Hydrogen Pipelines Market: Global Industry Analysis and Forecast (2024 -2030)

The Hydrogen Pipelines Market size was valued at USD 9.12 Bn. in 2023 and the total Hydrogen Pipelines revenue is expected to grow at a CAGR of 15.30% from 2024 to 2030, reaching nearly USD 24.7 Bn. by 2030.

Format : PDF | Report ID : SMR_2174

Hydrogen Pipelines Market Overview:

The global Hydrogen Pipelines market is experiencing significant growth driven by increasing investments in hydrogen energy infrastructure and the rising demand for clean energy solutions. Hydrogen Pipelines play a crucial role in transporting hydrogen gas from production facilities to end-users such as industrial plants, refineries, and fueling stations. The market is expected to grow at a compound annual growth rate (CAGR) of 15.30 % from 2024 to 2030 and is expected to reach a value of USD 24.7 billion by 2030. This growth is driven by multiple factors, including government policies and incentives promoting hydrogen as a clean energy source, advances in Hydrogen pipeline production technology, and increasing investments in hydrogen infrastructure.

Hydrogen Pipeline projects are notable worldwide. For example, in Europe, the European Commission's Hydrogen Strategy aims to install 6,800 km of Hydrogen pipeline by 2030, connecting major industrial clusters and urban areas. In Asia-Pacific, countries like Japan and South Korea are leading in hydrogen infrastructure development, with projects like the Hydrogen Energy Supply Chain in Japan and the H2 Korea project.

Key players in the Hydrogen Pipelines industry include major companies such as The Linde Group, Hexagon Plus, ArcelorMittal, Salzgitter AG, and Tenaris. These companies have invested heavily in research and development to improve pipeline equipment, Hydrogen pipeline safety standards, and overall performance. Innovations in pipeline technology, such as the use of integrated equipment and smart monitoring, are also helping the industry grow. For example, Linde is a global leader in industrial gases, including hydrogen production and distribution.

They are involved in various Hydrogen pipeline infrastructures worldwide, contributing significantly to the infrastructure expansion. Linde is part of the H2USA initiative in the United States, aimed at developing hydrogen infrastructure. Air Liquide is another major player in the hydrogen market, providing Hydrogen pipeline solutions and technologies. For example, Air Liquide is involved in the HyAMMED project in France, focusing on Hydrogen pipeline networks for industrial and transportation use.

To get more Insights: Request Free Sample Report

Hydrogen Pipelines Market Dynamics:

Renewable energy sources and a steady transition towards a low-carbon economy

The Hydrogen Pipelines market is experiencing significant growth in 2023. One of the major drivers is the global shift towards clean energy sources, where hydrogen plays a crucial role in decarbonizing industries such as Global hydrogen transportation and manufacturing. Governments worldwide are incentivizing hydrogen infrastructure development to meet climate targets, boosting market demand. For instance, In Europe the European Clean Hydrogen Alliance aims to deploy 40 GW of electrolyser’s and generate 10 million tons of renewable hydrogen by 2030, In Asia-Pacific, countries like Japan and South Korea are investing heavily in hydrogen infrastructure to achieve carbon neutrality target.

Challenges and Restraints that hinder its widespread adoption and growth Hydrogen Pipelines Market

When hydrogen is transported through pipelines, which causes embrittlement, reducing the structural integrity of metals over time. This phenomenon necessitates the use of specialized materials and coatings, increasing Hydrogen pipeline construction and maintenance costs. Establishing Hydrogen pipelines involves significant upfront investment due to the need for specialized infrastructure, safety measures, and regulatory compliance.

For instance, the construction of Hydrogen pipelines in remote or densely populated areas can escalate costs substantially. Additionally, ensuring the reliability and durability of hydrogen compression technology remains difficult. Integrating hydrogen into the energy system while also managing decarbonization efforts is a complex process as it involves dealing with various technical and logistical challenges along the way.

Opportunities driven by the global shift towards sustainable energy solutions and decarbonization efforts

The Hydrogen Pipelines market presents significant opportunities driven by the global shift towards sustainable energy solutions and decarbonization efforts such as,

- Government policies and incentives, such as grants and subsidies for hydrogen infrastructure development, further bolster market opportunities. For instance, the U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office provides funding for Hydrogen pipeline infrastructure.

