Digital Payment Market: Industry Analysis and Forecast (2023-2030)) Drivers, Statistics, Dynamics, Segmentation by Offerings, Transaction Type, Industry Vertical

The Digital Payment Market size was valued at USD 92.67 Billion in 2023 and the total Digital Payment revenue is expected to grow at a CAGR of 14.89% from 2024 to 2030, reaching nearly USD 244.86 Billion by 2030.

Format : PDF | Report ID : SMR_1566

The Digital Payment Market Overview

The term "digital payment" describes the electronic money transfers that take place between people, companies, or other entities in place of actual cash or checks. It involves starting, approving, and finishing transactions using digital or electronic devices including laptops, cellphones, and other internet-enabled gadgets. A digital transaction typically involves multiple parties: the payer (consumer), the payee (merchant), and the payment network, which consists of the banks that the payer and the payee use.

Digital payment Market is growing as it involves electronic checks, wire transfers, which increases the speed of operations and effectively manages the real time data. A number of players in the digital payment space, such as banks, financial institutions, and payment providers, are investing in technology to develop innovative and safe digital payment solutions, and as a result, the Digital payment market is growing. The Digital Payment market is catering to the growing demand of consumer preferring digitalization. Digital payment programs like Apple Pay and Google Pay, mobile wallets, and online bank transactions are contributing to the expanding Digital payment Market.

The Digital Payment market is dominated by North America with having a share of 35%, and having widespread use of credit/debit cards, mobile wallets, and online banking. North America is followed by Europe having well-established digital payment infrastructure with a high degree of contactless payment adoption. Asian-Pacific market is rapidly growing with the adoption of growing digital payment market driven by countries like China and India. With the adaption of platforms like Alipay and WeChat Pay, China is making a strong presence in the Digital Payment Market. Key players who are dominating the Digital Payment Market are Wirecard AG, Novetti Group Limited, PayPal Holdings Inc., ACI Worldwide Inc., Adyen N.V., MasterCard, Visa Inc., Alipay.com Co. Ltd, Amazon Inc., Fiserv, FIS, Global Payments, and Square.

Digital Payment Market Dynamics

Trends leading the Digital Payment Market forward-

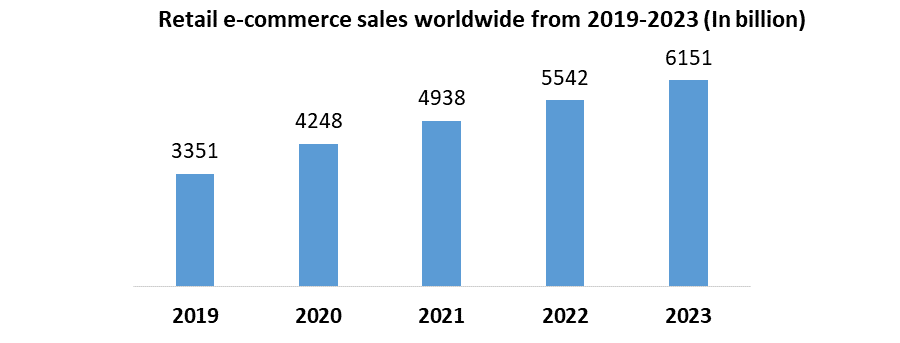

Online Shopping is revolutionizing the Digital Payment Market by providing a secure, efficient, and convenient way for customers to make purchases. This has boosted consumer loyalty and trust as well as improved security measures, which has fueled the use of digital payments in e-commerce. Online purchasing is in demand because digital payments are convenient and make the checkout process easier for customers.

Increase in the adoption of Crypto Currencies, some businesses started accepting crypto currencies as a form of payment, and central banks were exploring the development of their digital currencies. Crypto currencies operate on decentralized networks, enabling cross-border transactions without the need for traditional banking systems. This makes them particularly attractive for international payments, fueling the globalization of digital payments.

Subscription and Recurring Payments, removes the requirement for manual interventions, such keeping track of deadlines or starting payments every time a service or subscription expires. Recurring payment and subscription services give companies a consistent flow of income, which can increase profitability and return on investment. The Subscription and Recurring Payments Market is expected to grow at a CAGR of 7.2%.

