Memory IC Market: Industry Analysis and Forecast (2024-2030)

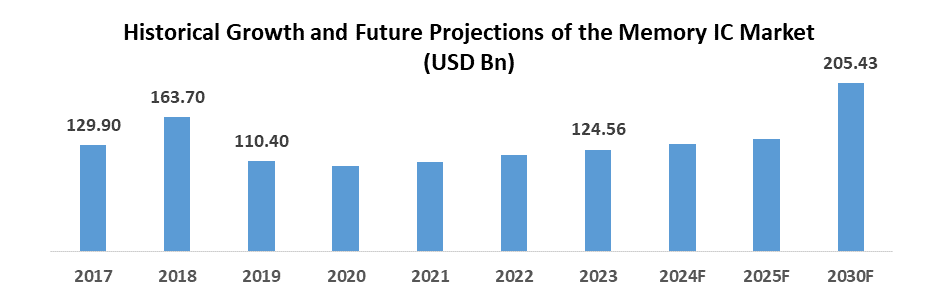

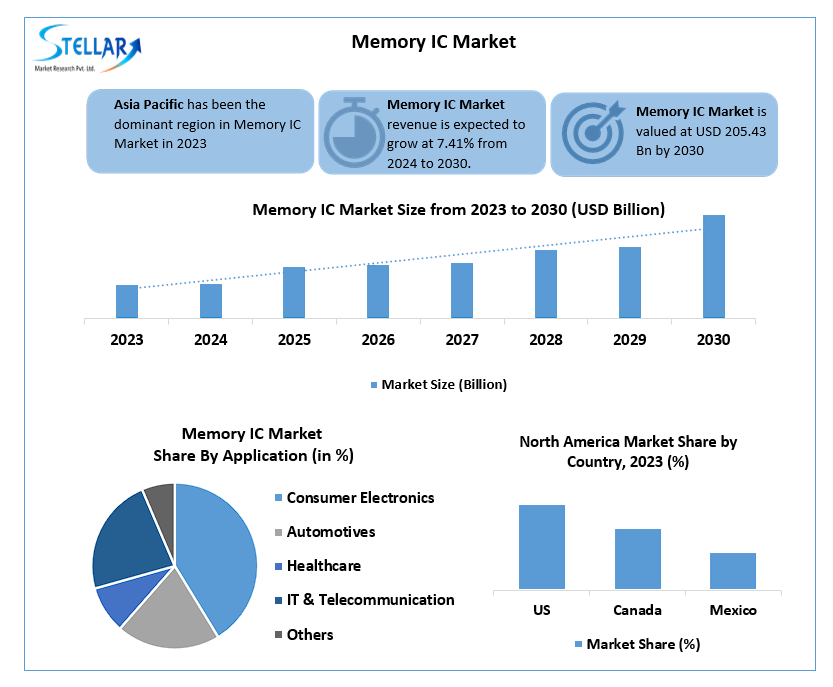

The Memory IC Market size was valued at USD 124.56 Bn. in 2023 and the total Global Memory IC revenue is expected to grow at a CAGR of 7.41% from 2024 to 2030, reaching nearly USD 205.43 Bn. by 2030.

Format : PDF | Report ID : SMR_1994

Memory IC Market Overview:

The Memory IC Market covers specialized integrated circuits designed to store data or process code using semiconductors. Memory ICs can retain data either permanently or temporarily through various types such as access memory (DRAM), read-only memory (ROM), random access memory (RAM) and others. The surge in data generation across industries, including consumer electronics, automotive, IT & Telecommunication, and other sectors, drives the adoption of memory-integrated chips as vital components in computers, smartphones, and various electronic devices. The rising volume of data handled in applications such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) further fuels the demand for Memory IC market.

With the Memory IC Market expected to grow significantly in the coming years, companies are investing in advanced memory technologies and expanding their global presence to meet the rising demand. The market's growth is attributed to the critical role Memory ICs play in the performance and functionality of modern electronic devices.

