Mastopexy Market: Global Industry Analysis and Forecast (2024-2030)

Mastopexy Market size was valued at USD 1.68 Bn. in 2023 and the Mastopexy revenue is expected to grow at a CAGR of 5.83% from 2024 to 2030, reaching nearly USD 2.50 Bn. by 2030.

Format : PDF | Report ID : SMR_2099

Mastopexy Market Overview:

Mastopexy Commonly known as a breast lift, mastopexy is a cosmetic surgery that involves raising women's breasts that have drooped due to things such as growing older having children bearing much body weight or genetics; it helps them appear rejuvenated. In order to accomplish this goal, plastic surgeons might eliminate too much skin from overlying the mammary glands, change its shape underneath or move them up hence looking younger and higher on the chest wall compared with when they were sagging. Mastopexy is mainly done to make the breast firmer and attractive in shape, and then, if need be, achieve its size. It should be understood that as a solo operation, mastopexy does not change the volume of a breast.

The mastopexy segment is undergoing rapid expansion, primarily ascribed to growing demand for better aesthetic appeal by women. Information from the American Society of Plastic Surgeons (ASPS) shows that there was a significant 17% rise in mastopexy procedures done in the United States between 2022 and 2023. This rising trajectory will not abate soon because more ladies prefer breast surgery for an enhanced chest look.

As women get older, it is a must that they have a mastopexy operation since there is always sagging of the mammary glands with aging. Just like in the case of pregnancy and breastfeeding, the mammary glands become loose. But on the contrary, they do not qualify for such services because of after surgery complications. These future post-operative issues are expected to impact the Mastopexy Market progress. Scars on the breast, changing sensations in the breast or nipple and breastfeeding problems are instances of these situations are some common complications that have been observed in women.

To get more Insights: Request Free Sample Report

Mastopexy Market Dynamics:

Drivers: Increasing number of Mastopexy Surgeries

In recent time the prevalence of mastopexy surgery also known as a breast lift has increased significantly The number of breast surgeries has seen an increase over the years owing to the growing nature of cosmetic surgery among women who wish to look more and subsequently become more confident about themselves so much so that for instance according to Aesthetic Society 2023 there were 465 000 breast augmentations done worldwide this year alone Additionally 178 000 women went for an implant removal

The growing popularity of mastopexy is influenced by various factor. Many women today including those who are new mothers have opted for breast lifts just after giving birth and breastfeeding since most of the time pregnancy and weight gain results in sagging breasts. The skin becomes less tight due to pregnancy leading to loss of firmness in the breasts. There have been changing clothes styles as well a push for healthy looking bodies that fits current trends More women are now opting to undergo breast lift surgery in order to reverse the signs of breast ptosis or drooping which could enhance their self-esteem and make them feel better about their bodies. The development of new and improved procedures has led to reduced scarring, quicker recovery times as well as more natural looking outcomes making this operation more appealing to the majority.

Restrains: High Treatment Costs

Mastopexy procedures are very expensive which hinders the Mastopexy Market’s expansion possibilities. The overall procedural costs, that includes fees charged for surgery/hospitalization/and anaesthesia, outside the range of $4000-$10000 usually depending on which approach is used and where these are practiced. Despite being cheaper in developing countries, they are still unaffordable for a large section of the female population worldwide, given the elective nature of the surgery. Charging expensively discourages many patients who qualify from taking on the process and make them think of other treatment options which could be inexpensive. This restrains the revenue streams for players operating in the mastopexy market.

Risks and Complications Associated with Surgeries

An important restriction to improved mastopexy market is general absence of risks and complications related to mastopexy surgery. Side effects, infections, hematomas nerve damage, poor scars and asymmetry are some of the common risks associated with surgery even though it is generally safe when conducted by qualified surgeons. There are also reports in few instances of loss of nipple sensation or inability to breastfeed after mastopexy operating. To achieve desired outcomes, it may be necessary to have revisional procedures done. This possibility of bad results makes some people not want to have such an operation done and makes them not confident about it. Invention as well as technology in addressing these surgical challenges would be helpful in easing barriers and making the market have more growth in the future.

