Inverter Market: Global Industry Analysis and Forecast (2024-2030)

Global Inverter Market size was valued at USD 19.10 Bn. in 2023 and is expected to reach USD 54.31 Bn. by 2030, at a CAGR of 16.1%.

Format : PDF | Report ID : SMR_2140

Inverter Market Overview

An inverter converts DC voltage to AC voltage, which is usually used to supply electricity from sources such as batteries and solar panels. The output AC voltage usually matches the grid supply voltage of 120V or 240V, depending on the country. Inverters act as standalone units or backup power supplies in applications such as solar power with separate battery charging. They are also installed in larger systems such as power supply units (PSUs) or uninterruptible power supplies (UPSs), where the inverter input comes from DC-rectified AC mains.

Inverters are classified based on switching technology, switch type, waveform, frequency and output waveform, which affects their circuit configurations and overall performance. Basic inverter circuits include oscillators, control circuits, driving circuits for electrical devices, switching devices, and transformers, which boost Inverter Market growth. DC to AC conversion is the alternate switching of devices such as MOSFETs or power transistors on and off, generating pulses sent to the main part of the transformer. This creates an alternating voltage in the secondary winding, increasing the voltage accordingly to grid-level matches, typically 12V DC to 120V or up to 240V AC.

Increasing demand for renewable energy, technological advancements and increasing demand for uninterruptible power supply are driving the Inverter Market growth. Inverters play an important role in converting DC power from components such as solar panels and batteries to AC power internally for grid or standalone applications. Increasing adoption of solar energy systems, as the commercial and industrial sectors benefit from the need for reliable and efficient energy management solutions.

Technological advances such as the development of smart inverters with grid-support functionality and improved performance are also driving the market growth. Key players in the inverter industry include SMA Solar Technology AG, ABB Limited, Huawei Technologies Co., Ltd., Enphase Energy, Inc. and others. These companies focus on product innovation, strategic communication and expansion of their products to strengthen their market position.

To get more Insights: Request Free Sample Report

Inverter Market Trend

Rapid Adoption of Smart Inverters

The rapid deployment of smart inverters is a growing trend in the inverter market, driven by the increasing integration of solar and other distributed energy (DER) into the electricity grid. Unlike traditional inverters, which only convert direct current (DC) from solar panels to alternating current (AC) for consumer use, smart inverters offer voltage regulation, frequency support, and ride-through. These features are important as the number of DERs in the grid increases, and the inverter efficiency needs to increase.

To support this, existing technical standards such as IEEE 1547 and UL 1741 are being updated to fully identify smart inverter capabilities. States are actively working to incorporate these updated standards through complex technical and legal frameworks. Organizations such as the Interstate Renewable Energy Council (IREC) are playing a key role in this transition, monitoring national progress and collaborating with partners to ensure the successful integration of smart inverters.

IREC services, such as the IEEE 1547-2018 Adoption Decision Options Matrix and the IEEE 1547™-2018 Adoption Monitor, help regulators and stakeholders align with the latest network regulations and standards. Smart inverters not only enable DER hosting not only high but also grid reliability and energy stability in different countries and markets. Advancements include California’s implementation of the “volt-watt” function, a smart inverter capability that supports the grid but reduces solar power production for individual customers. This milestone underscores the importance of balancing grid needs with consumer protection, which drives Inverter Market growth.

IEEE 1547.1-2020 established testing procedures for smart inverter certification in the revised IEEE 1547-2018 standard, paving the way for widespread adoption and grid support services by the ground-breaking National Renewable Energy Laboratory (NREL). It contributes to this task by developing smart inverters, control algorithms and power system impact studies. This effort emphasizes the importance of using advanced power electronics in the integration of renewable energy such as photovoltaic (PV) and energy storage devices in the distribution system.

Inverter Market Dynamics

Increasing integration of renewable energy sources to Boost Inverter Market

Renewable energy comes from limitless natural sources such as sunlight, wind, and waves for electricity generation, heating, cooling and transportation. These sources offer a sustainable alternative to finite fossil fuels such as coal, oil, and natural gas. Countries are striving to reduce carbon emissions and tackle climate change and the use of renewable energy is expanding rapidly. Technological advances and lower costs have largely driven the explosive rise in solar and wind energy, which is also helping to boost the Inverter Market growth.