Driving Factors contributing to the growth of Digital Payment Market-

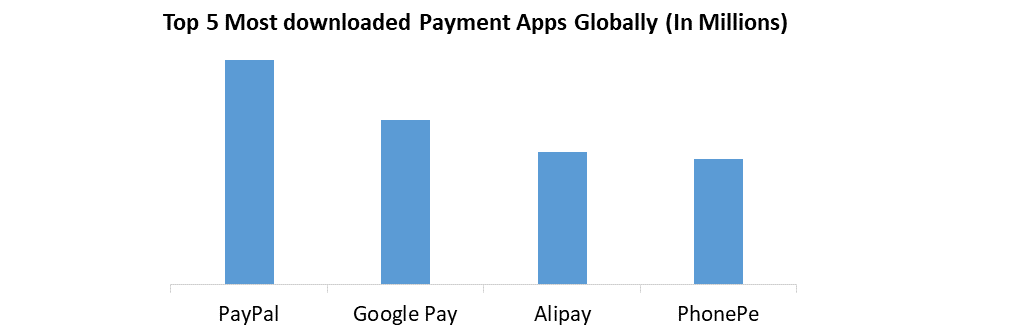

Increasing Penetration of Smartphones, One of the main factors propelling the growth of the digital payment market is the rising use of smartphones. Mobile payment companies have a large audience to reach thanks to the increasing popularity of smartphones, which spur adoption as more people take advantage of the ease of conducting business online with their mobile devices. The market of digital payments is growing because mobile payment solutions are simple to use and be integrated into daily activities. The adoption of smartphone penetration and high-speed mobile network availability is driving the demand for mobile-based payment solutions. Some Key Mobile digital payment apps are PayPal, Google Pay, Alipay, PhonePe, Cash App and Paytm.

Covid19 Pandemic, has significantly accelerated the growth of the digital payment market by influencing consumer behavior by accelerating Contactless Transactions for Safety, Government Support and Initiatives, Fintech Innovation, Remote Work and Digital Services. The global adoption and dependence on digital payment mechanisms for their efficiency, safety, and convenience have grown as a result of the COVID-19 epidemic.

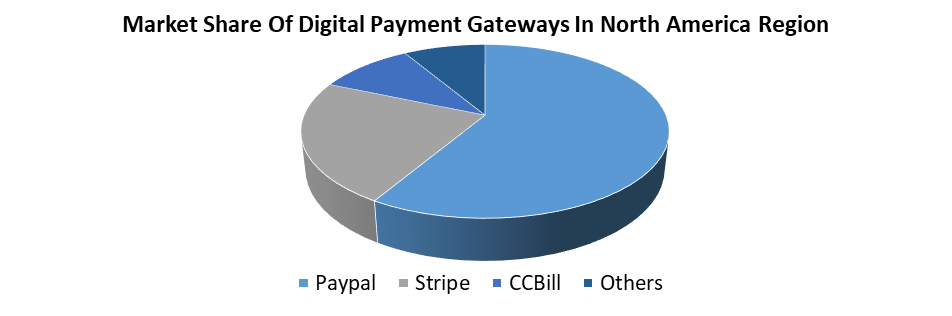

Global Digital Economy, The developed digital economy and the growth of the mobile commerce sector have both played a major role. Globally governments are launching a number of programs to encourage digital payments, which is driving up the demand for Digital Payment services. North America currently dominates the digital payment market because there are many providers of digital payment solutions there, and these solutions are widely used. PayPal, Stripe, CCBill, Braintree are the key Digital Payment Gateways platforms currently dominating the North American region.

Regulators Raising the Bar

The businesses of some suppliers of payment infrastructure are being impacted by governments' increased efforts to regulate payments. For instance, the Reserve Bank of India temporarily prohibited certain card networks from issuing new cards due to their failure to abide with regional data storage regulations. The European Commission has also released draft recommendations for the PSD 3, Payment Service Regulation, and Regulation for Financial Data Access in an effort to lower fraud rates, strengthen consumer protection laws, and level the playing field for banks and nonbanks. Furthermore, scheme issuance, and local railroads hinder card firms' ability to generate their revenue and impose new operational and data security obligations.

Digital Payment Market Segment Analysis

By Offerings, Solutions include a broad spectrum of services and technologies that support financial administration, electronic transactions, and smooth payment experiences such as Mobile Wallets, Banking Apps, Payment Gateways, Peer-to-Peer (P2P) Payment Platforms and Smart Cards and Contactless Payment Solutions which are the key factors for growing Digital Payment Market. . In contrast, Services are essential in providing infrastructure, support, and specialized skills needed to keep digital payment ecosystems operating smoothly. Payment Processing Services, Fraud Detection and Prevention, Security and Compliance Services, Customer Support and Helpdesk Services, Integration and Implementation Services, Consulting and Advisory Services and Custom Development Services are the Key Services offered in the segment which provides a pivotal role in supporting the growing digital economy and the increasing reliance on digital transactions.

