Cholic Acid Market: Global Industry Analysis and Forecast (2024-2030)

Global Cholic Acid Market size was valued at USD 198.22 Mn. in 2023 and is expected to reach USD 229.31 Mn. by 2030, at a CAGR of 7.5%.

Format : PDF | Report ID : SMR_2076

Cholic Acid Market Overview

Cholic acid is a bile acid prescribed for treating patients with bile acid synthesis disorders caused by single enzyme defects. It is also utilized to aid peroxisomal disorders such as Zellweger spectrum disorders, especially those experiencing liver disease symptoms, steatorrhea, or difficulty absorbing fat-soluble vitamins. The safety and efficacy of cholic acid to manage extrahepatic manifestations of bile acid synthesis and peroxisomal disorders remain unestablished. Cholic acid helps normalize bile production and enhance fat absorption by supplementing deficient bile acids. Thus, alleviating symptoms associated with these metabolic disorders which drive the Cholic Acid Market growth.

The growing number of gallstone cases globally due to obesity, genetic disorders and other medical conditions is the primary driving factor for the market growth. The increasing incidence of metabolic disorders, expansion of the therapeutic applications of the cholic acids and innovations in diagnostic technologies are also the driving factors for the Cholic Acid industry's growth. Cholic Acid addresses critical unmet medical needs, improving its demand, as an orphan drug designated by the FDA for specific conditions. Many Pharmaceutical companies invest in research and development activities for enhancing formulations and exploration of new indications.

Cholic Acid Key Players emphasizes personalized medicine approaches, providing targeted therapies that enhance and improve patient outcomes. The development of synthetic and semi-synthetic cholic acid derivatives is expected to have new opportunities for the Cholic Acid Market growth. Regulations such as the FDA and EMA help new entrances in the market, with their guidelines and approvals which influence industry growth.

To get more Insights: Request Free Sample Report

Cholic Acid Market Trend

Increasing focus on personalized medicine and targeted therapies

Modern medicine has rapidly shifted from classical disease-centered diagnosis and treatment paradigms to a more individualized approach termed Personalized Medicine (PM). This approach is particularly essential in the development of patient care, particularly in oncology, requiring advanced sciences including molecular biology and genetics. Personalized medicine is becoming increasingly significant in healthcare, aiming to treat each patient based on genetic and biological characteristics of the disease and patient-specific factors such as environment and lifestyle. This approach adds significant value to EBM, particularly in surgical interventions such as gallstone disease management, where genetic factors play an essential role in the disease's development, which drives Cholic Acid Market growth.

Cholic acid, a primary bile acid synthesized in the liver, helps to exert waste products, especially cholesterol, from the body. It is essential for emulsifying and absorbing fats and fat-soluble vitamins. Bile acid synthesis defects (BASDs) are rare but severely disabling diseases where cholic acid supplementation helps by decreasing endogenous bile acid production, stimulating bile secretion, and improving bile flow and micellar solubilization. Personalized medicine is particularly relevant here, as it addresses individual genetic and phenotypic variations in patients with these disorders. This approach helps to manage other conditions where cholic acid plays a role, such as liver and gastrointestinal diseases.

- For Instance, cholic acid therapy has shown promise in enhancing liver function in patients with Zellweger spectrum disorders and in reducing toxic bile acid accumulation in cholestasis, a hepatic disease.

The high bile acid levels have been linked to inflammatory bowel disease and certain cancers, where PM tailors therapies to individual metabolic profiles. In neuroscience, alterations in bile acid metabolism are being studied as biomarkers for neurodegenerative diseases, including Alzheimer's disease. The research and development towards more individualized and effective treatments, and enhancing patient outcomes through precision medicine approaches boost the increasing emphasis on personalized medicines and therapies, which boosts the Cholic Acid Market growth. This improves the therapeutic efficacy of cholic acid across several conditions and positions companies at the forefront of medical innovation in an increasing market.

Cholic Acid Market Dynamics

Increasing the prevalence of rare metabolic disorders, particularly bile acid synthesis disorders and peroxisomal disorders to Boost Market Growth

Bile acid synthesis disorders (BASDs), caused by single enzyme defects, result in insufficient production of bile acids essential for fat digestion and absorption. Peroxisomal disorders such as Zellweger spectrum disorders, impair multiple metabolic pathways and result in severe complications such as liver disease, developmental delays and neurological deficits. The growing awareness and enhanced diagnosis of these disorders are boosting the demand for cholic acid as an effective treatment.