Mastopexy Market Segment Analysis:

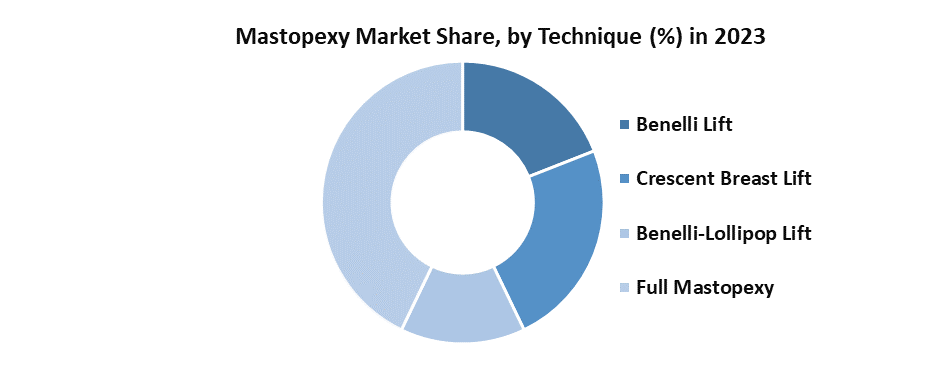

Based on technique, the full mastopexy segment held a majority of the Mastopexy Market share in terms of revenue. Breast sagginess in older women mainly necessitates full mastopexy. Mastopexy may also be done for breast cancer patients who have had either breast amputation or lumpectomy (when removal of cancerous tissue alone leaves the rest intact). This often results in breast reconstruction (attachment back together the rest of the breasts after removing the tumour) after removing the cancerous tissue.

According to the American Cancer Society, it was estimated that 287,850 new cases of invasive breast cancer would be diagnosed in the United States in 2022. The high incidence of breast cancer can thus boost Mastopexy Market growth. The mastopexy restores the volume and fullness of the breasts with or without the use of implants. Thus, the increase in the number of breast augmentations will help to propel the demand for full mastopexy during the forecast period.

Mastopexy Market Regional Insight:

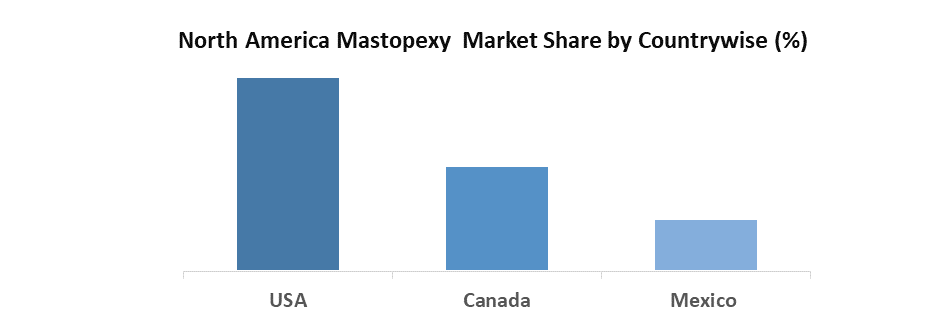

North America region is the largest contributor to the Mastopexy Market revenue share and during the forecast period the trend is expected to continue. The region’s growth is fueled by a number of factors, such as increasing demand for aesthetic procedures by women and higher disposable income levels. For instance, there are new creative procedures to reshape the body as seen in American Society of Plastic Surgeons statistics where minimally invasive cosmetic operations rose by almost 200% since 2000.

Breast enhancement is one of the top cosmetic surgical procedures performed in the North American region. In the United States, breast cancer is one of the leading cancer types. According to Breastcancer.org, updated in January 2022, about 1 in 8 women (about 13%) will develop invasive breast cancer over their lifetime. Such prevalence of breast cancer among women is expected to drive the growth of the market.

The demand for cosmetic surgeries and procedures in the United States is very high among women, which is one of the significant factors for the growth of the mastopexy market in the region. Moreover, the total number was 193,073 breast augmentation procedures in 2020. In addition, the increasing prevalence of breast cancer in North America will also complement the growth of the mastopexy market in the region. Therefore, North America is expected to hold a significant market share in the Mastopexy market during the forecast period.

