Military Protection Glasses Market: Global Industry Analysis and Forecast (2024-2030)

The Military Protection Glasses Market size was valued at USD 123.32 Mn. in 2023 and the total Submarines revenue is expected to grow at a CAGR of 4.1% from 2024 to 2030, reaching nearly USD 174.68 Bn. by 2030.

Format : PDF | Report ID : SMR_2067

Military Protection Glasses Market Overview:

Military protection glasses are designed to safeguard against hazards such as fragments from projectile weapons, bullets, unguided bombs, and rockets. They adhere to international standards STANAG, used by NATO countries, and MIL, endorsed by the US Military. Ballistic glasses with wraparound protection are essential for military combat eye protection and meet or exceed the U.S. Military Ballistic Standard MIL-PRF-31013. Military Protection Glasses provide superior protection in high-risk situations involving explosive weapons, sand, and dirt, while UV protection and colored lenses offer added security and clear vision in various environments. The ANSI Z87.1 standard, applicable to civilian safety eyewear, protects against impact injuries, radiation, liquid splashes, dust, and droplets.

This standard is used across various industries, including for first responders, firefighters, military personnel, and personal use which drives Military Protection Glasses. Vision is the most critical sense in combat conditions, and military-grade eyewear ensures servicemen's vision is protected, contributing to mission success. Military Protection Glasses Market provides outstanding eye protection for dangerous jobs and hazardous activities like military and tactical operations and hunting trips. They are lightweight, ergonomic, comfortable, and robust, designed specifically for shooting sports and military combat or tactical situations, protecting eyes from bright sun, strong winds, and debris.

To get more Insights: Request Free Sample Report

Military Protection Glasses Market Dynamics:

Advancements in Ballistic Goggles for Enhanced Soldier Safety Drives the Military Protection Glasses Market Growth

Military personnel have credited Glasses with preserving their vision in numerous combat situations. During military combat or unintended explosions, injuries often result from flying debris caused by explosions. The combat, only 19% of casualties are caused by bullets, while as many as 59% are caused by fragments, and around 22% are due to other reasons Military Protection Glasses maintain clear vision in extreme conditions, such as intense perspiration or temperature fluctuations, without compromising eye safety. These glasses are easily wearable with or without headgear or helmets. Ballistic goggles are an essential eye-saving product for military operations, counterinsurgency, de-mining operations, and any scenario where the human eye is at risk.

Designed for superb durability, they are impact-resistant, ANSI-rated, and rugged enough to offer eye protection for military personnel, law enforcement, firefighters, shooters, and hunters. For example, the New XC Military goggles meet the new military standard. Uvex XC Military Eyewear provides a unique solution tailored to the needs of U.S. Army personnel, offering superior ballistic protection, excellent vision, improved fit, and enhanced extended-wear comfort.

For instance, in 2023, the 31 NATO members accounted for $1,341 billion, or 55 percent of global military expenditure. U.S. military spending increased by 2.3 percent to $916 billion, making up 68 percent of total NATO military spending. Most European NATO members also increased their military expenditure in 2023, contributing 28 percent of NATO's total, the highest Military Protection Glasses market share in a decade. The remaining 4 percent came from Canada and Turkey.

Sustainability in Military Safety Glasses Production that Boosts Military Protection Glasses Market Growing Trend

The military protection glasses market is undergoing a transformative period fueled by technological advancements and a growing commitment to sustainability. For instance, companies like Revision Military have introduced innovative lens designs incorporating smart coatings that adapt to varying light conditions, ensuring optimal visibility for soldiers in dynamic environments. Similarly, brands such as Oakley SI offer polarized lenses in their tactical eyewear lineup, reducing glare and enhancing visual clarity, which is particularly crucial during operations in bright or reflective settings.

Moreover, advancements like the integration of heads-up display (HUD) systems into glasses, as demonstrated by companies like Smith Optics Elite, provide real-time data to soldiers, improving their situational awareness and decision-making abilities on the field. In parallel, sustainability initiatives are gaining momentum in the production of military safety glasses. For example, Wiley X Inc. has embraced eco-friendly materials in their eyewear manufacturing processes, incorporating biodegradable components and reducing waste throughout production. Additionally, efforts by brands like Bolle Safety to implement sustainable manufacturing practices, such as energy-efficient production techniques and reduced packaging materials, showcase a commitment to minimizing environmental impact.

Military Protection Glasses Market Segment Analysis:

Based on type, the market is divided into Laser safety, Bulletproof, Fire resistant, Ballistic Protection, and Others. Laser safety witnessed the highest Military Protection Glasses Market share in 2023 and is expected to continue their dominance during the forecast period. The widespread adoption of laser technology within the military has prompted the U.S. Air Force, Army, Navy, Coast Guard, and Marines to pursue contracts for advanced Next Generation Eye Protection (NGEP) laser safety glasses, as reported by Defense Systems. Upgraded eyewear capable of protecting against both ballistic threats and lasers is being sought after, catering to a diverse range of pilots.

