Green Steel Market: Global Industry Analysis and Forecast (2024 -2030)

Green Steel Market size was valued at USD 2.4 Bn. in 2023. The total Green Steel Market revenue is expected to grow by 101.23% from 2024 to 2030, reaching nearly USD 320.67 Bn.

Format : PDF | Report ID : SMR_2124

Green Steel Market Overview

Green steel is produced using low-carbon energy sources such as hydrogen, coal gasification, or electricity instead of fossil fuels. This eco-friendly method reduces greenhouse gas emissions, cuts costs, and enhances steel quality. Utilizing low-carbon hydrogen, such as blue and green hydrogen, significantly reduces the steel industry’s carbon footprint.

The green steel market within the steel industry represents a transformative shift that emphasizes the responsibility of sustainability and the environment. This is driven by the global need to reduce carbon emissions and combat climate change, given that traditional steel production is one of the largest industrial sources of CO2 emissions.

The market for green steel is expected to grow rapidly during the forecast period due to the increasing regulatory pressures, technological advancements and increasing demand from end-use industries. As more green steel companies and governments are committing to carbon neutrality, the adoption of green steel is accelerating. POSCO International, ArcelorMittal, Thyssenkrupp and SSAB are the top players in the green steel industry.

To get more Insights: Request Free Sample Report

Green Steel Market Competitive Landscape

The competition in the market is intensifying as the established steel producers, emerging companies and technology providers are making efforts to lead the transition towards sustainable steel production. This competitive landscape of the Green Steel market is characterized by innovation, strategic partnerships and substantial investments in research and development. Some examples of the recent developments of the Green Steel companies are:

- Collaboration: Masdar and Emirates Steel Arkan are collaborating on a pilot green hydrogen project set to commence operation in early 2024 at the Industrial City of Abu Dhabi. This initiative aims to decarbonize steel production by replacing natural gas with green hydrogen in the iron extraction process from iron ore. Emirates Steel Arkan aims to achieve a 40% reduction in carbon emissions by 2030 and net-zero emissions by 2050, marking a significant step towards sustainable steel manufacturing in the MENA region.

- Brand Introduction: Salzgitter AG has introduced its green steel brand SALCOS® at the Hannover Messe 2024, marking its commitment to sustainable steel production. SALCOS® products align with the Low Emission Steel Standard (LESS) of the German Steel Association, ensuring high decarbonization levels. These CO2-reduced steel products come with independent Product Carbon Footprint (PCF) certification. The SALCOS® brand supports customers in reducing Scope 3 emissions and achieving sustainability goals, offering high-quality steel with clear, transparent labeling.

- Product Supply Strategy: JFE Steel had planned to supply JGreeX™ green-steel products starting from the 2023 fiscal year, aiming for an initial annual capacity of 200,000 tons. These products, produced with advanced steelmaking processes, are expected to significantly reduce CO2 emissions. JFE Steel will use a mass balance approach to assess emissions reductions, with third-party certification by ClassNK. The initiative is part of JFE's strategy to achieve carbon neutrality by 2050, focusing on enhancing sustainability and efficiency in steel production.

Green Steel Market Dynamics

Increasing Global Initiatives to Promote Green Steel Production to Reduce CO2 Emissions Driving the Global Green Steel Market

Governments worldwide are implementing policies and incentives, such as carbon pricing, tax breaks and subsidies, to encourage the adoption of low-carbon steelmaking technologies. International collaborations, like the European Union's Green Deal and the Mission Possible Partnership, are fostering innovation and investment in green steel production. Additionally, global environmental agreements, including the Paris Agreement, are pushing industries to align with climate targets, further boosting green steel adoption.

Leading steel producers are also setting ambitious decarbonization goals, investing in renewable energy sources, and adopting cleaner production methods like hydrogen-based direct reduction and electric arc furnaces. These collective efforts are not only reducing the carbon footprint of the steel industry but also driving Green Steel market growth by increasing the demand for sustainable steel solutions across various sectors, including construction, automotive, and infrastructure.

|

Global Initiative |

Details |

|

First Movers Coalition |

An initiative by the World Economic Forum to decarbonize industrial sectors like steel. It has expanded to include 55 companies and nine countries committed to purchasing industrial materials and transport from near-zero or zero-carbon suppliers. |

|

Industrial Deep Decarbonization Initiative |

Encourages governments to report environmental data and use low-emission and near-zero emissions cement/concrete and steel in construction projects. Nine countries, including the U.S., have joined and are set to declare their pledges. |

|

SteelZero and ConcreteZero |

Corporate partnerships under the Climate Group, with 25 companies in SteelZero and 22 in ConcreteZero, committed to using net-zero steel and low- and net-zero emission concrete and cement. |

|

European Union |

By 2030, the EU is expected to host nearly 50 green and low-carbon steel projects, driven by policies like the European Union’s Carbon Border Adjustment Mechanism. |

|

Sweden |

Hybrit supplied Volvo with the first coal-free "green steel." H2 Green Steel is constructing a fossil fuel-free steel plant with a sustainable hydrogen facility in Sweden, aiming for eco-friendly steel production. |

