Liquid Soap Market: Global Industry Analysis and Forecast (2024 -2030)

Liquid Soap Market size was valued at USD 21.9 Bn. in 2023. The total Liquid Soap Market revenue is expected to grow by 6.12% from 2024 to 2030, reaching nearly USD 33.15 Bn.

Format : PDF | Report ID : SMR_2119

Liquid Soap Market Overview

Liquid soap is a cleansing agent that exists in liquid form, created from the salts of fatty acids derived from vegetable fats and animal fats. It is used in a variety of cleaning and lubricating products. Examples of liquid soap include floating soap and castile soap.

The liquid soap market has transformed and grown rapidly over recent years, driven by various factors such as rising consumer awareness about hygiene, technological advancements in product formulation, and the increasing demand for natural and organic products. The market is highly competitive with a huge number of global and regional players. It also includes a huge number of local players. The Asia Pacific and Europe regions held the major share in the liquid soap industry.

As per the study, the liquid soap market is expected to grow in the future because of the rising consumer preferences for convenience and innovation and the ongoing trend towards natural and organic products. Liquid Soap manufacturers are expected to focus on advanced formulations to meet evolving consumer demands in the future.

To get more Insights: Request Free Sample Report

Liquid Soap Market Dynamics

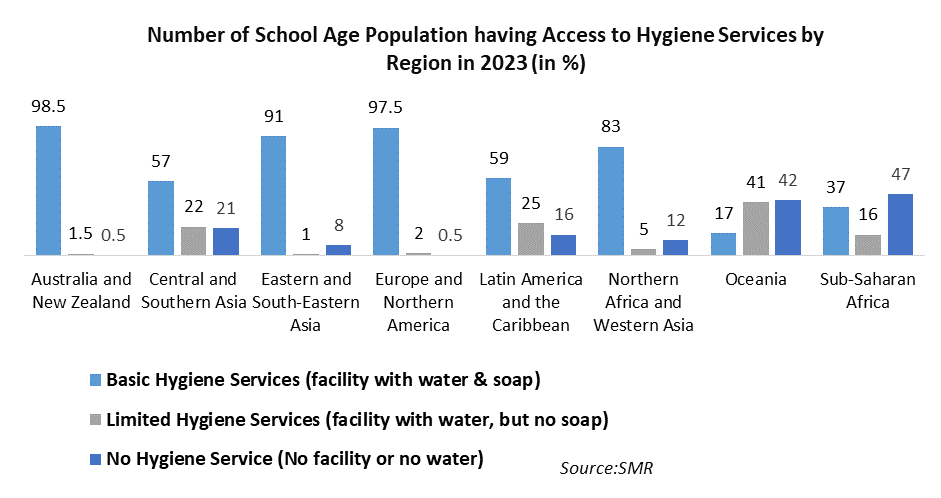

Rising Awareness of Hygiene and Health is Driving the Global Liquid Soap Market

The rising awareness of hygiene and health is supported by health organizations worldwide advocating for regular handwashing to prevent disease transmission. Additionally, advancements in liquid soap formulations, such as the inclusion of antibacterial and moisturizing properties, cater to consumer preferences for multifunctional products. The convenience and ease of use associated with liquid soap dispensers also contribute to its popularity, particularly in public and commercial settings. As consumers become more health-conscious and seek products that offer both protection and skincare benefits, the liquid soap market is poised for continued expansion, with manufacturers focusing on innovation and sustainable packaging to meet evolving demands.

The COVID-19 pandemic has significantly increased the demand for liquid soaps, particularly those with germ-killing properties. Companies like ITC Ltd, Godrej Consumer Products Ltd, Emami Ltd, and Dabur India have introduced antibacterial and hygiene-focused soaps to meet the surge in consumer demand. With heightened awareness about hygiene, consumers are favoring soaps with natural liquid soap ingredients such as neem and aloe vera.