Memory-Driven Demand to Boost IC Market in 2024:

ICs will represent the fastest-growing segment of the semiconductor industry in 2024, with discrete, and sensors all limited to low-to-mid single-digit growth for the year. ICs account for about 80% of the semiconductor industry and include analog, memory, programmable and standard logic, microcontroller, microprocessor, and memory ICs. Within the IC segment, the Memory IC market is set for the strongest growth by far, with a 44.8% surge in revenue, according to our study. After experiencing a 31% drop in memory revenue in 2023, this represents a stunning 79.8 percentage-point shift from negative to positive territory.

The electronics industry is already showing signs of strength in early 2024, with the Commodity IQ Demand Index for all electronic components rising to 103 in March, up from 87 in February. This above-the-baseline reading indicates that demand is on the rise. All but one IC type tracked by the Commodity IQ Demand Index generated double-digit growth in sourcing activity in March compared to February. The Memory IC market was the second-fastest growing component category, with the Commodity IQ Demand Index for memory rising by 31.3%. However, the memory market is coming off a weak month in February, when the index plunged well below the baseline level.

The anticipated growth in the Memory IC market is driven by increasing data generation across industries such as consumer electronics, automotive, data centers, and other sectors, making memory ICs a fundamental part of computers, smartphones, and various electronic devices. This surge reflects the critical role that memory ICs play in supporting modern technology infrastructures like cloud computing, AI, and the IoT.

Memory IC Market Dynamics:

Smartphone Evolution: The Impact of Memory IC Installation

The installation of memory ICs in smartphones is a necessary aspect of portable electronics production. Memory ICs, also referred to as flash ICs, constitute a vital component within the power section of smartphones, housing essential mobile software. The seamless operation of these memory ICs is paramount, as any malfunction could render smartphones inoperable. The burgeoning global consumption of smartphones is fueling a surge in demand for memory ICs within the consumer electronics domain.

For instance, Apple Inc., a prominent player in the smartphone industry, disclosed in its 2022 annual report that over half of its total revenue stemmed from iPhone sales, which witnessed a notable increase from 196.9 million units in 2020 to 232.2 million units in 2022. Furthermore, Apple Inc. announced its intention in March 2022 to explore NAND flash IC samples from leading memory IC manufacturers for potential integration into future iPhone productions. Consequently, the escalating demand for smartphones from various manufacturers serves as a pivotal driver for the growth of the Memory IC market.

Surveillance Camera Boom: Meeting Rising Demand of Memory IC

The rise in crime rates across various major economies, coupled with advancements in camera and recording technology, is driving the demand for surveillance cameras in diverse regions. For example, the National Crime Records Bureau (NCRB) of India reported a 16.02% increase in crimes against women nationwide in 2023. Furthermore, Honeywell Company, in its 2022 annual report, disclosed that its security division, which includes surveillance cameras, amassed a total revenue of INR 2,948 crore. Alongside the rise in crime rates, surveillance systems like CCV are extensively deployed in public spaces and corporate environments to safeguard properties. These surveillance cameras rely on memory ICs as essential components to ensure optimal functionality. Consequently, the widespread adoption of surveillance cameras global is poised to drive growth within the Memory IC market in the foreseeable future.

Overcoming Editing Hurdles: Impacts on the Memory IC Market

The challenges related with editing EEPROM memory ICs have the potential to impede the growth of the memory IC market. Editing EEPROM memory integrated chips, utilized in flash memory, is notably time intensive as each byte of the chip requires individual editing. To alleviate this, memory IC manufacturers have begun grouping bytes into blocks, aiming to streamline the editing process. However, despite the introduction of block editing, complexity persists as editing remains confined to entire blocks, lacking the precision to target specific byte segments. Consequently, unless there are advancements in current memory IC technology through additional research, the growth of the memory IC market could face constraints.

To get more Insights: Request Free Sample Report

Memory IC Market Trends:

- Development of IoT and Edge Computing: The proliferation of IoT devices and edge computing applications is driving demand for memory ICs optimized for low-power, high-reliability operation in edge devices, fueling growth opportunities in the Memory IC market.

- Increasing Integration in AI Systems: Memory ICs are being increasingly integrated into AI systems, serving as essential components for data storage and processing in AI-enabled devices and applications, thereby driving growth in the Memory IC market.