Innovations and Technological Advancements to Drive the Green Steel Market Growth

The digitalization and smart manufacturing techniques, including the use of AI and IoT, optimize green steel production processes, enhancing energy efficiency and minimizing waste. These technological strides, combined with supportive governmental policies and increasing corporate commitments to sustainability, are driving the green steel market towards a more sustainable and environmentally friendly future.

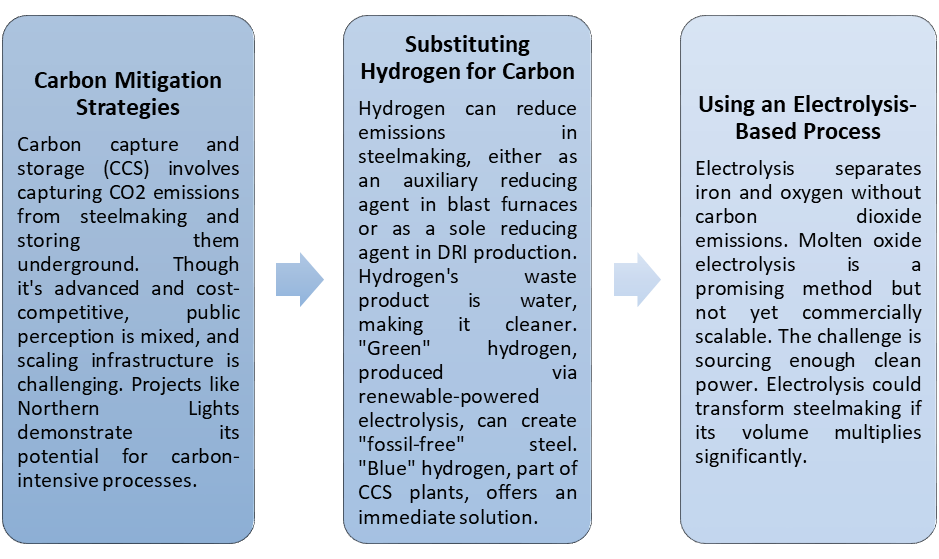

Three Decarbonizing Innovations Shaping the Green Steel

POSCO's HyREX technology represents a pioneering approach in green steelmaking, utilizing hydrogen as a reduction agent to drastically reduce carbon emissions. By replacing traditional fossil fuels in steel production, HyREX aims to achieve near-zero emissions. POSCO plans to scale up HyREX with a test facility expected by 2028 and aims for commercialization by 2030. This initiative aligns with POSCO's commitment to achieve net-zero carbon emissions by 2050, transitioning existing blast furnaces to hydrogen reduction steelmaking. The HyIS Forum underscores POSCO's leadership in promoting global collaboration on hydrogen-based steelmaking technologies, positioning HyREX as a significant advancement in sustainable steel production.

High Initial Investment Required for Green Steel Production Creating Challenges for the Green Steel Market

The high initial investment for green steel production facilities stems from the need for advanced technologies, specialized infrastructure, and a shift from traditional fossil fuel-based systems. Setting up hydrogen-based direct reduction or electric arc furnaces requires substantial capital to develop and implement these cutting-edge methods. Additionally, integrating renewable energy sources, such as wind or solar power, into the energy-intensive steel production process adds to the costs. Retrofitting existing plants or building new ones involves significant expenditure on new machinery, training for workers, and modifying supply chains. This financial burden is a major barrier, making green steel more expensive to produce initially compared to conventional steel, thus impacting its competitive edge in the Green Steel market.

Green hydrogen remains too costly for ArcelorMittal’s EU plants, despite substantial subsidies. The high cost makes it uncompetitive internationally. ArcelorMittal aims to decarbonize using hydrogen but faces prices of €6-7/kg for European-produced H2, far above the €2/kg needed for cost-effective low-carbon steel. Importing green hydrogen, though cheaper in production, incurs significant transport costs, making it impractical. Consequently, despite EU grants totaling €1.65 billion, ArcelorMittal's green steel plants may not use green hydrogen for years, relying instead on imported direct reduced iron (DRI).

