Sunflower Seeds Market: Global Industry Analysis and Forecast (2024-2030)

The Sunflower Seeds Market size was valued at USD 2132.58 Mn. in 2023 and the total Global Sunflower Seeds revenue is expected to grow at a CAGR of 7.9% from 2024 to 2030, reaching nearly USD 3631.24 Mn. by 2030.

Format : PDF | Report ID : SMR_2137

Sunflower Seeds Market Overview

Sunflower seeds are technically the fruits of the sunflower plant. The seeds are harvested from the plant’s large flower heads and have a mild, nutty flavor and a firm but tender texture. Sunflower seeds are excellent sources of several beneficial plant compounds that help prevent chronic diseases.

- According to SMR, the top 5 companies i.e. Corteva Agriscience, Euralis Semences, KWS SAAT SE & Co. KGaA, Land O'Lakes, Inc., and Nufarm in the sunflower seed market, which focus on hybrids, occupy 42.78% market share globally.

The report from Stellar Market Research presents a thorough analysis of the Sunflower Seeds Market, focusing on predicting market growth trends and offering valuable insights into the value chain and supply chain dynamics. The analysis of the Sunflower Seeds Market scope provides a detailed comprehension of the complex network of processes and stakeholders involved in the production and distribution of these seeds. The report intensely captures the growing interest in this field, detailing the extensive implications and the significant economic benefits that cultivation has brought to industries and local economies.

Key players play a crucial role in driving innovation and improving product efficacy, underscoring the importance of targeted strategies to meet evolving consumer demands. The report highlights the significance of import and export activities in the Sunflower Seeds Market, ensuring continuous transactions between suppliers and end-users. Additionally, the analysis evaluates the cost-profit ratio, assessing companies' financial capabilities for investing in research and development to introduce new products or enhance existing ones.

The market scope includes opportunities in new product development and advancements in formulation technologies, which propel market growth and innovation. Through quantitative research methods, the report offers statistical data on the effectiveness of Sunflower Seeds in various applications and their impact on market trends. Competitive intelligence analysis aids in comprehending market dynamics, competitor strategies, and customer perceptions, empowering market players to gain a competitive advantage in the global Sunflower Seeds Market.

To get more Insights: Request Free Sample Report

Sunflower Seeds Market Dynamics

Increasing Popularity of Healthy and Plant-Based Snacks

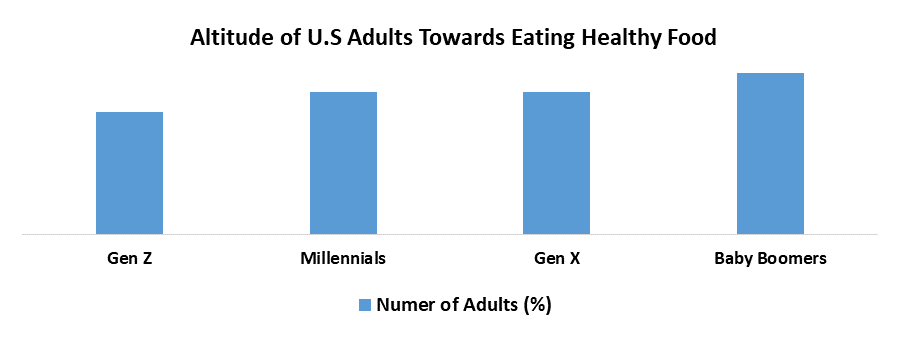

Consumers are increasingly becoming more health conscious and are opting for nutritional and natural snack options. Sunflower seeds are rich in protein, healthy fats, and essential vitamins such as vitamin E and B-complex vitamins, which align with the nutritional preferences of modern consumers. The growing popularity of plant-based snacks has resulted in a flow, with about a 20% rise in the sales of plant-based foods over the past year. The research and development demonstrate the advantages of plant-based foods like lower risk of heart disease and obesity.

Additionally, these seeds are flexible to be incorporated into any variety of snacks such as roasted seeds, flavored varieties, and inclusion in snack bars and granolas. The global increase in the vegan & vegetarian population estimated to have a rise of about 600% in the US over the past three years highlights the demand for plant-based snack options. Additionally, gluten-free, sunflower seeds are an attractive choice for those with celiac disease, which affects about 1 in 100 people globally, or gluten sensitivity.

