Secure Logistics Market: Global Industry Analysis and Forecast (2024-2030)

Secure Logistics Market size was valued at USD 89.1 Bn. in 2023 and the total Secure Logistics Market size is expected to grow at a CAGR of 8.16% from 2024 to 2030, reaching nearly USD 154.3 Bn. by 2030.

Format : PDF | Report ID : SMR_2123

Secure Logistics Market Overview

To manage people, goods, information, and other resources safely between a designated point of origin and its final destination, security logistics are designed. During transit and storage, high-value shipments, delicate materials, and private data are all protected by a variety of services and solutions known as "secure logistics." Secure logistics companies provide customized solutions to handle a range of security issues, from risk assessment and regulatory compliance to armored transportation and secure warehousing.

Secure Logistics Services intended to guarantee the secure transportation of valuable items, such as cash, precious metals, and private documents, are included in the secure logistics market. The market has grown significantly thanks to growing concerns about theft and the necessity of adhering to strict regulatory requirements. Among the main industries using these services are banks, retailers, and government organizations; each has specific security needs that call for specialized solutions. The secure logistics market is largely driven by innovations that enhance the security and efficacy of logistics operations, such as real-time monitoring, biometric authentication, and GPS tracking. Major players heavily invest in state-of-the-art armored vehicles, secure storage facilities, and sophisticated surveillance systems to stay ahead of the competition in this fiercely competitive market.

The detailed market analysis provides in-depth information on important factors that are expected to drive market growth and potential challenges that may hinder it going forward. The report also provides a comprehensive analysis of the competitive landscape and the variety of products available from top companies along with investment opportunities in the Secure Logistics industry.

To get more Insights: Request Free Sample Report

Secure Logistics Market Dynamics

Driving Forces Behind the Growth of the Secure Logistics Market

The e-commerce industry has been rapidly growing and the global supply chain has resulted in higher demand for secure transportation that has boosted the secure logistics market growth. The transportation of valuable and sensitive pharmaceutical products has been made safer by the use of secure logistics services by industries like the pharmaceutical industry. Ensuring compliance with strict regulations has also driven the growth of the secure logistics market. The market has grown thanks to the increase in thefts and robberies, especially when it comes to the transportation of valuable goods. As a result, there is a greater demand for secure logistics services.

The surge in the governments and regulatory bodies that have imposed stricter regulations on the transportation of valuable goods, compelling businesses to adopt secure logistics solutions has boosted the market growth. Additionally, the rise in e-commerce that has boomed higher volume of valuable goods being transported necessitating enhanced security measures has escalated the secure logistics market growth. The transportation of sensitive healthcare products, such as pharmaceuticals and medical devices, requires secure logistics to ensure safety and compliance with regulatory standards. Increased demand for secure cash transportation and management services from banks and financial institutions. The growth of international trade increases the demand for secure logistics services to ensure the safe transportation of valuable goods across borders.

