Infant Nutrition Market: Global Industry Analysis and Forecast (2024-2030)

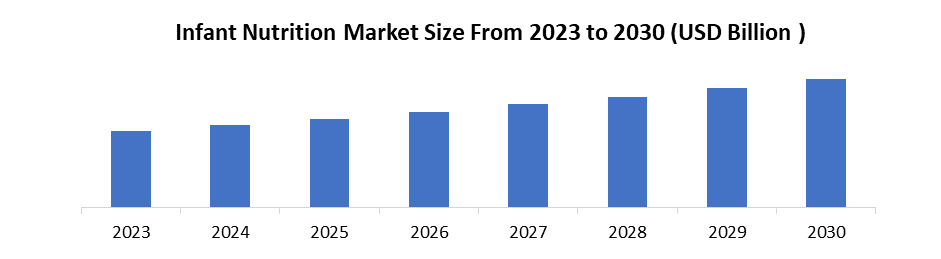

Infant Nutrition Market size was valued at USD 64.86 Bn. in 2023 and the Infant Nutrition revenue is expected to grow at a CAGR of 8 % from 2024 to 2030, reaching nearly USD 108.4 Bn. by 2030.

Format : PDF | Report ID : SMR_1897

Infant Nutrition Market Overview:

Children between the ages of birth and one year are considered infants. Infants grow very rapidly and have special nutritional requirements that are different from other age groups. Infant nutrition is designed to meet the special needs of very young children and give them a healthy start in life. Children under one-year-old do not have fully mature organ systems. They need nutrition that is easy to digest and contains enough calories, vitamins, minerals, and other nutrients to grow and develop normally. Infants also need the proper number of fluids for their immature kidneys to process. In addition, infant nutrition involves avoiding exposing infants to substances that are harmful to their growth and development.

The Infant Nutrition market provides market size, share, scope, growth, and potential of the industry. It offers valuable information to help businesses identify opportunities and potential risks within the market. In addition, the global Infant Nutrition market research reports provide detailed analysis of market conditions, trends, challenges, and recommendations for stakeholders in the industry. The reports highlight the increasing demand for infant nutrition products thanks to rising awareness about the importance of early childhood nutrition. Key findings include the growing popularity of organic and natural baby food products, as well as the impact of e-commerce on distribution channels.

To get more Insights: Request Free Sample Report

Infant Nutrition Market Dynamics:

Health Consciousness, Urbanization, and Changing Parental Priorities to Drive the Infant Nutrition Market

A significant driver of the Infant nutrition market is the growing consumer awareness of health and wellness. The heightened consciousness has resulted in a surge in demand for Infant nutrition products that are perceived as healthier and more natural alternatives. The growing prevalence of malnutrition among children and newborns has increased the need for Infant Nutrition. Because newborns lack the necessary muscles and teeth to chew properly, baby food and baby formula serve as their major sources of nutrition. Parents are becoming more conscious of the importance of proper nutrition in their child’s general growth and development.

The growing urban population and changing lifestyles of individuals as a result of significant increases in disposable incomes, are driving the overall growth of the Infant Nutrition market. Parents from different regions have slightly different top concerns for their children. Despite the differences, there is a clear trend that parents are increasingly seeking out products that use prebiotics and probiotics.

Challenges Facing the Infant Nutrition Market

Competition from Breast Milk Banks the proliferation of breast milk banks, which are places where moms give and collect breast milk, is hampering the market for infant nutrition. Donated breast milk is preferred by certain parents over commercial formula, which affects the demand in the market.

Rising concerns regarding the health implications of certain ingredients in baby formula and negative public perception significantly impact market demand. Instances of product recalls or controversies related to formula safety erode consumer trust and lead to a decline in sales. Additionally, Stringent regulations and increased scrutiny from regulatory bodies pose a significant threat to the baby infant formula market. Any changes in regulatory standards or compliance issues impact manufacturing processes, leading to potential disruptions and additional costs for companies.

