Folding Carton Market: Global Industry Analysis and Forecast (2024-2030)

The Folding Carton Market size was valued at USD 107.84 Bn. in 2023 and the total Global Folding Carton revenue is expected to grow at a CAGR of 4.78% from 2024 to 2030, reaching nearly USD 177.81 Bn. by 2030.

Format : PDF | Report ID : SMR_2115

Folding Carton Market Overview

A folding carton is a paper-based package that acts as the external container for an item or product. It's the box that almost every product in the world is stored in when it is put on a shelf.

- The folding carton market accounted for about 20% of the top six players, which are WestRock Company, DS Smith PLC, International Paper Company, Amcor Limited, Huhtamaki Oyj, and Smurfit Kappa Group Through quick product development and product customization experiments.

- According to SMR, in 2024, the top 3 major exporters of folding cartons are China with about 19760 shipments, Colombia with 6375 Shipments, and Germany with 5958 shipments globally.

The report from Stellar Market Research presents a thorough analysis of the Folding Carton Market, focusing on predicting market growth trends and offering valuable insights into the value chain and supply chain dynamics. The market scope includes opportunities in new product development and advancements in knitting technologies, which drive market growth and innovation. The report reflects various aspects and provides valuable insights into the Folding Carton industry. The research report also provides an overview of the current size and growth of the Folding Carton market. It includes historical data, market segmentation by material, structure type, end-use industry, and regional analysis.

The report identifies and analyzes the factors driving the growth of the Folding Carton market, such as government regulations, environmental concerns, technological advancements, and changing consumer preferences. It also highlights the challenges faced by the industry, including supply chain disruptions and raw material cost fluctuations.

Key players play a crucial role in driving innovation and improving product quality, underscoring the importance of targeted strategies to meet evolving consumer demands. The report highlights the significance of import and export activities in the Folding Carton Market, ensuring continuous transactions between suppliers and end-users. Additionally, the analysis evaluates the cost-profit ratio, assessing companies' financial capabilities for investing in research and development to introduce new products or enhance existing ones.

The report also offers an extensive evaluation of Porter's five forces analysis and SWOT analysis to furnish appropriate business insights. Porter's five forces model aids in understanding the competitive landscape, while the SWOT analysis identifies market attributes influencing company growth and sustainability in the long term.

To get more Insights: Request Free Sample Report

Folding Carton Market Dynamics

Innovative and Sustainable Trends Driving Folding Carton Market Growth

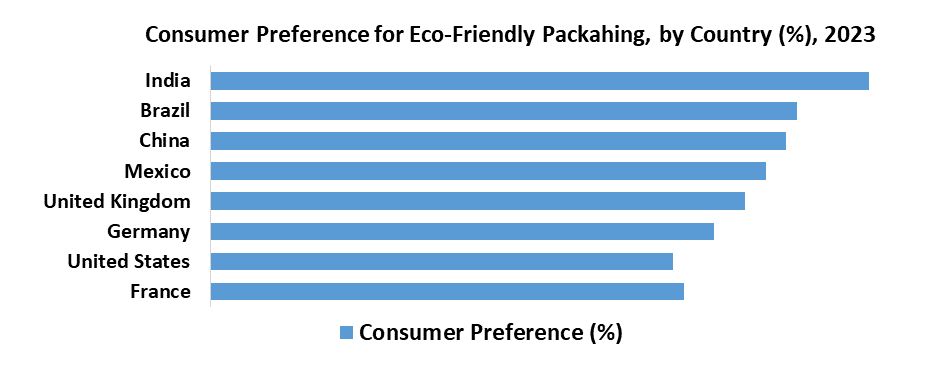

Innovative packaging designs encourage companies to invest more in distinctive and visually appealing packaging designs to differentiate themselves for attract customer attention. Companies are using cutting-edge design methods, such as digital printing and 3D modeling, to produce complex, personalized packaging that improves customer satisfaction and increases brand loyalty driving the demand for the folding carton market. Sustainability is becoming an important factor for both consumers and businesses. According to SMR analysis, 67% of consumers consider its environmental impact when making purchasing decisions. Businesses have been convinced to use eco-friendly packaging options by this increased awareness.

