Retail Logistics Market: Global Industry Analysis and Forecast (2024-2030)

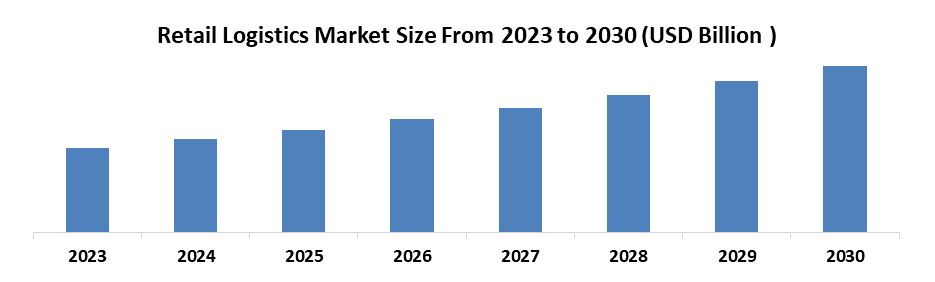

The Retail Logistics Market size was valued at USD 262.67 Bn. in 2023 and the Retail Logistics revenue is expected to grow at a CAGR of 10% from 2024 to 2030, reaching nearly USD 518.37 Bn. by 2030.

Format : PDF | Report ID : SMR_2017

Retail Logistics Market Overview:

Retail logistics involve all the inbound and outbound processes that result in the flow of finished goods from a business to the end user. The optimization of a solid retail logistics strategy is key to operating a sustainable direct-to-consumer (DTC) retail business. Stages of the retail logistics process include warehouse receiving, inventory management, fulfilment, and shipping. Every stage of the logistics process is optimized to meet customer expectations around fast, affordable delivery. Retail logistics operation often requires both labor (both warehouse workers and upper-level management roles, such as a logistics director) and supply chain technology which increases logistics costs significantly. In many cases, DTC brands outsource retail logistics to a third party to save on time and costs.

The report focuses on the Retail Logistics market size, competitor landscape, recent status, and development trends. Furthermore, the report provides a detailed cost analysis and supply chain. The retail Logistics market report shares valuable information about global development status, opportunities, and challenges shortly, as past data analyzed by industry experts which is helpful for needful discussions. Retail Logistics market study offers information about the sales and revenue during the forecast period of 2024 to 2030.

To get more Insights: Request Free Sample Report

Retail Logistics Market Dynamics:

Innovations in Technology and Urban Development

Advancements in technology like automation, AI, and IoT are transforming retail logistics. These technologies enhance the management of inventory, the fulfillment of orders, and the processes of delivery, resulting in increased efficiency and decreased costs. Additionally, the rapid expansion of online shopping has greatly raised the need for effective retail shipping and delivery services. The need for quick and dependable delivery services is causing retailers to improve their logistics capabilities to meet consumer expectations.

The growth of urban population and smart city growth are generating fresh possibilities for retail logistics. Enhanced logistics efficiency is achieved through improved infrastructure, such as upgraded roads and advanced warehouse facilities.

Navigating Demand Forecasting and Regulatory Compliance

Predicting customer demand accurately is a major challenge. Incorrect predictions of demand resulted in having too much inventory or not enough, both of which are expensive and harm customer happiness. Logistics operations need to adhere to diverse regulations that differ greatly depending on the location, covering transportation, labour, and environmental requirements.

Additionally, numerous retailers use obsolete logistics systems that do not align well with modern technologies. Incorporating new technologies such as automation, AI, and IoT is both complicated and expensive

Retail Logistics Market Segment Analysis:

