Lip and Face Oil Market: Global Industry Analysis and Forecast (2024-2030)

The Lip and Face Oil Market size was valued at USD 6.15 Bn. in 2023. Global Lip and Face Oil revenue is expected to grow at a CAGR of 4.1% from 2024 to 2030, reaching nearly USD 8.15 Bn. by 2030.

Format : PDF | Report ID : SMR_2165

Lip and Face Oil Market Overview

The lip and face oil market has been driven by changing consumer behavior and increasing awareness of skincare benefits. Consumers are more informed and selective about the products they use, favoring natural and organic formulations that promise hydration, anti-aging, and overall skin health benefits. This shift has led to a surge in demand for high-quality lip and face oils, with many consumers incorporating these products into their daily beauty routines. Brands are leveraging this trend by launching innovative products that cater to specific skin concerns, thereby expanding their target market.

Market research reports indicate that the target market for lip and face oils is predominantly women aged 25-45, who are keen on maintaining youthful and radiant skin. This demographic is highly influenced by social media, beauty influencers, and peer recommendations. Qualitative research highlights that consumers in this segment prioritize product efficacy, ingredient transparency, and brand reputation when making purchase decisions. Quantitative research further supports these findings, showing a strong correlation between these factors and consumer loyalty. As a result, brands are investing heavily in marketing strategies that highlight the unique benefits and natural ingredients of their products.

The Asia-Pacific region stands out as one of the fastest-growing markets for lip and face oils. With a burgeoning middle-class population and increasing disposable incomes, countries like South Korea, Japan, and China have witnessed a remarkable surge in demand for skincare products, including lip and face oils. In South Korea, the influence of K-beauty trends has popularized innovative formulations and rituals, driving consumer interest in products that offer both beauty and skincare benefits. Japan's market is characterized by a strong preference for high-quality, natural ingredients, contributing to the growth of brands focusing on organic and effective skincare solutions.

The comprehensive market research reports, incorporating both qualitative and quantitative research methods, provide valuable insights into the lip and face oil market. Qualitative research, through focus groups and in-depth interviews, helps brands understand consumer preferences and behavior on a deeper level. Meanwhile, quantitative research, through surveys and statistical analysis, offers measurable data on market trends, growth rates, and consumer demographics.

To get more Insights: Request Free Sample Report

Lip and Face Oil Market Dynamics

Growing Consumer Awareness and Preference for Natural and Organic Skincare Products

The lip and face oil market is growing owing to consumer awareness and preference for natural and organic skincare products. Consumers are increasingly seeking products that are free from synthetic ingredients and harsh chemicals, opting instead for formulations that include natural oils such as jojoba, argan, and rosehip. This shift is driven by a broader trend towards holistic wellness and sustainable living.

- For instance, brands like Tata Harper and Herbivore Botanicals have gained significant traction by promoting their natural ingredient lists and eco-friendly packaging.

The rise of social media influencers and beauty bloggers has amplified the demand for high-quality, effective skincare products, further driving market growth. The increasing disposable income in emerging economies also supports this trend, as consumers are more willing to spend on premium skincare products that promise better results and healthier skin.

High Cost of Production and Sourcing of Natural and Organic Ingredients.

The challenge for the lip and face oil market is the high cost of production and sourcing of natural and organic ingredients. Many of these ingredients are sourced from specific regions and require sustainable farming practices, which drives up costs. This often results in higher prices for end consumers, which limits the market's reach, particularly in price-sensitive markets.

- For example, luxury brands like La Mer and Drunk Elephant command high prices, making their products less accessible to a broader audience.

The market is also subject to stringent regulatory standards and certification processes, especially in regions like the European Union and North America, where compliance with organic and natural labeling requirements is rigorous and costly. These factors deter new entrants and limit the scalability of smaller, indie brands.