Infant Nutrition Market Segment Analysis:

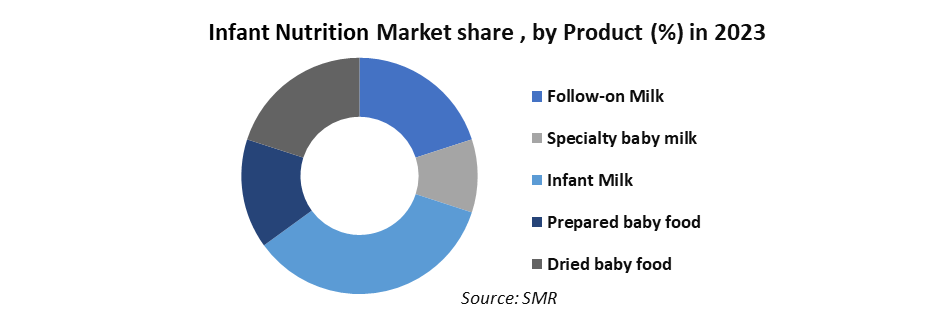

By Product, Infant Milk is the dominant segment in the Infant Nutrition Market. Infant milk, the initial feeding option for newborns, dominates the Infant Nutrition Market. Trends include a focus on probiotics, and the popularity of organic variants, reflecting parents’ desire for high-quality and wholesome options. Chinese parents are increasingly spending more on infant milk powder, with sales of premium and super-premium products rising faster than regular products. In 2023, Bobbie, a maker of clean-label infant formula, acquired Nature's One, an Ohio-based pediatric nutrition company.

- The top 3 exporters of Baby formula are China with 1,147 shipments followed by the United Kingdom with 818 and Netherlands at the 3rd spot with 466 shipments.

Infant Nutrition Market Regional Insight:

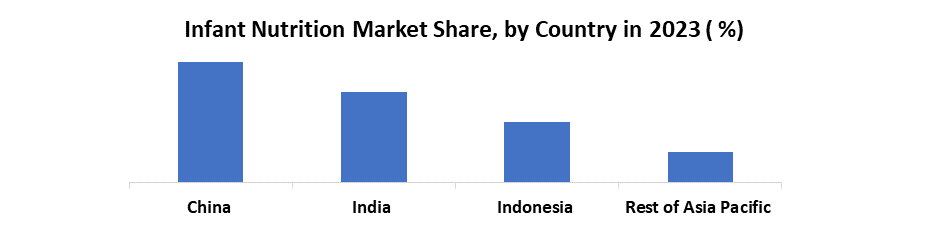

Asia Pacific held the largest share of the Infant Nutrition Market. The Asia-Pacific region's high birth rates and growing purchasing power have boosted demand for infant food and milk formula-based goods. China is the largest market in the region. Additionally, growing economies such as India and Indonesia are expected to fuel the region's market growth. In China, only 21% of babies are exclusively breastfed. Whenever babies are not exclusively breastfed during the first 6 months or when they start with complementary feeding at the age of 6 months, the most preferred second food is cow or buffalo milk.

The nutrient composition of cow or buffalo milk is not suitable for babies less than 1 year old and leads to certain deficiencies, for example, iron deficiency anemia. formula feeding is mainly used due to lack of breastmilk and with the perception that the child isn’t getting enough food, differences have been spotted in each market. While breast milk is the gold standard for infant feeding, moms in Indonesia, Vietnam, and China use formula milk to provide the right number of vitamins and growth. In Australia, the UK, and the US, the usage of formula is dominated by shared feeding responsibility between parents or caregivers.

Danone launched a new milk-formulated Infant Nutrition product, Nutrilon Yunhui Stage 3, in China in April 2022, containing a high level of essential vitamins. Additionally, Jennewein Biotechnologie and Yili Group signed a Memorandum of Understanding to develop innovative infant formula and Nutrition products tailored to the Chinese market through research and development of infant microbiomes and human milk oligosaccharides.

- In December 2023, the Codex Alimentarius, a document published jointly by the Food and Agriculture Organization of the United States (US FAO) and the World Health Organization (WHO) detailing guidelines and codes of practice for follow-up formula and other related products intended for children aged between one and three years, was released.

Infant Nutrition Market Competitive Landscape:

- In 2023, Danone Early Life Nutrition introduced a new infant formula containing milk droplets that closely mimic the structure found in mother's milk in China.

- In 2023, Gerber, a subsidiary of Nestle and the frontrunner in early childhood nutrition received clean-label certifications from a renowned non-profit clean-label project.

- November 2023, ELSE NUTRITION HOLDINGS INC. announced its multi-stage partnership with Danone S.A., wherein the first stage of their partnership involves providing Danone access to Else Nutrition's plant-based baby food portfolio. The signing of the definitive agreement was scheduled for the end of the first quarter of 2024, allowing Danone to negotiate opportunities beyond product commercialization.

