Cyber Warfare Market: Global Industry Analysis and Forecast (2024-2030)

The Cyber Warfare Market size was valued at USD 49.32 Bn. in 2023 and the total Global Cyber Warfare revenue is expected to grow at a CAGR of 15.76% from 2024 to 2030, reaching nearly USD 137.62 Bn. by 2030.

Format : PDF | Report ID : SMR_1960

Cyber Warfare Market Overview

Cyber Warfare refers to the use of digital tactics and technologies to conduct warfare in cyberspace. It includes offensive actions such as hacking into enemy networks, disrupting critical infrastructure, stealing sensitive information, or spreading misinformation. Cyber warfare uses all vectors accessible to cybercriminals. It includes viruses, email attachments, pop-up windows, instant messages, and other forms of deception on the internet. Cyber warfare can be conducted by nation-states, terrorist organizations, criminal groups, or even individuals with malicious intent.

The Cyber Warfare Market has significant growth driven by the increasing frequency and sophistication of cyber attacks, cyber espionage activities, and cyber terrorism threats. The growing dependence of countries and businesses on digital systems, the risk landscape is continuously evolving, resulting in higher investments in cybersecurity measures and offensive technologies. The growth of government-backed cyber warfare and the spread of cyber weapons are driving the rapid development of cybersecurity solutions and services. This report provides a quantitative analysis of the cyber warfare market share, segments, current trends, estimations, and dynamics of the cyber warfare market analysis from 2023 to 2030 to identify the prevailing cyber warfare market opportunities. The report includes an analysis of the regional as well as global cyber warfare market trends, key players, market segments, application areas, and cyber warfare market growth strategies.

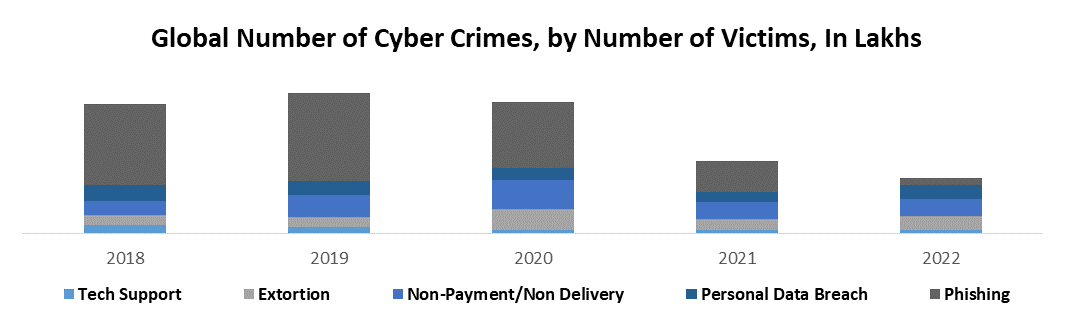

- According to SMR, Cyberattacks have severe consequences that run over financial loss. 80% of cyberattacks make use of computer vulnerabilities for which there are existing cyberpatches.

- According to SMR, cybercrime costs grow by 15% per year, reaching almost USD 8 Trillion globally in 2023 and about USD 13 Trillion annually by 2030.

- In 2019, there were 812.67 million reported malware infections and 27% of malware infections for SMBs (Small and medium-sized businesses) originated from infected USBs.

To get more Insights: Request Free Sample Report

Cyber Warfare Market Dynamics

Rising cyber-attacks and Increased Dependence on Technology drive market growth

The rising frequency and sophistication of cyber-attacks across industries and government sectors create opportunities for the cyber warfare market to develop advanced cybersecurity solutions, including intrusion detection systems, threat intelligence platforms, and incident response services. Cyberattacks are commonly used by nations to carry out secret operations without being easily traced, thanks to the anonymity and deniability they provide. As a result, there is an increased demand for states to have the ability to conduct cyber warfare to establish deterrence and respond to future cyber threats.

Geopolitical instability and conflicts leads to cyber espionage, as well as the theft of sensitive information and intellectual property. Countries engaged in disputes or competition often aim at critical infrastructure, government systems, and private enterprises of their adversaries to gain an advantage. The cyber warfare industry has grown in response to the increasing requirement for cybersecurity services and products.

Nations have been increasingly depending on technology and the internet for various areas of their daily operations, including national security and defense, in an increasingly globalized world. Governments have realized the significance of cyber warfare capabilities to protect their interests and defend against potential cyber threats as geopolitical tensions increase and wars develop. The connectivity of the digital environment has made it simpler for both state-sponsored and non-state actors to conduct cyberattacks against other countries. Cybercriminals are constantly developing new attack methods. The cybersecurity market needs to keep pace by innovating and offering solutions that address emerging threats like ransomware and supply chain attacks.

