Carry Bag Market: Global Industry Analysis and Forecast (2024-2030)

Carry Bag Market size was valued at USD 23.94 Bn. in 2023 and the total Carry Bag revenue is expected to grow at a CAGR of 4.92 % from 2024 to 2030, reaching nearly USD 33.5 Bn. by 2030.

Format : PDF | Report ID : SMR_1872

Carry Bag Market Overview:

Plastic carry bags are designed to help customers to carry products home with convenience. Colored retail carry bags are now available designed perfectly for more storage areas and easy to carry features. The plastic carrier bags are manufactured from low-density polyethylene making it ideal for the retail sector. The shopping bags have flexible and soft carry handles that are attached internally to help improve comfort while carrying. The high-quality plastic makes the bags visually attractive, strong, and durable. White plastic bags are the perfect partner for retail stores, shopping malls, trade shows, seminars, advertisements, conferences & promotions.

The comprehensive analysis report gives a detailed analysis of market evolution, growth drivers, restraints, opportunities, and challenges, Porter’s 5 Forces Framework, macroeconomic analysis, value chain analysis, and pricing analysis that directly shape the market at present and through the forecasted period. The drivers and restraints cover the internal factors of the market whereas opportunities and challenges are the external factors that are affecting the market. The Carry Bag industry report provides a comprehensive analysis of the latest developments in the market. The report covers market share and the impact of both domestic and centralized market players on the industry.

To get more Insights: Request Free Sample Report

Carry Bag Market Dynamics:

Rising Consumer Demand for Sustainable Packaging Drives Growth in the Carry Bag Market

The Growing demand for paper bags, particularly the need for recycled paper, signifies a growing consumer preference for sustainable options is driving the Carry Bag Market. The demand for eco-friendly packaging has risen owing to consumers' heightened environmental awareness. People actively seek out environmentally friendly options and are willing to pay more for products packaged in sustainable materials. The growing preference for paper bags reflects the change in consumer behavior. To align with customer values and preferences, businesses are incorporating paper bags into their packaging strategies.

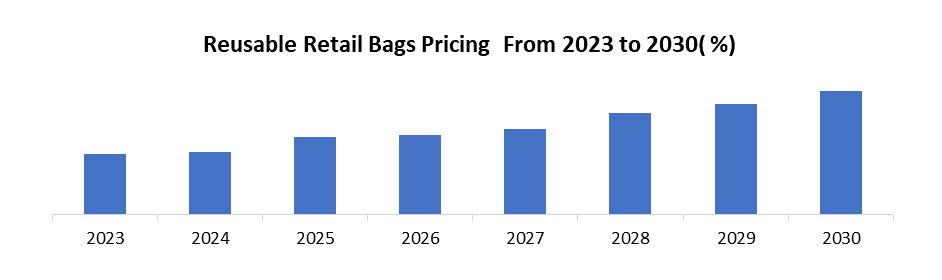

Manufacturers are investing in increasing manufacturing capacity, developing new designs, and improving paper bags’ overall quality and durability. The market has shifted away from classic brown bags and towards more aesthetically pleasing and functional designs catering to a wide range of consumer tastes. Additionally, advances in manufacturing technologies have reduced the cost of paper bags, making them a feasible option for enterprises in a variety of industries. Additionally, increasing reusable colored bags is also driving the carry bag market. Reusable Bags made from natural materials, including jute, hemp, bamboo, and cotton.

The materials used are organic- without the use of pesticides, recycled, or chemically treated. The surging of E-Commerce, Courier, and Delivery Services plays a pivotal role in shaping the carry bags market. Online shopping continues to surge, and to demand for secure and reliable packaging solutions has increased. Carry bags provide a branding opportunity for e-commerce companies.

Technological Advancements in Bag-Making Machines to Enhancing Sustainability and Efficiency

The latest technological advancements in the bag-making industry focus on various types of bag-making machines. The includes paper bag-making machines, square-bottom paper bag-making machines, V-bottom paper bag-making machines, and non-woven bag-making machines. Paper bag-making machines are capable of using sustainable and recyclable materials, supporting environmentally responsible bag production. Additionally, these machines are designed to minimize waste and optimize material usage. Advancements in mechanical and electronic components have allowed for higher production speeds, reducing lead times and improving overall productivity.

Smart sensors and control systems are integrated into modern machines. These systems monitor and adjust various parameters in real-time, ensuring consistent quality and reducing errors in the production process. Many non-woven bag making machines use ultrasonic technology for sealing. The eliminates the need for thread and glue, resulting in stronger and more durable seams. Many non-woven bag making machines use ultrasonic technology for sealing. These eliminates the need for thread and glue, resulting in stronger and more durable seams.