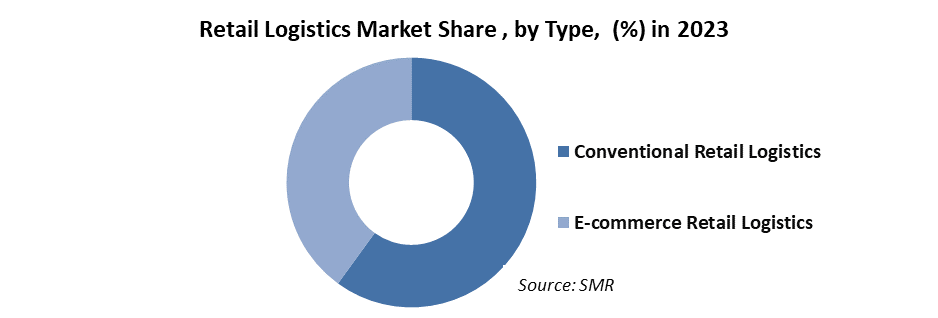

By type, the conventional retail logistics segment held a higher share of the Retail Logistics Market. Conventional retail refers to product sales from the store to the end consumer. Many employees, from warehouse personnel to sales officers, from store officers to shipping managers, act as a chain team. It is primarily owing to its established infrastructure and deep-rooted connections with traditional retail chains. The segment encompasses established warehousing, transportation, and distribution networks designed to support brick-and-mortar retail operations. Conventional retail logistics often relies on longstanding relationships with suppliers and distributors, providing reliability and consistency.

Conventional retail logistics include retailers, wholesalers, and logistics service providers. A traditional supply chain consists of several phases, including purchasing, shipping, warehousing, and distribution, all of which are optimized to make sure that products are delivered to physical storefronts promptly and effectively.

Retail Logistics Market Regional Insight:

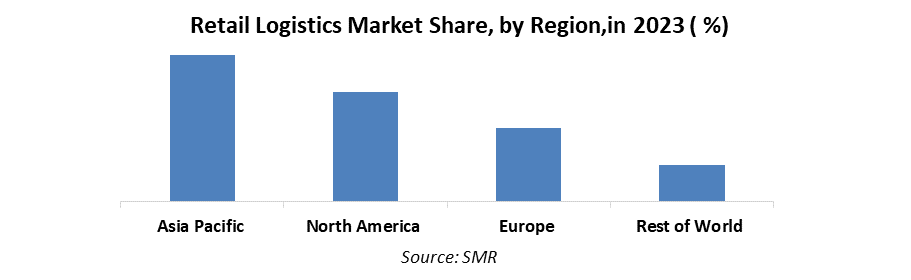

Asia Pacific held the largest share in 2023 for the Retail Logistics Market. China, Japan, and India are the largest countries for the logistics markets in Asia. Indonesia, Vietnam, and Thailand are likely to grow most quickly. APAC as a whole is a key growth engine for global logistics. Global logistics players revisit their Asia portfolios, reconfigure themselves to have Asia-relevant networks, reinforce their local presence in select markets, review their targeted customers, and decide which ones to serve and which respective go-to-market models to adopt. In the fast-changing, competitive business landscape in Asia, the window for harnessing growth and building a leading and sustained market position is quickly narrowing. The different stakeholders in the logistics ecosystem have a variety of strategies at their disposal to help them capture this opportunity.

On the other hand, the APAC region is immensely diverse across cultures, languages, political systems, and legal frameworks. Countries like Japan and Australia are leaders in digital commerce and transport infrastructure, while countries like Thailand and Vietnam are quickly following in their footsteps. For logistics companies operating across multiple markets, it is important to employ standardized solutions that are tailored to local needs. Strong local talent and skilled regional resources enable both localized expertise and regional cooperation across many markets in parallel. In Addition, Retailer infrastructure is important in APAC as well, as the brick & mortar landscape is a bit different than in other parts of the world. APAC countries, aside from Australia and Japan, do not have a lot of brick-and-mortar selling space when compared to the West. Growth in APAC is largely being found online and retailer strategies are taken into account.

- Siam Makro, a leading Thai wholesale retailer, opened its first store in China. Infosys designed and implemented Oracle Retail and EBS on AWS Public Cloud to grow the business across mainland China.

China Eastern Airlines carved out its logistics business, Eastern Air Logistics (EAL), to pilot mixed ownership in the national civil aviation sector and plans an IPO as an integrated logistics service provider to raise about $350 million. SpiceXpress, the cargo arm of the Indian budget carrier SpiceJet, is also reported to be preparing an IPO soon. These companies use the influx of liquidity to make bolder plays in the market.

Retail Logistics Market Competitive Landscape:

- In June 2022, A.P. Moller–Maersk acquired ResQ to strengthen Maersk Training’s offerings within safety training and emergency preparedness.

- In December 2022, Darktraco, a company that offers cybersecurity and AI solutions, announced that a considerable number of companies from the United States that operates in the transport and logistics industry had adopted their AI technology services to safeguard themselves from the United States has been included in the list of Companies that adopted their AI technology.

