Snus Market: Global Industry Analysis and Forecast (2024-2030)

The Snus Market size was valued at USD 3.01 Bn. in 2023 and the total Snus Market revenue is expected to grow at a CAGR of 4% from 2024 to 2030, reaching nearly USD 3.96 Bn. by 2030.

Format : PDF | Report ID : SMR_1866

Snus Market Overview

Snus is a smokeless tobacco product that is gaining popularity because of its health benefits, convenience, long shelf life, and lower taxes. Its pasteurization process eliminates bacteria and mold, making it a preferred choice for retailers who want a product that doesn't require frequent replenishment. The extended shelf life allows for large quantities of snus to be stored without risk of spoilage, allowing retailers to invest in larger quantities without fear of losing profits.

Snus small pouches make it easy to carry and use, making it a popular choice for busy lifestyles. The absence of smoke and the absence of additional accessories make it a preferred choice for those on the go. Snus is also popular among athletes, truck drivers, and soldiers, as it enhances performance and energy levels. Swedish hockey players use snus during games to improve their focus, further boosting their acceptance in the sporting community. Overall, snus offers a healthier alternative to smoking and a convenient alternative to traditional tobacco products.

To get more Insights: Request Free Sample Report

Snus Market Dynamics:

Growing Health Concerns are increasing the Snus Market Growth

The snus market has grown because of health concerns, as it is perceived as a less harmful alternative to traditional cigarette smoking. Smokeless snus is less likely to cause serious health problems like lung cancer and respiratory issues, as it does not involve burning tobacco and producing harmful smoke. The health benefits of snus are attributed to its smokeless nature, which eliminates the need for burning tobacco.

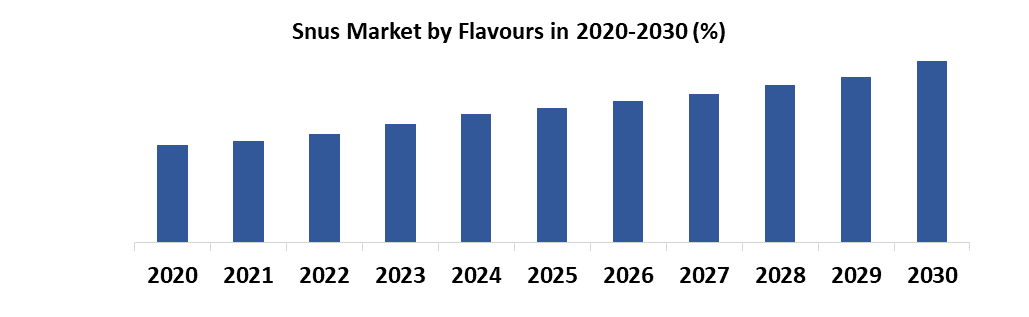

The snus market has been experiencing a surge in demand among young consumers because of its less harmful effects and the variety of flavors available. The snus industry has developed new flavors, such as menthol, licorice, and vanilla that appeal to young people, leading to increased use among teenagers. The industry is also introducing new flavors like fruits, eucalyptus, mint, berries, citrus, cedar, bergamot, hay, smoky, dry fruit, spices, hay, and tea, which is expected to boost product demand in the upcoming years. Snus is made by steam pasteurizing tobacco, preventing the development of tobacco-specific nitrosamines, which are known to cause cancer. Market players like Dholakiya Tobacco are offering different flavored snus products, which is expected to boost product demand during the forecast period.

The snus market's growth is severely restricted by rules and regulations, as numerous nations apply strict laws that restrict its distribution and marketing initiatives. Also limiting market growth are import restrictions on smokeless tobacco products like snus. The development of the market is further hampered by corporate barriers and economic difficulties in emerging economies. The market's potential is restrained by further legal constraints, such as age-related rules and bans on advertising. The combined effect of these limitations is to limit the snus market's growth trajectory, which presents difficulties for market players.

The snus market is attracting customers globally with a variety of products, including flavors like mint, eucalyptus, berries, fruits, licorice, whiskey, spices, bergamot, cedar, spearmint, wintergreen, menthol, citrus, dry fruit, hay, leather, smoky, and tea. Companies are upgrading their offerings to maintain brand image and gain customer loyalty. Key players in the market are offering tobacco products in different sizes, flavors, and attractive packaging, driving global demand for premium snus products. R&D activities are being conducted to offer better quality tobacco and innovative flavors to sustain competition.