- Infrastructure Development presents a robust opportunity in Hydrogen Pipelines. For instance, Europe's hydrogen strategy aims to deploy 6,800 km of Hydrogen pipeline by 2030, illustrating a substantial market growth potential.

- Regional Market Expansion in Countries like Germany and Japan, these countries are leading in hydrogen infrastructure investments. For example, Germany's National Hydrogen Strategy targets 5 GW of electrolyzer capacity and extensive pipeline networks, creating opportunities for pipeline manufacturers and infrastructure developers.

- Hydrogen Pipelines supports various industrial applications, including refining, chemical production, and power generation. For example, in the U.S., Hydrogen Pipelines play a crucial role in supporting refineries and petrochemical plants transitioning to hydrogen-based processes.

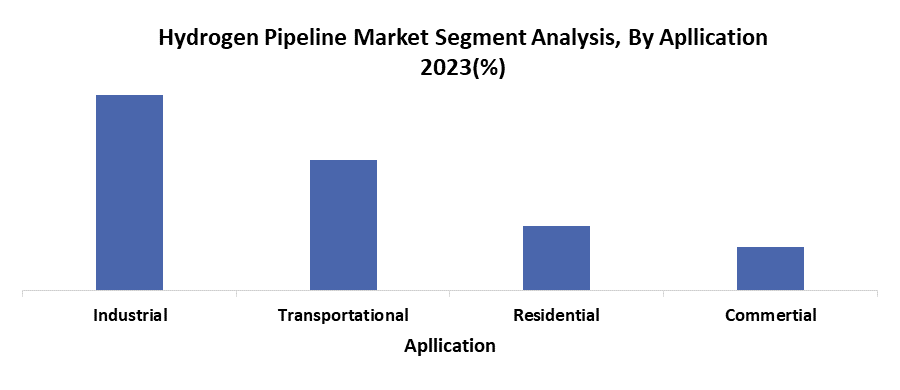

Hydrogen Pipelines Market Segment Analysis

By Application, The industrial market held the largest share of the Hydrogen Pipelines Market. Industrial processes are a significant driver for the Hydrogen Pipelines market. Hydrogen is widely used in refining processes, ammonia production, and methanol synthesis. For example, in the chemical industry, hydrogen is a crucial feedstock for producing ammonia, which is essential for fertilizers. The growing demand for cleaner industrial processes boosts the need for Hydrogen Pipelines, contributing to the market's expansion.

Transportation of hydrogen in Hydrogen fuel cell vehicles (FCVs) is gaining grip as a sustainable alternative to traditional internal combustion engines. Hydrogen Pipelines facilitate the distribution of hydrogen to refueling stations, supporting the growth of FCVs. For instance, countries like China are investing in hydrogen refueling infrastructure to promote hydrogen-powered buses, trucks, and passenger vehicles.

The Residential applications primarily involve the use of hydrogen fuel cells for backup power and heating solutions. Fuel cells can provide a reliable and clean source of energy for homes, reducing dependency on traditional fossil fuels. For example, Japan’s Residential Hydrogen Initiatives where Japan is a leader in residential hydrogen adoption, with projects like ENE-FARM, which provides residential fuel cell systems.

The Commercial application of Hydrogen Pipelines extends to supplying hydrogen to industries for various processes, including refining and ammonia production. The market size for the commercial application of Hydrogen Pipelines was a major component of the overall market valuation, contributing significantly to the estimated USD XX billion in 2023, with a projected CAGR of XX from 2024 to 2030.

