Human Resources Software Market: Global Industry Analysis and Forecast (2024-2030)

Human Resources Software Market size was valued at USD 18.87 Bn. in 2023 and the total Human Resources Software Market size is expected to grow at a CAGR of 11.55% from 2024 to 2030, reaching nearly USD 40.55 Bn. by 2030.

Format : PDF | Report ID : SMR_1881

Human Resources Software Market Overview

Human resource software is designed to help employees and manage performance at their full potential and is implemented by businesses of all sizes to boost productivity and overall employee satisfaction. HR software is a digital solution that helps organizations streamline HR-related processes such as employee information management and document routing. Such HR information systems are the standard for fast-growing businesses that need to store confidential employee data securely, stay compliant with regulations, and boost the productivity of their HR professionals on a day-to-day basis.

The Human Resources Software Market report has been meticulously crafted using a combination of primary and secondary research techniques to ensure its reliability and accuracy. Primary research methods encompassed the distribution of questionnaires, conducting surveys, and engaging in phone interviews with a diverse array of experts, industry luminaries, marketers, and entrepreneurs operating within the Human Resources Software sector. Employing a bottom-up methodology, the report provided estimations for both global and regional market sizes. Additionally, a SWOT analysis was leveraged to spotlight the strengths and weaknesses of prominent players in the Human Resources Software industry.

The report has also covered several aspects that have been influencing the market growth such as the increasing remote work culture that has boosted the HR software market, and companies that are estimated to enhance communication with teams working from home. Thus, virtual meetings, recruiting, and onboarding may become a norm, which requires stellar communication and has propelled the market growth.

- 36% of HR leaders say companies don’t have the resources to recruit top talent.

- Making a job application mobile-friendly increases applicants by more than 11%

- 24% of companies have no strategy to onboard internal promotions.

- Comprehensive onboarding makes employees 33% more engaged at work

To get more Insights: Request Free Sample Report

Human Resources Software Market Dynamics

Driving Forces Behind the Surge in Human Resources Software Adoption

Surged demand for Human Resources Software owing to the efficiency, cost-effectiveness, and proper utilization of human resources has propelled the market growth. HR software plays a crucial role in improving administrative efficiency and employee information security as a result many businesses have turned to cloud-based employee file management for the convenience, accessibility, and cost advantages that reduce the risks of unstructured data. An effective HR system has been consolidating crucial documentation in one place, so teams are able to retrieve files instantly and make more informed, faster decisions.

As there is a huge amount of sensitive employee data under the control of HR departments and it is crucial to adopt data protection measures at every step of the document management process, the software helps to manage and sort the documents easily. Additionally, HR organizations are shifting their focus from cost savings to strategic business alignment, process improvement, and employee engagement. Systems are able to schedule events, such as performance appraisals and benefit deadlines, automatically notifying and nudging if actions have not been performed. Organizations are actively seeking to transform the way to deliver and manage HR. As part of it, companies are increasingly buying and implementing new HR technology as a result it has accelerated the market growth.

The Role of AI and Cloud HR in Transforming Recruitment

One of the major trends in the HR Software market is the rapid development of technology such as AI, ML, NPL, etc. Technology is transforming the entire recruitment lifecycle. The surge in digitization has digitized everything, from resumes to interviews, and recruitment managers, who have tools at their disposal that help shape a seamless candidate experience. In 2024, the world is expected to rely on technology more than ever. trend is estimated to grow year on year, and companies are projected to implement advanced AI-based technology and tools. Recruiters have been automating tedious and repetitive tasks resulting in more time to focus on meaningful elements of recruitment.

Artificial intelligence is the present and future of HR trends, and its presence has been influencing globally. Companies are bound to use it to source candidates, parse resumes, and onboard candidates with more ease and accuracy. Even though 17% of organizations use AI in their HR function, another 30% is expected to use it by 2025. Thanks to collaborative project management and messaging suites like Slack or Trello, as well as cloud-based HR platforms, location is no longer an issue. Using cloud-based HR software is slowly becoming the norm not only for globally distributed teams. It’s much more scalable, so it’s great for fast-growing businesses, where it allows HR professionals to work with real-time data.

