola Oil Market Size and Forecast, by Nature(2023-2030)

10.1.1. Organic

10.1.2. Conventional

10.2. South America Canola Oil Market Size and Forecast, by Application(2023-2030)

10.2.1. Food Processing

10.2.2. Household

10.2.3. Personal Care

10.2.4. Biofuels

10.2.5. Others

10.3. South America Canola Oil Market Size and Forecast, by Distribution Channel (2023-2030)

10.3.1. Store-based

10.3.2. Non-store based

10.4. South America Canola Oil Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Archer Daniels Midland Company

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Bunge Limited

11.3. Cargill Inc.

11.4. CHS Inc.

11.5. Louis Dreyfus Company

11.6. Richardson International Limited

11.7. Sime Darby Oils

11.8. COFCO Corporation

11.9. Wilmar International Limited

11.10. Nisshin OilliO Group, Ltd.

11.11. Borges Agricultural & Industrial Nuts

11.12. Astro Oils Pvt. Ltd.

11.13. Cootamundra Oilseeds Pty Ltd.

11.14. Louis Dreyfus Company

11.15. Sunora Foods Inc.

11.16. Associated British Foods

11.17. Jivo Wellness Pvt Ltd

11.18. American Vegetable Oils

11.19. Highwood Crossing Foods

12. Key Findings

13. Industry Recommendations