Microgreens Market: Global Industry Analysis and Forecast (2024-2030)

Global Microgreens Market size was valued at USD 3.0 Bn in 2023 and is expected to reach USD 6.63 Bn by 2030, at a CAGR of 12%.

Format : PDF | Report ID : SMR_2027

Microgreens Market Overview

Microgreens are young vegetable greens containing roots, stems, and cotyledon leaves. The stems and leaves of microgreens are concentrated in nutrients making them a strong superfood. Microgreens are the first true leaves produced from a seedling of vegetables and herbs that are about 2-3 inches tall. There are so many varieties of plants such as turnips, radishes, broccoli, cauliflower, carrots, celery, chard, lettuce, spinach, arugula, amaranth, cabbage, beets, parsley and basil, to name a few, that are grown as a microgreen for a wholesome and nutritious addition to daily meals. The small leaves of most of the microgreens get ready for harvest in 12 to 14 days and are packed with nutrition and intense flavors emulating their mature counterparts, which boost Microgreens Market growth.

Microgreens are harvested at the cotyledon stage, which provides intense flavors, vibrant colors, and high nutritional value, making them popular ingredients in culinary dishes, salads, smoothies, and garnishes. This increase in demand for microgreens is due to the rising awareness of the health benefits associated with microgreens including their high levels of vitamins, minerals, and antioxidants. The increase in urban agriculture and indoor farming techniques has made it easier for producers to cultivate microgreens year-round, regardless of climate or location and drive Microgreens Market growth. The trend towards sustainability and eco-conscious consumerism has led to a preference for locally sourced and organically grown microgreens, boosting industry growth.

To get more Insights: Request Free Sample Report

Microgreens Market Trend

Increasing Demand for Locally Grown and Organic Microgreens

Organic microgreen farming is an emerging trend that is a potent tool for fostering environmental biodiversity conservation. Implementing organic farming practices that avoid synthetic fertilizers and pesticides, the cultivation of microgreens reduces soil and water pollution while developing a rich tapestry of biodiversity, and cultivation of a harmonious ecosystem teeming with diverse microorganisms, insects and avifauna, which boosts Microgreens Market growth.

The nutritional advantages of organic microgreens are incomparable, as they boast substantially higher levels of vitamins, minerals, and antioxidants compared to their mature counterparts, while also being free from potentially harmful pesticide residues, thus underscoring the promotion of human health and wellness. Beyond their nutritional prowess, increasing organic microgreens presents a fulfilling pursuit, fostering a profound connection with nature, mitigating stress, and improving mental well-being, while developing healthier dietary habits by facilitating easy access to fresh, organic greens.

The attraction of organic microgreens for culinary is characterized by their strong and concentrated flavors, which are widely recognized by chefs and culinary enthusiasts, who consider them essential for infusing dishes with gourmet sophistication and visual appeal. Economically, organic Microgreens farming is a lucrative venture, especially in urban areas where minimal space and resources are needed, thereby aligning with the increasing demand for organic produce and providing promising prospects for organic Microgreens farmers looking to capitalize on this mushrooming Microgreens Market segment.

The increase in sustainable and health-conscious consumer preferences helps to increase use of the organic microgreens to address modern societal imperatives, serving as a testament to the transformative potential of small-scale, sustainable agriculture in the development of a healthier planet. Beyond simple nourishment, organic microgreens emerge as veritable nutritional powerhouses, full of up to 40 times more vitamins and minerals than their mature counterparts while fascinating the senses with a mixture of flavors and hues that stimulate culinary creativity and elevate gastronomic experiences to new heights.

Microgreens Market Dynamics

Advances in agricultural technology and growing techniques to Boost Microgreens Market Growth

As the acceleration in global urbanization and increasing demands for arable land escalate, conventional agricultural practices struggle to meet food demands while intensifying environmental degradation through deforestation and intensive farming. In response, innovative approaches such as vertical farming technology have emerged and there is a revolution in the cultivation of microgreens. By efficiently leveraging horizontal and vertical space, vertical farming enhances resource utilization of water, nutrients, and time, yielding higher productivity per unit volume compared to conventional outdoor farming methods.