- October 2023 (Launch), Nestlé S.A. launched its new infant nutrition product, 'Sinergity', a proprietary blend comprising a specific probiotic combined with six different human milk oligosaccharides (HMOs). Probiotics play a key role in the development of the gut microbiome and infant immunity. Meanwhile, HMOs, a crucial component of breastmilk, support the development of intestinal microbiota and the fortification of the immune system during early childhood.

Infant Nutrition Market Scope:

|

Infant Nutrition Market Scope |

|

|

Market Size in 2023 |

USD 64.86 Bn. |

|

Market Size in 2030 |

USD 108.4 Bn. |

|

CAGR (2024-2030) |

8 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Follow-on Milk Specialty baby milk Infant Milk Prepared baby food Dried baby food |

|

By Form Solid baby food Liquid baby food |

|

|

By Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Infant Nutrition Market Key Players:

- Abbott Laboratories

- Danone S.A.

- Nestlé

- Mead Johnson Nutrition Company

- Reckitt Benckiser Group plc

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- The Honest Company

- HiPP GmbH & Co. Vertrieb KG

- Ausnutria Dairy Corporation Ltd.

- Beingmate Baby & Child Food Co., Ltd.

- FrieslandCampina

- Feihe International Inc.

- Hero Group

- Arla Foods amba

- Pinnacle Foods Inc.

- Plum, PBC

- Meiji Holdings Co. Ltd.

- Pfizer Inc.

- Morinaga Milk

- Perrigo

- Sun-Maid Growers of California, Inc.

- XXX Inc.

Frequently Asked Questions

Competition from breastfeeding milk bank is the challenge in the Infant Nutrition Market.

The Market size was valued at USD 64.86 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 8 % from 2024 to 2030, reaching nearly USD 108.4 Billion.

The segments covered in the market report are by Product, form and Distribution Channel.

1. Infant Nutrition Market: Research Methodology

2. Infant Nutrition Market: Executive Summary

3. Infant Nutrition Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Infant Nutrition Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Infant Nutrition Market: Dynamics

6.1. Market Trends by Region

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Middle East and Africa

6.1.5. South America

6.2. Market Drivers by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Restraints

6.4. Market Opportunities

6.5. Market Challenges

6.6. PORTER’s Five Forces Analysis

6.7. PESTLE Analysis

6.8. Strategies for New Entrants to Penetrate the Market

6.9. Regulatory Landscape by Region

6.9.1. North America

6.9.2. Europe

6.9.3. Asia Pacific

6.9.4. Middle East and Africa

6.9.5. South America

7. Infant Nutrition Market Size and Forecast by Segments (by Value Units)

7.1. Infant Nutrition Market Size and Forecast, by Product (2023-2030)

7.1.1. Follow-on Milk

7.1.2. Specialty baby milk

7.1.3. Infant Milk

7.1.4. Prepared baby food

7.1.5. Dried baby food

7.2. Infant Nutrition Market Size and Forecast, by Form (2023-2030)

7.2.1. Solid baby food

7.2.2. Liquid baby food

7.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2023-2030)

7.3.1. Online

7.3.2. Offline

7.4. Infant Nutrition Market Size and Forecast, by Region (2023-2030)

7.4.1. North America

7.4.2. Europe

7.4.3. Asia Pacific

7.4.4. Middle East and Africa

7.4.5. South America

8. North America Infant Nutrition Market Size and Forecast (by Value Units)

8.1. North America Infant Nutrition Market Size and Forecast, by Product (2023-2030)

8.1.1. Follow-on Milk

8.1.2. Specialty baby milk

8.1.3. Infant Milk

8.1.4. Prepared baby food

8.1.5. Dried baby food

8.2. Infant Nutrition Market Size and Forecast, by Form (2023-2030)

8.2.1. Solid baby food

8.2.2. Liquid baby food

8.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2023-2030)

8.3.1. Online

8.3.2. Offline

8.4. North America Infant Nutrition Market Size and Forecast, by Country (2023-2030)

8.4.1. United States

8.4.2. Canada

8.4.3. Mexico

9. Europe Infant Nutrition Market Size and Forecast (by Value Units)

9.1. Europe Infant Nutrition Market Size and Forecast, by Product (2023-2030)

9.1.1. Follow-on Milk

9.1.2. Specialty baby milk

9.1.3. Infant Milk

9.1.4. Prepared baby food

9.1.5. Dried baby food

9.2. Infant Nutrition Market Size and Forecast, by Form (2023-2030)

9.2.1. Solid baby food

9.2.2. Liquid baby food

9.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2023-2030)