Green Steel Market Segment Analysis

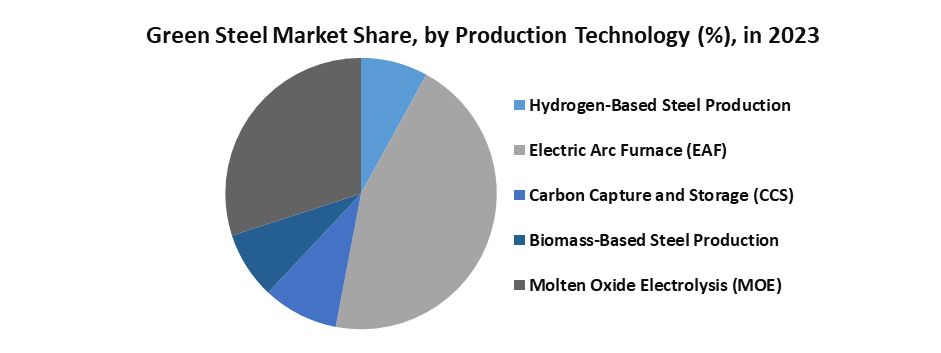

Based on Production Technology: The market is segmented into Hydrogen-Based Steel Production, Electric Arc Furnace (EAF), Carbon Capture and Storage (CCS), Biomass-Based Steel Production and Molten Oxide Electrolysis (MOE). The Electric Arc Furnace (EAF) segment dominated with the largest Green Steel Market share in 2023. Electric arc furnace (EAF)-based steel production is rising globally. Initially, EAFs accounted for about 25% of global steelmaking, but this has grown, reaching 30% (560 million tonnes) of global steel output in 2021. Planned EAF capacity surged to 43% of new capacity in 2023.

The International Energy Agency’s Net Zero by 2050 scenario targets 53% EAF-based steelmaking. Major steel producers like Tata Steel and British Steel are transitioning from blast furnaces to EAFs to reduce emissions. Despite a lower share, EAFs offer flexibility, efficiency, and significantly lower greenhouse gas emissions, utilizing steel scrap and green hydrogen-based sponge iron. China and India are also expanding their EAF capacities, with India targeting 35-40% EAF/induction furnace-based production by 2030.

Green Steel Market Regional Insights

Europe Green Steel Market dominated the global market in 2023 with the largest share. As per the study, the green steel pricing in the domestic flat product market reflects a consensus on the value of low-emission materials. The premium for CO2-reduced steel, mainly sourced from electric-arc furnaces (EAF), ranged from €200-300 per tonne as of June 8. Demand, driven by automotive sectors and impending legislation in construction, signals growing acceptance and willingness to pay higher prices for environmentally friendly steel. ArcelorMittal, based in Luxembourg, has secured funds for green steel initiatives in France in January 2024.

The company has agreed to invest €1.8 billion ($1.97 billion) to reduce greenhouse emissions at its steel plant in Dunkirk, northern France. The French government will provide a subsidy package of up to €850 million, approved by the European Commission. This financial support is expected to enable ArcelorMittal to purchase electric furnaces and establish a direct reduction plant, contributing to a 5.7% reduction in French industrial sector carbon emissions.

Asia Pacific Green Steel Market is expected to grow at a high rate during the forecast period. Nippon Steel is planning a $700 million 'Green Steel' project, aiming to replace coal with hydrogen to reduce emissions. Potential sites for this investment include Australia and Brazil. In the region, India is the key market for green steel. India is developing its unique pure-hydrogen-based DRI technology for green steel production, with the project report currently under ministerial review.

This process removes oxygen from iron ore using hydrogen instead of carbon-emitting fossil fuels, producing sponge iron, which is then used in electric arc furnaces to make steel. Various ministries, integrated and secondary steel makers, and the CSIR Lab are collaborating on a pilot plant under a consortium model. The Ministry of New and Renewable Energy has approved the scheme, focusing on capital grants and subsidized green hydrogen availability to support pilot projects under the National Green Hydrogen Mission.

Green Steel Market Scope

|

Green Steel Market |

|

|

Market Size in 2023 |

USD 2.4 Bn. |

|

Market Size in 2030 |

USD 320.67 Bn. |

|

CAGR (2024-2030) |

101.23% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

|

By Production Technology Hydrogen-Based Steel Production Electric Arc Furnace (EAF) Carbon Capture and Storage (CCS) Biomass-Based Steel Production Molten Oxide Electrolysis (MOE) |

|

By End Use Industry Construction Automotive Energy Sector Manufacturing Consumer Goods |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Green Steel Market Players

- POSCO International

- Nucor Corporation (Nucor Tubular Products)

- U.S. Steel Corporation

- NIPPON STEEL CORPORATION

- Arcelor Mittal

- Jindal Steel & Power Ltd.