Rise of Multifunctional and Personalized Skincare Products

A prominent trend in the lip and face oil market is the increasing integration of multifunctional products that offer multiple benefits in a single application. Consumers are looking for convenience without compromising on efficacy, leading to the popularity of products that combine hydration, anti-aging, and brightening properties.

- For instance, products like Vintner’s Daughter Active Botanical Serum, which serves as both a face oil and a comprehensive skincare treatment, have garnered a loyal following.

There is a growing trend towards customization and personalization in skincare, with brands offering tailored formulations based on individual skin types and concerns. This trend is supported by advancements in technology, such as AI-driven skin analysis tools that recommend specific products to consumers. Brands like Curology and Proven Skincare are at the forefront of this movement, offering bespoke skincare solutions that cater to unique customer needs.

Lip and Face Oil Market Segment Analysis

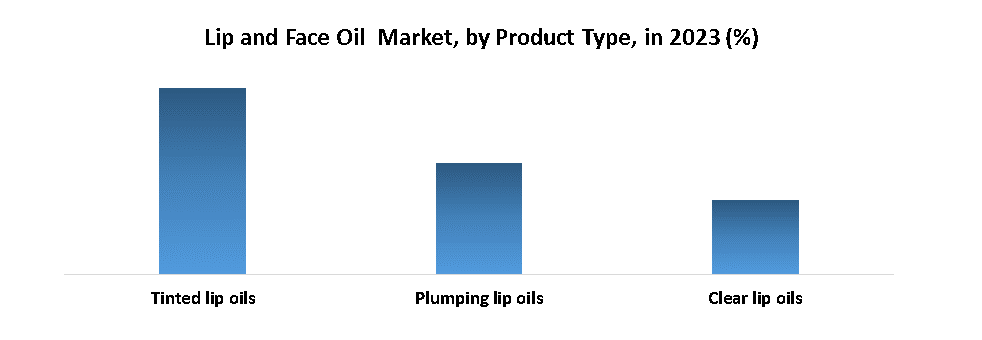

According to MMR analysis, among the various types of lip oils, tinted lip oils stand out as the leading segment in 2023 and are expected to dominate in the forecast period (2024-2030). Tinted lip oils offer the dual benefit of hydration and a hint of color, catering to consumers' desire for multifunctional beauty products. They appeal to those seeking a natural look with added lip care benefits, making them particularly popular among millennials and Gen Z. Brands like Clarins and Dior have capitalized on this trend, introducing tinted lip oils with nourishing ingredients like jojoba oil and raspberry seed oil, which provide a glossy finish without the sticky feel of traditional lip glosses. The growing demand for clean beauty has also pushed manufacturers to develop tinted lip oils with organic and vegan formulations, further boosting their popularity in the market.

In the face oil market, anti-aging face oils are the leading segment, driven by an increasing consumer focus on youthful and radiant skin. These oils, formulated with ingredients like retinol, vitamin C, and essential fatty acids, target fine lines, wrinkles, and other signs of aging. Brands such as Sunday Riley and Drunk Elephant have seen significant success with their anti-aging face oils, which promise to improve skin elasticity, firmness, and overall complexion. The demand for these products is particularly high among consumers aged 30 and above, who are looking for effective skincare solutions that provide both immediate and long-term benefits. The trend towards preventive skincare has further fueled the popularity of anti-aging face oils, making them a staple in many beauty routines.

- On June 5, 2024, L'Oréal Paris, a leader in permanent hair color innovation, will proudly present Colorsonic, their most recent creation. Colorsonic, an innovative at-home hair color equipment with over 29 patents, was created and nurtured for a decade by L'Oréal Paris. With the touch of a button, it produces long-lasting color effects by automatically blending developer and dye in the ideal ratio for different hair types, lengths, and textures. This simplifies the process of coloring hair.

