Cold and Flu Drugs Market: Industry Analysis and Forecast (2024-2030)

The Cold and Flu Drugs Market size was valued at USD 15.76 Bn. in 2023 and the total Global Cold and Flu Drugs revenue is expected to grow at a CAGR of 10.86% from 2024 to 2030, reaching nearly USD 32.43 Bn. by 2030.

Format : PDF | Report ID : SMR_1891

Cold and Flu Drugs Market Overview

Cold And Flu Drugs Market plays a significant role in providing effective and safe relief for common ailments, cold and flu drugs readily available for purchase without a prescription at pharmacies and local stores. These medications typically address symptoms like pain, congestion, allergies, and coughing. Before dispensing them, pharmacists verify the customer's age and identity to ensure safe usage. The most commonly used over-the-counter drugs include aspirin, acetaminophen, and ibuprofen. Both over-the-counter (OTC) and prescription medications are utilized to combat cold and flu symptoms. Cold And Flu Drugs Market OTC pharmaceuticals, also known as non-prescription drugs, are accessible without a doctor's prescription and are considered safe when used according to the instructions on the label.

In many countries, these medications are available in various establishments such as petrol stations, convenience stores, pharmacies, and grocery shops. However, only licensed pharmacists have the authority to dispense these medications after confirming the patient's age, identity, and understanding of the substance and its intended purpose. For minor medical conditions, over-the-counter medications such as pain relievers, skin treatments, and digestive aids are commonly employed. The production and regulation of OTC medications adhere to OTC Monograph or New Drug Application (NDA) procedures to ensure their safety and efficacy.

To get more Insights: Request Free Sample Report

Cold and Flu Drugs Market Dynamics

The market growth of cold and flu drugs is being propelled by seasonal variations and outbreaks.

Seasonal variability and outbreaks play a pivotal role in shaping the dynamics of the cold and flu drugs market. During peak flu seasons, which typically occur during the colder months of the year, there is a surge in the incidence of flu and cold viruses, leading to an increased demand for cold and flu drugs. For example, pharmacies experience a significant uptick in sales of cold and flu medications such as antivirals, decongestants, and pain relievers as people seek relief from symptoms such as fever, cough, and congestion.

Moreover, periodic outbreaks of flu strains, such as the emergence of new influenza viruses or novel strains with pandemic potential, further fuel demand for cold and flu drugs. For instance, the outbreak of the H1N1 influenza virus in 2009 led to a global pandemic, prompting widespread vaccination campaigns and increased use of antiviral medications to control the spread of the virus and mitigate its impact on public health. Additionally, seasonal variability in flu activity contributes to the cyclical nature of demand for cold and flu drugs. As flu activity wanes during warmer months, sales of cold and flu medications may decline, only to pick up again as flu season approaches. This cyclical demand pattern underscores the importance of seasonal forecasting and stockpiling of cold and flu drugs by manufacturers and retailers to meet anticipated demand fluctuations.

Seasonal variability and outbreaks of flu and cold viruses create a cyclical demand for cold and flu drugs, driving sales and market growth during peak flu seasons and periods of heightened influenza activity. Manufacturers and retailers must remain vigilant and responsive to these fluctuations to ensure an adequate supply of cold and flu drugs to meet consumer demand and support public health efforts to combat seasonal illnesses.

A surge in financial investments and population growth further fuels cold and flu drugs market growth.

A surge in financial investments channels resources into crucial areas such as R&D and marketing of new medications, facilitating market growth. Additionally, population growth amplifies the consumer base for cold and flu drugs market products, fuelling demand and rising market growth. Intensified research and development endeavours result in the creation of innovative drug delivery systems and treatments, effectively meeting the evolving needs of consumers. Moreover, the considerable potential for market growth stemming from these initiatives fortifies the market and promotes healthy competition, leading to the enhancement of products and services.

