Halal Cosmetics Market: Global Industry Analysis and Forecast (2024-2030)

The Halal Cosmetics Market size was valued at USD 42.39 Bn. in 2023 and the total Halal Cosmetics revenue is expected to grow at a CAGR of 11.6% from 2024 to 2030, reaching nearly USD 91.39 Bn. by 2030.

Format : PDF | Report ID : SMR_2120

Halal Cosmetics Market Overview

Halal cosmetics represent a growing segment of the cosmetics industry, characterized by compliance with Islamic laws prohibiting certain products and processes According to the Federal Food, Drug, and Cosmetic Act (FD&C Act) that is, cosmetics are intended to be used in the human body to cleanse, beautify or transform them. Halal preparations are detailed to ensure that products do not contain prohibited human or animal organs, genetically modified organisms (GMOs) that are considered impure and that non-halal products free of impurities during the entire manufacturing process and is safe for the users.

The food-focused halal industry has now expanded into various sectors including cosmetics, establishing a strong position in the global economy. The growth of this sector is reflected in the growing demand for cosmetics and halal-certified personal care products. In terms of global spending on cosmetics, the United States leads with an estimated $78 billion, followed by the United Kingdom and Germany with $40 billion and $34 billion respectively Muslim consumers in this Halal Cosmetics Market make a significant contribution, with an estimated $26 billion spent on cosmetics by 2021. This figure is poised to increase as the global Muslim population is predicted to reach approximately 2.2 billion out of a total world population of 8.3 billion by 2030.

For Muslims, the use of halal products is a religious obligation, not just a preference. The appeal of halal cosmetics is not limited to religious celebrations. A focus on environmental concerns and cleanliness also creates consumer preference, creating an increasingly loyal customer base. Importers of halal cosmetics are Saudi Arabia, Turkey, UAE, Malaysia and Indonesia, while leading exporters are France, Ireland, China, Germany, USA and India. The dynamic Halal Cosmetics Market builds on religious duty, emphasizing the intersection of environmental concerns and economic opportunity, driving strongly the growth of halal cosmetics in the global economy. Corporate expansion highlights its profound impact on international trade and consumer behavior.

To get more Insights: Request Free Sample Report

Halal Cosmetics Market Dynamics:

Rising Demand and Economic Factors in the Halal Cosmetics Market

The growing Muslim population is expected to reach 2.2 billion by 2030, and a large proportion of global consumers will need to produce halal products. The religious obligation of Muslims to consume halal products provides a loyal and growing consumer base on halal preparation. Governments also play an important role in promoting the halal industry. For example, the Malaysia Halal Industry Master Plan 2030 aims to integrate the Internet of Things (IoT) and other advanced technologies to increase competitiveness among stakeholders and motivate the country to become an income-generating society.

The halal cosmetics market presents an attractive opportunity for foreign investors through a combination of demographic, economic, and regulatory factors. As the world’s largest Muslim-majority country, Indonesia has a huge and growing demand for halal-certified products including cosmetics. This demand is an important driver of growth in halal cosmetics a market with a population of about 270 million increasing awareness and preference for halal products among consumers Increasing number of consumers. Rapid economic growth has led to a growing middle class with increasing disposable income, thereby increasing the demand for various consumer goods including cosmetics. This growing Halal Cosmetics Market this provides foreign investors with many buyers eager for high-quality, halal-certified cosmetics.

Furthermore, rich biodiversity offers unique opportunities for research and development (R&D) in the cosmetics industry. The country is the second most biologically diverse country in the world, with a wide variety of natural resources that can be used as ingredients in cosmetics. Foreign investors can use research and development to develop innovations dominating domestic and international markets. This not only helps reduce reliance on imports but also encourages sustainability and local sourcing, giving Indonesian cosmetics producers a competitive edge the value is greater enhancing the competitiveness of the Indonesian cosmetics industry.