Challenges Impacting the Secure Logistics Market

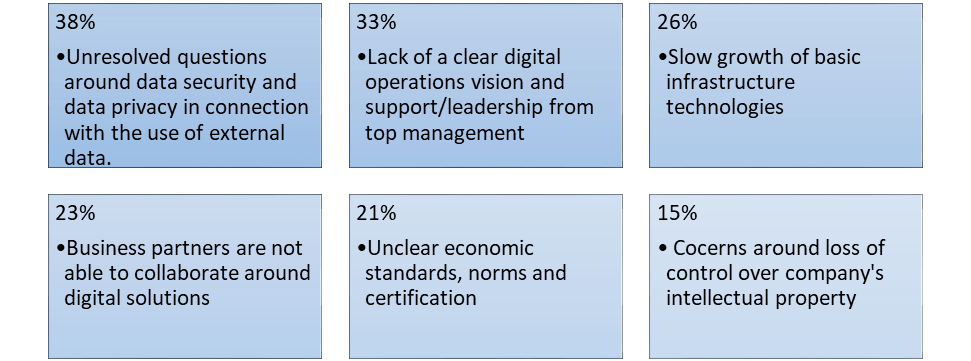

The growth and operational efficiency of the Secure Logistics market are affected by some major challenges. The high operating costs of deploying cutting-edge security technologies and keeping a trained staff are two of the main obstacles. Additionally, security protocols and technologies need to be updated frequently thanks to the dynamic nature of security threats, including cyber-attacks and sophisticated physical breaches. It has resulted in a significant resource requirement. A further layer of complexity is added by regulatory compliance, which requires businesses to navigate various laws and standards across different regions.

This frequently results in higher administrative costs and burdens. In addition, the secure logistics industry as a whole is battling supply chain interruptions brought on by international occurrences like natural disasters and geopolitical unrest, which exacerbates weaknesses in secure logistics operations. Maintaining customer trust and satisfaction is essential when handling these difficulties because any security lapse or service outage that seriously harm a business's brand and result in losses. To preserve the integrity and dependability of secure logistics services, these complex issues demand ongoing innovation and calculated investments.

Lack of Digital Culture and Training is the Biggest challenge Facing Logistics Companies

Secure Logistics Market Segment Analysis

Based on the Application, the Cash Management segment dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. The physical transfer of cash from one place to another is known as cash logistics. Secure cash services, bank ATM services, armored cash transportation, management services, and valuables transportation are all included in cash logistics services. Physical transfers of cash, coins, credit cards, and valuables between locations are a part of the entire process. Large retailers, ticket vending machines, bank branches, ATM vestibules, parking meters, and bulk cash junctions are among the locations. Cash is still used in a lot of the world's transactions, particularly in developing nations with underdeveloped digital infrastructure.

The need for safe transportation to and from ATMs and continuous restocking owing to the increased reliance of businesses, particularly those in retail, and financial institutions like banks on cash for day-to-day operations has driven the growth of the secure logistics market. The market has grown because secure logistics services are necessary for reducing the risks associated with cash. After all, it is a high-risk asset that is susceptible to theft, robbery, and fraud. These services include armored cars, skilled security personnel, and cutting-edge tracking systems. Cash management calls for specialized tools and knowledge to complete intricate tasks like sorting, counting, and confirming the legitimacy of bills. To ensure timely and safe deliveries, secure facilities and well-planned logistics are necessary for the proper storage and distribution of cash.

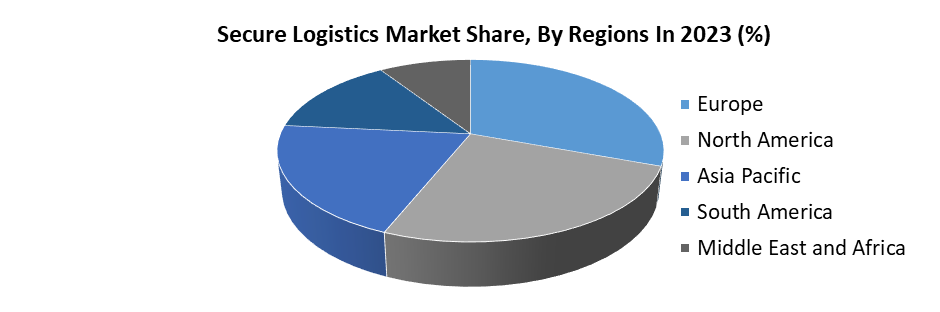

Secure Logistics Market Regional Analysis

Europe has dominated the market and is expected to maintain its dominance through the forecast period with an increasing CAGR. The European Union is a major trading force in the global economy, boasting one of the largest single markets in the world. Europe has a big influence on international trade because of its sizable market, extensive network of trade agreements, and combined economic power resulting in higher demand for the secure logistics market. Encouraging safety along the entire logistics chain is the goal of the European Secure Logistics Association. It is a non-profit association and relies on the exchange of best practices when working on higher safety standards for logistics.

