Guided Munitions Market: Global Industry Analysis and Forecast (2024-2030)

Guided Munitions Market size was valued at USD 33.74 Bn. in 2023 and the total Guided Munitions Market size is expected to grow at a CAGR of 5.42% from 2024 to 2030, reaching nearly USD 48.82 Bn. by 2030.

Format : PDF | Report ID : SMR_2048

Guided Munitions Market Overview

Guided munitions, also known as precision-guided munitions (PGMs), are weapons equipped with guidance systems that allow them to precisely target specific locations. These systems significantly enhance accuracy compared to unguided munitions, which rely on ballistic trajectories and are more susceptible to various forms of deviation.

The Guided Munitions Market report provides a comprehensive analysis of the strategies employed by top companies and a detailed examination of market segments and regional trends. It offers critical insights into pricing, costs, revenues, and profit margins, making it an invaluable resource for investors in this sector. By analyzing market dynamics, the report assesses the drivers of growth, potential constraints, opportunities, and challenges across different regions and segments.

The report employed a bottom-up methodology to determine market sizes at both global and regional levels. Additionally, a SWOT analysis was performed to identify the strengths and weaknesses of key players in the Guided Munitions sector. To ensure the accuracy of its findings, the report combined both primary and secondary research methods. Primary research included distributing surveys, administering questionnaires, and conducting phone interviews with industry experts, leaders, marketers, and entrepreneurs in the Guided Munitions market. Guided munitions represent a significant advancement in modern warfare, enabling forces to conduct operations with unprecedented precision and efficiency.

To get more Insights: Request Free Sample Report

Guided Munitions Market Dynamics

Surge in Guided Munitions Demand Spurs Global Market Development

Growth in the Guided Munitions Market has been fueled by the surge in guided munitions, which allow targets to be hit with high accuracy using pre-programmed coordinates. The need for GPS in munitions has grown since the device measures its position and compares it to the coordinates of the target. The market growth has been driven by significant investments made by major regions to acquire precision-guided weapons and smart munitions, which has resulted in an increase in demand for related ammunition in recent years. Several countries increasing their defense budgets in response to perceived threats and in an attempt to modernize their armed forces, the market for guided weapons has extended. For instance, the U. S. Department of Defense has consistently provided sizable funding for the development and procurement of state-of-the-art guided weapons.

Navigating Challenges: Legal, Ethical, and Competitive Hurdles in the Guided Munitions Market

Managing the intricate network of global arms trade laws, including the U.S. International Traffic in Arms Regulations (ITAR), and maintaining adherence to these rules is a major difficulty. There are moral and legal concerns about civilian casualties and compliance with international humanitarian law when using guided munitions, especially in conflict areas has restrained the Guided Munitions Market growth. Emerging companies and other established players pose fierce competition to even the market leaders. Preserving a competitive advantage concerning technology, cost, and excellence is essential.

It's always difficult to strike a balance between the demand for cutting-edge technology and affordable manufacturing techniques as a result it has slowed the growth of the market. Overspending on a project has resulted in delays and lower profitability. Contracts and policies of the government have been impacted by public opinion and media scrutiny. Reduced political support for guided munitions' development and application resulted from unfavorable opinions of military operations involving them.

Innovations Driving the Future of Guided Munitions Market

Military operations have been revolutionized by recent innovations that have increased their capabilities. Swarming technology and miniaturization allow smaller, more maneuverable munitions to precisely coordinate attacks, which puts enemy defenses to the test. Because of their increasing autonomy, these weapons have been adjusted in flight, saving operators time and improving their adaptability. Artificial intelligence-powered advanced target recognition technology helps with precise target engagement while reducing civilian casualties. While improved GPS and inertial navigation systems ensure pinpoint accuracy, integration into network-centric warfare improves coordination and effectiveness. By improving national security and lowering the material and human costs of warfare, these advancements represent a turning point in the development of the guided munitions market.