- 65 percent are using it to help generate job descriptions and 42 percent are using it to customize job postings, while about 33 percent are using AI to review or screen applicant resumes, to communicate with applicants during the interview process, or to automate candidate searches.

Navigating Challenges in HR Technology Adoption

Lack of awareness and education regarding the technology has been the biggest challenges that are faced by the market leaders. Companies have been heavily investing in high-quality HR technology that allows video interviews, continuous virtual communication, and meetings. But not every individual knows how to use these tools, so employers also have to provide employees with digital communication workshops resulting in a slower adoption rate of HR Software. Security is one of the major challenges in the Human Resources Software Market as systems are designed to prevent unauthorized access to sensitive and confidential data and also the unintended publication of such information.

This typically required many “compartments” and many levels of authority for access, all of which have to be monitored and maintained. Additionally, the rising demand has led to an increase in the cost of HR software. Especially for smaller companies, it has been a problem. For instance, with any system, there are acquisition costs and maintenance costs and with larger installations, there’s probably the cost of hiring an IT specialist to manage the system.

- According to the STELLAR Analysis, 36% of HR professionals say they don’t have adequate technology

Human Resources Software Segment Analysis

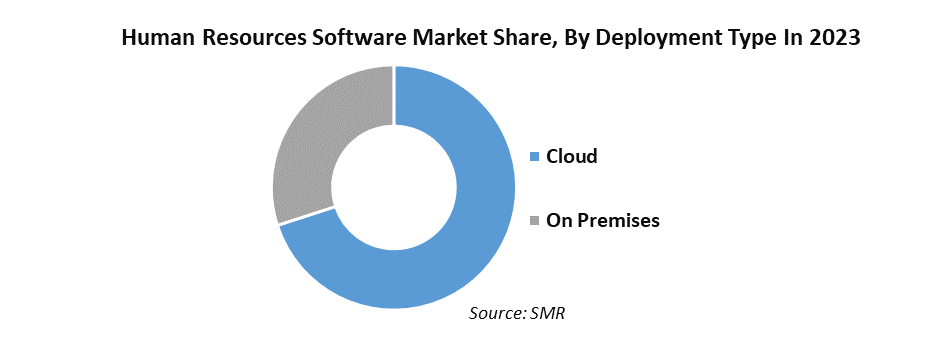

Based on the Deployment type, Cloud segment dominated the market and is projected to maintain its dominance through the forecast period with an increasing CAGR. The adoption rate of cloud-based HR software has accelerated the market growth. One of the primary benefits of utilizing cloud-based HR software lies in its unparalleled accessibility. With reliable internet connectivity, technology allows users to seamlessly access HR functions from any location and device, at any time. In a remote work setup, employees efficiently manage tasks such as attendance tracking, logging working hours, retrieving crucial documents, and submitting leave requests.

In contrast, on-premise HR software necessitates a physical presence for conducting HR operations, limiting flexibility and efficiency, particularly in remote work scenarios. In alignment with evolving organizational dynamics, cloud-based HR software offers a tailored approach, enabling customization of features to suit your workforce management needs. The flexibility empowers to enhance HR operations in response to changing demands, fostering agility and adaptability within your organization. A cloud-based HR software allows employees to access all their vital information and communicate with their peers easily. Providing 24/7 access to HR operations makes employees feel trusted and motivated.