- According to SMR analysis, 88% of AI (Artificial Intelligence) is essential for performing security tasks more efficiently.

In 2021, Alphabet, Amazon, Meta, Apple, and Microsoft spent a combined $2.4 billion on funding or acquiring 23 cybersecurity companies, an increase of roughly $1.8 billion or 336 percent according to data aggregated by CB Insights. Outright acquisitions in this space are rare, though. Since 2016, only 17 companies were bought up by GAFAM corporations, with Microsoft and Amazon leading the race with eight and four buyouts, respectively.

Cyber Warfare Market Restraints

The lack of readily available, up-to-date information on rapidly evolving cyber threats poses a significant challenge. The ever-changing nature of these threats, with new vulnerabilities and attack methods constantly emerging, makes it difficult for organizations and governments to effectively respond. The absence of timely and comprehensive sharing of threat intelligence across borders and industries hampers proactive defense against sophisticated cyber-attacks.

The increasing demand for cyber warfare solutions has increased the demand for cyber security professionals globally, which has created a gap in the skilled cyber security workforce due to the sudden rise in demand, challenging the market growth. The shortage of qualified cybersecurity professionals with the necessary knowledge and experience to implement and manage advanced cyber warfare solutions is a major obstacle to the market's growth

Cyber Warfare Market Segment Analysis

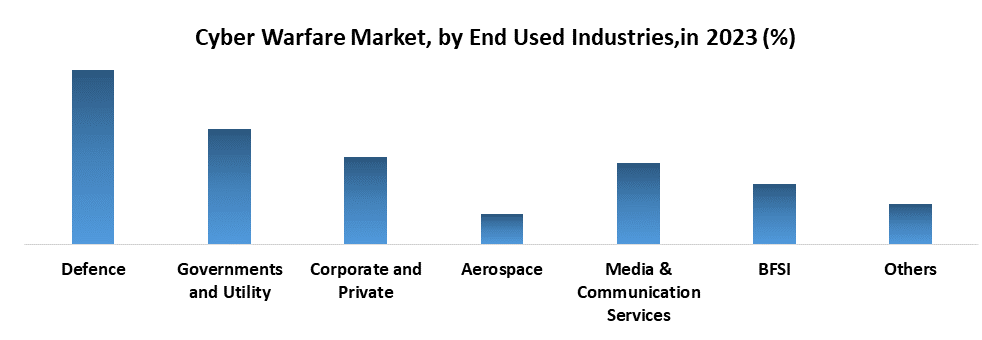

Based on the End Used Industries, the Defence segment held the largest market share in the Cyber Warfare Market in 2023. According to the SMR analysis, the segment is expected to grow during the forecast period and maintain its dominance till 2030. Defence sectors have held a significant share owing to their role in national security and critical infrastructure protection. Cyberwarfare is the use of cyber attacks against an enemy state, causing comparable harm to actual warfare and/or disrupting vital computer systems. Some intended outcomes could be espionage, sabotage, propaganda, manipulation, or economic warfare. The defense sector is investing heavily in digital security units to moderate and discourage the potential risk from a country and state programmer. The rise of innovations and the Internet of Things (IoT) in the resistance is foreseen to be the driving component for the use of the digital fighting framework in the defense segment.

- The rise in defense spending globally has boosted the demand for cyber warfare solutions. For example, in 2022, global military spending reached USD 2.24 trillion, the highest on record. The United States alone contributed almost 40% of the total military expenditure worldwide, showcasing a strong focus on advanced technologies in defense.