Despite challenges such as limited awareness and concerns regarding drug dependency, concerted efforts through education and regulatory measures ensure sustained growth within the Cold and Flu Drugs Market, ultimately boosting innovation, consumer access, and market competitiveness. For instance, the Centers for Disease Control and Prevention (CDC) estimates that the common cold causes approximately 22 million American students to miss school annually, with nearly 1 billion cases reported each year in the US alone. These statistics underscore the driving force behind the revenue surge in the cold and flu drugs market, emphasizing the market's significance and potential for further growth.

Growing awareness of flu-related mortality boosts demand for cold and flu drugs

Data from the World Health Organization (WHO) reveals a concerning annual death toll of 290,000 to 650,000 individuals due to the flu, prompting a surge in demand for cold and flu drugs among consumers striving to fortify their immune systems against such illnesses. These drugs are sought after to mitigate the risk of flu-related complications and mortality. The market for cold and flu drugs is experiencing steady growth, fuelled by heightened consumer awareness of their efficacy in preventing and managing flu symptoms.

Notably, there is a growing preference for drugs with natural and immunity-boosting properties, reflecting consumer preferences for holistic healthcare solutions. Tablets and capsules dominate the market, with continuous product innovations driving industry growth. Despite the initiation of free annual flu immunization programs by various governments, which could potentially limit market growth, manufacturers' increased investments in drug development are expected to propel sales during the forecast period.

Cold And Flu Drugs Market Segment Analysis

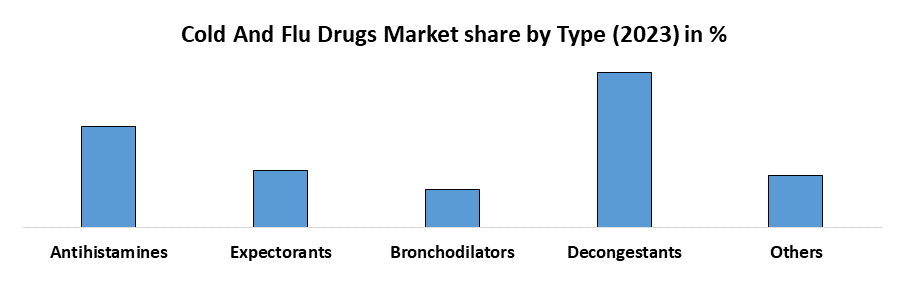

Based on Type, In the Cold and Flu Drugs Market, the segment that holds the maximum share is likely to be decongestants. Decongestants play a crucial role in providing relief from nasal congestion, a prevalent symptom of both colds and flu. As nasal congestion is often a significant discomfort for individuals affected by these respiratory illnesses, many consumers turn to decongestant medications for relief. Moreover, decongestants are easily accessible over the counter, making them a convenient choice for consumers seeking immediate relief from symptoms.

Additionally, decongestants are frequently included in multi-symptom cold and flu remedies, further enhancing their widespread usage and market dominance within the Cold and Flu Drugs Market. Therefore, the decongestant segment holds the maximum share in the cold and flu drugs market due to its effectiveness in addressing a prominent symptom and its widespread availability across various remedies and medications.

Based on Application, the Over the Counter (OTC) Application segment is likely to hold the maximum share. This dominance stems from the accessibility and convenience of OTC medications, which do not require a prescription from a healthcare provider. Consumers experiencing cold and flu symptoms often prefer the ease of purchasing these medications directly from pharmacies or retail stores, especially for mild to moderate symptoms.

OTC medications for cold and flu offer a wide array of symptom-relief options, including pain relievers, decongestants, antihistamines, and cough suppressants, catering to diverse consumer needs. Furthermore, the extensive marketing and availability of OTC medications in various forms such as tablets, capsules, syrups, and nasal sprays contribute to their popularity and widespread use in addressing cold and flu symptoms. Therefore, the Over the Counter (OTC) Application segment is expected to dominate the cold and flu drugs market during the forecast period.

