Home Use Air Purifiers Market: Industry Analysis and Forecast (2024-2030)

The Home Use Air Purifiers Market size was valued at USD 10.74 Bn. in 2023 and the total Home Use Air Purifiers revenue is expected to grow at a CAGR of 8.5% from 2024 to 2030, reaching nearly USD 19.01 Bn.

Format : PDF | Report ID : SMR_1898

Home Use Air Purifiers Market Overview

The home-use air purifiers is experiencing significant growth due to increasing awareness of indoor air quality and health concerns associated with pollutants. Modern air purifiers, like the VEWIOR model, feature advanced 3-stage filtration systems comprising a pre-filter, H13 True HEPA filter, and activated carbon filter to efficiently remove pollen, and smoke. These purifiers offer multiple fan speeds, efficient purification for rooms and additional features such as aromatherapy diffusers and ultra-quiet operation.

Another notable example is Dyson's air purifiers, which incorporate Air Multiplier technology, capturing 99.95% of particles as small as 0.1 microns and offering smart control via the Dyson Link app. These devices are designed to be safe, low maintenance, and effective in neutralizing airborne pollutants, viruses, and bacteria without producing harmful byproducts, making them suitable for various settings including homes, offices, and nurseries which drives Home Use Air Purifiers Market.

To get more Insights: Request Free Sample Report

Home Use Air Purifiers Market Dynamics:

Smart air purifiers can significantly reduce the risk of Airborne Diseases Drives with Smart Air Purification Technology

The home use air purifiers market is growing rapidly, driven by increasing awareness of the importance of indoor air quality for health. Clean air is essential for good health, as it helps create an allergy-friendly environment and mitigates the effects of "sick house syndrome," which can result from the buildup of indoor pollutants like formaldehyde and toxic VOC gases such as toluene. These pollutants, originating from sources like cooking, cleaning, building materials, and consumer products, can significantly impact indoor air quality and health.

IoT-enabled smart air purifiers, like those equipped with Philips VitaShield IPS, have proven effective in removing up to 99.9% of pathogens from indoor air. These devices come with advanced features such as real-time air quality monitoring, intelligent purification technology, and smart safety features that allow users to control and understand air quality in their homes. This results in healthier indoor air that is maintained consistently at optimal levels.

Smart air purifiers can significantly reduce the risk of airborne diseases by filtering out bacteria, viruses, and other pathogens. They also enhance overall well-being by improving sleep quality, as breathing cleaner air can lead to more restful sleep. These purifiers operate with maximum performance and low noise, ensuring they are suitable for various home environments, from bedrooms to living rooms. To further improve indoor air quality, it is recommended to reduce or remove pollution sources and ventilate with clean outdoor air.

Filtration serves as an effective supplement to these measures. Using portable air cleaners or upgrading HVAC filters can help reduce indoor pollution levels. While portable air cleaners are designed for single rooms, HVAC filters clean the air throughout an entire home. Although these devices cannot eliminate all indoor pollutants, they significantly reduce their concentration, contributing to a healthier living environment which propel the Home Use Air Purifiers Market.

Filter Replacement Realities and Managing Maintenance Costs Restrains Home Use Air Purifiers Market Growth

Air purifiers vary in cost, ranging from around $100 for basic models to over $800 for high-end options. Additionally, there are ongoing expenses to consider, as replacing filters annually can add $20 to $100 to your budget, making them a significant investment over time. However, noise levels can also be a factor in the decision-making process. While some purifiers operate quietly, emitting a sound to a whisper, others can be as loud as a busy office, with noise levels ranging from 30 to 70 decibels. Moreover, it's important to be cautious of ozone production, as some air purifiers release ozone, which can irritate the lungs and pose health risks, particularly with ionizers and ozone generators.

Additionally, air purifiers typically have a limited range, effectively cleaning spaces ranging from 100 to 1,500 square feet, depending on their design. For larger areas or whole-house purification, multiple units are necessary. High maintenance costs are a notable aspect of HEPA air purifiers, primarily due to the need for regular filter replacements. HEPA filters, while highly effective, do not last indefinitely and are replaced periodically. In areas with high levels of pollution, this need for filter replacement can occur more frequently, leading to increased maintenance expenses.