The automation integrates seamlessly into this paradigm to provide real-time monitoring factors such as soil moisture, humidity and light intensity. This precision-driven method optimizes growth conditions and minimizes resource wastage, to promote environmental sustainability. Automation minimizes labor costs and enhances scalability, making microgreen farming available to individuals and small-scale entrepreneurs even in urban areas. The adoption of advanced technologies, mainly Israeli-made in many cases, emphasizes a commitment to continuous innovation and excellence in agricultural practices, showing how technological advancements are driving the Microgreens Market toward a more sustainable and efficient future.

Technological advances such as artificial intelligence (AI) and machine learning (ML) enable specific monitoring of environmental factors such as humidity, temperature, and light to ensure optimal growing conditions. Automated watering and nutrient delivery systems have been developed to allow precise control and reduced waste, streamlining processes and enhancing sustainability. Innovations in LED lighting technology provide energy-efficient lighting solutions tailored to the needs of several microgreen varieties, with specific light ranges enhancing growth and nutritional value.

These technological advancements collectively contribute to more sustainable and scalable microgreen farming practices. Trends such as the increased use of AI and the Internet of Things (IoT) for precision agriculture, genetic research for developing new microgreen varieties and exploring the therapeutic potential of microgreens in diet and health indicate a favourable future for the Microgreens Market, which boosted due to ongoing innovation in agricultural technology and growing techniques.

Limited consumer awareness and understanding of hamper Microgreens Market Growth

Limited consumer awareness and understanding of microgreens pose significant challenges to market growth. Many consumers remain unaware of the existence and potential of microgreens, despite their numerous health advantages and culinary versatility. This lack of awareness is due to limited marketing efforts, insufficient education about the nutritional value of microgreens, and a general lack of exposure to these products in typical grocery stores and restaurants. This results in consumers overlooking microgreens when making purchasing decisions, choosing instead for more familiar produce options. Lack of understanding about how to use microgreens in cooking also contributes to consumer hesitation. The inadequate consumer knowledge translates into lower demand and Microgreens Market penetration for Microgreens, as potential customers overlook or bypass these nutritious greens in favor of more familiar options.

The lack of widespread promotion and education about microgreens also causes limitations to awareness of the benefits of microgreens. The culinary and nutritional potential of microgreens is not widely emphasized, leading to missed opportunities to educate consumers about their benefits. Without insufficient information about how to use microgreens in cooking, their unique flavors and their nutritional advantages, consumers perceive them as exotic or unfamiliar, hampering them from purchasing or integrating them into their diets.

Microgreens Market Segment Analysis

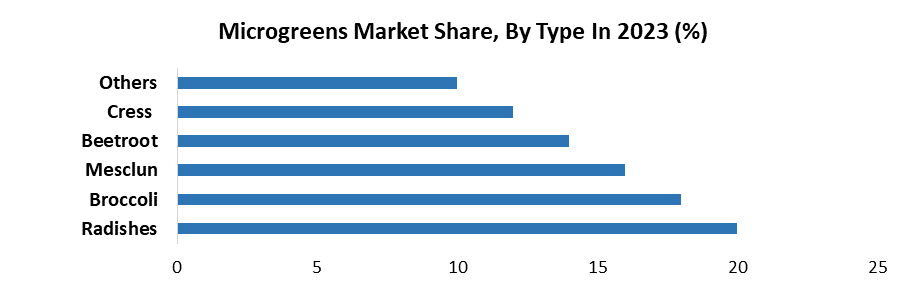

Based on Type, the market is segmented into Radishes, Broccoli, Mesclun, Beetroot, Cress and Others. Radishes are expected to have a significant CAGR for the Microgreens Market during the forecast period. Radish microgreens are a popular and highly beneficial choice among microgreens enthusiasts and health-conscious consumers. Prominent for their rapid germination and growth, these greens typically sprout within 1 to 2 days, flourishing in warm and cool conditions and reaching harvest maturity in just 5 to 10 days. Their nutritional ability is equally impressive, boasting high levels of minerals, vitamins and antioxidants, with established cancer-preventing properties.