- According to SMR, sunflower seeds' strong antioxidant content helps fight oxidative stress and inflammation and lowers the risk of chronic diseases including diabetes and heart disease.

Sunflower seeds are essential to the developing market for healthy snacks because of their health benefits and the growing trend of snacking, which experienced a 47% growth in 2022. In addition to their versatility, ease of use, and nutritional value, sunflower seeds are becoming a major force in the rapidly changing plant-based and health-conscious snacking market.

Dependency on Weather Conditions and Climate Variability

Sunflower crops are highly sensitive to weather patterns, requiring specific conditions for optimal growth. Unpredictable weather events, such as droughts, excessive rainfall, and temperature fluctuations, directly impact the yield and quality of sunflower seeds. For instance, the severe droughts experienced in the Black Sea region, a major sunflower-producing area, have led to a substantial decline in sunflower seed output.

- According to SMR studies, droughts reduce sunflower yields by up to 50%, drastically affecting supply chains and market stability.

Additionally, climate variability influences the incidence of pests and diseases, further threatening sunflower crops. It is observed that the frequency of extreme weather events has increased by 37% over the past three decades, intensifying the volatility in sunflower seed production. In Argentina, a key player in the sunflower seed market, unexpected frosts in recent years have caused significant damage to crops, leading to reduced yields and increased prices. Additionally, changing climate conditions have altered the traditional growing seasons and geographical suitability for sunflowers, necessitating adjustments in farming practices that not all producers afford or manage effectively.

The variability in weather also affects the oil content in sunflower seeds, a critical quality parameter for both food and industrial applications. Data from the International Sunflower Association indicates that variations in temperature and rainfall lead to about 20% reduction in oil content, affecting the profitability of processors and suppliers. The reliance on specific weather conditions makes sunflower seed production inherently risky, contributing to supply chain disruptions and price volatility. As climate change continues to alter weather patterns globally, the instability and uncertainty in sunflower seed production are likely to remain significant challenges for the market.

Sunflower Seeds Market Segment Analysis

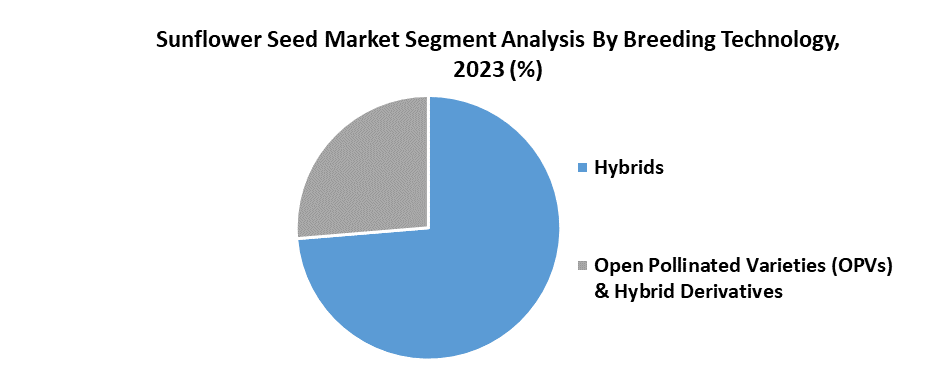

By Breeding Technology, According to SMR research, the Hybrids segment was dominant in the global Sunflower Seeds market in 2023. The hybrid breeding technology offers about 35% greater productivity important for the farmers to increase their yield and cost-effectiveness. The crops developed by the hybrid breeding technology are improved with drought tolerance and improved stress resistance to make them sustainable in varied climate conditions.

- According to SMR, in North Dakota, hybrid sunflowers yield up to 30% more than open-pollinated species. Similarly, in Uganda, hybrids have produced 1,500-1,800 kg/ha, while traditional varieties have generated 750-900 kg/ha.

Apart from getting greater yields, the hybrids are modified for superior disease and pest resistance to reduce production costs making the hybrid breeding technology segment dominant in the global Sunflower Seeds market. Additionally, the hybrid breeding technology offers sunflowers with high and superior quality oil that benefits edible oil production. The sunflower crops from the hybrid seeds mature more quickly helping the farmers to optimize the planting schedules and making them easier to harvest. This consistency facilitates automated harvesting, which lowers labor expenses, and makes better use of resources like fertilizer and water.

