Spices Market: Global Industry Analysis and Forecast (2024-2030)

The Spices Market size was valued at USD 23.46 Bn. in 2023 and the total Global Spices Market revenue is expected to grow at a CAGR of 5.3% from 2024 to 2030, reaching nearly USD 33.45 Bn. by 2030.

Format : PDF | Report ID : SMR_1874

Spices Market: Overview

A spice is any dried part of a plant, other than the leaves, used for seasoning and flavoring food. Spices are distinguished from herbs, which are the leaves, flowers, or stems of plants used for flavoring or as a garnish. Spices are usually classified into spices, spice seeds, and herbal categories. They are primarily used as food flavoring or to create variety, but sed to perfume cosmetics and incense. Historically, many spices were used in herbal medicine as well In the area of culinary delights, spices reign supreme, infusing dishes with exotic flavors and enticing aromas from around the globe. Among the spice capitals, India emerges as a formidable leader, boasting a rich array of natural spices and renowned for its masterful blends, including the beloved curry powder enjoyed worldwide.

The global Spices Market is driven by India's dominance as a key player in spice production and export. With exports valued at $538 million, India commands a substantial portion of this thriving trade landscape. The United States stands as a primary importer, displaying a fervent appetite for these culinary treasures, with imports totaling $364 million. This growth is attributed to the region's expanding food processing industries, especially in countries like India, China, and Vietnam. The changing eating habits influenced by rising incomes, urbanization, and exposure to exotic foods are positively impacting the Spices market in this region

Spices Market: Methodology

Stellar Market Research recently released a report analyzing trends in the Spices Industry to predict its growth. The report explores five key aspects such as size, share, scope, growth, and potential of the industry, providing valuable insights for businesses to identify opportunities and risks. It offers a thorough examination of the subject matter, covering market overview, segmentation, current and future growth analysis, competitive landscape, and more.

The report’s research objective is to provide an in-depth analysis of the Spices market by, Product, Form, and region. It furnishes comprehensive data on factors influencing the market and evaluates competition through mergers, expansions, product launches, and technological advancements. Key players are highlighted for their role in driving innovation in diagnostics technology, emphasizing the need for targeted strategies to meet changing consumer demands. Using quantitative research methods, the report presents statistical data on the effectiveness of Spices and its impact on market trends. Competitive intelligence analysis helps in understanding market dynamics, competitor strategies, and customer perceptions, enabling market players to gain a competitive edge in the global Spices Market.

To get more Insights: Request Free Sample Report

Spices Market Dynamics

Food Industry Innovation Drives the Spices Market

The Spices Market thrives on innovation boosted by diverse consumer preferences and industry trends. Innovative products that successfully cater to consumer preferences have a higher chance of thriving in the spices market. By understanding and adapting to industry trends, these products capture the attention and loyalty of consumers, leading to increased sales and Spices Market growth. Consumer demand for variety and exotic flavors drives research and development efforts, encouraging companies to introduce new spice blends and products. Health-conscious consumers seeking natural and organic options further drive innovation, prompting the creation of spices with perceived health benefits.

Some examples of innovative spice products that provide to consumer preferences include organic spice blends with reduced sodium and preservatives, spice-infused oils and vinegar for cooking and flavoring, and spice rubs specifically designed for grilling and barbecuing. These products not only provide unique and convenient flavor profiles but also align with the growing demand for healthier and more sustainable food options. Technological advancements facilitate the development of innovative extraction techniques and packaging solutions, enhancing product quality and freshness. Sustainability concerns prompt companies to adopt ethical sourcing practices, spurring innovation in supply chain management.

The demand for convenience leads to the creation of ready-to-use spice blends and meal kits, catering to busy lifestyles. Culinary trends, such as fusion cuisine, inspire the creation of unique spice combinations, further stimulating market innovation. In essence, the interplay of consumer demands, technological progress, and culinary trends fosters continuous innovation in the spices market, driving its growth and evolution.