Liquid Soap Market players like Dabur have launched new hygiene products under brands like Sanitize, while Wipro's Santoor has shifted its messaging to emphasize hygiene benefits. This shift in consumer behavior is expected to boost the overall soap market, though competition will intensify as new entrants challenge established liquid soap brands, focusing on immunity and protection rather than just beauty benefits.

Environmental Impact and Availability of Substitute Products such as Bar Soap are Key Challenges for the Liquid Soap Market

Bar soap is a more environmentally friendly choice compared to liquid soap for several reasons. First and foremost, bar soap significantly reduces plastic waste, as it typically comes wrapped in paper or cardboard, which are more easily recyclable. In contrast, liquid soap is usually packaged in plastic containers that are often not recyclable, leading to increased landfill waste. Additionally, the production and transportation of liquid soap require more energy compared to bar soap. The manufacturing process for liquid soap is more complex and energy-intensive, involving more steps and often using more water. Bar soap, on the other hand, can be produced with less energy and can be made locally, further reducing its carbon footprint.

Thus, the benefits of using bar soaps over liquid soaps and environmental impact of liquid soaps are key challenges for the global Liquid Soap Market. Furthermore, liquid soap often contains synthetic ingredients and chemicals that can contaminate water systems and harm aquatic life. Bar soap, typically made with natural ingredients, has a lower environmental impact and is less likely to cause water pollution. By choosing bar soap over liquid soap, consumers can reduce plastic waste, save energy, conserve water, and support more sustainable shopping practices. These small changes can collectively make a significant positive impact on the health of our planet.

Liquid Soap Market Segment Analysis

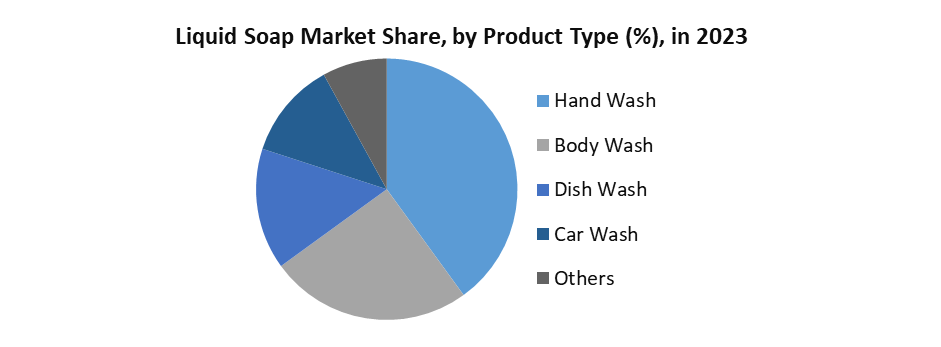

Based on Product Type: The market is segmented into Hand Wash, Body Wash, Dish Wash, Car Wash and Others. The Hand Wash segment held the largest Liquid Soap Market share in 2023. The trend towards more frequent and thorough hand hygiene practices is expected to continue to shape consumer behavior and drive global liquid hand wash market growth. The introduction of powder-to-liquid (L) handwash formats by Godrej Consumer Products (GCPL) five years ago has revolutionized the segment, now commanding over 31% of sales volumes in India. Priced significantly lower than traditional liquid handwashes, L products have appealed to cost-conscious consumers despite contributing only 12.5% to the Indian market's value. This format's success has prompted other brands to follow suit, contributing to its rapid growth and partly cannibalizing sales of washes.

The Body Wash segment held the second-largest Liquid Soap Market share in the global market in 2023. The demand for liquid body wash has increased globally due to its convenience and perceived hygienic benefits. Modern lifestyles favor the easy-to-use and aesthetically appealing nature of liquid body washes, which come in various scents and formulations catering to different skin types. Urbanization and higher disposable incomes have also fueled this demand, as consumers are more willing to spend on personal care products that offer luxury and indulgence. Additionally, the proliferation of marketing campaigns by leading brands has popularized liquid body wash, highlighting its moisturizing properties and dermatologically tested benefits.