Additionally, relying on HEPA purifiers can sometimes create inconveniences, as they do not eliminate odors from the air. Furthermore, in the air purification process, HEPA purifiers can produce ozone as a byproduct, which contributes to undesirable smells. Despite these drawbacks, it's worth noting that only safe wavelengths of UV light are used in these air purifiers, ensuring that they effectively remove harmful pathogens while maintaining safety standards which hinders the growth of the Home Use Air Purifiers Market.

Technological Integration Builds the Safe Home Ecosystem that Boosts the Home Use Air Purifiers Market Growth

The integration of IoT technology into home-use air purifiers significantly enhances air filtration by offering several advanced features. IoT-enabled air purifiers provide real-time monitoring of air quality parameters such as PM2.5 levels, humidity, temperature, and VOCs, accessible remotely via smartphone apps. This allows users to continuously track and manage the air quality in their surroundings. These smart air purifiers seamlessly integrate with existing smart home ecosystems, interacting with devices like smart thermostats to create an optimized indoor environment.

Users can control their air purifiers through voice commands or mobile apps, enhancing convenience and user experience. Smart scheduling and automation are also key features, enabling air purifiers to operate based on predefined schedules, occupancy patterns, or specific events. For instance, an air purifier can automatically activate when a user arrives home or adjust its settings according to room occupancy. This level of automation ensures that air purification to the user's needs, improving efficiency and convenience. Additionally, IoT connectivity allows for the implementation of various purification modes, such as allergy relief, sleep mode, or pet-friendly settings, further personalizing the air purification experience.

Remote monitoring and alerts notify users when filters need replacement, maintenance is required, or when there are significant changes in air quality, ensuring optimal performance and proactive maintenance. Integration with wearable devices allows air purifiers to track users' health and activity levels, adjusting air purification parameters accordingly for a customized experience. Voice control via virtual assistants like Alexa and Google Assistant adds another layer of convenience, enabling hands-free operation and information retrieval. Cloud connectivity facilitates remote management, firmware updates, and data storage, which is particularly beneficial for managing multiple devices across different locations. This centralized control is advantageous for both commercial applications and large households, ensuring that air purifiers operate efficiently and effectively which boost Home Use Air Purifiers Market.

Home Use Air Purifiers Market Segment Analysis:

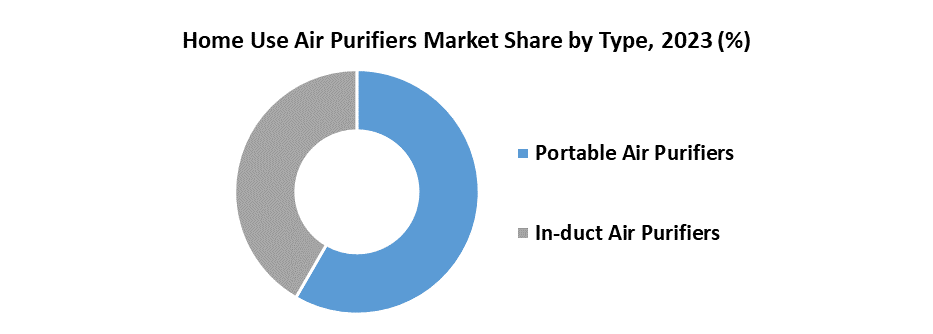

Based on Type, the market is divided into Portable Air Purifiers and In-duct Air Purifiers. Portable Air Purifiers witnessed the highest market share in 2023 and continue their dominance during the forecast period. The convenience and versatility offered by portable models make them popular among consumers. These devices can be easily moved from room to room, allowing users to target specific areas for air purification based on their needs. Additionally, portable air purifiers are often more affordable compared to larger, whole-house systems, making them accessible to a broader range of customers.

Furthermore, the increasing awareness of indoor air quality and its impact on health has spurred demand for portable air purifiers. Consumers are becoming more proactive in addressing air pollution concerns within their homes, driving the Home Use Air Purifiers Market adoption of these devices as a means of improving indoor air quality.