Lip and Face Oil Market Regional Analysis

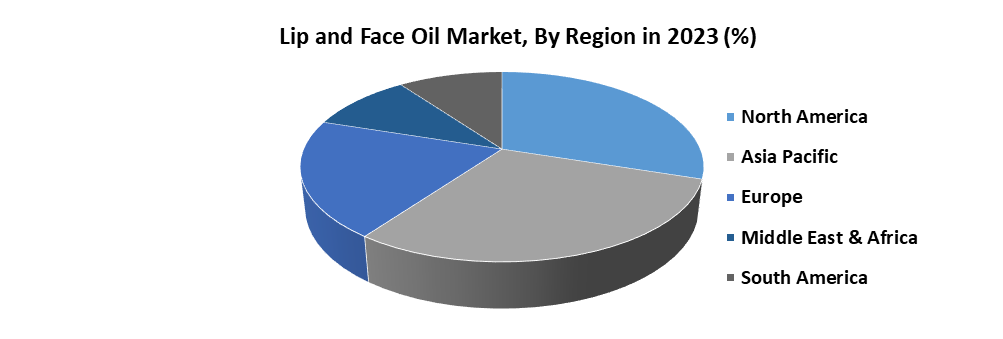

North America leads the lip oil market in 2023 and is expected to grow in the forecast period (2024-2030), driven by high consumer demand and strong supply chains. The region's preference for innovative and high-quality beauty products, along with the influence of social media and celebrity endorsements, boosts market growth. The United States, in particular, sees significant demand for lip oils, with brands like Burt's Bees and Fenty Beauty introducing diverse product lines. The Canadian lip oil industry also shows robust growth, driven by increasing awareness of natural and organic beauty products. This rising demand is supported by well-established retail networks and a growing number of online beauty platforms.

The Asia-Pacific region dominates the face oil market, with countries like South Korea, Japan, and China leading in both demand and supply. The region's long-standing tradition of skincare and beauty rituals, combined with a growing middle-class population, drives the market. In South Korea, the K-beauty trend has popularized face oils, with brands like Innisfree and Laneige offering innovative products. Japan's lip oil market is driven by a preference for high-quality, natural ingredients, as seen in brands like Tatcha. China, with its vast consumer base and increasing disposable income, also shows growing demand, supported by a surge in e-commerce platforms.

Lip and Face Oil Market Competitive Landscape

The lip and face oil market features a competitive landscape dominated by established global brands and niche players specializing in natural and organic formulations. Key players such as Clarins, Sunday Riley, and Drunk Elephant lead with innovative product offerings and strong brand recognition. They compete based on product efficacy, ingredient quality, and sustainability practices, targeting a diverse consumer base seeking skincare solutions that combine hydration with anti-aging benefits. Niche brands like Herbivore Botanicals and Vintner's Daughter appeal to consumers looking for clean beauty options. Market dynamics include continuous product innovation, strategic partnerships, and effective marketing strategies to maintain and expand market share.

- In May 2022, L’Oreal announced its third-employee stock ownership, which was implemented in 63 countries, giving all of its employees to become more involved in the growth of the company

- In May 2022, Symrise Cosmetic Ingredients introduced a 'Beauty Activations' brand accelerator project to work with cosmetics companies in North America. Brands receive access to in-depth marketing analytics, specialized formulas, and an award-winning ingredient range owing to the collaboration with Symrise via the Beauty Activations platform

- In September 2021, LVMH, Natura & Co., Henkel, L'Oreal, and Unilever have collaborated to establish a method for assessing and ranking the environmental effects of the cosmetics industry

• In April 2022, Hermès Beauty launched a new line of infused lip oils with six shade options: soft orange beige Sapotille, sun-kissed Corail Bigarade, pink Rose Pitaya, vivid red Rouge Amarelle, peachy rose Kola, and dark purple Pourpre Camarine. Each oil contains nearly 100% natural ingredients, with a non-sticky, comfortable formula that is highlighted by unique signature scents.