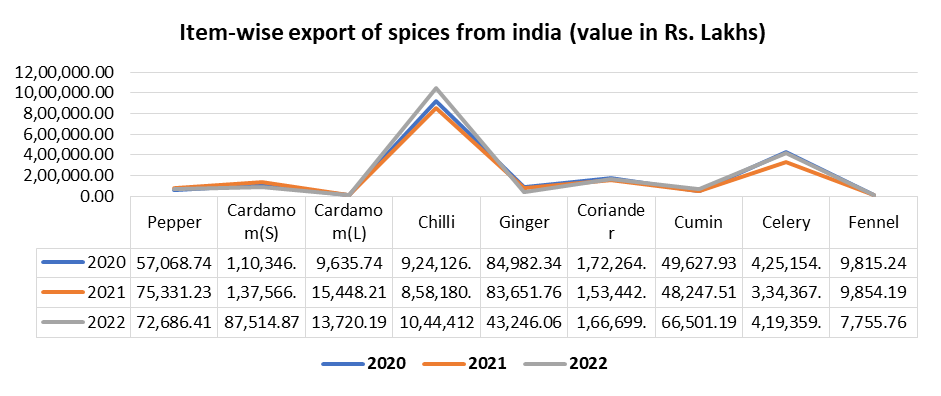

- The increasing Production of the Spices also helps to boost the Spices Market. India stands as the global leader in spice production, consumption, and exportation. Over recent years, the production of various spices has experienced significant growth. In the 2022-23 period, production reached 11.14 million tonnes, slightly surpassing the previous year's 11.12 million tonnes. Simultaneously, spice exports from India surged to US$ 3.73 billion, up from US$ 3.46 billion in 2021-22. Chilli emerged as the top exported spice in 2021-22, followed by spice oils and oleoresins, mint products, cumin, and turmeric.

India boasts the production of 75 out of the 109 varieties recognized by the International Organization for Standardization (ISO). Among the most produced and exported spices are pepper, cardamom, chili, ginger, turmeric, coriander, cumin, celery, fennel, fenugreek, garlic, nutmeg & mace, curry powder, spice oils, and oleoresins. Notably, chili, cumin, turmeric, ginger, and coriander collectively constitute around 76% of total production. Leading spice-producing states include Madhya Pradesh, Rajasthan, Gujarat, Andhra Pradesh, Telangana, Karnataka, Maharashtra, Assam, Orissa, Uttar Pradesh, West Bengal, Tamil Nadu, and Kerala.

High Volatility in prices restrains the Spices Market Growth

Uncertainty in pricing creates challenges for both producers and buyers in planning and decision-making. Producers find it difficult to predict their revenues and plan their production schedules effectively, leading to inefficiencies in resource allocation and investment decisions. On the other hand, buyers, such as food manufacturers and retailers, struggle to manage their procurement costs and pricing strategies, impacting their profit margins and competitiveness in the market. This uncertainty deters long-term investments in the industry and hinders Spices Market growth.

High price volatility limits consumer confidence and demand. When prices fluctuate rapidly, consumers become cautious about purchasing spices, opting for alternatives or reducing their consumption altogether. This behavior leads to stagnation and decline in demand, affecting the overall Spices market growth. The fluctuating prices also affect consumer perceptions of product quality and value, further dampening demand.

Price volatility poses risks to the financial stability of market participants. Small-scale farmers, who often form the backbone of the spices industry in many producing regions, face significant income fluctuations due to price volatility. This risks their livelihoods and undermines their ability to invest in sustainable farming practices or improve crop yields. Similarly, businesses along the supply chain, including traders, processors, and exporters, struggle to manage their cash flows and mitigate the risks associated with price fluctuations, impacting their viability and growth prospects.