Cyber Warfare Market Regional Analysis

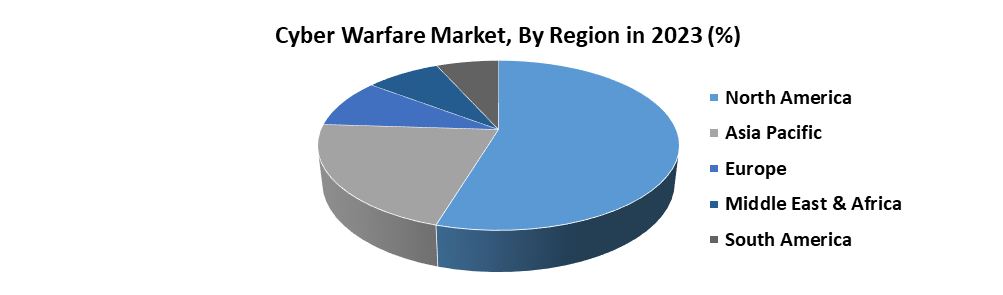

North America dominated the Cyber Warfare Market, with a leading market share of 57.88% in 2023. The region is expected to continue growing and maintain its dominance by 2030. North America region is dominating because Several major defense contractors and cybersecurity companies are headquartered in North America, focusing on the United States. The leading firms such as Lockheed Martin, Raytheon, Northrop Grumman, and Booz Allen Hamilton possess strong expertise in cyber warfare and secure a substantial share of government contracts in this field. The United States and Canada have made significant investments in cybersecurity efforts, spanning public and private sectors. It covers financing for cybersecurity education, research and development, and the creation of specialist organizations like the National Cybersecurity Center of Excellence and the U.S. Cyber Authority.

Governments are dedicating significant resources to improve their cyber capabilities, recognizing the essential need to safeguard digital infrastructure from ever-changing cyber threats. Collaborative actions by regional governments to protect their digital assets include reinforcing cybersecurity strategies, adopting innovative technologies, and enforcing strict regulations to strengthen the resilience of digital systems against cyber-attacks. North American countries have established strong collaboration partnerships and information-sharing mechanisms within the cybersecurity community at the government and private sector levels. This collaboration helps in developing comprehensive cyber warfare strategies and enhancing preparedness. North America has a large pool of skilled cybersecurity professionals, including those with expertise in offensive and defensive cyber warfare techniques. This skilled worker's talent pipeline is supported by leading educational institutions and training programs.

- In 2019, 88% of organizations reported experiencing phishing attacks, with 91% of all cyber attacks starting with aphishing emails and 89% mimicking corporate emails.

- Cyber readiness is critical for SMBs (Small and medium-sized businesses). In the last two years, 66% of SMBs experienced at least one cyber incident. Unfortunately 60% of small companies shut down within 6 months of falling victim to a cyber attack. Only a quarter of SMBs are able to withstand such attacks.

Asia Pacific has the fastest-growing region in the cyber warfare market with a large market share in 2023 and maintain its dominance by 2030. The Asia-Pacific area has experienced rise in cyber attacks and cyber espionage, fueled by different nation-state actors, cybercriminals, and hacktivist groups. This increased cyber threat scenario has led governments and organizations in the region to allocate resources to enhance their defense and deterrence measures through advanced cyber warfare capabilities. Additionally, developing countries, such as China and India, have been strategizing to increase their countries' capabilities in cyber defense, supporting market growth.

- For instance, in February 2023, India planned to launch the National Cyber Security Strategy 2023 by updating the old strategy of 2013, and the country has created an International counter Ransomware Taskforce in collaboration with the Finance and legal affairs ministries of the country.

Cyber Warfare Market Competitive Landscape

The global Cyber Warfare market is highly competitive and fragmented, with several major players competing for market share. Several smaller companies and startups are operating in the Cyber Warfare market. These companies are focused on developing innovative new treatments and technologies for Cyber Warfare disorders and are often able to move more quickly and adapt more easily to changing market conditions. Overall, the competitive landscape in the Cyber Warfare market is rapidly evolving, with new players and technologies continually entering the market.

- In April 2023, Thales partnered with 11 specialized cybersecurity organizations and companies in France to launch a platform focused on cyber intelligence and threat detection. The aim was to create a unified platform that provides cyber threat intelligence services to both companies and government entities.

- In March 2021, L3Harris Technologies, Inc expanded its security solutions and received a contract from Lockheed Martin for development of a new advanced electronic warfare system to protect the international F-16 multirole fighter aircraft against emerging radar and electronic threats.

- In May 2023, Mosaic joined forces with Safe Security to launch an innovative cyber coverage solution. This collaboration includes incorporating real-time cyber-risk data into Mosaic's underwriting procedure.

- In October 2022, BAE Systems launched a cybersecurity system for F-16 fighter aircraft. It supports over 100 F-16 onboard systems, including flight- and mission-critical components such as radar, engine control, navigation, communications, crash data recorders, electronic warfare, mission, and flight control.

- In April 2023, Raytheon Technologies launched RAIVEN, a revolutionary electro-optical intelligent-sensing capability, which will enable pilots to have faster and more precise threat identification.

- In August 2022, SynSaber successfully raised USD 13 million in a Series A funding round. This funding has been instrumental in further developing SynSaber's industrial asset and network monitoring solution. It has also facilitated the company's global expansion, supported sales, marketing, and development initiatives, and bolstered customer engagement as well as industry research endeavors.