Halal cosmetic products are particularly promising. With the ever increasing number of Muslims, demands according to Islamic law are increasing. This demand goes beyond personal consumption, as halal-certified products are being sought for gifting and export. Foreign companies have the opportunity to invest in halal cosmetic products that cater to these needs for the domestic market and other Muslim-majority countries e.g. The government has simplified the registration process by reducing the registration fee for a halal domestic product certificate to the US. just $3, and the delivery time has been reduced to 15 days.

Moreover, the establishment of various organizations to verify the halal certificates simplified the process, making it more efficient and cost-effective for industry These measures significantly reduce the barriers to entry for foreign investors and encourage greater compliance in the rehabilitation industry of Halal Cosmetics Market.

Halal Beauty Products Gain Popularity among Muslim and Non-Muslim Consumers which Propel the Halal Cosmetics Market

The growth of the Halal Cosmetics Market is driven by the increasing demand for transparent ingredients and cruelty-free products among Muslim and non-Muslim consumers. This trend is due to several key factors such as consumers increasing awareness, ethical considerations, and increasing importance of sustainability on the right. Halal certification ensures that products meet strict standards and that only safe and Islamic ingredients are used. This transparency builds consumer confidence, as individuals care more about how they use their skin.

The demand for clear and detailed ingredient lists is increasing, halal beauty products fulfill this need by providing detailed information and avoiding ingredients that can harm that product this attracts a lot of people not only Muslims but also non-Muslims who want to know the ingredients themselves the beauty products they can decide.

Demand for ethically produced and cruelty-free beauty products is growing, especially in Southeast Asia. According to Euromonitor International's Voice of the Consumer: Beauty Survey, 19% of online shoppers in the region do color cosmetics and skin care that are not tested on animals, cruelty-free, and/or 100% vegan Halal beauty products match well, as animal welfare is put first and animal testing is generally avoided.

This ethical harmony makes halal beauty products appealing to a wider audience, driving Halal Cosmetics Market growth. Furthermore, the importance of sustainability in consumer choices increases the appeal of halal beauty products. Many halal beauty products emphasize sustainable practices, such as using environmentally friendly products and packaging. As consumers become more environmentally conscious, the sustainability aspect of halal beauty products becomes a key selling point, making them more marketable and attractive.

Escalating Costs and Certification Delays the Impact of Imported Raw Materials Drives the Halal Cosmetics Market

The main obstacle is a heavy reliance on imports, about 90 percent of which come from Japan, South Korea, and the US. This dependency not only increases the costs for the industry but also complicates the halal verification process, which has added complexity and possible delays. Moreover, the Halal Cosmetics Market is becoming more competitive. Large international beauty brands are using their vast experience and global connections to dominate marketing and branding, making it harder for smaller local players to compete but local beauty brands are gaining traction with cheaper products density lifting, addressing the growing underclass population. Expanded purchasing power in this segment provides unique opportunities for local producers to gain market share.

Strategic Response Brands' Adaptation to Regulatory Changes in the Halal Cosmetics Market

Increasing awareness among consumers about the benefits and ethical considerations on halal beauty products. A growing number of consumers believe in past products in the halal certification process, viewing them as more ethical and in line with their religious food beliefs This increased demand is pushing more companies to achieve halal certification paper to meet the needs of a wider audience. Halal beauty products not only look ethically, but also apply to individuals with specific religious beliefs and dietary restrictions. The availability of halal beauty products offers consumers a wider range of options, driving the growth of the market. Brands are investing in halal-certified manufacturing facilities in response to growing consumer demand for halal beauty and personal care products.

For example, Singapore dental care company Pearly White obtained Halal certification in June 2022 and established a Halal-certified dental care facility in Singapore, offering about 20 Halal-certified products. Such actions by manufacturing companies highlight Halal Cosmetics Market responsiveness to consumer preferences and the importance of halal certification in manufacturing and marketing strategies Flexibility in law is a key driver in the halal cosmetics market. Muslim-majority countries like Indonesia, Malaysia, and Singapore have strict rules for authorities to issue halal certificates.