Cold and Flu Drugs Market Regional Insight

The Asia-Pacific region emerges as the largest market share holder and is expected to witness significant growth. This growth is attributed to rising patient awareness of Over the Counter (OTC) medications, encouraging self-medication practices. Particularly, the Chinese economy's rapid expansion contributes to this growth, driven by long-term improvements in various sectors.

In India, the demand for the antiviral drug Oseltamivir, known as Tamiflu, has surged, indicating a growing market for cold and flu drugs. With an increase in flu cases reported, the sales of Oseltamivir have seen substantial growth, especially during peak flu seasons. Notably, pharmaceutical companies like Cipla, Hetero Drugs, and MacLeod’s Pharmaceuticals have experienced significant gains in the Oseltamivir business, reflecting the market's upward trajectory. Additionally, other firms in India, such as Glenmark Pharmaceuticals and Natco Pharma, contribute to the production of Oseltamivir, further fuelling the market's growth. Overall, with the flu season peaking and the ongoing Covid-19 pandemic, the demand for Cold and Flu Drugs, particularly Oseltamivir, is expected to continue rising in India and across the Asia-Pacific region.

In Europe, the Cold and Flu Drugs market holds the second-largest share, driven by a growing demand for supplements due to shifting parental choices towards preventative healthcare and proactive sickness management. Notably, the German market dominates in market share, while the UK market exhibits the highest growth rate in the region.

Cold and Flu Drugs Market Key Players Overview

- Major players in the Cold and Flu Drugs market are heavily investing in research and development to diversify their product portfolios, driving market growth. Additionally, strategic initiatives such as product launches, partnerships, mergers, and acquisitions are being pursued to expand global presence and meet evolving consumer needs. To thrive in a competitive market environment, the industry must offer affordable products. Local production is a common strategy among manufacturers to reduce operational costs and enhance market penetration. Leading companies like F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb Company, AstraZeneca, GSK plc, Lilly, Merck & Co., Inc., and Novartis AG are investing in R&D to meet market demand.

- F. Hoffmann-La Roche AG, trading under the brand name Roche, is a multinational healthcare company specializing in diagnostics and pharmaceuticals. With its innovative Cobas 6800/8800 molecular testing system, Roche Diagnostics achieved a significant milestone by developing a high-volume Sars-CoV-2 diagnostic test approved by the FDA in 2020.

- Bristol-Myers Squibb Company (BMS), headquartered in the United States, is among the largest pharmaceutical firms globally. BMS focuses on various therapeutic categories, including cancer, HIV/AIDS, cardiovascular disease, and psychiatric disorders. In 2022, BMS announced the acquisition of Turning Point Therapeutics Inc. for $4.1 billion, aiming to expand its cancer medication portfolio with repotrectinib.

|

Cold And Flu Drugs Market Scope |

|

|

Market Size in 2023 |

USD 15.76 Bn. |

|

Market Size in 2030 |

USD 32.43 Bn. |

|

CAGR (2024-2030) |

10.86% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Antihistamines Expectorants Bronchodilators Decongestants Others |

|

|

By Application Over the Counter (OTC) Rx. Over the Counter (OTC) |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Cold And Flu Drugs Market

- Hoffmann-La Roche Ltd. - Switzerland

- Bristol-Myers Squibb Company - United States

- AstraZeneca - United Kingdom

- GSK plc (GlaxoSmithKline) - United Kingdom

- Lilly (Eli Lilly and Company) - United States

- Merck & Co., Inc. - United States

- Novartis AG - Switzerland

- Pfizer Inc. - United States

- Sun Pharmaceutical Industries Ltd. - India

- NATCO Pharma Limited - India

- Mylan N.V. - United States

- Sanofi - France

- Bayer AG - Germany

- Teva Pharmaceutical Industries Ltd. - Israel

- AbbVie Inc. - United States

- Johnson & Johnson - United States

- Takeda Pharmaceutical Company Limited - Japan

- Gilead Sciences, Inc. - United States

- Biogen Inc. - United States

- Amgen Inc. - United States

Frequently Asked Questions

The North America region is expected to hold the highest share of the Cold and Flu Drugs.

