Carbon black Market: Global Industry Analysis and Forecast (2024-2030)

The Carbon black Market size was valued at USD 23.48 Bn. in 2023 and the total Global Carbon black revenue is expected to grow at a CAGR of 5.1% from 2024 to 2030, reaching nearly USD 33.04 Bn. by 2030.

Format : PDF | Report ID : SMR_2159

Carbon black Market Overview

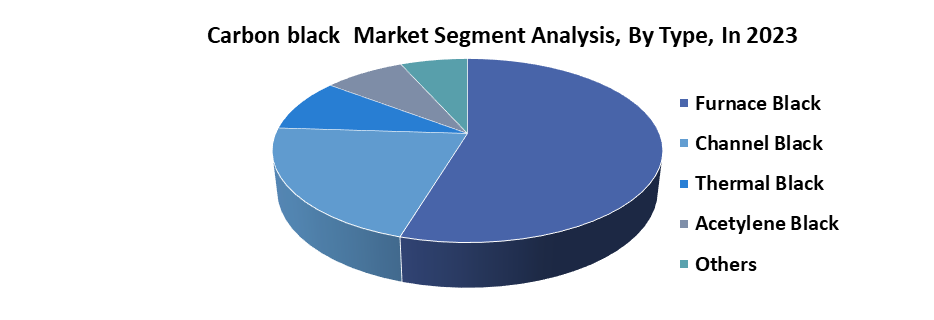

Carbon black is a versatile industrial material primarily composed of fine particles of elemental carbon, produced through the incomplete combustion of hydrocarbons. It finds extensive use across various industries due to its unique properties and applications. The report provides a comprehensive analysis of the market trends, challenges, and opportunities, with a focus on key segments and regional dynamics. The global carbon black Industry has shown consistent growth, driven by growing industrialization, infrastructure development, and increased automotive production worldwide. Primary demand comes from the tire manufacturing sector, where carbon black enhances durability and performance. Growth in plastics, coatings, and electronics sectors also contributes significantly. Furnace black dominates the Carbon black market due to its versatile applications and cost-effectiveness.

Leading players like Cabot Corporation, Orion Engineered Carbons, Birla Carbon, and Phillips Carbon Black Limited command substantial Carbon black market share. Rapid penetration into emerging markets such as Asia-Pacific presents lucrative prospects for growth through strategic investments in production facilities and distribution networks. These regions are experiencing rapid industrialization and rising consumer demand, particularly in sectors reliant on carbon black like automotive and construction.

Funding research and development initiatives to innovate high-performance carbon black grades and eco-friendly production methods differentiates companies and bolsters competitive advantage. Also, aligning with sustainability initiatives by investing in technologies that reduce emissions and improve energy efficiency not only meets regulatory standards but also aligns with evolving consumer preferences for environmentally responsible products.

To get more Insights: Request Free Sample Report

Carbon Black Market Dynamics

Role of Carbon Black in Driving Tire Manufacturing Amid Automotive Increase

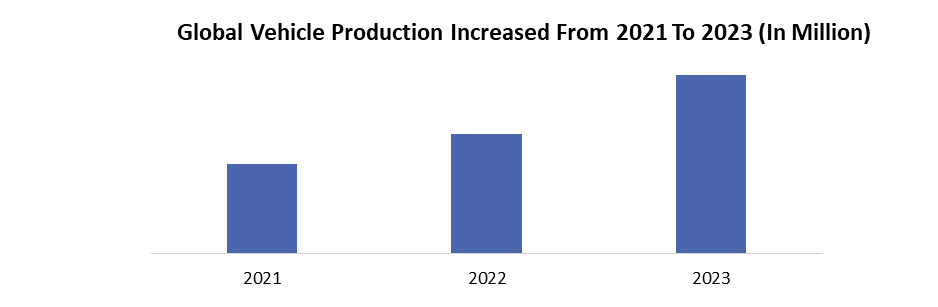

The automotive industry has seen significant growth from 2018 to 2023, especially in emerging economies such as China, India, and Southeast Asia. The growth is driven by rising income levels, urbanization, and increased mobility needs. The surge in vehicle production directly impacts tire manufacturing, as every new vehicle requires a set of tires. Carbon black is an essential component in tire manufacturing, accounting for about 30% of the tire's weight. It enhances the tire's strength, durability, and resistance to wear and tear. The growth in automotive and tire production has led to a proportional increase in the demand for carbon black.