Liquid Soap Market Regional Insights

Asia Pacific Liquid Soap Market dominated the global market with the largest share in 2023. In the region, India and China are the key markets for liquid soap. The regional market is majorly driven by the increasing disposable incomes, and the expansion of e-commerce platforms. Liquid soap, a preferred alternative to traditional bar soap due to its convenience and perceived hygiene benefits, is gaining popularity across the region.

China is one of the biggest manufacturers and consumers of consumer goods and services. Rapid consolidation is expected between medium and big businesses as the Chinese Government has encouraged industrial consolidation. The increasing spending on convenience products including liquid soap and growing online marketplaces are also contributing to the increasing market value of Liquid Soap in the country.

The Liquid Soap Market in India is expected to grow rapidly during the forecast period. In 2023, the NDTV-Dettol Banega Swasth India campaign celebrated its 10th anniversary. It began with the ‘Swachh Express’ in 2014, traveling across 30 cities and 75 villages to promote hygiene. Now covering all aspirational districts, the campaign is one of India's longest-running public health initiatives. The future focus is on 'One World Hygiene' to foster global health unity for a healthier tomorrow.

|

Initiatives |

Details |

|

10th Anniversary of Banega Swasth India Campaign |

The campaign celebrated a decade of promoting health and hygiene across India, expanding to cover all aspirational districts. |

|

Reckitt’s Coffee Table Book |

Launched during the Jaipur Literature Festival 2023, highlighting India’s journey towards universal hygiene and Dettol Banega Swasth India program’s impact. |

|

Zero Malaria Mission in Uttar Pradesh |

Initiative to eliminate malaria by 2030 through health awareness and behavior change. |

|

Hygiene Music Album in Tamil |

Folk music album launched to spread the message of hygiene practices in a fun and engaging way, backed by Tamil Nadu’s Health Ministry. |

|

DIY Hygiene Workbooks |

Launched for Grade 1 to Grade 3, focusing on instilling good hygiene habits in children through fun activities. |

|

Swasthya Mantra Video Podcast |

Launched on World Hand Hygiene Day by Suresh Raina to promote basic hygiene practices. Available on major platforms like Spotify, Apple, and YouTube. |

|

Second Edition of Hygiene Olympiad |

Reached over 30 million children across India, promoting hygiene literacy and pro-hygiene behavior. |

|

New Campaign Ambassador |

Ayushmann Khurrana launched the 10th season, emphasizing ‘One World Hygiene’ for global health unity. |

|

Self-Care Kit |

Launched to reduce anaemia, malnutrition, and infectious diseases among women and children, including supplements and hygiene products. |

|

Cultural Outreach |

Supported marginalized communities and promoted hygiene through cultural initiatives like music albums and participation in festivals. |

Liquid Soap Market Scope

|

Liquid Soap Market |

|

|

Market Size in 2023 |

USD 21.9 Bn. |

|

Market Size in 2030 |

USD 33.15 Bn. |

|

CAGR (2024-2030) |

6.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Type Hand Wash Body Wash Dish Wash Car Wash Others (Laundry Soaps & Surface Cleaners) |

|

By Nature Organic Convectional |

|

|

By End-Use Household Commercial |

|

|

By Distribution Channel Online Retail Supermarkets/Hypermarkets Convenience Stores Pharmacies/Drugstores Specialty Stores Direct Sales |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Top Liquid Soap Market Players

- GlaxoSmithKline [Brentford, United Kingdom]

- Procter & Gamble Co. (P&G) [Cincinnati, Ohio, USA]

- Unilever [London, United Kingdom, and Rotterdam, Netherlands]

- Johnson & Johnson [New Brunswick, New Jersey, USA]

- Kao Corporation [Tokyo, Japan]

- The Clorox Company [Oakland, California, USA]

- Beiersdorf AG [Hamburg, Germany]

- Himalaya Herbals [Bengaluru, India]

