Metal Pressure Hose Market: Global Industry Analysis and Forecast (2024-2030)

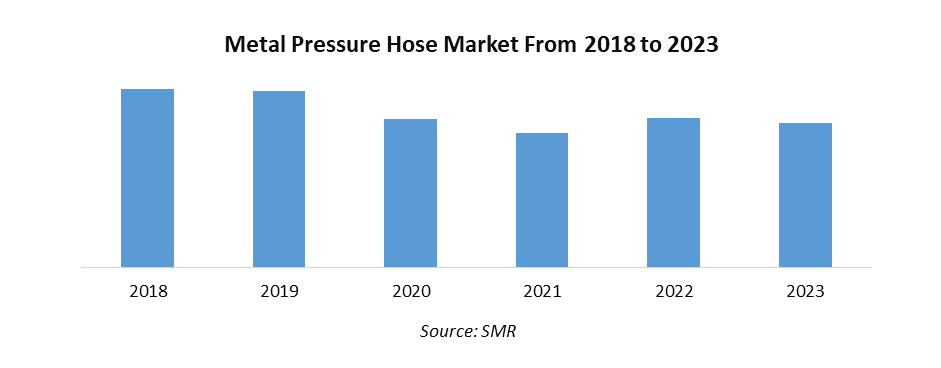

Metal Pressure Hose Market size was valued at USD 2.17 Bn. in 2023 and the total Metal Pressure Hose Market size is expected to grow at a CAGR of 4.64% from 2024 to 2030, reaching nearly USD 2.98 Bn. by 2030

Format : PDF | Report ID : SMR_2158

Metal Pressure Hose Market Overview

A metal hose is flexible piping available in two basic types based on design and application. The types of metal hose are strip wound hose and corrugated hose. While strip wound hoses have high mechanical strength, corrugated hoses render maximum leak tightness owing to their material and withstand high pressure.

The metal pressure hose market is characterized by robust growth, driven primarily by increasing industrialization and infrastructure development globally. The Asia-Pacific region stands out as a dominant player in the market, buoyed by its expensive manufacturing sector and burgeoning infrastructure projects. These nations' demand for durable fluid transmission systems across sectors such as manufacturing, construction, and automotive has propelled the market forward. The market in several regions has been characterized by a shift towards advanced materials and technologies, aimed at enhancing durability and performance in challenging operating environments. The aerospace and defense sectors in particular have emerged as key consumers of specialized metal pressure hoses, driven by stringent safety and performance requirements.

To get more Insights: Request Free Sample Report

Metal Pressure Hose Market Dynamics

Unveiling the Versatility and Durability of Metal Pressure Hoses in Industrial Applications

Metal pressure hoses are distinguished by their exceptional durability, capable of withstanding harsh conditions such as weathering, corrosion and physical damage. Constructed from materials like stainless steel or other high-strength metals, it ensures longevity in high-temperature, high-pressure, or corrosive environments, thereby driving market growth. Despite their strength, these hoses offer remarkable flexibility, maintaining structural integrity even when bent or twisted. It makes them ideal for complex routings or connections, unlike rigid pipe systems, accommodating movements and vibrations without performance compromise.

With innate resistance to high temperatures and pressures, metal pressure hoses excel in industrial applications from steam lines to cryogenic systems, maintaining shape and function under extreme conditions for reliable performance that has boosted the market growth. Metal Pressure Hose is flexible and simplifies installation, navigating tight spaces with ease and reducing the need for complex configurations or fittings, minimizing potential leak points resulting in higher demand for the metal pressure hose. Each industrial application benefits uniquely from the versatility of metal pressure hoses, tailored by manufacturers like Flextech Industries to specific operational needs. Custom-designed for length, diameter, end fittings, and other requirements, these hoses offer tailored solutions for industrial piping and fabrication needs has accelerated the market growth.

Challenges in the Use of Stainless Steel Hoses

The exterior of the hose often became hot when used with hot water, creating a risk of burns or discomfort during handling. Despite their durability, stainless steel hoses are prone to dents and scratches, particularly when dragged over rough surfaces, affecting both their aesthetic appeal and functionality in severe cases. The initial cost of stainless steel hoses is typically higher than that of traditional rubber or plastic hoses, deterring some buyers despite long-term savings attributed to their durability. Stainless steel's conductivity posed a potential risk if the hose came into contact with electrical sources or during thunderstorms, making it less safe compared to non-conductive hose materials that have created barriers in the market growth of metal pressure hose.

