Motorcycle Apparel Market: Global Industry Analysis and Forecast (2024-2030)

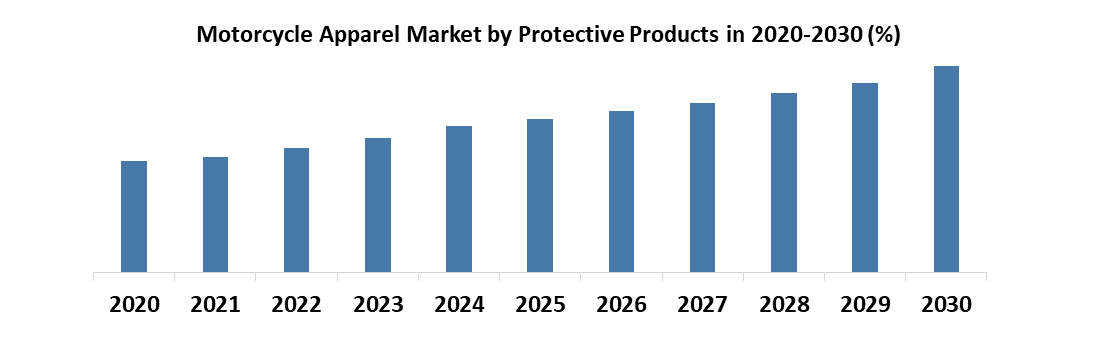

The Motorcycle Apparel Market size was valued at USD 24.90 Bn. in 2023 and the total Motorcycle Apparel Market revenue is expected to grow at a CAGR of 6.5% from 2024 to 2030, reaching nearly USD 38.69 Bn. by 2030.

Format : PDF | Report ID : SMR_1834

Motorcycle Apparel Market Overview

The global motorcycle apparel market is influenced by several factors, including iconic bike brands like Aprilia, Ducati, and Harley Davidson, online influencers, and technological advancements. Consumers are drawn to bike touring packages offered by travel companies, and safety measures are crucial in motorcycle racing events. The market is dynamic, with governments implementing strict regulations to mitigate risks. The demand for protective clothing and accessories, including smart helmets, is rising. Major industrial players focus on strategic marketing strategies to capture market share and increase business revenue.

The market is dynamic, influenced by the rising demand for riding gear and the popularity of scooters. Innovations like hands-free options and smart technology are reshaping the industry. Consumer preferences include fashion-forward items like cosmetics and alongside traditional apparel like shoes. Government initiatives, per capita incomes, and new industrial companies drive market dynamics, while supply chain disruptions prompt strategic adjustments. The market caters to various segments, from on-road to off-road gear, through diverse distribution channels.

To get more Insights: Request Free Sample Report

Motorcycle Apparel Market Dynamics

The growing trend of protective products in motorcycle apparel is driving the market growth.

The motorcycle apparel market is experiencing growth because of increasing demand for protective clothing, rising per capita incomes, and the rise in new industrial companies. Supply chain disruptions during the epidemic have put pressure on the market, but major industrial players have developed innovative strategies to control its expansion. The rise in traffic accidents is a significant factor in the market's expansion, as deteriorating infrastructure and the growing number of vehicles on the roads have led to more accidents. Traffic accidents often result in injuries and impairments, leading to chronic health issues and increased awareness of the effects of traffic accidents.

As a result, motorcycle riders globally are using more add-on items like visors and helmet screens to reduce distractions. Smart helmets are also becoming popular in the motorcycle racing apparel market. The demand for smart products is driven by developments in smart technology and rising consumer knowledge. Manufacturers are introducing smart helmets because of their functionality and convenience, including advanced noise cancellation, audio multitasking, an integrated camera, and Bluetooth 4.1 connectivity. In conclusion, the motorcycle apparel market is expected to increase because of factors such as rising demand, government programs, and the increasing popularity of smart helmets and motorcycle apparel market.

The motorcycle apparel market encounters significant hurdles stemming from the complexities of business dynamics. These difficulties pose challenges that impede growth opportunities and influence market performance. Factors such as evolving consumer preferences, changing regulatory landscapes, and competitive pressures contribute to the dynamic nature of the market. Also, economic fluctuations, supply chain disruptions, and technological advancements further complicate business operations.

