Formal Shoes Market: Global Industry Analysis and Forecast (2024-2030)

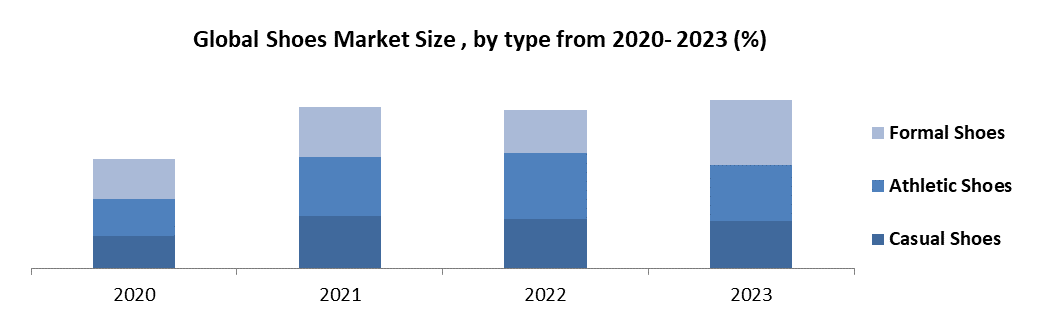

The Formal Shoes Market size was valued at USD 15.29 Bn. in 2023 and the total Global Formal Shoes revenue is expected to grow at a CAGR of 9.5% from 2024 to 2030, reaching nearly USD 31.90 Bn. by 2030.

Format : PDF | Report ID : SMR_1864

Formal Shoes Market Overview

Formal shoes are footwear specifically chosen to enhance the elegance and formality of an outfit, whether for professional settings, special events, or formal occasions, while also reflecting the personal style and modern trends in fashion. The latest trends in the men's formal shoes market include the introduction of innovative designs and styles. Manufacturers are combining new technologies and materials to enhance the comfort and durability of the shoes, the preference for eco-friendly and sustainable products is increasing, leading to its production of formal shoes made from recycled materials.

The report from Stellar Market Research presents a thorough analysis of the Formal Shoes market, focusing on forecasting market growth trends and offering valuable insights into the supply chain dynamics. The formal Shoes Market report provides an overview of market value structure, cost factor, and various driving factors and, also studies the global outline of industry size, demand, revenue, product, region, and segments. The Formal Shoes market report covers the recent developments, import-export analysis, production analysis, market share, and the impact of domestic and localized market players.

The Formal Shoes Market has driven by factors such as increasing disposable income, changing lifestyle trends, fashion consciousness among men, and the growing demand for branded and designer formal shoes. The availability of a wide range of styles and designs online, along with the highlighting of comfort and quality is growing the market's development, especially with the rising popularity of online shopping for men's formal shoes.

- The Asia Pacific region is a major importing hub for men's formal shoes, with countries like China, India, Vietnam, and Indonesia serving as key production centers.

- China holds the title of the world's largest formal shoe importer

- Hush Puppies expanded its availability to leading e-commerce marketplaces and shop-in-shops inside multi-brand retailers in India.

To get more Insights: Request Free Sample Report

Formal Shoes Market Dynamics

Increasing disposable income and rising demand for branded footwear

The growing urbanization and rapid economic growth have produced a significant population of consumers who are eager to invest in premium, well-known footwear brands. The Rising incomes allow individuals to afford higher-priced items, such as premium leather shoes, driving an increase in the formal shoe market. A stronger economy frequently links with more professional settings and events, where formal attire, including shoes, is required. This creates a sustained demand for formal footwear. Additionally, evolving fashion trends and the desire for status symbols contribute to the growth of the formal shoe market, as consumers seek stylish and prestigious brands to complement their attire.

The growth of the men's formal shoe industry is fueled by the rise of commercialization and the demand for branded shoes. It results in the development of innovative designs that offer a unique look, exceptional quality, and long-lasting durability. As consumers gain more purchasing power, there's a noticeable shift towards branded footwear in the formal shoe market. Branded shoes not only offer superior quality and craftsmanship but also carry a certain prestige and status. Branding creates a sense of identity and belonging, making branded formal shoes a desirable choice for those seeking to align with specific lifestyles or fashion trends. This increased demand for branded footwear contributes significantly to the growth of the formal shoe market.

