Electric 3-wheeler Market: Global Industry Analysis and Forecast (2024 -2030)

Electric 3-wheeler Market size was valued at USD 2.3 Bn. in 2023. The total Electric 3-wheeler Market revenue is expected to grow by 12.3% from 2024 to 2030, reaching nearly USD 5.18 Bn.

Format : PDF | Report ID : SMR_2162

Electric 3-wheeler Market Overview

An electric three-wheeler is a vehicle used for short-distance transportation. It features three wheels for stability, often configured with two wheels in the front for steering and one at the rear for driving. These vehicles are eco-friendly, emitting zero tailpipe emissions, and are popular in urban areas for their maneuverability and lower operating costs compared to traditional combustion-engine vehicles.

The electric 3-wheeler market has grown immensely in the past few years due to rising sustainability concerns and economic benefits. Ola Electric, Piaggio, and Bajaj Auto are the key players holding the largest share in the electric 3-wheeler industry. The Asia Pacific region dominated the global Electric 3-wheeler Market due to the growing urban population and increasing government initiatives. As per the study, the global market is expected to grow at a high rate in the future. This is attributed to technological advancements and increasing consumer awareness of environmental sustainability. As battery technology is evolving and economies of scale drive down costs, electric 3-wheelers are likely to become an integral part of urban transportation ecosystems across the world.

To get more Insights: Request Free Sample Report

Electric 3-wheeler Market Competitive Landscape

The global market has various players ranging from established automakers to startups, vying to capture market share by leveraging technological innovation, cost efficiencies, and regulatory support. As per the study, the competition in the industry is expected to intensify and the Electric 3-wheeler companies to innovate rapidly, optimize costs and forge strategic partnerships are likely to emerge as Electric 3-wheeler market leaders during the forecast period.

- Product Launch: Ola Electric planned to launch its 'Raahi' electric autorickshaw in March 2024. Ola Electric aims to establish a gigafactory and has filed a draft red herring prospectus to raise funds, reflecting its ambitious growth strategy in the EV sector.

- Partnership: Yamaha's leasing arm, Moto Business Service India (MBSI), has partnered with FullFily to supply 50 Omega Seiki Rage+ electric three-wheelers and 200 Hero Electric Nyx scooters for last mile delivery services in Tamil Nadu. MBSI plans to expand its electric vehicle fleet across India, aiming to manage over 2,000 vehicles in Tamil Nadu alone. The move aligns with MBSI's strategy to capitalize on the growing demand for electric three-wheelers amid rising fuel costs and environmental concerns.

- Product Launch: Yamaha introduced the Tricera, a futuristic electric three-wheeler featured triple-wheel steering, debuted at Japan Mobility Show 2023. The delta trike design includes two front wheels and a pivoting single rear wheel for enhanced maneuverability, offering both automatic and manual steering modes. With an open-top structure and immersive seating arrangement, Yamaha aims to blend elements of motorcycles and cars into a unique driving experience, showcasing their innovation in light electric vehicles.

- Sales: Bajaj Auto has made significant strides in India's Electric 3-wheeler market with its RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0, selling over 8,600 units since their June 2023 launch. The vehicles feature robust specifications including ranges of 178km and 183km respectively on a single charge, catering to both passenger and cargo transportation needs with competitive pricing post FAME II subsidies.

Electric 3-wheeler Market Dynamics

Environmental Regulations and Sustainability Goals Driving the Electric 3-wheeler Market Growth

Governments across the world are implementing stringent emissions regulations to combat air pollution and reduce carbon footprints. Electric 3-wheelers produce zero tailpipe emissions, which aligns with these regulatory requirements and sustainability targets. This makes them an attractive option for fleet operators, delivery services, and public transportation agencies aiming to comply with environmental standards while maintaining operational efficiency. Thus, driving the growth of the global Electric 3-wheeler Market.