- Focus on High-Performance Computing: The demand for high-performance memory ICs is rising, fueled by applications in data centers, supercomputers, and high-performance computing (HPC) clusters, driving innovation and investment in advanced memory solutions.

- Diversification of Memory IC Offerings: Manufacturers within the Memory IC market are diversifying their product offerings to cater to various applications and customer needs, including NAND flash, DRAM, SRAM, and emerging memory technologies like MRAM and RRAM.

- Rapid Advancements in Technology: Technological advancements such as process node scaling, 3D integration, and advanced packaging techniques are driving the development of next-generation memory ICs with higher capacities, faster speeds, and lower power consumption.

Memory IC Market Segmentation Analysis:

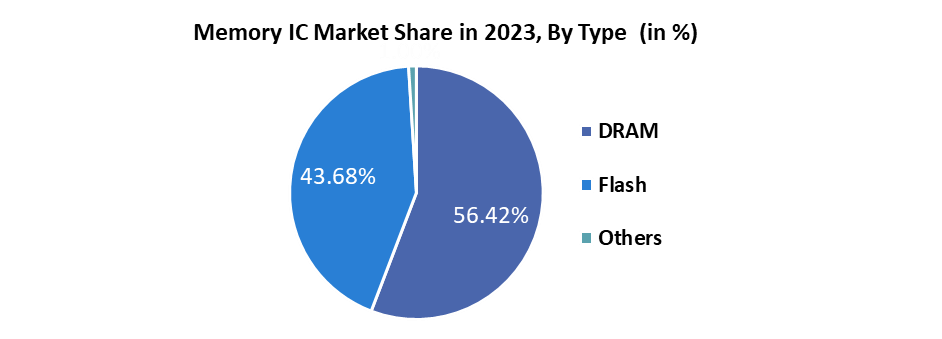

In 2023, DRAM to Account for 56.43% of Memory IC Market and Flash Memory for 42.68%

Type outlook, the DRAM segment of the Memory IC market held the largest market share 0f nearly 56.43% in 2023. DRAM is a type of volatile memory commonly used in computers, smartphones, and other electronic devices for data storage and retrieval. It is known for its high-speed data access capabilities, making it suitable for applications requiring quick and frequent access to data. In 2023, DRAM is expected to have a larger market share compared to flash memory within the Memory IC market. This distribution of market share provides insights into the demand dynamics and preferences of consumers, businesses, and industries for different types of memory technologies during that period.

Flash memory, on the other hand, is a non-volatile memory technology used for data storage in devices such as USB drives, SSDs (Solid State Drives), and memory cards. It retains data even when power is turned off and is often used for long-term storage in consumer electronics and industrial applications.

Memory IC Market Regional Analysis:

Geographically, The Asia-Pacific region, covering over 60% of the global population, stands as a focal point for the Memory IC market's growth. Its expanding population and escalating consumption of consumer electronics underscore its position as a key driver in the industry. Forecasts predict substantial growth in the Memory IC market within this region, fueled by surging demand for high-performance and low-power memory ICs. This demand surge is chiefly propelled by the increasing adoption of cutting-edge technologies like artificial intelligence (AI) and the proliferation of smart devices, both of which necessitate substantial memory storage capacities.

South Asia and the Pacific regions, with their burgeoning populations, are key contributors to the increasing demand for consumer electronics. Moreover, with a robust IT and telecom sector and a growing embrace of cloud computing, this area boasts the highest CAGR in the region. China, buoyed by its immense population, holds the world's largest share of smartphone users, and serves as a pivotal manufacturing hub for numerous multinational electronic product lines. This competitive landscape is further intensified by a substantial presence of both international and domestic vendors within and beyond China.

India has made significant strides in infrastructure, industrialization, and economic development, leveraging electronic devices for developmental objectives. The country's expanding economy, coupled with increased purchasing power among the middle class, continues to propel growth in the consumer electronics market, further driving demand within the Memory IC Market.