- In November 2023, Innovation in last-mile delivery solutions gained momentum. Startups offering drone delivery and micro-mobility options for urban areas secured significant funding, indicating a potential shift in how goods reach consumers in the final stage of the journey.

Retail Logistics Market Scope:

|

Retail Logistics Market |

|

|

Market Size in 2023 |

USD 262.67 Bn. |

|

Market Size in 2030 |

USD 518.37 Bn. |

|

CAGR (2024-2030) |

10 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments

|

By Type Conventional Retail Logistics E-commerce Retail Logistics |

|

By Solution Commerce Enablement Supply Chain Solutions Reverse Logistics & Liquidation Transportation Management Others |

|

|

Mode of Transport Railways Airways Roadways Waterways |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Retail Logistics Market Key Players:

- DSV

- XPO Logistics, Inc.

- Kuehne+Nagel International

- H Robinson Worldwide, Inc

- Fedex

- APL Logistics Ltd

- Nippon Express

- Schneider

- United Parcel Service

- P Moller- Maersk

- DHL International GmbH

- C.H. Robinson

- DB Schenker

- J.B. Hunt Transport Services

- Penske Logistics

- Geodis

- Agility Logistics

- Ryder System

- ArcBest Corporation

- Echo Global Logistics

- Lineage Logistics

- XX Ltd

Frequently Asked Questions

By weather conditions, with factors like droughts, floods, or other extreme weather events are challenges for the LEO Satellite Market.

The Market size was valued at USD 262.67 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 10% from 2024 to 2030, reaching nearly USD 518.37 Billion.

The segments covered in the market report are by Type, solutions and mode of transport.

1. Retail Logistics Market: Research Methodology

2. Retail Logistics Market: Executive Summary

3. Retail Logistics Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Retail Logistics Market: Dynamics

4.1. Market Driver

4.2. Market Trends by Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia Pacific

4.2.4. Middle East and Africa

4.2.5. South America

4.3. Market Drivers by Region

4.4. Market Restraints

4.5. Market Opportunities

4.6. Market Challenges

4.7. PORTER’s Five Forces Analysis

4.8. PESTLE Analysis

4.9. Strategies for New Entrants to Penetrate the Market

4.10. Regulatory Landscape by Region

4.10.1. North America

4.10.2. Europe

4.10.3. Asia Pacific

4.10.4. Middle East and Africa

4.10.5. South America

5. Retail Logistics Market Size and Forecast by Segmentations (by Value USD Million)

5.1. Retail Logistics Market Size and Forecast, by Type (2023- 2030)

5.1.1. Conventional Retail Logistics

5.1.2. E-commerce Retail Logistics

5.2. Retail Logistics Market Size and Forecast, by Solution (2023- 2030)

5.2.1. Commerce Enablement

5.2.2. Supply Chain Solutions

5.2.3. Reverse Logistics & Liquidation

5.2.4. Transportation Management

5.2.5. Others

5.3. Retail Logistics Market Size and Forecast, by Mode of Transport (2023- 2030)

5.3.1. Railways

5.3.2. Airways

5.3.3. Roadways

5.3.4. Waterways

5.4. Retail Logistics Market Size and Forecast, by Region (2023- 2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Retail Logistics Market Size and Forecast (by Value USD Million)