9.3.1. Online

9.3.2. Offline

9.4. Europe Infant Nutrition Market Size and Forecast, by Country (2023-2030)

9.4.1. UK

9.4.2. France

9.4.3. Germany

9.4.4. Italy

9.4.5. Spain

9.4.6. Sweden

9.4.7. Russia

9.4.8. Rest of Europe

10. Asia Pacific Infant Nutrition Market Size and Forecast (by Value Units)

10.1. Asia Pacific Infant Nutrition Market Size and Forecast, by Product (2023-2030)

10.1.1. Follow-on Milk

10.1.2. Specialty baby milk

10.1.3. Infant Milk

10.1.4. Prepared baby food

10.1.5. Dried baby food

10.2. Infant Nutrition Market Size and Forecast, by Form (2023-2030)

10.2.1. Solid baby food

10.2.2. Liquid baby food

10.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2023-2030)

10.3.1. Online

10.3.2. Offline

10.4. Asia Pacific Air Traffic Control (ATC) Communications Market Size and Forecast, by Country (2023-2030)

10.4.1. China

10.4.2. S Korea

10.4.3. Japan

10.4.4. India

10.4.5. Australia

10.4.6. Indonesia

10.4.7. Malaysia

10.4.8. Vietnam

10.4.9. Taiwan

10.4.10. Bangladesh

10.4.11. Pakistan

10.4.12. Rest of Asia Pacific

11. Middle East and Africa Infant Nutrition Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Infant Nutrition Market Size and Forecast, by Product (2023-2030)

11.1.1. Follow-on Milk

11.1.2. Specialty baby milk

11.1.3. Infant Milk

11.1.4. Prepared baby food

11.1.5. Dried baby food

11.2. Middle East and Africa Market Size and Forecast, by Form (2023-2030)

11.2.1. Solid baby food

11.2.2. Liquid baby food

11.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2023-2030)

11.3.1. Online

11.3.2. Offline

11.4. Middle East and Africa Infant Nutrition Market Size and Forecast, by Country (2023-2030)

11.4.1. South Africa

11.4.2. GCC

11.4.3. Egypt

11.4.4. Nigeria

11.4.5. Rest of ME&A

12. South America Infant Nutrition Market Size and Forecast (by Value Units)

12.1. South America Infant Nutrition Market Size and Forecast, by Product (2023-2030)

12.1.1. Follow-on Milk

12.1.2. Specialty baby milk

12.1.3. Infant Milk

12.1.4. Prepared baby food

12.1.5. Dried baby food

12.2. South America Market Size and Forecast, by Form (2023-2030)

12.2.1. Solid baby food

12.2.2. Liquid baby food

12.3. Infant Nutrition Market Size and Forecast, by Distribution Channel (2023-2030)

12.3.1. Online

12.3.2. Offline

12.4. South America Infant Nutrition Market Size and Forecast, by Country (2023-2030)

12.4.1. Brazil

12.4.2. Argentina

12.4.3. Rest of South America

13. Company Profile: Key players

13.1. Abbott Laboratories

13.1.1.1. Company Overview

13.1.1.2. Financial Overview

13.1.1.3. Business Portfolio

13.1.1.4. SWOT Analysis

13.1.1.5. Business Strategy

13.1.1.6. Recent Developments

13.2. Danone S.A.

13.3. Nestlé

13.4. Mead Johnson Nutrition Company

13.5. Reckitt Benckiser Group plc

13.6. The Kraft Heinz Company

13.7. The Hain Celestial Group, Inc.

13.8. The Honest Company

13.9. HiPP GmbH & Co. Vertrieb KG

13.10. Ausnutria Dairy Corporation Ltd.

13.11. Beingmate Baby & Child Food Co., Ltd.

13.12. FrieslandCampina

13.13. Feihe International Inc.

13.14. Hero Group

13.15. Arla Foods amba

13.16. Pinnacle Foods Inc.

13.17. Plum, PBC

13.18. Meiji Holdings Co. Ltd.

13.19. Pfizer Inc.

13.20. Morinaga Milk

13.21. Perrigo

13.22. Sun-Maid Growers of California, Inc.

13.23. XXX Inc.

14. Key Findings

15. Industry Recommendation