Luxury Jewelry Market: Global Industry Analysis and Forecast (2024-2030)

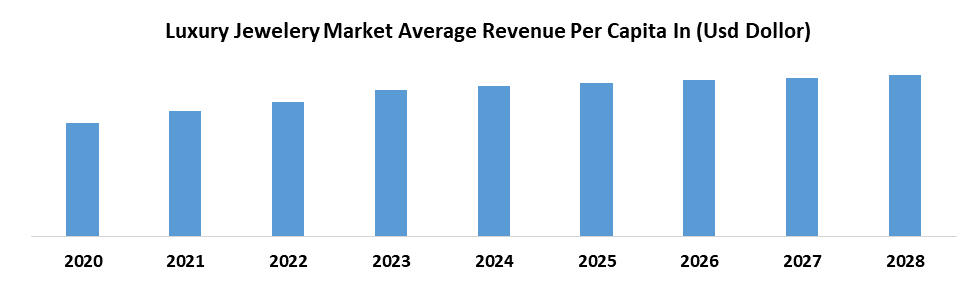

The Luxury Jewelry Market size was valued at USD 51.2 Bn. in 2023 and the total Global Luxury Jewelry revenue is expected to grow at a CAGR of 7.9 % from 2024 to 2030, reaching nearly USD 84.2 Bn. by 2030.

Format : PDF | Report ID : SMR_1835

Luxury Jewelry Market Overview

The luxury jewelry market is a dynamic and evolving sector that caters to consumers seeking prestige, status, and beauty in their accessories. The industry covers a wide range of products, including watches, rings, pearls, gold, diamonds, and silver, each with its pricing, marketing strategies, and consumer perceptions. The market's growth is driven by changing consumer behaviour and emerging trends, leading jewelry manufacturers to constantly innovate and stay updated to avoid becoming outdated.

Research objectives in the luxury jewelry market focus on understanding consumer preferences, market trends, and the competitive landscape. Qualitative data, such as consumer sentiments and brand perceptions, play a crucial role in shaping marketing strategies and product development. Quantitative data, including sales figures and market share, provide insights into the market's size and growth potential, helping businesses make informed decisions and stay competitive.

The report also includes an analysis of both quantitative and qualitative data, with a forecast period extending from 2024 to 2030. The report takes into consideration various factors such as product pricing and penetration at both country and regional levels, country GDP, market dynamics of parent market and child markets, end application industries, major players, consumer buying behaviour, and economic, political, and social scenarios of countries.

The report is divided into various segments to provide a detailed analysis of the market from every possible aspect. The market outlook section gives a detailed analysis of market evolution, growth drivers, restraints, opportunities, and challenges, Porter's 5 Forces Framework, macroeconomic analysis, value chain analysis, and pricing analysis that directly shape the market at present and over the forecasted period. The drivers and restraints cover the internal factors of the market, while opportunities and challenges are the external factors affecting the market. The market outlook section also indicates the trends influencing new business development and investment opportunities.

To get more Insights: Request Free Sample Report

Luxury Jewelry Dynamics

Rising Disposable Incomes and Consumer Preference for Branded Jewelry Driving the Market Growth.

The luxury jewelry market has experienced robust growth, driven by increased modernization, westernization, and rising personal disposable income levels have led to a surge in demand for high-end jewelry items. Consumers are increasingly seeking gender-fluid jewelry options, reflecting a broader societal trend towards inclusivity and diversity. This shift in consumer preferences has opened up new opportunities for growth and expansion in the jewelry industry.

Moreover, there is a growing tendency towards purchasing luxurious goods, including jewelry, as consumers seek to elevate their lifestyles and status. This trend has contributed to an increase in profit margins for luxury jewelry brands, as they command higher prices for their products. Also, the rise of fashion jewelry has further fuelled the growth of the market, with consumers seeking trendy and stylish pieces to complement their wardrobes.

Rising disposable incomes worldwide have also played a significant role in driving the luxury jewelry market. As consumers have more discretionary income to spend, they are increasingly indulging in luxury purchases, including high-end jewelry items. This trend has led to an increase in sales volume for luxury jewelry brands, as well as a rise in production costs due to the demand for high-quality materials and craftsmanship. Besides, the rise of online retail platforms has made luxury jewelry more accessible to consumers, further driving sales and market growth. Consumers easily browse and purchase luxury jewelry items from the comfort of their homes, contributing to the inclusive growth of the market. Additionally, the increasing demand for precious gemstones and the focus on innovations in the jewelry industry, such as lab-created diamonds, are further driving the growth of the luxury jewelry market.