Technological advancements have enhanced the performance and efficiency of portable air purifiers, making them more effective at capturing a wide range of pollutants, including allergens, dust, pet dander, and volatile organic compounds (VOCs). Many modern portable air purifiers also come equipped with features such as HEPA filters, activated carbon filters, UV-C light sterilization, and smart connectivity, further enhancing their appeal and effectiveness. As urbanization and industrialization continue to contribute to air pollution levels, particularly in densely populated areas, the demand for portable air purifiers is expected to remain strong. Additionally, factors such as the growing prevalence of respiratory illnesses, allergies, and concerns about airborne pathogens have heightened the importance of indoor air quality management, driving further adoption of Home Use Air Purifiers Market.

Home Use Air Purifiers Market Regional Insight:

Asia Pacific witnessed the highest market share in 2023 and continued their dominance during the forecast period. This trend is driven by several key factors. Firstly, rapid urbanization and industrialization across countries such as China, India, and Japan have significantly deteriorated air quality, increasing the demand for home-use air purifiers. As cities expand and industrial activities intensify, the concentration of pollutants in the air rises, prompting households to seek effective solutions to maintain healthy indoor environments. Moreover, the growing awareness of health issues related to poor air quality has played a crucial role in boosting the adoption of air purifiers in the region.

Increasing incidences of respiratory diseases, allergies, and asthma have heightened public consciousness about the importance of indoor air quality. Consumers are becoming more proactive in mitigating the adverse effects of air pollution on their health, leading to a surge in demand for home-use air purifiers.

Government initiatives and regulations aimed at improving air quality and reducing pollution levels have further supported market growth. Many countries in the Asia Pacific region are implementing stringent air quality standards and promoting the use of air purifiers through subsidies and public awareness campaigns. Technological advancements and the availability of a wide range of products tailored to meet diverse consumer needs have also contributed to the market's growth. Innovations such as HEPA filters, activated carbon filters, and smart air purifiers with real-time air quality monitoring and remote control capabilities are gaining popularity. These features enhance the effectiveness and convenience of Home Use Air Purifiers Market.

Home Use Air Purifiers Market Competitive Landscape:

- On February 16, 2023, Samsung Electronics has unveiled a groundbreaking air filter technology that captures particulate matter (PM) and decomposes volatile organic compounds (VOCs) while maintaining its performance for up to 20 years. This new filter, developed by researchers at the Samsung Advanced Institute of Technology (SAIT), uses photocatalysts such as copper oxide (Cu2O) and titanium dioxide (TiO2). The filter can be regenerated through simple water washing, significantly reducing the need for frequent replacements. The technology, detailed in the journal Nature Communications, combines PM and VOC removal in a single system, enhancing space efficiency and reducing waste. It increases dust loading capacity by four times compared to conventional filters. Samsung plans to produce prototypes for various applications, including office buildings and bus terminals, aiming to commercialize long-lasting, efficient air purification systems.

- On January 5, 2024, WELOV by AiDot has introduced the P200 Pro, the world's first Matter-Certified air purifier, enhancing its smart technology to connect with Matter-enabled ecosystems and Apple Health. this air purifier allows seamless integration into various smart home setups, offering users ease of control and customization. AiDot, a member of the Connectivity Standards Alliance since 2022, achieved its first Matter certification in November 2022. Building on the success of its Matter-compatible smart lighting products, AiDot aims to expand its Matter-compatible home appliances, promoting a safer and more convenient IoT environment.

|

Home Use Air Purifiers Market Scope |

|

|

Market Size in 2023 |

USD 11.8 Billion |

|

Market Size in 2030 |

USD 31.9 Billion |

|

CAGR (2024-2030) |

11.3% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Portable Air Purifiers In-duct Air Purifiers |

|

By Technology High-Efficiency Particulate Air (HEPA) Electrostatic Precipitators Activated Carbon Ultraviolet |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Home Use Air Purifiers Market

North America

- Honeywell International, Inc. (Charlotte, North Carolina, USA)

- Whirlpool (Benton Harbor, Michigan, USA)

- Alen Corporation (Austin, Texas, USA)

- Rabbit Air (Los Angeles, California, USA)

Europe

- Camfil (Stockholm, Sweden)

- Blueair (Stockholm, Sweden)

- Philips (Amsterdam, Netherlands)

- Dyson (Malmesbury, UK)

- IAM (London, UK)

- IQAir (Goldach, Switzerland)

- Boneco (Plaston Holding AG) (Widnau, Switzerland)

Asia-Pacific

- Samsung Electronics Co., Ltd. (Suwon, South Korea)

- Sharp Corporation (Osaka, Japan)

- LG Corporation (Seoul, South Korea)

- Panasonic (Kadoma, Osaka, Japan)

- Blue Star Limited (Mumbai, India)

- Coway (Seoul, South Korea)

- Xiaomi (MI) (Beijing, China)

- Levoit (Vesync Co., Ltd.) (Shenzhen, China)

- Winix (Seongnam, South Korea)?