Adapting to these dynamic conditions requires strategic foresight, agility, and innovative approaches to remain competitive. Failure to address these obstacles adequately results in market stagnation, reduced profitability, and loss of market share. Navigating through these challenges demands continuous monitoring, proactive decision-making, and effective risk management strategies. Ultimately, businesses that adeptly respond to the shifting business dynamics are better positioned to thrive and succeed in the motorcycle apparel market.

A significant challenge hindering growth in the motorcycle apparel sector is price wars driven by intense competition among vendors. Global, regional, and local suppliers provide a constant challenge to the prominent companies in the motorcycle apparel market. The manufacturers of advanced protective motorcycle riding gear that caters to a variety of riding conditions and riders including young, female, and male riders invest a significant amount of money in research and development. Regional and local enterprises are facing intense competition as a result of regional and local vendors concentrating on promoting a single product line in a particular area. Another major challenge for vendors in the market is traditional products, including the availability of ordinary clothing or jackets, especially for developing nations.

These jackets are comparatively less expensive than the protective motorcycle riding gear, which also includes motorcycle clothing. The advantages of protective motorcycle clothing are still unknown to consumers in underdeveloped countries. Therefore, other major obstacles facing the business are low per capita income and limited public awareness. Vendors are forced to lower their prices and profit margins when they adopt conventional, substitute, or counterfeit items, which in turn increases competition between them. As a result, it is expected that during the forecast period 2024 to 2030, all of these factors are going to hinder market growth.

Motorcycle Apparel Market Segment Analysis

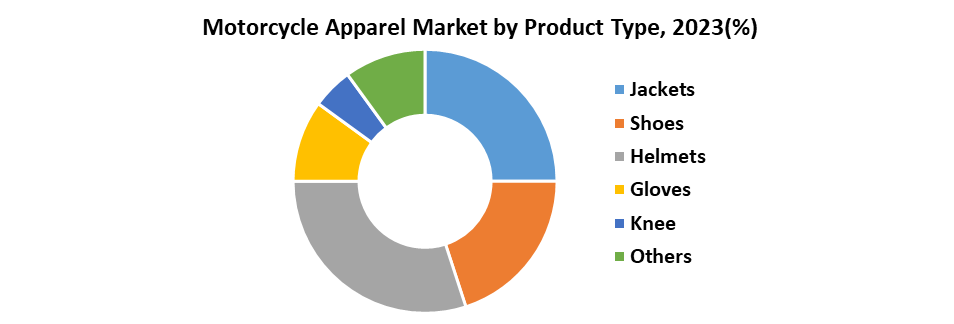

Based on Product Type, Motorcycle rider’s jackets are multifunctional jackets that shield wearers from the elements and any abrasions while riding. They are made of sturdy materials that are withstand wind, rain, and other factors found on the road, including leather or other materials. To improve rider safety in the case of an accident, many motorcycle jackets also have integrated protection inserts at critical impact points including the shoulders, elbows, and back.

These armor inserts provide good impact protection without compromising comfort or flexibility because they are frequently composed of materials like high-density foam or advanced polymers. Also, some jackets have reflective elements to improve visibility in low light, which increases rider safety, particularly during nighttime. Motorcycle jackets have ventilation systems for breathability and comfort. This keeps riders cool in hot weather while yet providing essential protection. To provide riders with the best possible safety and comfort, while choosing a motorcycle jacket, factors like fit, weatherproofing, armor coverage, and ventilation require consideration made.

The helmets category has become a dominant force in the global market because of the increasing emphasis on safety measures, particularly in emerging and developing countries. This has led to a surge in the use of helmets for motorcycle riders, as tightening road safety laws and regulations prompt more people to invest in protective gear. The evolving landscape of safety standards has further propelled the demand for helmets, making it a lucrative market segment. Increased motorcycling for transportation and leisure has also contributed to the prominence of helmets in the market. With safety consciousness rising globally, the helmets category is expected to maintain its dominance and continue to grow.

