Submarines Market: Global Industry Analysis and Forecast (2024-2030)

The Submarines Market size was valued at USD 24.92 Bn. in 2023 and the total Submarines revenue is expected to grow at a CAGR of 4.1% from 2024 to 2030, reaching nearly USD 33.01 Bn. by 2030.

Format : PDF | Report ID : SMR_1990

Submarines Market Overview:

Submarines play a critical role in modern naval warfare, contributing to sea control, sea denial, and power projection, making them essential assets for national security. The shift towards nuclear-powered submarines has enhanced their operational range, stealth, and endurance, increasing demand for advanced propulsion systems and nuclear technology. The global submarine market is experiencing significant growth driven by technological advancements, evolving maritime threats, and increased defense spending by naval powers worldwide. Submarines' multi-mission capabilities, including anti-submarine warfare, mine laying, reconnaissance, and special operations, create opportunities for modular and customizable designs.

The complexity of submarine development, requiring the integration of advanced weaponry, propulsion, and life-support systems within confined spaces, presents opportunities for high-tech engineering and systems integration firms. Emerging naval powers are increasingly investing in submarines, seeking scalable and cost-effective solutions to enhance their maritime capabilities. This trend opens new market segments for defense companies to provide comprehensive training, maintenance, and support services. The strategic advantage of submarines in covert operations, such as intelligence gathering and Special Forces deployment, further underscores their value in modern warfare, driving continuous investment and innovation in the submarine market.

To get more Insights: Request Free Sample Report

Submarines Market Dynamics:

Advanced Sonar and Stealth Technologies in Modern Submarines Market Growth

A submarine is a watercraft designed for underwater operations, distinct from submersibles due to its ability to operate independently for extended periods. Powered by nuclear reactors or diesel-electric systems, submarines have crucial applications in military and scientific fields. In the military, they provide strategic advantages through stealth capabilities, enabling covert surveillance, reconnaissance, and strategic deterrence with ballistic missile systems. Scientifically, submarines facilitate deep-sea exploration, advancing our understanding of marine biology, geology, and oceanography, and are used in underwater infrastructure maintenance. Innovations have significantly advanced submarine technology, enhancing their functionality and efficiency. The introduction of nuclear propulsion marked a transformative milestone, granting submarines virtually unlimited underwater endurance and high-speed capabilities, as nuclear reactors operate independently of air and provide substantial energy output.

Air-Independent Propulsion (AIP) systems, which include fuel cells and Stirling engines, further enhance the stealth and endurance of non-nuclear submarines by allowing prolonged submerged operations without surfacing. Modern submarines are equipped with advanced sonar systems for precise navigation and detection, and stealth technologies, such as anechoic coatings and noise-reduction mechanisms, significantly reduce the likelihood of detection by enemy forces. Additionally, the development of Unmanned Underwater Vehicles (UUVs) represents a cutting-edge innovation, extending the operational capabilities of submarines.

These autonomous or remotely operated vehicles perform a variety of underwater tasks, including reconnaissance and mine countermeasures, offering enhanced operational flexibility and reducing risks to human operators. The continuous evolution of submarine technology underscores their strategic significance and versatility, making them indispensable in both defense and scientific research, as they continue to play a vital role in national security and the exploration of the underwater world for Submarines Market. For instance, on April 26, 2023, Wuchang Shipbuilding launched the Pakistan Navy’s first Hangor-class submarine equipped with air-independent propulsion (AIP) for sea trials in Wuhan.

Submarines Market Trends:

The Strategic Role of Submarines in Maritime Operational Warfare Boosts the Submarines Market

The evolving role of submarines in modern naval warfare presents significant market opportunities for the defense industry. Advances in technology and the increasing complexity of maritime threats have underscored the submarine's multifaceted utility, driving demand among both large and emerging naval powers. Submarines are integral to maritime operational warfare, contributing to sea control, sea denial, and maritime power projection, making them indispensable to naval strategy and necessitating continued investment in their development and procurement. The shift towards nuclear-powered submarines has revolutionized their operational capabilities, enhancing their mobility, flexibility, and destructive potential.