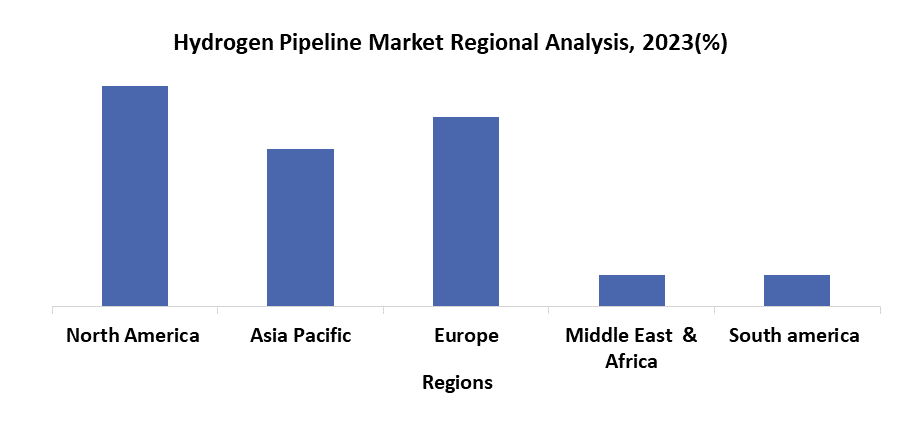

Hydrogen Pipelines Market Regional Analysis

The Hydrogen Pipelines market in North America is experiencing significant growth due to increasing investments in clean energy infrastructure and supportive government policies such as the Hydrogen Energy Earthshot initiative, which aims to reduce the cost of clean hydrogen by 80% to $1 per kilogram within a decade. This has enhanced the development and deployment of hydrogen infrastructure.

As of 2023, the global Hydrogen Pipelines market size exceeded USD XX billion, and it is expected to grow at a compound annual growth rate (CAGR) of about XX % between 2024 and 2030, driven by regions like North America. In Hydrogen Pipelines infrastructure Significant investments are being made that increase hydrogen production. For example, in the U.S., there are projects underway to expand the existing Hydrogen pipeline transportation network to facilitate the transportation of hydrogen from production sites to end-users.

The Asia-Pacific Hydrogen Pipelines market is projected to witness strong growth, contributing substantially to the global market, which is anticipated to reach USD 25.7 billion by 2030. The Asia-Pacific region's commitment to hydrogen infrastructure, backed by substantial government support and large-scale projects, positions it as a pivotal player in the global Hydrogen Pipelines market such as Countries like Japan, China, and South Korea are leading in hydrogen infrastructure development.

For instance, Japan's Hydrogen Society Roadmap aims to build a hydrogen-based economy with extensive pipeline networks. Asia-Pacific Australia is investing in green hydrogen projects, such as the Asian Renewable Energy Hub, which includes plans for extensive Hydrogen pipeline economics to export hydrogen to Asian markets. The Western Green Energy Hub project aims to develop a vast hydrogen production and pipeline network to export hydrogen to Asia, highlighting the region's export potential.

Hydrogen Pipelines Market Competitive Landscape:

The competitive landscape of the Hydrogen Pipelines market is characterized by rapid expansion driven by increasing investment. Key players are focusing on expanding the pipeline network to support the efficient distribution of hydrogen. Companies compete based on advances in plumbing equipment, Hydrogen pipeline safety standards, and integration with existing facilities. Industry leaders are critical of partnering with governments and energy companies to provide long-term contracts and spur innovation. The growth trend of the market demonstrates stability and reliability, allowing players to benefit from the growing demand for hydrogen as clean energy.

In 2024, Linde plc has recently signed an agreement to supply industrial gases to the world's first large-scale green steel plant, with operations expected to begin by 2026. They continue to expand their presence in supplying industrial gases, emphasizing eco-friendly energy solutions.

In 2023, Pipelife has taken a leading role in Europe's hydrogen infrastructure development, showcasing its expertise in providing piping system solutions across 24 countries. In 2023, Pipelife has taken a leading role in Europe's hydrogen infrastructure development, showcasing its expertise in providing piping system solutions across 24 countries.

Hydrogen Pipelines Market Scope:

