Phosphoramidite Market: Global Industry Analysis and Forecast (2024-2030)

The Phosphoramidite Market size was valued at USD 1.05 Bn. in 2023 and the total Global Phosphoramidite revenue is expected to grow at a CAGR of 7.19% from 2024 to 2030, reaching nearly USD 1.84 Bn. by 2030.

Format : PDF | Report ID : SMR_2144

Phosphoramidite Market Overview

Phosphoramidites are highly reactive derivatives of nucleosides and serve as building blocks for oligonucleotide sequences. They are preferred over other raw materials due to their prime protecting groups.

- According to SMR, genetic disorders and congenital abnormalities occur in about 2%-5% of all live births, account for up to 30% of paediatric hospital admissions and cause about 50% of childhood deaths in industrialized countries.

Stellar Market Research published a report that analyzes Phosphoramidite Market trends to predict the market's growth. This Phosphoramidite research report provides insights on market overview, market segmentation, current and future pricing, growth analysis, competitive landscape, and other such premium insights within the forecast period.

The global phosphoramidite market is dynamic and rapidly evolving, creating opportunities for life sciences companies. Companies involved in phosphoramidite development are working to bring novel manufacturing substitutes to improve the quality of oligonucleotides. Merck KGaA, LGC Science Group Holdings Limited, and Thermo Fisher Scientific Inc. are among the major companies spending widely on phosphoramidite product R&D.

The global phosphoramidite market is driven by several factors, including the increased use of synthetic nucleotides in medicines and the rise of synthetic biology. However, the market faces limitations owing to challenges in developing long nucleotide sequences and competition from emerging DNA synthesis technologies.

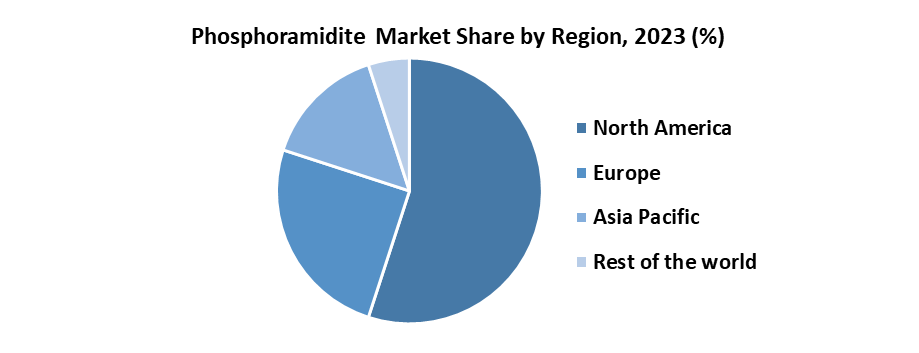

Type, application, end-user, and geographic factors are used to segment the market. The phosphoramidites market is dominated by biotechnology and pharmaceutical businesses. Drug manufacturers are considering the use of oligonucleotides increasingly, particularly in North America and Europe, to create new medicines for medical conditions to improve patient care.

With a strong healthcare sector and rising demand for pharmaceuticals and biotechnology goods, Europe appeared to have an economical phosphoramidite market. The research and marketing of medicines and biotechnology products are regulated by a well-established regulatory framework. The biotechnology and pharmaceutical sectors have seen a rise in research and development efforts because of the increasing incidence of infectious illnesses and genetic abnormalities which has increased the demand for phosphoramidites market.

To get more Insights: Request Free Sample Report

Phosphoramidite Market Dynamics

Demand Driven by Advancements in Genetic Diagnosis and Treatment

The occurrence of genetic diseases like cystic fibrosis, sickle cell anaemia, and Huntington’s disease is increasing rapidly. Globally about 70,000 people are affected by cystic fibrosis, while about 300,000 new boards are affected by sickle cell anaemia each year. The prevalence of these diseases increases the need for developing effective diagnostic and treatment options. Phosphoramidites are important for the synthesis of DNA and RNA oligonucleotides, which are used in genetic diagnosis and treatment. The genetic mutations, modifications, and personalized treatments are being provided by the synthetic oligonucleotides. The development of technologies such as CRISPR-Cas9 having an exactness rate of around 95% in gene editing, greatly broadened the possibilities for healing genetic disorders.