Memory IC Market Recent Development:

The adoption of advanced packaging technologies in the Memory IC market is driving innovation and enabling the development of more efficient, high-performance memory solutions to meet the growing demands of various applications, including mobile devices, automotive electronics, and data centers. Companies are implementing various strategies, kike strategic alliances, partnerships, mergers and acquisitions, geographical growth, and product/service launches, to enhance their presence in the Memory IC Market. For Example:

- In March 2023, Team Group, a company dedicated to producing storage and memory devices, unveiled a new memory storage product, VULCAN SO-DIMM DDR5, featuring an integrated IC chip designed to manage power and eliminate noise disturbances, catering specifically to gamers.

- In November 2022, Micron Technology, a leading manufacturer of computer data and storage devices, announced the commercial production launch of its latest dynamic random-access memory (DRAM) chips at its facility in Japan. This follows a significant investment of US$332 million from the Japanese Government to upgrade the plant's manufacturing capacity.

|

Memory IC Market Scope |

|

|

Market Size in 2023 |

USD 124.56 Bn. |

|

Market Size in 2030 |

USD 205.43 Bn. |

|

CAGR (2024-2030) |

7.41% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type DRAM Flash NOR NAND Others |

|

|

By Application Consumer Electronics Automotives Healthcare IT & Telecommunication Others |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key players in Memory IC Market

- Intel (United States)

- Integrated Silicon Solution Inc. (United States)

- Micron Technology Inc. (United States)

- Texas Instruments Incorporated (United States)

- Microchip Technology (United States)

- Alliance Memory (United States)

- Broadcom (United States)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- NXP (Netherlands)

- Macronix International Co. Ltd. (Taiwan)

- Samsung (South Korea)

- Toshiba Electronic Devices & Storage Corporation (Japan)

- Renesas (Japan)

- SK Hynix (South Korea)

- Fujitsu Limited (Japan)

- XMC Semiconductor Co., Ltd.(China)

- AP Memory Technology Corporation (Taiwan)

- GSI Technology, Inc. (United States)

- Nanya Technology Corporation (Taiwan)

- Cypress Semiconductor Corporation (United States)

- Adesto Technologies Corporation (United States)

Frequently Asked Questions

The Asia Pacific region is expected to hold the highest share of the Memory IC.

The market size of the Memory IC by 2030 is expected to reach US$ 205.43 Bn.

The market size of the Memory IC in 2023 was valued at US$ 124.56 Bn.

Intel, Integrated Silicon Solution Inc., Texas Instruments Incorporated, STMicroelectronics etc.

1. Memory IC Market Introduction

1.1. Study Assumption and Market Definition

1.2. Scope of the Study

1.3. Executive Summary

2. Global Memory IC Market: Competitive Landscape

2.1. MMR Competition Matrix

2.2. Competitive Landscape

2.3. Key Players Benchmarking

2.3.1. Company Name

2.3.2. Business Segment

2.3.3. End-user Segment

2.3.4. Revenue (2023)

2.3.5. Company Locations

2.4. Market Structure

2.4.1. Market Leaders

2.4.2. Market Followers

2.4.3. Emerging Players

2.5. Mergers and Acquisitions Details

3. Memory IC Market: Dynamics

3.1. Memory IC Market Trends by Region

3.1.1. North America Memory IC Market Trends

3.1.2. Europe Memory IC Market Trends

3.1.3. Asia Pacific Memory IC Market Trends

3.1.4. Middle East and Africa Memory IC Market Trends

3.1.5. South America Memory IC Market Trends

3.2. Memory IC Market Dynamics

3.2.1. Global Memory IC Market Drivers

3.2.2. Global Memory IC Market Restraints

3.2.3. Global Memory IC Market Opportunities

3.2.4. Global Memory IC Market Challenges

3.3. Key Stakeholders of Memory IC Development

3.4. Ecotourism and Memory IC Development

3.5. Memory IC Development and the Rise of Slow Tourism

3.6. PORTER’s Five Forces Analysis

3.7. PESTLE Analysis

3.8. Technology Roadmap

3.9. Regulatory Landscape by Region

3.9.1. North America

3.9.2. Europe

3.9.3. Asia Pacific

3.9.4. Middle East and Africa

3.9.5. South America

3.10. Key Opinion Leader Analysis For Memory IC Industry

4. Memory IC Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

4.1. Memory IC Market Size and Forecast, By Type (2023-2030)

4.1.1. DRAM

4.1.2. Flash

4.1.2.1. NOR

4.1.2.2. NAND

4.1.3. Others

4.2. Memory IC Market Size and Forecast, By Application (2023-2030)

4.2.1. Consumer Electronics

4.2.2. Automotives

4.2.3. Healthcare

4.2.4. IT & Telecommunication

4.2.5. Others

4.3. Memory IC Market Size and Forecast, by Region (2023-2030)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Memory IC Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Memory IC Market Size and Forecast, By Type (2023-2030)