Cholic acid supplementation normalizes bile production, improves fat absorption, and alleviates symptoms associated with these conditions, offering a lifeline for patients with insufficient treatment options. The designation of cholic acid as an orphan drug by regulatory bodies including the FDA underscores its importance in treating these rare diseases, driving the Cholic Acid Market growth. The emphasis on personalized medicine and targeted therapies is significantly influencing the cholic acid industry.

Personalized medicine (PM) involves tailoring treatment to individual patients based on genetic, phenotypic, biomarker-based and environmental factors. This approach is especially relevant for managing rare metabolic disorders, as it addresses the unique genetic and metabolic profiles of each patient.

- For instance, cholic acid therapy is customized to optimize the dosage and formulation based on a patient's specific genetic makeup and disease characteristics. This precision in treatment enhances the therapeutic efficacy and minimizes adverse effects, improving patient outcomes.

The incorporation of personalized medicine with evidence-based medicine (EBM) has gained popularity, where EBM emphasizes using precise accessible data for guiding treatment decisions.

Combining these approaches allows more effective and comprehensive patient care. For instance, genetic testing introduces specific enzyme defects in BASDs, allowing targeted cholic acid therapy which directly addresses the underlying metabolic dysfunction. This approach enhances clinical outcomes and minimizes healthcare costs by preventing complications and hospitalizations.

Innovations in diagnostic technologies including next-generation sequencing and metabolomics, are enabling the early detection and precise characterization of metabolic disorders to boost the demand for cholic acid which also drives the Cholic Acid Market growth. The increasing trend of patient-centric care is supported by technological innovations and increased healthcare spending, which raises substantial opportunities for pharmaceutical companies to innovate and increase their reach in addressing rare metabolic disorders.

Limited Awareness and Diagnostic Challenges to hamper Market Growth

Limited Awareness and Diagnostic Challenges for the Cholic acid industry due to their impact on the timely diagnosis and treatment initiation for rare metabolic disorders including peroxisomal disorders and Bile Acid Synthesis Disorders (BASDs). These conditions are considered complex and nonspecific symptoms, leading to underrecognition or misdiagnosis in clinical practice Healthcare providers lack familiarity with the clinical presentations of BASDs and peroxisomal disorders, leading to diagnostic delays and suboptimal management strategies. The absence of standardized diagnostic protocols and specialized testing facilities complicates precise disease identification, which hampers Cholic Acid Market growth.

Patients endure extended periods without appropriate treatment, delaying the potential advantages of cholic acid therapy in improving clinical outcomes. The high cost related to genetic testing and specialized diagnostic procedures shows a financial barrier, especially in healthcare systems with adequate resources or insufficient insurance coverage. This financial burden discourages inclusive diagnostic evaluations essential for identifying suitable candidates for cholic acid therapy.

Cholic Acid Market Segment Analysis

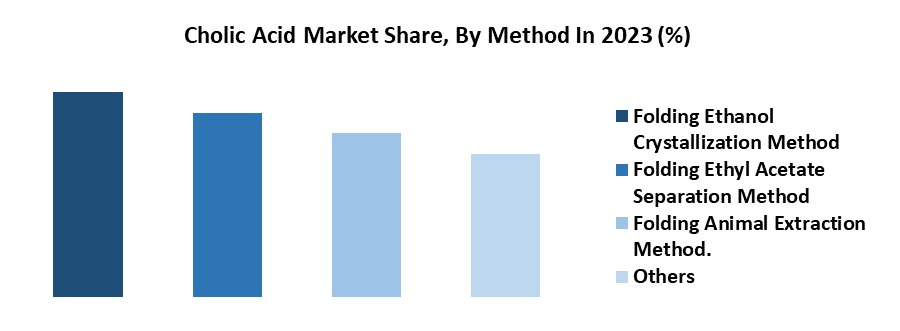

Based on the Method, the market is segmented into the Folding Ethanol Crystallization Method, Folding Ethyl Acetate Separation Method, Folding Animal Extraction Method and Others. Folding Ethyl Acetate Separation Method dominated the Cholic Acid Market in 2023. The ethyl Acetate method is highly selective in extracting cholic acid from natural sources or reaction mixtures, ensuring high purity and yield of the compound. This selectivity reduces the presence of impurities, meeting stringent quality standards required for pharmaceutical and other high-end applications.