For Example - Electric two and three-wheelers offer a pivotal solution to combat air pollution and reduce greenhouse gas emissions, particularly in rapidly urbanizing low and middle-income countries. With Asia leading in motorcycle fleet size and Africa experiencing significant growth rates, the shift from internal combustion engines to electric models can mitigate substantial particulate matter and black carbon emissions. UNEP projects a global transition to 90% battery-electric motorcycle sales by 2030, potentially cutting CO2 emissions by 11 billion tonnes by 2050.

This transformation not only promises cleaner air but also substantial economic benefits, including an estimated US $350 billion in savings from reduced fuel and maintenance costs. UNEP's initiatives across Africa, Asia, and Latin America aim to accelerate this transition through national programs and support platforms for electric mobility adoption.

Technological Advancements to Drive the Electric 3-wheeler Market

Technological advancements such as improved battery efficiency, lightweight materials for chassis, and smart connectivity solutions are expected to revolutionize the electric 3-wheeler market during the forecast period. Enhanced battery technologies, including fast-charging capabilities and longer range, mitigate range anxiety and boost operational efficiency. Lightweight materials such as composites and alloys increase vehicle durability and optimize energy consumption. Furthermore, integrated IoT solutions enable real-time fleet management, and predictive maintenance, and enhance driver safety. These advancements collectively make electric 3-wheelers more reliable, cost-effective, and environmentally sustainable, driving adoption across urban and last-mile transport sectors worldwide.

For Example -

- The WEEVIL project introduces a groundbreaking concept in three-wheel electric vehicles, featuring an innovative fiberglass structure for enhanced safety and maneuverability in city traffic. Equipped with an advanced magnet-free electric motor and a unique three-wheel setup adjustable for different speeds, it promises exceptional agility and stability. A key highlight is its Flash Battery lithium accumulator, offering interchangeable packs for customizable range and performance. This modular system aims to make electric vehicles more accessible and versatile, encouraging adoption among consumers seeking cost-effective and sustainable transport solutions. The project marks a significant advancement towards the mass production of efficient, user-friendly electric vehicles.

- Omega Seiki Mobility, in collaboration with Exponent Energy, launches the OSM Stream City Qik, a fast-charging electric three-wheeler priced at ?3,24,999 (Ex-Showroom). Featuring an 8.8 kWh battery, it boasts a 126 km city drive range and a rapid 15-minute charging capability, aimed at maximizing driver earnings and operational efficiency in urban areas.

- Three Wheels United (TWU), originally an NGO founded in 2010, operates as a tech-enabled finance startup facilitating the transition of Indian auto-rickshaw drivers to electric three-wheelers. Utilizing AI through their platform 'Prayana,' TWU offers affordable loans, leveraging data for optimal decision-making, thus enhancing driver income and reducing CO2 emissions significantly.

Lack of Charging Infrastructure for Electric 3-Wheelers in Developing Countries is a Key Challenge for the Electric 3-Wheeler Market

Unlike passenger cars that charge overnight at home, 3-wheelers used for commercial purposes necessitate accessible and fast-charging options scattered across urban and rural landscapes. The deployment of such infrastructure is crucial to mitigate range anxiety and ensure uninterrupted operations for fleet owners and drivers. However, the cost and logistics of establishing this infrastructure pose significant hurdles. In developing nations with limited resources, the financial burden of setting up charging stations, coupled with the challenge of grid capacity and stability, requires innovative solutions. This includes leveraging renewable energy sources and smart grid technologies to make charging networks sustainable and resilient.

These are the key challenges for the Global Electric 3-Wheeler Market. Collaborative efforts involving governments, private sector investors, and international organizations are crucial to address these barriers effectively. Moreover, adapting charging stations to cater to the unique needs of 3-wheelers, such as their size and operational patterns, adds complexity. Standardization of charging protocols and ensuring compatibility with vehicle models further enhance accessibility and usability. By addressing these multifaceted challenges with strategic planning and investment, developing countries foster an environment conducive to the accelerated adoption of electric 3-wheelers, contributing to sustainable urban mobility and reduced emissions.