Traditionally, snus was considered a value-priced tobacco product, but with increasing penetration among large markets, manufacturers are offering excellent flavored snus products that offer a rich experience. The smokeless tobacco market, including snus, is capitalizing on opportunities presented by global connectivity and e-commerce dominance. Manufacturers are leveraging online retail platforms and e-commerce to reach consumers worldwide, breaking down geographical barriers and facilitating access to their products. Strategic partnerships with local distributors and retailers have successfully entered previously untapped markets, broadening the potential consumer base and fuelling market growth.

Snus Market Segment Analysis:

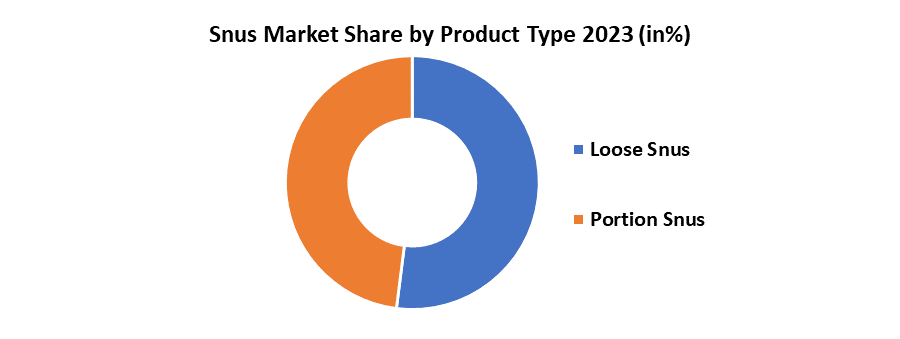

Based on Product Type, Loose Snus is popular because of its experience, allowing users to adjust the strength of the portion according to their nicotine tolerance. The tactile aspect of snus adds a ritualistic and enjoyable element to the encounter. Loose snus is also well-liked by consumers who seek a more genuine and conventional experience because it is consistent with snus's historical roots. Portion snus offers a pre-portioned format, eliminating the need for consumers to mold the snus themselves. Manufacturers invest in innovative packaging and pouch designs, ensuring optimal nicotine release and improved flavor delivery. A broad range of consumer segments are efficiently targeted by companies thanks to the availability of portion snus through both online and offline retail channels.

Flavors, snus offers a variety of flavors to cater to diverse consumer tastes and preferences, attracting a broader customer base, including non-smokers. These flavoured snus are perceived as a healthier alternative to smoking and chewing tobacco because of their smokeless nature and appealing taste. Manufacturers use innovative marketing strategies and unique branding to differentiate their products, enhancing product visibility and driving consumer interest, ultimately boosting sales.

The mint snus is driven by its attractive smell, flavor, pleasantness, and intensity, making it a popular choice among the younger generation. The main drivers of this segment are its ease of availability and freshness, making it a popular choice.

Snus Market Regional Insight:

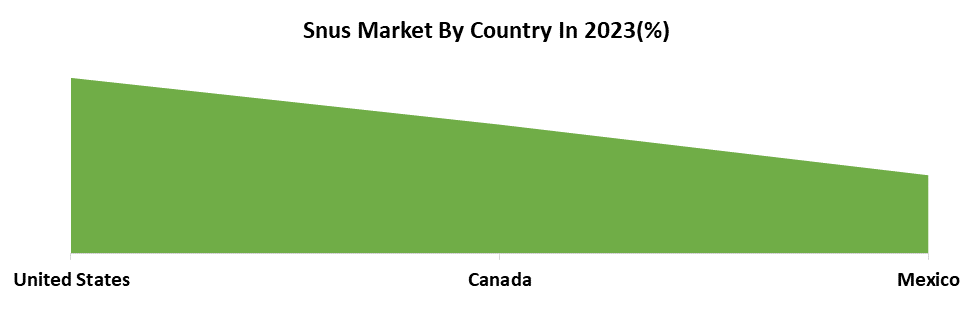

The snus market in North America is rapidly expanding because of its lower risk compared to smoking cigarettes. The market's growth is attributed to the younger, online-savvy client base and the availability of a wider product range from online retailers. The market is in its early stages, but it has created an environment for manufacturers to introduce smoking alternatives like snus and chewing tobacco. Investments in the US have intensified, and the region is leading the snus market. Government measures to reduce smoking and increased investments in new product development are expected to boost market growth. The US government's actions to reduce smoking and grow interest in new product development are expected to further drive the snus market.