- Ecolab Inc. [St. Paul, Minnesota, USA]

- Dr. Bronner's Magic Soaps [Vista, California, USA]

- Method Products, PBC [San Francisco, California, USA]

- LES ROBINETS PRESTO S.A. [Montrouge, France]

- Colgate-Palmolive Company [New York, New York, USA]

- Premier Healthcare & Hygiene Ltd [Rochdale, United Kingdom]

- Cleenol Group Ltd. [Banbury, United Kingdom]

- Christina May Ltd. [Hitchin, Hertfordshire, United Kingdom]

- Godrej [Mumbai, India]

- Reckitt Benckiser Group plc. [Slough, United Kingdom]

- Henkel Corporation [Düsseldorf, Germany]

Frequently Asked Questions

The Asia Pacific region is expected to hold the largest Liquid Soap Market share.

The Liquid Soap Market size by 2030 is expected to reach US$ 33.15 Bn.

Most liquid soap manufacturers target health-conscious consumers, including families, individuals with sensitive skin, and environmentally aware customers. They focus on diverse demographics, from young professionals to older adults, emphasizing convenience, hygiene, and sustainability.

Liquid soap companies often employ a multi-faceted marketing strategy, including eco-friendly branding, diverse scents and packaging innovations. They leverage social media campaigns, influencer collaborations, and customer testimonials to build trust and engagement. Additionally, they emphasize health benefits and hygiene to cater to the increased demand for personal care products.

1. Liquid Soap Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Liquid Soap Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Product

2.3.3. End-user

2.3.4. Revenue (2023)

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Liquid Soap Market: Dynamics

3.1. Liquid Soap Market Trends

3.2. Liquid Soap Market Dynamics

3.2.1. North America

3.2.2. Europe

3.2.3. Asia Pacific

3.2.4. Middle East and Africa

3.2.5. South America

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Value Chain Analysis

3.6. Regulatory Landscape

4. Liquid Soap Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030)

4.1. Liquid Soap Market Size and Forecast, by Product Type (2023-2030)

4.1.1. Hand Wash

4.1.2. Body Wash

4.1.3. Dish Wash

4.1.4. Car Wash

4.1.5. Others (Laundry Soaps & Surface Cleaners)

4.2. Liquid Soap Market Size and Forecast, by Nature (2023-2030)

4.2.1. Organic

4.2.2. Convectional

4.3. Liquid Soap Market Size and Forecast, by End-Use (2023-2030)

4.3.1. Household

4.3.2. Commercial

4.4. Liquid Soap Market Size and Forecast, by Distribution Channel (2023-2030)

4.4.1. Online Retail

4.4.2. Supermarkets/Hypermarkets

4.4.3. Convenience Stores

4.4.4. Pharmacies/Drugstores

4.4.5. Specialty Stores

4.4.6. Direct Sales

4.5. Liquid Soap Market Size and Forecast, by Region (2023-2030)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. North America Liquid Soap Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030)