High Cost of Manufacturing and Fluctuating Prices of Raw Materials Hindering the Market Growth

The luxury jewelry market faces challenges, including high manufacturing costs owing to high-quality materials, intricate designs, and skilled craftsmanship. Fluctuating raw material prices further increases manufacturing costs, impacting profit margins for luxury jewelry brands. These constraints pose barriers to entry for new players and affect pricing strategies. To remain profitable and sustainable in the long term, brands must adopt innovative strategies to manage manufacturing costs and raw material prices. Balancing high-quality standards with market competitiveness is crucial for luxury jewelry brands to thrive in the competitive market.

Luxury Jewelry Market Trends

The luxury jewelry market is driven by increasing consumer preference for branded jewelry, growth in the jewelry industry, and the rise in fashion jewelry. Television marketing and ornament usage are driving large-scale accessibility to luxury jewelry. A rise in consumer belief in astrology is also driving growth in the luxury apparel market. The demand for men's jewelry is also growing owing to men's focus on self-grooming and artistic appeal, as well as social media's influence on fashion trends. The market is expected to grow due to these factors. In some countries, strict government regulations on trading luxury jewelry and imports are causing high levies and duties.

Luxury Jewelry Market Segment Analysis

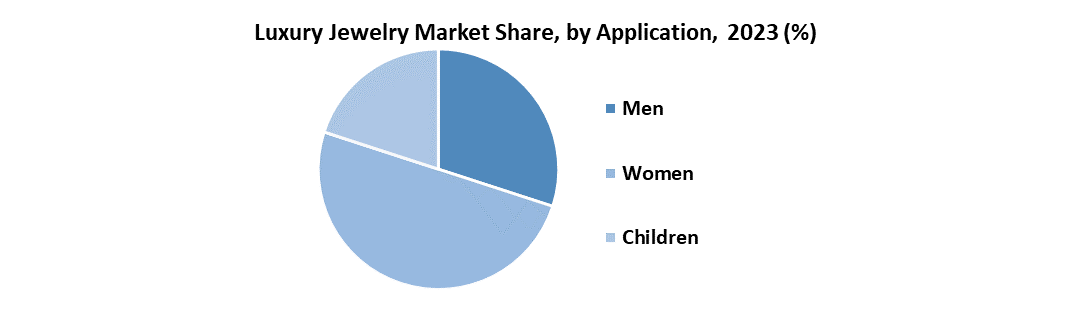

By Application, According to SMR research, the application segment is divided into Men, Women, and Children. The women's segment is leading the growth of the luxury jewelry market, with the highest revenue share over the forecast period (2024-2030). This segment's dominance is attributed to the increased presence of female self-purchasers, who are driving significant growth in the market. Research from the JCK State of the Jewelry Industry Report indicates a rising trend of women purchasing jewelry for themselves, with 76% of respondents in the jewelry industry noting an increase in such purchases.

The report also highlights that 73% of female jewelry purchasers bought at least one piece of jewelry for themselves over the past two years. This trend is not limited to younger generations, as 45% of older generations also reported buying jewelry for themselves. The focus on self-purchasing women has led to new design possibilities and innovations within the luxury jewelry segment, further fueling its growth.

Luxury Jewelry Market Regional Analysis

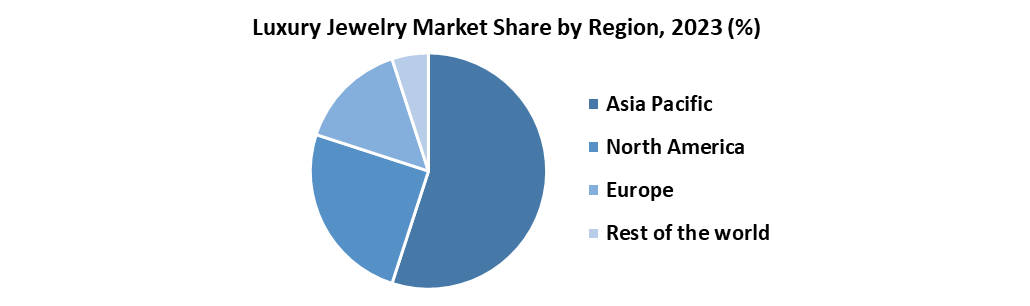

Asia-Pacific has dominated the global luxury jewelry market, boasted the largest market share and exhibited strong growth potential in 2023. The region, led by key players such as Tanishq, Malabar Gold and Diamonds, Qeelin, and Wallace Chan, is characterized by its vibrant market for luxury jewelry, driven by factors such as the latest designs, high-quality jewelry demand among elite customers, and the integration of advanced technologies like computer-aided design in manufacturing processes.