• In April 2021, Haus Labs by Lady Gaga launched a new collection of lip oils called Ph.D. Lip Oil Hybrid Stains. These lip oils dissolve from a glossy gloss to a sheer, transfer-proof shade, based solely on the wearer's pH.

Lip and Face Oil Market Scope

|

Lip and Face Oil Market |

|

|

Market Size in 2023 |

USD 6.15 Bn. |

|

Market Size in 2030 |

USD 8.15 Bn. |

|

CAGR (2024-2030) |

4.1 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Type • Lip oils Tinted lip oils Clear lip oils Plumping lip oils • Face oils Hydrating face oils Anti-aging face oils Brightening face oils Others (balancing face oils, calming face oils) |

|

By Packaging Dropper bottles Pump bottles Roll-on bottles Squeeze tubes Stick containers Others |

|

|

By Price Range Low Medium High |

|

|

By Distribution Channel Online Retail Specialty Stores Supermarkets/Hypermarkets Others |

|

|

Regional Scope |

North America(United States), Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Lip and Face Oil Market

- The Estée Lauder Companies Inc. - USA

- L'Oréal S.A. - France

- Procter & Gamble Co. - USA

- Unilever - UK/Netherlands

- Shiseido Company, Limited - Japan

- Johnson & Johnson - USA

- Beiersdorf AG - Germany

- Clarins Group - France

- Amorepacific Corporation - South Korea

- Coty Inc. - USA

- The Clorox Company - USA

- The Body Shop International Limited - UK

- Kiehl's LLC - USA

- Tata Harper Skincare - USA

- Herbivore Botanicals LLC - USA

- Charlotte Tilbury - UK

- MAC Cosmetics – Canada

- Fenty Beauty - USA

- XXX.Inc.

Frequently Asked Questions

North America and Asia Pacific are expected to hold the highest share of the Lip and Face Oil Market.

The Lip and Face Oil Market size was valued at USD 6.15 Billion in 2023 reaching nearly USD 8.15 Billion in 2030.

The most influential segment growing in the Global Lip and Face Oil Market is the anti-aging face oils segment.

The segments covered in the Lip and Face Oil Market report are based on Product Type, Packaging, Price Range, and Distribution Channel.

1. Lip and Face Oil Market: Research Methodology

2. Lip and Face Oil Market: Executive Summary

3. Lip and Face Oil Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

3.6. Global Import-Export Analysis

4. Lip and Face Oil Market: Dynamics

4.1. Market Driver

4.2. Market Trends

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Strategies for New Entrants to Penetrate the Market

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

5. Lip and Face Oil Market Size and Forecast by Segments (by Value in USD Billion)

5.1. Lip and Face Oil Market Size and Forecast, by Product Type (2023-2030)

5.1.1. Lip oils

5.1.1.1. Tinted lip oils

5.1.1.2. Clear lip oils

5.1.1.3. Plumping lip oils

5.1.2. Face oils

5.1.2.1. Hydrating face oils

5.1.2.2. Anti-aging face oils

5.1.2.3. Brightening face oils

5.2. Others (balancing face oils, calming face oils) Lip and Face Oil Market Size and Forecast, by Packaging (2023-2030)

5.2.1. Dropper bottles

5.2.2. Pump bottles

5.2.3. Roll-on bottles

5.2.4. Squeeze tubes

5.2.5. Stick containers

5.2.6. Others

5.3. Lip and Face Oil Market Size and Forecast, by Price Range (2023-2030)

5.3.1. Low

5.3.2. Medium

5.3.3. High

5.4. Lip and Face Oil Market Size and Forecast, by Distribution Channel (2023-2030)

5.4.1. Online Retail

5.4.2. Specialty Stores

5.4.3. Supermarkets/Hypermarkets

5.4.4. Others

5.5. Lip and Face Oil Market Size and Forecast, by Region (2023-2030)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Lip and Face Oil Market Size and Forecast (by Value in USD Billion)