Formal Shoes Market opportunity

Increasing globalization and rising disposable incomes have led to a surge in demand for premium and luxury footwear. Additionally, the growing trend of personal grooming and increasing awareness about fashion among men has driven market growth. The rise of e-commerce platforms has made it easier for consumers to access a wide range of formal shoe options. Consumers are increasingly drawn to name brands and high-quality materials, leading to potential growth in premium formal shoe segments.

The global workforce is expanding, particularly with more women entering professional fields, driving demand for formal footwear. Innovations in design and features, rising commercialization, and demand for branded footwear are key drivers of market growth, leading to unique looks, better finishes, and durability in formal shoes. The formal Shoes Market is expected to see continued growth because of the increasing preference for formal footwear in workplaces and social events.

Formal Shoes Market Segment Analysis

Based on the Product Type, the Boots segment held the largest market share of about 42.4% in the Formal Shoes Market in 2023. According to the SMR analysis, the segment is expected to grow at a CAGR of 9.5% during the forecast period and maintain its dominance till 2030.The segmentation of the Formal Shoes market offers insight into different consumer preferences and style inclinations. The boots segment has risen as a fundamental power, indicating a significant change in inclination towards these footwear choices within the formal wear classification. The trend underscores the adaptability and attraction of boots, which strike a balance between formal sophistication and practicality, catering to the evolving demands of consumers seeking both style and functionality in their footwear choices.

The increase in popularity of boots reflects a larger consumer preference for shoes that easily blend formal style with comfort and practicality. For professional settings or social gatherings, boots have become a preferred choice, representing a fusion of improvement and practicality that resonates with contemporary lifestyles. Consequently, their prominence in the Formal Shoes market reflects a keen understanding of consumer preferences and highlights the industry's ability to adapt to evolving fashion trends while retaining the essence of formal attire.

Formal Shoes Market Regional Analysis

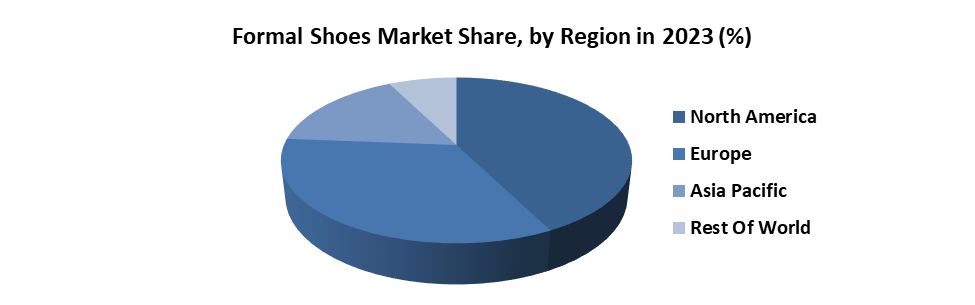

North America has dominated the Formal Shoes Market, which held the largest market share accounting for 45.90% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North America dominates with a growing number of women entering professional fields. It creates demand for a wider variety of formal shoe styles catering to both men's and women’s preferences. North America, specifically in the U.S. and Canada, has a long-standing professional workplace with stricter dress codes and cultures requiring formal attire, including shoes for many professions. The North American people are fashion-conscious and interested in brand recognition. It fuels the market for premier and designer formal shoes, driving the overall market. North America has likely remained a significant player in the global formal shoe market.

Asia Pacific represents the fastest-growing region for the Formal Shoes industry holding a market share and experiencing significant growth during its forecast period because The expansion of the middle class in countries like China and India has led to an increased demand for formal footwear. As people move into higher income brackets, they are more likely to invest in higher-quality products, including formal shoes for work and special occasions.