Their weight, although lighter than expected, remained heavier than some lightweight alternatives like fabric hoses, making them less desirable for users seeking ultra-lightweight options. Compatibility issues with attachments have also been major challenges, as some models required specific fittings or attachments not commonly available, leading to additional costs or inconvenience in sourcing compatible parts has hindered the metal pressure hose market growth.

Metal Pressure Hose Market Segment Analysis

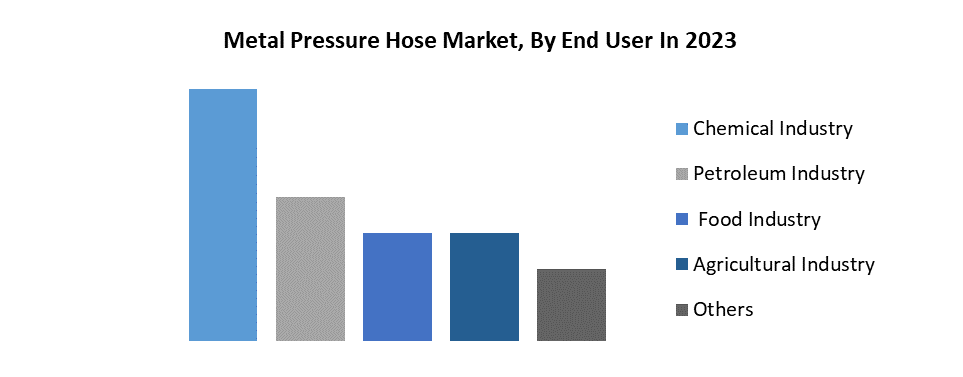

Based on End Users, the Chemical Industry dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. Chemical plants often deal with highly corrosive substances that require hoses made from durable materials like corrugated metal, which has been manufactured from various alloys to resist corrosion effectively. This versatility ensures that the hoses perform reliably in aggressive chemical environments, which is crucial for safety and efficiency and has boosted the metal pressure hose market. Chemical plants involve processes that operate under extreme temperatures, both hot and cold. Metal hoses, particularly those made from stainless steel, withstand these temperature extremes without losing integrity.

They maintain their functionality even at temperatures up to 1200°F, making them suitable for a wide range of chemical applications. Additionally, the surged demand for metal pressure hoses in the chemical industry requires hoses that handle high pressure and movement, as well as exposure to abrasive materials. Metal pressure hoses meet these demands because of their structural strength and flexibility. They are less prone to wear and tear compared to non-metallic hoses, which enhances their longevity and reliability in rigorous operational settings. The need for chemical compatibility is critical in the chemical industry as metal hoses prevent contamination and degradation when exposed to various chemicals, ensuring that the media transported through them remains uncontaminated and that the hose itself does not suffer premature failure.

Additionally, the chemical industry values the safety and reliability offered by metal pressure hoses. Their resistance to punctures and lower susceptibility to permeation make them ideal for containing gases and preventing leaks, thus safeguarding both operators and the environment. The welded fittings on metal hoses also reduce the risk of leakage compared to clamped or crimped fittings on non-metallic hoses.

Metal Pressure Hose Market Regional Analysis

Asia Pacific dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. A key reason is the region's robust industrialization and infrastructure development, which have fueled significant demand for reliable fluid transmission systems across various sectors such as manufacturing, construction, and automotive. Countries like China and India, with their growing industrial bases and large-scale infrastructure projects, have become pivotal markets for metal pressure hoses. Additionally, the presence of established manufacturing capabilities and a competitive cost structure in countries like Japan and South Korea further enhances the region's leadership in this market segment.

- Japan exports most of its Flexible metal hose to Russia, Indonesia, and India.

- The top 3 exporters of Flexible metal hose are India with 11,381 shipments followed by Turkey with 7,064 and China at the 3rd spot with 5,824 shipments.

- Global exports most of its Pressure hose and HSN Code 40092290 to Vietnam, Indonesia, and the Philippines

- The top 3 exporters of Pressure hose and HSN Code 40092290 are China with 1,155 shipments followed by Vietnam with 348 and Germany at the 3rd spot with 311 shipments.

