Snack Food Packaging Market: Global Industry Analysis and Forecast (2024-2030)

The Snack Food Packaging Market size was valued at USD 19.29 Bn. in 2023 and the total Snack Food Packaging Market size is expected to grow at a CAGR of 4.5% from 2024 to 2030, reaching nearly USD 26.25 Bn. by 2030.

Format : PDF | Report ID : SMR_2139

Snack Food Packaging Market Overview

Snack food packaging is a critical aspect of the snack enterprise, storing, keeping, and promoting diverse snacks like chips, nuts, goodies, and cookies. Its number one functions encompass preserving product freshness, prolonging shelf existence, and retaining the satisfactory and protection of the snacks. Snack food packaging substances range from flexible luggage and pouches to inflexible boxes and packing containers, with features like reseal label zippers, component control, and barrier movies. Eye-catching graphics and branding elements are crucial for attracting consumers and conveying product information.

The snack packaging enterprise is experiencing an accelerated call for answers catering to customer convenience and preferences. The global market is driven by e-commerce growth and the ever-evolving convenience trend, which fuels the demand for flexible packaging solutions. The growing array of single-size servings for convenience, portability, and portion control has led to fresh packaging opportunities. Also, growing environmental concerns have accelerated the need for environmentally-friendly packaging, further boosting the demand for better snack food packaging materials.

To get more Insights: Request Free Sample Report

Snack Food Packaging Market Dynamics:

The snack food packaging market has experienced significant growth because of rising ready-to-eat eating habits, the acceptance of healthier lifestyles, and the growth of retail outlets in metropolitan areas. Factors such as product attractiveness, nutritional value knowledge, product diversity, and an aging population are driving market growth. The industry is also focusing on environmentally friendly containers and ease of handling small packages. Modified ecosystem packaging (MAP) is being used to extend product shelf existence, and new strategies are being evolved to enhance resistance to chemical compounds and mechanical electricity.

Consumers are increasingly in search of health blessings, with protein-rich meals like bars, nuts, seeds, meat bars, and nutritional dietary supplements at the upward push. The snack food sector is also shifting towards flexible packaging, with digital printing being the future of adaptable packaging development. This allows brands to make last-minute modifications to their designs, simplifying the process of adding SKUs, changing dishes, or adding promotional material to packages. The growth of franchise food organizations, out-of-home eating in metropolitan areas, and the developing retail business are expected to further boost the snack food packaging industry.

The snack meals packaging marketplace faces complicated difficulties in balancing product shelf lifestyles with environmental worries. Consumers demand longer shelf life for snacks to hold freshness and reduce meal waste. Packaging innovations like modified surroundings packaging and barrier movies assist achieve this. However, the growing focus on plastic waste has led brands to adopt sustainable packaging alternatives like recyclable, biodegradable, or compostable substances.

These eco-friendly alternatives won't continually healthy the shelf-existence extension competencies of traditional substances, probably affecting product great and increasing meal waste chance. Balancing environmental responsibility with product freshness remains a hard assignment for snack food packaging manufacturers, necessitating ongoing innovation in sustainable packaging materials and technology.

Sustainability inside the snack food packaging marketplace is gaining momentum, but it also is Challenging. The transition closer to eco-friendly substances results in better production fees, impacting profit margins for manufacturers. The complexity of recycling and disposal techniques creates logistical challenges, hindering smaller players with limited assets. Despite the significance of sustainability for the planet's long-term health, it is a temporarily restrained marketplace call. Innovative packaging designs assist in differentiating brands and attracting consumers, but they are also highly priced and require a specialized system.

Complex designs do not align with sustainability goals, main to greater packaging waste or non-recyclable materials. Also, designs prioritizing aesthetics also lead to issues with product safety and maintenance. Therefore, innovation has to balance aesthetics and practicality to keep away from ability-demanding situations on marketplace demand.

Snack Food Packaging Market Segment Analysis:

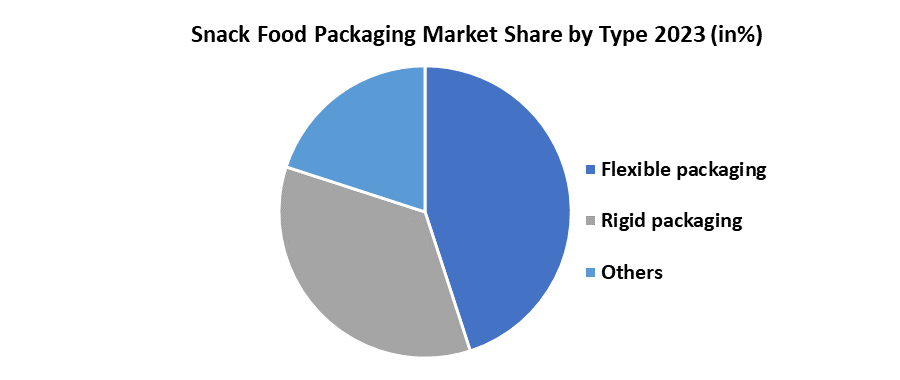

Based on Type, Flexible packaging and Rigid packaging are two types of snack food packaging segments. Flexible packaging is lighter and manufactured from substances like plastic, film, foil, or paper. Its capabilities encompass zippers, hook-and-loop fasteners, and resealable stickers. Its presence on shelves and various functions set it apart from competitors. Pouch packaging, on the other hand, maximizes shelf space by holding more products than rigid packaging. Its slender shape makes it easy to handle, ship, store, and refill without breaking. Also, pouches are easy to discard and take up less space, benefiting consumers when traveling or at home.