The growth of corporate culture and a focus on professional appearance in many Asian countries have boosted the demand for formal attire, including formal shoes. The rise of e-commerce platforms has made it easier for consumers in the Asia-Pacific region to access a wide range of formal shoe options from both domestic and international brands. So, the Asia-Pacific region is a key growth market for the formal shoe industry.

Formal Shoes Market Competitive Landscape

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the formal shoes Market. Players in the market are diversifying their service offerings to maintain market share. Key players in the market are focusing on launching new superhero characters and engaging in collaborations to attract more customers, diversify their portfolios, and target new fan bases, thereby driving industry growth.

- In May 2022, Bata India, which owns the Hush Puppies brand in India, launched a new campaign called "Neo Casuals for Neo Leaders" to promote the brand's evolved portfolio. The campaign aimed to position Hush Puppies as a premium and contemporary brand catering to working professionals across genders.

- In January 2021, Hush Puppies launched a campaign to collect stories of optimism from 5,000 people and share them on their social media channels, blogs, and media outlets. As a thank you, the brand gave away colorful knit beanies to select storytellers in the U.S.

- In November 2020, LionRock Capital (Hong Kong) made a significant investment in Clark International (Clarks). LionRock's acquisition of Clarks aided the company's continued growth, particularly in the Asia-Pacific region.

- The Aldo Group announced a long-term partnership with Authentic Brands Group for Hunter products, where Aldo Group will handle the design, production, and distribution of Hunter bag products and small leather goods in the U.S. and Canada.

|

Formal Shoes Market Scope |

|

|

Market Size in 2023 |

USD15.29 Bn. |

|

Market Size in 2030 |

USD 31.90 Bn. |

|

CAGR (2024-2030) |

9.5 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segment |

By Product Type Ballerina Mules Oxfords Derby Boots Others |

|

By End users Men Women |

|

|

By Distribution Channel Stores-based Non-Stores -based |

|

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Formal Shoes Market

- Clarks (England)

- Cole Haan (New Hampshire)

- Johnston & Murphy (U.S.)

- Allen Edmonds (Washinton)

- Church's (England)

- Hugo Boss (Germany)

- Alden Shoe Company (U.S.)

- Salvatore Ferragamo (Italy)

- Dolce & Gabbana Luxembourg S.r.l. (Italy)

- Magnanni Inc. (U.S.)

- The Aldo Group Inc. (Canada)

- ECCO Sko A/S (Denmark)

- Bruno Magli (New York)

- Bata Limited (Switzerland)

- Hush Puppies (Michigan)

- Steve Madden Ltd. (U.S.)

- Kenneth Cole Productions, Inc. (North America)

- Roush (Michigan)

- Burberry Group Inc. (London)

- Prada S.P.A. (U.S.)

Frequently Asked Questions

North America is expected to hold the highest share of the Formal Shoes Market.

The Formal Shoes Market size was valued at USD 15.29 billion in 2023 reaching nearly USD 31.90 billion in 2030.

Opportunities lie in Emerging economies in Asia and Africa are expected to witness a significant rise in demand for formal footwear owing to a growing professional class and increasing disposable income are significant opportunities in Formal Shoes Market.

The segments covered in the Formal Shoes Market report are based on Product Type, End Users, and Distribution Channel.

1. Formal Shoes Market: Research Methodology

2. Formal Shoes Market: Executive Summary

3. Formal Shoes Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Global Import-Export Analysis

5. Formal Shoes Market: Dynamics

5.1. Market Driver

5.1.1. Increased Focus on Sterility

5.1.2. Technological Advancements in single-use filters

5.1.3. Regulatory Requirements on Product Quality & Safety

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Formal Shoes Market Size and Forecast by Segments (by Value Units)

6.1. Formal Shoes Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Ballerina

6.1.2. Mules

6.1.3. Oxfords

6.1.4. Derby

6.1.5. Boots

6.1.6. Others

6.2. Formal Shoes Market Size and Forecast, by End Users (2023-2030)

6.2.1. Men

6.2.2. Women

6.3. Formal Shoes Market Size and Forecast, by Distribution Channel (2023-2030)

6.3.1. Store-based

6.3.2. Non-stores-based

6.4. Formal Shoes Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Formal Shoes Market Size and Forecast (by Value Units)