Increasing demand for Convenience and Ready-to-Use Products creates lucrative growth opportunities for the Spices Market Growth

The rising demand for convenience and ready-to-use products presents lucrative growth opportunities for the spices market due to shifting consumer preferences and lifestyles. Busy schedules, increased urbanization, and a desire for simplicity in meal preparation have boosted this trend. Ready-to-use spice blends and pre-packaged mixes cater to consumers seeking hassle-free cooking solutions, saving them time and effort in the kitchen.

For spices manufacturers and retailers, capitalizing on this trend involves creating innovative products that offer convenience without compromising on quality or flavor. Ready-to-use spice blends tailored for specific cuisines or dishes, such as curry powder, taco seasoning, or BBQ rubs, appeal to consumers looking for authentic flavors without the need to purchase multiple individual spices.

Also, these products often command higher profit margins compared to raw spices, as they offer added value through convenience and packaging. By tapping into the demand for convenience, spice companies expand their product offerings, reach new consumer segments, and strengthen brand loyalty. Embracing this trend allows businesses to stay relevant in a competitive market while meeting the evolving needs of modern consumers.

Spices Market: Segment Analysis

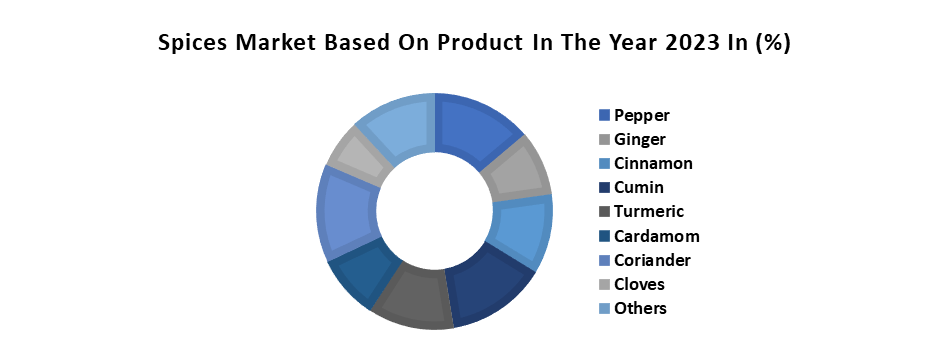

Based On the Product, the pepper sub-segment dominated the product segment of the global Spices Market in the year 2023. The pepper sub-segment emerged as a dominant force within the global Spices Market owing to its widespread popularity, versatile usage, and inherent qualities that appeal to consumers worldwide. Pepper's ubiquitous presence in cuisines across cultures played an important role in its dominance. Whether it's adding a subtle kick to savory dishes enhancing the flavor profile of sweet treats, pepper's versatility makes it a staple in kitchens globally. Its ability to complement a wide range of dishes, from soups and salads to meats and desserts, ensures its constant demand in the culinary world.

Also, pepper's rich history and cultural significance contribute to its enduring appeal. Dating back centuries, pepper has been prized for its medicinal properties and was once considered as valuable as currency. This historical reverence has ingrained pepper into culinary traditions worldwide, ensuring its continued relevance in modern-day cooking. The pepper sub-segment's domination is also attributed to its economic viability. Pepper cultivation is widespread, with major producers such as India, Vietnam, and Indonesia leading the Spices Market. This abundance ensures a steady supply of pepper to meet global demand, making it a cost-effective option for consumers and businesses alike.