Inverters required to convert direct current (DC) from renewable sources to alternating current (AC) used by households and businesses play a key role in this transition. Modern inverters, especially those with smart capabilities, transform energy and provide grid stability, reliability, and efficiency through advanced functions such as voltage regulation.

Government policies and incentives, such as updated standards such as IEEE 1547 and UL 1741, mandate the use of advanced inverters, increasing the demand. Various forms of energy are stored through power generation new hybrid systems that integrate multiple energy sources such as solar and wind. It is necessary to use an inverter with multiple-maximum-power-point monitors (MPPT) to monitor the inputs properly. Environmental benefits of renewable energy, such as reduced greenhouse gas emissions and air pollution, and decreased energy costs are factors that drive Inverter Market growth. Renewable Energy System also improves independence, which makes it attractive for remote, coastal, or isolated communities.

High initial cost and complex maintenance requirements associated with advanced inverter systems hamper Market growth

The financial cost of purchasing and installing an advanced inverter, especially one with capabilities, such as multiple maximum power point monitors (MPPTs), and real-time monitoring, is high. This high initial cost deters residential users, small and medium enterprises, and even some large organizations from investing in renewable energy solutions despite long-term cost savings. Financial constraints are particularly evident in regions where access to financial channels is limited due to low energy prices or incentives, which hamper Inverter Market growth. The impressive characteristics of this inverter aside from requiring specialized knowledge for installation, operation and maintenance, which scarce and expensive.

Routine maintenance and periodic replacement are necessary to ensure proper operation of these systems, increasing overall operating costs. Experienced technicians are required to troubleshoot any technical problems handled, and any mistake results in significant downtime, affecting energy production and economic profitability and hampering Inverter Market growth. The complexity of integrating an advanced inverter with other renewable energy sources such as solar panels, and air conditioners require extensive testing and refinement to ensure all parts work together seamlessly, which is time-consuming and costly.

Inverter Market Segment Analysis

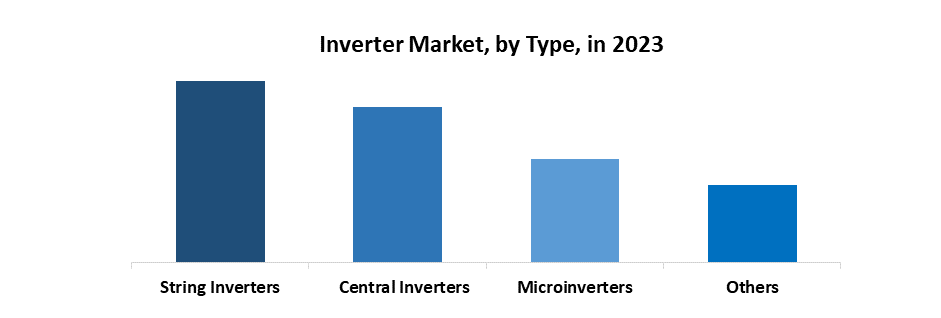

Based on Type, the market is segmented into String Inverters, Central Inverters, Microinverters and Others. String Inverters held the largest Inverter Market share in 2023. String inverters are an attractive option for both residential and commercial applications due to their low cost compared to other types, such as microinverters and central inverters. The technology behind string inverters is well-established and reliable, resulting in low maintenance costs and longevity. This reliability and ease of maintenance further contribute to their widespread acceptance. String inverters also offer a straightforward installation process, which simplifies deployment and reduces installation time and labor costs.

String inverters are highly versatile and can be used in a variety of solar installation sizes, from small residential systems to medium-sized commercial projects. This flexibility allows them to meet the needs of a wide range of customers and applications role, increasing their market interest. Technological advances have also played an important role in the control of transmission lines.

The combination of improved efficiency, improved performance in semi-shaded conditions, and smart grid technologies has improved the efficiency and capability of modern wire inverters, increasing their competitiveness in the Inverter Market. String inverters are compatible with a wide range of solar equipment systems and are readily available, contributing to widespread deployment in high-density solar regions such as Europe, Asia-Pacific, and North America.