Thanks to the contributions of its members and their variety of expertise, EUMOS has been instrumental in the elaboration of several standards for cargo security and is constantly working with load security experts to improve security standards in Europe. An estimated 2,500 fintech companies are based in Europe, with six of the top ten located in London. In several sectors, including banking, retail, and e-commerce, the incorporation of cash management services improves the security and efficiency of cash-related operations. Secure logistics are essential to the French retail industry's effective cash management, which includes cash pickups, deposits, and change orders. Secure logistics providers offer cash-handling solutions that optimize cash flow and security.

Secure Logistics Market Competitive Landscape

- July 2023: Artificial Intelligence Technology Solutions Inc. and its wholly owned subsidiary, Robotic Assistance Devices Inc. (RAD), established a partnership to deliver RAD products to GardaWorld Security Systems customers in Canada. GardaWorld Security Systems' commitment to providing cutting-edge technology is reflected in this new partnership.

- June 2023: Prosegur Cash and Linfox Armaguard, a financial logistics firm in Australia, planned a merger of Prosegur Australia, which will enable the combined entity to become a financially viable provider of CIT services for Australian customers by pooling its cash management and ATM capabilities under one roof.

|

Secure Logistics Market Scope |

|

|

Market Size in 2023 |

USD 89.1 Bn. |

|

Market Size in 2030 |

USD 154.3 Bn. |

|

CAGR (2024-2030) |

8.16 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type

|

|

By Mode of Transportation

|

|

|

By Service Type

|

|

|

By Application

|

|

|

By End User

|

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Secure Logistics Market Key Players

- Brinks

- G4S

- Loomis

- picthbookGardaWorld

- Allied Universal

- SECURITAS

- Cash-in-Transit

- CMS Info Systems

- TFI International

- Malca-Amit

- Thyssenkrupp

- Dicom

- Axiom Armored

- Sequelglobal

- Platinum Vault

- XXX ltd.

Frequently Asked Questions

High operating costs of deploying cutting-edge security technologies have restrained market growth.

The Market size was valued at USD 89.1 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 8.16 % from 2024 to 2030, reaching nearly USD 154.3 Billion.

The segments covered in the market report are by type, Mode of Transportation, Service Type, and Application, End User.

1. Secure Logistics Market: Research Methodology

2. Secure Logistics Market: Executive Summary

3. Secure Logistics Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Secure Logistics Market: Dynamics

5.1. Market Drivers

5.2. Market Trends

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Strategies for New Entrants to Penetrate the Market

5.9. Analysis of Government Schemes and Initiatives for the Secure Logistics Industry

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Secure Logistics Market Size and Forecast by Segments (by USD Value)