Paperboard-based folding cartons are a common option since they are easily recycled and often use recycled materials. In response, the industry is creating boxes that use less material and include biodegradable and compostable components, in line with international sustainability goals further driving the folding carton market. Economic sustainability goals and regulatory restrictions are driving demand for sustainable packaging; many businesses want to have all of their packaging recyclable or compostable by 2025. Automation and robots are examples of cutting-edge technology that have been incorporated into package design to improve the time to market for innovative package designs, lower costs, and satisfy environmental objectives further increasing the demand for the folding carton market.

Folding cartons are becoming more practical and engaging for consumers thanks to the addition of smart packaging, which includes NFC tags and QR codes. These developments appeal to tech-savvy customers and elevate conventional packaging by offering useful product information and engaging experiences. The folding carton market is changing as a result of the growing need for sustainable solutions combined with cutting-edge design services. This is driving growth and innovation in the folding carton industry which is becoming more sensitive to customer and environmental needs.

- NatureWorks with a global market share of 10% is the leading exporter and producer of Biodegradable Packaging Materials.

Supply Chain Disruptions & Raw Material Fluctuations

The folding carton market faces significant challenges owing to disruptions in the supply chain and fluctuations in raw material prices. Recent global events have uncovered the weaknesses of supply chains, leading to disruptions that affect the availability and cost of essential raw materials. SMR reports that the cost of paperboard increased by almost 20% over the past year. These fluctuations make it difficult for manufacturers to maintain consistent production costs and pricing. Additionally, geopolitical tensions and trade restrictions suddenly change the availability of raw materials, worsening supply chain challenges. Transportation issues, such as port blocking and a shortage of shipping containers, have further strained the supply chain, causing delays and higher logistics costs.

These factors create uncertainty in the production schedule, impacting the prompt delivery of folding cartons to end-users. In addition, environmental regulations and the demand for sustainability are driving the need for more eco-friendly raw materials, which are often costlier and harder to consistently source. The volatility in the cost and availability of materials puts pressure on manufacturers' profit margins and complicates budgeting and forecasting efforts. Energy costs also play a crucial role, as fluctuations in oil and gas prices affect production and transportation costs.

A 15% increase in energy prices last year has added to the operational costs of producing folding cartons. As energy prices continue to fluctuate, they contribute to the overall instability in the folding carton market. These combined challenges from disruptions in the supply chain and raw material fluctuations create a complex environment for folding carton manufacturers, constraining their ability to efficiently and economically meet folding carton market demands.

Folding Carton Market Segment Analysis

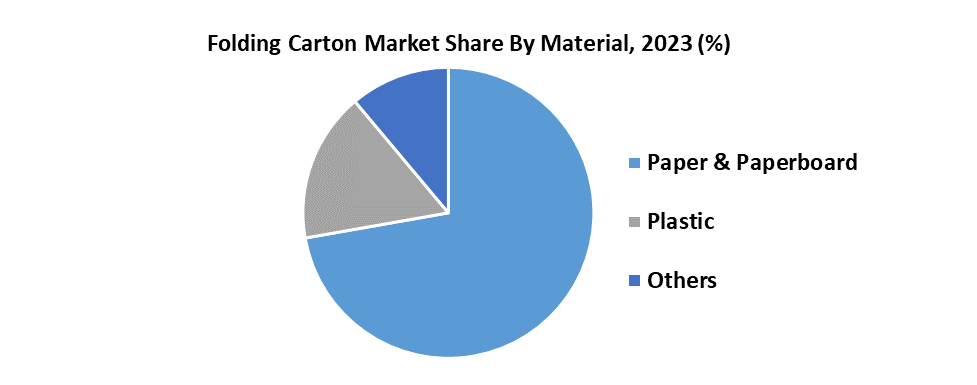

By Material, According to SMR research, the Paper & Paper Board segment has been dominant in 2023 and dominated the Folding Carton Market. The increasing demand for eco-friendly packaging from consumers has been driving the segment’s dominance in the folding carton market. The flexibility of the paperboards allows the manufacturers to meet different industry needs from the food and beverage industry to consumer goods. Its customer reach is widened by its adaptability as well as its adjustable thickness, strength, and surface qualities. The production process of the paper & paper board involves recycled paper further decreasing its environmental impact. Additionally, paperboard is also a cost-effective option compared to other materials like plastic.