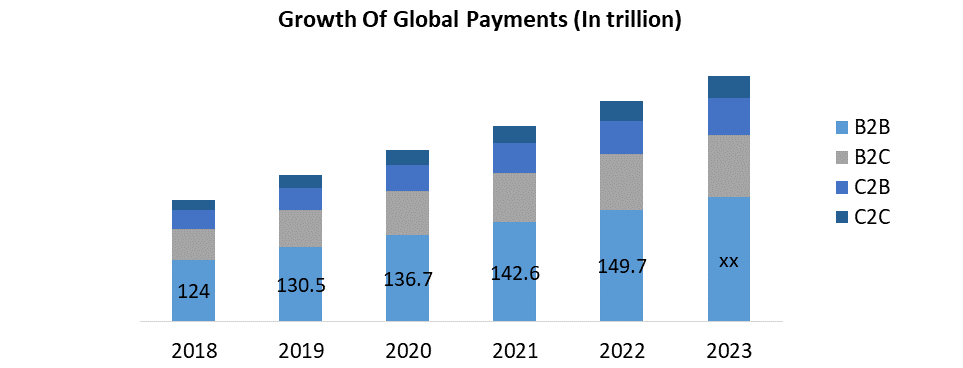

The Digital Payment Market is further segmented by Transaction, which is further divided into cross-border and domestic transactions. Payments done between people or firms in different nations are referred to as cross-border transactions, whereas domestic transactions are made within a single nation. Between 2018 and 2022, the value of cross-border payments grew by over $25 trillion to reach over $150 trillion, nearly 30 times the size of the entire global technology industry in 2023.

The Digital Payment Market is divided into industrial verticals, which enables solution providers to customize their products to meet the particular needs and difficulties of each business and encourages the broad acceptance and application of digital payment technology. The common Industrial verticals used for Segmentations are Retail and E-commerce, BFSI (Banking, Financial Services and Insurance), Healthcare, Telecommunications, Hospitality and Travel, Education, Government and Public Sector, and Transportation and Logistics. Digital payment methods have been widely adopted by the retail and e-commerce industries. Currently, digital wallets account for 48% of global e-commerce transactions, while credit cards account for 20%.

Competitive Landscape

The existence of multiple major firms defines the competitive environment of the digital payment sector. Companies such as PayPal Holdings, Inc., Alipay (Ant Group), WeChat Pay (Tencent), Apple Pay, Razorpay are dominating the Digital payment Market. The Entry of big giants through strategic investments such as Deutsche Bank and Fiserv building the joint venture to make payments acceptance and banking service available for small and medium-sized enterprises(SMEs) in an integrated product offering, Worldlines partnership with Credit Agricole Group combines Worldlines strength in In-store and online payment acceptance with Credit Agricole’s distribution capabilities in the French Market and JP Morgan purchasing WePay to gain online payfac (payment facilitator) enablement for over $400 million, makes it challenging for the Digital Payment Market environment to continuously evolve, innovate and enhance in their product offering not only for the emerging players but also the established firms as well.

|

Digital Payment Market Scope |

|

|

Market Size in 2023 |

USD 92.67 Bn. |

|

Market Size in 2030 |

USD 244.86 Bn. |

|

CAGR (2023-2030)) |

14.89% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment Scope |

By Offering

|

|

By Transaction Type

|

|

|

By Industry Vertical

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players of Digital Payment Market

- PayPal Holdings Inc.,

- Visa Inc.,

- MasterCard Incorporated,

- Rupay

- Alipay.com Co. Ltd,

- Amazon Inc.,

- Fiserv, FIS,

- Global Payments,

- Square,

- Total System Services

Frequently Asked Questions

The Digital Payment Market is expected to grow at a CAGR of 14.89% during forecasting period 2023-2029.

Digital Payment Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

The important key players in the Digital Payment Market are – PayPal Holdings Inc., Visa Inc., MasterCard Incorporated, Alipay.com Co. Ltd, Amazon Inc., Fiserv, FIS, Global Payments, Square, and Total System Services.

The Global Market is studied from 2023 to 2030.

