Submarine Payload Market: Global Industry Analysis and Forecast (2024-2030)

The Submarine Payload Market size was valued at USD 9.77 Bn. in 2023 and the Submarine Payload revenue is expected to grow at a CAGR of 5.06% from 2024 to 2030, reaching nearly USD 13.80 Bn. by 2030.

Format : PDF | Report ID : SMR_2049

Submarine Payload Market Overview:

Submarines are complex platforms in the Navy equipped with payload systems that enhance their war-fighting capabilities. The wide variety of payloads, including nuclear-powered and ballistic missile submarines, make them more flexible, survivable, and effective. Significant investment has been made in submarine payload development, leading to rapid growth in the market. However, limited defense expenses and lack of modernization restrain the market.

Recent developments include BAE Systems signing a contract with General Dynamics Electric Boat to produce Virginia Payload Module (VPM) tubes for Block V Virginia-class submarines, General Dynamics Electric Boat providing research and development services for Virginia-class nuclear-powered attack submarines, and Raytheon building Tomahawk cruise missiles from new submarine payload tubes. These developments highlight the need for countries to invest in submarine payload systems to meet the growing demand for submarines.

The Submarine Payload market is gaining international collaborations and partnerships because of the need for advanced payloads. These partnerships share technological know-how, research resources, and interoperable systems for allied navies. Advanced underwater communication technologies are being integrated into submarine payloads to improve coordination among submarines, surface vessels, and other naval forces, enhancing the effectiveness of undersea operations. This trend is driven by the increasing need for submarines to operate collaboratively and share critical information in real time.

To get more Insights: Request Free Sample Report

Submarine Payload Market Dynamics:

The Submarine Payload market is witnessing significant trends in undersea warfare capabilities and technological advancements. The growing emphasis on autonomous underwater vehicles (AUVs) as integral components of submarine payloads is a key trend, as they are used for reconnaissance, surveillance, and mine countermeasures. The incorporation of advanced autonomous underwater vehicles (AUVs) into submarine payloads is a manifestation of the larger trend towards unmanned systems, which amplifies the operating range and adaptability of submarines. Advancements in sensor technologies, such as advanced sonar systems and electro-optical sensors, are also gaining traction as navies seek to enhance submarines' detection capabilities.

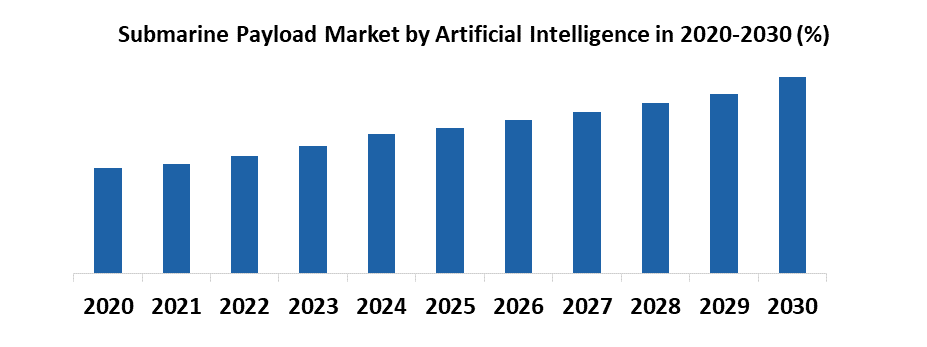

These sensors improve situational awareness, which makes it possible for submarines to function better in a variety of demanding underwater conditions. Combining machine learning (ML) with artificial intelligence (AI) skills is another significant Submarine Payload market growth. As submarines collect more sensor data, AI and ML algorithms are employed to analyze and interpret this information, enhancing submarines' ability to process complex data sets, make real-time decisions, and optimize mission outcomes. Modular and adaptable submarine payloads are also gaining prominence, as submarines seek payload systems that are easily reconfigured to accommodate diverse mission requirements. With the use of modular payloads, submarines carry a variety of sensors, weapons, or unmanned systems to perform a range of tasks during a single operational deployment.

Submarine Payload Market Restraint

The submarine payload market faces restraints because of technical integration, reduction, power and energy restraints, environmental adaptability, cyber security exposures, monitoring export controls, economic restraints, and political doubts. These issues hinder the seamless integration of payloads into submarines, prominent to delays and improved costs. Also, strict export controls and compliance values hinder market access, though economic restraints like high development costs and limited defense costs slow down investment and obtaining cycles. To overcome these restraints, intensive efforts and innovative solutions are required.