The global recycling statistics show that 67% of paper packaging compared to only 2% of plastic is recycled. The usefulness of paperboard over plastic allows more differentiation in shapes, designs, and decorative effects that help enhance its appeal making the products stand out in the folding carton market. Another essential feature of paperboard is its strength & stiffness which makes it appropriate for packaging applications that call for stacking and protection because of this, paperboard has always been competitive in the folding carton market. Additionally, paperboard packaging efficiently preserves food products, just as well as plastic packing does further increasing its demand in the folding carton market.

The dominance of the paper & paperboard segment in the folding carton market branched from its sustainability, cost-effectiveness, versatility, consumer preference, and ability to maintain product quality. The benefits of the paperboard production process place it as the preferred choice for a variety of applications, even when industry demands and customer tastes change.

Folding Carton Market Regional Analysis

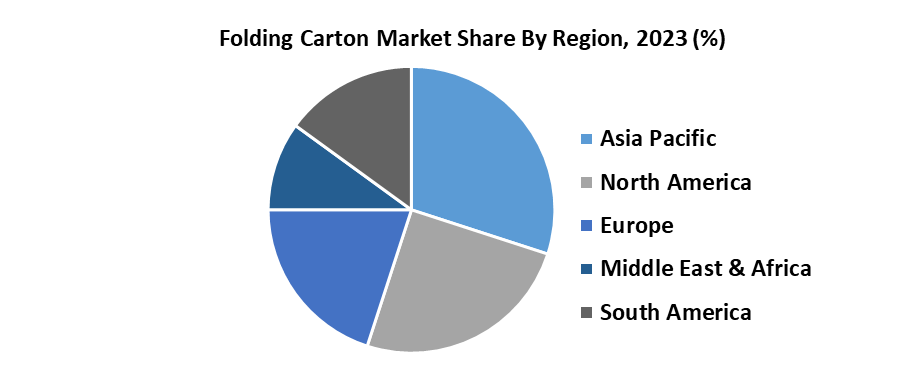

Asia Pacific held the dominant position in the folding carton market in 2023 driven by the rapid growth of economies in developing nations like China, India, and Indonesia. The purchasing patterns of consumers in these nations are changing significantly, with rising disposable incomes and the growing demand for packaged foods like ready-to-eat meals. In addition to the convenience and simplicity of use, folding cartons have grown increasing in demand further driving the folding carton market growth in the region. The growth of organized retail also further drives the folding carton market. There is a growing need for packaged food items and folding cartons are helpful as they provide both attractive display and protection, which is important in competitive markets.

The growth is also supported by the advent of e-commerce. Folding cartons are the perfect option for the increasing amount of items that need to be delivered safely and responsibly thanks to the rapid rise in online shopping in the Asia Pacific region. Urbanization and the construction of infrastructure are two additional factors fueling the folding carton market growth.

The demand for a variety of items, including food and drinks, rises as cities grow and infrastructure advances. With their durability and adaptability, folding cartons are ideally suited to satisfy the requirement, especially for goods that need sturdy packaging alternatives. With several factors, including economic growth, shifting consumer behavior, the rise of organized retail and e-commerce, the development of infrastructure, and a strong emphasis on sustainability, the Asia Pacific region dominated the folding carton industry and is expected to continue its dominance.

- According to SMR analysis, 80% of Indians cited the Environmental Impacts of packaging as very important.

Folding Carton Market Competitive Landscape

The competitive landscape of the Folding Carton Market includes key players such as WestRock Company, Graphic Packaging International LLC, Mayr-Melnhof Packaging, Smurfit Kappa Group, Seaboard Corporation, and Amcor Limited among others. These companies play a crucial role in growing the folding carton market by providing high-quality, innovative, and sustainable packaging solutions to their customers. They help drive sales revenue by continuously investing in research and development, expanding their product offerings, and focusing on customer satisfaction.

- In 2023, Mayr-Melnhof Karton AG acquired Essentra Packaging, a leading manufacturer of Folding Carton, for £312 million. This acquisition enhanced Mayr-Melnhof's position in the pharmaceutical and healthcare packaging markets.

- In 2023, Metsä Board collaborated with Stora Enso to develop a new folding carton material made from renewable and recyclable materials. The material is designed to be a sustainable alternative to traditional plastic packaging.

