Compression Fittings Market: Global Industry Analysis and Forecast (2024 -2030)

Compression Fittings Market size was valued at USD 9.6 Bn. in 2023. The total Compression Fittings Market revenue is expected to grow by 7.1% from 2024 to 2030, reaching nearly USD 15.52 Bn.

Format : PDF | Report ID : SMR_2156

Compression Fittings Market Overview

Compression fittings are versatile pipe joints used in plumbing and mechanical systems. They connect pipes of various materials like copper, PVC, or steel without the need for additional sealing materials. Their threaded design allows for easy assembly and disassembly, facilitating maintenance or replacement. Compression fittings are ideal for low-pressure applications in refrigeration, air conditioning, and plumbing, ensuring reliable connections with minimal leakage potential. Thus, the market for compression fittings plays an important role in various industries, primarily in plumbing and fluid handling applications.

The compression fittings market is highly competitive, with numerous global and regional players. This has made the compression fittings industry challenging for new entrants to establish themselves. The key strategies adopted by compression fittings companies include product innovation, strategic partnerships, and geographic expansion to strengthen their market presence. Major players are mainly focusing on enhancing product reliability, sustainability, and compliance with industry standards to cater to diverse customer requirements.

As per the study, the compression fittings market is expected to grow due to the growing urbanization, infrastructure development, and technological advancements. The increasing focus on water conservation and efficiency in fluid handling systems is boosting the demand for compression fittings across the world. The adoption of smart fittings and sustainable materials are key trends that are shaping the market landscape.

To get more Insights: Request Free Sample Report

Compression Fittings Market Dynamics

Growing Infrastructure Development is Driving the Global Compression Fittings Market

Infrastructure development plays a crucial role in driving global market growth through several key mechanisms. Firstly, as countries invest in upgrading their water and gas distribution networks, there is an increased demand for reliable and durable piping systems, where compression fittings excel due to their ease of installation and robustness. Moreover, urbanization trends globally necessitate efficient plumbing systems in residential and commercial buildings, further boosting the adoption of compression fittings. These fittings are integral to ensuring leak-proof connections and reducing maintenance costs over the long term, which appeals to infrastructure developers and maintenance engineers alike.

Additionally, the emphasis on sustainable construction practices drives the preference for materials like brass and stainless steel in compression fittings, which offer longevity and environmental benefits. As infrastructure projects expand across regions such as Asia-Pacific, North America, and Europe, the compression fittings market is expected to witness sustained growth, driven by the critical need for reliable and efficient plumbing solutions in modern infrastructure development initiatives.

For example - The expansion of Waste Connections of Canada's renewable natural gas (RNG) facilities, including their latest project in Chatham-Kent, Ontario, underscored a growing demand for compression fittings in the infrastructure supporting clean energy initiatives in April, 2022. As Waste Connections continues to convert landfill gas into RNG for local distribution systems, there is an increasing need for robust compression fittings to ensure the efficient and leak-free operation of pipelines transporting this renewable energy source.

The reliability and durability of compression fittings make them essential components in maintaining the integrity of natural gas networks, particularly in applications where environmental sustainability and regulatory compliance are critical factors. With Waste Connections' commitment to expanding RNG production across Canada, including their significant fleet of compressed natural gas vehicles, the demand for compression fittings is expected to rise, driven by the imperative for safe and efficient energy distribution systems in the renewable energy sector.

Technological Advancements Creating Opportunities for the Compression Fittings Market Growth

Technological advancements are poised to significantly propel the growth of the global compression fittings market by enhancing product performance and efficiency. Innovations such as advanced sealing mechanisms, precision machining techniques, and the integration of smart technologies like IoT sensors for monitoring pipe conditions are revolutionizing compression fittings. These developments not only improve installation speed and reliability but also address sustainability concerns by optimizing material usage and reducing energy consumption during manufacturing. As industries and infrastructure projects increasingly demand higher standards of safety, efficiency, and environmental impact, technological advancements will play a crucial role in driving the adoption of compression fittings worldwide.

For example - HDPE Compression Fittings represents a revolutionary leap in piping solutions, offering unmatched versatility and durability for infrastructure projects worldwide. Engineered to accommodate diverse pipe sizes and materials, these fittings simplify installation with their user-friendly design, eliminating the need for specialized tools and reducing labor costs. Their robust construction ensures long-term reliability in harsh environments, from municipal water systems to industrial applications. By enhancing the resilience and sustainability of piping networks, HDPE Compression Fittings are poised to redefine modern engineering practices, setting new standards for efficiency and performance in the construction and maintenance of infrastructure.

Malpractices in the Compression Fittings Industry are a Major Challenge to its Growth

Malpractices in the compression fittings market, such as deceptive labeling, substandard materials, and inconsistent manufacturing practices, severely hinder market growth. Deceptive labeling misleads consumers about product specifications and performance, eroding trust and reliability. Substandard materials used in fittings lead to frequent failures, increasing maintenance costs and downtime for users. Moreover, inconsistent manufacturing practices result in unreliable product quality, impacting overall operational efficiency.

