Plant Hormones Market: Global Industry Analysis and Forecast (2024-2030)

The Plant Hormones Market size was valued at USD 4.50 Bn. in 2023 and the total Plant Hormones Market size is expected to grow at a CAGR of 8.86% from 2024 to 2030, reaching nearly USD 8.15 Bn. by 2030.

Format : PDF | Report ID : SMR_2040

Plant Hormones Market Overview

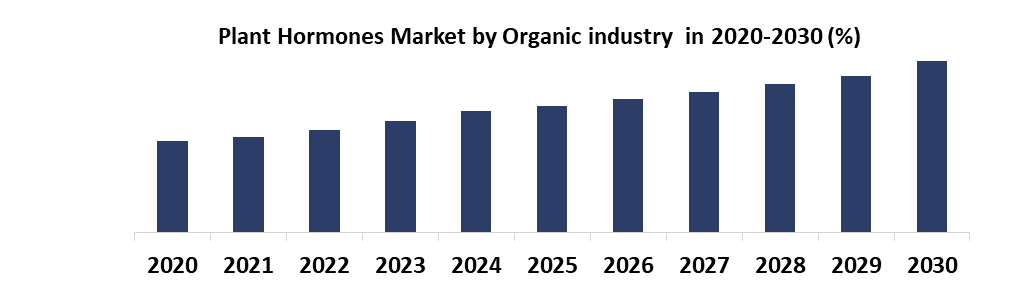

Plant hormones are chemicals found in plants at low concentrations that promote plant growth, aiding in cell division, root elongation, shoot, ripening, and flowering. Commercially available plant hormones include auxins, cytokines, ethylene, and gibberellins. The organic industry has rapidly expanded, with the development of crop-specific products as a strategy to penetrate the global market. Plant hormones control growth processes like leaf and flower formation, stem elongation, fruit development, and ripening. They have become an integral part of organic farming practices, particularly from algae, because of their natural origin. The use of natural hormones in organic fruit growing and cash crops has increased demand, making organic farming one of the fastest-growing industries globally.

Plant hormones interact with one another to affect the growth and development of plants. The five plant hormones that are considered classical are ethylene, gibberellins, auxins, cytokinins, and abscisic acid. These are small, diffusible molecules that pass through cells easily. Also, new clans of plant hormones, including salicylic acid, jasmonic acid, brassinosteroids, and numerous tiny proteins or peptides, have been identified. These hormones are important in regulating the growth and development of plants.

To get more Insights: Request Free Sample Report

Plant Hormones Market Dynamics:

The organic industry's growth is driven by the importance of sustainable agriculture and increased investment in developing countries. Farmers have better access to plant hormones because of better financial resources. Patent protection and exclusivity help companies recoup research and development costs, incentivizing future investments. Plant hormones have gained global status as they promote plant growth and spread. The main driver of market growth is the increased demand for agricultural products like fruits, vegetables, cereals, pulses, and other crops.

The demand for crop productivity-related products has also increased. Features such as the growth of the textile industry and the organic agriculture industry are expected to raise demand for plant hormones. High crop productivity associated with plant hormones encourages global sales. The enhancement of products and technological developments are major reasons for the growth of the plant hormones market.

Farmers are shifting from traditional practices, increasing demand for advanced technologies like plant hormones. These hormones promote seed germination, stem and root elongation, and plant growth, boosting adoption rates. Manufacturing companies are also producing innovative, high-quality products to attract larger consumer bases. These products, which contain high concentrations of Ascophyllum nodossum and Folic acid, enhance flowering, reduce flower drops, and improve flower and fruit, thus contributing to market growth.

The market of plant hormones is expected to grow, but there are several difficulties in the market. Commercialization and scalability are delayed by regulatory complications and restrictive approval procedures for new goods, which create obstacles to market access and innovation. Also, problems with human health and environmental sustainability require thorough risk assessment and mitigation plans, which raises manufacturing costs and market uncertainty. In addition, pricing tactics, brand distinctiveness, and market penetration are all restricted by market fragmentation and fierce rivalry among manufacturers and suppliers. To address these problems, collaborative efforts and market consolidation efforts are necessary.

The plant hormone market offers significant growth opportunities for stakeholders because of the increasing global population and food demand. Sustainable agricultural practices are being adopted to optimize crop production and resource utilization. Expansion into emerging markets like Asia-Pacific and Latin America presents available growth prospects. Advancements in precision agriculture and digital farming technologies provide opportunities for developing innovative, data-driven plant hormone products. The demand for organic products is rising because of concerns about synthetic chemicals, and developing countries are experiencing rapid progress and population growth. Advancements in biotechnology are advancing novel plant hormone-based products.