As the demand for sunflower oil rises there has been an increase in the requirement for sunflower crops that yield high quantities of high-quality produce. Hybrid seeds are ideally suited to meet this demand, providing farmers with a dependable and profitable choice. The ongoing investment in agricultural technology, projected to grow at a CAGR of 7.22% from 2024 to 2033, ensures that hybrid seeds remain at the forefront of innovation. These combined factors establish hybrid breeding technology as the leading segment in the Sunflower Seeds market, offering significant benefits in terms of yield, quality, and sustainability.

Sunflower Seeds Market Regional Analysis

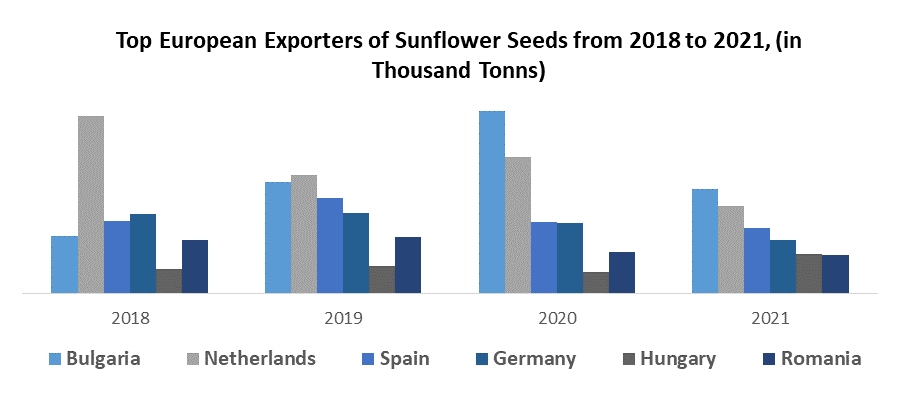

Europe dominated the global Sunflower Seeds market in 2023 and is expected to grow significantly during the forecast period. The Sunflower Seeds market in Europe is comparatively mature as the volume of the seeds imported to the region increased by about 3% showing a stable annual growth rate. The demand for sunflower seeds seems strongest in Europe in nations including France, Hungary, Romania, Bulgaria, the Netherlands, Spain, and Germany. Processors in Poland and niche markets in France and Italy have the potential to contribute to future growth in the Sunflower Seeds industry marking the dominance of the region in the global Sunflower Seeds market.

The Netherlands is vital to other European nations as a center for trade. Bulgaria with its output of almost 2 million tonnes, has the greatest crushing capacity for sunflowers in Europe in 2021. Also, it buys sunflower seeds from other producing nations to satisfy its overwhelming demands; as a result, it ranks first among European importers, making up 18% of total imports in 2021 making the region dominant in the global Sunflower Seeds market. The third-largest importer, Spain, is mostly dependent on local demand, especially for the popular snack, roasted sunflower seeds. 11% of all imports from the region went to Spain in 2021, primarily from France, Romania, and Bulgaria.

Additionally, Spain's output of 767 thousand tonnes suggests that a considerable amount of imports was utilized to fulfil domestic demand for sunflower oil, which is the highest in the EU, despite the country's massive crushing capacity of 1.2 million tonnes. The demand for sunflower seeds is driven by the German baking and confectionery industries, with imports significantly surpassing exports. The dominance of Europe in the global Sunflower Seeds market is highlighted by its ability to maintain a stable supply chain.

The region's strong processing and processing capacities along with its demand make it dominant in the global Sunflower Seeds market. Europe's importance in the Sunflower Seeds industry is expected to rise as the demand for ready-to-eat, plant-based, and nutritious meals grows globally. This allows Europe to maintain its leading position in the global Sunflower Seeds industry.

Sunflower Seeds Market Competitive Landscape

The sunflower seeds market is moderately consolidated, with key players including Corteva Agriscience, Euralis Semences, Land O'Lakes, Inc., and Nufarm among others. These leading companies are focused on developing and marketing high-performing hybrid sunflower seed varieties that offer advantages like increased yields, drought tolerance, and disease resistance. Persistent investment in agricultural R&D and an increase in production capacity have allowed these major players to maintain their dominant position in the global sunflower seeds market. Competitive rivalry, mergers and acquisitions, and geographic enlargement are key dynamics shaping the competitive landscape of this industry.