Frequently Asked Questions

Growing awareness of the health impacts of poor indoor air quality, such as respiratory issues and allergies, is motivating consumers to invest in air purifiers.

The significant growth potential in emerging economies where urbanization and industrialization are increasing pollution levels, and consumer awareness about air quality is rising.

The Home Use Air Purifiers Market size was valued at USD 10.74 Billion in 2023 and the total Global Home Use Air Purifiers revenue is expected to grow at a CAGR of 8.5% from 2024 to 2030, reaching nearly USD 19.01 Billion by 2030.

The segments covered in the market report are Type, Technology, and region.

1. Home Use Air Purifiers Market: Research Methodology

2. Home Use Air Purifiers Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Home Use Air Purifiers Market: Dynamics

3.1. Home Use Air Purifiers Market Trends

3.2. Home Use Air Purifiers Market Dynamics

3.2.1.1. Drivers

3.2.1.2. Restraints

3.2.1.3. Opportunities

3.2.1.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Technology Roadmap

3.6. Regulatory Landscape by Region

3.6.1. North America

3.6.2. Europe

3.6.3. Asia Pacific

3.6.4. Middle East and Africa

3.6.5. South America

4. Home Use Air Purifiers Market: Global Market Size and Forecast (Value in USD Million) (2023-2030)

4.1. Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

4.1.1. Portable Air Purifiers

4.1.2. In-duct Air Purifiers

4.2. Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

4.2.1. High-Efficiency Particulate Air (HEPA)

4.2.2. Electrostatic Precipitators

4.2.3. Activated Carbon

4.2.4. Ultraviolet

4.3. Home Use Air Purifiers Market Size and Forecast, by Region (2023-2030)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Home Use Air Purifiers Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

5.1. North America Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

5.1.1. Portable Air Purifiers

5.1.2. In-duct Air Purifiers

5.2. North America Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

5.2.1. High-Efficiency Particulate Air (HEPA)

5.2.2. Electrostatic Precipitators

5.2.3. Activated Carbon

5.2.4. Ultraviolet

5.3. North America Home Use Air Purifiers Market Size and Forecast, by Country (2023-2030)

5.3.1. United States

5.3.1.1. United States Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

5.3.1.1.1. Portable Air Purifiers

5.3.1.1.2. In-duct Air Purifiers

5.3.1.2. United States Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

5.3.1.2.1. High-Efficiency Particulate Air (HEPA)

5.3.1.2.2. Electrostatic Precipitators

5.3.1.2.3. Activated Carbon

5.3.1.2.4. Ultraviolet

5.3.2. Canada

5.3.2.1. Canada Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

5.3.2.1.1. Portable Air Purifiers

5.3.2.1.2. In-duct Air Purifiers

5.3.2.2. Canada Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

5.3.2.2.1. High-Efficiency Particulate Air (HEPA)

5.3.2.2.2. Electrostatic Precipitators

5.3.2.2.3. Activated Carbon

5.3.2.2.4. Ultraviolet

5.3.3. Mexico

5.3.3.1. Mexico Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

5.3.3.1.1. Portable Air Purifiers

5.3.3.1.2. In-duct Air Purifiers

5.3.3.2. Mexico Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

5.3.3.2.1. High-Efficiency Particulate Air (HEPA)

5.3.3.2.2. Electrostatic Precipitators

5.3.3.2.3. Activated Carbon

5.3.3.2.4. Ultraviolet

6. Europe Home Use Air Purifiers Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

6.1. Europe Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.2. Europe Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3. Europe Home Use Air Purifiers Market Size and Forecast, by Country (2023-2030)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.1.2. United Kingdom Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.2. France