The Islamic Religious Council of Singapore (MUIS), Department of Islamic Development Malaysia (JAKIM), and Indonesian Kaulama Council (MUI) are responsible for ensuring that beauty products meet halal standards, especially the Indonesian “Halal Product Assurance” law, which mandates everyone to have halal certified beauty products. It is a compulsory law for both local and international companies to obtain Halal certification in the next few years, driving the growth of the Halal cosmetics market.

Halal Cosmetics Market Segment Analysis:

Based on product type, the Halal Cosmetics Market is divided into Personal Care Products, Color Cosmetics, and Fragrances. Personal care products within the halal cosmetics market witnessed the highest market share in 2023 and continued their dominance during the forecast period. They cover a wide range of products designed for hygiene, grooming and beauty routines that adhere to Islamic principles. These products include essential skin care, hair care, oral care, and hygiene products designed, manufactured and certified in accordance with Halal standards For example, products such as Safi, Malaysia’s first skin care, offers Halal-certified products that give Muslim consumers a skin tone consistent with their religious beliefs.

Catering to those searching care solutions Safi ensures that its products are free from alcohol, pork derivatives and other ingredients prohibited under Islamic law, providing its customers with transparency and confidence in oral care, Singapore brand Pearly White has achieved Halal certification for its range of oral care products.

This certification demonstrates adherence to strict halal guidelines in the production and manufacture of products, which appeals not only to Muslim consumers but also to those seeking fair and transparent approaches to personal care Improved access in halal personal care products is due to increased consumer awareness of ethical considerations As a rule and consumer preferences continue to evolve, manufacturers are investing in halal-certified production facilities and obtaining certifications needed to meet growing demand in global markets.

Halal Cosmetics Market Regional Insight:

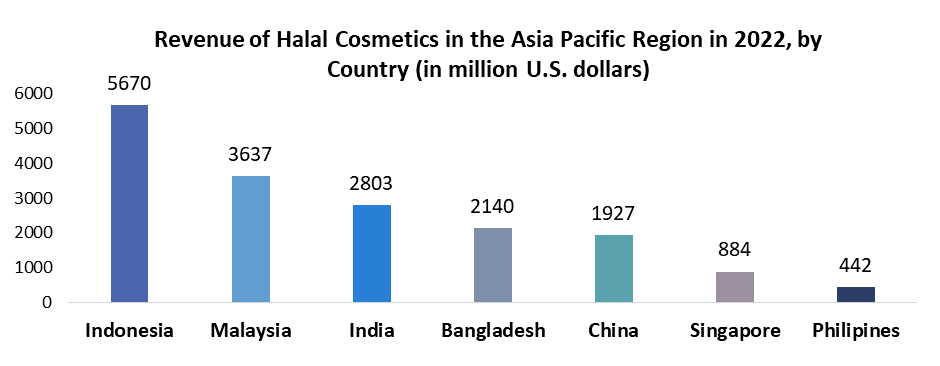

Asia Pacific region dominated the global halal cosmetics market in 2023. It is mainly driven by the high growth rate of India and China. The dominance of this segment comes from a large and diverse consumer base, increasing disposable income and growing preference for Halal-certified products India stands out as a leading market for certified cosmetics as Halal within Asia. Because of the large Muslim population, there is a strong demand for products that conform to Islamic law and moral values. The increasing availability of halal beauty products and their popularity among Indians has encouraged both local and international brands to focus on this segment of the market.

Additionally, India’s expanding middle class, and growing purchasing power, are driving demand for a wider range of beauty products, including halal-certified products The country’s rich tradition of natural herbal beauty products about also supports the demand for halal cosmetics, which are generally natural and safe ingredients The emphasis is that China, although not predominantly Muslim, represents a significant opportunity for halal cosmetics because of with huge market size and increasing consumer awareness of product safety and ethical considerations Chinese consumers are becoming more health conscious, looking for products with transparent cosmetic ingredients and ethical sources.