|

Hydrogen Pipelines Market |

|

|

Market Size in 2023 |

USD 9.12 Bn. |

|

Market Size in 2030 |

USD 24.7 Bn. |

|

CAGR (2024-2030) |

15.30 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

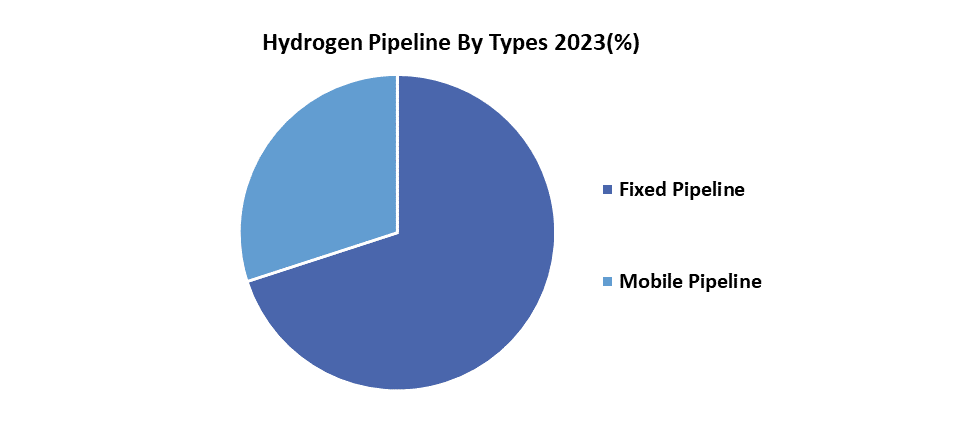

By Type Fixed Mobile |

|

By Form Gas Liquid |

|

|

By Distribution Pipelines Cylinders High-pressure tube trailers |

|

|

By Application Ammonia Production Methanol Production Refiling |

|

Hydrogen Pipelines Market by Region

North America (United States, Canada, and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC)

Middle East and Africa (South Africa, GCC, 8.3.3. Nigeria, Rest of ME & A)

South America (Brazil, Argentina Rest of South America)

Hydrogen Pipelines Market Key Players:

- Cenergy Holdings

- SoluForce B.V.

- Salzgitter AG

- Gruppo Sarplast S.r.l

- Tenaris

- Hexagon Purus

- Pipelife International GmbH

- Europe Technologies

- H2 Clipper, Inc.

- NPROXX

- GF Piping Systems

- ArcelorMittal

- Jindal Saw Limited

- Linde PLC

- Hexagon Purus

- ArcelorMittal

- Salzgitter AG

- Tenaris

- GF Piping Systems

- Air Liquide

- Air Products and Chemicals, Inc.

- Shell plc

- Ferrostaal GmbH

- ENGIE

- ITM Power

- Plug Power

- Toyota Tsusho Corporation

- Nel ASA

- Hyundai

- Covestro AG

- Chart Industries

- Snam S.p.A.

Frequently Asked Questions

The Hydrogen Pipelines Market size is expected to reach USD 24.7 Billion by 2030.

The segments covered in the market report are Type, regional analysis, deployment, and Market Competitive Landscape.

North America had the largest share of the market.

1. Hydrogen Pipelines Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Hydrogen Pipelines Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Segments

2.3.3. Revenue (2023)

2.4. Leading Hydrogen Pipelines Market Companies, by Market Capitalization

2.5. Market Structure

2.5.1. Market Leaders

2.5.2. Market Followers

2.5.3. Emerging Players

2.6. Mergers and Acquisitions Details

3. Hydrogen Pipelines Market: Dynamics

3.1. Market Trends by Region

3.1.1. North America Hydrogen Pipelines Market Trends

3.1.2. Europe Hydrogen Pipelines Market Trends

3.1.3. Asia Pacific Hydrogen Pipelines Market Trends

3.1.4. Middle East and Africa Hydrogen Pipelines Market Trends

3.2. Market Dynamics by Global

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Technological Roadmap

3.7. Regulatory Landscape by Region

3.7.1. North America

3.7.2. Europe

3.7.3. Asia Pacific

3.7.4. Middle East and Africa

3.7.5. South America

3.8. Analysis of Other Schemes and Initiatives for the Hydrogen Pipelines Industry

4. Hydrogen Pipelines Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030)

4.1. Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

4.1.1. Fixed Pipeline

4.1.2. Mobile Pipeline

4.2. Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

4.2.1. Gas

4.2.2. Liquid

4.3. Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

4.3.1. Pipelines

4.3.2. Cylinders

4.3.3. High-pressure tube trailers

4.4. Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

4.4.1. Commercial

4.4.2. Residential

4.4.3. Institutional & Government

4.4.4. Industrial

4.4.5. Transportation

4.5. Hydrogen Pipelines Market Size and Forecast, By Region (2023-2030)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Hydrogen Pipelines Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030)