Ethyl acetate is cost-effective and readily accessible, making it economically viable for industrial-scale production. Its widespread availability also improves scalability, allowing manufacturers to meet varying demand levels efficiently. Environmental considerations increase its appeal, as ethyl acetate is relatively less toxic and more environmentally friendly as compared to alternative solvents used in extraction processes. This aligns with global trends towards sustainable practices and regulatory requirements for eco-friendly production methods.

The versatility of the Folding Ethyl Acetate Separation Method enables its application across different sources of cholic acid, whether from natural bile or synthetic processes, providing flexibility in production strategies. These factors collectively position the Folding Ethyl Acetate Separation Method as the preferred choice in the cholic acid market, offering a balanced approach that combines efficiency, cost-effectiveness, environmental responsibility, and versatility to meet the diverse needs of pharmaceutical, cosmetic, and dietary supplement industries globally.

Based on the Application, the market is categorized into Organic Acid, Emulsifiers, Detergents, Medicines and Others. Medicines are expected to dominate the Cholic Acid Market during the forecast period. Cholic Acid is used in the treatment of bile acid synthesis disorders due to single enzyme defects, such as 3β-Hydroxy-Δ5-C27-steroid oxidoreductase deficiency and Δ4-3-Oxosteroid 5β-reductase deficiency. These conditions impair the body's capability to produce primary bile acids, resulting in the accumulation of toxic intermediates that cause severe liver damage, growth failure, and fat-soluble vitamin deficiencies.

Cholic acid supplementation restores normal bile flow, reduces liver enzyme levels and encourages the absorption of fats and fat-soluble vitamins, thereby enhancing symptoms and improving patient outcomes. Its role in the emulsification and absorption of dietary fats makes it indispensable in the formulation of certain lipid-based drug delivery systems, enhancing the bioavailability of poorly soluble drugs.

Beyond these direct therapeutic uses, cholic acid and its derivatives are instrumental in research and diagnostic applications. They serve as biocompatible detergents in the isolation and stabilization of membrane proteins, which are important for drug development and understanding cellular mechanisms, which boost Cholic Acid Market growth. Cholic Acid's involvement in modulating gut microbiota and its potential anti-inflammatory properties are being explored for the treatment of inflammatory bowel diseases and other gastrointestinal conditions. Its synthesis and regulatory mechanisms are also critical in understanding cholesterol metabolism and developing cholesterol-lowering therapies.

The multifaceted roles of cholic acid in treating and managing complex liver and metabolic disorders, coupled with its utility in drug formulation and biomedical research, underscore its predominance in the medical application category. This extensive therapeutic potential, spanning from life-saving treatments to enhancing pharmaceutical formulations, clearly delineates why medicine stands as the dominant sector for cholic acid application, reflecting its indispensable role in modern healthcare and biomedical research.

Cholic Acid Market Regional Insights

Europe dominated the Cholic Acid Market in 2023 and is expected to continue its dominance over the forecast period. Cholic acid, a vital component found in bile, facilitates the digestion of fats. Orphacol (European Medicines Agency) is specifically indicated for patients such as adults and children from one month of age, who suffer from inborn errors in primary bile acid synthesis. These genetic irregularities result in deficiencies in indispensable liver enzymes responsible for producing primary bile acids including cholic acid. The European Medicines Agency (EMA) has thoroughly assessed Orphacol to ensure its compliance with EU standards for safety, efficacy, and quality. The medicine's approval underscores its capability to restore limited bile acid levels, thereby preventing liver damage and improving patient outcomes.

The advancements in genetic testing technologies and the establishment of specialized centers of excellence are enhancing diagnostic accuracy and allowing more accurate patient management strategies. These initiatives are essential to overcome existing barriers and expand the reach of cholic acid therapies to benefit more patients suffering from rare metabolic disorders. As Europe continues to lead in the field of cholic acid therapies, ongoing research and collaboration are essential to optimize treatment outcomes and enhance the quality of life for individuals affected by these challenging conditions.

North America is expected to have a significant CAGR for Cholic Acid Market over the forecast period. The rising prevalence of rare metabolic disorders including bile acid synthesis disorders and peroxisomal disorders, increasing awareness, expansion of the healthcare infrastructure and advancements in diagnostic capabilities are the driving factors of the regional Cholic Acid Market Growth.

