Graphene Coating Market: Global Industry Analysis and Forecast (2024-2030)

The Graphene Coating Market size was valued at USD 1.14 Bn. in 2023 and the total Global Graphene Coating revenue is expected to grow at a CAGR of 6.1% from 2024 to 2030, reaching nearly USD 7.13 Bn. by 2030.

Format : PDF | Report ID : SMR_2154

Graphene Coating Market Overview

Graphene coating is a thin layer of graphene material applied to the surface of an object for various purposes such as enhancing its properties like strength, conductivity, and even barrier capabilities. The SMR Report provides a comprehensive analysis of the graphene coating market, covering key aspects from market dynamics and competitive landscape to technological trends and regulatory impacts. It aims to offer valuable insights for stakeholders, investors, and Graphene Coating industry participants seeking to understand and navigate the evolving landscape of graphene coatings. Investment opportunities in the graphene coating market are substantial, particularly in the electronics, automotive, and energy storage sectors.

The electronics sector is experiencing an increasing demand for advanced devices, and graphene coatings offer significant benefits in terms of performance and durability. These coatings enhance conductivity and strength, making electronic components more efficient and longer-lasting. As the electronics Industry is expected to reach USD 3 trillion by 2025, investing in companies specializing in graphene-coated components is highly profitable. In the automotive industry, the need for lightweight, strong, and durable materials presents a prime opportunity for graphene coatings. Their excellent anti-corrosion properties are essential for automotive parts exposed to harsh conditions.

Companies developing these coatings are poised for growth, with the adoption rate in the automotive sector growing at 25% annually. Also, graphene's conductive properties make it ideal for energy storage solutions like batteries and supercapacitors, enhancing energy density, charge/discharge rates, and lifespan. These opportunities drive demand and innovation in the graphene coating market, accelerating commercialization, reducing production costs, and improving scalability. The growth attracts more investors, raising further advancements and ensuring long-term profitability and technological leadership.

To get more Insights: Request Free Sample Report

Graphene Coating Market Dynamics

Advancements in Production Techniques

Advancements in production techniques have been pivotal in shaping the graphene coating market. Specifically, innovations in cost reduction and quality improvement have made graphene coatings more accessible and reliable for various applications. Innovations in chemical vapor deposition (CVD) have significantly improved the control over the thickness and uniformity of graphene layers, resulting in higher-quality sheets with fewer defects.

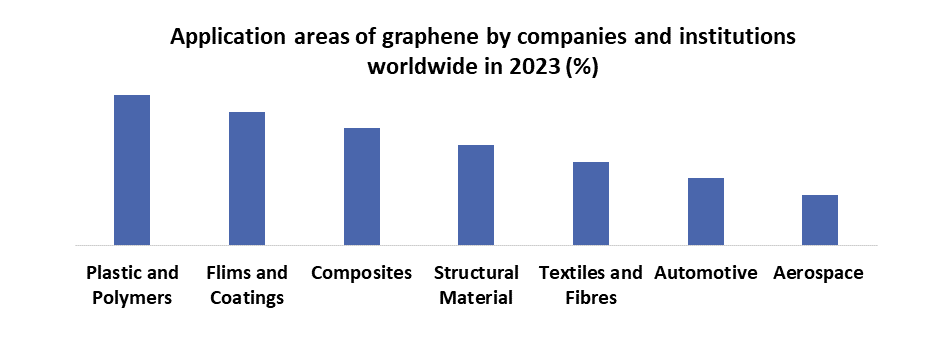

Additionally, enhanced purification processes have been developed to effectively remove impurities from graphene, leading to a purer and more consistent material. These advancements ensure that the graphene produced is of superior quality, making it more reliable for high-performance applications across various industries such as Plastics, textiles, electronics, aerospace, and automotive. These improvements have been crucial in driving the adoption and Graphene Coating market growth of graphene coatings.

In the automotive industry, reduced production costs and improved quality have made graphene coatings more economically viable, leading to their increased use in anti-corrosion coatings and conductive paints. In electronics, high-quality graphene coatings are now extensively used in flexible electronics and high-performance components due to their superior electrical properties and lower costs. The energy sector also benefits, with graphene coatings enhancing the performance and lifespan of batteries and supercapacitors. These advancements have significantly expanded the applications of graphene coatings across these industries, driving Graphene Coating market growth and adoption.

- According to SMR Analysis, the cost of high-quality graphene has decreased by more than 50% from 2018 to 2023. For instance, in 2018, the cost of producing graphene using CVD was approximately $100 per gram. By 2023, the cost had dropped to around $45 per gram due to improved production efficiencies and economies of scale

- Adoption rates of graphene coatings have risen across various industries. For example, in the automotive sector, the use of graphene coatings has grown by about 35% annually during this period, driven by the demand for lighter and more durable materials.