5.1. North America Liquid Soap Market Size and Forecast, by Product Type (2023-2030)

5.1.1. Hand Wash

5.1.2. Body Wash

5.1.3. Dish Wash

5.1.4. Car Wash

5.1.5. Others (Laundry Soaps & Surface Cleaners)

5.2. North America Liquid Soap Market Size and Forecast, by Nature (2023-2030)

5.2.1. Organic

5.2.2. Convectional

5.3. North America Liquid Soap Market Size and Forecast, by End-Use (2023-2030)

5.3.1. Household

5.3.2. Commercial

5.4. North America Liquid Soap Market Size and Forecast, by Distribution Channel (2023-2030)

5.4.1. Online Retail

5.4.2. Supermarkets/Hypermarkets

5.4.3. Convenience Stores

5.4.4. Pharmacies/Drugstores

5.4.5. Specialty Stores

5.4.6. Direct Sales

5.5. North America Liquid Soap Market Size and Forecast, by Country (2023-2030)

5.5.1. United States

5.5.2. Canada

5.5.3. Mexico

6. Europe Liquid Soap Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030)

6.1. Europe Liquid Soap Market Size and Forecast, by Product Type (2023-2030)

6.2. Europe Liquid Soap Market Size and Forecast, by Nature (2023-2030)

6.3. Europe Liquid Soap Market Size and Forecast, by End-Use (2023-2030)

6.4. Europe Liquid Soap Market Size and Forecast, by Distribution Channel (2023-2030)

6.5. Europe Liquid Soap Market Size and Forecast, by Country (2023-2030)

6.5.1. United Kingdom

6.5.2. France

6.5.3. Germany

6.5.4. Italy

6.5.5. Spain

6.5.6. Sweden

6.5.7. Austria

6.5.8. Rest of Europe

7. Asia Pacific Liquid Soap Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030)

7.1. Asia Pacific Liquid Soap Market Size and Forecast, by Product Type (2023-2030)

7.2. Asia Pacific Liquid Soap Market Size and Forecast, by Nature (2023-2030)

7.3. Asia Pacific Liquid Soap Market Size and Forecast, by End-Use (2023-2030)

7.4. Asia Pacific Liquid Soap Market Size and Forecast, by Distribution Channel (2023-2030)

7.5. Asia Pacific Liquid Soap Market Size and Forecast, by Country (2023-2030)

7.5.1. China

7.5.2. S Korea

7.5.3. Japan

7.5.4. India

7.5.5. Australia

7.5.6. Indonesia

7.5.7. Malaysia

7.5.8. Vietnam

7.5.9. Taiwan

7.5.10. Rest of Asia Pacific

8. Middle East and Africa Liquid Soap Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030)

8.1. Middle East and Africa Liquid Soap Market Size and Forecast, by Product Type (2023-2030)

8.2. Middle East and Africa Liquid Soap Market Size and Forecast, by Nature (2023-2030)

8.3. Middle East and Africa Liquid Soap Market Size and Forecast, by End-Use (2023-2030)

8.4. Middle East and Africa Liquid Soap Market Size and Forecast, by Distribution Channel (2023-2030)

8.5. Middle East and Africa Liquid Soap Market Size and Forecast, by Country (2023-2030)

8.5.1. South Africa

8.5.2. GCC

8.5.3. Nigeria

8.5.4. Rest of ME&A

9. South America Liquid Soap Market Size and Forecast by Segmentation (by Value USD Mn) (2023-2030)

9.1. South America Liquid Soap Market Size and Forecast, by Product Type (2023-2030)

9.2. South America Liquid Soap Market Size and Forecast, by Nature (2023-2030)

9.3. South America Liquid Soap Market Size and Forecast, by End-Use (2023-2030)

9.4. South America Liquid Soap Market Size and Forecast, by Distribution Channel (2023-2030)

9.5. South America Liquid Soap Market Size and Forecast, by Country (2023-2030)

9.5.1. Brazil

9.5.2. Argentina

9.5.3. Rest Of South America

10. Company Profile: Key Players

10.1. GlaxoSmithKline

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent DevelopFood and Beveragests

10.2. Procter & Gamble Co. (P&G)

10.3. Unilever

10.4. Johnson & Johnson

10.5. Kao Corporation

10.6. The Clorox Company

10.7. Beiersdorf AG

10.8. Himalaya Herbals

10.9. Ecolab Inc.

10.10. Dr. Bronner's Magic Soaps

10.11. Method Products, PBC

10.12. LES ROBINETS PRESTO S.A.

10.13. Colgate-Palmolive Company

10.14. Premier Healthcare & Hygiene Ltd

10.15. Cleenol Group Ltd.

10.16. Christina May Ltd.

10.17. Godrej

10.18. Reckitt Benckiser Group plc.

10.19. Henkel Corporation

11. Key Findings

12. Industry Recommendations

13. Liquid Soap Market: Research Methodology