Cyber Warfare Market Scope

|

Cyber Warfare Market |

|

|

Market Size in 2023 |

USD 49.32 Bn. |

|

Market Size in 2030 |

USD 137.62 Bn. |

|

CAGR (2024-2030) |

15.76 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Component Hardware Software Services

|

|

By Type Cyberattacks Espionage Sabotage

|

|

|

By Deployment Cloud On-premises

|

|

|

By End used Industries Defence Governments and Utility Corporate and Private Aerospace Media & Communication Services BFSI Others

|

|

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Cyber Warfare Market

- General Dynamics Corporation (U.S.)

- Airbus (Netherlands)

- L3Harris Technologies Inc. (U.S.)

- Intel (California)

- Booz Allen Hamilton Inc.(Virginia)

- BAE Systems (U.K.)

- The Boeing Company (U.S.)

- Lockheed Martin Corporation (U.S.)

- Palo Alto Networks, Inc.(California)

- Fortinet, Inc.(California)

- Advanced Micro Devices, Inc. (AMD) (U.S.)

- FireEye, Inc.(California)

- IBM Corporation (U.S.)

- Leonardo S.p.A. (Italy)

- Northrop Grumman (U.S.)

- Raytheon Technologies Corporation (U.S.)

- F-Secure (Finland)

- Symantec (U.S.)

- Kaspersky Lab (Russia)

- Cisco Systems (California)

- CACI International (Virginia)

- Trend Micro (Tokyo, Japan)

- CrowdStrike (Sunnyvale, California, USA)

- Thales Group (France)

- XX Inc.

Frequently Asked Questions

North America is expected to hold the highest share of the Cyber Warfare Market.

The Cyber Warfare Market size was valued at USD 49.32 Billion in 2023 reaching nearly USD 137.62 Billion in 2030.

The rise in advanced cyber-attacks and increased dependence on technology are increasing trends in the cyber warfare market globally.

The segments covered in the Cyber Warfare Market report are based on Component, Type, Deployment, and End used Industries.

1. Cyber Warfare Market: Research Methodology

2. Cyber Warfare Market: Executive Summary

3. Cyber Warfare Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.6. Global Import-Export Analysis

4. Cyber Warfare Market: Dynamics

4.1. Market Driver

4.2. Market Trends

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Strategies for New Entrants to Penetrate the Market

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Cyber Warfare Market Size and Forecast by Segments (by Value in USD Billion )

5.1. Cyber Warfare Market Size and Forecast, by Component (2023-2030)

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Cyber Warfare Market Size and Forecast, by Type (2023-2030)

5.2.1. Cyberattacks

5.2.2. Espionage

5.2.3. Sabotage

5.3. Cyber Warfare Market Size and Forecast, by Deployment (2023-2030)

5.3.1. Cloud

5.3.2. On-Premises

5.4. Cyber Warfare Market Size and Forecast, by End Used Industries (2023-2030)

5.4.1. Defence

5.4.2. Governments and Utility

5.4.3. Corporate and Private

5.4.4. Aerospace

5.4.5. Media & Communication Services

5.4.6. BFSI

5.4.7. Others

5.5. Cyber Warfare Market Size and Forecast, by Region (2023-2030)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Cyber Warfare Market Size and Forecast (by Value in USD Billion )

6.1. North America Cyber Warfare Market Size and Forecast, by Component (2023-2030)

6.1.1. Hardware

6.1.2. Software

6.1.3. Services

6.2. North America Cyber Warfare Market Size and Forecast, by Type (2023-2030)

6.2.1. Cyberattacks

6.2.2. Espionage

6.2.3. Sabotage

6.3. North America Cyber Warfare Market Size and Forecast, by Deployment (2023-2030)

6.3.1. Cloud

6.3.2. On-Premises

6.4. Cyber Warfare Market Size and Forecast, by End Used Industries (2023-2030)

6.4.1. Defence

6.4.2. Governments and Utility

6.4.3. Corporate and Private

6.4.4. Aerospace

6.4.5. Media & Communication Services

6.4.6. BFSI

6.4.7. Others

6.5. North America Cyber Warfare Market Size and Forecast, by Country (2023-2030)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Cyber Warfare Market Size and Forecast (by Value in USD Billion )

