PCR Plastic Packaging Market: Global Industry Analysis and Forecast (2024-2030)

PCR Plastic Packaging Market size was valued at USD 31.6 Bn. in 2023 and the PCR Plastic Packaging revenue is expected to grow at a CAGR of 8.47 % from 2024 to 2030, reaching nearly USD 55.83 Bn. by 2030.

Format : PDF | Report ID : SMR_2039

PCR Plastic Packaging Market Overview:

Post-consumer resin (PCR) is referred to as an eco-friendly option in packaging that producers nowadays are using to respond to peoples needs, help in recycling efforts, and reduce their ecological imprint on landfills. Collected from community recycling programs, recycled PET bottles and other plastics are processed into PCR plastics and utilized in the manufacture of additional packaging materials. Global packaging companies are always in a race to cut down on carbon emissions as well as improve highly sustainable yet reusable packaging alternatives by developing more sophisticated economies of scale in the market for PCR plastic packaging.

Increase of knowledge among their leaders on eco-packaging solutions influences the increase of global use of PCR packaging by various industries. These PCR packaging materials are now being used daily by businesses to avail circular economy supporting products. Moreover, increased sales and continued capital injection from the major players in the industry in order to amplify their range of PCR plastic packaging are boosting the growth of the market.

To get more Insights: Request Free Sample Report

PCR Plastic Packaging Market Dynamics:

Market growth is being driven by an increasing focus on enhancing the circular economy's efficiency.

Increasing the efficiency of the circular economy is one of the factors driving the PCR plastic packaging market. Leading and mid-sized players in the global packaging industry are constantly working toward lowering their carbon footprints and improving the quality of their range of highly sustainable but reusable packaging solutions. The increased awareness of these package manufacturers regarding ecologically sustainable packaging practices is one of the key factors driving the growth of the global PCR packaging market. Businesses are adopting PCR plastic packaging solutions on a day-to-day basis to develop and launch solutions that aid their circular economy initiatives. The long-term financial commitment of the leading companies towards increasing their range of PCR plastic packaging is also significantly boosting the growth of the market.

Also, the majority of the demand is driven by the high-potential beverage, food, and drug companies. Increased per capita spending on beverages, food, and pharmaceuticals generates significant global demand for the food and non-food items as well as the packaging for them. These industries have produced much more in the last few years, and it is likely to be continued in the upcoming years as well. Leading players in the global packaging market provide diverse solutions to meet the needs arising from various end-use industries. In the food and beverage and pharmaceutical sectors, the potential PCR packaging solutions are trays & clamshells, bottles, cups, bags, and blisters. For generating higher sales and profit, the manufacturers are targeting these potential end-use markets for the packaging. All these factors are driving the PCR Plastic Packaging Market.

Quality and Consistency are major restrains for the industry.

Maintaining quality and consistency in PCR plastic is one of the greatest challenges. Variations in the input materials lead to variance in quality, colour, and performance as PCR plastics are produced from recyclables. This is a serious issue for companies relying on high-end packaging. Recycled plastic contamination is also a big issue. Even a very small number of impurities or non-recyclable elements cause damage to the integrity of PCR plastic packaging. The necessity for highly effective sorting and cleaning processes to ensure purity results in increased complexity and cost of production. PCR plastic packaging is often more costly than alternatives made from normal plastic, which gives tough competition to the PCR plastic packaging industry.

PCR Plastic Packaging Market Segment Analysis:

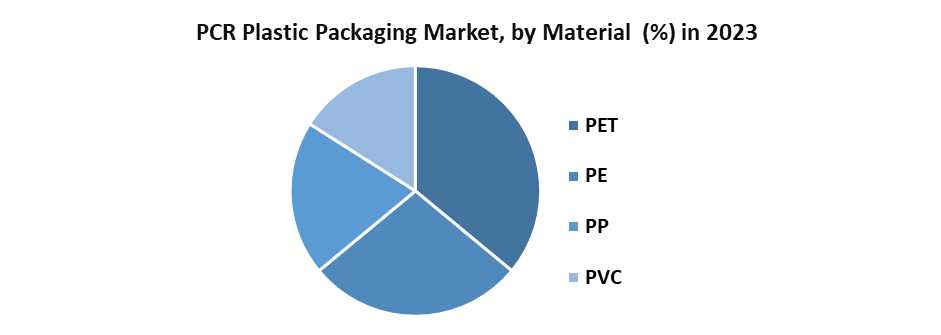

By Material, the PET segment held the largest share of revenue in 2023. PET is a commonly used thermoplastic polymer in the PCR plastic packaging business. It is valued for being clear, strong, and recyclable. Currently, there is a growing focus on using high levels of recycled PET content in PET for PCR plastic packaging to limit the environmental effect. As the brands and manufacturers seek to meet consumer demand for sustainable solutions and meet their sustainability objectives, they use more PCR PET in their packaging, all while assuring the protection and quality of the product. All these factors are propelling the growth of the segment in the market.