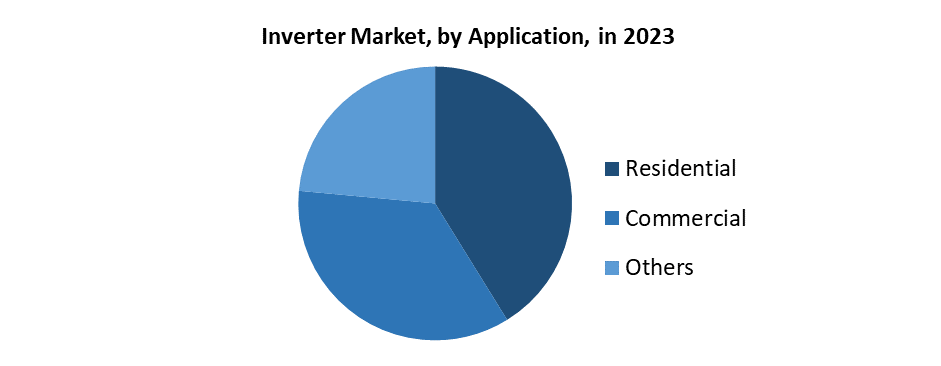

Based on the Application, the market is categorized into Residential, Commercial and others. Commercial is expected to dominate the Inverter Market during the forecast period. Commercial properties such as office buildings, office buildings, malls, and industrial complexes require large solar systems. This benefits greatly from the increased economy offered by inverters, especially string central inverters, which makes it possible which is ideal for this project.

Fiscal incentives and cost savings associated with solar energy largely motivate the industry, as initial investments in inverters and solar panels are offset by long-term reductions in energy costs. This economic attraction of government incentives, subsidies, and tax credits aimed at encouraging renewable energy adoption and getting more energy, lowers the barrier to entry for commercial solar installations.

Corporate social responsibility (CSR) and sustainability goals motivate businesses to embrace renewable energy to reduce their carbon footprint enhance their environmental stewardship and drive Inverter Market growth. Technological advances have also made inverters more efficient, and capable of handling complex energy applications, such as remote monitoring and smart grid compatibility, for which they are particularly valuable to retail establishments.

Inverter Market Regional Insights

Asia Pacific dominated the Inverter Market in 2023 and is expected to continue its dominance over the forecast period. Rapid industrialization and urbanization in countries such as China, India, Japan and South Korea are increasing energy demands, and there is a need to adopt efficient and sustainable energy solutions. China has been heavily investing in renewable energy and becoming the largest producer of solar panels and wind turbines in the world.

The Chinese government's aggressive renewable energy targets, subsidies, and sound regulatory framework have motivated the use of advanced inverters to efficiently deploy renewable energy in the grid. India has set ambitious targets for solar capacity and has implemented policies to promote solar power generation, which has led to higher demand for inverters. The inverter market share in India has grown significantly due to the commitment of these countries to reduce their carbon emissions and rely on fossil fuels.

Technological advances and the presence of major market players have enhanced its dominance in the Asia Pacific. The region is home to many leading inverter manufacturers who are constantly innovating and offering cost-effective solutions to meet the needs of the market. The region benefits from economies of scale, including large-scale manufacturing and cost-cutting exports, which drive Inverter Market growth. Improvements in smart grid systems and investments in energy storage solutions in countries such as South Korea and Australia boost advanced inverter demand, good weather such as sunshine, and the solar inverters market share.

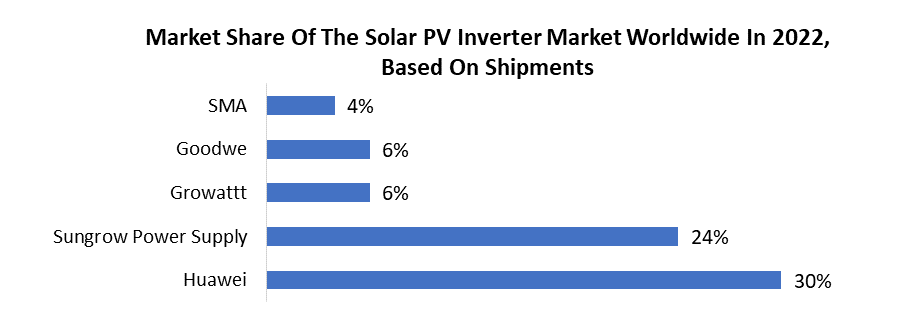

In 2022, the global solar PV inverter market saw significant growth, with Asia Pacific emerging as the dominant region, accounting for the largest share of shipments. Major manufacturers like Huawei, Sungrow, and Growatt led the market, driven by robust solar energy adoption and government incentives in the region.