Motorcycle Apparel Market Regional Analysis

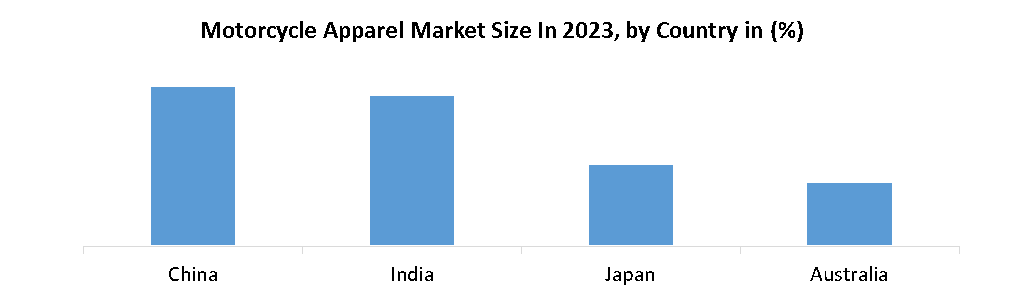

The Asia Pacific Motorcycle Apparel market held a 45.80% market share in 2023. Asia-Pacific is host to some of the largest motorcycle manufacturers, such as Bajaj, Hero, Honda, and TVS. These producers market their models on a large scale across continents such as Latin America and Africa. To improve the client experience during the purchase process, OEMs such as TVS and Royal Enfield ventured into the riding gear industry and promoted their products in showrooms. Sales of motorcycles have increased greatly in recent years, particularly in the sports bike sector in the Asia-Pacific area. In addition, the motorcycle apparel market in China had the most market share, while the motorcycle apparel market in India had the fastest growth in the Asia-Pacific region.

The North American motorcycle apparel market is expected to grow significantly from 2024 to 2030. People in North America prefer riding motorcycles for sportswear, road trips, expeditions, and commuting. The population's purchasing power is going to rise as a result of the increasing disposable income and rising household final consumption in the area, which in speed up the demand for motorcycles and motorcycle apparel. In 2023, the US made a major contribution to the North American market. In addition, the motorcycle apparel market in the United States had the most market share, while the motorcycle apparel market in Canada had the fastest rate of growth in North America.

Motorcycle Apparel Market competitive landscape

The market of motorcycle apparel is expected to grow more rapidly as a result of major players in the industry making significant R&D investments to extend their product ranges. In addition, market players are engaging in a range of calculated moves to broaden their reach. Prominent developments in the industry include the introduction of new products, deals, mergers and acquisitions, increased investment, and joint ventures with other businesses. The motorcycle apparel sector needs to provide affordable products to grow and thrive in a more competitive and dynamic market.

- On 15 March 2024 Designed by SENA exclusively for HJC Helmets, the SMART HJC 11B is a dedicated Bluetooth communication system. The 2nd generation premium Bluetooth model boasts an all-in-one design fully integrated into the helmet. Experience optimal weight balance and aerodynamic performance while enjoying seamless communication on your rides.

- In 2024, Yoshimura and Kushitani are once again be announcing collaborative products that reflect their unique racing spirit. Yoshimura, which has long provided outstanding performance and innovation in the world of motorsports, and Kushitani, known for its high-quality riding apparel, announced a new line of jointly developed collaborative products. This partnership builds on the deep ties that both companies have built through their racing careers and a long-standing association that leverages technical insight into product development.

|

Motorcycle Apparel Market scope |

|

|

Market size in 2023 |

USD 24.90 bn. |

|

Market size in 2030 |

USD 38.69 bn. |

|

CAGR (2024-2030) |

6.5% |

|

Historic data |

2018-2022 |

|

Base year |

2023 |

|

Forecast period |

2024-2030 |

|

Segment scope |

By Product Type Jackets Shoes Helmets Gloves Knee Others |

|

By Material Leather Textile |

|

|

By Distribution Channel Non-Store Store Built |

|

|

By End-User On-Road Motorbike Wear Off-Road Motorbike Wear |

|

|

Regional scope |

North America- United States, Canada, And Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, And Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, Asean, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of The Middle East And Africa South America – Brazil, Argentina, Rest Of South America |

Key player in the Motorcycle Apparel Market

- Dunham's Sports (USA)

- ZhuHai Safety Helmets MFG Co., Ltd (China)

- Foshan Nanhai Xinyuan Helmets Co., Ltd. (China)

- Vega Helmet USA (USA)