The integration of naval combat systems and sensors faces challenges because of the large amounts of data generated, requiring high bandwidths for real-time data sharing. Solutions include 5G technology, combat clouds, and an "Internet of Things" architecture. Future systems should have increased autonomy to reduce control bandwidth and reduce vulnerability to jamming. Multi-mission submarine payloads are becoming a popular trend, enhancing submarines' versatility and adaptability to dynamic operational scenarios. This aligns with the evolving nature of naval operations, where submarines are expected to address a spectrum of threats and challenges.

Submarine Payload Market Segment Analysis:

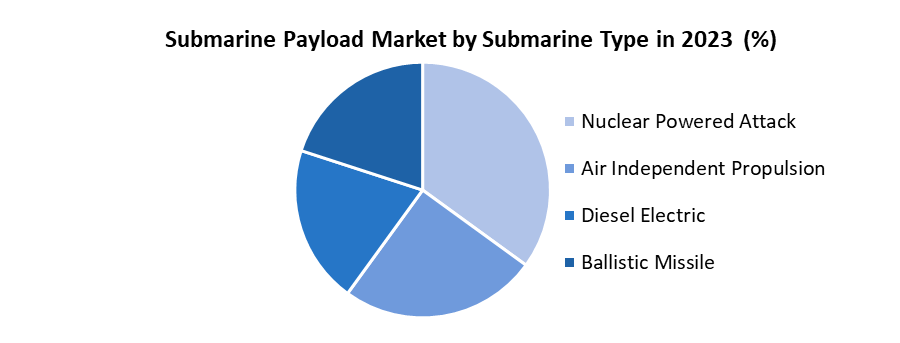

Based on Submarine Type, the nuclear-powered attack submarine is the most popular type and held the largest Submarine Payload market share within its category. Vertical missile launch tubes, lock-out/lock-in chambers, and torpedo tubes are among the payload systems installed on the submarines. The submarine payload systems are intended for use in counterterrorism, nuclear warheads, and localized warfare operations. Because of the growing number of submarines being used, newly built submarines being purchased, newly built submarines being exported, and the global expansion of submarine production, the market of submarine payloads is growing increasingly competitive.

Submarine Payload Market Regional Insight:

North America Submarine Payload Market is dominated in 2023 and is expected to exhibit a significant CAGR growth during the forecast period 2024 to 2030. The nation's need for Submarine is mostly driven by the presence of major Submarine Payload manufacturers and tier players. North America is expected to keep taking the leading position in the Submarine Payload Market in the forecast period 2024 to 2030. Also, in the upcoming years, the region is probably going to experience some robust growth. The market of Submarine Payload in North America is growing mostly because the US holds the largest market share and the Canadian market is the fastest-growing in the region.

- The United States spends the most on its military of any country in the world. As China and Russia pose a greater danger, the US Department of Defines is attempting to bolster its naval capabilities by introducing new surface ships and submarines.

Submarine Payload Market Competitive Landscape:

- 21 Mar 2024, The Australian Government has selected BAE Systems and ASC Pty Ltd to build Australia's new fleet of nuclear-powered submarines in the latest significant development in the AUKUS trilateral security pact between the United States, the United Kingdom, and Australia.

- April 10, 2024, Collins Aerospace, an RTX (NYSE: RTX) business, is introducing two major upgrades to the Ascentia software platform. Ascentia is a software solution for aircraft reliability management that is designed to streamline operations, enhance decision-making, and predict future events.

- June 7, 2024, Mitsubishi Shipbuilding Co., Ltd., a Mitsubishi Heavy Industries (MHI) Group company based in Yokohama, held a christening and launch ceremony for the TRANS HARMONY GREEN, the first of two LNG-powered roll-on/roll-off (RO/RO) ships (Note) under construction for Toyofuji Shipping Co., Ltd. The ceremony took place at the Enoura Plant of MHI's Shimonoseki Shipyard & Machinery Works in Yamaguchi Prefecture.

|

Submarine Payload Market Scope |

|

|

Market Size in 2023 |

USD 9.77 Bn. |

|

Market Size in 2030 |

USD 13.80 Bn. |

|

CAGR (2024-2030) |

5.06 % |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Submarine Type Nuclear Powered Attack Air Independent Propulsion Diesel Electric Ballistic Missile |

|

By Payload Sensors Electronic Support Measures Armaments |

|

|

By Application Military Marine Environmental Monitoring Detection of Oil Resources Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Submarine Payload Market Key Players:

- Lockheed Martin Corporation (United States)

- Northrop Grumman Corporation (United States)

- Kawasaki Heavy Industries (Japan)

- Collins Aerospace (United States)