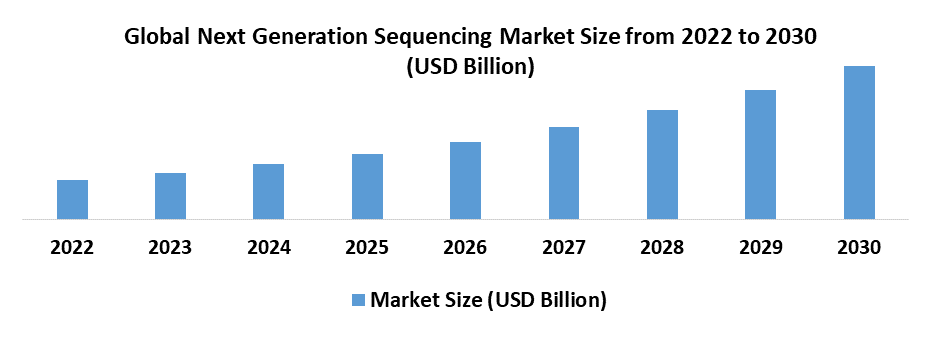

This method depends on high-quality produced oligonucleotides, increasing the need for the phosphoramidite industry and driving its growth. In addition, next-generation sequencing (NGS) technologies, which analyze up to 45 billion nucleotides per run, have changed genomics by enabling quick analysis of genetic data. Gene therapy has shown promising results in disease treatment, and the synthesis of particular DNA and RNA sequences for gene treatments is pushing up demand for high-quality phosphoramidites. Also, personalized medicine relies on genetic testing and treatment planning, which drives up demand for phosphoramidite market growth.

The increased frequency of gene-related disorders, as well as a rising emphasis on therapy and diagnostics, are important drivers for the phosphoramidite market. The growing need for sophisticated diagnostic tools, gene editing technologies, next-generation sequencing, gene treatments, and personalized medicine is driving up the demand for high-quality phosphoramidites.

High Costs of DNA Synthesis as a Barrier

DNA synthesis, or the process of generating artificial DNA sequences, is vital for many applications in science, medicine, and biotechnology. However, this procedure is typically expensive, mostly because it involves the expense of phosphoramidites, which are the building blocks utilized in DNA synthesis. For instance, the cost of creating a single base of DNA ranges from $0.10 to $1, based on the sequence's size and complexity. This adds up rapidly; creating a medium-length DNA sequence of 100 base pairs costs between $10 and $100. These costs are increased by the need for high purity and quality, as impurities cause mistakes in the DNA sequence, making the synthesized DNA unsuitable for its intended application.

In addition, DNA synthesis requires specialized equipment and experienced workers, which raises the entire cost. For example, high-throughput DNA synthesizers range in price from $50,000 to $250,000. Additionally, the chemicals and solvents used in the synthesis process tend to be costly and need to be handled with caution to prevent contamination. These high prices limit the availability of DNA synthesis methods, particularly for smaller research institutions and startups, limiting the expansion of the phosphoramidite market.

Phosphoramidite Market Segment Analysis

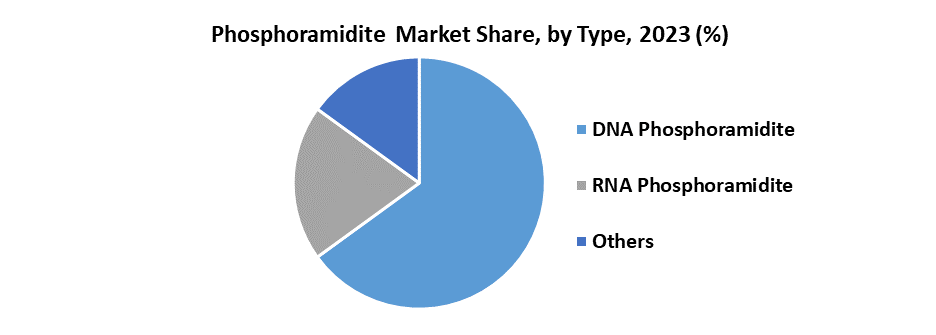

By Type, According to SMR research, the DNA Phosphoramidite segment has been the largest in 2023 and dominates the phosphoramidite market. DNA phosphoramidite chemistry remains the unchallenged leader in DNA synthesis, which provides a new level of use and productivity, making it possible to synthesize long oligonucleotide sequences (up to 200 base pairs) and meet the bulk DNA needs of the developing area of synthetic biology. DNA phosphoramidites are vital to the pharmaceutical and biotechnology industries' drug development, production, and discovery processes marking the dominance of the segment in the global phosphoramidite market. As a result of continuous research and development, DNA phosphoramidite products are becoming increasingly beneficial in the field of gene editing.

This is in perfect coordination with the increasing incidence of infectious illnesses and genetic problems, which is driving up demand for phosphoramidite-powered DNA synthesis in the market. Additionally, technological advances further solidify the dominance of the segment in the phosphoramidite market by increasing the demand for DNA phosphoramidites in designing oligonucleotides essential for Next-Generation Sequencing.