- In 2024, European seed companies, Euralis Semences and Caussade Semences Group merged to create a robust unit capable of driving innovation in the sunflower seeds market, particularly in the development of hybrid seeds with enhanced resistance to pests and diseases.

- In 2023, Corteva Agriscience entered into a strategic partnership with a leading biotechnology firm, Evogene. This collaboration aims to leverage Evogene's cutting-edge gene editing technologies to develop innovative sunflower seed traits that improve crop resilience and productivity.

- In 2022, Syngenta acquired Sensako, a South African seed company, to enhance its sunflower seed portfolio and expand its footprint in Africa.

|

Sunflower Seeds Market Scope |

|

|

Market Size in 2023 |

USD 2132.58 Mn. |

|

Market Size in 2030 |

USD 3631.24 Mn. |

|

CAGR (2024-2030) |

7.9% |

|

Historic Data |

2018-2022 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2030 |

|

Segments |

By Breeding Technology Hybrids Open Pollinated Varieties (OPVs) & Hybrid Derivatives |

|

By Type Oil Seed Non-Oil Seed |

|

|

By Application Edible Oil Snacks Bakery Products Confectionary Others |

|

|

By Distribution Channel Supermarkets/Hypermarkets Convenience Stores Online Retail Others |

|

|

Regional Scope |

North America- United States, Canada, and Mexico Europe – UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe Asia Pacific – China, India, Japan, South Korea, Australia, ASEAN, Rest of APAC Middle East and Africa - South Africa, GCC, Egypt, Nigeria, Rest of the Middle East and Africa South America – Brazil, Argentina, Rest of South America |

Key Player in the Sunflower Seeds Market

- Bayer Crop Science AG (Germany)

- Corteva Agriscience (United States)

- Syngenta AG (Switzerland)

- BASF (Germany)

- Limagrain (France)

- KWS SAAT SE & Co KGaA (Germany)

- Sakata Seed Corporation (Japan)

- AgReliant Genetics, LLC (United States)

- DLF Seeds A/S (Denmark)

- Yuan Longping High-tech Agriculture Corporation Limited (China)

- Euralis Semences (France)

- Land O'Lakes, Inc. (USA)

- Nufarm (Australia)

- KENKKO (Japan)

- CONAGRA FOODS (USA)

- Limagrain UK (UK)

- GIANT Snacks (USA)

- CHS Inc (USA)

- Sakata Seed Corporation (Japan)

- Others

Frequently Asked Questions

Competition from alternative seed crops and snack options, and price volatility in the agricultural commodities industry are the challenges in the global Sunflower Seeds market.

Asia Pacific region is the fastest-growing region in the Sunflower Seeds Market during the forecast period.

The Market size was valued at USD 2132.58 Million in 2023 and the total Market revenue is expected to grow at a CAGR of 7.9% from 2024 to 2030, reaching nearly USD 3631.24 Million.

The segments covered in the market report are Breeding Technology, Type, Application, Distribution Channel, and region.