This trend benefits companies specializing in nuclear technology and advanced propulsion systems. Additionally, the submarines' ability to conduct diverse missions ranging from anti-submarine warfare and mine laying to reconnaissance and special operations creates opportunities for the submarines market development of modular and customizable designs tailored to specific mission requirements.

The complexity of submarine development, which involves integrating advanced propulsion, sophisticated weaponry, and efficient crew accommodations, presents opportunities for high-tech engineering and systems integration firms. The growing interest in submarines by medium and small navies highlights a Submarines Market segment, as these nations seek scalable and cost-effective solutions to bolster their maritime capabilities. Defense companies can capitalize on this by offering comprehensive training, maintenance, and logistical support, fostering long-term relationships and recurring revenue streams. The strategic advantage provided by submarines in covert operations, such as intelligence gathering and Special Forces deployment, emphasizes their value in modern warfare.

Developing advanced communication systems and stealth technologies can enhance their operational effectiveness, creating additional market opportunities. For instance, on Feb 26, 2024, NATO's Exercise Dynamic Manta 24, the largest and most complex submarine warfare exercise in the Mediterranean, is underway off Sicily's coast, involving ships, submarines, aircraft, and thousands of personnel from nine nations. The exercise aims to enhance anti-submarine and anti-surface warfare skills, interoperability, and teamwork. For the second time, submarine assets will work with Allied Special Operations Forces, with a Greek SOF team conducting a mission from an Italian submarine.

Submarines Market Segment Analysis:

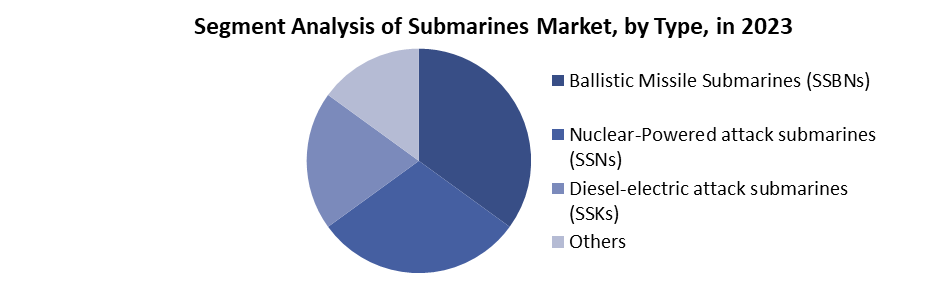

Based on type, the market is divided into Ballistic Missile Submarines (SSBNs), Nuclear-Powered attack submarines (SSNs), Diesel-electric attack submarines (SSKs), and others. Ballistic Missile Submarines (SSBNs). Ballistic Missile Submarines (SSBNs) witnessed the highest market share and are expected to continue their dominance during the forecast period. Ballistic missile submarines, commonly referred to as "boomers," are nuclear-powered vessels equipped with intercontinental ballistic missiles (ICBMs). They offer a strategic deterrent by serving as a concealed and mobile platform for nuclear weapons. These submarines can launch missiles from beneath the surface, making them challenging to detect and intercept. Notable examples include the Ohio Class and Columbia Class submarines. For instance, in October 2023, Lockheed Martin Corp.'s strategic weapons experts were awarded a $1.2 billion contract to produce additional UGM-133A Trident II D5 submarine-launched nuclear ballistic missiles and provide support for deployed D5 nuclear weapons.

The U.S. Navy Strategic Systems Programs (SSP) office in Washington has tasked the Lockheed Martin Space Systems segment in Titusville, Fla., with the production of Trident II (D5) missiles and support for deployed systems for both the U.S. Navy and the United Kingdom Royal Navy. The Trident II D5 stands as one of the world's most advanced long-range submarine-launched nuclear missiles. It serves as the primary U.S. sea-based nuclear ballistic missile and is deployed aboard U.S. Navy Ohio-class ballistic missile submarines. With 14 ballistic missile submarines in operation, each capable of carrying up to 24 Trident II missiles, the U.S. Navy maintains a formidable nuclear deterrent. However, while the Trident II is designed to carry up to 12 multiple independently targetable reentry vehicle (MIRV) warheads, current treaties limit this number to four or five warheads.