Guided Munitions Market Segment Analysis

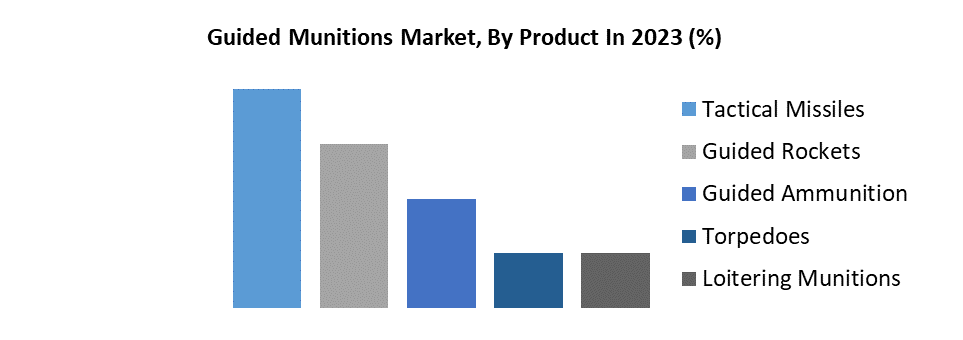

Based on Product, the Tactical Missiles segment held the largest Guided Munitions Market share and is expected to dominate the market with an increasing CAGR through the forecast period. The growing popularity of tactical missiles has risen owing to their widespread application in combat and it is designed for immediate use in combat zones, tactical guided missiles are weapons with a shorter range. Progress in materials science, propulsion systems, and guidance systems has enabled increased missile efficiency, accuracy, and versatility.

The continuous and escalating regional conflicts and geopolitical tensions have significantly increased the need for tactical missiles. Nations try to bolster their military power to repel enemies and respond swiftly in the event of a threat. For example, in the Middle East, the hostilities between Iran and its neighbors, as well as the wars in Syria and Yemen, have led to an increase in missile production. Tactical missiles have more accuracy thanks to their advanced guidance systems. Examples of precision developments driving demand are the Javelin anti-tank missile and the HIMARS (High Mobility Artillery Rocket System). Many countries are pursuing defense modernization programs aimed at swapping out outdated armaments for state-of-the-art tactical missile systems has boosted the Guided Munitions Market growth.

Guided Munitions Market Regional Analysis

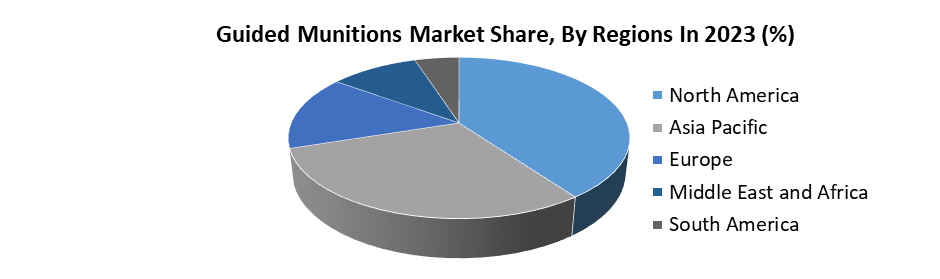

North America Guided Munitions Market held the largest regional share and is expected to maintain its dominance with an increasing CAGR through the forecast period. North America is at the forefront of innovating defense technology, with companies like Northrop Grumman, Lockheed Martin, and Raytheon leading the development of next-generation guided munitions. In 2023, Raytheon Technologies was contracted to manufacture and supply advanced guided missile systems for a whopping USD 985 million. The United States, known for having one of the world's largest defense budgets, allocated a significant portion of its USD 886 billion defense budget in 2023 for sophisticated weapons like guided munitions.