5.1. North America Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

5.1.1. Fixed Pipeline

5.1.2. Mobile Pipeline

5.2. North America Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

5.2.1. Gas

5.2.2. Liquid

5.3. North America Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

5.3.1. Pipelines

5.3.2. Cylinders

5.3.3. High-pressure tube trailers

5.4. North America Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

5.4.1. Commercial

5.4.2. Residential

5.4.3. Institutional & Government

5.4.4. Industrial

5.4.5. Transportation

5.5. North America Hydrogen Pipelines Market Size and Forecast, by Country (2023-2030)

5.5.1. United States

5.5.1.1. United States Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

5.5.1.1.1. Fixed Pipeline

5.5.1.1.2. Mobile Pipeline

5.5.1.2. United States Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

5.5.1.2.1. Gas

5.5.1.2.2. Liquid

5.5.1.3. United States Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

5.5.1.3.1. Pipelines

5.5.1.3.2. Cylinders

5.5.1.3.3. High-pressure tube trailers

5.5.1.4. United States Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

5.5.1.4.1. Commercial

5.5.1.4.2. Residential

5.5.1.4.3. Institutional & Government

5.5.1.4.4. Industrial

5.5.1.4.5. Transportation

5.5.2. Canada

5.5.2.1. Canada Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

5.5.2.1.1. Fixed Pipeline

5.5.2.1.2. Mobile Pipeline

5.5.2.2. Canada Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

5.5.2.2.1. Gas

5.5.2.2.2. Liquid

5.5.2.3. Canada Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

5.5.2.3.1. Pipelines

5.5.2.3.2. Cylinders

5.5.2.3.3. High-pressure tube trailers

5.5.2.4. Canada Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

5.5.2.4.1. Commercial

5.5.2.4.2. Residential

5.5.2.4.3. Institutional & Government

5.5.2.4.4. Industrial

5.5.2.4.5. Transportation

5.5.3. Mexico

5.5.3.1. Mexico Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

5.5.3.1.1. Fixed Pipeline

5.5.3.1.2. Mobile Pipeline

5.5.3.2. Mexico Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

5.5.3.2.1. Gas

5.5.3.2.2. Liquid

5.5.3.3. Mexico Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

5.5.3.3.1. Pipelines

5.5.3.3.2. Cylinders

5.5.3.3.3. High-pressure tube trailers

6. Europe Hydrogen Pipelines Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030)

6.1. Europe Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.2. Europe Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.3. Europe Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.4. Europe Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5. Europe Hydrogen Pipelines Market Size and Forecast, by Country (2023-2030)

6.5.1. United Kingdom

6.5.1.1. United Kingdom Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.1.2. United Kingdom Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.1.3. United Kingdom Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.1.4. United Kingdom Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.2. France

6.5.2.1. France Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.2.2. France Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.2.3. France Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.2.4. France Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.3. Germany

6.5.3.1. Germany Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.3.2. Germany Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.3.3. Germany Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.3.4. Germany Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.4. Italy

6.5.4.1. Italy Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.4.2. Italy Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.4.3. Italy Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.4.4. Italy Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.5. Spain

6.5.5.1. Spain Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.5.2. Spain Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.5.3. Spain Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.5.4. Spain Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.6. Sweden

6.5.6.1. Sweden Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.6.2. Sweden Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.6.3. Sweden Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.6.4. Sweden Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.7. Austria

6.5.7.1. Austria Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.7.2. Austria Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.7.3. Austria Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.7.4. Austria Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

6.5.8. Rest of Europe

6.5.8.1. Rest of Europe Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

6.5.8.2. Rest of Europe Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

6.5.8.3. Rest of Europe Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

6.5.8.4. Rest of Europe Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7. Asia Pacific Hydrogen Pipelines Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030)

7.1. Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.2. Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.3. Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.4. Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5. Asia Pacific Hydrogen Pipelines Market Size and Forecast, by Country (2023-2030)

7.5.1. China

7.5.1.1. China Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.1.2. China Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.1.3. China Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.1.4. China Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.2. S Korea

7.5.2.1. S Korea Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.2.2. S Korea Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.2.3. S Korea Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.2.4. S Korea Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.3. Japan

7.5.3.1. Japan Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.3.2. Japan Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.3.3. Japan Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.3.4. Japan Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.4. India

7.5.4.1. India Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.4.2. India Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.4.3. India Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.4.4. India Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.5. Australia

7.5.5.1. Australia Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.5.2. Australia Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.5.3. Australia Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.5.4. Australia Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.6. Indonesia

7.5.6.1. Indonesia Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.6.2. Indonesia Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.6.3. Indonesia Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.6.4. Indonesia Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.7. Malaysia