6.3.2.1. France Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.2.2. France Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.3. Germany

6.3.3.1. Germany Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.3.2. Germany Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.4. Italy

6.3.4.1. Italy Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.4.2. Italy Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.5. Spain

6.3.5.1. Spain Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.5.2. Spain Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.6. Sweden

6.3.6.1. Sweden Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.6.2. Sweden Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.7. Russia

6.3.7.1. Russia Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.7.2. Russia Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

6.3.8.2. Rest of Europe Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7. Asia Pacific Home Use Air Purifiers Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030)

7.1. Asia Pacific Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.2. Asia Pacific Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3. Asia Pacific Home Use Air Purifiers Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.1.1. China Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.1.2. China Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.2. S Korea

7.3.2.1. S Korea Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.2.2. S Korea Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.3. Japan

7.3.3.1. Japan Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.3.2. Japan Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.4. India

7.3.4.1. India Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.4.2. India Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.5. Australia

7.3.5.1. Australia Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.5.2. Australia Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.6. Indonesia

7.3.6.1. Indonesia Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.6.2. Indonesia Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.7. Malaysia

7.3.7.1. Malaysia Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.7.2. Malaysia Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.8. Vietnam

7.3.8.1. Vietnam Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.8.2. Vietnam Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.9. Taiwan

7.3.9.1. Taiwan Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.9.2. Taiwan Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

7.3.10.2. Rest of Asia Pacific Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

8. Middle East and Africa Home Use Air Purifiers Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030

8.1. Middle East and Africa Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

8.2. Middle East and Africa Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

8.3. Middle East and Africa Home Use Air Purifiers Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.1.1. South Africa Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

8.3.1.2. South Africa Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

8.3.2. GCC

8.3.2.1. GCC Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

8.3.2.2. GCC Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

8.3.3. Nigeria

8.3.3.1. Nigeria Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

8.3.3.2. Nigeria Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

8.3.4.2. Rest of ME&A Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

9. South America Home Use Air Purifiers Market Size and Forecast by Segmentation (Value in USD Million) (2023-2030

9.1. South America Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

9.2. South America Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

9.3. South America Home Use Air Purifiers Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.1.1. Brazil Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

9.3.1.2. Brazil Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

9.3.2. Argentina

9.3.2.1. Argentina Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

9.3.2.2. Argentina Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Home Use Air Purifiers Market Size and Forecast, By Type (2023-2030)

9.3.3.2. Rest Of South America Home Use Air Purifiers Market Size and Forecast, By Technology (2023-2030)

10. Global Home Use Air Purifiers Market: Competitive Landscape

10.1. SMR Competition Matrix

10.2. Competitive Landscape

10.3. Key Players Benchmarking

10.3.1. Company Name

10.3.2. Service Segment

10.3.3. End-user Segment

10.3.4. Revenue (2022)

10.3.5. Company Locations

10.4. Leading Home Use Air Purifiers Market Companies, by Market Capitalization

10.5. Market Structure

10.5.1. Market Leaders

10.5.2. Market Followers

10.5.3. Emerging Players

10.6. Mergers and Acquisitions Details

11. Company Profile: Key Players

11.1. Honeywell International, Inc. (Charlotte, North Carolina, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Whirlpool (Benton Harbor, Michigan, USA)

11.3. Alen Corporation (Austin, Texas, USA)

11.4. Rabbit Air (Los Angeles, California, USA)

11.5. Camfil (Stockholm, Sweden)

11.6. Blueair (Stockholm, Sweden)

11.7. Philips (Amsterdam, Netherlands)

11.8. Dyson (Malmesbury, UK)

11.9. IAM (London, UK)

11.10. IQAir (Goldach, Switzerland)

11.11. Boneco (Plaston Holding AG) (Widnau, Switzerland)

11.12. Samsung Electronics Co., Ltd. (Suwon, South Korea)

11.13. Sharp Corporation (Osaka, Japan)

11.14. LG Corporation (Seoul, South Korea)

11.15. Panasonic (Kadoma, Osaka, Japan)

11.16. Blue Star Limited (Mumbai, India)

11.17. Coway (Seoul, South Korea)

11.18. Xiaomi (MI) (Beijing, China)

11.19. Levoit (Vesync Co., Ltd.) (Shenzhen, China)

11.20. Winix (Seongnam, South Korea)

12. Key Findings

13. Industry Recommendations