PCR Plastic Packaging Market Regional Insight:

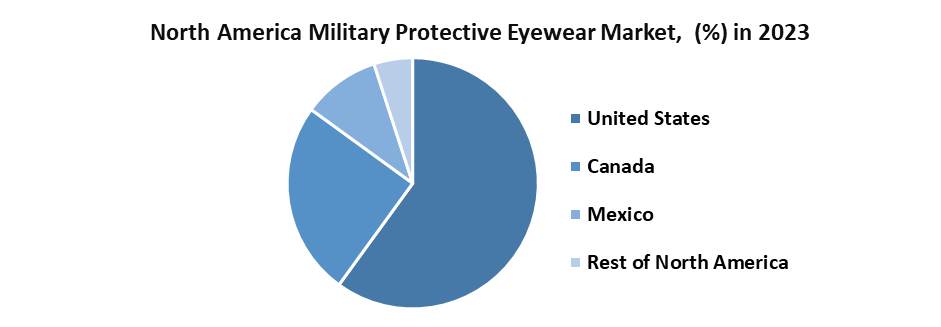

North America, held the largest market share in 2023. Gradually occurring significant advancements are evident in North America’s Post-Consumer Recycled (PCR) plastic packaging market. This is driven by the increasing need for green packaging options due to fears surrounding the issue of long-term availability vis-à-vis conservation. Consequently, both buyers and sellers are opting for items manufactured using plastic remnants. Legislative initiatives that support recycling and reduce plastic waste are shaping the market. Innovations in PCR plastic packaging design and materials are also taking place in the region representing a strong commitment to packaging solutions that are friendly to the environment. This trend indicates that there has been a growing emphasis on sustainability within the packaging industry in North America.

PCR Plastic Packaging Market Competitive Landscape:

- In August 2023, Berry Global merged its M&H and PET Power divisions to form a new Europe-wide enterprise. Berry Agile Solutions, the latest company, promises short lead times and cheap minimum order quantities (MOQs), including multi-product orders.

- In February 2023, Mobil used fifty percent of PCR plastic pails in India. ExxonMobil recycles more than 90% of lubricant operations waste yearly for new applications.

- In November 2023, with the acquisition of Italian company Silte srl, the French manufacturer of plastic jars, bottles, and closures for the personal care and food industries, completed a new external growth operation.

PCR Plastic Packaging Market Scope:

|

PCR Plastic Packaging Market |

|

|

Market Size in 2023 |

USD 31.6 Bn. |

|

Market Size in 2030 |

USD 55.83 Bn. |

|

CAGR (2024-2030) |

8.47 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Material PET PE PP PVC |

|

By End Use Food and Beverage Pharmaceutical Cosmetics Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

PCR Plastic Packaging Market Key Players:

- Berry Global

- Amcor Limited

- Plastipak

- Sealed Air

- Mondi

- Sonoco

- Huhtamäki

- DS Smith

- Winpak

- Silgan Holdings

- Printpack

- Greif

- Constantia Flexibles

- ProAmpac

- D&W Fine Pack

- Pretium Packaging

- ePac Flexible Packaging

- TC Transcontinental

- Berry Global

- Coveris

- XX Ltd

Frequently Asked Questions

Quality and Consistency are the challenge in the PCR Plastic Packaging Market.

The Market size was valued at USD 31.6 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 8.47 % from 2024 to 2030, reaching nearly USD 55.83 Billion.

The segments covered in the market report are by Material, and End Use.

1. PCR Plastic Packaging Market: Research Methodology

2. PCR Plastic Packaging Market: Executive Summary

3. PCR Plastic Packaging Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. PCR Plastic Packaging Market Import Export Landscape