Carry Bag Market Segment Analysis:

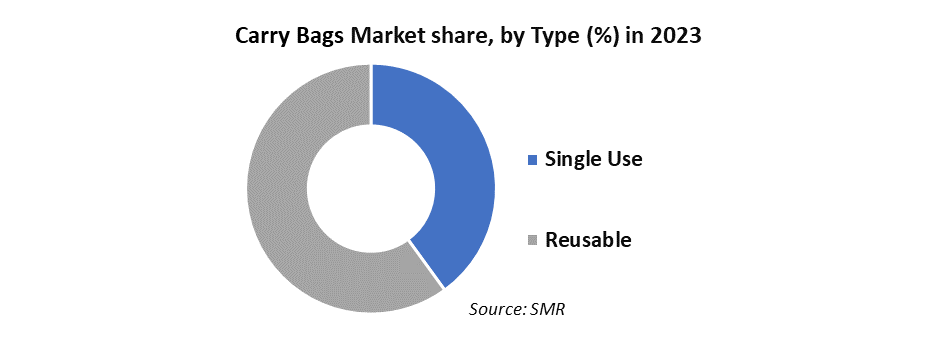

By Type, Reusable bags is bag that’s used more than once, including paper and plastic bags. Generally speaking, canvas totes, wine bags, and cooler bags are also reusable options. Reusable bags made from natural fibres such as cotton or jute or synthetic fibres such as nylon or polypropylene. The manufacturing process vary depending on the type of bag, the materials used, and of course, the manufacturer. While a one-time-use plastic bag handle 17 pounds, a reusable grocery bag easily holds around 22 pounds. Additionally, bags made of heavy-duty cotton canvas are stronger and hold more weight than usual. The design & materials used for manufacturing naturally impact the holding capacity. According to the US Environmental Protection Agency, only 1-3% of plastic bags are recycled in the US each year.

The plastic bags kill up to 100,000 marine animals annually. By switching to reusable bags, curbing plastic pollution to a great extent and creating a positive impact on the Earth. These bags are made from either recycled or sustainable materials that are durable but don’t harm the environment, like plastic bags. The cost of production for most non-woven bags typically is around 10-25 cents ($0.10-0.25), but they are sold for $0.99-$3. The total cost of litter collection, disposal, and enforcement in the US is estimated to be at least $11.5 billion annually. By switching to reusable bags, are saving the environment and curbing unnecessary spending as consumers.

The most commonly used plastic bags are made of high-density polyethylene (HDPE) plastic. Other commonly used plastic bags include low density polyethylene (LDPE) plastic and polypropylene (PP) plastic for more reusable bags.

Carry Bag Market Regional Insight:

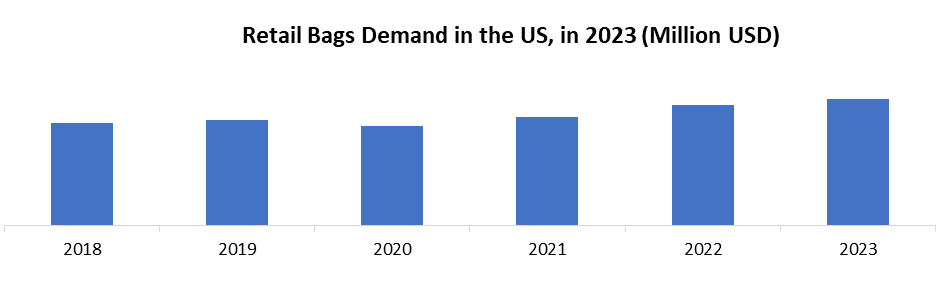

North America has been the dominant region in the Carry Bag Market. Growing usage of paper bags in various industries such as food and beverages, and cosmetic products among others is major factors driving the Carry Bag Market. Walmart eliminate single-use paper and plastic carryout bags at the register from stores in New York, Connecticut and Colorado. Walmart is trying to get ahead of legislation in some states that are cracking down on plastics. Many customers are also demanding change, and Walmart has outlined corporate environmental goals to achieve zero waste in its US operations by 2025. The company previously stopped giving out single-use plastic bags in New York and Connecticut and in some areas in Colorado. Walmart offers reusable shopping bags starting at 74 cents for customers without their own bags.

Most of the growth in production comes from paper bags, which have seen increased demand across all markets due to their perceived sustainability and the impact of plastic ban bans. As paper bag manufacturers seek to increase production capacity, more plastic bag manufacturers continue to transition from low gauge HDPE bags to high gauge LDPE bags that better comply with single-use bag bans and restrictions. Foodservice market has been a relatively minor component of bag demand compared to grocery and other retail stores. A strong increase in the popularity of takeout and delivery orders continue to drive the use of retail bags at many foodservice establishments.