While it is traditionally consumed as a root vegetable, radish microgreens provide a flavorful alternative, with their peppery taste adding a unique dimension to salads, sandwiches, and several culinary creations. There is a rich glucosinolate profile, with shoots showcasing up to 45 times the capacity of roots to induce phase 2 enzymes, thereby enhancing their anti-cancer potential. Loaded with vitamins C, copper, and folate, along with essential minerals such as calcium and iron, radish microgreens stand as a nutrient powerhouse, encouraging cellular repair and bolstering overall health.

Their versatility and compact size make them a preferable choice for urban inhabitants with limited gardening space, while their popularity among gourmet chefs underscores their culinary appeal which boosts Microgreens Market growth. This comprehensive guide serves as a gateway to the fascinating world of radish microgreens, exploring their nutritional benefits, culinary versatility and practical tips for easy cultivation at home, providing a wealth of information for enthusiasts enthusiastic to integrate these nutrient-dense greens into their daily meals.

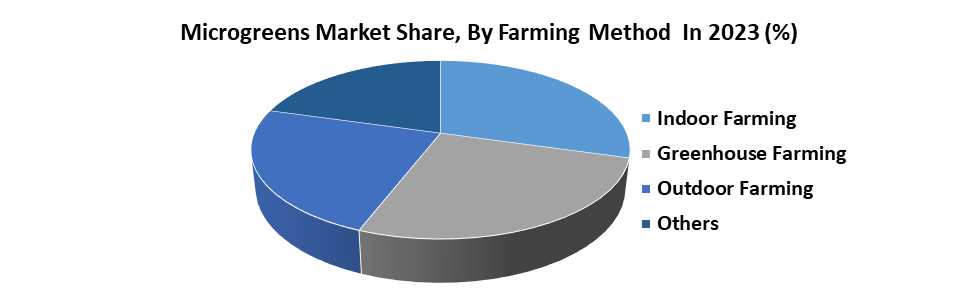

By Farming Method, the market is categorized into Indoor Farming, Greenhouse Farming, Outdoor Farming and Others. Indoor Farming is expected to have the highest CAGR for Microgreens Market over the forecast period. Indoor farming for microgreens encompasses several techniques such as hydroponics, vertical farming, and indoor grow rooms, and offers unparalleled advantages that make it necessary to meet the increasing demand for fresh, nutrient-rich greens. Indoor farming has benefits lies in its capability to provide precise control over growing conditions, ensuring optimal temperature, humidity, and light levels regardless of external factors such as weather or season. This specific control fosters accelerated growth and enhances the consistency and quality of the harvest, meeting the stringent standards of both consumers and commercial buyers.

Indoor farming maximizes space utilization, making it particularly suitable for urban areas where land accessibility is limited. By utilizing vertical space efficiently, growers cultivate microgreens in multi-tiered setups, substantially raising yield per square foot of growing area. This high-density cultivation maximizes productivity and minimizes resource consumption, including water and nutrients, contributing to sustainability and environmental stewardship, which boost Microgreens Market growth. Indoor farming minimizes the reliance on pesticides and herbicides, creating a safer and healthier growing environment while reducing the risk of contamination. Indoor farming enables year-round production, eliminating seasonal fluctuations and ensuring a consistent and reliable supply of microgreens to meet market demand.

Microgreens Market Regional Insights

North America dominated Microgreens Market in 2023 and is expected to continue its dominance over the forecast period. The region has a strong agricultural infrastructure, particularly in the United States, which offers a fertile ground for the cultivation and distribution of microgreens. The country's enormous expanses of farmland, coupled with advanced farming techniques and technologies, enable efficient as well as scalable production of microgreens to meet the increasing demand. The region has urban landscape, characterized by densely populated cities such as New York, San Francisco, and Toronto, has boosted the increase of urban farming initiatives where microgreens flourish. These urban centers have witnessed a surge in rooftop gardens, indoor hydroponic setups, and vertical farming ventures, providing ideal conditions for microgreen cultivation due to their compact size and rapid growth cycles.