Electric 3-wheeler Market Segment Analysis

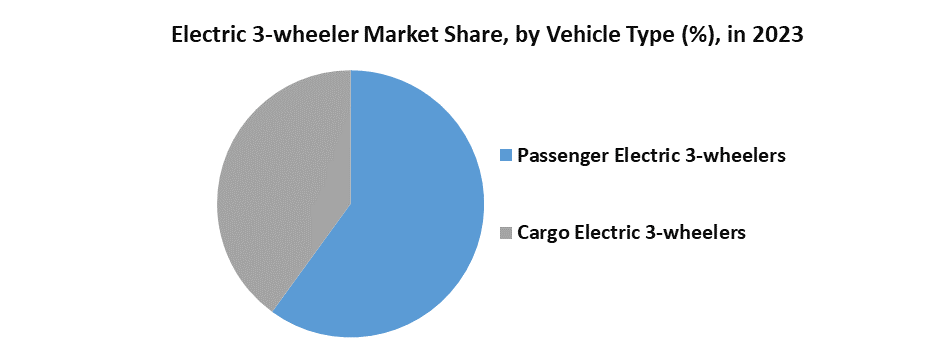

Based on Vehicle Type: The market is segmented into Passenger Electric 3-wheelers and Cargo Electric 3-wheelers. The Passenger Electric 3-wheelers segment held the largest Electric 3-wheeler Market share in 2023. Passenger Electric 3-wheelers often appeal to commuters looking for convenient and affordable alternatives to traditional cars or public transportation. The emphasis on comfort, safety features, and increasingly longer ranges due to advancements in battery technology further enhances their attractiveness to urban dwellers seeking sustainable mobility options.

The Cargo Electric 3-wheelers segment is expected to grow rapidly during the forecast period. Cargo Electric 3-wheelers are specially designed to carry goods over short distances efficiently. They are gaining popularity among e-commerce companies, logistics providers, and local delivery services looking to optimize their operations while meeting environmental regulations and consumer expectations for sustainable business practices.

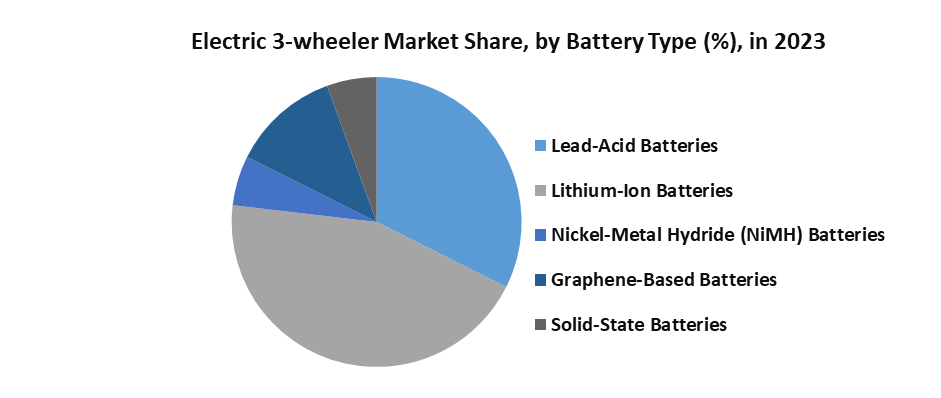

Based on Battery Type: The market is segmented into Lead-Acid Batteries, Lithium-Ion Batteries, Nickel-Metal Hydride (NiMH) Batteries, Graphene-Based Batteries and Solid-State Batteries. The Lithium-Ion Batteries held the largest Electric 3-wheeler Market share in 2023. Neuron Energy and Urja Mobility are set to introduce a battery leasing model for e-rickshaws in Kolkata, aiming to replace lead-acid batteries with GPS-enabled lithium-ion alternatives. The initiative targets a fleet of 50 lakh e-rickshaws nationwide, promoting cost-effective, environmentally friendly transport solutions with monthly lease rentals starting at Rs 4,500. The Nickel-Metal Hydride (NiMH) Batteries, Graphene-Based Batteries & Solid-State Batteries segments held niche presence in the market in 2023.