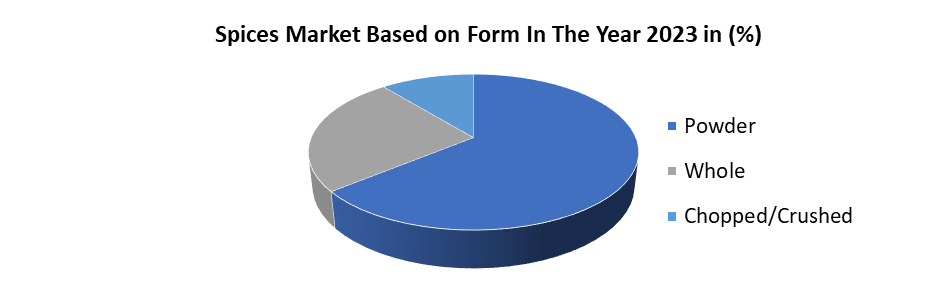

Based on Form, the Powdered form segment dominated the Spices Market in the year 2023. Due to its convenience and versatility. Powdered spices are easy to use since they don't need to be chopped or ground before cooking, saving time and effort in the kitchen. They also mix well into dishes, spreading their flavor evenly, which is important for making tasty meals. Also, powdered spices have a longer shelf life compared to whole spices, staying fresh for longer periods, which makes them a practical choice for both consumers and manufacturers. Too, powdered spices are often used in recipes that require precise measurements, such as baking, where consistency is key to getting the right taste and texture. Because of these reasons, the powdered form segment became the top choice for many people cooking at home and for businesses making packaged food products.

Spices Market Regional Analysis:

Asia Pacific Region dominated the Spices Market in the year 2023. The region boasts a rich history of spice cultivation and trade, with countries such as India, China, Indonesia, and Vietnam being major producers and exporters of a wide variety of spices such as pepper, cardamom, cloves, and cinnamon. India is known for its large-scale production and export of spices, particularly black pepper and cardamom. China, on the other hand, specializes in the production and export of cloves, while Indonesia is a major player in the cinnamon market. Vietnam excels in the production and export of a diverse range of spices, including ginger, turmeric, and nutmeg. Together, these countries contribute significantly to the dominance of the Asia Pacific region in the global spices market.

Favorable climatic conditions in many parts of Asia Pacific provide ideal environments for spice cultivation, ensuring high-quality produce, traditional knowledge and expertise passed down through generations have contributed to the development of sophisticated cultivation and processing techniques, further enhancing the region's competitive edge in the global Spices Industry. The traditional knowledge and expertise in spice cultivation in the Asia Pacific region have been honed over centuries, resulting in a deep understanding of the optimal growing conditions, harvesting techniques, and post-harvest processing methods.

This accumulated wisdom has allowed farmers in countries such as India, China, Indonesia, and Vietnam to achieve consistent yields of high-quality spices, meeting the global demand and maintaining their position as key players in the spices market. The growing demand for ethnic cuisines, natural food ingredients, and health-conscious consumption patterns worldwide has significantly boosted the demand for spices, with Asia Pacific being the primary beneficiary due to its abundance of supply.

The strategic government initiatives, trade agreements, and investments in infrastructure have facilitated the efficient production, distribution, and export of spices from the region, solidifying its position as the leading player in the global Spices Market.

|

Spices Market Scope |

|

|

Market Size in 2023 |

USD 23.46 Bn. |

|

Market Size in 2030 |

USD 33.45 Bn. |

|

CAGR (2024-2030) |

5.3 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Product Pepper Ginger Cinnamon Cumin Turmeric Cardamom Coriander Cloves Others |

|

By Form Powder Whole Chopped/Crushed |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Russia, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Players in the Spices Market

- McCormick & Company, Inc. (USA)

- Olam International (Singapore)

- Everest Spices (India)

- Ajinomoto Co., Inc. (Japan)

- MDH Spices (India)

- Baria Pepper (Vietnam)

- Archer Daniels Midland Company (ADM) (USA)

- Unilever (Knorr) (United Kingdom)

- Nestlé SA (Switzerland)

- Sensient Technologies Corporation (USA)

- Ajanta Spices (India)

- Frontier Co-op (USA)

- DS Group (India)

- Paprika Oleo's (Spain)

- Synthite Industries Ltd. (India)

- British Pepper & Spice Company (United Kingdom)

- Fuchs Group (Germany)

- Givaudan SA (Switzerland)

- Asian Star Company Limited (Vietnam)

Frequently Asked Questions

Rising consumption of packaged food products fueling the need for efficient Spices and mixers in food preparation.