Based on Material, The Snack Food Packaging market segment includes plastic, paper, and metal materials. Plastic generated the highest market revenue of XX% in 2023, primarily used for creating snack pouches and disposable cans or bags for tinned or frozen food products. It is commonly used for fruit snacks, baby food, and crisps. Technological advancements have made plastic a preferred material because of its lightweight construction, shatter resistance, and airtight seal. It offers flexibility in shape and size, catering to various consumer needs.

Snack Food Packaging Market Regional Insight:

The Asia-Pacific Snack Food Packaging market is expected to grow, with China dominating the marketplace proportion. India, a key participant in the savory snack market, is predicted to experience a good-sized increase. The savory snacks are expected to upward thrust, highlighting the need for modern and effective snack packaging answers. The Asia-Pacific snack packaging sector is dynamic, adapting to marketplace demands because the place navigates monetary transitions and converting purchaser traits. The marketplace is expected to develop steadily, with India's demand for savory snacks expected to grow.

Snack Food Packaging Market Competitive Landscape:

- On May 30, 2024, Amcor opened its European Innovation Center in Belgium. The facility partners with brands and retailers from across the region to design packaging that delivers better results for consumers and the environment alike.

- On June 12, 2024, Constantia Flexibles introduces EcoTwistPaper, an innovative packaging solution for the confectionery industry. This new product, a wax-free twist-wrap made entirely from paper, prioritizes recyclability and supports the global shift toward sustainable products.

- April 13, 2022, Bryce Corporation, a leader in the flexible packaging industry, is investing $80 million to increase its operations in Searcy, Ark., the company announced. This expansion is part of the company’s five-year strategic growth plan and is expected to grow the company’s asset base, and physical footprint and create 142 new jobs in Searcy.

- 31.5.2024, Huhtamaki has decided to consolidate its three Flexible Packaging manufacturing sites in the United Arab Emirates, keeping one factory in Jebel Ali and expanding the one in Ras Al Khaimah.

|

Snack Food Packaging Market Scope |

|

|

Market Size in 2023 |

USD 19.29 Bn. |

|

Market Size in 2030 |

USD 26.25 Bn. |

|

CAGR (2024-2030) |

4.5 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Flexible packaging Rigid packaging Others |

|

By Material Plastic Paper Metal Others |

|

|

By Application Bakery snacks Candy & confections Chips Savory snacks Nuts & dried fruits Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Snack Food Packaging Market

- Amcor Plc - Australia

- Huhtamaki Oyj - Finland

- Sonoco Products Company - United States

- Insta Polypack - India

- Berry Global Group - United States

- Safepack Solutions - India

- IIC Packaging - United States

- Graham Packaging Holdings - United States

- Swiss pack private limited - Switzerland

- Sealed Air Corporation - United States

- American Packaging Corporation - United States

- Bryce Corporation - United States

- Clondalkin Flexible Packaging - Netherlands

- ProAmpac - United States

- Modern-Pak Pte Ltd - Singapore

- WestRock Company - United States

- Constantia Flexibles - Austria

- Winpak Ltd. - Canada

- Printpack, Inc. - United States

- Ball Corporation - United States

- DS Smith plc - United Kingdom

- XX.inc

Frequently Asked Questions

Asia-Pacific is expected to lead the Snack Food Packaging Market during the forecast period.

An analysis of profit trends and projections for companies in the Snack Food Packaging Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Snack Food Packaging Market size was valued at USD 19.29 Billion in 2023 and the total Snack Food Packaging Market size is expected to grow at a CAGR of 4.5% from 2024 to 2030, reaching nearly USD 26.25 Billion by 2030.

The segments covered in the market report are by Type, by Material, and by Application.