Human Resources Software Market Regional Analysis

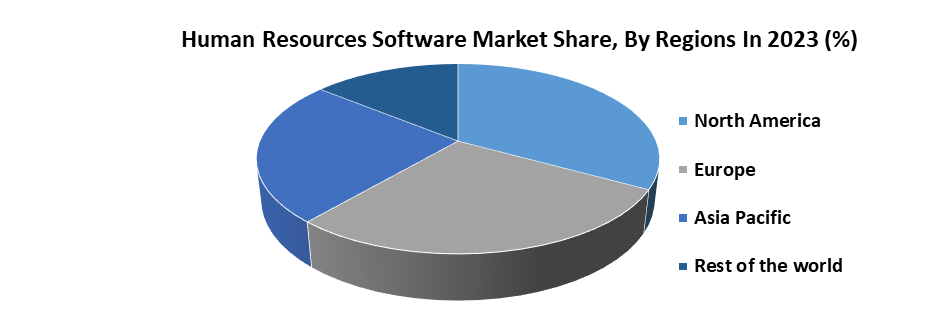

North America dominated the market and is expected to maintain its dominance through the forecast period (2024 - 2030) with an increasing CAGR. The main factor boosting the market is the increase in the digitalization for effective human resources management systems across various industrial domains which has led to a rise in the demand for the HR software market in the region. In Addition, the surge in automation of HR processes has also influenced the market growth.

The key players in the region have been actively participating in the technology development that led to high demand in the market. For instance, in October 2023, EY and IBM joined together to introduce EY.ai Workforce, a cutting-edge HR platform that helps businesses smoothly integrate AI into their core HR business operations. This is a major step forward in the continued collaboration between the two organizations and a noteworthy accomplishment in terms of using AI to boost HR productivity.

North America has been a consistent adopter of contemporary technology and has embraced cloud-native technologies in excess. Integrating analytics into HRM systems is becoming easier due to advancements in current technologies like machine learning (ML), AI, and predictive analytics. AI-powered chatbots are being used by HR software and services to respond to common inquiries from employees on matters like leave policies and pay scales.

According to the STELLAR Analysis, there were 6.5 million business establishments in the U.S. with between 1 and 299 employees. 50 percent of SMBs use HR management software, it is estimated that around 3.2 million SMBs in the U.S. are expected to use these programs.

Human Resources Software Market Software Competitive Landscape

- On September, 2023, Oracle announced that it had agreed to acquire Next Technik. Next Technik provides field service management capabilities for NetSuite customers, which enable businesses to digitize and streamline scheduling and dispatch and the management of inventory and assets for increased productivity, and customer satisfaction.

- In April 2024, the HR Tech industry maintained its momentum with 23 significant deals. Talent Acquisition spearheaded the consolidation activity, trailed closely by HRMS. Additionally, other categories secured one deal each, showcasing a diverse landscape of consolidations.

- In July 2023, Info tech systems Integrators, a prominent Singaporean provider of cloud based HR and accounting software, signed a memorandum of understanding with Republic polytechnic. The strategic collaboration represents a noteworthy achievement for info tech and is geared toward promoting cooperation and generating valuable prospects.

|

Human Resources Software Market |

|

|

Market Size in 2023 |

USD 18.87 Bn. |

|

Market Size in 2030 |

USD 40.55 Bn. |

|

CAGR (2024-2030) |

11.55 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Deployment Mode

|

|

By Organization Size

|

|

|

By Application

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Human Resources Software Market Software Key Players

North America

- ADP (Automatic Data Processing)

- Oracle Corporation

- Workday, Inc

- IBM Corporation

- Cornerstone OnDemand, Inc.

- Paychex, Inc

- Mercer

- Aon plc

- ManpowerGroup Inc

- BambooHR

- Gusto

- iCIMS

- Greenhouse Software

- Jobvite

- Insperity

- UKG Company

- HRSoft

- Cornerstone OnDemand

Europe

- Randstad Holding NV

- Accenture plc

- Deloitte Consulting LLP

- Ernst & Young LLP (EY)

- nCore HR

- Namely

- Cezanne HR

- Infor

- HR-Technologies

- Midland HR

Asia Pacific

- MyHR

- EDE Human Resource

- SAP SuccessFactors

- Oracle HCM Cloud

- Workday

- JuzTalent

- Kronos

- HR Cloud

- HR Mangtaa

- Agile HR

- HR Trace

Frequently Asked Questions

Lack of awareness has restrained the market growth.