Submarines Market Regional Analysis:

North America witnessed the highest market share in submarine industry

North America witnessed significant dominance in the submarine market, primarily driven by the technological prowess and strategic imperatives of the United States. The U.S. Navy, one of the world's largest and most technologically advanced naval forces, has been at the forefront of submarine development and deployment, thereby contributing significantly to North America region held highest market share in this industry. The United States maintains a formidable fleet of submarines, including both nuclear-powered and conventional vessels, equipped with cutting-edge technologies and capabilities.

For example, the Virginia-class submarines, designed for multi-mission capabilities such as anti-submarine warfare, intelligence gathering, and strike missions, showcase the technological superiority of North American submarines. With ongoing advancements such as the Virginia Payload Module (VPM), which enhances the submarine's strike capabilities, the U.S. Navy continues to invest in maintaining its technological edge. Furthermore, the U.S. Navy's Ohio-class submarines, originally designed for nuclear deterrence missions, are being converted into guided-missile submarines (SSGNs), further expanding their versatility and combat capabilities. These submarines carry a mix of Tomahawk cruise missiles, Special Operations Forces, and unmanned aerial vehicles, enabling them to conduct a wide range of missions with precision and effectiveness.

|

Submarines Market Scope |

|

|

Market Size in 2023 |

USD 24.92 Billion |

|

Market Size in 2030 |

USD 33.01 Billion |

|

CAGR (2024-2030) |

4.1% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Type Ballistic Missile Submarines (SSBNs) Nuclear-Powered attack submarines (SSNs) Diesel-electric attack submarines (SSKs) Others |

|

By Platform Commercial Military |

|

|

By Application Military surveillance and Combat Marine Weather Monitoring and Scientific Research Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Submarines Market Key Players

- Huntington Ingalls Industries (United States)

- General Dynamics Corporation (United States)

- BAE Systems plc (United Kingdom)

- Naval Group (France)

- ThyssenKrupp Marine Systems (Germany)

- Saab AB (Sweden)

- Lockheed Martin Corporation (United States)

- Mitsubishi Heavy Industries (Japan)

- Kawasaki Heavy Industries (Japan)

- Fincantieri S.p.A. (Italy)

- Navantia (Spain)

- ASC Pty Ltd (Australia)

- Northrop Grumman Corporation (United States)

- Rosoboronexport (Russia)

- Babcock International Group (United Kingdom)

- Hyundai Heavy Industries (South Korea)

- Daewoo Shipbuilding & Marine Engineering (DSME) (South Korea)

- Larsen & Toubro (India)

- Kockums AB (Sweden)

- Mazagon Dock Shipbuilders Limited (India)

Frequently Asked Questions

North America is expected to dominate the submarine market during the forecast period.

The submarine market size is expected to reach USD 33.01 billion by 2030.

The major top players in the Global Submarines Market are Huntington Ingalls Industries, General Dynamics Corporation, and BAE Systems plc.

The global submarines market growth is driven by technological advancements enhancing operational capabilities and the increasing complexity of maritime threats necessitating advanced defense solutions.