The market size of the Cold and Flu Drugs by 2030 is expected to reach US$ 32.43 Tn.

The market size of the Cold and Flu Drugs in 2023 was valued at US$ 15.76 Tn.

Bristol-Myers Squibb Company - United States , AstraZeneca - United Kingdom, GSK plc (GlaxoSmithKline) - United Kingdom , Lilly (Eli Lilly and Company) - United States, Merck & Co., Inc. - United States, Novartis AG – Switzerland, Pfizer Inc. - United States, Sun Pharmaceutical Industries Ltd. - India.

1. Cold And Flu Drugs Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Cold And Flu Drugs Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Business Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Cold And Flu Drugs Market: Dynamics

3.1. Cold And Flu Drugs Market Trends by Region

3.1.1. North America Cold And Flu Drugs Market Trends

3.1.2. Europe Cold And Flu Drugs Market Trends

3.1.3. Asia Pacific Cold And Flu Drugs Market Trends

3.1.4. Middle East and Africa Cold And Flu Drugs Market Trends

3.1.5. South America Cold And Flu Drugs Market Trends

3.2. Cold And Flu Drugs Market Dynamics

3.2.1. Global Cold And Flu Drugs Market Drivers

3.2.2. Global Cold And Flu Drugs Market Restraints

3.2.3. Global Cold And Flu Drugs Market Opportunities

3.2.4. Global Cold And Flu Drugs Market Challenges

3.3. Key Stakeholders of Cold And Flu Drugs Development

3.4. Ecotourism and Cold And Flu Drugs Development

3.5. Cold And Flu Drugs Development and the Rise of Slow Tourism

3.6. PORTER’s Five Forces Analysis

3.7. PESTLE Analysis

3.8. Technology Roadmap

3.9. Regulatory Landscape by Region

3.9.1. North America

3.9.2. Europe

3.9.3. Asia Pacific

3.9.4. Middle East and Africa

3.9.5. South America

3.10. Key Opinion Leader Analysis For Cold And Flu Drugs Industry

4. Cold And Flu Drugs Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

4.1. Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

4.1.1. Antihistamines

4.1.2. Expectorants

4.1.3. Bronchodilators

4.1.4. Decongestants

4.1.5. Others

4.2. Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

4.2.1. Over the Counter (OTC)

4.2.2. Rx. Over the Counter (OTC)

4.3. Cold And Flu Drugs Market Size and Forecast, by Region (2023-2030)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Cold And Flu Drugs Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

5.1.1. Antihistamines

5.1.2. Expectorants

5.1.3. Bronchodilators

5.1.4. Decongestants

5.1.5. Others

5.2. Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

5.2.1. Over the Counter (OTC)

5.2.2. Rx. Over the Counter (OTC)

5.3. North America Cold And Flu Drugs Market Size and Forecast, by Country (2023-2030)

5.3.1. United States

5.3.1.1. Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

5.3.1.1.1. Antihistamines

5.3.1.1.2. Expectorants

5.3.1.1.3. Bronchodilators

5.3.1.1.4. Decongestants

5.3.1.1.5. Others

5.3.1.2. Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

5.3.1.2.1. Over the Counter (OTC)

5.3.1.2.2. Rx. Over the Counter (OTC)

5.3.2. Canada

5.3.2.1. Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

5.3.2.1.1. Antihistamines

5.3.2.1.2. Expectorants

5.3.2.1.3. Bronchodilators

5.3.2.1.4. Decongestants

5.3.2.1.5. Others

5.3.2.2. Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

5.3.2.2.1. Over the Counter (OTC)

5.3.2.2.2. Rx. Over the Counter (OTC)

5.3.3. Mexico

5.3.3.1. Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

5.3.3.1.1. Antihistamines

5.3.3.1.2. Expectorants

5.3.3.1.3. Bronchodilators

5.3.3.1.4. Decongestants

5.3.3.1.5. Others

5.3.3.2. Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

5.3.3.2.1. Over the Counter (OTC)

5.3.3.2.2. Rx. Over the Counter (OTC)

6. Europe Cold And Flu Drugs Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.2. Europe Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.3. Europe Cold And Flu Drugs Market Size and Forecast, By Age Group (2023-2030)