Inverter Market Scope

|

Inverter Market |

|

|

Market Size in 2023 |

USD 19.10 Bn. |

|

Market Size in 2030 |

USD 54.31 Bn. |

|

CAGR (2024(2030) |

16.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Inverter Market Segments |

By Type

|

|

By Power Rating

|

|

|

By Connection Type

|

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa ( South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Inverters Market Key players

North America

- Enphase Energy ( Fremont, California, USA)

- SolarEdge Technologies (Milpitas, California, USA)

- SunPower Corporation ( San Jose, California, USA)

- OutBack Power Technologies ( Arlington, Washington, USA)

- SMA America ( Rocklin, California, USA )

- Schneider Electric ( Andover, Massachusetts, USA)

- General Electric (GE Renewable Energy) ( Schenectady, New York, USA)

Europe

- SMA Solar Technology AG (Niestetal, Germany)

- Fronius International GmbH (Pettenbach, Austria)

- ABB (Zurich, Switzerland)

- Ingeteam (Zamudio, Spain)

- Siemens (Munich, Germany)

- Kostal Solar Electric (Freiburg, Germany)

- FIMER (Terranuova Bracciolini, Italy)

- Delta Electronics (Hoofddorp, Netherlands)

- FIMER (Terranuova Bracciolini, Italy)

- Kaco New Energy (Neckarsulm, Germany)

Asia Pacific

- Huawei Technologies (Shenzhen, China)

- Sungrow Power Supply Co., Ltd. v Hefei, China)

- Delta Electronics (Taipei, Taiwan)

- Growatt New Energy Technology (Shenzhen, China)

- GoodWe (Jiangsu GoodWe Power Supply Technology Co., Ltd.) (Suzhou, China)

- TBEA Sunoasis Co., Ltd. (Urumqi, China)

- Hitachi ( Tokyo, Japan)

Frequently Asked Questions

Asia Pacific is expected to dominate the Inverter Market during the forecast period.

The Inverter Market size is expected to reach USD 54.31 Billion by 2030.

The major top players in the Global Inverter Market are Enphase Energy - Fremont, California, USA), SolarEdge Technologies - Milpitas, California, USA), SunPower Corporation - San Jose, California, USA), OutBack Power Technologies - Arlington, Washington, USA),SMA America - Rocklin, California, USA ), Schneider Electric - Andover, Massachusetts, USA), General Electric (GE Renewable Energy) - Schenectady, New York, USA)and others.

Increasing Demand for Renewable Energy and government initiatives and subsidies are expected to drive market growth during the forecast period.

1. Inverter Market: Research Methodology

2. Inverter Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Inverter Market: Competitive Landscape

3.1. MMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Type Segment

3.3.3. Connection Type Segment

3.3.4. Revenue (2023)

3.3.5. Headquarter

3.4. Mergers and Acquisitions Details

4. Inverter Market: Dynamics

4.1. Inverter Market Trends

4.2. Inverter Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Value Chain Analysis

4.6. Analysis of Government Schemes and Initiatives For Inverter Market

5. Inverter Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Inverter Market Size and Forecast, by Type (2023-2030)

5.1.1. String Inverters

5.1.2. Central Inverters

5.1.3. Microinverters

5.1.4. Others

5.2. Inverter Market Size and Forecast, by Power Rating (2023-2030)

5.2.1. Low Power (Below 10 kW)

5.2.2. Medium Power (10 kW - 100 kW)

5.2.3. High Power (Above 100 kW)

5.3. Inverter Market Size and Forecast, by Connection Type (2023-2030)

5.3.1. Grid-Tied (Grid-Connected) Inverters

5.3.2. Off-grid (Stand-Alone) Inverters

5.3.3. Others

5.4. Inverter Market Size and Forecast, by Application (2023-2030)

5.4.1. Residential

5.4.2. Commercial

5.4.3. Others

5.5. Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

5.5.1. Direct Sales

5.5.2. Distributors and Wholesalers

5.5.3. Online Retailer

5.5.4. Others

5.6. Inverter Market Size and Forecast, by Region (2023-2030)

5.6.1. North America

5.6.2. Europe

5.6.3. Asia Pacific

5.6.4. Middle East and Africa

5.6.5. South America

6. North America Inverter Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. North America Inverter Market Size and Forecast, by Type (2023-2030)