Plant Hormones Market Segment Analysis:

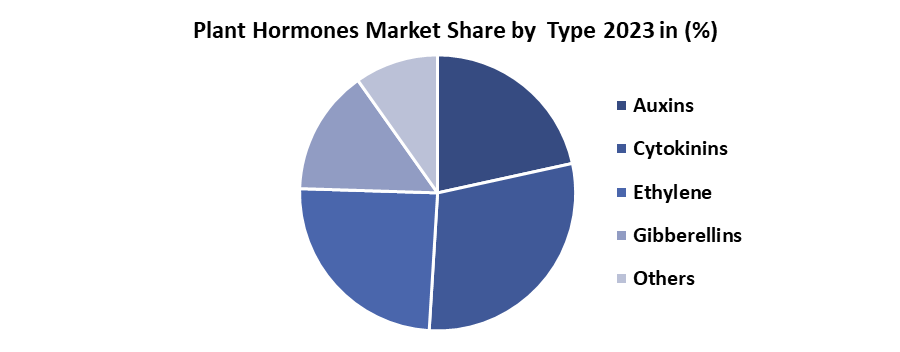

Based on Type, Cytokinins a type of plant hormone, are important for plant growth and development. They account for XX% of the global market share and are widely consumed because of their benefits, such as preventing leaf senescence and decaying plant aging. They are particularly abundant in germinating seeds, roots, sap streams, fruits, and tumor tissues. Cytokinins are naturally produced in various parts of plants, including root meristems, young leaves, fruits, seeds, and developing tissues. They enhance seed germination, especially in darkness, and work in combination with other plant hormones like gibberellins to break photo-dormancy in certain seeds. Synthetic cytokinins have also been developed for various purposes in plant research and agriculture.

- Cytokinins play a crucial role in cell division, elongation, and enlargement, contributing to the growth and development of plant tissues and organs. They stimulate cell division, resulting in new cell formation and tissue growth. They are widely used in tissue culture techniques to induce regeneration and growth of new plant tissues and organs. Cytokinins also regulate flowering and fruit development by controlling cell division, growth, and hormonal balance.

Plant Hormones Market Regional Insight:

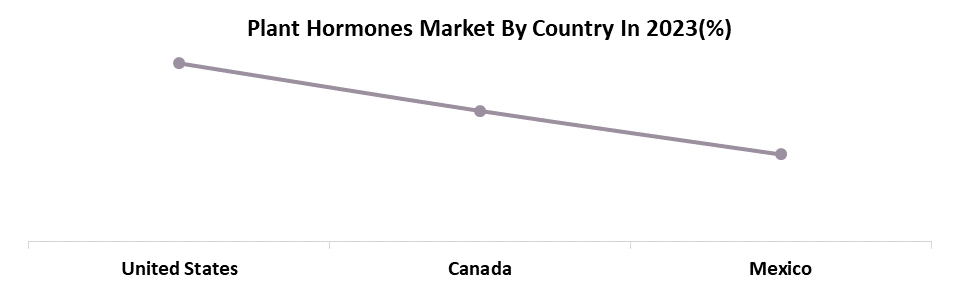

The North American Plant Hormones Market had a XX% market share in 2023. Growing consumption, especially in the United States, of produce crops is driving the business in North America. Corn, cotton, fruit, tree nuts, soybean & oil crops, wheat, and pulses are the principal produce crops grown in the US. Canada is one of the biggest exporters of agricultural products globally, so it makes sense that demand for all PGRs is significantly rising. The agricultural sector in Western Canada has evolved all over time, both in terms of the crops grown and farmed. Gibberellin inhibitors and ethylene-releasing compounds are the two primary PGR types that are available commercially in Western Canada. Also, in the North American area, the market of plant hormones in the United States had the most market share, while the market in Canada was growing at the fastest rate.

Plant Hormones Market Competitive Landscape:

- May 14, 2024, FMC Corporation a leading global agricultural sciences company, today announced a collaboration with Optibrium, a leading developer of software and artificial intelligence (AI) solutions for small molecule discovery. The agreement is part of FMC's strategic plan to accelerate the discovery and commercialization of FMC's pipeline. Expanding FMC's Discovery process to include Optibrium's innovative Augmented Chemistry® AI technologies are help bring new solutions to growers faster. Machine learning and AI methods serve to identify promising compounds, optimize their properties, and continue the company’s focus on sustainable products.