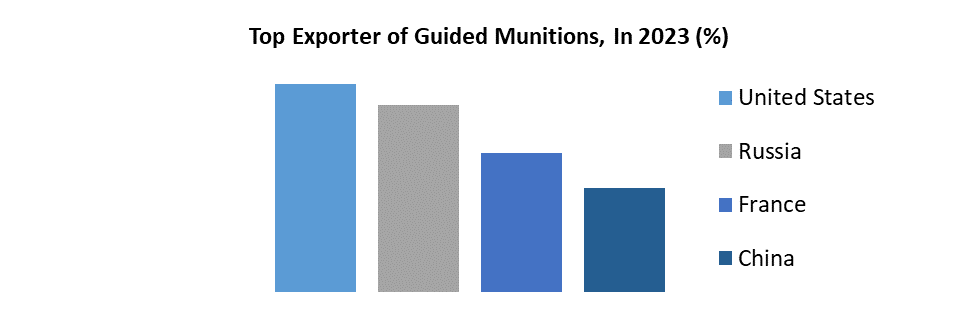

- The two largest spenders the United States (37%) and China (12%) made up around half of global military spending, increasing their expenditure by 2.3% and 6% respectively.

- In 2023, the U.S. Department of Defense awarded several contracts for the procurement of guided munitions. For example, Lockheed Martin received a contract worth USD 8.6 billion to supply precision-guided munitions.

The main objective of the U.S. Department of Defense's focus on the Joint All-Domain Command and Control (JADC2) system is to bring together different branches of the military to improve the efficiency and effectiveness of guided munitions.

Guided Munitions Market Competitive Landscape

- In May 2024, Boeing wins a USD 7.5 billion contract from the US Air Force for guided bombs. The company is expected to provide JDAM tail kits and other supplies under the sole-source fixed-price, indefinite-delivery/indefinite-quantity contract, the Pentagon. The company is expected to work on the kits, as well as spares, repairs, technical assistance, and laser JDAM sensor kits, at its St Louis, Missouri, facility through the end of February 2030.

- In October 2023, The U.S. Navy awarded Northrop Grumman Corporation (NYSE: NOC) a development contract for the company’s newly designed 57mm guided high explosive ammunition. Designated for use with the Mk110 Naval Gun Mount, the company will test and mature the munition for qualification.

- In March 2023, BAE Systems Australia and MBDA announced a collaboration to help Australia increase its guided weapons and explosive ordnance (GWEO) capabilities. The partnership is expected to leverage MBDA’s missile production and BAE’s local experience and expertise. The companies have delivered a range of GWEO capabilities to Australia, including BAE’s Evolved Sea Sparrow Missile and Nulka subsystems and MBDA’s ASRAAM air-to-air missile program.

|

Guided Munitions Market |

|

|

Market Size in 2023 |

USD 33.74 Bn. |

|

Market Size in 2030 |

USD 48.82 Bn. |

|

CAGR (2024-2030) |

5.42 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Speed

|

|

By Product

|

|

|

By Technology

|

|

|

|

By Launch Platform

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players Guided Munitions Market

- Lockheed Martin

- Boeing

- Northrop Grumman

- BAE Systems

- General Dynamics

- Thales Group

- MBDA

- Israel Aerospace Industries (IAI)

- Rheinmetall AG

- Leonardo S.p.A.

- LIG Nex1

- Rafael Advanced Defense Systems

- Elbit Systems

- MKEK (Mechanical and Chemical Industry Corporation)

- Hanwha Defense

- Textron Systems

- Harris Corporation (L3Harris)

- General Atomics

- Kaman Corporation

- AeroVironment

Frequently Asked Questions

Legal, Ethical, and Competitive Hurdles in the Guided Munitions Market have restrained the market growth.

The Market size was valued at USD 33.74 Million in 2023 and the total Market revenue is expected to grow at a CAGR of 5.42 % from 2024 to 2030, reaching nearly USD 48.82 Million.

The segments covered in the market report are Speed, Product, Technology, and launch Platform.