6.4. Europe Cold And Flu Drugs Market Size and Forecast, by Country (2023-2030)

6.4.1. United Kingdom

6.4.1.1. United Kingdom Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.1.2. United Kingdom Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.2. France

6.4.2.1. France Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.2.2. France Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.3. Germany

6.4.3.1. Germany Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.3.2. Germany Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.4. Italy

6.4.4.1. Italy Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.4.2. Italy Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.5. Spain

6.4.5.1. Spain Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.5.2. Spain Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.6. Sweden

6.4.6.1. Sweden Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.6.2. Sweden Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.7. Austria

6.4.7.1. Austria Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.7.2. Austria Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

6.4.8. Rest of Europe

6.4.8.1. Rest of Europe Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

6.4.8.2. Rest of Europe Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7. Asia Pacific Cold And Flu Drugs Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.2. Asia Pacific Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3. Asia Pacific Cold And Flu Drugs Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.1.1. China Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.1.2. China Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.2. S Korea

7.3.2.1. S Korea Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.2.2. S Korea Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.3. Japan

7.3.3.1. Japan Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.3.2. Japan Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.4. India

7.3.4.1. India Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.4.2. India Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.5. Australia

7.3.5.1. Australia Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.5.2. Australia Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.6. Indonesia

7.3.6.1. Indonesia Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.6.2. Indonesia Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.7. Malaysia

7.3.7.1. Malaysia Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.7.2. Malaysia Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.8. Vietnam

7.3.8.1. Vietnam Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.8.2. Vietnam Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.9. Taiwan

7.3.9.1. Taiwan Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.9.2. Taiwan Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

7.3.10.2. Rest of Asia Pacific Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

8. Middle East and Africa Cold And Flu Drugs Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

8.2. Middle East and Africa Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

8.3. Middle East and Africa Cold And Flu Drugs Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.1.1. South Africa Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

8.3.1.2. South Africa Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

8.3.2. GCC

8.3.2.1. GCC Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

8.3.2.2. GCC Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

8.3.3. Nigeria

8.3.3.1. Nigeria Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

8.3.3.2. Nigeria Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

8.3.4.2. Rest of ME&A Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

9. South America Cold And Flu Drugs Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

9.2. South America Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

9.3. South America Cold And Flu Drugs Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.1.1. Brazil Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

9.3.1.2. Brazil Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

9.3.2. Argentina

9.3.2.1. Argentina Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

9.3.2.2. Argentina Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Cold And Flu Drugs Market Size and Forecast, By Type (2023-2030)

9.3.3.2. Rest Of South America Cold And Flu Drugs Market Size and Forecast, By Application (2023-2030)

10. Company Profile: Key Players

10.1. Hoffmann-La Roche Ltd. - Switzerland

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Bristol-Myers Squibb Company - United States

10.3. AstraZeneca - United Kingdom

10.4. GSK plc (GlaxoSmithKline) - United Kingdom

10.5. Lilly (Eli Lilly and Company) - United States

10.6. Merck & Co., Inc. - United States

10.7. Novartis AG - Switzerland

10.8. Pfizer Inc. - United States

10.9. Sun Pharmaceutical Industries Ltd. - India

10.10. NATCO Pharma Limited - India

10.11. Mylan N.V. - United States

10.12. Sanofi - France

10.13. Bayer AG - Germany

10.14. Teva Pharmaceutical Industries Ltd. - Israel

10.15. AbbVie Inc. - United States

10.16. Johnson & Johnson - United States

10.17. Takeda Pharmaceutical Company Limited - Japan

10.18. Gilead Sciences, Inc. - United States

10.19. Biogen Inc. - United States

10.20. Amgen Inc. - United States

11. Key Findings

12. Analyst Recommendations

13. Cold And Flu Drugs Market: Research Methodology