- Increased vehicle usage, reflected in higher vehicle miles traveled globally, has been a key driver of replacement tire demand. For instance, in the United States, vehicle miles traveled increased from 3.2 trillion in 2018 to 3.5.1 trillion in 2023.

Carbon Black Market Challenges

The development of substitute materials like silica and nanomaterials presents a significant challenge to traditional carbon black applications. These substitutes are increasingly preferred due to their perceived eco-friendly profiles and specific performance advantages, posing a threat to the market dynamics of carbon black. The carbon black market faces intensified competition from substitutes like silica and nanomaterials in sectors such as tires, plastics, and coatings.

The competitive pressure influences pricing strategies and Carbon black market share dynamics among carbon black manufacturers. Simultaneously, shifts in consumer preferences towards sustainability drive demand for eco-friendly alternatives, reshaping purchasing decisions across industries. The trend diminishes dependence on carbon black in favor of greener options, reflecting a broader movement towards environmental consciousness and regulatory compliance. As a result, manufacturers innovate to meet evolving Carbon black market demands while balancing environmental impact and performance requirements to maintain competitiveness in the marketplace.

Carbon Black Market Segment Analysis

By Type, Furnace Black is the most dominant segment in the carbon black market. Furnace black is produced by the incomplete combustion of hydrocarbons like coal tar, petroleum, and natural gas. The process involves pre-heating the hydrocarbon feedstock, which is then introduced into a reaction furnace for partial combustion with limited air or oxygen. The resulting carbon black particles are rapidly cooled (quenched) to halt combustion and control particle size. Finally, the carbon black is pelletized for easier handling and transportation.

The method allows precise control over properties such as particle size, surface area, and structure, making the furnace black versatile for applications in tires, rubber products, plastics, inks, and coatings. Furnace black, produced through the incomplete combustion of hydrocarbons in a controlled environment, is known for its versatility and cost-effectiveness. It is predominantly used in tire manufacturing and other rubber products for its reinforcing properties. Additionally, furnace black is utilized in plastics, inks, and coatings, enhancing the durability and performance of these materials. The wide range of applications ensures a steady demand, driving the Carbon black market growth for furnace black.

- In 2023, the global consumption of furnace black reached around 13.6 million tons, up from 12 million tons in 2018.

Carbon Black Market Regional Insights

The Asia-Pacific region held a significant share of the global carbon black market in 2023, driven by rapid industrialization, urbanization, and the robust growth of the automotive and manufacturing sectors. The region's dominance is primarily due to the substantial demand for carbon black in tire manufacturing, which is encouraged by the growing automotive industry in countries like China and India. Major players like Birla Carbon and Cabot Corporation have expanded production capacities in the Asia-Pacific region to meet the growing demand for carbon black. For example, Birla Carbon announced an expansion of its production facility in India in 2021.

Companies are also investing in research and development to produce high-performance and environmentally friendly carbon black, leading to improved product quality and sustainability. Also, strategic partnerships between local and international companies have enhanced Carbon black market reach and technological capabilities. For instance, Orion Engineered Carbons partnered with a Chinese firm to strengthen its market presence in China. The Chinese government has implemented stricter environmental regulations, prompting companies to adopt cleaner production technologies and reduce emissions.

The Indian government's "Make in India" campaign promotes domestic manufacturing, supporting the growth of the automotive and industrial sectors. The initiative has significantly increased the demand for carbon black in the country. These countries have heavily invested in research and development to produce high-quality carbon black, supporting their robust automotive and electronics industries. China leads the region with the highest carbon black production capacity, reaching approximately 4 million tons in 2023. As the world's largest automobile producer, China’s demand for carbon black in tire manufacturing is substantial, driving the market's growth in the region.