The need for phosphoramidites is being further fueled by the growing uses of DNA synthesis in targeted cancer treatments which have shown efficacy rates of up to 70%, gene therapies, and personalized medicine. The DNA phosphoramidite segment's dominance in the worldwide phosphoramidite market is based on its long-standing function in DNA synthesis, as well as ongoing advances in genomics, synthetic biology, gene editing, and DNA sequencing technologies.

Phosphoramidite Market Regional Analysis

North America has been the dominant region in the global Phosphoramidite market in 2023 and is expected to continue its dominance during the forecast period. The dominance is attributed to factors such as advanced R&D, a huge industrial base, government funding, and regulatory framework. North America, led by the U.S. has major biotech industries that drive the demand for phosphoramidite which is used in gene therapy, drug discovery, and manufacturing. Cities like San Diego, Boston, etc have a large number of these companies involved in the research and development of oligonucleotide synthesis in Next Generation Sequencing applications which drives the development of the phosphoramidite market in the region.

Additionally, investments in genomics, advanced technologies like CRISPR-Cas, and synthetic biology that depend on phosphoramidites are supported by funding from various research institutes further driving the demand for the phosphoramidite market. For instance, global spending for research and development related to biopharmaceuticals rose to $72 billion in 2023 from $61 billion in 2022. The research and marketing of biotechnology products that assure the end users of the market are controlled by the government of North America through an established regulatory framework. The dominance of North America in the Phosphoramidite market is further strengthened by its capacity to develop and innovate new applications thud driving sustained growth in the market globally.

Phosphoramidite Market Competitive Landscape

The Phosphoramidite market is competitive with major players such as Thermo Fisher Scientific, Biosynth Carbosynth, TriLink BioTechnologies, and Bioneer Corporation among others. The companies are focusing on escalating their product portfolios with the launch of best-in-class distinctive novel phosphoramidites and trying to address the limitations and challenges of diversifying phosphoramidites products with efforts to increase their global footprint. The primary contributing methods among the several significant developments were business development followed by acquisitions.

- In 2023, Integrated DNA Technologies (IDT), announced the availability of xGen NGS products designed exclusively for the Ultima Genomics UG 100™ platform. The suite of new xGen NGS tools supports a wide range of applications, including DNA, RNA, and methylation sequencing workflows, as well as IDT’s proven hybridization capture chemistry. The products are designed to minimize sequence errors from PCR or sequencing that might impact demultiplexing.

- In 2023, Merck KGaA partnered with Aurigene Pharmaceutical Services to jointly develop and manufacture novel phosphoramidite-based oligonucleotide therapeutics.

|

Phosphoramidite Market Scope |

|

|

Market Size in 2023 |

USD 1.05 Billion |

|

Market Size in 2030 |

USD 1.84 Billion |

|

CAGR (2024-2030) |

7.19% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type DNA Phosphoramidite RNA Phosphoramidite Others |

|

|

By Application Drug Discovery & Development Diagnostics Development Gene Editing & Synthetic Biology Others |

|

|

By End Use Biotechnology & Pharmaceutical Companies Academic & Research Institutes Others |

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Phosphoramidite Market

- Thermo Fisher Scientific (USA)

- Biosynth Carbosynth (Switzerland)

- TriLink BioTechnologies (USA)

- Bioneer Corporation (South Korea)

- Hongene Biotech Corporation (USA)

- Merk KGaA (USA)

- Glen Research (USA)

- Integrated DNA Technologies (USA)

- ChemGenes Corporation (USA)

- Others

Frequently Asked Questions

The rising prevalence of gene-related diseases and applications of synthetic nucleotides are the drivers of the Phosphoramidite market.

Asia Pacific is the fastest-growing region in the Phosphoramidite market during the forecast period.

The Market size was valued at USD 1.05 billion in 2023 and the total Market revenue is expected to grow at a CAGR of 7.19% from 2024 to 2030, reaching nearly USD 1.84 billion.

The segments covered in the market report are Type, Application, End-Use, and region.

1. Phosphoramidite Market: Research Methodology

2. Phosphoramidite Market: Executive Summary

3. Phosphoramidite Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Phosphoramidite Market: Dynamics

5.1. Market Trends

5.2. Market Drivers

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Technology Roadmap

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Phosphoramidite Market Size and Forecast by Segments (by Value USD Billion)