- Lanxi Yema Motorcycle Fittings Co., LTD. (China)

- HJC Helmets (South Korea)

- AGV Sports Group Inc. (USA)

- Alpinestars (Italy)

- Dainese (Italy)

- FLY Racing (USA)

- Fox (USA)

- KIDO Sports Co. Ltd. (Japan)

- KUSHITANI Co. Ltd. (Japan)

- Polaris Inc. (USA)

- Rynox Gear (India)

- SULLIVANS Inc. (USA)

- Vega Auto Accessories Pvt. Ltd. (India)

- Zeus Motor Cycle Gear (India)

- Bikeratti (India)

- Moto Central India (India)

- Klim (USA)

Frequently Asked Questions

An analysis of profit trends and projections for companies in the Motorcycle Apparel Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The forecast period of the market is 2024 to 2030.

The Motorcycle Apparel Market size was valued at USD 24.90 Billion in 2023 and the total Motorcycle Apparel Market size is expected to grow at a CAGR of 6.5% from 2024 to 2030, reaching nearly USD 38.69 Billion by 2030.

The segments covered in the market report are by Product Type, by Material, by Distribution Channel and by end user.

1. Motorcycle Apparel Market: Research Methodology

2. Motorcycle Apparel Market: Executive Summary

3. Motorcycle Apparel Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Import and export of Motorcycle Apparel Market

5. Motorcycle Apparel Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Motorcycle Apparel Market Size and Forecast by Segments (by value Units)