The farm-to-table movement, which emphasizes locally sourced and sustainably grown produce, has gained substantial traction in the region, driving demand for microgreens as consumers increasingly prioritize freshness, flavor, and nutritional value in their food choices. There are diverse culinary landscapes and culinary innovation hubs driven by the integration of microgreens into a wide range of dishes, from salads and sandwiches to gourmet entrees and cocktails, growing their market appeal and solidifying their position as a culinary essential. The region has proactive food safety regulations and quality standards to ensure that consumers have access to high-quality, safe microgreens, boosting Microgreens Market growth.

|

Region |

Key Trends |

|

North America |

Urban areas like New York, San Francisco, and Toronto witnessed a surge in rooftop and indoor urban farming initiatives, emphasizing microgreens due to their low space requirements and quick turnaround time. |

|

Europe |

The Netherlands leads in microgreen cultivation in controlled environments, while Scandinavian countries integrate indoor cultivation techniques for year-round fresh produce. |

|

Asia |

Singapore focuses on self-sufficiency in food production through vertical farming, while Japan incorporates microgreens into traditional dishes for their aesthetic appeal and nutritional benefits. |

|

South America |

Urban farming initiatives in cities like Sao Paulo and Mexico City address food security with microgreens, adaptable to small-scale urban agriculture. |

|

Africa |

Africa Nairobi and Johannesburg see increased interest in microgreens among young entrepreneurs and urban farmers, supported by initiatives fostering green entrepreneurship and equipping youth with climate-smart farming skills. |

Microgreens Market Scope

|

Microgreens Market |

|

|

Market Size in 2023 |

USD 3.0 Bn. |

|

Market Size in 2030 |

USD 6.63 Bn. |

|

CAGR (2024(2030) |

12 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Radishes Broccoli Mesclun Beetroot Cress Others |

|

By Farming Method Indoor Farming Greenhouse Farming Outdoor Farming Others |

|

|

By Application Culinary Nutraceuticals Cosmetics Others |

|

|

By Distribution Channel Direct Sales Online Retail Others |

|

|

Regional Scope |

North America (United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa ( South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Microgreens Market Key Players

North America:

- BrightFarms (New York, USA)

- Gotham Greens (New York, USA)

- AeroFarms (New Jersey, USA)

- Plenty Unlimited Inc. (California, USA)

- Local Roots Farms (California, USA)

Europe:

- Infarm (Berlin, Germany)

- Nordic Harvest (Denmark)

- Jones Food Company (UK)

- GrowUp Farms (UK)

- LettUs Grow (UK)

Asia Pacific:

- Ponix Systems (Singapore)

- Farmshelf (Singapore)

- InFarm (Hong Kong)

- YesHealth Group (Taiwan)

- Sky Greens (Singapore)

Middle East & Africa (MEA):

- GreenBridge (South Africa)

- Crop One Holdings (UAE)

- Emirates Hydroponics Farms (UAE)

- Greenheart UAE (UAE)

- Pure Harvest Smart Farms (UAE)

South America:

- Sky Urban Solutions (Brazil)

- Urbano Greens (Brazil)

- Metropolis Farms (Brazil)

- Smart Green (Brazil)

- Greenhouse Brazil (Brazil)

Frequently Asked Questions

North America is expected to dominate the Microgreens Market during the forecast period.

The Microgreens Market size is expected to reach USD 6.63 Billion by 2030.

The major top players in the Global Microgreens Market are BrightFarms (New York, USA), Gotham Greens (New York, USA),AeroFarms (New Jersey, USA),Plenty Unlimited Inc. (California, USA),Local Roots Farms (California, USA) ,Infarm (Berlin, Germany), Nordic,Harvest (Denmark)and others.

The rising awareness of the health benefits associated with microgreens including their high levels of vitamins, minerals, and antioxidants are expected to drive market growth during the forecast period.

1. Microgreens Market: Research Methodology

2. Microgreens Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Microgreens Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Type Segment

3.3.3. Application Segment

3.3.4. Revenue (2023)

3.3.5. Headquarter

3.4. Mergers and Acquisitions Details

4. Microgreens Market: Dynamics

4.1. Microgreens Market Trends by Region

4.1.1. North America Microgreens Market Trends

4.1.2. Europe Microgreens Market Trends

4.1.3. Asia Pacific Microgreens Market Trends

4.1.4. Middle East and Africa Microgreens Market Trends

4.1.5. South America Microgreens Market Trends

4.2. Microgreens Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Value Chain Analysis

4.6. Analysis of Government Schemes and Initiatives For Microgreens Market

5. Microgreens Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Microgreens Market Size and Forecast, by Type (2023-2030)