The European snus Market is the second-largest because of its widespread acceptance and popularity of smokeless tobacco products, cultural preferences for oral tobacco consumption, and established snus companies. The German Snus Market holds the largest share, while the UK Snus Market is the fastest-growing in the European region. The snus market in Europe is poised for further expansion because of growing public awareness of harm reduction strategies and changing tobacco consumption perceptions. The prevalence of tobacco use in European countries influences the demand for smokeless alternatives like snus, as smoking charges debility.

Snus Market Competitive Landscape:

- 10 JANUARY 2024, BAT has launched a new version of its heating device from its glo range. Glo is an alternative to smoking that doesn’t involve burning, producing fewer and lower levels of toxicants than conventional cigarettes. The glo Hyper Pro device is lightweight, fits easily in your pocket, and comes with improvements in performance. With this new device, one charge takes approximately 90 minutes and lasts all day. Once charged, consumers are expected to use the device for 20 sessions in total.

- On 10 November 2023, Scandinavian Tobacco Group A/S announced that a share buy-back program of an aggregated value of up to DKK 850 million was launched with the purpose of adjusting the Company’s capital structure and meet obligations relating to the Group’s share-based incentive program.

- 3 March 2024, Altria Announces Intent to Sell a Portion of its Investment in Anheuser-Busch InBevIn addition, ABI has agreed to repurchase $200 million of ordinary shares directly from Altria, concurrently with, and conditional on, completion of the offering.

|

Snus Market Scope |

|

|

Market Size in 2023 |

USD 3.01 Bn. |

|

Market Size in 2030 |

USD 3.96 Bn. |

|

CAGR (2024-2030) |

4 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Type Loose Snus Portion Snus |

|

By Flavors Mint Berries Dry Fruit Others |

|

|

By Distribution Channel Tobacco Stores Convenience Stores Online Retail Stores Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Snus Market

- Swedish Match AB – Sweden

- GN Tobacco - Sweden

- Nordic Spirit - Sweden

- SnusMe.com - Sweden

- Skruf snus - Sweden

- Japan Tobacco International - Japan

- Imperial Brands plc - United Kingdom

- Altria Group - United States

- British American Tobacco p.l.c. - United Kingdom

- Kretek International, Inc. - United States

- Mac Baren Tobacco Company A/S - Denmark

- Scandinavian Tobacco Group - Denmark

- SnusCentral - United States

- Chickylicious AB - Sweden

- Gajane Gross AB - Sweden

- Philip Morris Products S.A - Switzerland

- Turning Point Brands Inc - United States

- TIGERSNUS ORGANIC SNUS TOBACCO – Sweden

- Gotlands snus – Sweden

- Nordic snus ab – Sweden

Frequently Asked Questions

North America is expected to lead the Snus Market during the forecast period.

An analysis of profit trends and projections for companies in the Snus Market is included, offering insights into factors driving profitability, cost management strategies, and financial performance metrics.

The Snus Market size was valued at USD 3.01 Billion in 2023 and the total Snus Market size is expected to grow at a CAGR of 4% from 2024 to 2030, reaching nearly USD 3.96 Billion by 2030.

The segments covered in the market report are by Product Type, by Flavors, and by Distribution Channel.

1. Snus Market: Research Methodology

2. Snus Market: Executive Summary

3. Snus Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

4.6. Import and export of Snus Market

5. Snus Market: Dynamics

5.1. Market Driver

5.1.1. Increasing Consumer Awareness

5.1.2. Innovation in Product Offerings

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.3.1. North America

5.3.2. Europe

5.3.3. Asia Pacific

5.3.4. Middle East and Africa

5.3.5. South America

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Snus Market Size and Forecast by Segments (by value Units)

6.1. Snus Market Size and Forecast, by Product Type (2023-2030)

6.1.1. Loose Snus

6.1.2. Portion Snus

6.2. Snus Market Size and Forecast, by Flavors (2023-2030)

6.2.1. Mint

6.2.2. Berries

6.2.3. Dry Fruit

6.2.4. Others

6.3. Snus Market Size and Forecast, by Distribution Channel (2023-2030)

6.3.1. Tobacco Stores

6.3.2. Convenience Stores

6.3.3. Online Retail Stores

6.3.4. Others

6.4. Snus Market Size and Forecast, by Region (2023-2030)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Snus Market Size and Forecast (by value Units)