1. Guided Munitions Market: Research Methodology

2. Guided Munitions Market: Executive Summary

3. Guided Munitions Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Guided Munitions Market: Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunities

5.4. Challenges

5.5. Market Trends by Region

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

5.6. Market Drivers by Region

5.6.1. North America

5.6.2. Europe

5.6.3. Asia Pacific

5.6.4. Middle East and Africa

5.6.5. South America

5.7. Market Restraints

5.8. Market Opportunities

5.9. Market Challenges

5.10. PORTER’s Five Forces Analysis

5.11. PESTLE Analysis

5.12. Strategies for New Entrants to Penetrate the Market

5.13. Analysis of Government Schemes and Initiatives for the Guided Munitions Industry

5.14. Regulatory Landscape by Region

5.14.1. North America

5.14.2. Europe

5.14.3. Asia Pacific

5.14.4. Middle East and Africa

5.14.5. South America

5.15. Guided Munitions Market Size and Forecast by Segments (by Value Units)

5.15.1. Guided Munitions Market Size and Forecast, by Speed (2023-2030)

5.15.1.1. Subsonic

5.15.1.2. Supersonic

5.15.1.3. Hypersonic

5.15.2. Guided Munitions Market Size and Forecast, by Product (2023-2030)

5.15.2.1. Tactical Missiles

5.15.2.2. Guided Rockets

5.15.2.3. Guided Ammunition

5.15.2.4. Torpedoes

5.15.2.5. Loitering Munitions

5.15.3. Guided Munitions Market Size and Forecast, by Technology (2023-2030)

5.15.3.1. Infrared

5.15.3.2. Laser

5.15.3.3. Inertial Navigation System

5.15.3.4. Global Positioning System

5.15.3.5. Radar Homing

5.15.3.6. Anti Radiation

5.15.4. Guided Munitions Market Size and Forecast, by Launch Platform (2023-2030)

5.15.4.1. Land

5.15.4.2. Airborne

5.15.4.3. Naval

5.16. Guided Munitions Market Size and Forecast, by Region (2023-2030)

5.16.1. North America

5.16.2. Europe

5.16.3. Asia Pacific

5.16.4. Middle East and Africa

5.16.5. South America

6. North America Guided Munitions Market Size and Forecast (by Value Units)

6.1. North America Guided Munitions Market Size and Forecast, by Speed (2023-2030)

6.1.1. Subsonic

6.1.2. Supersonic

6.1.3. Hypersonic

6.2. North America Guided Munitions Market Size and Forecast, by Product (2023-2030)

6.2.1. Tactical Missiles

6.2.2. Guided Rockets

6.2.3. Guided Ammunition

6.2.4. Torpedoes

6.2.5. Loitering Munitions

6.3. North America Guided Munitions Market Size and Forecast, by Technology (2023-2030)

6.3.1. Infrared

6.3.2. Laser

6.3.3. Inertial Navigation System

6.3.4. Global Positioning System

6.3.5. Radar Homing

6.3.6. Anti Radiation

6.4. North America Guided Munitions Market Size and Forecast, by Launch Platform (2023-2030)

6.4.1. Land

6.4.2. Airborne

6.4.3. Naval

6.5. North America Guided Munitions Market Size and Forecast, by Country (2023-2030)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Guided Munitions Market Size and Forecast (by Value Units)

7.1. Europe Guided Munitions Market Size and Forecast, by Speed (2023-2030)

7.1.1. Subsonic

7.1.2. Supersonic

7.1.3. Hypersonic

7.2. Europe Guided Munitions Market Size and Forecast, by Product (2023-2030)

7.2.1. Tactical Missiles

7.2.2. Guided Rockets

7.2.3. Guided Ammunition

7.2.4. Torpedoes

7.2.5. Loitering Munitions

7.3. Europe Guided Munitions Market Size and Forecast, by Technology (2023-2030)

7.3.1. Infrared

7.3.2. Laser

7.3.3. Inertial Navigation System

7.3.4. Global Positioning System

7.3.5. Radar Homing

7.3.6. Anti Radiation

7.4. Europe Guided Munitions Market Size and Forecast, by Launch Platform (2023-2030)

7.4.1. Land

7.4.2. Airborne

7.4.3. Naval

7.5. Europe Guided Munitions Market Size and Forecast, by Country (2023-2030)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Russia