1. Snack Food Packaging Market: Research Methodology

2. Snack Food Packaging Market: Executive Summary

3. Snack Food Packaging Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Import and export of Snack Food Packaging Market

5. Snack Food Packaging Market : Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Snack Food Packaging Market Size and Forecast by Segments (by value Units)

6.1. Snack Food Packaging Market Size and Forecast, by Type (2023-2030)

6.1.1. Flexible packaging

6.1.2. Rigid packaging

6.1.3. Others

6.2. Snack Food Packaging Market Size and Forecast, by Material (2023-2030)

6.2.1. Plastic

6.2.2. Paper

6.2.3. Metal

6.2.4. Others

6.3. Snack Food Packaging Market Size and Forecast, by Application (2023-2030)

6.3.1. Bakery snacks

6.3.2. Candy & confections

6.3.3. Chips

6.3.4. Savory snacks

6.3.5. Nuts & dried fruits

6.3.6. Others

6.4. Snack Food Packaging Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Snack Food Packaging Market Size and Forecast (by value Units)

7.1. North America Snack Food Packaging Market Size and Forecast, by Type (2023-2030)

7.1.1. Flexible packaging

7.1.2. Rigid packaging

7.1.3. Others

7.2. North America Snack Food Packaging Market Size and Forecast, by Material (2023-2030)

7.2.1. Plastic

7.2.2. Paper

7.2.3. Metal

7.2.4. Others

7.3. North America Snack Food Packaging Market Size and Forecast, by Application (2023-2030)

7.3.1. Bakery snacks

7.3.2. Candy & confections

7.3.3. Chips

7.3.4. Savory snacks

7.3.5. Nuts & dried fruits

7.3.6. Others

7.4. North America Snack Food Packaging Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Snack Food Packaging Market Size and Forecast (by Value Units)

8.1. Europe Snack Food Packaging Market Size and Forecast, by Type (2023-2030)

8.1.1. Flexible packaging

8.1.2. Rigid packaging

8.1.3. Others

8.2. Europe Snack Food Packaging Market Size and Forecast, by Material (2023-2030)

8.2.1. Plastic

8.2.2. Paper

8.2.3. Metal

8.2.4. Others

8.3. Europe Snack Food Packaging Market Size and Forecast, by Application (2023-2030)

8.3.1. Bakery snacks

8.3.2. Candy & confections

8.3.3. Chips

8.3.4. Savory snacks

8.3.5. Nuts & dried fruits

8.3.6. Others

8.4. Europe Snack Food Packaging Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Snack Food Packaging Market Size and Forecast (by Value Units)

9.1. Asia Pacific Snack Food Packaging Market Size and Forecast, by Type (2023-2030)

9.1.1. Flexible packaging

9.1.2. Rigid packaging

9.1.3. Others

9.2. Asia Pacific Snack Food Packaging Market Size and Forecast, by Material (2023-2030)

9.2.1. Plastic

9.2.2. Paper

9.2.3. Metal

9.2.4. Others

9.3. Asia Pacific Snack Food Packaging Market Size and Forecast, by Application (2023-2030)

9.3.1. Bakery snacks

9.3.2. Candy & confections

9.3.3. Chips

9.3.4. Savory snacks

9.3.5. Nuts & dried fruits

9.3.6. Others

9.4. Asia Pacific Snack Food Packaging Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Asean

9.4.7. Rest of Asia Pacific

10. Middle East and Africa Snack Food Packaging Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Snack Food Packaging Market Size and Forecast, by Type (2023-2030)

10.1.1. Flexible packaging

10.1.2. Rigid packaging

10.1.3. Others

10.2. Middle East and Africa Snack Food Packaging Market Size and Forecast, by Material (2023-2030)

10.2.1. Plastic

10.2.2. Paper

10.2.3. Metal

10.2.4. Others

10.3. Middle East and Africa Snack Food Packaging Market Size and Forecast, by Application (2023-2030)

10.3.1. Bakery snacks

10.3.2. Candy & confections

10.3.3. Chips

10.3.4. Savory snacks

10.3.5. Nuts & dried fruits

10.3.6. Others

10.4. Middle East and Africa Snack Food Packaging Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Rest of ME&A

11. South America Snack Food Packaging Market Size and Forecast (by Value Units)

11.1. South America Snack Food Packaging Market Size and Forecast, by Type (2023-2030)

11.1.1. Flexible packaging

11.1.2. Rigid packaging

11.1.3. Others

11.2. South America Snack Food Packaging Market Size and Forecast, by Material (2023-2030)

11.2.1. Plastic

11.2.2. Paper

11.2.3. Metal

11.2.4. Others

11.3. South America Snack Food Packaging Market Size and Forecast, by Application (2023-2030)

11.3.1. Bakery snacks

11.3.2. Candy & confections

11.3.3. Chips

11.3.4. Savory snacks

11.3.5. Nuts & dried fruits

11.3.6. Others

11.4. South America Snack Food Packaging Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Amcor Plc

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Huhtamaki Oyj

12.3. Sonoco Products Company

12.4. Insta Polypack

12.5. Berry Global Group

12.6. Safepack Solutions

12.7. IIC Packaging

12.8. Graham Packaging Holdings

12.9. Swiss pack private limited

12.10. Sealed Air Corporation

12.11. American Packaging Corporation

12.12. Bryce Corporation

12.13. Clondalkin Flexible Packaging

12.14. ProAmpac

12.15. Modern-Pak Pte Ltd

12.16. WestRock Company

12.17. Constantia Flexibles

12.18. Winpak Ltd.

12.19. Printpack, Inc.

12.20. Ball Corporation

12.21. DS Smith plc

12.22. XX.inc

13. Key Findings

14. Industry Recommendation