5.1.1. DRAM

5.1.2. Flash

5.1.2.1. NOR

5.1.2.2. NAND

5.1.3. Others

5.2. North America Memory IC Market Size and Forecast, By Application (2023-2030)

5.2.1. Consumer Electronics

5.2.2. Automotives

5.2.3. Healthcare

5.2.4. IT & Telecommunication

5.2.5. Others

5.3. North America Memory IC Market Size and Forecast, by Country (2023-2030)

5.3.1. United States

5.3.1.1. United States Memory IC Market Size and Forecast, By Type (2023-2030)

5.3.1.1.1. DRAM

5.3.1.1.2. Flash

5.3.1.1.2.1. NOR

5.3.1.1.2.2. NAND

5.3.1.1.3. Others

5.3.1.2. United States Memory IC Market Size and Forecast, By Application (2023-2030)

5.3.1.2.1. Consumer Electronics

5.3.1.2.2. Automotives

5.3.1.2.3. Healthcare

5.3.1.2.4. IT & Telecommunication

5.3.1.2.5. Others

5.3.2. Canada

5.3.2.1. Canada Memory IC Market Size and Forecast, By Type (2023-2030)

5.3.2.1.1. DRAM

5.3.2.1.2. Flash

5.3.2.1.2.1. NOR

5.3.2.1.2.2. NAND

5.3.2.1.3. Others

5.3.2.2. Canada Memory IC Market Size and Forecast, By Application (2023-2030)

5.3.2.2.1. Consumer Electronics

5.3.2.2.2. Automotives

5.3.2.2.3. Healthcare

5.3.2.2.4. IT & Telecommunication

5.3.2.2.5. Others

5.3.3. Mexico

5.3.3.1. Mexico Memory IC Market Size and Forecast, By Type (2023-2030)

5.3.3.1.1. DRAM

5.3.3.1.2. Flash

5.3.3.1.2.1. NOR

5.3.3.1.2.2. NAND

5.3.3.1.3. Others

5.3.3.2. Mexico Memory IC Market Size and Forecast, By Application (2023-2030)

5.3.3.2.1. Consumer Electronics

5.3.3.2.2. Automotives

5.3.3.2.3. Healthcare

5.3.3.2.4. IT & Telecommunication

5.3.3.2.5. Others

6. Europe Memory IC Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Memory IC Market Size and Forecast, By Type (2023-2030)

6.2. Europe Memory IC Market Size and Forecast, By Application (2023-2030)

6.3. Europe Memory IC Market Size and Forecast, by Country (2023-2030)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.1.2. United Kingdom Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.2. France

6.3.2.1. France Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.2.2. France Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.3. Germany

6.3.3.1. Germany Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.3.2. Germany Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.4. Italy

6.3.4.1. Italy Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.4.2. Italy Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.5. Spain

6.3.5.1. Spain Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.5.2. Spain Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.6. Sweden

6.3.6.1. Sweden Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.6.2. Sweden Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.7. Austria

6.3.7.1. Austria Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.7.2. Austria Memory IC Market Size and Forecast, By Application (2023-2030)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Memory IC Market Size and Forecast, By Type (2023-2030)

6.3.8.2. Rest of Europe Memory IC Market Size and Forecast, By Application (2023-2030)

7. Asia Pacific Memory IC Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Memory IC Market Size and Forecast, By Type (2023-2030)

7.2. Asia Pacific Memory IC Market Size and Forecast, By Application (2023-2030)

7.3. Asia Pacific Memory IC Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.1.1. China Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.1.2. China Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.2. S Korea