6.1. Motorcycle Apparel Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Jackets

6.1.2. Shoes

6.1.3. Helmets

6.1.4. Gloves

6.1.5. Knee

6.1.6. Others

6.2. Motorcycle Apparel Market Size and Forecast, by Material (2023-2030)

6.2.1. Leather

6.2.2. Textile

6.3. Motorcycle Apparel Market Size and Forecast, by Distribution Channel (2023-2030)

6.3.1. Non-Store

6.3.2. Store Built

6.4. Motorcycle Apparel Market Size and Forecast, by End-User (2023-2030)

6.4.1. On-Road Motorbike Wear

6.4.2. Off-Road Motorbike Wear

6.5. Motorcycle Apparel Market Size and Forecast, by Region (2023-2030)

6.5.1. North America

6.5.2. Europe

6.5.3. Asia Pacific

6.5.4. Middle East and Africa

6.5.5. South America

7. North America Motorcycle Apparel Market Size and Forecast (by value Units)

7.1. North America Motorcycle Apparel Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Jackets

7.1.2. Shoes

7.1.3. Helmets

7.1.4. Gloves

7.1.5. Knee

7.1.6. Others

7.2. North America Motorcycle Apparel Market Size and Forecast, by Material (2023-2030)

7.2.1. Leather

7.2.2. Textile

7.3. North America Motorcycle Apparel Market Size and Forecast, by Distribution Channel (2023-2030)

7.3.1. Non-Store

7.3.2. Store Built

7.4. North America Motorcycle Apparel Market Size and Forecast, by End-User (2023-2030)

7.4.1. On-Road Motorbike Wear

7.4.2. Off-Road Motorbike Wear

7.5. North America Motorcycle Apparel Market Size and Forecast, by Country (2023-2030)

7.5.1. United States

7.5.2. Canada

7.5.3. Mexico

8. Europe Motorcycle Apparel Market Size and Forecast (by Value Units)

8.1. Europe Motorcycle Apparel Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Jackets

8.1.2. Shoes

8.1.3. Helmets

8.1.4. Gloves

8.1.5. Knee

8.1.6. Others

8.2. Europe Motorcycle Apparel Market Size and Forecast, by Material (2023-2030)

8.2.1. Leather

8.2.2. Textile

8.3. Europe Motorcycle Apparel Market Size and Forecast, by Distribution Channel (2023-2030)

8.3.1. Non-Store

8.3.2. Store Built

8.4. Europe Motorcycle Apparel Market Size and Forecast, by End-User (2023-2030)

8.4.1. On-Road Motorbike Wear

8.4.2. Off-Road Motorbike Wear

8.5. Europe Motorcycle Apparel Market Size and Forecast, by Country (2023-2030)

8.5.1. UK

8.5.2. France

8.5.3. Germany

8.5.4. Italy

8.5.5. Spain

8.5.6. Sweden

8.5.7. Austria

8.5.8. Rest of Europe

9. Asia Pacific Motorcycle Apparel Market Size and Forecast (by Value Units)

9.1. Asia Pacific Motorcycle Apparel Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Jackets

9.1.2. Shoes

9.1.3. Helmets

9.1.4. Gloves

9.1.5. Knee

9.1.6. Others

9.2. Asia Pacific Motorcycle Apparel Market Size and Forecast, by Material (2023-2030)

9.2.1. Leather

9.2.2. Textile

9.3. Asia Pacific Motorcycle Apparel Market Size and Forecast, by Distribution Channel (2023-2030)

9.3.1. Non-Store

9.3.2. Store Built

9.4. Asia Pacific Motorcycle Apparel Market Size and Forecast, by End-User (2023-2030)

9.4.1. On-Road Motorbike Wear

9.4.2. Off-Road Motorbike Wear

9.5. Asia Pacific Motorcycle Apparel Market Size and Forecast, by Country (2023-2030)

9.5.1. China

9.5.2. S Korea

9.5.3. Japan

9.5.4. India

9.5.5. Australia

9.5.6. Indonesia

9.5.7. Malaysia

9.5.8. Vietnam

9.5.9. Taiwan

9.5.10. Bangladesh

9.5.11. Pakistan

9.5.12. Rest of Asia Pacific

10. Middle East and Africa Motorcycle Apparel Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Motorcycle Apparel Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Jackets

10.1.2. Shoes

10.1.3. Helmets

10.1.4. Gloves

10.1.5. Knee

10.1.6. Others

10.2. Middle East and Africa Motorcycle Apparel Market Size and Forecast, by Material (2023-2030)

10.2.1. Leather

10.2.2. Textile

10.3. Middle East and Africa Motorcycle Apparel Market Size and Forecast, by Distribution Channel (2023-2030)

10.3.1. Non-Store

10.3.2. Store Built

10.4. Middle East and Africa Motorcycle Apparel Market Size and Forecast, by End-User (2023-2030)

10.4.1. On-Road Motorbike Wear

10.4.2. Off-Road Motorbike Wear

10.5. Middle East and Africa Motorcycle Apparel Market Size and Forecast, by Country (2023-2030)

10.5.1. South Africa

10.5.2. GCC

10.5.3. Egypt

10.5.4. Nigeria

10.5.5. Rest of ME&A

11. South America Motorcycle Apparel Market Size and Forecast (by Value Units)

11.1. South America Motorcycle Apparel Market Size and Forecast, by Product Type (2023-2030)

11.1.1. Jackets

11.1.2. Shoes

11.1.3. Helmets

11.1.4. Gloves

11.1.5. Knee

11.1.6. Others

11.2. South America Motorcycle Apparel Market Size and Forecast, by Material (2023-2030)

11.2.1. Leather

11.2.2. Textile

11.3. South America Motorcycle Apparel Market Size and Forecast, by Distribution Channel (2023-2030)

11.3.1. Non-Store

11.3.2. Store Built

11.3.3. South America Motorcycle Apparel Market Size and Forecast, by End-User (2023-2030)

11.3.4. On-Road Motorbike Wear

11.3.5. Off-Road Motorbike Wear

11.4. South America Motorcycle Apparel Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Dunham's Sports

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. ZhuHai Safety Helmets MFG Co., Ltd

12.3. Foshan Nanhai Xinyuan Helmets Co., Ltd.

12.4. Vega Helmet USA

12.5. Lanxi Yema Motorcycle Fittings Co., LTD.

12.6. HJC Helmets

12.7. AGV Sports Group Inc.

12.8. Alpinestars

12.9. Dainese

12.10. FLY Racing

12.11. Fox

12.12. KIDO Sports Co. Ltd.

12.13. KUSHITANI Co. Ltd.

12.14. Polaris Inc.

12.15. Rynox Gear

12.16. SULLIVANS Inc.

12.17. Vega Auto Accessories Pvt. Ltd.

12.18. Zeus Motor Cycle Gear

12.19. Bikeratti

12.20. Moto Central India

12.21. Klim

13. Key Findings

14. Industry Recommendation