Economic Viability of Graphene Coatings

High production costs come from the complex processes required to produce high-quality graphene, such as chemical vapor deposition (CVD) and exfoliation. These techniques are resource-intensive, requiring advanced equipment, controlled environments, and highly skilled labor. Additionally, the raw materials, including graphite and specialized gases, contribute to the overall expense. Maintaining the purity and quality of these materials further escalates costs, making the production of graphene coatings economically challenging. As a result, these high costs limit the widespread adoption of graphene coatings, particularly in cost-sensitive industries.

High production costs confine graphene coatings to high-value applications where the benefits outweigh the expenses. While graphene's properties are ideal for numerous industrial uses, sectors such as aerospace, luxury automotive, and high-end electronics are currently the primary adopters due to their ability to afford the integration costs. Industries with narrow profit margins, like consumer electronics and general manufacturing, struggle to adopt graphene coatings because of the high costs. These sectors often choose cheaper alternatives that provide a reasonable balance of performance and affordability.

- High production costs have driven increased investment in research and development. From 2018 to 2023, investments in R&D for cost-effective graphene production techniques have grown by an average of 15% annually. These investments aim to lower production costs further and enhance the economic viability of graphene coatings.

- In 2018, the cost of producing high-quality graphene using CVD was approximately $100 per gram. Despite technological advancements and scaling efforts, by 2023, the cost had decreased to about $45 per gram. While it represents a significant reduction, it is still high compared to traditional Graphene coating materials.

Graphene Coating Market Segment Analysis

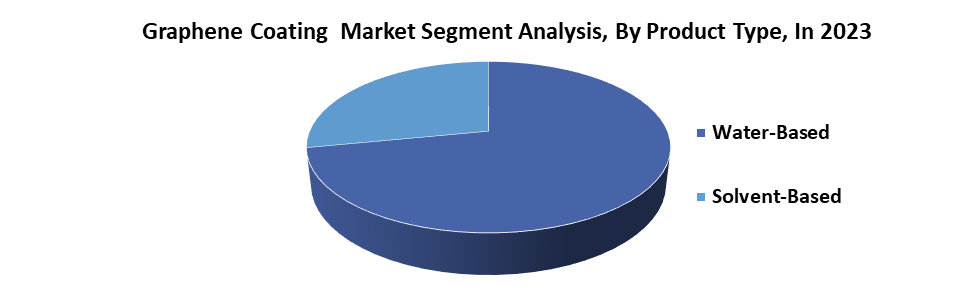

By Product Type, Water-based graphene coatings constitute a significant segment of the graphene coating market, owing to their environmental benefits and regulatory compliance advantages. As of recent data, water-based formulations hold approximately 45% of the graphene coating market share globally. These coatings are preferred in industries that prioritize sustainability and environmental responsibility. They significantly reduce Volatile Organic Compounds (VOC) emissions compared to solvent-based coatings, aligning with stringent environmental regulations in many regions.

The characteristic makes them suitable for applications in indoor environments and areas with strict emission standards. Water-based graphene coatings offer several performance advantages. They provide excellent adhesion to various substrates, including metals, plastics, and composites. They also exhibit good flexibility, which is crucial in applications where materials undergo growth and contraction. Also, these coatings are easier to apply and clean up, contributing to operational efficiency and reduced downtime in manufacturing processes.

Graphene Coating Market Regional Insights

North America plays a pivotal role in the global graphene coating market because of its advanced technological infrastructure, substantial investments in research and development, and high adoption rates across various industries. The aerospace and automotive industries in North America are major adopters of graphene coatings, leveraging its properties for enhanced performance and durability. The electronics sector is also integrating graphene coatings for advanced components and flexible electronics. In North America, there has been a notable uptick in research collaborations among universities, research institutions, and industry leaders, focusing on refining cost-effective production methods and exploring novel applications for graphene coatings.

Simultaneously, companies are increasingly introducing graphene-based products, such as lightweight automotive components with enhanced corrosion resistance. The surge in commercial applications is supported by substantial investments in graphene-related start-ups and technology development. Major corporations and venture capital firms have collectively invested more than $500 million in graphene research and development from 2018 to 2023, underscoring the region's commitment to advancing graphene technologies and increasing its Graphene Coating market presence. The production cost of graphene remains notably high, averaging about $45 per gram in 2023.

The cost is driven by the need for sophisticated equipment and meticulous processes essential for producing high-quality graphene. Also, raw material expenses, particularly for high-purity graphite and specialized gases essential in production, constitute a significant portion, approximately 30%, of the total production cost in the same year. These factors highlight the economic challenges associated with graphene production in the region, despite ongoing efforts to enhance efficiency and reduce costs through technological advancements and scale-up initiatives.