The Market size was valued at USD 18.87 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 11.55 % from 2024 to 2030, reaching nearly USD 40.55 Billion.

The segments covered in the market report are by Deployment Type, Organisation Size and Application.

1. Human Resources Software Market: Research Methodology

2. Human Resources Software Market: Executive Summary

3. Human Resources Software Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Human Resources Software Market: Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunities

5.4. Challenges

5.5. Market Trends by Region

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

5.6. Market Drivers by Region

5.6.1. North America

5.6.2. Europe

5.6.3. Asia Pacific

5.6.4. Middle East and Africa

5.6.5. South America

5.7. Market Restraints

5.8. Market Opportunities

5.9. Market Challenges

5.10. PORTER’s Five Forces Analysis

5.11. PESTLE Analysis

5.12. Strategies for New Entrants to Penetrate the Market

5.13. Analysis of Government Schemes and Initiatives for the Human Resources Software Industry

5.14. Regulatory Landscape by Region

5.14.1. North America

5.14.2. Europe

5.14.3. Asia Pacific

5.14.4. Middle East and Africa

5.14.5. South America

5.15. Human Resources Software Market Size and Forecast by Segments (by Value Units)

5.15.1. Human Resources Software Market Size and Forecast, by Deployment Mode (2023-2030)

5.15.1.1. Cloud

5.15.1.2. On Premise

5.15.2. Human Resources Software Market Size and Forecast, by Organization Size (2023-2030)

5.15.2.1. Small and Medium Enterprise

5.15.2.2. Large Enterprise

5.15.3. Human Resources Software Market Size and Forecast, by Application(2023-2030)

5.15.3.1. IT and Telecommunication

5.15.3.2. BFSI

5.15.3.3. Government

5.15.3.4. Healthcare

5.15.3.5. Retail

5.15.3.6. Others

5.15.4. Human Resources Software Market Size and Forecast, by Region (2023-2030)

5.15.4.1. North America

5.15.4.2. Europe

5.15.4.3. Asia Pacific

5.15.4.4. Middle East and Africa

5.15.4.5. South America

6. North America Human Resources Software Market Size and Forecast (by value Units)

6.1. North America Human Resources Software Market Size and Forecast, by Deployment Mode (2023-2030)

6.1.1. Cloud

6.1.2. On Premise

6.2. North America Human Resources Software Market Size and Forecast, by Organization Size (2023-2030)

6.2.1. Small and Medium Enterprise

6.2.2. Large Enterprise

6.3. North America Human Resources Software Market Size and Forecast, by Application(2023-2030)

6.3.1. IT and Telecommunication

6.3.2. BFSI

6.3.3. Government

6.3.4. Healthcare

6.3.5. Retail

6.3.6. Others

6.4. North America Human Resources Software Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Human Resources Software Market Size and Forecast (by Value Units)

7.1. Europe Human Resources Software Market Size and Forecast, by Deployment Mode (2023-2030)

7.1.1. Cloud

7.1.2. On Premise

7.2. Europe Human Resources Software Market Size and Forecast, by Organization Size (2023-2030)

7.2.1. Small and Medium Enterprise

7.2.2. Large Enterprise

7.3. Europe Human Resources Software Market Size and Forecast, by Application(2023-2030)

7.3.1. IT and Telecommunication

7.3.2. BFSI

7.3.3. Government

7.3.4. Healthcare

7.3.5. Retail

7.3.6. Others

7.4. Europe Human Resources Software Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Human Resources Software Market Size and Forecast (by Value Units)

8.1. Asia Pacific Human Resources Software Market Size and Forecast, by Deployment Mode (2023-2030)

8.1.1. Cloud

8.1.2. On Premise

8.2. Asia Pacific Human Resources Software Market Size and Forecast, by Organization Size (2023-2030)

8.2.1. Small and Medium Enterprise

8.2.2. Large Enterprise

8.3. Asia Pacific Human Resources Software Market Size and Forecast, by Application(2023-2030)

8.3.1. IT and Telecommunication

8.3.2. BFSI

8.3.3. Government

8.3.4. Healthcare

8.3.5. Retail

8.3.6. Others

8.4. Asia Pacific Human Resources Software Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Human Resources Software Market Size and Forecast (by Value Units)