Electric 3-wheeler Market Regional Insights

Asia Pacific Electric 3-wheeler Market dominated the global market with the largest share in 2023. In 2023, India emerged as the world's largest market for electric three-wheelers, with sales exceeding 580,000 units, surpassing China's 320,000 units. India's dominance, attributing it to government subsidies under the FAME II scheme, which lowered ownership costs. Globally, electric three-wheeler sales reached nearly 1 million units, a 30% increase from 2022, with India alone accounting for 60% of global sales. China and India combined constituted over 95% of the market, consolidating their positions in electric and conventional three-wheeler sales.

Europe Electric 3-wheeler Market held the second largest share in global market in 2023 and is expected to grow rapidly during the forecast period. This is attributed to the advancements in technology, regulatory incentives, and shifting consumer preferences towards sustainable mobility solutions. Initiatives such as the European Green Deal and Euro 7 emission standards push for cleaner transport options, making electric three-wheelers an attractive alternative. Furthermore, the compact size and maneuverability of 3-wheelers make them ideal for navigating through dense urban environments where space is at a premium. This characteristic is particularly appealing in European cities known for their narrow streets and congestion issues.

Electric 3-wheeler Market Scope

|

Electric 3-wheeler Market |

|

|

Market Size in 2023 |

USD 2.3 Bn. |

|

Market Size in 2030 |

USD 5.18 Bn. |

|

CAGR (2024-2030) |

12.3% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Vehicle Type Passenger Electric 3-wheelers Cargo Electric 3-wheelers |

|

By Battery Type Lead-Acid Batteries Lithium-Ion Batteries Nickel-Metal Hydride (NiMH) Batteries Graphene-Based Batteries Solid-State Batteries |

|

|

By End User Commercial Fleet Operators Individual Consumers |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Electric 3-wheeler Market Players

- Mahindra Electric (India)

- Piaggio & C. Spa (Italy)

- Bajaj Auto (India)

- Kinetic Green (India)

- Terra Motors Corporation (Japan)

- Lohia Auto Industries (India)

- E-Tuk Factory BV (Netherlands)

- Omega Seiki Private Limited (India)

- ATUL Auto Limited (India)

- BILITI ELECTRIC INC. (China)

- Euler Motors (India)

- Hop Motors Private Limited (India)

- Yamaha Motor Company Limited (Japan)

- ola electric (India)

Frequently Asked Questions

Asia Pacific is expected to dominate the Electric 3-wheeler market during the forecast period.

The Electric 3-wheeler market size is expected to reach USD 5.18 Bn by 2030.

The Electric 3-wheeler Market is segmented by Vehicle Type, Battery Type and End-User for the research.

The global Electric 3-wheeler market is driven by government incentives and support programs to reduce CO2 emissions.

1. Electric 3-wheeler Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Electric 3-wheeler Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Electric 3-wheeler Market: Dynamics

3.1. Electric 3-wheeler Market Trends

3.2. Electric 3-wheeler Market Dynamics

3.2.1. Electric 3-wheeler Market Drivers

3.2.2. Electric 3-wheeler Market Restraints

3.2.3. Electric 3-wheeler Market Opportunities

3.2.4. Electric 3-wheeler Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape

3.7. Key Opinion leaders Analysis

4. Electric 3-wheeler Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2023-2030)

4.1. Electric 3-wheeler Market Size and Forecast, by Vehicle Type (2023-2030)

4.1.1. Passenger Electric 3-wheelers

4.1.2. Cargo Electric 3-wheelers

4.2. Electric 3-wheeler Market Size and Forecast, by Battery Type (2023-2030)

4.2.1. Lead-Acid Batteries

4.2.2. Lithium-Ion Batteries

4.2.3. Nickel-Metal Hydride (NiMH) Batteries

4.2.4. Graphene-Based Batteries

4.2.5. Solid-State Batteries

4.3. Electric 3-wheeler Market Size and Forecast, by End User (2023-2030)

4.3.1. Commercial Fleet Operators

4.3.2. Individual Consumers

4.4. Electric 3-wheeler Market Size and Forecast, by Region (2023-2030)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Electric 3-wheeler Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Electric 3-wheeler Market Size and Forecast, by Vehicle Type (2023-2030)