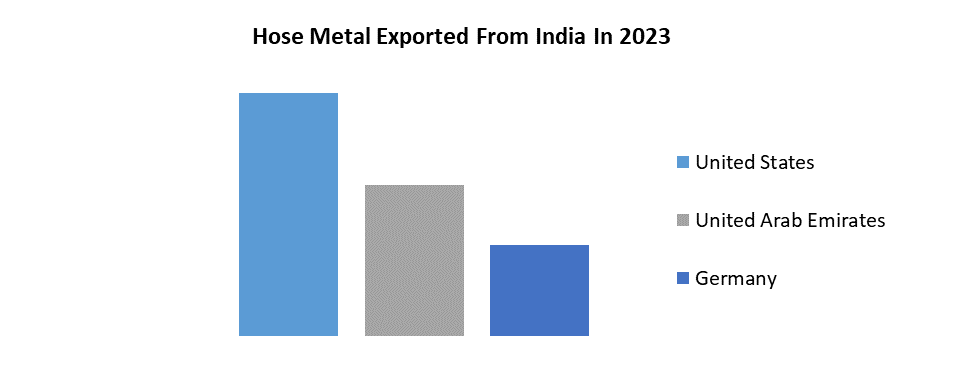

- India exports most of its Hose metal to the United States, the United Arab Emirates, and Germany.

- Japan was the second largest exporter of metal hose flexible accounting for 32.37% of the total imports of metal hose flexible.

Metal Pressure Hose Market Competitive Landscape

- In March 2023, an association of hose distributors added two suppliers and a tech firm to its ranks. NAHAD, the Association for Hose and Accessories Distribution, welcomed United Hose Incorporated and Tubes International, and later announced the addition of Kyklo.

|

Metal Pressure Hose Market |

|

|

Market Size in 2023 |

USD 2.17 Bn. |

|

Market Size in 2030 |

USD 2.98 Bn. |

|

CAGR (2024-2030) |

4.64 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Diameter

|

|

By End User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Metal Pressure Hose Market Key Players

- Eaton

- Parker Hannifin

- ContiTech AG

- Gates Corporation

- Senior Flexonics

- Flexicraft Industries

- Universal Hose & Braid

- JGB Enterprises

- Metline Industries

- ZEC S.p.A.

- Polyhose India Pvt. Ltd.

- Pirtek

- Hydroflex Pipe Pvt. Ltd.

- Aero-Flex Corp.

- Hose Master

- Plastiflex

- Pacific Hoseflex

- FlexFit Hose LLC

- Kongsberg Automotive

- Alfagomma

- XX.Ltd.

Frequently Asked Questions

The high cost of raw materials has restrained market growth.

The Market size was valued at USD 2.17 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 4.64 % from 2024 to 2030, reaching nearly USD 2.98 Billion.

The segments covered in the market report are by Diameter and End User.