Mastopexy Market Competitive Landscape:

- On 9 January 2024, Dr. Dana Coberly, a plastic surgeon based in Tampa and certified by the board, released an article discussing the benefits of breast lifts. According to a report published in December 2011, it can increase cup size, reshape or lift sagging breasts, tighten up skin around one’s body and more.

- In January 2023, The Marena Group, a pioneer in the design and production of shapewear and post-surgery compression apparel, introduced a ground-breaking new technology that can significantly improve the patient's recovery from surgical breast treatments.

- In May 2022, GC Aesthetics launched Nipple Areola Complex (NAC) reconstruction implant innovation, which is able to meet the clinical requirements of women from all over the globe

- In February 2022, Galderma got clearance from the United States Food and Drug Administration for RESTYLANE DEFYNE to enhance and correct mild to moderate chin retrusion in adults.

Mastopexy Market Scope:

|

Mastopexy Market |

|

|

Market Size in 2023 |

USD 1.68 Bn. |

|

Market Size in 2030 |

USD 2.50 Bn. |

|

CAGR (2024-2030) |

5.83 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Technique Benelli Lift Crescent Breast Lift Benelli-Lollipop Lift Full Mastopexy |

|

By End Use Speciality Clinics Hospitals |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Mastopexy Market Key Players:

- Johnson & Johnson (MENTOR)

- Cynosure

- Allergan

- Lumenis

- Mentor Worldwide

- SOLTA Medical

- Syneron Medical

- Galderma

- GC Aesthetics (Dublin)

- Lipoelastic (England)

- Sientra, Inc. (U.S.)

- POLYTECH Health & Aesthetics (Germany)

- Olympus Cosmetic Group

- Spire Healthcare Group plc

- Aurora Clinics

- The Esthetic Clinics

- Guangzhou Wanhe Plastic Materials

- Rau Plastic Surgery

- Establishment Labs

- Hologic, Inc.

- XX Ltd

Frequently Asked Questions

Risks and Complications Associated with Surgeries are the challenges in the Mastopexy Market.

The Market size was valued at USD 1.68 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 5.83 % from 2024 to 2030, reaching nearly USD 2.50 Billion.

The segments covered in the market report are by Technique, and By End Use.

1. Mastopexy Market: Research Methodology

2. Mastopexy Market: Executive Summary

3. Mastopexy Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Mastopexy Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. Mastopexy Market: Dynamics