- 3 May 2024, Rallis India Limited, a Tata enterprise and a leading player in the Indian Agri inputs industry, announces the establishment of an automated 8000 Metric Ton WSF plant in Akola, Maharashtra. This strategic initiative underscores Rallis' commitment to innovation, enhancing farm productivity, and advancing sustainable agriculture practices.

|

Plant Hormones Market Scope |

|

|

Market Size in 2023 |

USD 4.50 Bn. |

|

Market Size in 2030 |

USD 8.15 Bn. |

|

CAGR (2024-2030) |

8.86 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Auxins Cytokinins Ethylene Gibberellins Others |

|

By Formulation Solutions Granules Wet Powders Others |

|

|

By Function Growth Promoters Growth Inhibitors |

|

|

By Application Fruits & Vegetables Cereals & Pulses Oilseeds & Grains Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Plant Hormones Market

- Nufarm Australia Ltd. (Australia)

- FMC Corporation (USA)

- Bayer (Germany)

- Adama Agricultural Solutions Ltd. (Israel)

- Valent BioSciences Corporation (USA)

- Dow Chemical Company (USA)

- BASF SE (Germany)

- Syngenta Group (Switzerland)

- Tata Chemicals Ltd. (India)

- UPL (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nippon Soda Co., Ltd. (Japan)

- DHANUKA AGRITECH LTD (India)

- Sichuan Guoguang Agrochemical Co., (China)

- Zagro (Singapore)

- BioWorks Inc. (USA)

- Biowin Agro Research (Poland)

- WinField United (USA)

- Seipasa (Spain)

- XX.inc

Frequently Asked Questions

North America is expected to lead the Plant Hormones Market during the forecast period.

An analysis of profit trends and projections for companies in the Plant Hormones Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Plant Hormones Market size was valued at USD 4.50 Billion in 2023 and the total Plant Hormones Market size is expected to grow at a CAGR of 8.86% from 2024 to 2030, reaching nearly USD 8.15 Billion by 2030.

The segments covered in the market report are by Type, by Formulation, by Function, and by Application.