1. Sunflower Seeds Market: Research Methodology

2. Sunflower Seeds Market: Executive Summary

3. Sunflower Seeds Market: Competitive Landscape

4. Potential Areas for Investment

4.1. Stellar Competition Matrix

4.2. Competitive Landscape

4.3. Key Players Benchmarking

4.4. Market Structure

4.4.1. Market Leaders

4.4.2. Market Followers

4.4.3. Emerging Players

4.5. Consolidation of the Market

5. Sunflower Seeds Market: Dynamics

5.1. Market Trends

5.2. Market Drivers

5.3. Market Restraints

5.4. Market Opportunities

5.5. Market Challenges

5.6. PORTER’s Five Forces Analysis

5.7. PESTLE Analysis

5.8. Value Chain Analysis

5.9. Strategies for New Entrants to Penetrate the Market

5.10. Regulatory Landscape by Region

5.10.1. North America

5.10.2. Europe

5.10.3. Asia Pacific

5.10.4. Middle East and Africa

5.10.5. South America

5.11. Analysis of the government schemes in the sunflower seed industry.

5.12. Global Import-Export Analysis

6. Sunflower Seeds Market Size and Forecast by Segments (by Value in USD Million)

6.1. Sunflower Seeds Market Size and Forecast, By Breeding Technology (2023-2030)

6.1.1. Hybrids

6.1.2. Open Pollinated Varieties (OPVs) & Hybrid Derivatives

6.2. Sunflower Seeds Market Size and Forecast, by Type (2023-2030)

6.2.1. Oil Seed

6.2.2. Non-Oil Seed

6.3. Sunflower Seeds Market Size and Forecast, by Application (2023-2030)

6.3.1. Edible Oil

6.3.2. Snacks

6.3.3. Bakery Products

6.3.4. Confectionary

6.3.5. Others

6.4. Sunflower Seeds Market Size and Forecast, by Distribution Channel (2023-2030)

6.4.1. Supermarkets/Hypermarkets

6.4.2. Convenience Stores

6.4.3. Online Retail

6.4.4. Others

6.5. Sunflower Seeds Market Size and Forecast, by Region (2023-2030)

6.5.1. North America

6.5.2. Europe

6.5.3. Asia Pacific

6.5.4. Middle East and Africa

6.5.5. South America

7. North America Sunflower Seeds Market Size and Forecast (by Value in USD Million)

7.1. North America Sunflower Seeds Market Size and Forecast, By Breeding Technology (2023-2030)

7.1.1. Hybrids

7.1.2. Open Pollinated Varieties (OPVs) & Hybrid Derivatives

7.2. North America Sunflower Seeds Market Size and Forecast, by Type (2023-2030)

7.2.1. Oil Seed

7.2.2. Non-Oil Seed

7.3. North America Sunflower Seeds Market Size and Forecast, by Application (2023-2030)

7.3.1. Edible Oil

7.3.2. Snacks

7.3.3. Bakery Products

7.3.4. Confectionary

7.3.5. Others

7.4. North America Sunflower Seeds Market Size and Forecast, by Distribution Channel (2023-2030)

7.4.1. Supermarkets/Hypermarkets

7.4.2. Convenience Stores

7.4.3. Online Retail

7.4.4. Others

7.5. North America Sunflower Seeds Market Size and Forecast, by Country (2023-2030)

7.5.1. United States

7.5.2. Canada

7.5.3. Mexico

8. Europe Sunflower Seeds Market Size and Forecast (by Value in USD Million)

8.1. Europe Sunflower Seeds Market Size and Forecast, By Breeding Technology (2023-2030)

8.1.1. Hybrids

8.1.2. Open Pollinated Varieties (OPVs) & Hybrid Derivatives

8.2. Europe Sunflower Seeds Market Size and Forecast, by Type (2023-2030)

8.2.1. Oil Seed

8.2.2. Non-Oil Seed

8.3. Europe Sunflower Seeds Market Size and Forecast, by Application (2023-2030)

8.3.1. Edible Oil

8.3.2. Snacks

8.3.3. Bakery Products

8.3.4. Confectionary

8.3.5. Others

8.4. Europe Sunflower Seeds Market Size and Forecast, by Distribution Channel (2023-2030)

8.4.1. Supermarkets/Hypermarkets

8.4.2. Convenience Stores

8.4.3. Online Retail

8.4.4. Others

8.5. Europe Sunflower Seeds Market Size and Forecast, by Country (2023-2030)

8.5.1. UK

8.5.2. France

8.5.3. Germany

8.5.4. Italy

8.5.5. Spain

8.5.6. Sweden

8.5.7. Austria

8.5.8. Rest of Europe