7.3.2.1. S Korea Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.2.2. S Korea Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.3. Japan

7.3.3.1. Japan Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.3.2. Japan Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.4. India

7.3.4.1. India Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.4.2. India Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.5. Australia

7.3.5.1. Australia Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.5.2. Australia Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.6. Indonesia

7.3.6.1. Indonesia Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.6.2. Indonesia Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.7. Malaysia

7.3.7.1. Malaysia Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.7.2. Malaysia Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.8. Vietnam

7.3.8.1. Vietnam Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.8.2. Vietnam Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.9. Taiwan

7.3.9.1. Taiwan Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.9.2. Taiwan Memory IC Market Size and Forecast, By Application (2023-2030)

7.3.10. Rest of Asia Pacific

7.3.10.1. Rest of Asia Pacific Memory IC Market Size and Forecast, By Type (2023-2030)

7.3.10.2. Rest of Asia Pacific Memory IC Market Size and Forecast, By Application (2023-2030)

8. Middle East and Africa Memory IC Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Memory IC Market Size and Forecast, By Type (2023-2030)

8.2. Middle East and Africa Memory IC Market Size and Forecast, By Application (2023-2030)

8.3. Middle East and Africa Memory IC Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.1.1. South Africa Memory IC Market Size and Forecast, By Type (2023-2030)

8.3.1.2. South Africa Memory IC Market Size and Forecast, By Application (2023-2030)

8.3.2. GCC

8.3.2.1. GCC Memory IC Market Size and Forecast, By Type (2023-2030)

8.3.2.2. GCC Memory IC Market Size and Forecast, By Application (2023-2030)

8.3.3. Nigeria

8.3.3.1. Nigeria Memory IC Market Size and Forecast, By Type (2023-2030)

8.3.3.2. Nigeria Memory IC Market Size and Forecast, By Application (2023-2030)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Memory IC Market Size and Forecast, By Type (2023-2030)

8.3.4.2. Rest of ME&A Memory IC Market Size and Forecast, By Application (2023-2030)

9. South America Memory IC Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Memory IC Market Size and Forecast, By Type (2023-2030)

9.2. South America Memory IC Market Size and Forecast, By Application (2023-2030)

9.3. South America Memory IC Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.1.1. Brazil Memory IC Market Size and Forecast, By Type (2023-2030)

9.3.1.2. Brazil Memory IC Market Size and Forecast, By Application (2023-2030)

9.3.2. Argentina

9.3.2.1. Argentina Memory IC Market Size and Forecast, By Type (2023-2030)

9.3.2.2. Argentina Memory IC Market Size and Forecast, By Application (2023-2030)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Memory IC Market Size and Forecast, By Type (2023-2030)

9.3.3.2. Rest Of South America Memory IC Market Size and Forecast, By Application (2023-2030)

10. Company Profile: Key Players

10.1. Intel (United States)

10.1.1. Company Overview

10.1.2. Business Portfolio

10.1.3. Financial Overview

10.1.4. SWOT Analysis

10.1.5. Strategic Analysis

10.1.6. Recent Developments

10.2. Integrated Silicon Solution Inc. (United States)

10.3. Micron Technology Inc. (United States)

10.4. Texas Instruments Incorporated (United States)

10.5. Microchip Technology (United States)

10.6. Alliance Memory (United States)

10.7. Broadcom (United States)

10.8. Infineon Technologies AG (Germany)

10.9. STMicroelectronics (Switzerland)

10.10. NXP (Netherlands)

10.11. Macronix International Co. Ltd. (Taiwan)

10.12. Samsung (South Korea)

10.13. Toshiba Electronic Devices & Storage Corporation (Japan)

10.14. Renesas (Japan)

10.15. SK Hynix (South Korea)

10.16. Fujitsu Limited (Japan)

10.17. XMC Semiconductor Co., Ltd.(China)

10.18. AP Memory Technology Corporation (Taiwan)

10.19. GSI Technology, Inc. (United States)

10.20. Nanya Technology Corporation (Taiwan)

10.21. Cypress Semiconductor Corporation (United States)

10.22. Adesto Technologies Corporation (United States)

11. Key Findings

12. Analyst Recommendations

13. Memory IC Market: Research Methodology