- Emirates Steel Arkan

- Green Steel Group Inc.

- H2 Green Steel

- JFE Steel Corporation

- Voestalpine AG

- Salzgitter AG

- SSAB

- Thyssenkrupp Steel Europe

- Tata Steel

Frequently Asked Questions

The segments covered in the Green Steel Market report are based on Production Technology, End Use Industry and Region.

The Europe region is expected to hold the largest Green Steel Market share.

The Green Steel Market size by 2030 is expected to reach US$ 320.67 Bn.

Environmental Regulations and Policies are the key drivers of the global Green Steel Market.

1. Green Steel Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Green Steel Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Green Steel Market: Dynamics

3.1. Green Steel Market Trends

3.2. Green Steel Market Dynamics

3.2.1. Green Steel Market Drivers

3.2.2. Green Steel Market Restraints

3.2.3. Green Steel Market Opportunities

3.2.4. Green Steel Market Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape

3.7. Key Opinion Leader Analysis For the Green Steel Industry

4. Green Steel Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2023-2030)

4.1. Green Steel Market Size and Forecast, by Production Technology (2023-2030)

4.1.1. Capsules/Tablets

4.1.2. Softgels

4.1.3. Powders

4.1.4. Liquids

4.1.5. Gummies

4.2. Green Steel Market Size and Forecast, by End Use Industry (2023-2030)

4.2.1. Male

4.2.2. Female

4.2.3. End Use Industry

5. North America Green Steel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Green Steel Market Size and Forecast, by Production Technology (2023-2030)

5.1.1. Capsules/Tablets

5.1.2. Softgels

5.1.3. Powders

5.1.4. Liquids

5.1.5. Gummies

5.2. North America Green Steel Market Size and Forecast, by End Use Industry (2023-2030)

5.2.1. Male

5.2.2. Female

5.2.3. End Use Industry

5.3. North America Green Steel Market Size and Forecast, by Country (2023-2030)

5.3.1. United States

5.3.2. Canada

5.3.3. Mexico

6. Europe Green Steel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Green Steel Market Size and Forecast, by Production Technology (2023-2030)

6.2. Europe Green Steel Market Size and Forecast, by End Use Industry (2023-2030)

6.3. Europe Green Steel Market Size and Forecast, by Country (2023-2030)

6.3.1. United Kingdom

6.3.2. France

6.3.3. Germany

6.3.4. Italy

6.3.5. Spain

6.3.6. Sweden

6.3.7. Austria

6.3.8. Rest of Europe

7. Asia Pacific Green Steel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Green Steel Market Size and Forecast, by Production Technology (2023-2030)

7.2. Asia Pacific Green Steel Market Size and Forecast, by End Use Industry (2023-2030)

7.3. Asia Pacific Green Steel Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.2. S Korea

7.3.3. Japan

7.3.4. India

7.3.5. Australia

7.3.6. Indonesia

7.3.7. Malaysia

7.3.8. Vietnam

7.3.9. Taiwan

7.3.10. Rest of Asia Pacific

8. Middle East and Africa Green Steel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Green Steel Market Size and Forecast, by Production Technology (2023-2030)

8.2. Middle East and Africa Green Steel Market Size and Forecast, by End Use Industry (2023-2030)

8.3. Middle East and Africa Green Steel Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.2. GCC

8.3.3. Nigeria

8.3.4. Rest of ME&A

9. South America Green Steel Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Green Steel Market Size and Forecast, by Production Technology (2023-2030)

9.2. South America Green Steel Market Size and Forecast, by End Use Industry (2023-2030)

9.3. South America Green Steel Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.2. Argentina

9.3.3. Rest Of South America

10. Company Profile: Key Players

10.1. POSCO International

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Nucor Corporation (Nucor Tubular Products)

10.3. U.S. Steel Corporation

10.4. NIPPON STEEL CORPORATION

10.5. Arcelor Mittal

10.6. Jindal Steel & Power Ltd.

10.7. Emirates Steel Arkan

10.8. Green Steel Group Inc.

10.9. H2 Green Steel

10.10. JFE Steel Corporation

10.11. Voestalpine AG

10.12. Salzgitter AG

10.13. SSAB

10.14. Thyssenkrupp Steel Europe

11. Key Findings

12. Industry Recommendations

13. Green Steel Market: Research Methodology