6.1.1. String Inverters

6.1.2. Central Inverters

6.1.3. Microinverters

6.1.4. Others

6.2. North America Inverter Market Size and Forecast, by Power Rating (2023-2030)

6.2.1. Low Power (Below 10 kW)

6.2.2. Medium Power (10 kW - 100 kW)

6.2.3. High Power (Above 100 kW)

6.3. North America Inverter Market Size and Forecast, by Connection Type (2023-2030)

6.3.1. Grid-Tied (Grid-Connected) Inverters

6.3.2. Off-grid (Stand-Alone) Inverters

6.3.3. Others

6.4. North America Inverter Market Size and Forecast, by Application (2023-2030)

6.4.1. Residential

6.4.2. Commercial

6.4.3. Others

6.5. North America Inverter Market Size and Forecast, by Distribution Channel(2023-2030)

6.5.1. Direct Sales

6.5.2. Distributors and Wholesalers

6.5.3. Online Retailer

6.5.4. Others

6.6. North America Inverter Market Size and Forecast, by Country (2023-2030)

6.6.1. United States

6.6.2. Canada

6.6.3. Mexico

7. Europe Inverter Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Europe Inverter Market Size and Forecast, by Type (2023-2030)

7.2. Europe Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.3. Europe Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.4. Europe Inverter Market Size and Forecast, by Application (2023-2030)

7.5. Europe Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6. Europe Inverter Market Size and Forecast, by Country (2023-2030)

7.6.1. United Kingdom

7.6.1.1. United Kingdom Inverter Market Size and Forecast, by Type (2023-2030)

7.6.1.2. United Kingdom Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.1.3. United Kingdom Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.1.4. United Kingdom Inverter Market Size and Forecast, by Application (2023-2030)

7.6.1.5. United Kingdom Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.2. France

7.6.2.1. France Inverter Market Size and Forecast, by Type (2023-2030)

7.6.2.2. France Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.2.3. France Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.2.4. France Inverter Market Size and Forecast, by Application (2023-2030)

7.6.2.5. France Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.3. Germany

7.6.3.1. Germany Inverter Market Size and Forecast, by Type (2023-2030)

7.6.3.2. Germany Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.3.3. Germany Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.3.4. Germany Inverter Market Size and Forecast, by Application (2023-2030)

7.6.3.5. Germany Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.4. Italy

7.6.4.1. Italy Inverter Market Size and Forecast, by Type (2023-2030)

7.6.4.2. Italy Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.4.3. Italy Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.4.4. Italy Inverter Market Size and Forecast, by Application (2023-2030)

7.6.4.5. Italy Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.5. Spain

7.6.5.1. Spain Inverter Market Size and Forecast, by Type (2023-2030)

7.6.5.2. Spain Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.5.3. Spain Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.5.4. Spain Inverter Market Size and Forecast, by Application (2023-2030)

7.6.5.5. Spain Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.6. Russia

7.6.6.1. Russia Inverter Market Size and Forecast, by Type (2023-2030)

7.6.6.2. Russia Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.6.3. Russia Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.6.4. Russia Inverter Market Size and Forecast, by Application (2023-2030)

7.6.6.5. Russia Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.7. Austria

7.6.7.1. Austria Inverter Market Size and Forecast, by Type (2023-2030)

7.6.7.2. Austria Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.7.3. Austria Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.7.4. Austria Inverter Market Size and Forecast, by Application (2023-2030)

7.6.7.5. Austria Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

7.6.8. Rest of Europe

7.6.8.1. Rest of Europe Inverter Market Size and Forecast, by Type (2023-2030)

7.6.8.2. Rest of Europe Inverter Market Size and Forecast, by Power Rating (2023-2030)

7.6.8.3. Rest of Europe Inverter Market Size and Forecast, by Connection Type (2023-2030)

7.6.8.4. Rest of Europe Inverter Market Size and Forecast, by Application (2023-2030)

7.6.8.5. Rest of Europe Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8. Asia Pacific Inverter Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Asia Pacific Inverter Market Size and Forecast, by Type (2023-2030)