6.1. Market Trends by Region

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Middle East and Africa

6.1.5. South America

6.2. Market Drivers by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Restraints

6.4. Market Opportunities

6.5. Market Challenges

6.6. PORTER’s Five Forces Analysis

6.7. PESTLE Analysis

6.8. Strategies for New Entrants to Penetrate the Market

6.9. Regulatory Landscape by Region

6.9.1. North America

6.9.2. Europe

6.9.3. Asia Pacific

6.9.4. Middle East and Africa

6.9.5. South America

7. Mastopexy Market Size and Forecast by Segments (by Value Units)

7.1. Mastopexy Market Size and Forecast, by Technique (2023-2030)

7.1.1. Benelli Lift

7.1.2. Crescent Breast Lift

7.1.3. Benelli-Lollipop Lift

7.1.4. Full Mastopexy

7.2. Mastopexy Market Size and Forecast, by End Use (2023-2030)

7.2.1. Speciality Clinics

7.2.2. Hospitals

7.3. Mastopexy Market Size and Forecast, by region (2023-2030)

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

8. North America Mastopexy Market Size and Forecast (by Value Units)

8.1. North America Mastopexy Market Size and Forecast, by Technique (2023-2030)

8.1.1. Benelli Lift

8.1.2. Crescent Breast Lift

8.1.3. Benelli-Lollipop Lift

8.1.4. Full Mastopexy

8.2. Mastopexy Market Size and Forecast, by End Use (2023-2030)

8.2.1. Speciality Clinics

8.2.2. Hospitals

8.3. North America Mastopexy Market Size and Forecast, by Country (2023-2030)

8.3.1. United States

8.3.2. Canada

8.3.3. Mexico

9. Europe Mastopexy Market Size and Forecast (by Value Units)

9.1. Europe Mastopexy Market Size and Forecast, by Technique (2023-2030)

9.1.1. Benelli Lift

9.1.2. Crescent Breast Lift

9.1.3. Benelli-Lollipop Lift

9.1.4. Full Mastopexy

9.2. Mastopexy Market Size and Forecast, by End Use (2023-2030)

9.2.1. Speciality Clinics

9.2.2. Hospitals

9.3. Europe Mastopexy Market Size and Forecast, by Country (2023-2030)

9.3.1. UK

9.3.2. France

9.3.3. Germany

9.3.4. Italy

9.3.5. Spain

9.3.6. Sweden

9.3.7. Russia

9.3.8. Rest of Europe

10. Asia Pacific Mastopexy Market Size and Forecast (by Value Units)

10.1. Asia Pacific Mastopexy Market Size and Forecast, by Technique (2023-2030)

10.1.1. Benelli Lift

10.1.2. Crescent Breast Lift

10.1.3. Benelli-Lollipop Lift

10.1.4. Full Mastopexy

10.2. Mastopexy Market Size and Forecast, by End Use (2023-2030)

10.2.1. Speciality Clinics

10.2.2. Hospitals

10.3. Asia Pacific Mastopexy Market Size and Forecast, by Country (2023-2030)

10.3.1. China

10.3.2. S Korea

10.3.3. Japan

10.3.4. India

10.3.5. Australia

10.3.6. Indonesia

10.3.7. Malaysia

10.3.8. Vietnam

10.3.9. Taiwan

10.3.10. Bangladesh

10.3.11. Pakistan

10.3.12. Rest of Asia Pacific

11. Middle East and Africa Mastopexy Market Size and Forecast (by Value Units)

11.1. Middle East and Africa Mastopexy Market Size and Forecast, by Technique (2023-2030)

11.1.1. Benelli Lift

11.1.2. Crescent Breast Lift

11.1.3. Benelli-Lollipop Lift

11.1.4. Full Mastopexy

11.2. Middle East and Africa Market Size and Forecast, by End Use (2023-2030)

11.2.1. Speciality Clinics

11.2.2. Hospitals

11.3. Middle East and Africa Mastopexy Market Size and Forecast, by Country (2023-2030)

11.3.1. South Africa

11.3.2. GCC

11.3.3. Egypt

11.3.4. Nigeria

11.3.5. Rest of ME&A

12. South America Mastopexy Market Size and Forecast (by Value Units)

12.1. South America Mastopexy Market Size and Forecast, by Technique (2023-2030)

12.1.1. Benelli Lift

12.1.2. Crescent Breast Lift

12.1.3. Benelli-Lollipop Lift

12.1.4. Full Mastopexy

12.2. South America Market Size and Forecast, by End Use (2023-2030)

12.2.1. Speciality Clinics

12.2.2. Hospitals

12.3. South America Mastopexy Market Size and Forecast, by Country (2023-2030)

12.3.1. Brazil

12.3.2. Argentina

12.3.3. Rest of South America

13. Company Profile: Key players

13.1. Johnson & Johnson (Mentor)

13.1.1.1. Company Overview

13.1.1.2. Financial Overview

13.1.1.3. Business Portfolio

13.1.1.4. SWOT Analysis

13.1.1.5. Business Strategy

13.1.1.6. Recent Developments

13.2. Cynosure

13.3. Allergan

13.4. Lumenis

13.5. Mentor Worldwide

13.6. SOLTA Medical

13.7. Syneron Medical

13.8. Galderma

13.9. GC Aesthetics (Dublin)

13.10. Lipoelastic (England)

13.11. Sientra, Inc. (U.S.)

13.12. POLYTECH Health & Aesthetics (Germany)

13.13. Olympus Cosmetic Group

13.14. Spire Healthcare Group plc

13.15. Aurora Clinics

13.16. The Esthetic Clinics

13.17. Guangzhou Wanhe Plastic Materials

13.18. Rau Plastic Surgery

13.19. Establishment Labs

13.20. Hologic, Inc.

13.21. XX Ltd

14. Key Findings

15. Industry Recommendation