1. Submarines Market: Research Methodology

2. Submarines Market Introduction

2.1. Study Assumption and Market Definition

2.2. Scope of the Study

2.3. Executive Summary

3. Global Submarines Market: Competitive Landscape

3.1. SMR Competition Matrix

3.2. Competitive Landscape

3.3. Key Players Benchmarking

3.3.1. Company Name

3.3.2. Product Type Segment

3.3.3. Product Segment

3.3.4. Revenue (2023)

3.3.5. Headquarter

3.4. Mergers and Acquisitions Details

4. Submarines Market: Dynamics

4.1. Submarines Market Trends

4.2. Submarines Market Dynamics

4.2.1.1. Drivers

4.2.1.2. Restraints

4.2.1.3. Opportunities

4.2.1.4. Challenges

4.3. PORTER’s Five Forces Analysis

4.4. PESTLE Analysis

4.5. Value Chain Analysis

4.6. Analysis of Government Schemes and Initiatives For Submarines Market

5. Submarines Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

5.1. Submarines Market Size and Forecast, by Type (2023-2030)

5.1.1. Ballistic Missile Submarines (SSBNs)

5.1.2. Nuclear-Powered attack submarines (SSNs)

5.1.3. Diesel-electric attack submarines (SSKs)

5.1.4. others

5.2. Submarines Market Size and Forecast, by Platform (2023-2030)

5.2.1. Commercial

5.2.2. Military

5.3. Submarines Market Size and Forecast, by Application (2023-2030)

5.3.1. Military surveillance and Combat

5.3.2. Marine Weather Monitoring and Scientific Research

5.3.3. Others

5.4. Submarines Market Size and Forecast, by Region (2023-2030)

5.4.1. North America

5.4.2. Europe

5.4.3. Asia Pacific

5.4.4. Middle East and Africa

5.4.5. South America

6. North America Submarines Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

6.1. North America Submarines Market Size and Forecast, by Type (2023-2030)

6.1.1. Ballistic Missile Submarines (SSBNs)

6.1.2. Nuclear-Powered attack submarines (SSNs)

6.1.3. Diesel-electric attack submarines (SSKs)

6.1.4. Others

6.2. North America Submarines Market Size and Forecast, by Platform (2023-2030)

6.2.1. Commercial

6.2.2. Military

6.3. North America Submarines Market Size and Forecast, by Application (2023-2030)

6.3.1. Military Surveillance and Combat

6.3.2. Marine Weather Monitoring and Scientific Research

6.3.3. Others

6.4. North America Submarines Market Size and Forecast, by Country (2023-2030)

6.4.1. United States

6.4.1.1. United States Submarines Market Size and Forecast, by Type (2023-2030)

6.4.1.1.1. Mattresses and Pillows

6.4.1.1.2. Ballistic Missile Submarines (SSBNs)

6.4.1.1.3. Nuclear-Powered attack submarines (SSNs)

6.4.1.1.4. Diesel-electric attack submarines (SSKs)

6.4.1.1.5. Others

6.4.1.2. United States Submarines Market Size and Forecast, by Platform (2023-2030)

6.4.1.2.1. Commercial

6.4.1.2.2. Military

6.4.1.3. United States Submarines Market Size and Forecast, by Application (2023-2030)

6.4.1.3.1. Military surveillance and Combat

6.4.1.3.2. Marine Weather Monitoring and Scientific Research

6.4.1.3.3. Others

6.4.2. Canada

6.4.2.1. Canada Submarines Market Size and Forecast, by Type (2023-2030)

6.4.2.1.1. Ballistic Missile Submarines (SSBNs)

6.4.2.1.2. Nuclear-Powered attack submarines (SSNs)

6.4.2.1.3. Diesel-electric attack submarines (SSKs)

6.4.2.1.4. Others

6.4.2.2. Canada Submarines Market Size and Forecast, by Platform (2023-2030)

6.4.2.2.1. Commercial

6.4.2.2.2. Military

6.4.2.3. Canada Submarines Market Size and Forecast, by Application (2023-2030)

6.4.2.3.1. Military surveillance and Combat

6.4.2.3.2. Marine Weather Monitoring and Scientific Research

6.4.2.3.3. Others

6.4.3. Mexico

6.4.3.1. Mexico Submarines Market Size and Forecast, by Type (2023-2030)

6.4.3.1.1. Ballistic Missile Submarines (SSBNs)

6.4.3.1.2. Nuclear-Powered attack submarines (SSNs)

6.4.3.1.3. Diesel-electric attack submarines (SSKs)

6.4.3.1.4. Others

6.4.3.2. Mexico Submarines Market Size and Forecast, by Platform (2023-2030)

6.4.3.2.1. Commercial

6.4.3.2.2. Military

6.4.3.3. Mexico Submarines Market Size and Forecast, by Application (2023-2030)

6.4.3.3.1. Military surveillance and Combat

6.4.3.3.2. Marine Weather Monitoring and Scientific Research

6.4.3.3.3. Others

7. Europe Submarines Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

7.1. Europe Submarines Market Size and Forecast, by Type (2023-2030)

7.2. Europe Submarines Market Size and Forecast, by Platform (2023-2030)

7.3. Europe Submarines Market Size and Forecast, by Application (2023-2030)

7.4. Europe Submarines Market Size and Forecast, by Country (2023-2030)

7.4.1. United Kingdom

7.4.1.1. United Kingdom Submarines Market Size and Forecast, by Type (2023-2030)

7.4.1.2. United Kingdom Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.1.3. United Kingdom Submarines Market Size and Forecast, by Application (2023-2030)