Carbon black Market Competitive Landscape

1. In June 2023, Bridgestone Corporation initiated the development of tire-derived oil and recovered carbon black using pyrolysis technology for worn tires. Test units were set up at the Bridgestone Innovation Park in Tokyo, aiming to promote the widespread adoption of chemical recycling methods that efficiently convert used tires.

2. In April 2023, Orion Engineered Carbons implemented new cogeneration technology at its Ivanhoe plant in Louisiana, USA. This technology includes a steam turbine generator that utilizes waste steam from the carbon black production process to generate renewable electricity.

3. In March 2023, Tokai Carbon Co., Ltd. partnered with Sekisui Chemical Co., Ltd. to advance the real-world application of Carbon Capture and Utilization (CCU) technology. The collaboration focuses on producing various carbon products and materials for capturing and storing carbon dioxide (CO2) in solid form.

|

Carbon black Market Scope |

|

|

Market Size in 2023 |

USD 23.48 Bn. |

|

Market Size in 2030 |

USD 33.04 Bn. |

|

CAGR (2024-2030) |

5.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Furnace Black Channel Black Thermal Black Acetylene Black Others |

|

By Grade Standard Grade Specialty Grade |

|

|

By Application Tire Non-tire Rubber Plastics Inks & Coatings Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Carbon black Market

- Cabot Corporation

- Birla Carbon

- Orion Engineered Carbons

- Continental Carbon Company

- Tokai Carbon Co. Ltd.

- Phillips Carbon Black Limited

- Mitsubishi Chemical Corporation

- Jiangxi Black Cat Carbon Black Inc.

- OCI Company Ltd.

- Longxing Chemical Group

- China Synthetic Rubber Corporation

- Himadri Specialty Chemicals Ltd.

- Omsk Carbon Group

- Asahi Carbon Co. Ltd.

- Ralson Carbon

- Shandong Huadong Rubber Materials Co. Ltd.

- Nippon Steel Chemical & Material Co. Ltd.

- Jinneng Science & Technology Co. Ltd.

- China Synthetic Rubber Corporation

- Atlas Organic Pvt. Ltd.

- XXX Inc.

Frequently Asked Questions

Carbon black production can generate emissions of carbon monoxide and other pollutants. As a result, there is a growing emphasis on adopting cleaner production technologies and sustainable practices to mitigate environmental impacts.

Key challenges include competition from substitute materials like silica, fluctuating raw material costs, and the need for continuous innovation to meet evolving consumer preferences and regulatory standards.

The Market size was valued at USD 23.48 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 5.1 % from 2024 to 2030, reaching nearly 33.04 billion.

The segments covered in the market report are by Type, Grade, and Application.

1. Carbon black Market: Research Methodology

2. Carbon black Market: Executive Summary

3. Carbon black Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Carbon black Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Carbon black Market Size and Forecast by Segments (by Value Units)

6.1. Carbon black Market Size and Forecast, by Type (2023-2030)

6.1.1. Furnace Black

6.1.2. Channel Black

6.1.3. Thermal Black

6.1.4. Acetylene Black

6.1.5. Others

6.2. Carbon black Market Size and Forecast, by Grade (2023-2030)

6.2.1. Standard Grade

6.2.2. Specialty Grade

6.3. Carbon black Market Size and Forecast, by Application (2023-2030)

6.3.1. Tire

6.3.2. Non- tire Rubber

6.3.3. Plastics

6.3.4. Inks & Coatings

6.3.5. Others

6.4. Carbon black Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North American Carbon black Market Size and Forecast (by Value Units)

7.1. North America Carbon black Market Size and Forecast, by Type (2023-2030)

7.1.1. Furnace Black

7.1.2. Channel Black

7.1.3. Thermal Black

7.1.4. Acetylene Black

7.1.5. Others

7.2. North America Carbon black Market Size and Forecast, by Grade (2023-2030)

7.2.1. Standard Grade

7.2.2. Specialty Grade

7.3. North America Carbon black Market Size and Forecast, by Application (2023-2030)

7.3.1. Tire

7.3.2. Non- tire Rubber

7.3.3. Plastics

7.3.4. Inks & Coatings

7.3.5. Others

7.4. North America Carbon black Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Carbon black Market Size and Forecast (by Value Units)