8.2. Asia Pacific Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.3. Asia Pacific Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.4. Asia Pacific Inverter Market Size and Forecast, by Application (2023-2030)

8.5. Asia Pacific Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6. Asia Pacific Inverter Market Size and Forecast, by Country (2023-2030)

8.6.1. China

8.6.1.1. China Inverter Market Size and Forecast, by Type (2023-2030)

8.6.1.2. China Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.1.3. China Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.1.4. China Inverter Market Size and Forecast, by Application (2023-2030)

8.6.1.5. China Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6.2. S Korea

8.6.2.1. S Korea Inverter Market Size and Forecast, by Type (2023-2030)

8.6.2.2. S Korea Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.2.3. S Korea Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.2.4. S Korea Inverter Market Size and Forecast, by Application (2023-2030)

8.6.2.5. S Korea Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6.3. Japan

8.6.3.1. Japan Inverter Market Size and Forecast, by Type (2023-2030)

8.6.3.2. Japan Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.3.3. Japan Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.3.4. Japan Inverter Market Size and Forecast, by Application (2023-2030)

8.6.3.5. Japan Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6.4. India

8.6.4.1. India Inverter Market Size and Forecast, by Type (2023-2030)

8.6.4.2. India Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.4.3. India Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.4.4. India Inverter Market Size and Forecast, by Application (2023-2030)

8.6.4.5. India Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6.5. Australia

8.6.5.1. Australia Inverter Market Size and Forecast, by Type (2023-2030)

8.6.5.2. Australia Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.5.3. Australia Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.5.4. Australia Inverter Market Size and Forecast, by Application (2023-2030)

8.6.5.5. Australia Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6.6. ASEAN

8.6.6.1. ASEAN Inverter Market Size and Forecast, by Type (2023-2030)

8.6.6.2. ASEAN Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.6.3. ASEAN Inverter Market Size and Forecast, by Application 2023-2030)

8.6.6.4. ASEAN Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.6.5. ASEAN Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

8.6.7. Rest of Asia Pacific

8.6.7.1. Rest of Asia Pacific Inverter Market Size and Forecast, by Type (2023-2030)

8.6.7.2. Rest of Asia Pacific Inverter Market Size and Forecast, by Power Rating (2023-2030)

8.6.7.3. Rest of Asia Pacific Inverter Market Size and Forecast, by Connection Type (2023-2030)

8.6.7.4. Rest of Asia Pacific Inverter Market Size and Forecast, by Application (2023-2030)

8.6.7.5. Rest of Asia Pacific Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

9. Middle East and Africa Inverter Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. Middle East and Africa Inverter Market Size and Forecast, by Type (2023-2030)

9.2. Middle East and Africa Inverter Market Size and Forecast, by Power Rating (2023-2030)

9.3. Middle East and Africa Inverter Market Size and Forecast, by Connection Type (2023-2030)

9.4. Middle East and Africa Inverter Market Size and Forecast, by Application (2023-2030)

9.5. Middle East and Africa Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

9.6. Middle East and Africa Inverter Market Size and Forecast, by Country (2023-2030)

9.6.1. South Africa

9.6.1.1. South Africa Inverter Market Size and Forecast, by Type (2023-2030)

9.6.1.2. South Africa Inverter Market Size and Forecast, by Power Rating (2023-2030)

9.6.1.3. South Africa Inverter Market Size and Forecast, by Connection Type (2023-2030)

9.6.1.4. South Africa Inverter Market Size and Forecast, by Application (2023-2030)

9.6.1.5. South Africa Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

9.6.2. GCC

9.6.2.1. GCC Inverter Market Size and Forecast, by Type (2023-2030)

9.6.2.2. GCC Inverter Market Size and Forecast, by Power Rating (2023-2030)

9.6.2.3. GCC Inverter Market Size and Forecast, by Connection Type (2023-2030)

9.6.2.4. GCC Inverter Market Size and Forecast, by Application (2023-2030)

9.6.2.5. GCC Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

9.6.3. Nigeria

9.6.3.1. Nigeria Inverter Market Size and Forecast, by Type (2023-2030)

9.6.3.2. Nigeria Inverter Market Size and Forecast, by Power Rating (2023-2030)

9.6.3.3. Nigeria Inverter Market Size and Forecast, by Connection Type (2023-2030)

9.6.3.4. Nigeria Inverter Market Size and Forecast, by Application (2023-2030)

9.6.3.5. Nigeria Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

9.6.3.6.