Cholic Acid Market Scope

|

Cholic Acid Market |

|

|

Market Size in 2023 |

USD 138.22 Mn. |

|

Market Size in 2030 |

USD 229.31 Mn. |

|

CAGR (2024(2030) |

7.5% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Method Folding Ethanol Crystallization Method Folding Ethyl Acetate Separation Method Folding Animal Extraction Method. Others |

|

By Application Organic Acid Emulsifiers Detergents Medicines Others |

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa ( South Africa, GCC, Egypt, Nigeria, the Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Cholic Acid Market Key Players

North America

- Avanti Polar Lipids (Alabaster, Alabama, USA)

- Cayman Chemical (Ann Arbor, Michigan, USA)

- Toronto Research Chemicals (North York, Ontario, Canada)

- Sigma-Aldrich (Merck Group) (St. Louis, Missouri, USA)

- Pfizer CentreOne (New York, New York, USA)

- TCI America (Portland, Oregon, USA)

- VWR International (Radnor, Pennsylvania, USA)

Europe

- ICE Pharma (Reggio Emilia, Ital?y)

- PharmaZell (Raubling, Germany)

- Cfm Oskar Tropitzsch GmbH (Marktredwitz, Germany)

- Dextra Laboratories (Reading, United Kingdom)

- Fabbrica Italiana Sintetici (FIS) (Montecchio Maggiore, Italy)

- BASF (Ludwigshafen, Germany)

- Janus Pharma (Amsterdam, Netherlands)

Asia-Pacific

- Shanghai Shenghao Chemical (Shanghai, China)

- Tianjin Zhongxin Chemtech Co., Ltd (Tianjin, China)

- Tokyo Chemical Industry Co., Ltd. (TCI) (Tokyo, Japan)

- Lianyungang Guangda Chemical Co., Ltd. (Jiangsu, China)

- Jigchem Universal (Maharashtra, India)

Middle East and Africa

- Mash Premiere (Cairo, Egypt)

- Tabuk Pharmaceuticals (Tabuk, Saudi Arabia)

South America

- FarmaSino Pharmaceuticals (Sao Paulo, Brazil)

Frequently Asked Questions

Europe is expected to dominate the Cholic Acid Market during the forecast period.

The Cholic Acid Market size is expected to reach USD 229.31 Million by 2030.

The major top players in the Global Cholic Acid Market are Avanti Polar Lipids (Alabaster, Alabama, USA), Cayman Chemical (Ann Arbor, Michigan, USA), Toronto Research Chemicals (North York, Ontario, Canada), Sigma-Aldrich (Merck Group) (St. Louis, Missouri, USA), Pfizer CentreOne (New York, New York, USA), TCI America (Portland, Oregon, USA) and others.

The increasing use in the pharmaceutical industry, particularly for treating liver and gallbladder disorders and the growing elderly population, particularly in regions such as Europe and the Americas are expected to drive market growth during the forecast period.

1. Cholic Acid Market: Research Methodology

2. Cholic Acid Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Cholic Acid Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Segment

3.3.3. End-user Segment

3.3.4. Revenue (2023)

3.3.5. Company Headquarter

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Mergers and Acquisitions Details