- Zivko Aeronautics (United States)

- Saab AB (Sweden)

- Navantia (Spain)

- BAE Systems (United Kingdom)

- General Dynamics (United States)

- FINCANTIERI (Italy)

- Naval Group (France)

- ThyssenKrupp Marine Systems AG (Germany)

- Mitsubishi Heavy Industries (Japan)

- Hyundai Heavy Industries (South Korea)

- LIG Nex1 (South Korea)

- ST Engineering (Singapore)

- Atlas Elektronik (Germany)

- Bharat Electronics Limited (India)

- Walchandnagar Industries Ltd. (India)

- Hindustan Aeronautics Limited (HAL) (India)

- XX.inc

Frequently Asked Questions

An analysis of profit trends and projections for companies in the Submarine Payload Market is included, offering insights into factors driving profitability, cost management strategies and financial performance metrics.

The Submarine Payload Market size was valued at USD 9.77 Billion in 2023 and the Submarine Payload revenue is expected to grow at a CAGR of 5.06% from 2024 to 2030, reaching nearly USD 13.80 Billion by 2030.

The segments covered in the market report are by Submarine Type, by Payload and by Applications.

1. Submarine Payload Market: Research Methodology

2. Submarine Payload Market: Executive Summary

3. Submarine Payload Market: Competitive Landscape

3.1. Stellar Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.4. Market Structure

3.4.1. Market Leaders

3.4.2. Market Followers

3.4.3. Emerging Players

3.5. Consolidation of the Market

4. Submarine Payload Market Import Export Landscape

4.1. Import Trends

4.2. Export Trends

4.3. Regulatory Compliance

4.4. Major Export Destinations

4.5. Import-Export Disparities

5. Submarine Payload Market: Dynamics

5.1. Market Driver

5.2. Market Trends by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East and Africa

5.2.5. South America

5.3. Market Drivers by Region

5.4. Market Restraints

5.5. Market Opportunities

5.6. Market Challenges

5.7. PORTER’s Five Forces Analysis

5.8. PESTLE Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

6. Submarine Payload Market Size and Forecast by Segmentations (by Value USD Million)

6.1. Submarine Payload Market Size and Forecast, by Submarine Type (20232-20320)

6.1.1. Nuclear Powered Attack

6.1.2. Air Independent Propulsion

6.1.3. Diesel Electric

6.1.4. Ballistic Missile

6.2. Submarine Payload Market Size and Forecast, by Payload (20232-20320)

6.2.1. Sensors

6.2.2. Electronic Support Measures

6.2.3. Armaments

6.3. Submarine Payload Market Size and Forecast, by Application (20232-20320)

6.3.1. Military Marine

6.3.2. Environmental Monitoring

6.3.3. Detection of Oil Resources

6.3.4. Others

6.4. Submarine Payload Market Size and Forecast, by Region (20232-20320)

6.4.1. North America

6.4.2. Europe

6.4.3. Asia Pacific

6.4.4. Middle East and Africa

6.4.5. South America

7. North America Submarine Payload Market Size and Forecast (by Value USD Million)

7.1. North America Submarine Payload Market Size and Forecast, by Submarine Type (2023-2030)

7.1.1. Nuclear Powered Attack

7.1.2. Air Independent Propulsion

7.1.3. Diesel Electric

7.1.4. Ballistic Missile

7.2. North America Submarine Payload Market Size and Forecast, by Payload (2023-2030)

7.2.1. Sensors

7.2.2. Electronic Support Measures

7.2.3. Armaments

7.3. North America Submarine Payload Market Size and Forecast, by Application (2023-2030)

7.3.1. Military Marine

7.3.2. Environmental Monitoring

7.3.3. Detection of Oil Resources

7.3.4. Others

7.4. North America Submarine Payload Market Size and Forecast, by Country (2023-2030)

7.4.1. United States

7.4.2. Canada

7.4.3. Mexico

8. Europe Submarine Payload Market Size and Forecast (by Value USD Million)

8.1. Europe Submarine Payload Market Size and Forecast, by Submarine Type (2023-2030)

8.1.1. Nuclear Powered Attack

8.1.2. Air Independent Propulsion

8.1.3. Diesel Electric

8.1.4. Ballistic Missile

8.2. Europe Submarine Payload Market Size and Forecast, by Payload (2023-2030)