5.1.1. Passenger Electric 3-wheelers

5.1.2. Cargo Electric 3-wheelers

5.2. North America Electric 3-wheeler Market Size and Forecast, by Battery Type (2023-2030)

5.2.1. Lead-Acid Batteries

5.2.2. Lithium-Ion Batteries

5.2.3. Nickel-Metal Hydride (NiMH) Batteries

5.2.4. Graphene-Based Batteries

5.2.5. Solid-State Batteries

5.3. North America Electric 3-wheeler Market Size and Forecast, by End User (2023-2030)

5.3.1. Commercial Fleet Operators

5.3.2. Individual Consumers

5.4. North America Electric 3-wheeler Market Size and Forecast, by Country (2023-2030)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Electric 3-wheeler Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Electric 3-wheeler Market Size and Forecast, by Vehicle Type (2023-2030)

6.2. Europe Electric 3-wheeler Market Size and Forecast, by Battery Type (2023-2030)

6.3. Europe Electric 3-wheeler Market Size and Forecast, by End User (2023-2030)

6.4. Europe Electric 3-wheeler Market Size and Forecast, by Country (2023-2030)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Austria

6.4.8. Rest of Europe

7. Asia Pacific Electric 3-wheeler Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Electric 3-wheeler Market Size and Forecast, by Vehicle Type (2023-2030)

7.2. Asia Pacific Electric 3-wheeler Market Size and Forecast, by Battery Type (2023-2030)

7.3. Asia Pacific Electric 3-wheeler Market Size and Forecast, by End User (2023-2030)

7.4. Asia Pacific Electric 3-wheeler Market Size and Forecast, by Country (2023-2030)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. Indonesia

7.4.7. Malaysia

7.4.8. Vietnam

7.4.9. Taiwan

7.4.10. Rest of Asia Pacific

8. Middle East and Africa Electric 3-wheeler Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Electric 3-wheeler Market Size and Forecast, by Vehicle Type (2023-2030)

8.2. Middle East and Africa Electric 3-wheeler Market Size and Forecast, by Battery Type (2023-2030)

8.3. Middle East and Africa Electric 3-wheeler Market Size and Forecast, by End User (2023-2030)

8.4. Middle East and Africa Electric 3-wheeler Market Size and Forecast, by Country (2023-2030)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America Electric 3-wheeler Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Electric 3-wheeler Market Size and Forecast, by Vehicle Type (2023-2030)

9.2. South America Electric 3-wheeler Market Size and Forecast, by Battery Type (2023-2030)

9.3. South America Electric 3-wheeler Market Size and Forecast, by End User (2023-2030)

9.4. South America Electric 3-wheeler Market Size and Forecast, by Country (2023-2030)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Of South America

10. Company Profile: Key Players

10.1. Mahindra Electric

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Piaggion & C. Spa

10.3. Bajaj Auto

10.4. Kinetic Green

10.5. Terra Motors Corporation

10.6. Lohia Auto Industries

10.7. E-Tuk Factory BV

10.8. Omega Seiki Private Limited

10.9. ATUL Auto Limited Source

10.10. BILITI ELECTRIC INC.

10.11. Euler motors

10.12. Hop Motors Private Limited

10.13. Yamaha Motor Company Limited

10.14. ola electric

11. Key Findings

12. Industry Recommendations

13. Electric 3-wheeler Market: Research Methodology