6.1. Phosphoramidite Market Size and Forecast, by Type (2023-2030)

6.1.1. DNA Phosphoramidite

6.1.2. RNA Phosphoramidite

6.1.3. Others

6.2. Phosphoramidite Market Size and Forecast, by Application (2023-2030)

6.2.1. Drug Discovery & Development

6.2.2. Diagnostics Development

6.2.3. Gene Editing & Synthetic Biology

6.2.4. Others

6.3. Phosphoramidite Market Size and Forecast, by End-Use (2023-2030)

6.3.1. Biotechnology & Pharmaceutical Companies

6.3.2. Academic & Research Institutes

6.3.3. Others

6.4. Phosphoramidite Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Phosphoramidite Market Size and Forecast (by Value USD Billion)

7.1. North America Phosphoramidite Market Size and Forecast, by Type (2023-2030)

7.1.1. DNA Phosphoramidite

7.1.2. RNA Phosphoramidite

7.1.3. Others

7.2. North America Phosphoramidite Market Size and Forecast, by Application (2023-2030)

7.2.1. Drug Discovery & Development

7.2.2. Diagnostics Development

7.2.3. Gene Editing & Synthetic Biology

7.2.4. Others

7.3. North America Phosphoramidite Market Size and Forecast, by End-Use (2023-2030)

7.3.1. Biotechnology & Pharmaceutical Companies

7.3.2. Academic & Research Institutes

7.3.3. Others

7.4. North America Phosphoramidite Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Phosphoramidite Market Size and Forecast (by Value USD Billion)

8.1. Europe Phosphoramidite Market Size and Forecast, by Type (2023-2030)

8.1.1. DNA Phosphoramidite

8.1.2. RNA Phosphoramidite

8.1.3. Others

8.2. Europe Phosphoramidite Market Size and Forecast, by Application (2023-2030)

8.2.1. Drug Discovery & Development

8.2.2. Diagnostics Development

8.2.3. Gene Editing & Synthetic Biology

8.2.4. Others

8.3. Europe Phosphoramidite Market Size and Forecast, by End-Use (2023-2030)

8.3.1. Biotechnology & Pharmaceutical Companies

8.3.2. Academic & Research Institutes

8.3.3. Others

8.4. Europe Phosphoramidite Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Phosphoramidite Market Size and Forecast (by Value USD Billion)

9.1. Asia Pacific Phosphoramidite Market Size and Forecast, by Type (2023-2030)

9.1.1. DNA Phosphoramidite

9.1.2. RNA Phosphoramidite

9.1.3. Others

9.2. Asia Pacific Phosphoramidite Market Size and Forecast, by Application (2023-2030)

9.2.1. Drug Discovery & Development

9.2.2. Diagnostics Development

9.2.3. Gene Editing & Synthetic Biology

9.2.4. Others

9.3. Asia Pacific Phosphoramidite Market Size and Forecast, by End-Use (2023-2030)

9.3.1. Biotechnology & Pharmaceutical Companies

9.3.2. Academic & Research Institutes

9.3.3. Others

9.4. Asia Pacific Phosphoramidite Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Phosphoramidite Market Size and Forecast (by Value USD Billion)

10.1. Middle East and Africa Phosphoramidite Market Size and Forecast, by Type (2023-2030)

10.1.1. DNA Phosphoramidite

10.1.2. RNA Phosphoramidite

10.1.3. Others

10.2. Middle East and Africa Phosphoramidite Market Size and Forecast, by Application (2023-2030)

10.2.1. Drug Discovery & Development

10.2.2. Diagnostics Development

10.2.3. Gene Editing & Synthetic Biology

10.2.4. Others

10.3. Middle East and Africa Phosphoramidite Market Size and Forecast, by End-Use (2023-2030)

10.3.1. Biotechnology & Pharmaceutical Companies

10.3.2. Academic & Research Institutes

10.3.3. Others

10.4. Middle East and Africa Electric Vehicle Traction Motor Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Phosphoramidite Market Size and Forecast (by Value USD Billion)

11.1. South America Phosphoramidite Market Size and Forecast, by Type (2023-2030)

11.1.1. DNA Phosphoramidite

11.1.2. RNA Phosphoramidite

11.1.3. Others

11.2. South America Phosphoramidite Market Size and Forecast, by Application (2023-2030)

11.2.1. Drug Discovery & Development

11.2.2. Diagnostics Development

11.2.3. Gene Editing & Synthetic Biology

11.2.4. Others

11.3. South America Phosphoramidite Market Size and Forecast, by End-Use (2023-2030)

11.3.1. Biotechnology & Pharmaceutical Companies

11.3.2. Academic & Research Institutes

11.3.3. Others

11.4. South America Phosphoramidite Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Thermo Fisher Scientific

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Biosynth Carbosynth

12.3. TriLink BioTechnologies

12.4. Bioneer Corporation

12.5. Hongene Biotech Corporation

12.6. Merk KGaA

12.7. Glen Research

12.8. ChemGenes Corporation

12.9. Others

13. Key Findings

14. Industry Recommendations