7.4.2. France

7.4.2.1. France Submarines Market Size and Forecast, by Type (2023-2030)

7.4.2.2. France Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.2.3. France Submarines Market Size and Forecast, by Application (2023-2030)

7.4.3. Germany

7.4.3.1. Germany Submarines Market Size and Forecast, by Type (2023-2030)

7.4.3.2. Germany Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.3.3. Germany Submarines Market Size and Forecast, by Application (2023-2030)

7.4.4. Italy

7.4.4.1. Italy Submarines Market Size and Forecast, by Type (2023-2030)

7.4.4.2. Italy Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.4.3. Italy Submarines Market Size and Forecast, by Application (2023-2030)

7.4.5. Spain

7.4.5.1. Spain Submarines Market Size and Forecast, by Type (2023-2030)

7.4.5.2. Spain Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.5.3. Spain Submarines Market Size and Forecast, by Application (2023-2030)

7.4.6. Russia

7.4.6.1. Russia Submarines Market Size and Forecast, by Type (2023-2030)

7.4.6.2. Russia Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.6.3. Russia Submarines Market Size and Forecast, by Application (2023-2030)

7.4.7. Austria

7.4.7.1. Austria Submarines Market Size and Forecast, by Type (2023-2030)

7.4.7.2. Austria Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.7.3. Austria Submarines Market Size and Forecast, by Application (2023-2030)

7.4.8. Rest of Europe

7.4.8.1. Rest of Europe Submarines Market Size and Forecast, by Type (2023-2030)

7.4.8.2. Rest of Europe Submarines Market Size and Forecast, by Platform (2023-2030)

7.4.8.3. Rest of Europe Submarines Market Size and Forecast, by Application (2023-2030)

8. Asia Pacific Submarines Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

8.1. Asia Pacific Submarines Market Size and Forecast, by Type (2023-2030)

8.2. Asia Pacific Submarines Market Size and Forecast, by Platform (2023-2030)

8.3. Asia Pacific Submarines Market Size and Forecast, by Application (2023-2030)

8.4. Asia Pacific Submarines Market Size and Forecast, by Country (2023-2030)

8.4.1. China

8.4.1.1. China Submarines Market Size and Forecast, by Type (2023-2030)

8.4.1.2. China Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.1.3. China Submarines Market Size and Forecast, by Application (2023-2030)

8.4.2. S Korea

8.4.2.1. S Korea Submarines Market Size and Forecast, by Type (2023-2030)

8.4.2.2. S Korea Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.2.3. S Korea Submarines Market Size and Forecast, by Application (2023-2030)

8.4.3. Japan

8.4.3.1. Japan Submarines Market Size and Forecast, by Type (2023-2030)

8.4.3.2. Japan Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.3.3. Japan Submarines Market Size and Forecast, by Application (2023-2030)

8.4.4. India

8.4.4.1. India Submarines Market Size and Forecast, by Type (2023-2030)

8.4.4.2. India Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.4.3. India Submarines Market Size and Forecast, by Application (2023-2030)

8.4.5. Australia

8.4.5.1. Australia Submarines Market Size and Forecast, by Type (2023-2030)

8.4.5.2. Australia Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.5.3. Australia Submarines Market Size and Forecast, by Application (2023-2030)

8.4.6. ASEAN

8.4.6.1. ASEAN Submarines Market Size and Forecast, by Type (2023-2030)

8.4.6.2. ASEAN Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.6.3. ASEAN Submarines Market Size and Forecast, by Application (2023-2030)