7.1. North America Formal Shoes Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Ballerina

7.1.2. Mules

7.1.3. Oxfords

7.1.4. Derby

7.1.5. Boots

7.1.6. Others

7.2. North America Formal Shoes Market Size and Forecast, by End Users (2023-2030)

7.2.1. Men

7.2.2. Women

7.3. Formal Shoes Market Size and Forecast, by Distribution Channel (2023-2030)

7.3.1. Store-based

7.3.2. Non-stores-based

7.4. North America Formal Shoes Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Formal Shoes Market Size and Forecast (by Value Units)

8.1. Europe Formal Shoes Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Ballerina

8.1.2. Mules

8.1.3. Oxfords

8.1.4. Derby

8.1.5. Boots

8.1.6. Others

8.2. Europe Formal Shoes Market Size and Forecast, by End Users (2023-2030)

8.2.1. Men

8.2.2. Women

8.3. Formal Shoes Market Size and Forecast, by Distribution Channel (2023-2030)

8.3.1. Store-based

8.3.2. Non-stores-based

8.4. Europe Formal Shoes Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Formal Shoes Market Size and Forecast (by Value Units)

9.1. Asia Pacific Formal Shoes Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Ballerina

9.1.2. Mules

9.1.3. Oxfords

9.1.4. Derby

9.1.5. Boots

9.1.6. Others

9.2. Asia Pacific Formal Shoes Market Size and Forecast, by End Users (2023-2030)

9.2.1. Men

9.2.2. Women

9.3. Formal Shoes Market Size and Forecast, by Distribution Channel (2023-2030)

9.3.1. Store-based

9.3.2. Non-stores-based

9.4. Asia Pacific Formal Shoes Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Formal Shoes Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Formal Shoes Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Ballerina

10.1.2. Mules

10.1.3. Oxfords

10.1.4. Derby

10.1.5. Boots

10.1.6. Others

10.2. Middle East and Africa Formal Shoes Market Size and Forecast, by End Users (2023-2030)

10.2.1. Men

10.2.2. Women

10.3. Formal Shoes Market Size and Forecast, by Distribution Channel (2023-2030)

10.3.1. Store-based

10.3.2. Non-stores-based

10.4. Middle East and Africa Formal Shoes Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Formal Shoes Market Size and Forecast (by Value Units)

11.1. South America Formal Shoes Market Size and Forecast, by Product Type (2023-2030)

11.1.1. Ballerina

11.1.2. Mules

11.1.3. Oxfords

11.1.4. Derby

11.1.5. Boots

11.1.6. Others

11.2. South America Formal Shoes Market Size and Forecast, by End Users (2023-2030)

11.2.1. Men

11.2.2. Women

11.3. Formal Shoes Market Size and Forecast, by Distribution Channel (2023-2030)

11.3.1. Store-based

11.3.2. Non-stores-based

11.4. South America Formal Shoes Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Hush Puppies (Michigan)

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Clarks (England)

12.3. Cole Haan (New Hampshire)

12.4. Johnston & Murphy (U.S.)

12.5. Allen Edmonds (Washinton)

12.6. Church's (England)

12.7. Hugo Boss (Germany)

12.8. Alden Shoe Company (U.S.)

12.9. Salvatore Ferragamo (Italy)

12.10. Dolce & Gabbana Luxembourg S.r.l. (Italy)

12.11. Magnanni Inc. (U.S.)

12.12. The Aldo Group Inc. (Canada)

12.13. ECCO Sko A/S (Denmark)

12.14. Bruno Magli (New York)

12.15. Bata Limited (Switzerland)

12.16. Steve Madden Ltd. (U.S.)

12.17. Kenneth Cole Productions, Inc. (North America)

12.18. Roush (Michigan)

12.19. Burberry Group Inc. (London)

12.20. Prada S.P.A. (U.S.)

13. Key Findings

14. Industry Recommendations