China and India stand out as the region's top markets for luxury jewelry, fueling the overall growth trajectory. The region's dominance is further emphasized by its significant role in the value chain, with a prominent presence in both import and export activities. The growing focus on visual appeal, the influence of social media, and the increasing trend of internet browsing among consumers have also contributed to the market's growth in the region.

Furthermore, the Asia-Pacific region is witnessing a surge in online distribution channels, catering to evolving consumer preferences and shopping behaviours. With continuous restrictions on international travel and the growth of domestic duty-free zones in China, the demand for luxury jewelry from younger customers and domestic shoppers is expected to rise significantly. Thus, Asia-Pacific's leadership in the luxury jewelry market is set to continue, driven by a combination of economic growth, changing consumer lifestyles, and a growing appreciation for luxury goods.

Luxury Jewelry Market Competitive Landscape

The competitive landscape of the luxury jewelry market is characterized by intense rivalry among established brands, each striving to differentiate themselves and capture market share. Key players such as Tiffany & Co., Cartier, and Bulgari compete not only on product quality and design but also on brand prestige and customer experience. These brands invest heavily in marketing and advertising to maintain their luxury image and attract affluent consumers. Additionally, the rise of online retail platforms has intensified competition, as brands vie for digital visibility and engagement. New entrants face significant barriers to entry, including high manufacturing costs and the need to establish brand recognition and credibility. Thus, the competitive landscape of the luxury jewelry market is dynamic and evolving, driven by changing consumer preferences and trends.

- In October, luxury conglomerate Kering, with Cartier, launched its Watch and Jewellery Initiative 2030 which invites brands to commit to ESG objectives and collaborate to create a more positive planetary impact within the industry.

- In 2023, Luxury Jewellery Brand, Aurate, Partners with Helzberg Diamonds to Launch Exclusive Collection

- In 2023, Byredo Is launched Fine Jewellery

- In May 2023, Saint Laurent launched a jewellery line

- June 2023- Explora Journeys proclaimed that its ships, EXPLORA I and EXPLORA II, has featured a new luxury watch and jewelry retail offering. The new retail offerings include Cartier, Panerai, and a watch and jewelry store called Piaget.

- On 4th Aug 2023, aurate, a premium, high-quality, and sustainable jewelry company, revealed the debut of its new collection, 'Laure by Aurate,' created exclusively in collaboration with Helzberg Diamonds, a top national diamond store.

- June 2022- A visionary in fine jewelry, ANNA ZUCKERMAN, unveiled a collection that redefines affordable luxury. Anna Zuckerman created a line of demi-fine jewelry that emanates boldness, self-assurance, and timeless beauty through her passion for gemstones and commitment to ethical practices

- On 7th Jan 2021, LVMH Acquires French Jewelry Manufacturing Group To Strengthen Capacities Of Tiffany & Co.

|

Luxury Jewelry Market Scope |

|

|

Market Size in 2023 |

USD 51.2 Bn. |

|

Market Size in 2030 |

USD 84.2 Bn. |

|

CAGR (2024-2030) |

7.9% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

Segments |

by Product TypeNecklacesRingEarringsBraceletsOther |

by ApplicationMenWomenChildren |

|

|

by Distribution Channel Online Offline |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Luxury Jewelry

- Tiffany & Co. (USA)

- Harry Winston Inc. (USA)

- Chopard International SA (Switzerland)

- Graff Diamond Corporation (UK)

- Compagnie Financiere Richemont S.A. (Switzerland)

- Bulgari S.P.A. (Italy)

- LVMH Moet Hennessy (France)

- Pandora Jewelry, LLC (USA)

- Giorgio Armani S.p.A (Italy)

- Prada S.p.A (Italy)

- Swarovski Group (Austria)

- Piaget (India)

- Pandora Jewelry LLC (USA)

- Chow Tai Fook Jewellery Company Limited (Hong Kong)

- Signet Jewelers (USA)

- David Yurman (USA)

- Mountain Diamonds (Switzerland)

- The Swatch Group Ltd. (Switzerland)

- Van Cleef and Arpels (France)

- Tanishq (India)

- XXX

Frequently Asked Questions

Key factors that are driving the luxury jewelry market growth include increasing consumer preference for branded jewelry and a rising standard of living among the urban class population worldwide.

The Luxury Jewelry Market size was valued at USD 51.2 Billion in 2023 and the total Global Luxury Jewelry revenue is expected to grow at a CAGR of 7.9 % from 2024 to 2030, reaching nearly USD 84.2 Billion by 2030.

The Luxury Jewelry is Segmented by Product type, Application, Distribution Channel and Geography.