9.1. Middle East and Africa Human Resources Software Market Size and Forecast, by Deployment Mode (2023-2030)

9.1.1. Cloud

9.1.2. On Premise

9.2. Middle East and Africa Pool Tables Market Size and Forecast, by Organization Size (2023-2030)

9.2.1. Small and Medium Enterprise

9.2.2. Large Enterprise

9.3. Middle East and Africa Human Resources Software Market Size and Forecast, by Application(2023-2030)

9.3.1. IT and Telecommunication

9.3.2. BFSI

9.3.3. Government

9.3.4. Healthcare

9.3.5. Retail

9.3.6. Others

9.4. Middle East and Africa Human Resources Software Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Rest of ME&A

10. South America Human Resources Software Market Size and Forecast (by Value Units)

10.1. South America Human Resources Software Market Size and Forecast, by Deployment Mode (2023-2030)

10.1.1. Cloud

10.1.2. On Premise

10.2. South America Human Resources Software Market Size and Forecast, by Organization Size (2023-2030)

10.2.1. Small and Medium Enterprise

10.2.2. Large Enterprise

10.3. South America Human Resources Software Market Size and Forecast, by Application(2023-2030)

10.3.1. IT and Telecommunication

10.3.2. BFSI

10.3.3. Government

10.3.4. Healthcare

10.3.5. Retail

10.3.6. Others

10.4. South America Human Resources Software Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

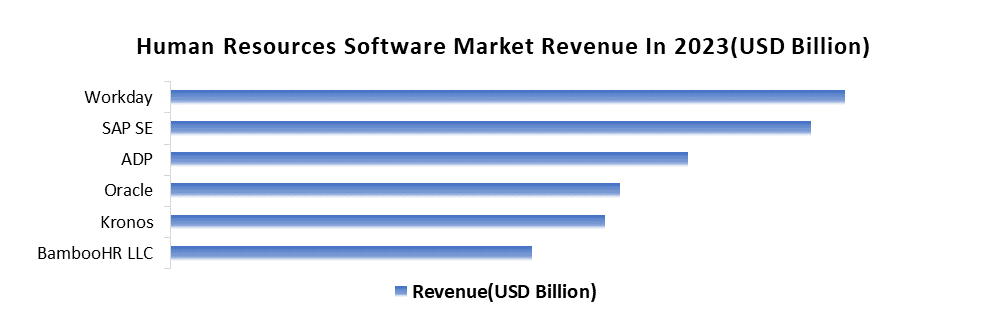

11.1. ADP (Automatic Data Processing)

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. Oracle Corporation

11.3. Workday, Inc

11.4. IBM Corporation

11.5. Cornerstone OnDemand, Inc.

11.6. Paychex, Inc

11.7. Mercer

11.8. Aon plc

11.9. ManpowerGroup Inc

11.10. BambooHR

11.11. Gusto

11.12. iCIMS

11.13. Greenhouse Software

11.14. Jobvite

11.15. Insperity

11.16. UKG Company

11.17. HRSoft

11.18. Cornerstone OnDemand

11.19. Randstad Holding NV

11.20. Accenture plc

11.21. Deloitte Consulting LLP

11.22. Ernst & Young LLP (EY)

11.23. nCore HR

11.24. Namely

11.25. Cezanne HR

11.26. Infor

11.27. HR-Technologies

11.28. Midland HR

11.29. MyHR

11.30. EDE Human Resource

11.31. SAP SuccessFactors

11.32. Oracle HCM Cloud

11.33. Workday

11.34. JuzTalent

11.35. Kronos

11.36. HR Cloud

11.37. HR Mangtaa

11.38. Agile HR

11.39. HR Trace

12. Key Findings

13. Industry Recommendation