- In 2022, Graphic Packaging Holding Company acquired AR Packaging Group AB, a leading European consumer packaging company, for $1.45 billion. This acquisition expanded Graphic Packaging's footprint in Europe and strengthened its position as a global leader in Folding Carton.

|

Folding Carton Market Scope |

|

|

Market Size in 2023 |

USD 107.84Bn. |

|

Market Size in 2030 |

USD 177.81Bn. |

|

CAGR (2024-2030) |

4.78% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Material Paper & Paperboard Plastic Others |

|

By Structure Type Straight Turk End Reverse Tuck End Full Seal End Cartons Others |

|

|

By End-Use Industry Food & Beverage Pharmaceuticals Personal Care & Cosmetics Electrical & Electronics Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Folding Carton Market

- WestRock Company (USA)

- Graphic Packaging International LLC (USA)

- Mayr-Melnhof Packaging (Austria)

- Smurfit Kappa Group (Ireland)

- Seaboard Corporation (USA)

- Amcor Limited (Australia)

- Huhtamaki Oyj (Finland)

- DS Smith PLC (United Kingdom)

- Edelmann GmbH (Germany)

- CCL Healthcare (Canada)

- Sonoco Products Company (USA)

- Graphic Packaging Holding Company (USA)

- Schur Pack Germany GmbH (Germany)

- PaperWorks (USA)

- Georgia-Pacific LLC (USA)

- Multi Packaging Solutions Inc. (USA)

- Rengo Co. Ltd. (Japan)

- Stora Enso (Finland)

- Metsä Board (Finland)

- Mondi Group (Austria)

- Iggesund Paperboard (Sweden)

- Kotkamills (Finland)

- Sappi (South Africa)

- Cascades (Canada)

- Caraustar Industries (USA)

Frequently Asked Questions

The growing electronic industry and massively growing food and beverage industry are the drivers of the Folding Carton Market.

Asia Pacific is the fastest-growing region in the Folding Carton market during the forecast period.

The Market size was valued at USD 107.84 billion in 2023 and the total Market revenue is expected to grow at a CAGR of 4.78% from 2024 to 2030, reaching nearly USD 177.81 billion.

The segments covered in the market report are material, structure, end-use, and region.

1. Folding Carton Market: Research Methodology

2. Folding Carton Market: Executive Summary

3. Folding Carton Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Folding Carton Market: Dynamics

5.1. Market Trends

5.2. Market Drivers

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Value Chain Analysis

5.9. Technology Roadmap

5.10. Strategies for New Entrants to Penetrate the Market

5.11. Regulatory Landscape by Region

5.11.1. North America

5.11.2. Europe

5.11.3. Asia Pacific

5.11.4. Middle East and Africa

5.11.5. South America

5.12. Global Import Export Analysis

6. Folding Carton Market Size and Forecast by Segments (by Value USD Billion)

6.1. Folding Carton Market Size and Forecast, by Material (2023-2030)

6.1.1. Paper & Paperboard

6.1.2. Plastic

6.1.3. Others

6.2. Folding Carton Market Size and Forecast, by Structure Type (2023-2030)

6.2.1. Straight Turk End

6.2.2. Reverse Tuck End

6.2.3. Full Seal End Cartons

6.2.4. Others

6.3. Folding Carton Market Size and Forecast, by End-Use Industry (2023-2030)

6.3.1. Food & Beverage

6.3.2. Pharmaceuticals

6.3.3. Personal Care & Cosmetics

6.3.4. Electrical & Electronics

6.3.5. Others

6.4. Folding Carton Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Folding Carton Market Size and Forecast (by Value USD Billion)

7.1. North America Folding Carton Market Size and Forecast, by Material (2023-2030)

7.1.1. Paper & Paperboard

7.1.2. Plastic

7.1.3. Others

7.2. North America Folding Carton Market Size and Forecast, by Structure Type (2023-2030)

7.2.1. Straight Turk End

7.2.2. Reverse Tuck End

7.2.3. Full Seal End Cartons

7.2.4. Others

7.3. North America Folding Carton Market Size and Forecast, by End-Use Industry (2023-2030)

7.3.1. Food & Beverage

7.3.2. Pharmaceuticals

7.3.3. Personal Care & Cosmetics

7.3.4. Electrical & Electronics

7.3.5. Others

7.4. North America Folding Carton Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Folding Carton Market Size and Forecast (by Value USD Billion)