7.1. Europe Cyber Warfare Market Size and Forecast, by Component (2023-2030)

7.1.1. Hardware

7.1.2. Software

7.1.3. Services

7.2. Europe Cyber Warfare Market Size and Forecast, by Type (2023-2030)

7.2.1. Cyberattacks

7.2.2. Espionage

7.2.3. Sabotage

7.3. Europe Cyber Warfare Market Size and Forecast, by Deployment (2023-2030)

7.3.1. Cloud

7.3.2. On-Premises

7.4. Cyber Warfare Market Size and Forecast, by End Used Industries (2023-2030)

7.4.1. Defence

7.4.2. Governments and Utility

7.4.3. Corporate and Private

7.4.4. Aerospace

7.4.5. Media & Communication Services

7.4.6. BFSI

7.4.7. Others

7.5. Europe Cyber Warfare Market Size and Forecast, by Country (2023-2030)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Cyber Warfare Market Size and Forecast (by Value in USD Billion )

8.1. Asia Pacific Cyber Warfare Market Size and Forecast, by Component (2023-2030)

8.1.1. Hardware

8.1.2. Software

8.1.3. Services

8.2. Asia Pacific Cyber Warfare Market Size and Forecast, by Type (2023-2030)

8.2.1. Cyberattacks

8.2.2. Espionage

8.2.3. Sabotage

8.3. Asia Pacific Cyber Warfare Market Size and Forecast, by Deployment (2023-2030)

8.3.1. Cloud

8.3.2. On-Premises

8.4. Cyber Warfare Market Size and Forecast, by End Used Industries (2023-2030)

8.4.1. Defence

8.4.2. Governments and Utility

8.4.3. Corporate and Private

8.4.4. Aerospace

8.4.5. Media & Communication Services

8.4.6. BFSI

8.4.7. Others

8.5. Asia Pacific Cyber Warfare Market Size and Forecast, by Country (2023-2030)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Cyber Warfare Market Size and Forecast (by Value in USD Billion )

9.1. Middle East and Africa Cyber Warfare Market Size and Forecast, by Component (2023-2030)

9.1.1. Hardware

9.1.2. Software

9.1.3. Services

9.2. Middle East and Africa Cyber Warfare Market Size and Forecast, by Type (2023-2030)

9.2.1. Cyberattacks

9.2.2. Espionage

9.2.3. Sabotage

9.3. Middle East and Africa Cyber Warfare Market Size and Forecast, by Deployment (2023-2030)

9.3.1. Cloud

9.3.2. On-Premises

9.4. Cyber Warfare Market Size and Forecast, by End Used Industries (2023-2030)

9.4.1. Defence

9.4.2. Governments and Utility

9.4.3. Corporate and Private

9.4.4. Aerospace

9.4.5. Media & Communication Services

9.4.6. BFSI

9.4.7. Others

9.5. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Cyber Warfare Market Size and Forecast (by Value in USD Billion )

10.1. South America Cyber Warfare Market Size and Forecast, by Component (2023-2030)

10.1.1. Hardware

10.1.2. Software

10.1.3. Services

10.2. South America Cyber Warfare Market Size and Forecast, by Type (2023-2030)

10.2.1. Cyberattacks

10.2.2. Espionage

10.2.3. Sabotage

10.3. South America Cyber Warfare Market Size and Forecast, by Deployment (2023-2030)

10.3.1. Cloud

10.3.2. On-Premises

10.4. Cyber Warfare Market Size and Forecast, by End Used Industries (2023-2030)

10.4.1. Defence

10.4.2. Governments and Utility

10.4.3. Corporate and Private

10.4.4. Aerospace

10.4.5. Media & Communication Services

10.4.6. BFSI

10.4.7. Others

10.5. South America Cyber Warfare Market Size and Forecast, by Country (2023-2030)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. F-Secure (Finland)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Intel (California)

11.3. General Dynamics Corporation (U.S.)

11.4. Airbus (Netherlands)

11.5. L3Harris Technologies Inc. (U.S.)

11.6. Booz Allen Hamilton Inc.(Virginia)

11.7. BAE Systems (U.K.)

11.8. Boeing Company (U.S.)

11.9. Lockheed Martin Corporation (U.S.)

11.10. Palo Alto Networks, Inc.(California)

11.11. Fortinet, Inc.(California)

11.12. Advanced Micro Devices, Inc. (AMD) (U.S.)

11.13. FireEye, Inc.(California)

11.14. IBM Corporation (U.S.)

11.15. Leonardo S.p.A. (Italy)

11.16. Northrop Grumman (U.S.)

11.17. Raytheon Technologies Corporation (U.S.)

11.18. Symantec (U.S.)

11.19. Kaspersky Lab (Russia)

11.20. Cisco Systems (California)

11.21. CACI International (Virginia)

11.22. Trend Micro (Tokyo, Japan)

11.23. CrowdStrike (Sunnyvale, California, USA)

11.24. Thales Group (France)

12. Key Findings

13. Industry Recommendations