- United States Carry bag Buyers & importers directory, there are 4,776 active Carry bag Importers in United States Importing from 4,213Suppliers.

- GLOPACK INC accounted for maximum import market share with 4,685 shipments.

Carry Bag Market Competitive Landscape:

- In April 2023, Mondi partnered with Megaflex and introduced a renewable, easily disposable, and recyclable Kraft paper-based mattress rolling packaging. They also stated this could be an effective alternative to plastic-based roll packaging. This product launch helped the company widen its portfolio and market impact.

- In February 2023, International Paper was named on the list of Fortune magazine's most admired companies. The company stated they are much honored to feature for the 20th time on the occasion of the international paper's 125th year in the industry

Carry Bag Market Scope:

|

Carry Bag Market |

|

|

Market Size in 2023 |

USD 23.94 Bn. |

|

Market Size in 2030 |

USD 33.5 Bn. |

|

CAGR (2024-2030) |

4.92 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Material Type Plastic Polyethylene Paper Jute Cotton & Canvas Other |

|

By Type Single Use Reusable |

|

|

By Application Residential Commercial |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Carry Bag Market Key Players:

- The Carry Bag Company

- Global-Pak Inc.

- Novolex Holdings

- International Paper Company

- Mondi Group Plc

- Coveris

- Atlantic Poly Inc.

- Rutan Poly Industries Inc.

- Smurfit Kappa Group

- El Dorado Packaging Inc.

- Andrew Kohn Pty Ltd.

- GLOPACK INC

- JohnPac Inc, ProAmpac LLC,

- Stora Enso Oyj,

- Ronopac Inc,

- Atlas Paper Bag Co Ltd,

- Huhtamki OYJ,

- United Bag, Inc,

- Caravan Paper Products

- Arc Creations

- Apna Cloth Bags

- Accuretta Composites

- Shree Neelkanth Corporation

- XXX Inc.

Frequently Asked Questions

Growing Reusable Bags is trend in the Carry Bags Market. Also, the includes paper bag making machines, square bottom paper bag making machines, V-bottom paper bag making machines, and non-woven bag making machines.

The Market size was valued at USD 23.94 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 4.92 % from 2024 to 2030, reaching nearly USD 33.5 Billion.

The segments covered in the market report are by Material Type, Type and Applications.

1. Carry Bag Market: Research Methodology

2. Carry Bag Market: Executive Summary

3. Carry Bag Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Carry Bag Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Carry Bag Market: Dynamics