7.1. North America Snus Market Size and Forecast, by Product Type (2023-2030)

7.1.1. Loose Snus

7.1.2. Portion Snus

7.2. North America Snus Market Size and Forecast, by Flavors (2023-2030)

7.2.1. Mint

7.2.2. Berries

7.2.3. Dry Fruit

7.2.4. Others

7.3. North America Snus Market Size and Forecast, by Distribution Channel (2023-2030)

7.3.1. Tobacco Stores

7.3.2. Convenience Stores

7.3.3. Online Retail Stores

7.3.4. Others

7.4. North America Snus Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Snus Market Size and Forecast (by Value Units)

8.1. Europe Snus Market Size and Forecast, by Product Type (2023-2030)

8.1.1. Loose Snus

8.1.2. Portion Snus

8.2. Europe Snus Market Size and Forecast, by Flavors (2023-2030)

8.2.1. Mint

8.2.2. Berries

8.2.3. Dry Fruit

8.2.4. Others

8.3. Europe Snus Market Size and Forecast, by Distribution Channel (2023-2030)

8.3.1. Tobacco Stores

8.3.2. Convenience Stores

8.3.3. Online Retail Stores

8.3.4. Others

8.4. Europe Snus Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Austria

8.4.8. Rest of Europe

9. Asia Pacific Snus Market Size and Forecast (by Value Units)

9.1. Asia Pacific Snus Market Size and Forecast, by Product Type (2023-2030)

9.1.1. Loose Snus

9.1.2. Portion Snus

9.2. Asia Pacific Snus Market Size and Forecast, by Flavors (2023-2030)

9.2.1. Mint

9.2.2. Berries

9.2.3. Dry Fruit

9.2.4. Others

9.3. Asia Pacific Snus Market Size and Forecast, by Distribution Channel (2023-2030)

9.3.1. Tobacco Stores

9.3.2. Convenience Stores

9.3.3. Online Retail Stores

9.3.4. Others

9.4. Asia Pacific Snus Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Asean

9.4.7. Rest of Asia Pacific

10. Middle East and Africa Snus Market Size and Forecast (by Value Units)

10.1. Middle East and Africa Snus Market Size and Forecast, by Product Type (2023-2030)

10.1.1. Loose Snus

10.1.2. Portion Snus

10.2. Middle East and Africa Snus Market Size and Forecast, by Flavors (2023-2030)

10.2.1. Mint

10.2.2. Berries

10.2.3. Dry Fruit

10.2.4. Others

10.3. Middle East and Africa Snus Market Size and Forecast, by Distribution Channel (2023-2030)

10.3.1. Tobacco Stores

10.3.2. Convenience Stores

10.3.3. Online Retail Stores

10.3.4. Others

10.4. Middle East and Africa Snus Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Rest of ME&A

11. South America Snus Market Size and Forecast (by Value Units)

11.1. South America Snus Market Size and Forecast, by Product Type (2023-2030)

11.1.1. Loose Snus

11.1.2. Portion Snus

11.2. South America Snus Market Size and Forecast, by Flavors (2023-2030)

11.2.1. Mint

11.2.2. Berries

11.2.3. Dry Fruit

11.2.4. Others

11.3. South America Snus Market Size and Forecast, by Distribution Channel (2023-2030)

11.3.1. Tobacco Stores

11.3.2. Convenience Stores

11.3.3. Online Retail Stores

11.3.4. Others

11.4. South America Snus Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Swedish Match AB

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. GN Tobacco

12.3. Nordic Spirit

12.4. SnusMe.com

12.5. Skruf snus

12.6. Japan Tobacco International.

12.7. Imperial Brands plc

12.8. Altria Group

12.9. British American Tobacco p.l.c.

12.10. Kretek International, Inc.

12.11. Mac Baren Tobacco Company A/S

12.12. Scandinavian Tobacco Group

12.13. SnusCentral

12.14. Chickylicious AB

12.15. Gajane Gross AB

12.16. Philip Morris Products S.A

12.17. Turning Point Brands Inc

12.18. TIGERSNUS ORGANIC SNUS TOBACCO,

13. Key Findings

14. Industry Recommendation