Investors can capitalize on opportunities in the Spices market by focusing on companies that are leading in innovation trends such as advanced technology adoption. Additionally, investing in companies with strong distribution channels and a growing online retail presence can offer the potential for growth as the market expands globally.

The Market size was valued at USD 23.46 Billion in 2023 and the total Market revenue is expected to grow at a CAGR of 5.3 % from 2024 to 2030, reaching nearly USD 33.45 Billion.

The segments covered in the market report are Product, Form, and region.

1. Spices Market: Research Methodology

2. Spices Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Spices Market: Dynamics

3.1. Spices Market Trends by Region

3.1.1. North America Spices Market Trends

3.1.2. Europe Spices Market Trends

3.1.3. Asia Pacific Spices Market Trends

3.1.4. Middle East and Africa Spices Market Trends

3.1.5. South America Spices Market Trends

3.2. Spices Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. PORTER’s Five Forces Analysis

3.4. PESTLE Analysis

3.5. Regulatory Landscape

3.6. Key Opinion Leader Analysis for Spices Market

3.7. Analysis of Government Schemes and Initiatives For the Spices Market

4. Spices Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

4.1. Spices Market Size and Forecast, By Product (2023-2030)

4.1.1. Pepper

4.1.2. Ginger

4.1.3. Cinnamon

4.1.4. Cumin

4.1.5. Turmeric

4.1.6. Cardamom

4.1.7. Coriander

4.1.8. Cloves

4.1.9. Others

4.2. Spices Market Size and Forecast, By Form (2023-2030)

4.2.1. Powder

4.2.2. Whole

4.2.3. Chopped/Crushed

4.3. Spices Market Size and Forecast, by Region (2023-2030)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East and Africa

4.3.5. South America

5. North America Spices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. North America Spices Market Size and Forecast, By Product (2023-2030)