5.1.1. Radishes

5.1.2. Broccoli

5.1.3. Mesclun

5.1.4. Beetroot

5.1.5. Cress

5.1.6. Others

5.2. Microgreens Market Size and Forecast, by Farming Method (2023-2030)

5.2.1. Indoor Farming

5.2.2. Greenhouse Farming

5.2.3. Outdoor Farming

5.2.4. Others

5.3. Microgreens Market Size and Forecast, by Application (2023-2030)

5.3.1. Culinary

5.3.2. Nutraceuticals

5.3.3. Cosmetics

5.3.4. Others

5.4. Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

5.4.1. Direct Sales

5.4.2. Online Retail

5.4.3. Others

5.5. Microgreens Market Size and Forecast, by Region (2023-2030)

5.5.1. North America

5.5.2. Europe

5.5.3. Asia Pacific

5.5.4. Middle East and Africa

5.5.5. South America

6. North America Microgreens Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. North America Microgreens Market Size and Forecast, by Type (2023-2030)

6.1.1. Radishes

6.1.2. Broccoli

6.1.3. Mesclun

6.1.4. Beetroot

6.1.5. Cress

6.1.6. Others

6.2. North America Microgreens Market Size and Forecast, by Farming Method (2023-2030)

6.2.1. Indoor Farming

6.2.2. Greenhouse Farming

6.2.3. Outdoor Farming

6.2.4. Others

6.3. North America Microgreens Market Size and Forecast, by Application (2023-2030)

6.3.1. Culinary

6.3.2. Nutraceuticals

6.3.3. Cosmetics

6.3.4. Others

6.4. North America Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

6.4.1. Direct Sales

6.4.2. Online Retail

6.4.3. Others

6.5. North America Microgreens Market Size and Forecast, by Country (2023-2030)

6.5.1. United States

6.5.1.1. United States Microgreens Market Size and Forecast, by Type (2023-2030)

6.5.1.1.1. Radishes

6.5.1.1.2. Broccoli

6.5.1.1.3. Mesclun

6.5.1.1.4. Beetroot

6.5.1.1.5. Cress

6.5.1.1.6. Others

6.5.1.2. United States Microgreens Market Size and Forecast, by Farming Method (2023-2030)

6.5.1.2.1. Indoor Farming

6.5.1.2.2. Greenhouse Farming

6.5.1.2.3. Outdoor Farming

6.5.1.2.4. Others

6.5.1.3. United States Microgreens Market Size and Forecast, by Application (2023-2030)

6.5.1.3.1. Culinary

6.5.1.3.2. Nutraceuticals

6.5.1.3.3. Cosmetics

6.5.1.3.4. Others

6.5.1.4. United States Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

6.5.1.4.1. Direct Sales

6.5.1.4.2. Online Retail

6.5.1.4.3. Others

6.5.2. Canada

6.5.2.1. Canada Microgreens Market Size and Forecast, by Type (2023-2030)

6.5.2.1.1. Radishes

6.5.2.1.2. Broccoli

6.5.2.1.3. Mesclun

6.5.2.1.4. Beetroot

6.5.2.1.5. Cress

6.5.2.1.6. Others

6.5.2.2. Canada Microgreens Market Size and Forecast, by Farming Method (2023-2030)

6.5.2.2.1. Indoor Farming

6.5.2.2.2. Greenhouse Farming

6.5.2.2.3. Outdoor Farming

6.5.2.2.4. Others

6.5.2.3. Canada Microgreens Market Size and Forecast, by Application (2023-2030)

6.5.2.3.1. Culinary

6.5.2.3.2. Nutraceuticals

6.5.2.3.3. Cosmetics

6.5.2.3.4. Others

6.5.2.4. Canada Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

6.5.2.4.1. Direct Sales

6.5.2.4.2. Online Retail

6.5.2.4.3. Others

6.5.3. Mexico

6.5.3.1. Mexico Microgreens Market Size and Forecast, by Type (2023-2030)

6.5.3.1.1. Radishes

6.5.3.1.2. Broccoli

6.5.3.1.3. Mesclun

6.5.3.1.4. Beetroot

6.5.3.1.5. Cress

6.5.3.1.6. Others

6.5.3.2. Mexico Microgreens Market Size and Forecast, by Farming Method (2023-2030)

6.5.3.2.1. Indoor Farming

6.5.3.2.2. Greenhouse Farming

6.5.3.2.3. Outdoor Farming

6.5.3.2.4. Others

6.5.3.3. Mexico Microgreens Market Size and Forecast, by Application (2023-2030)

6.5.3.3.1. Culinary

6.5.3.3.2. Nutraceuticals

6.5.3.3.3. Cosmetics

6.5.3.3.4. Others

6.5.3.4. Mexico Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

6.5.3.4.1. Direct Sales

6.5.3.4.2. Online Retail

6.5.3.4.3. Others

7. Europe Microgreens Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Europe Microgreens Market Size and Forecast, by Type (2023-2030)

7.2. Europe Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.3. Europe Microgreens Market Size and Forecast, by Application (2023-2030)

7.4. Europe Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5. Europe Microgreens Market Size and Forecast, by Country (2023-2030)

7.5.1. United Kingdom

7.5.1.1. United Kingdom Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.1.2. United Kingdom Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.1.3. United Kingdom Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.1.4. United Kingdom Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.2. France

7.5.2.1. France Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.2.2. France Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.2.3. France Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.2.4. France Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.3. Germany