These malpractices not only undermine customer confidence but also deter potential investments in innovation and product development. Addressing these issues through stringent regulations, quality standards enforcement, and consumer education is crucial to fostering a transparent and sustainable compression fittings market that can support long-term growth and industry advancement.

For example - In response to widespread malpractices plaguing various industries in South Africa, in 2023, the IRESA, through collaboration with the government, aims to bolster regulatory enforcement and standards adherence. This initiative is crucial to combatting the influx of substandard goods and services flooding the market, which undermines local businesses unable to compete on unfair terms. The situation has already led to significant job losses and hindered skills development, exacerbating socio-economic challenges. This has directly impacted the growth of the Compression Fittings Market in South Africa.

IRESA's approach involves coordinating efforts among industry bodies to advocate for stricter enforcement measures. Government support, exemplified by successful partnerships like those in the petroleum and automotive sectors, underscores the potential for impactful collaboration. However, challenges persist, such as inadequate monitoring of imported products and non-compliance with building standards, highlighting the urgent need for robust regulatory frameworks and enforcement to safeguard public safety and industry sustainability.

Compression Fittings Market Segment Analysis

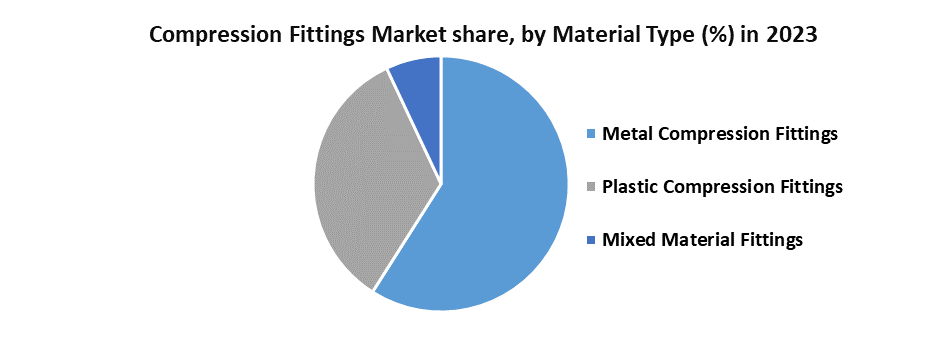

Based on Material Type: The market is segmented into Metal Compression Fittings, Plastic Compression Fittings and Mixed Material Fittings. The Metal Compression Fittings held the largest Compression Fittings Market share in 2023. Metal compression fittings are robust components highly used in plumbing and fluid systems for their ability to create secure and leak-resistant connections. Typically made from materials such as brass or stainless steel, these fittings consist of a body, compression ring (ferrule), nut, and sometimes an insert. The compression fitting works by compressing the ferrule tightly around the pipe or tubing when the nut is tightened, thereby forming a seal that prevents leaks.

This design not only ensures a strong connection but also allows for easy installation without the need for soldering or welding. Compression fittings are widely employed in applications ranging from residential plumbing to industrial fluid handling, including gas lines, HVAC systems, and hydraulic machinery. Their durability, reusability, and versatility in accommodating various pipe materials and sizes make them indispensable in ensuring efficient and reliable fluid transmission across different environments and industries. Therefore, the demand for it is increasing.

Compression Fittings Market Regional Insights

North America Compression Fittings Market held the largest share in the global market in 2023. One of the main drivers of the market is the increasing construction activities across residential, commercial, and industrial sectors in North America. As infrastructure development continues to expand, there is an increasing demand for efficient and durable piping systems, where compression fittings excel due to their ease of installation and maintenance. The emphasis on water and gas conservation is increasing the adoption of compression fittings. As sustainability is becoming a focus in building practices, compression fittings are emerging as a preferred choice for their contribution to water and energy efficiency.

Asia Pacific Compression Fittings Market is expected to grow at a high rate during the forecast period. India is one of the key markets for Compression Fittings in the region. One of the key drivers of the regional market is the rapid industrialization and infrastructure development in countries such as China, India, and Southeast Asian nations. As these economies expand, there is an increase in demand for reliable fluid handling solutions, including compression fittings, to support the growth of industries ranging from construction to automotive. Furthermore, the shift towards smart manufacturing and automation is increasing the adoption of compression fittings that integrate seamlessly with advanced control systems and IoT-enabled devices.

Compression Fittings Market Scope

|

Compression Fittings Market |

|

|

Market Size in 2023 |

USD 9.6 Bn. |

|

Market Size in 2030 |

USD 15.52 Bn. |

|

CAGR (2024-2030) |

7.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Type Compression Elbow Fittings Compression Tee Fittings Compression Union and Coupler Fittings Compression cross Fittings |

|

By Material Type Metal Compression Fittings Plastic Compression Fittings Mixed Material Fittings (Combinations of metal and plastic) |

|

|

By End User Residential Commercial |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Top Compression Fittings Market Players

- Beswick Engineering - [Greenland, New Hampshire, USA]

- Brennan - [Solon, Ohio, USA]

- Cameron International Corporation (part of Schlumberger) - [Houston, Texas, USA]