6.1. North America Retail Logistics Market Size and Forecast, by Type (2023-2030)

6.1.1. Conventional Retail Logistics

6.1.2. E-commerce Retail Logistics

6.2. North America Retail Logistics Market Size and Forecast, by Solution (2023-2030)

6.2.1. Commerce Enablement

6.2.2. Supply Chain Solutions

6.2.3. Reverse Logistics & Liquidation

6.2.4. Transportation Management

6.2.5. Others

6.3. Retail Logistics Market Size and Forecast, by Mode of Transport (2023- 2030)

6.3.1. Railways

6.3.2. Airways

6.3.3. Roadways

6.3.4. Waterways

6.4. North America Retail Logistics Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.2. Canada

6.4.3. Mexico

7. Europe Retail Logistics Market Size and Forecast (by Value USD Million)

7.1. Europe Retail Logistics Market Size and Forecast, by Type (2023-2030)

7.1.1. Conventional Retail Logistics

7.1.2. E-commerce Retail Logistics

7.2. Europe Retail Logistics Market Size and Forecast, by Solution (2023-2030)

7.2.1. Commerce Enablement

7.2.2. Supply Chain Solutions

7.2.3. Reverse Logistics & Liquidation

7.2.4. Transportation Management

7.2.5. Others

7.3. Retail Logistics Market Size and Forecast, by Mode of Transport (2023- 2030)

7.3.1. Railways

7.3.2. Airways

7.3.3. Roadways

7.3.4. Waterways

7.4. Europe Retail Logistics Market Size and Forecast, by Country (2023-2030)

7.4.1. UK

7.4.2. France

7.4.3. Germany

7.4.4. Italy

7.4.5. Spain

7.4.6. Sweden

7.4.7. Russia

7.4.8. Rest of Europe

8. Asia Pacific Retail Logistics Market Size and Forecast (by Value USD Million)

8.1. Asia Pacific Retail Logistics Market Size and Forecast, by Type (2023-2030)

8.1.1. Conventional Retail Logistics

8.1.2. E-commerce Retail Logistics

8.2. Asia Pacific Retail Logistics Market Size and Forecast, by Solution (2023-2030)

8.2.1. Commerce Enablement

8.2.2. Supply Chain Solutions

8.2.3. Reverse Logistics & Liquidation

8.2.4. Transportation Management

8.2.5. Others

8.3. Retail Logistics Market Size and Forecast, by Mode of Transport (2023- 2030)

8.3.1. Railways

8.3.2. Airways

8.3.3. Roadways

8.3.4. Waterways

8.4. Asia Pacific Retail Logistics Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.2. S Korea

8.4.3. Japan

8.4.4. India

8.4.5. Australia

8.4.6. Indonesia

8.4.7. Malaysia

8.4.8. Vietnam

8.4.9. Taiwan

8.4.10. Bangladesh

8.4.11. Pakistan

8.4.12. Rest of Asia Pacific

9. Middle East and Africa Retail Logistics Market Size and Forecast (by Value USD Million)

9.1. Middle East and Africa Retail Logistics Market Size and Forecast, by Type (2023-2030)

9.1.1. Conventional Retail Logistics

9.1.2. E-commerce Retail Logistics

9.2. Middle East and Africa Retail Logistics Market Size and Forecast, by Solution (2023-2030)

9.2.1. Commerce Enablement

9.2.2. Supply Chain Solutions

9.2.3. Reverse Logistics & Liquidation

9.2.4. Transportation Management

9.2.5. Others

9.3. Retail Logistics Market Size and Forecast, by Mode of Transport (2023- 2030)

9.3.1. Railways

9.3.2. Airways

9.3.3. Roadways

9.3.4. Waterways

9.4. Middle East and Africa Retail Logistics Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.2. GCC

9.4.3. Egypt

9.4.4. Nigeria

9.4.5. Rest of ME&A

10. South America Retail Logistics Market Size and Forecast (by Value USD Million)

10.1. South America Retail Logistics Market Size and Forecast, by Type (2023-2030)

10.1.1. Conventional Retail Logistics

10.1.2. E-commerce Retail Logistics

10.2. South America Retail Logistics Market Size and Forecast, by Solution (2023-2030)

10.2.1. Commerce Enablement

10.2.2. Supply Chain Solutions

10.2.3. Reverse Logistics & Liquidation

10.2.4. Transportation Management

10.2.5. Others

10.3. Retail Logistics Market Size and Forecast, by Mode of Transport (2023- 2030)

10.3.1. Railways

10.3.2. Airways

10.3.3. Roadways

10.3.4. Waterways

10.4. South America Retail Logistics Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Company Profile: Key players

11.1. DSV

11.1.1. Company Overview

11.1.2. Financial Overview

11.1.3. Business Portfolio

11.1.4. SWOT Analysis

11.1.5. Business Strategy

11.1.6. Recent Developments

11.2. XPO Logistics, Inc.

11.3. Kuehne+Nagel International

11.4. H Robinson Worldwide, Inc.

11.5. https://www.fedex.com/global/choose-location.htmlFedEx

11.6. APL Logistics Ltd

11.7. Nippon Express

11.8. Schneider

11.9. United Parcel Service

11.10. P Moller- Maersk

11.11. DHL International GmbH

11.12. C.H. Robinson

11.13. DB Schenker

11.14. J.B. Hunt Transport Services

11.15. Penske Logistics

11.16. Geodis

11.17. Agility Logistics

11.18. Ryder System

11.19. ArcBest Corporation

11.20. Echo Global Logistics

11.21. Lineage Logistics

12. Key Findings

13. Industry Recommendation