6.1. North America Lip and Face Oil Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Lip oils

6.1.1.1. Tinted lip oils

6.1.1.2. Clear lip oils

6.1.1.3. Plumping lip oils

6.1.2. Face oils

6.1.2.1. Hydrating face oils

6.1.2.2. Anti-aging face oils

6.1.2.3. Brightening face oils

6.2. North America Lip and Face Oil Market Size and Forecast, by Packaging (2023-2030)

6.2.1. Dropper bottles

6.2.2. Pump bottles

6.2.3. Roll-on bottles

6.2.4. Squeeze tubes

6.2.5. Stick containers

6.2.6. Others

6.3. North America Lip and Face Oil Market Size and Forecast, by Price Range (2023-2030)

6.3.1. Low

6.3.2. Medium

6.3.3. High

6.4. North America Lip and Face Oil Market Size and Forecast, by Distribution Channel (2023-2030)

6.4.1. Online Retail

6.4.2. Specialty Stores

6.4.3. Supermarkets/Hypermarkets

6.4.4. Others

6.5. North America Lip and Face Oil Market Size and Forecast, by Country (2023-2030)

6.5.1. United States

6.5.2. Canada

6.5.3. Mexico

7. Europe Lip and Face Oil Market Size and Forecast (by Value in USD Billion )

7.1. Europe Lip and Face Oil Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Lip oils

7.1.1.1. Tinted lip oils

7.1.1.2. Clear lip oils

7.1.1.3. Plumping lip oils

7.1.2. Face oils

7.1.2.1. Hydrating face oils

7.1.2.2. Anti-aging face oils

7.1.2.3. Brightening face oils

7.2. Europe Lip and Face Oil Market Size and Forecast, by Packaging (2023-2030)

7.2.1. Dropper bottles

7.2.2. Pump bottles

7.2.3. Roll-on bottles

7.2.4. Squeeze tubes

7.2.5. Stick containers

7.2.6. Others

7.3. Europe Lip and Face Oil Market Size and Forecast, by Price Range (2023-2030)

7.3.1. Low

7.3.2. Medium

7.3.3. High

7.4. Europe Lip and Face Oil Market Size and Forecast, by Distribution Channel (2023-2030)

7.4.1. Hospital Pharmacies

7.4.2. Retail Pharmacies

7.4.3. Online Pharmacies

7.5. Europe Lip and Face Oil Market Size and Forecast, by Country (2023-2030)

7.5.1. UK

7.5.2. France

7.5.3. Germany

7.5.4. Italy

7.5.5. Spain

7.5.6. Sweden

7.5.7. Austria

7.5.8. Rest of Europe

8. Asia Pacific Lip and Face Oil Market Size and Forecast (by Value in USD Billion )

8.1. Asia Pacific Lip and Face Oil Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Lip oils

8.1.1.1. Tinted lip oils

8.1.1.2. Clear lip oils

8.1.1.3. Plumping lip oils

8.1.2. Face oils

8.1.2.1. Hydrating face oils

8.1.2.2. Anti-aging face oils

8.1.2.3. Brightening face oils

8.2. Asia Pacific Lip and Face Oil Market Size and Forecast, by Packaging (2023-2030)

8.2.1. Dropper bottles

8.2.2. Pump bottles

8.2.3. Roll-on bottles

8.2.4. Squeeze tubes

8.2.5. Stick containers

8.2.6. Others

8.3. Asia Pacific Lip and Face Oil Market Size and Forecast, by Price Range (2023-2030)

8.3.1. Low

8.3.2. Medium

8.3.3. High

8.4. Asia Pacific Lip and Face Oil Market Size and Forecast, by Distribution Channel (2023-2030)

8.4.1. Online Retail

8.4.2. Specialty Stores

8.4.3. Supermarkets/Hypermarkets

8.4.4. Others

8.5. Asia Pacific Lip and Face Oil Market Size and Forecast, by Country (2023-2030)

8.5.1. China

8.5.2. S Korea

8.5.3. Japan

8.5.4. India