9. Asia Pacific Sunflower Seeds Market Size and Forecast (by Value in USD Million)

9.1. Asia Pacific Sunflower Seeds Market Size and Forecast, By Breeding Technology (2023-2030)

9.1.1. Hybrids

9.1.2. Open Pollinated Varieties (OPVs) & Hybrid Derivatives

9.2. Asia Pacific Sunflower Seeds Market Size and Forecast, by Type (2023-2030)

9.2.1. Oil Seed

9.2.2. Non-Oil Seed

9.3. Asia Pacific Sunflower Seeds Market Size and Forecast, by Application (2023-2030)

9.3.1. Edible Oil

9.3.2. Snacks

9.3.3. Bakery Products

9.3.4. Confectionary

9.3.5. Others

9.4. Asia Pacific Sunflower Seeds Market Size and Forecast, by Distribution Channel (2023-2030)

9.4.1. Supermarkets/Hypermarkets

9.4.2. Convenience Stores

9.4.3. Online Retail

9.4.4. Others

9.5. Asia Pacific Sunflower Seeds Market Size and Forecast, by Country (2023-2030)

9.5.1. China

9.5.2. S Korea

9.5.3. Japan

9.5.4. India

9.5.5. Australia

9.5.6. Indonesia

9.5.7. Malaysia

9.5.8. Vietnam

9.5.9. Taiwan

9.5.10. Bangladesh

9.5.11. Pakistan

9.5.12. Rest of Asia Pacific

10. Middle East and Africa Sunflower Seeds Market Size and Forecast (by Value in USD Million)

10.1. Middle East and Africa Sunflower Seeds Market Size and Forecast, By Breeding Technology (2023-2030)

10.1.1. Hybrids

10.1.2. Open Pollinated Varieties (OPVs) & Hybrid Derivatives

10.2. Middle East and Africa Sunflower Seeds Market Size and Forecast, by Type (2023-2030)

10.2.1. Oil Seed

10.2.2. Non-Oil Seed

10.3. Middle East and Africa Sunflower Seeds Market Size and Forecast, by Application (2023-2030)

10.3.1. Edible Oil

10.3.2. Snacks

10.3.3. Bakery Products

10.3.4. Confectionary

10.3.5. Others

10.4. Middle East & Africa Sunflower Seeds Market Size and Forecast, by Distribution Channel (2023-2030)

10.4.1. Supermarkets/Hypermarkets

10.4.2. Convenience Stores

10.4.3. Online Retail

10.4.4. Others

10.5. Middle East and Africa Single-Use Filtration Assembly Market Size and Forecast, by Country (2023-2030)

10.5.1. South Africa

10.5.2. GCC

10.5.3. Egypt

10.5.4. Nigeria

10.5.5. Rest of ME&A

11. South America Sunflower Seeds Market Size and Forecast (by Value in USD Million)

11.1. South America Sunflower Seeds Market Size and Forecast, By Breeding Technology (2023-2030)

11.1.1. Hybrids

11.1.2. Open Pollinated Varieties (OPVs) & Hybrid Derivatives

11.2. South America Sunflower Seeds Market Size and Forecast, by Type (2023-2030)

11.2.1. Oil Seed

11.2.2. Non-Oil Seed

11.3. South America Sunflower Seeds Market Size and Forecast, by Application (2023-2030)

11.3.1. Edible Oil

11.3.2. Snacks

11.3.3. Bakery Products

11.3.4. Confectionary

11.3.5. Others

11.4. South America Sunflower Seeds Market Size and Forecast, by Distribution Channel (2023-2030)

11.4.1. Supermarkets/Hypermarkets

11.4.2. Convenience Stores

11.4.3. Online Retail

11.4.4. Others

11.5. South America Sunflower Seeds Market Size and Forecast, by Country (2023-2030)

11.5.1. Brazil

11.5.2. Argentina

11.5.3. Rest of South America

12. Company Profile: Key players

12.1. Bayer Crop Science AG

12.1.1. Company Overview

12.1.2. Financial Overview

12.1.3. Business Portfolio

12.1.4. SWOT Analysis

12.1.5. Business Strategy

12.1.6. Recent Developments

12.2. Corteva Agriscience

12.3. Syngenta AG

12.4. BASF

12.5. Limagrain

12.6. KWS SAAT SE & Co KGaA

12.7. Sakata Seed Corporation

12.8. AgReliant Genetics, LLC

12.9. DLF Seeds A/S

12.10. Yuan Longping High-tech Agriculture Co Ltd

12.11. Euralis Semences

12.12. Land O'Lakes, Inc.

12.13. Nufarm

12.14. KENKKO

12.15. CONAGRA FOODS

12.16. Limagrain UK

12.17. GIANT Snacks

12.18. CHS Inc

12.19. Sakata Seed Corporation

12.20. Others

13. Key Findings

14. Industry Recommendations