1. Plant Hormones Market: Research Methodology

2. Plant Hormones Market: Executive Summary

3. Plant Hormones Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Import and export of Plant Hormones Market

5. Plant Hormones Market: Dynamics

5.1. Market Trends by Region

5.1.1. North America

5.1.2. Europe

5.1.3. Asia Pacific

5.1.4. Middle East and Africa

5.1.5. South America

5.2. Market Drivers by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Regulatory Landscape by Region

5.9.1. North America

5.9.2. Europe

5.9.3. Asia Pacific

5.9.4. Middle East and Africa

5.9.5. South America

6. Plant Hormones Market Size and Forecast by Segments (by value Units)

6.1. Plant Hormones Market Size and Forecast, by Type (2023-2030)

6.1.1. Auxins

6.1.2. Cytokinins

6.1.3. Ethylene

6.1.4. Gibberellins

6.1.5. Others

6.2. Plant Hormones Market Size and Forecast, by Formulation (2023-2030)

6.2.1. Solutions

6.2.2. Granules

6.2.3. Wet Powders

6.2.4. Others

6.3. Plant Hormones Market Size and Forecast, by Function (2023-2030)

6.3.1. Growth Promoters

6.3.2. Growth Inhibitors

6.4. Plant Hormones Market Size and Forecast, by Application (2023-2030)

6.4.1. Fruits & Vegetables

6.4.2. Cereals & Pulses

6.4.3. Oilseeds & Grains

6.4.4. Others

6.5. Plant Hormones Market Size and Forecast, by Region (2023-2030)

6.5.1. North America

6.5.2. Europe

6.5.3. Asia Pacific

6.5.4. Middle East and Africa

6.5.5. South America

7. North America Plant Hormones Market Size and Forecast (by value Units)

7.1. North America Plant Hormones Market Size and Forecast, by Type (2023-2030)

7.1.1. Auxins

7.1.2. Cytokinins

7.1.3. Ethylene

7.1.4. Gibberellins

7.1.5. Others

7.2. North America Plant Hormones Market Size and Forecast, by Formulation (2023-2030)

7.2.1. Solutions

7.2.2. Granules

7.2.3. Wet Powders

7.2.4. Others

7.3. North America Plant Hormones Market Size and Forecast, by Function (2023-2030)

7.3.1. Growth Promoters

7.3.2. Growth Inhibitors

7.4. North America Plant Hormones Market Size and Forecast, by Application (2023-2030)

7.4.1. Fruits & Vegetables

7.4.2. Cereals & Pulses

7.4.3. Oilseeds & Grains

7.4.4. Others

7.5. North America Plant Hormones Market Size and Forecast, by Country (2023-2030)

7.5.1. United States

7.5.2. Canada

7.5.3. Mexico

8. Europe Plant Hormones Market Size and Forecast (by Value Units)

8.1. Europe Plant Hormones Market Size and Forecast, by Type (2023-2030)

8.1.1. Auxins

8.1.2. Cytokinins

8.1.3. Ethylene

8.1.4. Gibberellins

8.1.5. Others

8.2. Europe Plant Hormones Market Size and Forecast, by Formulation (2023-2030)

8.2.1. Solutions

8.2.2. Granules

8.2.3. Wet Powders

8.2.4. Others

8.3. Europe Plant Hormones Market Size and Forecast, by Function (2023-2030)

8.3.1. Growth Promoters

8.3.2. Growth Inhibitors

8.4. Europe Plant Hormones Market Size and Forecast, by Application (2023-2030)

8.4.1. Fruits & Vegetables

8.4.2. Cereals & Pulses

8.4.3. Oilseeds & Grains

8.4.4. Others

8.5. Europe Plant Hormones Market Size and Forecast, by Country (2023-2030)

8.5.1. UK

8.5.2. France

8.5.3. Germany

8.5.4. Italy

8.5.5. Spain

8.5.6. Sweden

8.5.7. Austria

8.5.8. Rest of Europe

9. Asia Pacific Plant Hormones Market Size and Forecast (by Value Units)

9.1. Asia Pacific Plant Hormones Market Size and Forecast, by Type (2023-2030)

9.1.1. Auxins

9.1.2. Cytokinins

9.1.3. Ethylene

9.1.4. Gibberellins

9.1.5. Others

9.2. Asia Pacific Plant Hormones Market Size and Forecast, by Formulation (2023-2030)

9.2.1. Solutions

9.2.2. Granules

9.2.3. Wet Powders

9.2.4. Others

9.3. Asia Pacific Plant Hormones Market Size and Forecast, by Function (2023-2030)

9.3.1. Growth Promoters

9.3.2. Growth Inhibitors

9.4. Asia Pacific Plant Hormones Market Size and Forecast, by Application (2023-2030)

9.4.1. Fruits & Vegetables

9.4.2. Cereals & Pulses

9.4.3. Oilseeds & Grains

9.4.4. Others

9.5. Asia Pacific Plant Hormones Market Size and Forecast, by Country (2023-2030)

9.5.1. China

9.5.2. S Korea

9.5.3. Japan

9.5.4. India

9.5.5. Australia

9.5.6. Asean

9.5.7. Rest of Asia Pacific

10. Middle East and Africa Plant Hormones Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Plant Hormones Market Size and Forecast, by Type (2023-2030)

10.1.1. Auxins

10.1.2. Cytokinins

10.1.3. Ethylene

10.1.4. Gibberellins

10.1.5. Others

10.2. Middle East and Africa Plant Hormones Market Size and Forecast, by Formulation (2023-2030)

10.2.1. Solutions

10.2.2. Granules

10.2.3. Wet Powders

10.2.4. Others

10.3. Middle East and Africa Plant Hormones Market Size and Forecast, by Function (2023-2030)

10.3.1. Growth Promoters

10.3.2. Growth Inhibitors

10.4. Middle East and Africa Plant Hormones Market Size and Forecast, by Application (2023-2030)

10.4.1. Fruits & Vegetables

10.4.2. Cereals & Pulses

10.4.3. Oilseeds & Grains

10.4.4. Others

10.5. Middle East and Africa Plant Hormones Market Size and Forecast, by Country (2023-2030)

10.5.1. South Africa

10.5.2. GCC

10.5.3. Rest of ME&A

11. South America Plant Hormones Market Size and Forecast (by Value Units)

11.1. South America Plant Hormones Market Size and Forecast, by Type (2023-2030)

11.1.1. Auxins

11.1.2. Cytokinins

11.1.3. Ethylene

11.1.4. Gibberellins

11.1.5. Others

11.2. South America Plant Hormones Market Size and Forecast, by Formulation (2023-2030)

11.2.1. Solutions

11.2.2. Granules

11.2.3. Wet Powders

11.2.4. Others

11.3. South America Plant Hormones Market Size and Forecast, by Function (2023-2030)

11.3.1. Growth Promoters

11.3.2. Growth Inhibitors

11.4. South America Plant Hormones Market Size and Forecast, by Application (2023-2030)

11.4.1. Fruits & Vegetables

11.4.2. Cereals & Pulses

11.4.3. Oilseeds & Grains

11.4.4. Others

11.5. South America Plant Hormones Market Size and Forecast, by Country (2023-2030)

11.5.1. Brazil

11.5.2. Argentina

11.5.3. Rest of South America

12. Company Profile: Key players

12.1. Nufarm Australia Ltd.

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. FMC Corporation

12.3. Bayer

12.4. Adama Agricultural Solutions Ltd.

12.5. Valent BioSciences Corporation

12.6. Dow Chemical Company

12.7. BASF SE

12.8. Syngenta Group

12.9. Tata Chemicals Ltd.

12.10. UPL

12.11. Sumitomo Chemical Co., Ltd.

12.12. Nippon Soda Co., Ltd.

12.13. DHANUKA AGRITECH LTD

12.14. Sichuan Guoguang Agrochemical Co.,

12.15. Zagro

12.16. BioWorks Inc.

12.17. Biowin Agro Research

12.18. winfield united

12.19. seipasa

12.20. XX.inc

13. Key Findings

14. Industry Recommendation