6.1. Secure Logistics Market Size and Forecast, by Type (2023-2030)

6.1.1. Static

6.1.2. Mobile

6.2. Secure Logistics Market Size and Forecast, by Mode of Transportation (2023-2030)

6.2.1. Roadways

6.2.2. Railways

6.2.3. Airways

6.3. Secure Logistics Market Size and Forecast, by Service Type (2023-2030)

6.3.1. Cash Services

6.3.2. Security Services

6.4. Secure Logistics Market Size and Forecast, by Applications (2023-2030)

6.4.1. Cash Management

6.4.2. Diamonds

6.4.3. Jewellery and Precious Metal

6.4.4. Others

6.5. Secure Logistics Market Size and Forecast, by End User (2023-2030)

6.5.1. Financial Institutions

6.5.2. Retailers

6.5.3. Government

6.5.4. Others

6.6. Secure Logistics Market Size and Forecast, by Region (2023-2030)

6.6.1. North America

6.6.2. Europe

6.6.3. Asia Pacific

6.6.4. Middle East and Africa

6.6.5. South America

7. North America Secure Logistics Market Size and Forecast (by USD Value)

7.1. North America Secure Logistics Market Size and Forecast, by Type (2023-2030)

7.1.1. Static

7.1.2. Mobile

7.2. North America Secure Logistics Market Size and Forecast, by Mode of Transportation (2023-2030)

7.2.1. Roadways

7.2.2. Railways

7.2.3. Airways

7.3. North America Secure Logistics Market Size and Forecast, by Service Type (2023-2030)

7.3.1. Cash Services

7.3.2. Security Services

7.4. North America Secure Logistics Market Size and Forecast, by Applications (2023-2030)

7.4.1. Cash Management

7.4.2. Diamonds

7.4.3. Jewellery and Precious Metal

7.4.4. Others

7.5. North America Secure Logistics Market Size and Forecast, by End User (2023-2030)

7.5.1. Financial Institutions

7.5.2. Retailers

7.5.3. Government

7.5.4. Others

7.6. North America Secure Logistics Market Size and Forecast, by Country (2023-2030)

7.6.1. United States

7.6.2. Canada

7.6.3. Mexico

8. Europe Secure Logistics Market Size and Forecast (by USD Value)

8.1. Europe Secure Logistics Market Size and Forecast, by Type (2023-2030)

8.1.1. Static

8.1.2. Mobile

8.2. Europe Secure Logistics Market Size and Forecast, by Mode of Transportation (2023-2030)

8.2.1. Roadways

8.2.2. Railways

8.2.3. Airways

8.3. Europe Secure Logistics Market Size and Forecast, by Service Type (2023-2030)

8.3.1. Cash Services

8.3.2. Security Services

8.4. Europe Secure Logistics Market Size and Forecast, by Applications (2023-2030)

8.4.1. Cash Management

8.4.2. Diamonds

8.4.3. Jewellery and Precious Metal

8.4.4. Others

8.5. Europe Secure Logistics Market Size and Forecast, by End User (2023-2030)

8.5.1. Financial Institutions

8.5.2. Retailers

8.5.3. Government

8.5.4. Others

8.6. Europe Secure Logistics Market Size and Forecast, by Country (2023-2030)

8.6.1. UK

8.6.2. France

8.6.3. Germany

8.6.4. Italy

8.6.5. Spain

8.6.6. Sweden

8.6.7. Russia

8.6.8. Rest of Europe

9. Asia Pacific Secure Logistics Market Size and Forecast (by USD Value)

9.1. Asia Pacific Secure Logistics Market Size and Forecast, by Type (2023-2030)

9.1.1. Static

9.1.2. Mobile

9.2. Asia Pacific Secure Logistics Market Size and Forecast, by Mode of Transportation (2023-2030)

9.2.1. Roadways

9.2.2. Railways

9.2.3. Airways