1. Metal Pressure Hose Market: Research Methodology

2. Metal Pressure Hose Market: Executive Summary

3. Metal Pressure Hose Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Metal Pressure Hose Market: Dynamics

4.1. Market Trends

4.2. Market Drivers

4.3. Market Restraints

4.4. Market Opportunities

4.5. Market Challenges

4.6. PORTER’s Five Forces Analysis

4.7. PESTLE Analysis

4.8. Strategies for New Entrants to Penetrate the Market

4.9. Regulatory Landscape by Region

4.9.1. North America

4.9.2. Europe

4.9.3. Asia Pacific

4.9.4. Middle East and Africa

4.9.5. South America

4.10. Metal Pressure Hose Market Size and Forecast by Segments (by Value USD Million)

4.10.1. Metal Pressure Hose Market Size and Forecast, by Diameter (2023-2030)

4.10.1.1. Up to 2.5 Inch

4.10.1.2. 7.3. 2.5 to 6 Inch

4.10.1.3. 7.4. 6 to 20 Inch

4.10.1.4. 7.5. Above 20 Inch

4.10.2. Metal Pressure Hose Market Size and Forecast, by End User (2023-2030)

4.10.2.1. Chemical Industry

4.10.2.2. Petroleum Industry

4.10.2.3. Food Industry

4.10.2.4. Agricultural Industry

4.10.2.5. Others

4.10.3. Metal Pressure Hose Market Size and Forecast, by Region (2023-2030)

4.10.3.1. North America

4.10.3.2. Europe

4.10.3.3. Asia Pacific

4.10.3.4. Middle East and Africa

4.10.3.5. South America

5. North America Metal Pressure Hose Market Size and Forecast (by Value USD Million)

5.1. North America Metal Pressure Hose Market Size and Forecast, by Diameter (2023-2030)

5.1.1. Up to 2.5 Inch

5.1.2. 7.3. 2.5 to 6 Inch

5.1.3. 7.4. 6 to 20 Inch

5.1.4. 7.5. Above 20 Inch

5.2. North America Metal Pressure Hose Market Size and Forecast, by End User (2023-2030)

5.2.1. Chemical Industry

5.2.2. Petroleum Industry

5.2.3. Food Industry

5.2.4. Agricultural Industry

5.2.5. Others

5.3. North America Metal Pressure Hose Market Size and Forecast, by Country (2023-2030)

5.3.1. United States

5.3.2. Canada

5.3.3. Mexico

6. Europe Metal Pressure Hose Market Size and Forecast (by Value USD Million)

6.1. Europe Metal Pressure Hose Market Size and Forecast, by Diameter (2023-2030)

6.1.1. Up to 2.5 Inch

6.1.2. 7.3. 2.5 to 6 Inch

6.1.3. 7.4. 6 to 20 Inch

6.1.4. 7.5. Above 20 Inch

6.2. Europe Metal Pressure Hose Market Size and Forecast, by End User (2023-2030)

6.2.1. Chemical Industry

6.2.2. Petroleum Industry

6.2.3. Food Industry

6.2.4. Agricultural Industry

6.2.5. Others

6.3. Europe Metal Pressure Hose Market Size and Forecast, by Country (2023-2030)

6.3.1. UK

6.3.2. France

6.3.3. Germany

6.3.4. Italy

6.3.5. Spain

6.3.6. Sweden

6.3.7. Russia

6.3.8. Rest of Europe

7. Asia Pacific Metal Pressure Hose Market Size and Forecast (by Value USD Million)

7.1. Asia Pacific Metal Pressure Hose Market Size and Forecast, by Diameter (2023-2030)

7.1.1. Up to 2.5 Inch

7.1.2. 7.3. 2.5 to 6 Inch

7.1.3. 7.4. 6 to 20 Inch

7.1.4. 7.5. Above 20 Inch

7.2. Asia Pacific Metal Pressure Hose Market Size and Forecast, by End User (2023-2030)

7.2.1. Chemical Industry

7.2.2. Petroleum Industry

7.2.3. Food Industry

7.2.4. Agricultural Industry

7.2.5. Others

7.3. Asia Pacific Metal Pressure Hose Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.2. S Korea

7.3.3. Japan

7.3.4. India

7.3.5. Australia

7.3.6. ASEAN

7.3.7. Rest of Asia Pacific

8. Middle East and Africa Metal Pressure Hose Market Size and Forecast (by Value USD Million)

8.1. Middle East and Africa Metal Pressure Hose Market Size and Forecast, by Diameter (2023-2030)

8.1.1. Up to 2.5 Inch

8.1.2. 7.3. 2.5 to 6 Inch

8.1.3. 7.4. 6 to 20 Inch

8.1.4. 7.5. Above 20 Inch

8.2. Middle East and Africa Metal Pressure Hose Market Size and Forecast, by End User (2023-2030)

8.2.1. Chemical Industry

8.2.2. Petroleum Industry

8.2.3. Food Industry

8.2.4. Agricultural Industry

8.2.5. Others

8.3. Middle East and Africa Metal Pressure Hose Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.2. GCC

8.3.3. Egypt

8.3.4. Rest of ME&A

9. South America Metal Pressure Hose Market Size and Forecast (by Value USD Million)

9.1. South America Metal Pressure Hose Market Size and Forecast, by Diameter (2023-2030)

9.1.1. Up to 2.5 Inch

9.1.2. 7.3. 2.5 to 6 Inch

9.1.3. 7.4. 6 to 20 Inch

9.1.4. 7.5. Above 20 Inch

9.2. South America Metal Pressure Hose Market Size and Forecast, by End User (2023-2030)

9.2.1. Chemical Industry

9.2.2. Petroleum Industry

9.2.3. Food Industry

9.2.4. Agricultural Industry

9.2.5. Others

9.3. South America Metal Pressure Hose Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.2. Argentina

9.3.3. Rest of South America

10. Company Profile: Key players

10.1. Eaton

10.1.1. Company Overview

10.1.2. Financial Overview

10.1.3. Business Portfolio

10.1.4. SWOT Analysis

10.1.5. Business Strategy

10.1.6. Recent Developments

10.2. Parker Hannifin

10.3. ContiTech AG

10.4. Gates Corporation

10.5. Senior Flexonics

10.6. Flexicraft Industries

10.7. Universal Hose & Braid

10.8. JGB Enterprises

10.9. Metline Industries

10.10. ZEC S.p.A.

10.11. Polyhose India Pvt. Ltd.

10.12. Pirtek

10.13. Hydroflex Pipe Pvt. Ltd.

10.14. Aero-Flex Corp.

10.15. Hose Master

10.16. Plastiflex

10.17. Pacific Hoseflex

10.18. FlexFit Hose LLC

10.19. Kongsberg Automotive

10.20. Alfagomma

11. Key Findings

12. Industry Recommendation