8.1. Europe Carbon black Market Size and Forecast, by Type (2023-2030)

8.1.1. Furnace Black

8.1.2. Channel Black

8.1.3. Thermal Black

8.1.4. Acetylene Black

8.1.5. Others

8.2. Europe Carbon black Market Size and Forecast, by Grade (2023-2030)

8.2.1. Standard Grade

8.2.2. Specialty Grade

8.3. Europe Carbon black Market Size and Forecast, by Application (2023-2030)

8.3.1. Tire

8.3.2. Non- tire Rubber

8.3.3. Plastics

8.3.4. Inks & Coatings

8.3.5. Others

8.4. Europe Carbon black Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Carbon black Market Size and Forecast (by Value Units)

9.1. Asia Pacific Carbon black Market Size and Forecast, by Type (2023-2030)

9.1.1. Furnace Black

9.1.2. Channel Black

9.1.3. Thermal Black

9.1.4. Acetylene Black

9.1.5. Others

9.2. Asia Pacific Carbon black Market Size and Forecast, by Grade (2023-2030)

9.2.1. Standard Grade

9.2.2. Specialty Grade

9.3. Asia Pacific Carbon black Market Size and Forecast, by Application (2023-2030)

9.3.1. Tire

9.3.2. Non- tire Rubber

9.3.3. Plastics

9.3.4. Inks & Coatings

9.3.5. Others

9.4. Asia Pacific Carbon black Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Carbon black Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Carbon black Market Size and Forecast, by Type (2023-2030)

10.1.1. Furnace Black

10.1.2. Channel Black

10.1.3. Thermal Black

10.1.4. Acetylene Black

10.1.5. Others

10.2. Middle East and Africa Carbon black Market Size and Forecast, by Grade (2023-2030)

10.2.1. Standard Grade

10.2.2. Specialty Grade

10.3. Middle East and Africa Carbon black Market Size and Forecast, by Application (2023-2030)

10.3.1. Tire

10.3.2. Non- tire Rubber

10.3.3. Plastics

10.3.4. Inks & Coatings

10.3.5. Others

10.4. Middle East and Africa Carbon black Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Carbon black Market Size and Forecast (by Value Units)

11.1. South America Carbon black Market Size and Forecast, by Type (2023-2030)

11.1.1. Furnace Black

11.1.2. Channel Black

11.1.3. Thermal Black

11.1.4. Acetylene Black

11.1.5. Others

11.2. South America Carbon black Market Size and Forecast, by Grade (2023-2030)

11.2.1. Standard Grade

11.2.2. Specialty Grade

11.3. South America Carbon black Market Size and Forecast, by Application (2023-2030)

11.3.1. Tire

11.3.2. Non- tire Rubber

11.3.3. Plastics

11.3.4. Inks & Coatings

11.3.5. Others

11.4. South America Carbon black Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Cabot Corporation.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Birla Carbon

12.3. Orion Engineered Carbons

12.4. Continental Carbon Company

12.5. Tokai Carbon Co. Ltd.

12.6. Phillips Carbon Black Limited

12.7. Mitsubishi Chemical Corporation

12.8. Jiangxi Black Cat Carbon Black Inc.

12.9. OCI Company Ltd.

12.10. Longxing Chemical Group

12.11. China Synthetic Rubber Corporation

12.12. Himadri Specialty Chemicals Ltd.

12.13. Omsk Carbon Group

12.14. Asahi Carbon Co. Ltd.

12.15. Ralson Carbon

12.16. Shandong Huadong Rubber Materials Co. Ltd.

12.17. Nippon Steel Chemical & Material Co. Ltd.

12.18. Jinneng Science & Technology Co. Ltd.

12.19. China Synthetic Rubber Corporation

12.20. Atlas Organic Pvt. Ltd.

12.21. XXX Inc.

13. Key Findings

14. Industry Recommendation