- DK-Lok - [Gyeonggi-do, South Korea]

- Eaton - [Dublin, Ireland]

- Emerson Electric Co. - [Ferguson, Missouri, USA]

- Georg Fischer Ltd. - [Schaffhausen, Switzerland]

- Ham-Let group - [Lokne, Israel]

- HOKE - [Spartanburg, South Carolina, USA]

- Hy-lok - [Gyeonggi-do, South Korea]

- Mid-America Fittings - [Overland Park, Kansas, USA]

- Parker Hannifin - [Cleveland, Ohio, USA]

- SMC Corporation - [Tokyo, Japan]

- Swagelok - [Solon, Ohio, USA]

- Schwer Fittings Ltd. [ UK ]

Frequently Asked Questions

The segments covered in the Compression Fittings Market report are based on Product Type, Material Type, End User and Region.

The North America region is expected to hold the largest Compression Fittings Market share.

The Compression Fittings Market size by 2030 is expected to reach US$ 15.52 Bn.

The Global Compression Fittings Market is majorly driven by growing infrastructure development.

1. Compression Fittings Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Compression Fittings Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Compression Fittings Market: Dynamics

3.1. Compression Fittings Market Trends

3.2. Compression Fittings Market Dynamics

3.2.1. Compression Fittings Market Drivers

3.2.2. Compression Fittings Market Restraints

3.2.3. Compression Fittings Market Opportunities

3.2.4. Compression Fittings Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape

4. Compression Fittings Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2023-2030)

4.1. Compression Fittings Market Size and Forecast, by Product Type (2023-2030)

4.1.1. Compression Elbow Fittings

4.1.2. Compression Tee Fittings

4.1.3. Compression Union and Coupler Fittings

4.1.4. Compression cross Fittings

4.2. Compression Fittings Market Size and Forecast, by Material Type (2023-2030)

4.2.1. Metal Compression Fittings

4.2.2. Plastic Compression Fittings

4.2.3. Mixed Material Fittings (Combinations of metal and plastic)

4.3. Compression Fittings Market Size and Forecast, by End User (2023-2030)

4.3.1. Residential

4.3.2. Commercial

4.4. Compression Fittings Market Size and Forecast, by Region (2023-2030)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Compression Fittings Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Compression Fittings Market Size and Forecast, by Product Type (2023-2030)

5.1.1. Compression Elbow Fittings

5.1.2. Compression Tee Fittings

5.1.3. Compression Union and Coupler Fittings

5.1.4. Compression cross Fittings

5.2. North America Compression Fittings Market Size and Forecast, by Material Type (2023-2030)

5.2.1. Metal Compression Fittings

5.2.2. Plastic Compression Fittings

5.2.3. Mixed Material Fittings (Combinations of metal and plastic)

5.3. North America Compression Fittings Market Size and Forecast, by End User (2023-2030)

5.3.1. Residential

5.3.2. Commercial

5.4. North America Compression Fittings Market Size and Forecast, by Country (2023-2030)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Compression Fittings Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Compression Fittings Market Size and Forecast, by Product Type (2023-2030)

6.2. Europe Compression Fittings Market Size and Forecast, by Material Type (2023-2030)

6.3. Europe Compression Fittings Market Size and Forecast, by End User (2023-2030)

6.4. Europe Compression Fittings Market Size and Forecast, by Country (2023-2030)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Compression Fittings Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Compression Fittings Market Size and Forecast, by Product Type (2023-2030)

7.2. Asia Pacific Compression Fittings Market Size and Forecast, by Material Type (2023-2030)

7.3. Asia Pacific Compression Fittings Market Size and Forecast, by End User (2023-2030)

7.4. Asia Pacific Compression Fittings Market Size and Forecast, by Country (2023-2030)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa Compression Fittings Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Compression Fittings Market Size and Forecast, by Product Type (2023-2030)

8.2. Middle East and Africa Compression Fittings Market Size and Forecast, by Material Type (2023-2030)

8.3. Middle East and Africa Compression Fittings Market Size and Forecast, by End User (2023-2030)

8.4. Middle East and Africa Compression Fittings Market Size and Forecast, by Country (2023-2030)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America Compression Fittings Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Compression Fittings Market Size and Forecast, by Product Type (2023-2030)

9.2. South America Compression Fittings Market Size and Forecast, by Material Type (2023-2030)

9.3. South America Compression Fittings Market Size and Forecast, by End User (2023-2030)

9.4. South America Compression Fittings Market Size and Forecast, by Country (2023-2030)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Of South America

10. Company Profile: Key Players

10.1. Beswick Engineering

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Brennan

10.3. Cameron International Corporation

10.4. DK-Lok

10.5. Eaton

10.6. Emerson Electric Co.

10.7. Georg Fischer Ltd.

10.8. Ham-Let group

10.9. HOKE

10.10. Hy-lok

10.11. Mid-America Fittings

10.12. Parker Hannifin

10.13. SMC Corporation

10.14. Swagelok

10.15. Schwer Fittings Ltd.

11. Key Findings

12. Industry Recommendations

13. Compression Fittings Market: Research Methodology