8.2.1. Sensors

8.2.2. Electronic Support Measures

8.2.3. Armaments

8.3. Europe Submarine Payload Market Size and Forecast, by Application (2023-2030)

8.3.1. Military Marine

8.3.2. Environmental Monitoring

8.3.3. Detection of Oil Resources

8.3.4. Others

8.4. Europe Submarine Payload Market Size and Forecast, by Country (2023-2030)

8.4.1. UK

8.4.2. France

8.4.3. Germany

8.4.4. Italy

8.4.5. Spain

8.4.6. Sweden

8.4.7. Russia

8.4.8. Rest of Europe

9. Asia Pacific Submarine Payload Market Size and Forecast (by Value USD Million)

9.1. Asia Pacific Submarine Payload Market Size and Forecast, by Submarine Type (2023-2030)

9.1.1. Nuclear Powered Attack

9.1.2. Air Independent Propulsion

9.1.3. Diesel Electric

9.1.4. Ballistic Missile

9.2. Asia Pacific Submarine Payload Market Size and Forecast, by Payload (2023-2030)

9.2.1. Sensors

9.2.2. Electronic Support Measures

9.2.3. Armaments

9.3. Europe Submarine Payload Market Size and Forecast, by Application (2023-2030)

9.3.1. Military Marine

9.3.2. Environmental Monitoring

9.3.3. Detection of Oil Resources

9.3.4. Others

9.4. Asia Pacific Submarine Payload Market Size and Forecast, by Country (2023-2030)

9.4.1. China

9.4.2. S Korea

9.4.3. Japan

9.4.4. India

9.4.5. Australia

9.4.6. Indonesia

9.4.7. Malaysia

9.4.8. Vietnam

9.4.9. Taiwan

9.4.10. Bangladesh

9.4.11. Pakistan

9.4.12. Rest of Asia Pacific

10. Middle East and Africa Submarine Payload Market Size and Forecast (by Value USD Million)

10.1. Middle East and Africa Submarine Payload Market Size and Forecast, by Submarine Type (2023-2030)

10.1.1. Nuclear Powered Attack

10.1.2. Air Independent Propulsion

10.1.3. Diesel Electric

10.1.4. Ballistic Missile

10.2. Middle East and Africa Submarine Payload Market Size and Forecast, by Payload (2023-2030)

10.2.1. Sensors

10.2.2. Electronic Support Measures

10.2.3. Armaments

10.3. Middle East and Africa Submarine Payload Market Size and Forecast, by Application (2023-2030)

10.3.1. Military Marine

10.3.2. Environmental Monitoring

10.3.3. Detection of Oil Resources

10.3.4. Others

10.4. Middle East and Africa Submarine Payload Market Size and Forecast, by Country (2023-2030)

10.4.1. South Africa

10.4.2. GCC

10.4.3. Egypt

10.4.4. Nigeria

10.4.5. Rest of ME&A

11. South America Submarine Payload Market Size and Forecast (by Value USD Million)

11.1. South America Submarine Payload Market Size and Forecast, by Submarine Type (2023-2030)

11.1.1. Nuclear Powered Attack

11.1.2. Air Independent Propulsion

11.1.3. Diesel Electric

11.1.4. Ballistic Missile

11.2. South America Submarine Payload Market Size and Forecast, by Payload (2023-2030)

11.2.1. Sensors

11.2.2. Electronic Support Measures

11.2.3. Armaments

11.3. South America Submarine Payload Market Size and Forecast, by Application (2023-2030)

11.3.1. Military Marine

11.3.2. Environmental Monitoring

11.3.3. Detection of Oil Resources

11.3.4. Others

11.4. South America Submarine Payload Market Size and Forecast, by Country (2023-2030)

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Rest of South America

12. Company Profile: Key players

12.1. Lockheed Martin Corporation

12.1.1.1. Company Overview

12.1.1.2. Financial Overview

12.1.1.3. Business Portfolio

12.1.1.4. SWOT Analysis

12.1.1.5. Business Strategy

12.1.1.6. Recent Developments

12.2. Northrop Grumman Corporation

12.3. Kawasaki Heavy Industries

12.4. Collins Aerospace

12.5. Zivko Aeronautics

12.6. Saab AB

12.7. Navantia

12.8. BAE Systems

12.9. General Dynamics

12.10. Fincantieri

12.11. Naval Group

12.12. ThyssenKrupp Marine Systems AG

12.13. Mitsubishi Heavy Industries

12.14. Hyundai Heavy Industries

12.15. LIG Nex1

12.16. ST Engineering

12.17. Atlas elektronik

12.18. Bharat Electronics Limited: BEL

12.19. Walchandnagar Industries Ltd.

12.20. Hindustan Aeronautics Limited (HAL)

12.21. XX.inc

13. Key Findings

14. Industry Recommendation