The necessity for enhanced eye protection has become evident due to the rising incidents of individuals utilizing personal laser pointers, commonly used for activities like presentations and pet entertainment, to target military and civilian aircraft. In military settings, laser safety glasses serve dual purposes: defensively, against potential enemy laser attacks, and protectively, for internal usage. Internal applications span various non-combat scenarios, including medical procedures, industrial tasks, weapons training, logistics operations, and research and development endeavors. With the advancement and widespread accessibility of laser technology globally, both civilian and military pilots, as well as ground troops, face increasing threats from laser weapons, necessitating the adoption of comprehensive protective measures which drives the Military Protection Glasses Market.

Military Protection Glasses Market Regional Analysis:

North America region dominated the market in the year 2023 and is expected to continue its dominance during the forecast period. North America boasts a robust defense sector characterized by substantial military spending and investments in advanced technologies. Countries like the United States, in particular, allocate substantial budgets to defense procurement, including the procurement of protective gear such as military protection glasses. This strong financial commitment fuels demand for innovative and high-quality protective eyewear, driving Military Protection Glasses Market growth in the region. North America is home to several leading manufacturers and suppliers of military protection glasses, leveraging the region's advanced manufacturing capabilities and technological expertise.

These companies continually innovate to meet the evolving needs of military personnel, offering cutting-edge solutions that provide superior protection and performance in diverse operational environments. Their presence and prominence contribute significantly to North America's dominance in the market. Additionally, the region benefits from a vast military infrastructure and extensive deployment of military personnel across various theaters of operation. As military activities and operations continue to evolve and expand, the demand for effective protective gear, including military protection glasses, remains consistently high. This sustained demand further solidifies North America's position as a key Military Protection Glasses Market for military eyewear solutions.

|

Military Protection Glasses Market Scope |

|

|

Market Size in 2023 |

USD 123.32 Million |

|

Market Size in 2030 |

USD 174.68 Million |

|

CAGR (2024-2030) |

4.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Laser safety Bulletproof Fire resistant Ballistic Protection Others |

|

By Material Glass fiber Sapphire Quartz Polycarbonate Others |

|

|

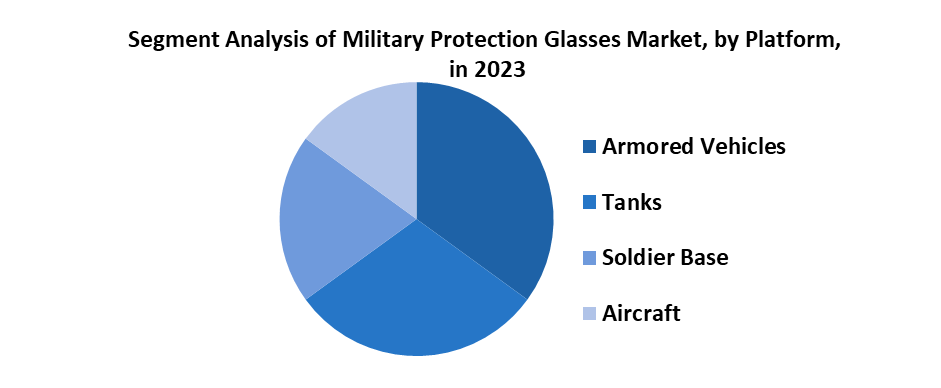

By Platform Armored Vehicles Tanks Soldier Base Aircraft Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Military Protection Glasses Market Key Players

- Oakley SI (Standard Issue) (California, USA)

- ESS (Eye Safety Systems) (California, USA)

- Revision Military (Vermont, USA)

- Smith Optics Elite (Idaho, USA)

- 3M Company (3M Eye Protection) (Minnesota, USA)

- Wiley X Inc. (California, USA)

- Pyramex Safety Products, LLC (Tennessee, USA)

- Bolle Safety (Suresnes, France)

- Uvex Safety Group GmbH & Co. KG (Fürth, Germany)

- Honeywell Safety Products (Rhode Island, USA)

- Rudy Project (Treviso, Italy)

- SPY Optic Inc. (California, USA)

- Edge Eyewear (Utah, USA)

- Bobster Eyewear (California, USA)

- DEWALT Safety Glasses (Maryland, USA)

- Radians, Inc. (Tennessee, USA)

- MCR Safety (Tennessee, USA)

- JSP Safety (Oxfordshire, United Kingdom)

- HexArmor (Michigan, USA)

- Delta Plus Group (Apt, France)

Frequently Asked Questions

North America is expected to dominate the submarine market during the forecast period.

The submarine market size is expected to reach USD 174.68 Million by 2030.

The major top players in the Global Military Protection Glasses Market are Oakley SI (Standard Issue) (California, USA), ESS (Eye Safety Systems) (California, USA), and Revision Military (Vermont, USA).

The growth of the global military protection glasses market is driven by increased defense spending and rising awareness of soldier safety, alongside advancements in protective eyewear technology offering enhanced durability and vision clarity.