This trend fits well with the principles of halal cosmetics that emphasize purity, safety and ethical production. Growing interest in sustainable and cruelty-free beauty products in China further supports the use of halal-certified cosmetics

|

Halal Cosmetics Market Scope |

|

|

Market Size in 2023 |

USD 42.39 Billion |

|

Market Size in 2030 |

USD 91.39 Billion |

|

CAGR (2024-2030) |

11.6% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments covered in the Halal Cosmetics Market |

By Products Type Personal Care Products Color Cosmetics Fragrances |

|

By Application Hair Care Skin Care Face Care Beauty Care |

|

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players Halal Cosmetics Market

- Amara Halal Cosmetics (USA)

- Inika Organic (Australia)

- IBA Halal Care (India)

- Wardah Cosmetics (Indonesia)

- PHB Ethical Beauty (UK)

- Sampure Minerals (UK)

- Saaf Skincare (UK)

- Clara International (Malaysia)

- Talent Cosmetics Co., Ltd. (South Korea)

- Tuesday in Love (Canada)

- Martha Tilaar Group (Indonesia)

- OnePure Beauty (UAE)

- Prolab Cosmetics (Turkey)

- Cosmax Inc. (South Korea)

- IVY Beauty Corporation (Malaysia)

- Colgate-Palmolive Company (USA)

- Kose Corporation (Japan)

- L'Oreal (France)

- Procter & Gamble (USA)

- Unilever (UK/Netherlands)

Frequently Asked Questions

Consumer preferences in the Halal Cosmetics market are influencing product development by driving companies to focus on ethical, sustainable, and cruelty-free ingredients, ensuring strict halal certification processes, and expanding product lines to cater to a diverse range of skincare and beauty needs.

The Halal Cosmetics Market includes tapping into the increasing demand from non-Muslim consumers seeking ethical and natural products, expanding into emerging markets with growing Muslim populations, and leveraging online retail channels to reach a broader audience. Additionally, innovation in product formulations and packaging to meet evolving consumer preferences and regulatory standards can further drive market growth.

The high cost and complexity of obtaining and maintaining halal certification, limited consumer awareness and understanding of halal products outside Muslim-majority regions, and competition from well-established mainstream and natural cosmetic brands. Additionally, ensuring supply chain integrity and transparency to meet halal standards can be difficult.

The Halal Cosmetics Market size was valued at USD 42.39 Billion in 2023 and the total Global Halal Cosmetics revenue is expected to grow at a CAGR of 11.6% from 2024 to 2030, reaching nearly USD 91.39 Billion by 2030.

1. Halal Cosmetics Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Halal Cosmetics Market: Competitive Landscape

2.1. SMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product Segment

2.3.3. End Use Segment

2.3.4. Revenue (2023)

2.3.5. Manufacturing Locations

2.4. Leading Halal Cosmetics Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Halal Cosmetics Market: Dynamics

3.1. Market Trends by Region

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Middle East and Africa

3.1.5. South America

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

4. Halal Cosmetics Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

4.1. Halal Cosmetics Market Size and Forecast, By Products Type (2023-2030)

4.1.1. Personal Care Products

4.1.2. Color Cosmetics

4.1.3. Fragrances

4.2. Halal Cosmetics Market Size and Forecast, By Application (2023-2030)

4.2.1. Hair Care

4.2.2. Skin Care

4.2.3. Face Care

4.2.4. Beauty Care

4.3. Halal Cosmetics Market Size and Forecast, By Distribution Channel (2023-2030)

4.3.1. Online

4.3.2. Offline

4.4. Halal Cosmetics Market Size and Forecast, By Region (2023-2030)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia Pacific

4.4.4. Middle East and Africa

4.4.5. South America

5. North America Halal Cosmetics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Halal Cosmetics Market Size and Forecast, By Products Type (2023-2030)