8.1. Europe Folding Carton Market Size and Forecast, by Material (2023-2030)

8.1.1. Paper & Paperboard

8.1.2. Plastic

8.1.3. Others

8.2. Europe Folding Carton Market Size and Forecast, by Structure Type (2023-2030)

8.2.1. Straight Turk End

8.2.2. Reverse Tuck End

8.2.3. Full Seal End Cartons

8.2.4. Others

8.3. Europe Folding Carton Market Size and Forecast, by End-Use Industry (2023-2030)

8.3.1. Food & Beverage

8.3.2. Pharmaceuticals

8.3.3. Personal Care & Cosmetics

8.3.4. Electrical & Electronics

8.3.5. Others

8.4. Europe Folding Carton Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Folding Carton Market Size and Forecast (by Value USD Billion)

9.1. Asia Pacific Folding Carton Market Size and Forecast, by Material (2023-2030)

9.1.1. Paper & Paperboard

9.1.2. Plastic

9.1.3. Others

9.2. Asia Pacific Folding Carton Market Size and Forecast, by Structure Type (2023-2030)

9.2.1. Straight Turk End

9.2.2. Reverse Tuck End

9.2.3. Full Seal End Cartons

9.2.4. Others

9.3. Asia Pacific Folding Carton Market Size and Forecast, by End-Use Industry (2023-2030)

9.3.1. Food & Beverage

9.3.2. Pharmaceuticals

9.3.3. Personal Care & Cosmetics

9.3.4. Electrical & Electronics

9.3.5. Others

9.4. Asia Pacific Folding Carton Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Folding Carton Market Size and Forecast (by Value USD Billion)

10.1. Middle East and Africa Folding Carton Market Size and Forecast, by Material (2023-2030)

10.1.1. Paper & Paperboard

10.1.2. Plastic

10.1.3. Others

10.2. Middle East and Africa Folding Carton Market Size and Forecast, by Structure Type (2023-2030)

10.2.1. Straight Turk End

10.2.2. Reverse Tuck End

10.2.3. Full Seal End Cartons

10.2.4. Others

10.3. Middle East and Africa Folding Carton Market Size and Forecast, by End-Use Industry (2023-2030)

10.3.1. Food & Beverage

10.3.2. Pharmaceuticals

10.3.3. Personal Care & Cosmetics

10.3.4. Electrical & Electronics

10.3.5. Others

10.4. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Folding Carton Market Size and Forecast (by Value USD Billion)

11.1. South America Folding Carton Market Size and Forecast, by Material (2023-2030)

11.1.1. Paper & Paperboard

11.1.2. Plastic

11.1.3. Others

11.2. South America Folding Carton Market Size and Forecast, by Structure Type (2023-2030)

11.2.1. Straight Turk End

11.2.2. Reverse Tuck End

11.2.3. Full Seal End Cartons

11.2.4. Others

11.3. South America Folding Carton Market Size and Forecast, by End-Use Industry (2023-2030)

11.3.1. Food & Beverage

11.3.2. Pharmaceuticals

11.3.3. Personal Care & Cosmetics

11.3.4. Electrical & Electronics

11.3.5. Others

11.4. South America Folding Carton Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. WestRock Company

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. DS Smith PLC

12.3. International Paper Company

12.4. Amcor Limited

12.5. Huhtamaki Oyj

12.6. Graphic Packaging International LLC

12.7. Mayr-Melnhof Packaging

12.8. Smurfit Kappa Group

12.9. Seaboard Corporation

12.10. Edelmann GmbH

12.11. CCL Healthcare

12.12. Sonoco Products Company

12.13. Graphic Packaging Holding Company

12.14. Schur Pack Germany GmbH

12.15. PaperWorks

12.16. Georgia-Pacific LLC

12.17. Multi Packaging Solutions Inc.

12.18. Rengo Co. Ltd.

12.19. Stora Enso

12.20. Metsä Board

12.21. Mondi Group

12.22. Iggesund Paperboard

12.23. Kotkamills

12.24. Sappi

12.25. Cascades

12.26. Caraustar Industries

13. Key Findings

14. Industry Recommendations