9.6.4. Rest of ME&A

9.6.4.1. Rest of ME&A Inverter Market Size and Forecast, by Type (2023-2030)

9.6.4.2. Rest of ME&A Inverter Market Size and Forecast, by Power Rating (2023-2030)

9.6.4.3. Rest of ME&A Inverter Market Size and Forecast, by Connection Type (2023-2030)

9.6.4.4. Rest of ME&A Inverter Market Size and Forecast, by Application (2023-2030)

9.6.4.5. Rest of ME&A Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

10. South America Inverter Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

10.1. South America Inverter Market Size and Forecast, by Type (2023-2030)

10.2. South America Inverter Market Size and Forecast, by Power Rating (2023-2030)

10.3. South America Inverter Market Size and Forecast, by Connection Type (2023-2030)

10.4. South America Inverter Market Size and Forecast, by Application (2023-2030)

10.5. South America Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

10.6. South America Inverter Market Size and Forecast, by Country (2023-2030)

10.6.1. Brazil

10.6.1.1. Brazil Inverter Market Size and Forecast, by Type (2023-2030)

10.6.1.2. Brazil Inverter Market Size and Forecast, by Power Rating (2023-2030)

10.6.1.3. Brazil Inverter Market Size and Forecast, by Connection Type (2023-2030)

10.6.1.4. Brazil Inverter Market Size and Forecast, by Application (2023-2030)

10.6.1.5. Brazil Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

10.6.2. Argentina

10.6.2.1. Argentina Inverter Market Size and Forecast, by Type (2023-2030)

10.6.2.2. Argentina Inverter Market Size and Forecast, by Power Rating (2023-2030)

10.6.2.3. Argentina Inverter Market Size and Forecast, by Connection Type (2023-2030)

10.6.2.4. Argentina Inverter Market Size and Forecast, by Application (2023-2030)

10.6.2.5. Argentina Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

10.6.3. Rest Of South America

10.6.3.1. Rest Of South America Inverter Market Size and Forecast, by Type (2023-2030)

10.6.3.2. Rest Of South America Inverter Market Size and Forecast, by Power Rating (2023-2030)

10.6.3.3. Rest Of South America Inverter Market Size and Forecast, by Connection Type (2023-2030)

10.6.3.4. Rest Of South America Inverter Market Size and Forecast, by Application (2023-2030)

10.6.3.5. Rest Of South America Inverter Market Size and Forecast, by Distribution Channel (2023-2030)

11. Company Profile: Key Players

11.1. Enphase Energy (Fremont, California, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. SolarEdge Technologies ( Milpitas, California, USA)

11.3. SunPower Corporation ( San Jose, California, USA)

11.4. OutBack Power Technologies ( Arlington, Washington, USA)

11.5. SMA America ( Rocklin, California, USA )

11.6. Schneider Electric ( Andover, Massachusetts, USA)

11.7. General Electric (GE Renewable Energy) - Schenectady, New York, USA)

11.8. SMA Solar Technology AG (Niestetal, Germany)

11.9. Fronius International GmbH (Pettenbach, Austria)

11.10. ABB (Zurich, Switzerland)

11.11. Ingeteam (Zamudio, Spain)

11.12. Siemens (Munich, Germany)

11.13. Kostal Solar Electric (Freiburg, Germany)

11.14. FIMER (Terranuova Bracciolini, Italy)

11.15. Delta Electronics (Hoofddorp, Netherlands)

11.16. FIMER (Terranuova Bracciolini, Italy)

11.17. Kaco New Energy (Neckarsulm, Germany)

11.18. Huawei Technologies (Shenzhen, China)

11.19. Sungrow Power Supply Co., Ltd. v Hefei, China)

11.20. Delta Electronics (Taipei, Taiwan)

11.21. Growatt New Energy Technology (Shenzhen, China)

11.22. GoodWe (Jiangsu GoodWe Power Supply Technology Co., Ltd.) (Suzhou, China)

11.23. TBEA Sunoasis Co., Ltd. (Urumqi, China)

11.24. Hitachi ( Tokyo, Japan)

12. Key Findings

13. Analyst Recommendations