5.1. Import Trends

5.2. Export Trends

5.3. Regulatory Compliance

5.4. Major Export Destinations

5.5. Import-Export Disparities

6. PCR Plastic Packaging Market: Dynamics

6.1. Market Trends by Region

6.1.1. North America

6.1.2. Europe

6.1.3. Asia Pacific

6.1.4. Middle East and Africa

6.1.5. South America

6.2. Market Drivers by Region

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Middle East and Africa

6.2.5. South America

6.3. Market Restraints

6.4. Market Opportunities

6.5. Market Challenges

6.6. PORTER’s Five Forces Analysis

6.7. PESTLE Analysis

6.8. Strategies for New Entrants to Penetrate the Market

6.9. Regulatory Landscape by Region

6.9.1. North America

6.9.2. Europe

6.9.3. Asia Pacific

6.9.4. Middle East and Africa

6.9.5. South America

7. PCR Plastic Packaging Market Size and Forecast by Segments (by Value Units)

7.1. PCR Plastic Packaging Market Size and Forecast, by Material (2023-2030)

7.1.1. PET

7.1.2. PE

7.1.3. PP

7.1.4. PVC

7.2. PCR Plastic Packaging Market Size and Forecast, by End Use (2023-2030)

7.2.1. Food and Beverage

7.2.2. Pharmaceutical

7.2.3. Cosmetics

7.2.4. Others

7.3. PCR Plastic Packaging Market Size and Forecast, by Region (2023-2030)

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East and Africa

7.3.5. South America

8. North America PCR Plastic Packaging Market Size and Forecast (by Value Units)

8.1. North America PCR Plastic Packaging Market Size and Forecast, by Material (2023-2030)

8.1.1. PET

8.1.2. PE

8.1.3. PP

8.1.4. PVC

8.2. PCR Plastic Packaging Market Size and Forecast, by End Use (2023-2030)

8.2.1. Food and Beverage

8.2.2. Pharmaceutical

8.2.3. Cosmetics

8.2.4. Others

8.3. North America PCR Plastic Packaging Market Size and Forecast, by Country (2023-2030)

8.3.1. United States

8.3.2. Canada

8.3.3. Mexico

9. Europe PCR Plastic Packaging Market Size and Forecast (by Value Units)

9.1. Europe PCR Plastic Packaging Market Size and Forecast, by Material (2023-2030)

9.1.1. PET

9.1.2. PE

9.1.3. PP

9.1.4. PVC

9.2. PCR Plastic Packaging Market Size and Forecast, by End Use (2023-2030)

9.2.1. Food and Beverage

9.2.2. Pharmaceutical

9.2.3. Cosmetics

9.2.4. Others

9.3. Europe PCR Plastic Packaging Market Size and Forecast, by Country (2023-2030)

9.3.1. UK

9.3.2. France

9.3.3. Germany

9.3.4. Italy

9.3.5. Spain

9.3.6. Sweden

9.3.7. Russia

9.3.8. Rest of Europe

10. Asia Pacific PCR Plastic Packaging Market Size and Forecast (by Value Units)

10.1. Asia Pacific PCR Plastic Packaging Market Size and Forecast, by Material (2023-2030)

10.1.1. PET

10.1.2. PE

10.1.3. PP

10.1.4. PVC

10.2. PCR Plastic Packaging Market Size and Forecast, by End Use (2023-2030)

10.2.1. Food and Beverage

10.2.2. Pharmaceutical

10.2.3. Cosmetics

10.2.4. Others

10.3. Asia Pacific Air Traffic Control (ATC) Communications Market Size and Forecast, by Country (2023-2030)

10.3.1. China

10.3.2. S Korea

10.3.3. Japan

10.3.4. India

10.3.5. Australia

10.3.6. Indonesia

10.3.7. Malaysia

10.3.8. Vietnam

10.3.9. Taiwan

10.3.10. Bangladesh

10.3.11. Pakistan

10.3.12. Rest of Asia Pacific

11. Middle East and Africa PCR Plastic Packaging Market Size and Forecast (by Value Units)

11.1. Middle East and Africa PCR Plastic Packaging Market Size and Forecast, by Material (2023-2030)

11.1.1. PET

11.1.2. PE

11.1.3. PP

11.1.4. PVC

11.2. Middle East and Africa Market Size and Forecast, by End Use (2023-2030)

11.2.1. Food and Beverage

11.2.2. Pharmaceutical

11.2.3. Cosmetics

11.2.4. Others

11.3. Middle East and Africa PCR Plastic Packaging Market Size and Forecast, by Country (2023-2030)

11.3.1. South Africa

11.3.2. GCC

11.3.3. Egypt

11.3.4. Nigeria

11.3.5. Rest of ME&A

12. South America PCR Plastic Packaging Market Size and Forecast (by Value Units)

12.1. South America PCR Plastic Packaging Market Size and Forecast, by Material (2023-2030)

12.1.1. PET

12.1.2. PE

12.1.3. PP

12.1.4. PVC

12.2. South America Market Size and Forecast, by End Use (2023-2030)

12.2.1. Food and Beverage

12.2.2. Pharmaceutical

12.2.3. Cosmetics

12.2.4. Others

12.3. South America PCR Plastic Packaging Market Size and Forecast, by Country (2023-2030)

12.3.1. Brazil

12.3.2. Argentina

12.3.3. Rest of South America

13. Company Profile: Key players

13.1. Berry Global

13.1.1.1. Company Overview

13.1.1.2. Financial Overview

13.1.1.3. Business Portfolio

13.1.1.4. SWOT Analysis

13.1.1.5. Business Strategy

13.1.1.6. Recent Developments

13.2. Amcor Limited

13.3. Plastipak

13.4. Sealed Air

13.5. Mondi

13.6. Sonoco

13.7. Huhtamäki

13.8. DS Smith

13.9. Winpak

13.10. Silgan Holdings

13.11. Printpack

13.12. Greif

13.13. Constantia Flexibles

13.14. ProAmpac

13.15. D&W Fine Pack

13.16. Pretium Packaging

13.17. ePac Flexible Packaging

13.18. TC Transcontinental

13.19. Berry Global

13.20. Coveris

13.21. XX

14. Key Findings

15. Industry Recommendation