6.1. Market Driver

6.1.1. Growing demand for paper bags

6.1.2. surging of E-Commerce, Courier, and Delivery Services

6.2. Market Trends by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Drivers by Region

6.3.1. North America

6.3.2. Europe

6.3.3. Asia Pacific

6.3.4. Middle East and Africa

6.3.5. South America

6.4. Market Restraints

6.5. Market Opportunities

6.6. Market Challenges

6.7. PORTER’s Five Forces Analysis

6.8. PESTLE Analysis

6.9. Strategies for New Entrants to Penetrate the Market

6.10. Regulatory Landscape by Region

6.10.1. North America

6.10.2. Europe

6.10.3. Asia Pacific

6.10.4. Middle East and Africa

6.10.5. South America

7. Carry Bag Market Size and Forecast by Segments (by Value Units)

7.1. Carry Bag Market Size and Forecast, by Material Type (2023-2030)

7.1.1. Plastic Polyethylene

7.1.2. Paper

7.1.3. Jute

7.1.4. Cotton & Canvas

7.1.5. Others

7.2. Carry Bag Market Size and Forecast, by Type (2023-2030)

7.2.1. Single Use

7.2.2. Reusable

7.3. Carry Bag Market Size and Forecast, by Application (2023-2030)

7.3.1. Residential

7.3.2. Commercial

7.4. Carry Bag Market Size and Forecast, by Region (2023-2030)

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Middle East and Africa

7.4.5. South America

8. North America Carry Bag Market Size and Forecast (by Value Units)

8.1. North America Carry Bag Market Size and Forecast, by Material Type (2023-2030)

8.2. Plastic Polyethylene

8.3. Paper

8.4. Jute

8.5. Cotton & Canvas

8.6. Others

8.7. Carry Bag Market Size and Forecast, by Type (2023-2030)

8.7.1. Single Use

8.7.2. Reusable

8.8. Carry Bag Market Size and Forecast, by Application (2023-2030)

8.8.1. Residential

8.8.2. Commercial

8.9. North America Carry Bag Market Size and Forecast, by Country (2023-2030)

8.9.1. United States

8.9.2. Canada

8.9.3. Mexico

9. Europe Carry Bag Market Size and Forecast (by Value Units)

9.1. Europe Carry Bag Market Size and Forecast, by Material Type (2023-2030)

9.2. Plastic Polyethylene

9.3. Paper

9.4. Jute

9.5. Cotton & Canvas

9.6. Others

9.7. Carry Bag Market Size and Forecast, by Type (2023-2030)

9.7.1. Single Use

9.7.2. Reusable

9.8. Carry Bag Market Size and Forecast, by Application (2023-2030)

9.8.1. Residential

9.8.2. Commercial

9.9. Europe Carry Bag Market Size and Forecast, by Country (2023-2030)

9.9.1. UK

9.9.2. France

9.9.3. Germany

9.9.4. Italy

9.9.5. Spain

9.9.6. Sweden

9.9.7. Russia

9.9.8. Rest of Europe

10. Asia Pacific Carry Bag Market Size and Forecast (by Value Units)

10.1. Asia Pacific Carry Bag Market Size and Forecast, by Material Type (2023-2030)

10.2. Plastic Polyethylene

10.3. Paper

10.4. Jute

10.5. Cotton & Canvas

10.6. Others

10.7. Carry Bag Market Size and Forecast, by Type (2023-2030)

10.7.1. Single Use

10.7.2. Reusable

10.8. Carry Bag Market Size and Forecast, by Application (2023-2030)

10.8.1. Residential

10.8.2. Commercial

10.9. Asia Pacific Air Traffic Control (ATC) Communications Market Size and Forecast, by Country (2023-2030)

10.9.1. China

10.9.2. S Korea

10.9.3. Japan

10.9.4. India

10.9.5. Australia

10.9.6. Indonesia

10.9.7. Malaysia

10.9.8. Vietnam

10.9.9. Taiwan

10.9.10. Bangladesh

10.9.11. Pakistan

10.9.12. Rest of Asia Pacific

11. Middle East and Africa Carry Bag Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Carry Bag Market Size and Forecast, by Material Type (2023-2030)

11.2. Plastic Polyethylene

11.3. Paper

11.4. Jute

11.5. Cotton & Canvas

11.6. Others

11.7. Middle East and Africa Market Size and Forecast, by Type (2023-2030)

11.7.1. Single Use

11.7.2. Reusable

11.8. Carry Bag Market Size and Forecast, by Application (2023-2030)

11.8.1. Residential

11.8.2. Commercial

11.9. Middle East and Africa Carry Bag Market Size and Forecast, by Country (2023-2030)

11.9.1. South Africa

11.9.2. GCC

11.9.3. Egypt

11.9.4. Nigeria

11.9.5. Rest of ME&A

12. South America Carry Bag Market Size and Forecast (by Value Units)

12.1. South America Carry Bag Market Size and Forecast, by Material Type (2023-2030)

12.2. Plastic Polyethylene

12.3. Paper

12.4. Jute

12.5. Cotton & Canvas

12.6. Others

12.7. South America Market Size and Forecast, by Type (2023-2030)

12.7.1. Single Use

12.7.2. Reusable

12.8. Carry Bag Market Size and Forecast, by Application (2023-2030)

12.8.1. Residential

12.8.2. Commercial

12.9. South America Carry Bag Market Size and Forecast, by Country (2023-2030)

12.9.1. Brazil

12.9.2. Argentina

12.9.3. Rest of South America

13. Company Profile: Key players

13.1. The Carry Bag Company

13.1.1. Company Overview

13.1.2. Financial Overview

13.1.3. Business Portfolio

13.1.4. SWOT Analysis

13.1.5. Business Strategy

13.1.6. Recent Developments

13.2. The Carry Bag Company

13.3. Global-Pak Inc.

13.4. Novolex Holdings

13.5. International Paper Company

13.6. Mondi Group Plc

13.7. Coveris

13.8. Atlantic Poly Inc.

13.9. Rutan Poly Industries Inc.

13.10. Smurfit Kappa Group

13.11. El Dorado Packaging Inc.

13.12. Andrew Kohn Pty Ltd.

13.13. GLOPACK INC

13.14. JohnPac Inc, ProAmpac LLC,

13.15. Stora Enso Oyj,

13.16. Ronopac Inc,

13.17. Atlas Paper Bag Co Ltd,

13.18. Huhtamki OYJ,

13.19. United Bag, Inc,

13.20. Caravan Paper Products

13.21. Arc Creations

13.22. Apna Cloth Bags

13.23. Accuretta Composites

13.24. Shree Neelkanth Corporation

14. Key Findings

15. Industry Recommendation