Graphene Coating Market Competitive Landscape

In the competitive graphene coating market, major players like Graphenea, NanoXplore, Applied Graphene Materials, and XG Sciences drive innovation through strategic alliances and technological advancements. New product launches, such as graphene-enhanced paints for the automotive and aerospace sectors, strengthen Graphene Coating market growth by improving durability and performance.

These innovations expand applications in electronics and energy storage, enhancing Graphene Coating market penetration and competitive positioning. For instance, advancements in graphene-coated battery technology have extended lifespan and accelerated charging, attracting interest from electric vehicle manufacturers and renewable energy sectors. Continuous research and development investments underscore ongoing efforts to advance graphene technologies and meet evolving Graphene Coating industry demands.

- In May 2023, Gerdau Graphene unveiled its new graphene additives, NanoDUR and NanoLAV, for water-based paints & coatings without changing pH levels.

- In April 2023, Stolt Tankers announced its plan to apply graphene-based propeller coating, Ultra-Slick Prop Coating, to 25 more vessels (five ships) in its fleet after a significant reduction in fuel consumption in a trial test. As this application penetrates the market, in the future there will be a significant rise in the demand for graphene coating.

- July 2023- Haydale announced its collaboration with Cadent to develop graphene ink-based low-power radiator heaters.

- April 2023- Haydale partnered with CERN, the European particle physics laboratory, for a project aimed at increasing the lifetime of the lubricants by adding functionalized nanomaterials, including graphene.

- December 2022- Haydale launched its graphene-enhanced prepreg to deliver cost-efficient composite tooling with extended tooling life, improved surface quality, and enhanced thermal conductivity.

|

Graphene Coating Market Scope |

|

|

Market Size in 2023 |

USD 1.14 Bn. |

|

Market Size in 2030 |

USD 7.13 Bn. |

|

CAGR (2024-2030) |

6.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Type Water-Based Solvent-Based |

|

By Application Corrosion-resistant Coating Scratch-resistant Coating Anti-Fouling Coating Flame Retardant Coating Others |

|

|

|

By End-use Automotive Aerospace Electronics Medical Marine Others |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Graphene Coating Market

- Directa Plus S.p.A.

- Global Graphene Group

- Grafoid Inc.

- Graphenea Inc.

- Haydale Graphene Industries PLC

- KISHO Corporation Co., Ltd.

- NanoXplore Inc.

- Petroliam Nasional Berhad (PETRONAS)

- Universal Matter

- Vorbeck Materials Corp

- Xiamen Knano Graphene Technology Co., Ltd.

- NanoXplore Inc.

- Directa Plus S.p.A.

- Graphite Central

- G6 Materials Corp.

- Advance Industrial Coatings LLC

- XG Sciences,

- Supervac Industries LLP

- ACS Material LLC

- Applied Graphene Materials

- Thomas Swan & Co. Ltd.

- KNV'S Incorporation

- Surface Protective Solutions

- Artdeshine Pte. Ltd.

- XXX Inc.

Frequently Asked Questions

Graphene coatings are generally considered environmentally friendly due to their low VOC emissions compared to traditional solvent-based coatings. However, the production process and disposal of graphene materials require careful management to minimize environmental impact.

Graphene coating is a thin layer of graphene applied to surfaces to enhance properties like strength, conductivity, and barrier performance. Unlike traditional coatings, graphene coatings offer superior mechanical strength, flexibility, and thermal conductivity.

The Market size was valued at USD 1.14 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 6.1% from 2024 to 2030, reaching nearly 7.13 billion.

The segments covered in the market report are by Product and Distribution Channel.

1. Graphene Coating Market: Research Methodology

2. Graphene Coating Market: Executive Summary

3. Graphene Coating Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Graphene Coating Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Graphene Coating Market Size and Forecast by Segments (by Value Units)

6.1. Graphene Coating Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Water-Based

6.1.2. Solvent-Based

6.2. Graphene Coating Market Size and Forecast, by Application (2023-2030)

6.2.1. Corrosion-resistant Coating

6.2.2. Scratch-resistant Coating

6.2.3. Anti-Fouling Coating

6.2.4. Flame Retardant Coating

6.2.5. Others

6.3. Graphene Coating Market Size and Forecast, by End-use (2023-2030)

6.3.1. Automotive

6.3.2. Aerospace

6.3.3. Electronics

6.3.4. Medical

6.3.5. Marine

6.3.6. Others

6.4. Graphene Coating Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Graphene Coating Market Size and Forecast (by Value Units)