7.5.3.1. Germany Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.3.2. Germany Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.3.3. Germany Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.3.4. Germany Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.4. Italy

7.5.4.1. Italy Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.4.2. Italy Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.4.3. Italy Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.4.4. Italy Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.5. Spain

7.5.5.1. Spain Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.5.2. Spain Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.5.3. Spain Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.5.4. Spain Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.6. Russia

7.5.6.1. Russia Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.6.2. Russia Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.6.3. Russia Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.6.4. Russia Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.7. Austria

7.5.7.1. Austria Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.7.2. Austria Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.7.3. Austria Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.7.4. Austria Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

7.5.8. Rest of Europe

7.5.8.1. Rest of Europe Microgreens Market Size and Forecast, by Type (2023-2030)

7.5.8.2. Rest of Europe Microgreens Market Size and Forecast, by Farming Method (2023-2030)

7.5.8.3. Rest of Europe Microgreens Market Size and Forecast, by Application (2023-2030)

7.5.8.4. Rest of Europe Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8. Asia Pacific Microgreens Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Asia Pacific Microgreens Market Size and Forecast, by Type (2023-2030)

8.2. Asia Pacific Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.3. Asia Pacific Microgreens Market Size and Forecast, by Application (2023-2030)

8.4. Asia Pacific Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5. Asia Pacific Microgreens Market Size and Forecast, by Country (2023-2030)

8.5.1. China

8.5.1.1. China Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.1.2. China Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.1.3. China Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.1.4. China Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5.2. S Korea

8.5.2.1. S Korea Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.2.2. S Korea Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.2.3. S Korea Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.2.4. S Korea Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5.3. Japan

8.5.3.1. Japan Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.3.2. Japan Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.3.3. Japan Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.3.4. Japan Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5.4. India

8.5.4.1. India Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.4.2. India Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.4.3. India Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.4.4. India Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5.5. Australia

8.5.5.1. Australia Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.5.2. Australia Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.5.3. Australia Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.5.4. Australia Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5.6. ASEAN

8.5.6.1. ASEAN Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.6.2. ASEAN Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.6.3. ASEAN Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.6.4. ASEAN Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

8.5.7. Rest of Asia Pacific

8.5.7.1. Rest of Asia Pacific Microgreens Market Size and Forecast, by Type (2023-2030)

8.5.7.2. Rest of Asia Pacific Microgreens Market Size and Forecast, by Farming Method (2023-2030)

8.5.7.3. Rest of Asia Pacific Microgreens Market Size and Forecast, by Application (2023-2030)

8.5.7.4. Rest of Asia Pacific Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

9. Middle East and Africa Microgreens Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. Middle East and Africa Microgreens Market Size and Forecast, by Type (2023-2030)