1. Luxury Jewelry Market: Research Methodology

2. Luxury Jewelry Market: Executive Summary

3. Luxury Jewelry Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Luxury Jewelry Market: Dynamics

5.1. Market Trends by Region

5.1.1. North America

5.1.2. Europe

5.1.3. Asia Pacific

5.1.4. Middle East and Africa

5.1.5. South America

5.2. Market Drivers by Region

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Regulatory Landscape by Region

5.9.1. North America

5.9.2. Europe

5.9.3. Asia Pacific

5.9.4. Middle East and Africa

5.9.5. South America

6. Luxury Jewelry Market Size and Forecast by Segments (by Value Units)

6.1. Luxury Jewelry Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Necklaces

6.1.2. Ring

6.1.3. Earrings

6.1.4. Bracelets

6.1.5. Others

6.2. Luxury Jewelry Market Size and Forecast, by Application (2023-2030)

6.2.1. Men

6.2.2. Women

6.2.3. Children

6.3. Luxury Jewelry Market Size and Forecast, by Distribution Channel (2023-2030)

6.3.1. Online

6.3.2. Offline

6.4. Luxury Jewelry Market Size and Forecast, by region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Luxury Jewelry Market Size and Forecast (by Value Units)

7.1. North America Luxury Jewelry Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Necklaces

7.1.2. Ring

7.1.3. Earrings

7.1.4. Bracelets

7.1.5. Others

7.2. North America Luxury Jewelry Market Size and Forecast, by Application (2023-2030)

7.2.1. Men

7.2.2. Women

7.2.3. Children

7.3. North America Luxury Jewelry Market Size and Forecast, by Distribution Channel (2023-2030)

7.3.1. Online

7.3.2. Offline

7.4. North America Luxury Jewelry Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Luxury Jewelry Market Size and Forecast (by Value Units)

8.1. Europe Luxury Jewelry Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Necklaces

8.1.2. Ring

8.1.3. Earrings

8.1.4. Bracelets

8.1.5. Others

8.2. Europe Luxury Jewelry Market Size and Forecast, by Application (2023-2030)

8.2.1. Men

8.2.2. Women

8.2.3. Children

8.3. Europe Luxury Jewelry Market Size and Forecast, by Distribution Channel (2023-2030)

8.3.1. Online

8.3.2. Offline

8.4. Europe Luxury Jewelry Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Luxury Jewelry Market Size and Forecast (by Value Units)

9.1. Asia Pacific Luxury Jewelry Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Necklaces

9.1.2. Ring

9.1.3. Earrings

9.1.4. Bracelets

9.1.5. Others

9.2. Asia Pacific Luxury Jewelry Market Size and Forecast, by Application (2023-2030)

9.2.1. Men

9.2.2. Women

9.2.3. Children

9.3. Asia Pacific Luxury Jewelry Market Size and Forecast, by Distribution Channel (2023-2030)

9.3.1. Online

9.3.2. Offline

9.4. Asia Pacific Luxury Jewelry Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Luxury Jewelry Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Luxury Jewelry Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Necklaces

10.1.2. Ring

10.1.3. Earrings

10.1.4. Bracelets

10.1.5. Others

10.2. Middle East and Africa Luxury Jewelry Market Size and Forecast, by Application (2023-2030)

10.2.1. Men

10.2.2. Women

10.2.3. Children

10.3. Middle East & Africa Luxury Jewelry Market Size and Forecast, by Distribution Channel (2023-2030)

10.3.1. Online

10.3.2. Offline

10.4. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Luxury Jewelry Market Size and Forecast (by Value Units)

11.1. South America Luxury Jewelry Market Size and Forecast, by Product Type (2023-2030)

11.1.1. Necklaces

11.1.2. Ring

11.1.3. Earrings

11.1.4. Bracelets

11.1.5. Others

11.2. South America Luxury Jewelry Market Size and Forecast, by Application (2023-2030)

11.2.1. Men

11.2.2. Women

11.2.3. Children

11.3. South America Luxury Jewelry Market Size and Forecast, by Distribution Channel (2023-2030)

11.3.1. Online

11.3.2. Offline

11.4. South America Luxury Jewelry Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Tiffany & Co.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Harry Winston Inc.

12.3. Chopard International SA

12.4. . Graff Diamond Corporation

12.5. Compagnie Financiere Richemont S.A.

12.6. Bulgari S.P.A.

12.7. LVMH Moet Hennessy

12.8. Pandora Jewelry, LLC

12.9. Giorgio Armani S.p.A

12.10. Prada S.p.A

12.11. Swarovski Group

12.12. Piaget

12.13. Chow Tai Fook Jewellery Company Limited

12.14. Signet Jewelers

12.15. David Yurman

12.16. MOUNTAIN DIAMONDS

12.17. The Swatch Group Ltd.

12.18. Van Cleef and Arpels

12.19. Tanishq

13. Key Findings

14. Industry Recommendations