8.4.7. Rest of Asia Pacific

8.4.7.1. Rest of Asia Pacific Submarines Market Size and Forecast, by Type (2023-2030)

8.4.7.2. Rest of Asia Pacific Submarines Market Size and Forecast, by Platform (2023-2030)

8.4.7.3. Rest of Asia Pacific Submarines Market Size and Forecast, by Application (2023-2030)

9. Middle East and Africa Submarines Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

9.1. Middle East and Africa Submarines Market Size and Forecast, by Type (2023-2030)

9.2. Middle East and Africa Submarines Market Size and Forecast, by Platform (2023-2030)

9.3. Middle East and Africa Submarines Market Size and Forecast, by Application (2023-2030)

9.4. Middle East and Africa Submarines Market Size and Forecast, by Country (2023-2030)

9.4.1. South Africa

9.4.1.1. South Africa Submarines Market Size and Forecast, by Type (2023-2030)

9.4.1.2. South Africa Submarines Market Size and Forecast, by Platform (2023-2030)

9.4.1.3. South Africa Submarines Market Size and Forecast, by Application (2023-2030)

9.4.2. GCC

9.4.2.1. GCC Submarines Market Size and Forecast, by Type (2023-2030)

9.4.2.2. GCC Submarines Market Size and Forecast, by Platform (2023-2030)

9.4.2.3. GCC Submarines Market Size and Forecast, by Application (2023-2030)

9.4.3. Nigeria

9.4.3.1. Nigeria Submarines Market Size and Forecast, by Type (2023-2030)

9.4.3.2. Nigeria Submarines Market Size and Forecast, by Platform (2023-2030)

9.4.3.3. Nigeria Submarines Market Size and Forecast, by Application (2023-2030)

9.4.4. Rest of ME&A

9.4.4.1. Rest of ME&A Submarines Market Size and Forecast, by Type (2023-2030)

9.4.4.2. Rest of ME&A Submarines Market Size and Forecast, by Platform (2023-2030)

9.4.4.3. Rest of ME&A Submarines Market Size and Forecast, by Application (2023-2030)

10. South America Submarines Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030)

10.1. South America Submarines Market Size and Forecast, by Type (2023-2030)

10.2. South America Submarines Market Size and Forecast, by Platform (2023-2030)

10.3. South America Submarines Market Size and Forecast, by Application (2023-2030)

10.4. South America Submarines Market Size and Forecast, by Country (2023-2030)

10.4.1. Brazil

10.4.1.1. Brazil Submarines Market Size and Forecast, by Type (2023-2030)

10.4.1.2. Brazil Submarines Market Size and Forecast, by Platform (2023-2030)

10.4.1.3. Brazil Submarines Market Size and Forecast, by Application (2023-2030)

10.4.2. Argentina

10.4.2.1. Argentina Submarines Market Size and Forecast, by Type (2023-2030)

10.4.2.2. Argentina Submarines Market Size and Forecast, by Platform (2023-2030)

10.4.2.3. Argentina Submarines Market Size and Forecast, by Application (2023-2030)

10.4.3. Rest Of South America

10.4.3.1. Rest Of South America Submarines Market Size and Forecast, by Type (2023-2030)

10.4.3.2. Rest Of South America Submarines Market Size and Forecast, by Platform (2023-2030)

10.4.3.3. Rest Of South America Submarines Market Size and Forecast, by Application (2023-2030)

11. Company Profile: Key Players

11.1. Huntington Ingalls Industries (United States)

11.1.1. Company Overview

11.1.2. Business Portfolio

11.1.3. Financial Overview

11.1.4. SWOT Analysis

11.1.5. Strategic Analysis

11.1.6. Recent Developments

11.2. General Dynamics Corporation (United States)

11.3. BAE Systems plc (United Kingdom)

11.4. Naval Group (France)

11.5. ThyssenKrupp Marine Systems (Germany)

11.6. Saab AB (Sweden)

11.7. Lockheed Martin Corporation (United States)

11.8. Mitsubishi Heavy Industries (Japan)

11.9. Kawasaki Heavy Industries (Japan)

11.10. Fincantieri S.p.A. (Italy)

11.11. Navantia (Spain)

11.12. ASC Pty Ltd (Australia)

11.13. Northrop Grumman Corporation (United States)

11.14. Rosoboronexport (Russia)

11.15. Babcock International Group (United Kingdom)

11.16. Hyundai Heavy Industries (South Korea)

11.17. Daewoo Shipbuilding & Marine Engineering (DSME) (South Korea)

11.18. Larsen & Toubro (India)

11.19. Kockums AB (Sweden)

11.20. Mazagon Dock Shipbuilders Limited (India)

12. Key Findings and Analyst Recommendations