5.1.1. Personal Care Products

5.1.2. Color Cosmetics

5.1.3. Fragrances

5.2. North America Halal Cosmetics Market Size and Forecast, By Application (2023-2030)

5.2.1. Hair Care

5.2.2. Skin Care

5.2.3. Face Care

5.2.4. Beauty Care

5.3. North America Halal Cosmetics Market Size and Forecast, By Distribution Channel (2023-2030)

5.3.1. Online

5.3.2. Offline

5.4. North America Halal Cosmetics Market Size and Forecast, by Country (2023-2030)

5.4.1. United States

5.4.2. Canada

5.4.3. Mexico

6. Europe Halal Cosmetics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Halal Cosmetics Market Size and Forecast, By Products Type (2023-2030)

6.2. Europe Halal Cosmetics Market Size and Forecast, By Application (2023-2030)

6.3. Europe Halal Cosmetics Market Size and Forecast, By Distribution Channel (2023-2030)

6.4. Europe Halal Cosmetics Market Size and Forecast, by Country (2023-2030)

6.4.1. United Kingdom

6.4.2. France

6.4.3. Germany

6.4.4. Italy

6.4.5. Spain

6.4.6. Sweden

6.4.7. Russia

6.4.8. Rest of Europe

7. Asia Pacific Halal Cosmetics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Halal Cosmetics Market Size and Forecast, By Product Type (2023-2030)

7.2. Asia Pacific Halal Cosmetics Market Size and Forecast, By Application (2023-2030)

7.3. Asia Pacific Halal Cosmetics Market Size and Forecast, By Distribution Channel (2023-2030)

7.4. Asia Pacific Halal Cosmetics Market Size and Forecast, by Country (2023-2030)

7.4.1. China

7.4.2. S Korea

7.4.3. Japan

7.4.4. India

7.4.5. Australia

7.4.6. ASEAN

7.4.7. Rest of Asia Pacific

8. Middle East and Africa Halal Cosmetics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Halal Cosmetics Market Size and Forecast, By Products Type (2023-2030)

8.2. Middle East and Africa Halal Cosmetics Market Size and Forecast, By Application (2023-2030)

8.3. Middle East and Africa Halal Cosmetics Market Size and Forecast, By Distribution Channel (2023-2030)

8.4. Middle East and Africa Halal Cosmetics Market Size and Forecast, by Country (2023-2030)

8.4.1. South Africa

8.4.2. GCC

8.4.3. Nigeria

8.4.4. Rest of ME&A

9. South America Halal Cosmetics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Halal Cosmetics Market Size and Forecast, By Products Type (2023-2030)

9.2. South America Halal Cosmetics Market Size and Forecast, By Application (2023-2030)

9.3. South America Halal Cosmetics Market Size and Forecast, By Distribution Channel (2023-2030)

9.4. South America Halal Cosmetics Market Size and Forecast, by Country (2023-2030)

9.4.1. Brazil

9.4.2. Argentina

9.4.3. Rest Of South America

10. Company Profile: Key Players

10.1. Amara Halal Cosmetics (USA)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Inika Organic (Australia)

10.3. IBA Halal Care (India)

10.4. Wardah Cosmetics (Indonesia)

10.5. PHB Ethical Beauty (UK)

10.6. Sampure Minerals (UK)

10.7. Saaf Skincare (UK)

10.8. Clara International (Malaysia)

10.9. Talent Cosmetics Co., Ltd. (South Korea)

10.10. Tuesday in Love (Canada)

10.11. Martha Tilaar Group (Indonesia)

10.12. OnePure Beauty (UAE)

10.13. Prolab Cosmetics (Turkey)

10.14. Cosmax Inc. (South Korea)

10.15. IVY Beauty Corporation (Malaysia)

10.16. Colgate-Palmolive Company (USA)

10.17. Kose Corporation (Japan)

10.18. L'Oreal (France)

10.19. Procter & Gamble (USA)

10.20. Unilever (UK/Netherlands)

11. Key Findings

12. Industry Recommendation

13. Halal Cosmetics Market: Research Methodology