5.1.1. Pepper

5.1.2. Ginger

5.1.3. Cinnamon

5.1.4. Cumin

5.1.5. Turmeric

5.1.6. Cardamom

5.1.7. Coriander

5.1.8. Cloves

5.1.9. Others

5.2. North America Spices Market Size and Forecast, By Form (2023-2030)

5.2.1. Powder

5.2.2. Whole

5.2.3. Chopped/Crushed

5.3. North America Spices Market Size and Forecast, by Country (2023-2030)

5.3.1. United States

5.3.1.1. United States Spices Market Size and Forecast, By Product (2023-2030)

5.3.1.1.1. Pepper

5.3.1.1.2. Ginger

5.3.1.1.3. Cinnamon

5.3.1.1.4. Cumin

5.3.1.1.5. Turmeric

5.3.1.1.6. Cardamom

5.3.1.1.7. Coriander

5.3.1.1.8. Cloves

5.3.1.1.9. Others

5.3.1.2. United States Spices Market Size and Forecast, By Form (2023-2030)

5.3.1.2.1. Powder

5.3.1.2.2. Whole

5.3.1.2.3. Chopped/Crushed

5.3.2. Canada

5.3.2.1. Canada Spices Market Size and Forecast, By Product (2023-2030)

5.3.2.1.1. Pepper

5.3.2.1.2. Ginger

5.3.2.1.3. Cinnamon

5.3.2.1.4. Cumin

5.3.2.1.5. Turmeric

5.3.2.1.6. Cardamom

5.3.2.1.7. Coriander

5.3.2.1.8. Cloves

5.3.2.1.9. Others

5.3.2.2. Canada Spices Market Size and Forecast, By Form (2023-2030)

5.3.2.2.1. Powder

5.3.2.2.2. Whole

5.3.2.2.3. Chopped/Crushed

5.3.3. Mexico

5.3.3.1. Mexico Spices Market Size and Forecast, By Product (2023-2030)

5.3.3.1.1. Pepper

5.3.3.1.2. Ginger

5.3.3.1.3. Cinnamon

5.3.3.1.4. Cumin

5.3.3.1.5. Turmeric

5.3.3.1.6. Cardamom

5.3.3.1.7. Coriander

5.3.3.1.8. Cloves

5.3.3.1.9. Others

5.3.3.2. Mexico Spices Market Size and Forecast, By Form (2023-2030)

5.3.3.2.1. Powder

5.3.3.2.2. Whole

5.3.3.2.3. Chopped/Crushed

6. Europe Spices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. Europe Spices Market Size and Forecast, By Product (2023-2030)

6.2. Europe Spices Market Size and Forecast, By Form (2023-2030)

6.3. Europe Spices Market Size and Forecast, by Country (2023-2030)

6.3.1. United Kingdom

6.3.1.1. United Kingdom Spices Market Size and Forecast, By Product (2023-2030)

6.3.1.2. United Kingdom Spices Market Size and Forecast, By Form (2023-2030)

6.3.2. France

6.3.2.1. France Spices Market Size and Forecast, By Product (2023-2030)

6.3.2.2. France Spices Market Size and Forecast, By Form (2023-2030)

6.3.3. Germany

6.3.3.1. Germany Spices Market Size and Forecast, By Product (2023-2030)

6.3.3.2. Germany Spices Market Size and Forecast, By Form (2023-2030)

6.3.4. Italy

6.3.4.1. Italy Spices Market Size and Forecast, By Product (2023-2030)

6.3.4.2. Italy Spices Market Size and Forecast, By Form (2023-2030)

6.3.5. Spain

6.3.5.1. Spain Spices Market Size and Forecast, By Product (2023-2030)

6.3.5.2. Spain Spices Market Size and Forecast, By Form (2023-2030)

6.3.6. Russia

6.3.6.1. Russia Spices Market Size and Forecast, By Product (2023-2030)

6.3.6.2. Russia Spices Market Size and Forecast, By Form (2023-2030)

6.3.7. Austria

6.3.7.1. Austria Spices Market Size and Forecast, By Product (2023-2030)

6.3.7.2. Austria Spices Market Size and Forecast, By Form (2023-2030)

6.3.8. Rest of Europe

6.3.8.1. Rest of Europe Spices Market Size and Forecast, By Product (2023-2030)

6.3.8.2. Rest of Europe Spices Market Size and Forecast, By Form (2023-2030)

7. Asia Pacific Spices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Asia Pacific Spices Market Size and Forecast, By Product (2023-2030)

7.2. Asia Pacific Spices Market Size and Forecast, By Form (2023-2030)

7.3. Asia Pacific Spices Market Size and Forecast, by Country (2023-2030)

7.3.1. China

7.3.1.1. China Spices Market Size and Forecast, By Product (2023-2030)

7.3.1.2. China Spices Market Size and Forecast, By Form (2023-2030)

7.3.2. S Korea

7.3.2.1. S Korea Spices Market Size and Forecast, By Product (2023-2030)

7.3.2.2. S Korea Spices Market Size and Forecast, By Form (2023-2030)

7.3.3. Japan

7.3.3.1. Japan Spices Market Size and Forecast, By Product (2023-2030)

7.3.3.2. Japan Spices Market Size and Forecast, By Form (2023-2030)

7.3.4. India

7.3.4.1. India Spices Market Size and Forecast, By Product (2023-2030)

7.3.4.2. India Spices Market Size and Forecast, By Form (2023-2030)

7.3.5. Australia

7.3.5.1. Australia Spices Market Size and Forecast, By Product (2023-2030)

7.3.5.2. Australia Spices Market Size and Forecast, By Form (2023-2030)

7.3.6. ASEAN

7.3.6.1. ASEAN Spices Market Size and Forecast, By Product (2023-2030)

7.3.6.2. ASEAN Spices Market Size and Forecast, By Form (2023-2030)

7.3.7. Rest of Asia Pacific

7.3.7.1. Rest of Asia Pacific Spices Market Size and Forecast, By Product (2023-2030)

7.3.7.2. Rest of Asia Pacific Spices Market Size and Forecast, By Form (2023-2030)

8. Middle East and Africa Spices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Middle East and Africa Spices Market Size and Forecast, By Product (2023-2030)