8.5.5. Australia

8.5.6. Indonesia

8.5.7. Malaysia

8.5.8. Vietnam

8.5.9. Taiwan

8.5.10. Bangladesh

8.5.11. Pakistan

8.5.12. Rest of Asia Pacific

9. Middle East and Africa Lip and Face Oil Market Size and Forecast (by Value in USD Billion )

9.1. Middle East and Africa Lip and Face Oil Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Lip oils

9.1.1.1. Tinted lip oils

9.1.1.2. Clear lip oils

9.1.1.3. Plumping lip oils

9.1.2. Face oils

9.1.2.1. Hydrating face oils

9.1.2.2. Anti-aging face oils

9.1.2.3. Brightening face oils

9.2. Middle East and Africa Lip and Face Oil Market Size and Forecast, by Packaging (2023-2030)

9.2.1. Dropper bottles

9.2.2. Pump bottles

9.2.3. Roll-on bottles

9.2.4. Squeeze tubes

9.2.5. Stick containers

9.2.6. Others

9.3. Middle East and Africa Lip and Face Oil Market Size and Forecast, by Price Range (2023-2030)

9.3.1. Low

9.3.2. Medium

9.3.3. High

9.4. Middle East and Africa Lip and Face Oil Market Size and Forecast, by Distribution Channel (2023-2030)

9.4.1. Online Retail

9.4.2. Specialty Stores

9.4.3. Supermarkets/Hypermarkets

9.4.4. Others

9.5. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

9.5.1. South Africa

9.5.2. GCC

9.5.3. Egypt

9.5.4. Nigeria

9.5.5. Rest of ME&A

10. South America Lip and Face Oil Market Size and Forecast (by Value in USD Billion )

10.1. South America Lip and Face Oil Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Lip oils

10.1.1.1. Tinted lip oils

10.1.1.2. Clear lip oils

10.1.1.3. Plumping lip oils

10.1.2. Face oils

10.1.2.1. Hydrating face oils

10.1.2.2. Anti-aging face oils

10.1.2.3. Brightening face oils

10.2. South America Lip and Face Oil Market Size and Forecast, by Packaging (2023-2030)

10.2.1. Dropper bottles

10.2.2. Pump bottles

10.2.3. Roll-on bottles

10.2.4. Squeeze tubes

10.2.5. Stick containers

10.2.6. Others

10.3. South America Lip and Face Oil Market Size and Forecast, by Price Range (2023-2030)

10.3.1. Low

10.3.2. Medium

10.3.3. High

10.4. South America Lip and Face Oil Market Size and Forecast, by Distribution Channel (2023-2030)

10.4.1. Online Retail

10.4.2. Specialty Stores

10.4.3. Supermarkets/Hypermarkets

10.4.4. Others

10.5. South America Lip and Face Oil Market Size and Forecast, by Country (2023-2030)

10.5.1. Brazil

10.5.2. Argentina

10.5.3. Rest of South America

11. Company Profile: Key players

11.1. The Estée Lauder Companies Inc. - USA

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. L'Oréal S.A. - France

11.3. Procter & Gamble Co. - USA

11.4. Unilever - UK/Netherlands

11.5. Shiseido Company, Limited - Japan

11.6. Johnson & Johnson - USA

11.7. Beiersdorf AG - Germany

11.8. Clarins Group - France

11.9. Amorepacific Corporation - South Korea

11.10. Coty Inc. - USA

11.11. The Clorox Company - USA

11.12. The Body Shop International Limited - UK

11.13. Kiehl's LLC - USA

11.14. Tata Harper Skincare - USA

11.15. Herbivore Botanicals LLC - USA

11.16. Charlotte Tilbury - UK

11.17. MAC Cosmetics – Canada

11.18. Fenty Beauty - USA

11.19. XXX.Inc

12. Key Findings

13. Industry Recommendations