9.3. Asia Pacific Secure Logistics Market Size and Forecast, by Service Type (2023-2030)

9.3.1. Cash Services

9.3.2. Security Services

9.4. Asia Pacific Secure Logistics Market Size and Forecast, by Applications (2023-2030)

9.4.1. Cash Management

9.4.2. Diamonds

9.4.3. Jewellery and Precious Metal

9.4.4. Others

9.5. Asia Pacific Secure Logistics Market Size and Forecast, by End User (2023-2030)

9.5.1. Financial Institutions

9.5.2. Retailers

9.5.3. Government

9.5.4. Others

9.6. Asia Pacific Secure Logistics Market Size and Forecast, by Country (2023-2030)

9.6.1. China

9.6.2. S Korea

9.6.3. Japan

9.6.4. India

9.6.5. Australia

9.6.6. ASEAN

9.6.7. Rest of Asia Pacific

10. Middle East and Africa Secure Logistics Market Size and Forecast (by USD Value)

10.1. Middle East and Africa Secure Logistics Market Size and Forecast, by Type (2023-2030)

10.1.1. Static

10.1.2. Mobile

10.2. Middle East and Africa Secure Logistics Market Size and Forecast, by Mode of Transportation (2023-2030)

10.2.1. Roadways

10.2.2. Railways

10.2.3. Airways

10.3. Middle East and Africa Secure Logistics Market Size and Forecast, by Service Type (2023-2030)

10.3.1. Cash Services

10.3.2. Security Services

10.4. Middle East and Africa Secure Logistics Market Size and Forecast, by Applications (2023-2030)

10.4.1. Cash Management

10.4.2. Diamonds

10.4.3. Jewellery and Precious Metal

10.4.4. Others

10.5. Middle East and Africa Secure Logistics Market Size and Forecast, by End User (2023-2030)

10.5.1. Financial Institutions

10.5.2. Retailers

10.5.3. Government

10.5.4. Others

10.6. Middle East and Africa Secure Logistics Market Size and Forecast, by Country (2023-2030)

10.6.1. South Africa

10.6.2. GCC

10.6.3. Egypt

10.6.4. Rest of ME&A

11. South America Secure Logistics Market Size and Forecast (by USD Value)

11.1. South America Secure Logistics Market Size and Forecast, by Type (2023-2030)

11.1.1. Static

11.1.2. Mobile

11.2. South America Secure Logistics Market Size and Forecast, by Mode of Transportation (2023-2030)

11.2.1. Roadways

11.2.2. Railways

11.2.3. Airways

11.3. South America Secure Logistics Market Size and Forecast, by Service Type (2023-2030)

11.3.1. Cash Services

11.3.2. Security Services

11.4. South America Secure Logistics Market Size and Forecast, by Applications (2023-2030)

11.4.1. Cash Management

11.4.2. Diamonds

11.4.3. Jewellery and Precious Metal

11.4.4. Others

11.5. South America Secure Logistics Market Size and Forecast, by End User (2023-2030)

11.5.1. Financial Institutions

11.5.2. Retailers

11.5.3. Government

11.5.4. Others

11.6. South America Secure Logistics Market Size and Forecast, by Country (2023-2030)

11.6.1. Brazil

11.6.2. Argentina

11.6.3. Rest of South America

12. Company Profile: Key players

12.1. Brinks

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

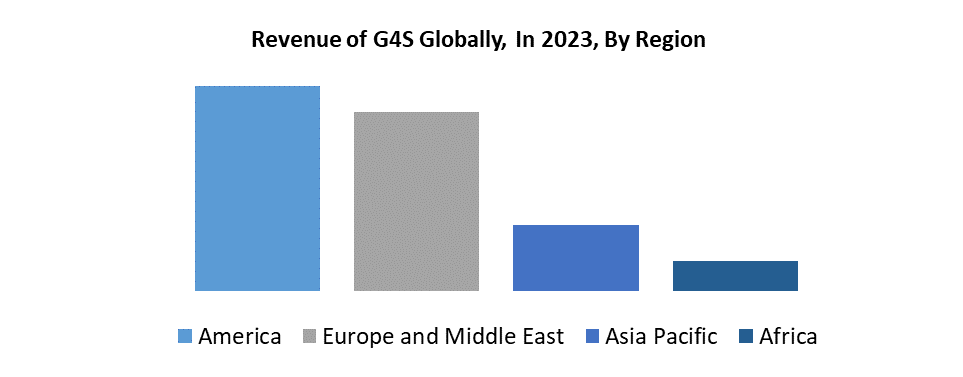

12.2. G4S

12.3. Loomis

12.4. picthbookGardaWorld

12.5. Allied Universal

12.6. SECURITAS

12.7. Cash-in-Transit

12.8. CMS Info Systems

12.9. TFI International

12.10. Malca-Amit

12.11. Thyssenkrupp

12.12. Dicom

12.13. Axiom Armored

12.14. Sequelglobal

12.15. Platinum Vault

13. Key Findings

14. Industry Recommendation