9.2. Middle East and Africa Microgreens Market Size and Forecast, by Farming Method (2023-2030)

9.3. Middle East and Africa Microgreens Market Size and Forecast, by Application (2023-2030)

9.4. Middle East and Africa Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

9.5. Middle East and Africa Microgreens Market Size and Forecast, by Country (2023-2030)

9.5.1. South Africa

9.5.1.1. South Africa Microgreens Market Size and Forecast, by Type (2023-2030)

9.5.1.2. South Africa Microgreens Market Size and Forecast, by Farming Method (2023-2030)

9.5.1.3. South Africa Microgreens Market Size and Forecast, by Application (2023-2030)

9.5.1.4. South Africa Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

9.5.2. GCC

9.5.2.1. GCC Microgreens Market Size and Forecast, by Type (2023-2030)

9.5.2.2. GCC Microgreens Market Size and Forecast, by Farming Method (2023-2030)

9.5.2.3. GCC Microgreens Market Size and Forecast, by Application (2023-2030)

9.5.2.4. GCC Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

9.5.3. Nigeria

9.5.3.1. Nigeria Microgreens Market Size and Forecast, by Type (2023-2030)

9.5.3.2. Nigeria Microgreens Market Size and Forecast, by Farming Method (2023-2030)

9.5.3.3. Nigeria Microgreens Market Size and Forecast, by Application (2023-2030)

9.5.3.4. Nigeria Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

9.5.3.5.

9.5.4. Rest of ME&A

9.5.4.1. Rest of ME&A Microgreens Market Size and Forecast, by Type (2023-2030)

9.5.4.2. Rest of ME&A Microgreens Market Size and Forecast, by Farming Method (2023-2030)

9.5.4.3. Rest of ME&A Microgreens Market Size and Forecast, by Application (2023-2030)

9.5.4.4. Rest of ME&A Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

10. South America Microgreens Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

10.1. South America Microgreens Market Size and Forecast, by Type (2023-2030)

10.2. South America Microgreens Market Size and Forecast, by Farming Method (2023-2030)

10.3. South America Microgreens Market Size and Forecast, by Application (2023-2030)

10.4. South America Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

10.5. South America Microgreens Market Size and Forecast, by Country (2023-2030)

10.5.1. Brazil

10.5.1.1. Brazil Microgreens Market Size and Forecast, by Type (2023-2030)

10.5.1.2. Brazil Microgreens Market Size and Forecast, by Farming Method (2023-2030)

10.5.1.3. Brazil Microgreens Market Size and Forecast, by Application (2023-2030)

10.5.1.4. Brazil Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

10.5.2. Argentina

10.5.2.1. Argentina Microgreens Market Size and Forecast, by Type (2023-2030)

10.5.2.2. Argentina Microgreens Market Size and Forecast, by Farming Method (2023-2030)

10.5.2.3. Argentina Microgreens Market Size and Forecast, by Application (2023-2030)

10.5.2.4. Argentina Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

10.5.3. Rest Of South America

10.5.3.1. Rest Of South America Microgreens Market Size and Forecast, by Type (2023-2030)

10.5.3.2. Rest Of South America Microgreens Market Size and Forecast, by Farming Method (2023-2030)

10.5.3.3. Rest Of South America Microgreens Market Size and Forecast, by Application (2023-2030)

10.5.3.4. Rest Of South America Microgreens Market Size and Forecast, by Distribution Channel (2023-2030)

11. Company Profile: Key Players

11.1. BrightFarms (New York, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. Gotham Greens (New York, USA)

11.3. AeroFarms (New Jersey, USA)

11.4. Plenty Unlimited Inc. (California, USA)

11.5. Local Roots Farms (California, USA)

11.6. Infarm (Berlin, Germany)

11.7. Nordic Harvest (Denmark)

11.8. Jones Food Company (UK)

11.9. GrowUp Farms (UK)

11.10. LettUs Grow (UK)

11.11. Ponix Systems (Singapore)

11.12. Farmshelf (Singapore)

11.13. InFarm (Hong Kong)

11.14. YesHealth Group (Taiwan)

11.15. Sky Greens (Singapore)

11.16. GreenBridge (South Africa)

11.17. Crop One Holdings (UAE)

11.18. Emirates Hydroponics Farms (UAE)

11.19. Greenheart UAE (UAE)

11.20. Pure Harvest Smart Farms (UAE)

11.21. Sky Urban Solutions (Brazil)

11.22. Urbano Greens (Brazil)

11.23. Metropolis Farms (Brazil)

11.24. Smart Green (Brazil)

11.25. Greenhouse Brazil (Brazil)

12. Analyst Recommendations