7.5.8. Rest of Europe

8. Asia Pacific Guided Munitions Market Size and Forecast (by Value Units)

8.1. Asia Pacific Guided Munitions Market Size and Forecast, by Speed (2023-2030)

8.1.1. Subsonic

8.1.2. Supersonic

8.1.3. Hypersonic

8.2. Asia Pacific Guided Munitions Market Size and Forecast, by Product (2023-2030)

8.2.1. Tactical Missiles

8.2.2. Guided Rockets

8.2.3. Guided Ammunition

8.2.4. Torpedoes

8.2.5. Loitering Munitions

8.3. Asia Pacific Guided Munitions Market Size and Forecast, by Technology (2023-2030)

8.3.1. Infrared

8.3.2. Laser

8.3.3. Inertial Navigation System

8.3.4. Global Positioning System

8.3.5. Radar Homing

8.3.6. Anti Radiation

8.4. Asia Pacific Guided Munitions Market Size and Forecast, by Launch Platform (2023-2030)

8.4.1. Land

8.4.2. Airborne

8.4.3. Naval

8.5. Asia Pacific Guided Munitions Market Size and Forecast, by Country (2023-2030)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. ASEAN

8.5.7. Rest of Asia Pacific

9. Middle East and Africa Guided Munitions Market Size and Forecast (by Value Units)

9.1. Middle East and Africa Guided Munitions Market Size and Forecast, by Speed (2023-2030)

9.1.1. Subsonic

9.1.2. Supersonic

9.1.3. Hypersonic

9.2. Middle East and Africa Guided Munitions Market Size and Forecast, by Product (2023-2030)

9.2.1. Tactical Missiles

9.2.2. Guided Rockets

9.2.3. Guided Ammunition

9.2.4. Torpedoes

9.2.5. Loitering Munitions

9.3. Middle East and Africa Guided Munitions Market Size and Forecast, by Technology (2023-2030)

9.3.1. Infrared

9.3.2. Laser

9.3.3. Inertial Navigation System

9.3.4. Global Positioning System

9.3.5. Radar Homing

9.3.6. Anti Radiation

9.4. Middle East and Africa Guided Munitions Market Size and Forecast, by Launch Platform (2023-2030)

9.4.1. Land

9.4.2. Airborne

9.4.3. Naval

9.5. Middle East and Africa Guided Munitions Market Size and Forecast, by Country (2023-2030)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Rest of ME&A

10. South America Guided Munitions Market Size and Forecast (by Value Units)

10.1. South America Guided Munitions Market Size and Forecast, by Speed (2023-2030)

10.1.1. Subsonic

10.1.2. Supersonic

10.1.3. Hypersonic

10.2. South America Guided Munitions Market Size and Forecast, by Product (2023-2030)

10.2.1. Tactical Missiles

10.2.2. Guided Rockets

10.2.3. Guided Ammunition

10.2.4. Torpedoes

10.2.5. Loitering Munitions

10.3. South America Guided Munitions Market Size and Forecast, by Technology (2023-2030)

10.3.1. Infrared

10.3.2. Laser

10.3.3. Inertial Navigation System

10.3.4. Global Positioning System

10.3.5. Radar Homing

10.3.6. Anti Radiation

10.4. South America Guided Munitions Market Size and Forecast, by Launch Platform (2023-2030)

10.4.1. Land

10.4.2. Airborne

10.4.3. Naval

10.5. South America Guided Munitions Market Size and Forecast, by Country (2023-2030)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. Lockheed Martin

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Boeing

11.3. Northrop Grumman

11.4. BAE Systems

11.5. General Dynamics

11.6. Thales Group

11.7. MBDA

11.8. Israel Aerospace Industries (IAI)

11.9. Rheinmetall AG

11.10. Leonardo S.p.A.

11.11. LIG Nex1

11.12. Rafael Advanced Defense Systems

11.13. Elbit Systems

11.14. MKEK (Mechanical and Chemical Industry Corporation)

11.15. Hanwha Defense

11.16. Textron Systems

11.17. Harris Corporation (L3Harris)

11.18. General Atomics

11.19. Kaman Corporation

11.20. AeroVironment

12. Key Findings

13. Industry Recommendation