1. Military Protection Glasses Market: Research Methodology

2. Military Protection Glasses Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Military Protection Glasses Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Type Segment

3.3.3. Product Segment

3.3.4. Revenue (2023)

3.3.5. Headquarter

3.4. Mergers and Acquisitions Details

4. Military Protection Glasses Market: Dynamics

4.1. Military Protection Glasses Market Trends by Region

4.1.1. North America Military Protection Glasses Market Trends

4.1.2. Europe Military Protection Glasses Market Trends

4.1.3. Asia Pacific Military Protection Glasses Market Trends

4.1.4. Middle East and Africa Military Protection Glasses Market Trends

4.1.5. South America Military Protection Glasses Market Trends

4.2. Military Protection Glasses Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Value Chain Analysis

4.6. Analysis of Government Schemes and Initiatives For Military Protection Glasses Market

5. Military Protection Glasses Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Military Protection Glasses Market Size and Forecast, by Type (2023-2030)

5.1.1. Laser safety

5.1.2. Bulletproof

5.1.3. Fire resistant

5.1.4. Ballistic Protection

5.1.5. Others

5.2. Military Protection Glasses Market Size and Forecast, by Material (2023-2030)

5.2.1. Glass fiber

5.2.2. Sapphire

5.2.3. Quartz

5.2.4. Polycarbonate

5.2.5. Others

5.3. Military Protection Glasses Market Size and Forecast, by Platform (2023-2030)

5.3.1. Armored Vehicles

5.3.2. Tanks

5.3.3. Soldier Base

5.3.4. Aircraft

5.3.5. Others

5.4. Military Protection Glasses Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Military Protection Glasses Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. North America Military Protection Glasses Market Size and Forecast, by Type (2023-2030)

6.1.1. Laser safety

6.1.2. Bulletproof

6.1.3. Fire resistant

6.1.4. Ballistic Protection

6.1.5. Others

6.2. North America Military Protection Glasses Market Size and Forecast, by Material (2023-2030)

6.2.1. Glass fiber

6.2.2. Sapphire

6.2.3. Quartz

6.2.4. Polycarbonate

6.2.5. Others

6.3. North America Military Protection Glasses Market Size and Forecast, by Platform (2023-2030)

6.3.1. Armored Vehicles

6.3.2. Tanks

6.3.3. Soldier Base

6.3.4. Aircraft

6.3.5. Others

6.4. North America Military Protection Glasses Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Military Protection Glasses Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Europe Military Protection Glasses Market Size and Forecast, by Type (2023-2030)

7.2. Europe Military Protection Glasses Market Size and Forecast, by Material (2023-2030)

7.3. Europe Military Protection Glasses Market Size and Forecast, by Platform (2023-2030)

7.4. Europe Military Protection Glasses Market Size and Forecast, by Country (2023-2030)

7.4.1. United Kingdom

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Military Protection Glasses Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Asia Pacific Military Protection Glasses Market Size and Forecast, by Type (2023-2030)

8.2. Asia Pacific Military Protection Glasses Market Size and Forecast, by Material (2023-2030)

8.3. Asia Pacific Military Protection Glasses Market Size and Forecast, by Platform (2023-2030)

8.4. Asia Pacific Military Protection Glasses Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. ASEAN

8.4.7. Rest of Asia Pacific

9. Middle East and Africa Military Protection Glasses Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. Middle East and Africa Military Protection Glasses Market Size and Forecast, by Type (2023-2030)

9.2. Middle East and Africa Military Protection Glasses Market Size and Forecast, by Material (2023-2030)

9.3. Middle East and Africa Military Protection Glasses Market Size and Forecast, by Platform (2023-2030)

9.4. Middle East and Africa Military Protection Glasses Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Rest of ME&A

10. South America Military Protection Glasses Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

10.1. South America Military Protection Glasses Market Size and Forecast, by Type (2023-2030)

10.2. South America Military Protection Glasses Market Size and Forecast, by Material (2023-2030)

10.3. South America Military Protection Glasses Market Size and Forecast, by Platform (2023-2030)

10.4. South America Military Protection Glasses Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest Of South America

11. Company Profile: Key Players

11.1. Oakley SI (Standard Issue) (California, USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. ESS (Eye Safety Systems) (California, USA)

11.3. Revision Military (Vermont, USA)

11.4. Smith Optics Elite (Idaho, USA)

11.5. 3M Company (3M Eye Protection) (Minnesota, USA)

11.6. Wiley X Inc. (California, USA)

11.7. Pyramex Safety Products, LLC (Tennessee, USA)

11.8. Bolle Safety (Suresnes, France)

11.9. Uvex Safety Group GmbH & Co. KG (Fürth, Germany)

11.10. Honeywell Safety Products (Rhode Island, USA)

11.11. Rudy Project (Treviso, Italy)

11.12. SPY Optic Inc. (California, USA)

11.13. Edge Eyewear (Utah, USA)

11.14. Bobster Eyewear (California, USA)

11.15. DEWALT Safety Glasses (Maryland, USA)

11.16. Radians, Inc. (Tennessee, USA)

11.17. MCR Safety (Tennessee, USA)

11.18. JSP Safety (Oxfordshire, United Kingdom)

11.19. HexArmor (Michigan, USA)

11.20. Delta Plus Group (Apt, France)

12. Key Findings and Analyst Recommendations