8.2. Middle East and Africa Spices Market Size and Forecast, By Form (2023-2030)

8.3. Middle East and Africa Spices Market Size and Forecast, by Country (2023-2030)

8.3.1. South Africa

8.3.1.1. South Africa Spices Market Size and Forecast, By Product (2023-2030)

8.3.1.2. South Africa Spices Market Size and Forecast, By Form (2023-2030)

8.3.2. GCC

8.3.2.1. GCC Spices Market Size and Forecast, By Product (2023-2030)

8.3.2.2. GCC Spices Market Size and Forecast, By Form (2023-2030)

8.3.3. Nigeria

8.3.3.1. Nigeria Spices Market Size and Forecast, By Product (2023-2030)

8.3.3.2. Nigeria Spices Market Size and Forecast, By Form (2023-2030)

8.3.4. Rest of ME&A

8.3.4.1. Rest of ME&A Spices Market Size and Forecast, By Product (2023-2030)

8.3.4.2. Rest of ME&A Spices Market Size and Forecast, By Form (2023-2030)

9. South America Spices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. South America Spices Market Size and Forecast, By Product (2023-2030)

9.2. South America Spices Market Size and Forecast, By Form (2023-2030)

9.3. South America Spices Market Size and Forecast, by Country (2023-2030)

9.3.1. Brazil

9.3.1.1. Brazil Spices Market Size and Forecast, By Product (2023-2030)

9.3.1.2. Brazil Spices Market Size and Forecast, By Form (2023-2030)

9.3.2. Argentina

9.3.2.1. Argentina Spices Market Size and Forecast, By Product (2023-2030)

9.3.2.2. Argentina Spices Market Size and Forecast, By Form (2023-2030)

9.3.3. Rest Of South America

9.3.3.1. Rest Of South America Spices Market Size and Forecast, By Product (2023-2030)

9.3.3.2. Rest Of South America Spices Market Size and Forecast, By Form (2023-2030)

10. Global Spices Market: Competitive Landscape

10.1. MMR Competition Matrix

10.2. Competitive Landscape

10.3. Key Players Benchmarking

10.3.1. Company Name

10.3.2. Service Segment

10.3.3. End-user Segment

10.3.4. Revenue (2023)

10.3.5. Headquarter

10.4. Mergers and Acquisitions Details

11. Company Profile: Key Players

11.1. McCormick & Company, Inc. (USA)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Details on Partnership

11.1.7. Recent Developments

11.2. Olam International (Singapore)

11.3. Everest Spices (India)

11.4. Ajinomoto Co., Inc. (Japan)

11.5. MDH Spices (India)

11.6. Baria Pepper (Vietnam)

11.7. Archer Daniels Midland Company (ADM) (USA)

11.8. Unilever (Knorr) (United Kingdom)

11.9. Nestlé SA (Switzerland)

11.10. Sensient Technologies Corporation (USA)

11.11. Ajanta Spices (India)

11.12. Frontier Co-op (USA)

11.13. DS Group (India)

11.14. Paprika Oleo's (Spain)

11.15. Synthite Industries Ltd. (India)

11.16. British Pepper & Spice Company (United Kingdom)

11.17. Fuchs Group (Germany)

11.18. Givaudan SA (Switzerland)

11.19. Asian Star Company Limited (Vietnam)

12. Key Findings

13. Industry Recommendations