7.1. North America Graphene Coating Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Water-Based

7.1.2. Solvent-Based

7.2. North America Graphene Coating Market Size and Forecast, by Application (2023-2030)

7.2.1. Corrosion-resistant Coating

7.2.2. Scratch-resistant Coating

7.2.3. Anti-Fouling Coating

7.2.4. Flame Retardant Coating

7.2.5. Others

7.3. North America Graphene Coating Market Size and Forecast, by End-use (2023-2030)

7.3.1. Automotive

7.3.2. Aerospace

7.3.3. Electronics

7.3.4. Medical

7.3.5. Marine

7.3.6. Others

7.4. North America Graphene Coating Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Graphene Coating Market Size and Forecast (by Value Units)

8.1. Europe Graphene Coating Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Water-Based

8.1.2. Solvent-Based

8.2. Europe Graphene Coating Market Size and Forecast, by Application (2023-2030)

8.2.1. Corrosion-resistant Coating

8.2.2. Scratch-resistant Coating

8.2.3. Anti-Fouling Coating

8.2.4. Flame Retardant Coating

8.2.5. Others

8.3. Europe Graphene Coating Market Size and Forecast, by End-use (2023-2030)

8.3.1. Automotive

8.3.2. Aerospace

8.3.3. Electronics

8.3.4. Medical

8.3.5. Marine

8.3.6. Others

8.4. Europe Graphene Coating Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Graphene Coating Market Size and Forecast (by Value Units)

9.1. Asia Pacific Graphene Coating Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Water-Based

9.1.2. Solvent-Based

9.2. Asia Pacific Graphene Coating Market Size and Forecast, by Application (2023-2030)

9.2.1. Corrosion-resistant Coating

9.2.2. Scratch-resistant Coating

9.2.3. Anti-Fouling Coating

9.2.4. Flame Retardant Coating

9.2.5. Others

9.3. Asia Pacific Graphene Coating Market Size and Forecast, by End-use (2023-2030)

9.3.1. Automotive

9.3.2. Aerospace

9.3.3. Electronics

9.3.4. Medical

9.3.5. Marine

9.3.6. Others

9.4. Asia Pacific Graphene Coating Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Graphene Coating Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Graphene Coating Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Water-Based

10.1.2. Solvent-Based

10.2. Middle East and Africa Graphene Coating Market Size and Forecast, by Application (2023-2030)

10.2.1. Corrosion-resistant Coating

10.2.2. Scratch-resistant Coating

10.2.3. Anti-Fouling Coating

10.2.4. Flame Retardant Coating

10.2.5. Others

10.3. Middle East and Africa Graphene Coating Market Size and Forecast, by End-use (2023-2030)

10.3.1. Automotive

10.3.2. Aerospace

10.3.3. Electronics

10.3.4. Medical

10.3.5. Marine

10.3.6. Others

10.4. Middle East and Africa Graphene Coating Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Graphene Coating Market Size and Forecast (by Value Units)

11.1. South America Graphene Coating Market Size and Forecast, by Product Type (2023-2030)

11.1.1. Water-Based

11.1.2. Solvent-Based

11.2. South America Graphene Coating Market Size and Forecast, by Application (2023-2030)

11.2.1. Corrosion-resistant Coating

11.2.2. Scratch-resistant Coating

11.2.3. Anti-Fouling Coating

11.2.4. Flame Retardant Coating

11.2.5. Others

11.3. South America Graphene Coating Market Size and Forecast, by End-use (2023-2030)

11.3.1. Automotive

11.3.2. Aerospace

11.3.3. Electronics

11.3.4. Medical

11.3.5. Marine

11.3.6. Others

11.4. South America Graphene Coating Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Directa plus S.p.A.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Global Graphene Group

12.3. Grafoid Inc.

12.4. Graphenea Inc.

12.5. Haydale Graphene Industries PLC

12.6. KISHO Corporation Co., Ltd.

12.7. NanoXplore Inc.

12.8. Petroliam Nasional Berhad (PETRONAS)

12.9. Universal Matter

12.10. Vorbeck Materials Corp

12.11. Xiamen Knano Graphene Technology Co., Ltd.

12.12. NanoXplore Inc.

12.13. Directa Plus S.p.A.

12.14. Graphite Central

12.15. G6 Materials Corp.

12.16. Advance Industrial Coatings LLC

12.17. XG Sciences,

12.18. Supervac Industries LLP

12.19. ACS Material LLC

12.20. Applied Graphene Materials

12.21. Thomas Swan & Co. Ltd.

12.22. KNV'S Incorporation

12.23. Surface Protective Solutions

12.24. Artdeshine Pte. Ltd.

12.25. XXX Inc.

13. Key Findings

14. Industry Recommendation