7.5.7.1. Malaysia Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.7.2. Malaysia Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.7.3. Malaysia Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.7.4. Malaysia Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.8. Vietnam

7.5.8.1. Vietnam Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.8.2. Vietnam Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.8.3. Vietnam Hydrogen Pipelines Market Size and Forecast, By Distribution Method 2023-2030)

7.5.8.4. Vietnam Hydrogen Pipelines Market Size and Forecast, By Application 2023-2030)

7.5.9. Taiwan

7.5.9.1. Taiwan Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.9.2. Taiwan Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.9.3. Taiwan Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.9.4. Taiwan Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

7.5.10. Rest of Asia Pacific

7.5.10.1. Rest of Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

7.5.10.2. Rest of Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

7.5.10.3. Rest of Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

7.5.10.4. Rest of Asia Pacific Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

8. Middle East and Africa Hydrogen Pipelines Market Size and Forecast (by Value in USD Billion) (2023-2030

8.1. Middle East and Africa Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

8.2. Middle East and Africa Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

8.3. Middle East and Africa Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

8.4. Middle East and Africa Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

8.5. Middle East and Africa Hydrogen Pipelines Market Size and Forecast, by Country (2023-2030)

8.5.1. South Africa

8.5.1.1. South Africa Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

8.5.1.2. South Africa Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

8.5.1.3. South Africa Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

8.5.1.4. South Africa Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

8.5.2. GCC

8.5.2.1. GCC Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

8.5.2.2. GCC Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

8.5.2.3. GCC Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

8.5.2.4. GCC Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

8.5.3. Nigeria

8.5.3.1. Nigeria Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

8.5.3.2. Nigeria Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

8.5.3.3. Nigeria Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

8.5.3.4. Nigeria Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

8.5.4. Rest of ME&A

8.5.4.1. Rest of ME&A Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

8.5.4.2. Rest of ME&A Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

8.5.4.3. Rest of ME&A Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

8.5.4.4. Rest of ME&A Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

9. South America Hydrogen Pipelines Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030

9.1. South America Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

9.2. South America Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

9.3. South America Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

9.4. South America Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

9.5. South America Hydrogen Pipelines Market Size and Forecast, by Country (2023-2030)

9.5.1. Brazil

9.5.1.1. Brazil Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

9.5.1.2. Brazil Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

9.5.1.3. Brazil Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

9.5.1.4. Brazil Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

9.5.2. Argentina

9.5.2.1. Argentina Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

9.5.2.2. Argentina Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

9.5.2.3. Argentina Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

9.5.2.4. Argentina Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

9.5.3. Rest Of South America

9.5.3.1. Rest Of South America Hydrogen Pipelines Market Size and Forecast, By Pipeline Types (2023-2030)

9.5.3.2. Rest Of South America Hydrogen Pipelines Market Size and Forecast, By Hydrogen Form (2023-2030)

9.5.3.3. Rest Of South America Hydrogen Pipelines Market Size and Forecast, By Distribution Method (2023-2030)

9.5.3.4. Rest Of South America Hydrogen Pipelines Market Size and Forecast, By Application (2023-2030)

10. Company Profile: Key Players

10.1. Cenergy Holdings

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Cenergy Holdings

10.3. SoluForce B.V.

10.4. Salzgitter AG

10.5. Gruppo Sarplast S.r.l

10.6. Tenaris

10.7. Hexagon Purus

10.8. Pipelife International GmbH

10.9. Europe Technologies

10.10. H2 Clipper, Inc.

10.11. NPROXX

10.12. GF Piping Systems

10.13. ArcelorMittal

10.14. Jindal Saw Limited

10.15. Linde PLC

10.16. Hexagon Purus

10.17. ArcelorMittal

10.18. Salzgitter AG

10.19. Tenaris

10.20. GF Piping Systems

10.21. Air Liquide

10.22. Air Products and Chemicals, Inc.

10.23. Shell plc

10.24. Ferrostaal GmbH

10.25. ENGIE

10.26. ITM Power

10.27. Plug Power

10.28. Toyota Tsusho Corporation

10.29. Nel ASA

10.30. Hyundai

10.31. Covestro AG

10.32. Chart Industries

10.33. Snam S.p.A.

11. Key Findings

12. Industry Recommendations

13. Hydrogen Pipelines Market: Research Methodology