4. Cholic Acid Market: Dynamics

4.1. Cholic Acid Market Trends

4.2. Cholic Acid Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Application Roadmap

4.6. Regulatory Landscape by Region

4.6.1. North America

4.6.2. Europe

4.6.3. Asia Pacific

4.6.4. Middle East and Africa

4.6.5. South America

5. Cholic Acid Market: Global Market Size and Forecast (Value in USD Million) (2023-2030)

5.1. Cholic Acid Market Size and Forecast, By Method (2023-2030)

5.1.1. Folding Ethanol Crystallization Method

5.1.2. Folding Ethyl Acetate Separation Method

5.1.3. Folding Animal Extraction Method.

5.1.4. Others

5.2. Cholic Acid Market Size and Forecast, By Application (2023-2030)

5.2.1. Organic Acid

5.2.2. Emulsifiers

5.2.3. Detergents

5.2.4. Medicines

5.2.5. Others

5.3. Cholic Acid Market Size and Forecast, by Region (2023-2030)

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

6. North America Cholic Acid Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

6.1. North America Cholic Acid Market Size and Forecast, By Method (2023-2030)

6.1.1. Folding Ethanol Crystallization Method

6.1.2. Folding Ethyl Acetate Separation Method

6.1.3. Folding Animal Extraction Method.

6.1.4. Others

6.2. North America Cholic Acid Market Size and Forecast, By Application (2023-2030)

6.2.1. Organic Acid

6.2.2. Emulsifiers

6.2.3. Detergents

6.2.4. Medicines

6.2.5. Others

6.3. North America Cholic Acid Market Size and Forecast, by Country (2023-2030)

6.3.1. United States

6.3.2. Canada

6.3.3. Mexico

7. Europe Cholic Acid Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

7.1. Europe Cholic Acid Market Size and Forecast, By Method (2023-2030)

7.2. Europe Cholic Acid Market Size and Forecast, By Application (2023-2030)

7.3. Europe Cholic Acid Market Size and Forecast, by Country (2023-2030)

7.3.1. United Kingdom

7.3.2. France

7.3.3. Germany

7.3.4. Italy

7.3.5. Spain

7.3.6. Sweden

7.3.7. Russia

7.3.8. Rest of Europe

8. Asia Pacific Cholic Acid Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

8.1. Asia Pacific Cholic Acid Market Size and Forecast, By Method (2023-2030)

8.2. Asia Pacific Cholic Acid Market Size and Forecast, By Application (2023-2030)

8.3. Asia Pacific Cholic Acid Market Size and Forecast, by Country (2023-2030)

8.3.1. China

8.3.2. S Korea

8.3.3. Japan

8.3.4. India

8.3.5. Australia

8.3.6. ASEAN

8.3.7. Rest of Asia Pacific

9. Middle East and Africa Cholic Acid Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

9.1. Middle East and Africa Cholic Acid Market Size and Forecast, By Method (2023-2030)

9.2. Middle East and Africa Cholic Acid Market Size and Forecast, By Application (2023-2030)

9.3. Middle East and Africa Cholic Acid Market Size and Forecast, by Country (2023-2030)

9.3.1. South Africa

9.3.2. GCC

9.3.3. Nigeria

9.3.4. Rest of ME&A

10. South America Cholic Acid Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

10.1. South America Cholic Acid Market Size and Forecast, By Method (2023-2030)

10.2. South America Cholic Acid Market Size and Forecast, By Application (2023-2030)

10.3. South America Cholic Acid Market Size and Forecast, by Country (2023-2030)

10.3.1. Brazil

10.3.2. Argentina

10.3.3. Rest Of South America

11. Company Profile: Key Players

11.1. Avanti Polar Lipids (Alabaster, Alabama, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Cayman Chemical (Ann Arbor, Michigan, USA)

11.3. Toronto Research Chemicals (North York, Ontario, Canada)

11.4. Sigma-Aldrich (Merck Group) (St. Louis, Missouri, USA)

11.5. Pfizer CentreOne (New York, New York, USA)

11.6. TCI America (Portland, Oregon, USA)

11.7. VWR International (Radnor, Pennsylvania, USA)

11.8. ICE Pharma (Reggio Emilia, Italy)

11.9. PharmaZell (Raubling, Germany)

11.10. Cfm Oskar Tropitzsch GmbH (Marktredwitz, Germany)

11.11. Dextra Laboratories (Reading, United Kingdom)

11.12. Fabbrica Italiana Sintetici (FIS) (Montecchio Maggiore, Italy)

11.13. BASF (Ludwigshafen, Germany)

11.14. Janus Pharma (Amsterdam, Netherlands)

11.15. Shanghai Shenghao Chemical (Shanghai, China)

11.16. Tianjin Zhongxin Chemtech Co., Ltd (Tianjin, China)

11.17. Tokyo Chemical Industry Co., Ltd. (TCI) (Tokyo, Japan)

11.18. Lianyungang Guangda Chemical Co., Ltd. (Jiangsu, China)

11.19. Jigchem Universal (Maharashtra, India)

11.20. Mash Premiere (Cairo, Egypt)

11.21. Tabuk Pharmaceuticals (Tabuk, Saudi Arabia)

11.22. FarmaSino Pharmaceuticals (São Paulo, Brazil)

12. Key Findings

13. Industry Recommendations