1. Digital Payment Market : Research Methodology

2. Digital Payment Market : Executive Summary

3. Digital Payment Market : Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Digital Payment Market : Dynamics

4.1. Market Trends by Region

4.1.1. North America

4.1.2. Europe

4.1.3. Asia Pacific

4.1.4. Middle East and Africa

4.1.5. South America

4.2. Market Drivers by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Value Chain Analysis

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Digital Payment Market Size and Forecast by Segments (by Value USD and Volume Units)

5.1. Digital Payment Market Size and Forecast, by Offering mode (2023-2030)

5.1.1. Solutions

5.1.2. Services

5.2. Digital Payment Market Size and Forecast, by Transaction Type(2023-2030)

5.2.1. Domestic

5.2.2. Cross-border

5.3. Digital Payment Market Size and Forecast, by Industry Vertical(2023-2030)

5.3.1. BFSI

5.3.2. IT

5.3.3. Healthcare

5.3.4. Media and Healthcare

5.4. Digital Payment Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Digital Payment Market Size and Forecast (by Value USD and Volume Units)

6.1. North America Digital Payment Market Size and Forecast, by Offering mode (2023-2030)

6.1.1. Solutions

6.1.2. Services

6.2. North America Digital Payment Market Size and Forecast, by Transaction (2023-2030)

6.2.1. Domestic

6.2.2. Cross-border

6.3. North America Digital Payment Market Size and Forecast, by Industry Vertical (2023-2030)

6.3.1. BFSI

6.3.2. IT

6.3.3. Healthcare

6.3.4. Media and Healthcare

6.4. North America Digital Payment Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Digital Payment Market Size and Forecast (by Value USD and Volume Units)

7.1. Europe Digital Payment Market Size and Forecast, by Offering mode (2023-2030)

7.1.1. Solutions

7.1.2. Services

7.2. Europe Digital Payment Market Size and Forecast, by Transaction (2023-2030)

7.2.1. Domestic

7.2.2. Cross-border

7.3. Europe Digital Payment Market Size and Forecast, by Industry Vertical (2023-2030)

7.3.1. BFSI

7.3.2. IT

7.3.3. Healthcare

7.3.4. Media and Healthcare

7.4. Europe Digital Payment Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Austria

7.4.8. Rest of Europe

8. Asia Pacific Digital Payment Market Size and Forecast (by Value USD and Volume Units)

8.1. Asia Pacific Digital Payment Market Size and Forecast, by Offering mode (2023-2030)

8.1.1. Solutions

8.1.2. Services

8.2. Asia Pacific Digital Payment Market Size and Forecast, by Transaction (2023-2030)

8.2.1. Domestic

8.2.2. Cross-border

8.3. Asia Pacific Digital Payment Market Size and Forecast, by Industry Vertical (2023-2030)

8.3.1. BFSI

8.3.2. IT

8.3.3. Healthcare

8.3.4. Media and Healthcare

8.4. Asia Pacific Digital Payment Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Digital Payment Market Size and Forecast (by Value USD and Volume Units)

9.1. Middle East and Africa Digital Payment Market Size and Forecast, by Offering mode (2023-2030)

9.1.1. Solutions

9.1.2. Services

9.2. Middle East and Africa Digital Payment Market Size and Forecast, by Transaction (2023-2030)

9.2.1. Domestic

9.2.2. Cross-border

9.3. Middle East and Africa Digital Payment Market Size and Forecast, by Industry Vertical (2023-2030)

9.3.1. BFSI

9.3.2. IT

9.3.3. Healthcare

9.3.4. Media and Healthcare

9.4. Middle East and Africa Digital Payment Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Digital Payment Market Size and Forecast (by Value USD and Volume Units)

10.1. South America Digital Payment Market Size and Forecast, by Offering mode (2023-2030)

10.1.1. Solutions

10.1.2. Services

10.2. South America Digital Payment Market Size and Forecast, by Transaction (2023-2030)

10.2.1. Domestic

10.2.2. Cross-border

10.3. South America Digital Payment Market Size and Forecast, by Industry Vertical (2023-2030)

10.3.1. BFSI

10.3.2. IT

10.3.3. Healthcare

10.3.4. Media and Healthcare

10.4. South America Digital Payment Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. Oracle

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. PayPal Holdings Inc.,

11.3. Visa Inc.

11.4. MasterCard Incorporated

11.5. Rupay

11.6. Alipay.com Co. Ltd

11.7. Amazon Inc.

11.8. Fiserv, FIS

11.9. Global Payments

11.10. Square

11.11. Total System Services